Abstract

We analyze telecommunications prices in Mexico by using a panel data of countries similar to Mexico to estimate demand models for mobile and fixed-line telecommunications. We find that Mexico’s actual mobile and fixed-line prices are below the predicted prices based on similar countries’ prices. Mexican consumers are paying lower prices than what one would expect based on comparisons of comparable countries. We calculate that in 2011 Mexican consumers received at least $4–$5 billion (USD) in consumer surplus from these lower mobile prices and in 2010 they received over $1 billion (USD) in consumer surplus from these lower fixed-line prices. These findings are in contrast to the general perception that concentrated telecommunications markets in Mexico are resulting in high prices and harming consumers.

Similar content being viewed by others

Notes

A recent study from the Organization for Economic Cooperation and Development (OECD) published in January 2012 entitled, “Estimation of Loss in Consumer Surplus Resulting from Excessive Pricing of Telecommunication Services in Mexico” concludes that high pricing of Mexico’s telecommunications services caused a loss in consumer surplus estimated at $129.2 billion (USD) from 2005 to 2009, or 1.8 percent of Mexico’s annual GDP, OECD (2012). We have critiqued the OECD (2012) econometric analysis and price data sources extensively in Hausman and Ros (2012).

The remaining BoA/ML upper middle income countries not selected were dropped because of other data constraints such as not having the sufficient yearly data.

Specifically, we used voice revenue per minute from Bank of America–Merrill Lynch because those data are frequently used and represent actual expenditures rather than some other non-market based measures, such as the price for a hypothetical mobile call of a given length. Although errors in variables (EIV) may exist in the Bank of America–Merrill Lynch data as a measure of price, EIV should not present a significant problem because we always treat the price variable as (jointly) endogenous. See, e.g., Hausman (1977).

The FCC also examines the cellular component of the CPI for determining cellular service price trends, see FCC 15th Annual Mobile Wireless Competition Report.

Mexico’s PPP-adjusted price in 2011 Q3 is $0.0582. The mean PPP-adjusted price is $0.105. Mexico is below the 95 % confidence interval for the mean.

See, e.g., Kenndy (2003, pp. 151–152).

A Hausman specification test for the joint endogeneity of price rejects the hypothesis that price is exogenous. The test statistic is 24.8, which is distributed as chi square with 1 degree of freedom. The \(p\) value is 0.00000065. Endogeneity can be a problem because, if unobserved variables jointly affect both the dependent and independent variables, then the coefficient estimates for the independent variables may be biased. An instrument is used to adjust for this problem. An effective instrument will be correlated with the independent variable (in this case, price) but not correlated with the unobserved variables, which are captured by the stochastic error terms.

This approach passes the “weak instrument” tests. Also, the estimate of the price variable coefficient in the demand equation is very precise.

We use the econometric software Eviews for the estimation.

This estimate contrasts with the OECD (2012) results, which finds no effect of GDP per capita in its sample of rich countries.

We estimate a price elasticity of \(-\)0.492 (\(t\) statistic \(=\) 7.94) and a GDP elasticity of 0.608 (t statistic \(=\) 4.21) using PPP-deflated data.

We do a Sargan–Hansen test of over-identification beginning with the results in Table 3 and then including the DLPRICEIV1 instrument from Table 4. The test statistic is 0.46, which is distributed as a chi square with 1 degree of freedom. The \(p\) value is 0.497, which does not reject that the over-identifying restrictions are orthogonal to the stochastic disturbance.

The model passes the Sargan–Hansen test of over-identification: the test statistic is 2.38, which is distributed as chi square with 2 degrees of freedom, so the \(p\) value of the test is 0.304.

The total effect is \(-0.1055/(1-0.7784)\), and the \(t\) statistic is estimated using the delta method.

We also tested the model specification by including a time trend variable, but its effect is small and not significant (with a \(t\) statistic \(=\) 0.503). We also included log of population, but again, the effect is very small and not significant (\(t\) statistic \(=\) 0.456). Lastly, the model passes the Sargan–Hansen test of over-identification, although the \(p\) value is 0.055.

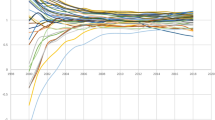

To test how robust are our results, we repeat the comparison of Mexico’s actual and forecasted mobile prices using alternative estimations. Our results are consistent across the alternative forecasting methods: Mexico’s actual mobile prices have fallen below the predicted prices. First, we estimate a model using least squares instead of fixed effects. By 2011, Mexico’s actual mobile price was 55.5-percent below the least-squares forecasted price. Second, we repeat this exercise using least squares but remove Mexico from the sample when we estimate the equation. Using this method, we find that Mexico’s actual mobile price in 2011 was 59.8-percent below the least-squares forecasted price. Third, we do the same estimation but instead use the PPP-adjusted prices. Under this estimation, in 2011, Mexico’s actual mobile prices were 32.3-percent below forecasted prices on a PPP basis. All our estimations show that, when we compare Mexico’s average mobile prices with forecasted prices based on other countries’ prices and the average of other countries’ prices, Mexico has had lower prices since about mid-2006. By 2011, Mexico’s actual mobile prices were significantly lower than the forecasted prices, by 32 % or more.

