Abstract

This paper investigates the effect of good or bad news (the asymmetric effect) on the time-varying beta of firms in the UK during good periods (booms) and bad periods (recessions). Daily data from twenty five UK firms of different sizes and from different industries are applied in the empirical tests. The data ranges from 2004 to 2010, which includes the current global financial crisis. The time-varying betas are created by means of the bivariate BEKK GARCH model, and then linear regressions are applied to test for the asymmetric effect of news on the beta. The asymmetric effects are investigated based on both market and non-market shocks. Most firms and industries seem to support the market efficiency hypothesis during both periods. However, the level of market efficiency seems to decline significantly from the pre-crisis to crisis period. Both the results of market efficiency and declining market efficiency from the pre-crisis to crisis periods provide ample evidence of the asymmetric effect of the financial crisis on the beta of UK firms.

Similar content being viewed by others

Notes

Harel et al. (2011) provide an analysis of efficient markets.

Of course, the crisis has carried on beyond 2010.

Veronesi (1999) presents a two state continuous time hidden Markov chain model to explain the stock market under-reaction to bad news in good times. We use a BEKK GARCH framework analysing the impact of good and bad news in good and bad periods and present empirical evidence for 5 major industry classifications leading up to and during the recent financial crisis period.

Dwyer and Lothian (2012) state that cross-country evidence and analyses of individual countries suggest a common explanation to the cause of the financial crisis is likely to be based in rapid credit expansion and economic growth. Dias and Ramos (2013) study the behaviour of the banking sector of 40 countries during the period 2007–2010. They show that although there were periods of intense contagion, the impact was uneven among sample countries. Marsh and Pfleiderer (2012) provide a discussion of black swans and the financial crisis.

However, Kamin and DeMarco (2012) conclude that issues with U.S. Sub Prime mortgages more plausibly were a wake-up call about banking problems around the world than a direct cause of those problems.

See Shin (2009). Reflections on Northern Rock.

In autumn 2008, financial markets did move very much in sync, with stock prices around the world falling by 30 % or more (Bartram and Bodnar 2009 ).

On average the Index declined by approximately 10 % between the periods 2004 to 2007 and 2007 to 2010.

These figures were sourced from the financial times and the BBC website.

However, sentence et al. (2012) state that the substantial increase in the UK house prices and capital inflows associated with growth of private sector debt combined with a large financial sector exposed to foreign developments led many observers to expect a worse experience than has transpired.

We thank the referee for suggesting the correlation and covariance tests.

According to Klemkosky and Martin (1975), betas will be time-varying if excess returns are characterized by conditional heteroscedasticity.

Hansen and Richard (1987) have shown that omission of conditioning information, as is done in tests of constant beta versions of the CAPM, can lead to erroneous conclusions regarding the conditional mean variance efficiency of a portfolio.

This is also referred to as the “leverage effect”.

Christie (1982) shows that equity volatility is increasing in financial leverage, and hence there is a negative relationship between the variance of returns and the value of equity. However, Christie (1982) and Black (1976) point out that financial and operational leverage is not enough to fully account for the asymmetry of volatility.

According to Brooks and Henry (2002), if the risk premium is increasing in volatility, and if beta is a proper measure of the sensitivity to risk, then time variation and asymmetry in the variance–covariance structure of returns may lead to time variation and asymmetry in beta.

Thus we estimate the BEKK model for each firm to create 25 individual time varying betas.

The BEKK description relies heavily on Choudhry and Jayasekera (2012).

We estimate the BEKK GARCH to obtain \({\hat{\text{H}}}_{{ 1 2,{\text{t}}}}\) and \({\hat{\text{H}}}_{{ 2 2,{\text{t}}}}\) for each firm to estimate the betas.

The ADF tests are applied with six lags maximum.

Previous research by Braun et al. (1995) support the overreaction theory (asset mispricing) by finding a weak asymmetric effect in beta. They conclude, based on the evidence of the low frequency (weekly) data, that betas are not responsive enough to account for the differing return performances of "winners" and "losers", and thus support De Bondt and Thaler (1989).

There are two possible explanations. (1) Leverage based—viewing equity as a call option for the firm’s assets—if the value of a leveraged firm drops, its equity becomes highly leveraged, causing an increase in volatility (Black 1976; Christie 1982). (2) Positive relation between volatility and the expected market risk premium—an increase in volatility increases the expected return which in turn lowers the stock price contributing to the asymmetric effect in volatility (Pindyck 1984; Poterba and Summers 1986; French et al. 1987; Bollerslev, Engle and Wooldridge, 1988; Engle, Ng and Rothschild, 1990; Campbell and Hentschel 1992).

