Abstract

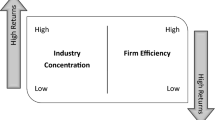

The main purpose of this paper is to provide direct evidence that product market structure affects stock returns. This is not only through industry concentration, as found in Hou and Robinson (J Finance 61:1927–1956, 2006), but also based on firms’ product substitutability and industry market size. Furthermore, the predictive power of product substitutability and market size for stock returns is not subsumed by industry concentration. Our results highlight the multi-dimensional structure of product market competition and its impact on asset prices.

Similar content being viewed by others

Notes

A notable exception is Melicher et al. (1976), who examined the relationship between concentration and stock returns for 495 firms for the period 1967–1974, and documented only “average” returns for the shareholders of high concentration ratio firms.

However, some studies are skeptical that market structure affects a firm’s R&D expenditure. For example, Cohen and Levin (1989), using panel data models along with controls for technology, document that the supposed relationship between market concentration and the amount a company invests in research and development disappears.

One could argue that stock returns are related to the direct measures of barriers to entry, since those firms in industries with high barriers to entry will face lesser distress risk, thereby lowering expected returns. However, Hou and Robinson (2006) argue that the direct measures of barriers to entry are either unattractive or, at best, incomplete, since barriers to entry reflect the strategic choices of incumbents firms as well as the primitive levels of industry production technology.

Although the firms in higher concentration ratios have larger sales, it need not necessarily imply that industries associated with these firms also have larger sales on average. For this to happen there should also be more number of firms in the higher concentration ratio industries. In fact we found a negative correlation between Herfindhal–Hirschman index and the number of firms. This is consistent with the notion that we observe less competition in the higher concentration ratio industries partly because of fewer numbers of firms being present in them.

We also used the 1- and 2-year average returns from the CRSP value-weighted index in order to classify the market states; we found similar results as those reported here.

References

Aghion P, Bloom N, Blundell R, Griffith R, Howitt P (2001). Empirical estimates of the relationship between product market competition and innovation. Mimeo

Aguerrevere F (2009) Real options, product market competition and asset returns. J Finance 64:957–983

Ali A, Klasa S, Yeung E (2009) The limitations of industry concentration measures constructed with compustat data: implications for finance research. Rev Finan Stud 22:3839–3871

Bain J (1956) Barriers to new competition. Harvard University Press, Cambridge, MA

Bernier G (1987) Market power and systematic risk: an empirical analysis using Tobin’s Q ratio. J Econ Bus 39:91–99

Besanko D, Dranove R, Shanley M (2000) Economics of strategy. Wiley, New York

Booth L (1981) Market structure uncertainty and the cost of capital. J Bank Finance 5:467–482

Carlton D, Perloff J (1994) Modern industrial organization. Harper Collins College Publishers, New York

Chan K, Lakonishok J, Sougiannis T (2001) The stock market valuation of research and development expenditures. J Finance 56:2431–2456

Chen K, Cheng D, Hite G (1986) Systematic risk and market power: an application of Tobin’s Q. Q J Econ Bus Autumn 26:58–72

Cohen W, Levin R (1989) Innovation and market structure. In: Schmalensee R, Willing R (eds) Handbook of industrial organization. Elsevier, Amsterdam

Collins N, Preston L (1969) Price-cost margins and industry structure. Rev Econ Stat 51:271–286

Cooper M, Gutierrez R Jr, Hameed A (2004) Market states and momentum. J Finance 59:1345–1365

Cooper M, Gulen H, Schill M (2008) Asset growth and the cross-section of stock returns. J Finance 63:1609–1652

Curley A, Hexter J, Choi D (1982) The cost of capital and the market power of firms: a comment. Rev Econ Stat 64:519–523

Demsetz H (1973) Industry structure, market rivalry and public policy. J Law Econ 16:1–10

Demsetz H (1997) The economics of the firm: seven critical commentaries. Cambridge University Press, Cambridge

Fama E, French K (1992) The cross-section of expected stock returns. J Finance 47:427–465

Fama E, MacBeth J (1973) Risk, return and equilibrium: empirical tests. J Polit Econ 81:607–636