For the development of the consumer surplus equations, see Hausman (2003).

Anomalous price data for five countries required us to reduce the sample size of peer countries.

The countries that we dropped from the analysis due to missing and anomalous data were Argentina, Chile, Colombia, Poland, and South Africa.

The finding for exogeneity of price in fixed line may well arise, in part, because fixed line prices are set by regulation, not by competition, in some countries in the sample.

These results are on the high side of previous findings, see Garbacz and Thompson (2007).

OECD (2012, p. 44 tbl.39).

References

Baltagi, B. (2008). Econometric analysis of panel data (4th ed.). Chichester: Wiley.

Baltagi, B. (2011). Econometrics (5th ed.). Springer, Berlin.

Deaton, A. (2010). Price indexes, inequality, and the measurement of world poverty. American Economic Review, 100(1), 5–34.

Garbacz, C., & Thompson, H. (2007). Demand for telecommunications services in developing countries. Telecommunications Policy, 32, 276–289.

Greene, W. (2003). Econometric analysis (5th ed.). Upper Saddle River, NJ: Prentice Hall.

Hausman, J. (1977). Errors in variables in simultaneous equation models. Journal of Econometrics, 5, 398–402.

Hausman, J. (1978). Specification tests in econometrics. Econometrica, 46, 1251, 1262–63, 1273.

Hausman, J. (1997a). Valuation of new goods under perfect and imperfect competition. In T. Bresnahan & R. Gordon (Eds.), The economics of new goods. Chicago: University of Chicago Press.

Hausman, J. (1997b). Valuing the effect of regulation on new services in telecommunications. Brookings papers on economic activity. Microeconomics, 1–38.

Hausman, J. (2003). Sources of bias and solutions to bias in the CPI. Journal of Economic Perspectives, 17, 23–44.

Hausman, J. (2010). Mobile phones in developing countries. MIT Working Paper. Cambridge, MA.

Hausman, J., & Leonard, G. (2002). The competitive effects of a new product introduction: A case study. Journal of Industrial Economics, 50(3), 237–263.

Hausman, J., & Ros, A. (2012). Correcting the OECD’s erroneous assessment of telecommunications competition in Mexico. CPI Antitrust Chronicle. http://www.competitionpolicyinternational.com/correcting-the-oecd-s-erroneous-assessment-of-telecommunications-competition-in-mexico.

Hausman, J., & Taylor W. (1981). Panel data and unobservable individual effects. Econometrica, 49, 1377–1398.

Hausman, J., et al. (1994). Competitive analysis with differentiated products. Annales D’Economie et de Statistique, 34, 159–180.

Hsiao, C. (2003). Analysis of panel data. Cambridge: Cambridge University Press.

Karacuka, M., Haucap, J., & Heimeshoff, U. (2011). Competition in Turkish mobile telecommunications markets: Price elasticities and network substitution. Telecommunications Policy, 35, 202–210.

Kathuria, R., Uppal, R. & Mamta, (2009). An econometric analysis of the impact of mobile. Policy Paper Series Vodafone Public Policy Series No. 9, UK. www.icrier.org/pdf/public_policy19jan09.pdf.

Kennedy, P. (2003). A guide to econometrics (5th ed.). Cambridge, MA: MIT Press.

Lee, D., & Lee, D. (2006). Estimating consumer surplus in the mobile telecommunications market: The case of Korea. Telecommunications Policy, 30, 424–444.

Madden, G., Coble-Neal, G., & Dalzell, B. (2004). A dynamic model of mobile telephony subscription incorporating a network effect. Telecommunications Policy, 28, 133–144.

Nevo, A. (2001). Measuring market power in the ready-to-eat cereal industry. Econometrica,69, 307–342.

OECD. (2011). Communications outlook 2011.

OECD. (2012). Marta Stryszowska, estimation of loss in consumer surplus resulting from excessive pricing of telecommunications services in Mexico. OECD Digital Economy Papers No. 191.

Waverman, L., Meschi, M., & Fuss, M. (2005). The impact of telecoms on economic growth in developing countries. The Policy Paper Series Vodofone Public Policy Series No. 2. http://www.vodafone.com/content/dam/vodafone/about/public_policy/policy_papers/public_policy_series_2.pdf

Acknowledgments

The work in this paper was in part based upon a report that was commissioned and funded by América Móvil, the fixed-line provider and largest mobile carrier in Mexico. The views expressed here, however, are solely the authors. The authors thank Douglas Umana for research and data analysis.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hausman, J.A., Ros, A.J. An econometric assessment of telecommunications prices and consumer surplus in Mexico using panel data. J Regul Econ 43, 284–304 (2013). https://doi.org/10.1007/s11149-013-9212-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-013-9212-0