A zero order for AR in beta gives the beta extreme volatility implying complete stochastic behaviour analogous to a random walk. Given that beta is a time-varying process, zero order for AR does not seem to be a realistic model.

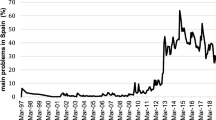

“Appendix” shows how repeated attempts at predicting the oil price made by the US Department of Energy exhibited huge deviations from the actual price levels, thus serving to illustrate the difficulty in predicting the movements in the oil prices.

This is intuitive as the demand for food is relatively inelastic.

VSTOXX Index, developed by Deutsche Borse and Goldman Sachs is a measure of volatility in the Eurozone. It measures implied volatility on options across all maturities.

References

Agrawal A, Jaffe F, Mandelker G (1992) The post-merger performance of acquiring firms: a re-examination of an anomaly. J Financ 47:1605–1621

Asquith P (1983) Merger bids, uncertainty and stockholder returns. J Financ Econ 11:51–83

Ball R, Brown P (1968) An empirical evaluation of accounting income numbers. J Account Res 6:159–178

Ball R, Kothari SP (1989) Nonstationary expected returns: implications for tests of market efficiency and serial and correlation in returns. J Financ Econ 25:51–74

Bartram SM, Bodnar GM (2009) No place to hide: the global crisis in equity markets in 2008/2009. J Int Money Financ 28:1246–1292

Bernard V, Thomas J (1990) Evidence that stock prices do not fully reflect the implications of current earnings for future earnings. J Account Econ 13:305–322

Black F (1976) Studies of stock market volatility changes. In: Proceedings of the American Statistical Association. Business and Economics Statistics Section, pp 177–181

Bodurtha J, Mark N (1991) Testing the CAPM with time-varying risk and returns. J Financ 46:1485–1505

Bollerslev T, Engle RF, Wooldridge JM (1988) A capital asset pricing model with time varying covariances. J Polit Econ 96:116–131

Bollerslev T, Chou R, Kroner K (1992) ARCH modeling in finance. J Econom 52:5–59

Braun P, Nelson D, Sunier A (1995) Good news, bad news, volatility and betas. J Financ 50:1575–1601

Brooks C, Henry O (2002) The impact of news on measures of undiversifiable risk: evidence from the UK stock market. Oxf Bull Econ Stat 64:487–507

Campbell J, Hentschel L (1992) No news is good news: an asymmetric model of changing volatility in stock return. J Financ Econ 31:281–318

Chan KC (1988) On the contrarian investment strategy. J Bus 61:147–163

Cho YH, Engle R (1999) Time-varying betas and symmetric effects of news: empirical analysis of blue chip stocks. National Bureau of Economic Research. Working paper no. 7330

Chopra N, Lakinishok J, Ritter J (1992) Measuring abnormal returns: do stocks overreact? J Financ Econ 10:289–321

Choudhry T (2002) Stochastic Structure of the time-varying beta: evidence from the UK companies. Manch Sch 70:768–791

Choudhry T, Jayasekera R (2012) Comparison of efficiency characteristics between the banking sectors of US and UK during the global financial crisis of 2007–2011. Int Rev Financ Anal 25:106–116

Christie A (1982) The Stochastic behavior of common stock variances: value, leverage and interest rate effects. J Financ Econ 10:407–432

Cusatis P, Miles J, Wooldridge J (1993) Restructuring through spinoffs. J Financ Econ 33:293–311

De Bondt WFH, Thaler R (1989) Anomalies: a mean-reverting walk down wall street. J Econ Perspect 3:189–202

Desai H, Jain P (1997) Long-run common stock returns following splits and reverse splits. J Bus 70:409–433

Dharan B, Ikenberry D (1995) The long-run negative drift of post-listing stock returns. J Financ 50:1547–1574

Dias JG, Ramos SB (2013) The aftermath of the subprime crisis: a clustering analysis of the world banking sector. Forthcoming Review of Quantitative Accounting and Finance

Dwyer GP, Lothian JR (2012) International and historical dimensions of the financial crisis of 2007 and 2008. J Int Money Financ 31:1–9

Dwyer GP, Tkac P (2009) The financial crisis of 2008 in fixed-income markets. J Int Money Financ 28:1293–1316

Engle R, Kroner K (1995) Multivariate simultaneous generalized ARCH. Econom Theory 11:122–150

Engle R, Ng VM, Rothschild M (1990) Asset pricing with a factor-ARCH structure: empirical estimates for treasury bills. J Econom 45:213–237

European Commission (2009) Economic crisis in Europe: causes, consequences and responses. European Economy

Fama E (1970) Efficient capital markets: a review of theory and empirical work. J Financ 25:383–417