Gaspar J, Massa M (2006) Idiosyncratic volatility and product market competition. J Bus 79:3125–3152

Hoberg G, Phillips G (2010) Real and financial industry booms and busts. J Finance 65:45–86

Hou K, Robinson DT (2006) Industry concentration and average stock returns. J Finance 61:1927–1956

Karuna C (2007) Industry product market competition and managerial incentives. J Account Econ 43:275–297

Kothari S, Laguerre T, Leone A (2002) Capitalization versus expensing: evidence on the uncertainty of future earnings from capital expenditures versus R&D outlays. Rev Acc Stud 7:355–382

Lee C, Liaw K, Rahman S (1990) Impacts of market power and capital-labor ratio on systematic risk: a Cobb-Douglas approach. J Econ Bus 42:237–241

Lerner A (1934) The concept of monopoly and the measurement of monopoly power. Rev Econ Stud 3:157–175

Lev B, Sougiannis T (1996) The capitalization, amortization and value-relevance of R&D. J Account Econ 21:107–138

Mann M (1966) Seller concentration, barriers to entry and rates of return in thirty industries. Rev Econ Stat 48:296–307

Mas-Colell A, Whinston M, Green J (1995) Microeconomic theory. Oxford University Press, New York

Melicher R, Rush D, Winn D (1976) Degree of industry concentration and market risk-return performance. J Finan Q Anal 11:627–635

Moyer RC, Chatfield R (1983) Market power and systematic risk. J Econ Bus 35:123–130

Nevo A (2001) Measuring market power in the ready-to-eat cereal industry. Econometrica 69:307–342

Pastor L, Veronesi P (2009) Technological revolutions and stock prices. Am Econ Rev 99:1451–1483

Penman S, Zhang X (2002) Accounting conservatism, the quality of earnings and stock returns. Account Rev 77:237–264

Peress J (2010) Product market competition, insider trading and stock market efficiency. J Finance 65:1–43

Peyser P (1999) Firm-theoretic limitations on proposition III. Rev Quant Financ Acc 12:65–88

Qualls D (1972) Concentration barriers to entry and long-run economic profit margins. J Indus Econ 20:146–158

Raith M (2003) Competition, risk, and managerial incentives. Am Econ Rev 93:1425–1436

Rhoades S (1979) Concentration, barriers and rates of return: a note. J Indus Econ 19:82–88

Schumpeter J (1912) The theory of economic development. Harvard University Press, Cambridge, Mass

Subrahmanyam M, Thomadakis S (1980) Systematic risk and the theory of the firm. Quart J Econ 94:437–451

Sullivan T (1978) The cost of capital and the market power of firms. Rev Econ Stat 60:209–217

Sullivan T (1982) The cost of capital and the market power of firms: reply and correction. Rev Econ Stat 64:525–532

Sutton J (1991) Sunk costs and market structure. MIT Press, Cambridge

Symeonidis G (2002) The effects of competition: Cartel policy and the evolution of strategy and structure in British industry. The MIT Press, Cambridge

Thomadakis S (1976) A model of market power, valuation and the firm’s return. Bell J Econ Manage Sci 7:150–162

Tu A, Chen S (2000) Bank market structure and performance in Taiwan before and after the 1991 liberalization. Rev Pac Basin Finan Mark Policies 3:475–490

Van H (1982) Corporate monopoly power and risk. Eur Econ Rev 18:115–124

Wallace M, Watson S, Yandle B (1988) Environmental regulation: a financial markets test. Q Rev Econ Bus (Spring):69–87

Weisss L (1974) The concentration-profit relationship and antitrust. In: Goldschmid HJ et al (eds) Industrial concentration: the new learning. Little, Brown, Boston, pp 201–220

Acknowledgments

I am grateful to C.F. Lee (the editor) and special thanks are due to two anonymous referees for many constructive and illuminating comments and suggestions, which immensely helped me improve the paper. I am responsible for any errors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sharma, V. Stock returns and product market competition: beyond industry concentration. Rev Quant Finan Acc 37, 283–299 (2011). https://doi.org/10.1007/s11156-010-0205-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-010-0205-0