Fama E (1991) Efficient capital markets: II. J Financ 46:1575–1617

Fama E (1998) Market efficiency, long term returns, and behavioral finance. J Financ Econ 49:283–306

Fama E, French K (1992) The cross-section of expected stock returns. J Financ 47:427–465

Fama E, French K (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Fama E, French K (1998) Value versus growth: the international evidence. J Financ 53:1975–1999

Fama E, French K (2002) Testing trade-off and pecking order predictions about dividends and debt. Rev Financ Stud 15:1–33

Frazzini A (2006) The Disposition effect and underreaction to news. J Financ 61:2017–2046

French KR, Schwert GW, Stambaugh RF (1987) Expected stock returns and volatility. J Polit Econ 99:385–415

Giannopoulos K (1995) Estimating the time-varying components of international stock markets risk. Eur J Financ 1:129–164

Grossman SJ, Stiglitz JE (1980) On the impossibility of informationally efficient markets. Am Econ Rev 70:393–408

Hansen L, Richard S (1987) The role of conditioning information in deducing testable restriction implied by dynamic asset pricing models. Econometrica 55:587–614

Harel A, Harpaz G, Francis JC (2011) Analysis of efficient markets. Rev Quant Financ Acc 36:287–296

Ikenberry D, Lakonishok J (1993) Corporate governance through the proxy contest: evidence and implications. J Bus 66:405–435

Ikenberry D, Lakonishok J, Vermaelen T (1995) Market underreaction to open market share repurchases. J Financ Econ 39:181–208

Ikenberry D, Rankine G, Stice E (1996) What do stock splits really signal? J Financ Quant Anal 31:357–377

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Financ 48:65–91

Kamin SB, DeMarco LP (2012) How did a domestic housing slump turn into a global financial crisis? J Int Money Financ 31:10–41

Klemkosky R, Martin J (1975) The adjustment of beta forecasts. J Financ 30:1123–1128

Lakonishok J, Vermaelen T (1990) Anomalous price behaviour around repurchase tender offers. J Financ 45:455–477

Lesmond DA, Schillb MJ, Zhouc C (2004) The illusory nature of momentum profits. J Financ Econ 71:349–380

Lintner J (1965) The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Rev Econ Stat 47:13–37

Loughran T, Ritter J (1995) The new issues puzzle. J Financ 50:23–51

Malkiel GB (2003) The efficient market hypothesis and Its critics. J Econ Perspect 17:59–82

Markowitz H (1952) Portfolio selection. J Financ 7:77–91

Marsh T, Pfleiderer P (2012) Black swans and the financial crisis. Rev Pac Basin Financ Markets Policies 15:1–12

Michaely R, Thaler R, Womack K (1995) Price reactions to dividend initiations and omissions. J Financ 50:573–608

Muth J (1961) Rational expectation and the theory of price movements. Econometrica 29:1–23

Nelson DB (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59:347–370

Pindyck RS (1984) Risk, inflation, and the stock market. Am Econ Rev 74:335–351

Poterba TM, Summers LH (1986) The persistence of volatility and stock market fluctuations. Am Econ Rev 76:1142–1151

Ritter J (1991) The long-term performance of initial public offerings. J Financ 46:3–27

Roll R (1986) The hubris hypothesis of corporate takeovers. J Bus 59:197–216

Schwert GW (1989) Why does stock market volatility change over time. J Financ 44:1115–1154

Sentance A, Taylor MP, Wieladek T (2012) How the UK economy weathered the financial storm. J Int Money Financ 31:102–123

Sharpe W (1964) Capital asset prices: a theory of market equilibrium under conditions of risk. J Financ 19:425–442

Shin H (2009) Reflections on Northern Rock: the bank run that heralded the global financial crisis. J Econ Perspect 23:101–119

Spiess D, Affleck-Graves J (1995) Underperformance in long-run stock returns following seasoned equity offerings. J Financ Econ 38:243–267

Susmel R, Engle R (1994) Hourly volatility spillovers between international equity markets. J Int Money Financ 13:3–25

Timmermann A, Granger CWJ (2004) Efficient market hypothesis and forecasting. Int J Forecast 20:15–27

Veronesi P (1999) Stock market overreaction to bad news in good times: a rational expectations equilibrium model. Rev Financ Stud 12:975–1007

Acknowledgments

We thank an anonymous referee for several useful comments. Any remaining errors are the authors’ responsibility.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Choudhry, T., Jayasekera, R. Level of efficiency in the UK equity market: empirical study of the effects of the global financial crisis. Rev Quant Finan Acc 44, 213–242 (2015). https://doi.org/10.1007/s11156-013-0404-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-013-0404-6