Abstract

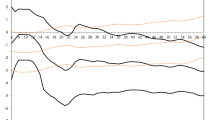

We examine the record of the CD Howe’s shadow Monetary Policy Council (SMPC) in Canada. We report a considerable diversity of opinion about the recommended future path of interest rates inside the SMPC. During the period of Bank of Canada forward guidance, market determined forward rates diverge considerably from the recommendations implied by the SMPC. Nevertheless, there is little evidence that the Bank of Canada and the SMPC coordinate their future views about the interest rate path. Finally, changes in views about future changes in policy rates for horizons beyond the next two interest rate decisions are difficult to explain. Our findings imply that there remain challenges in understanding the evolution of future interest rate paths over time. We conclude with some policy implications.

Similar content being viewed by others

Notes

At the time of this writing, the CDHI’s SMPC is the only shadow council which aims at providing independent advice about the appropriate stance of the BoC’s monetary policy. Internationally, there are relatively few such shadow committees. To our knowledge, only the UK has two shadow committees. See also Neuenkirch and Siklos (2013) for empirical evidence for the euro area and the UK.

The data used in this study will be made available on the Central Bank Communication Network’s website (http://www.central-bank-communication.net/).

See, for example, https://www.ecb.europa.eu/press/inter/date/2014/html/sp140804.en.html.

The policy rate is the interest rate target on overnight borrowing by major financial institutions. An operating band is permitted around the target which the Bank can control. See http://www.bankofcanada.ca/monetary-policy-introduction/key-interest-rate/.

Complete details about the Bank’s monetary policy strategy can be found at http://www.bankofcanada.ca/monetary-policy-introduction/framework/inflation-control-target/.

Egert (2010) assesses the effects of central bank communication on the exchange rate in South Africa.

Prior to 2013, the BoC’s policy rate announcement was made on Tuesdays. Since then the Bank has been able to release its quarterly Monetary Policy Report (a further four interim updates of which are also published) earlier permitting the simultaneous release. The SMPC discussed the possibility of delaying its own policy rate announcement but chose to retain the Thursday meeting schedule.

Note that the organizations the professional economists on the SMPC represent do publish forecasts which are routinely discussed inside the SMPC.

For a recent analysis of inflation reports and their clarity, see Bulir et al. (2013).

It is conceivable that the Governing Council was created by former Governor Gordon Thiessen in reaction to the so-called Manley Report (see Manley and Dorin 1992) which essentially concluded that, when it comes to BoC governance, “if it ain’t broke, don’t fix it”. Also, see Laidler (1991). For a recent study of the determinants and consequences of transparency in monetary policy committees, see Hayo and Mazhar (2013).

The current and past membership of the SMPC can be found at http://www.cdhowe.org/monetary-policy-council-2 while the Bank’s current GC membership is available at http://www.bankofcanada.ca/about/corporate-governance/governing-council/.

Bill Robson, President of the C.D. Howe, who created and Chairs the SMPC, also wrote to us that “…reputation in the relevant field of analysis was a key criterion.” He also goes on to add, in private correspondence with us: “…it has always seemed more congenial to have our academic members be from different institutions and our business members be from different companies.” Finally, he adds: “…former senior BoC [Bank of Canada] employees, though extensively consulted over the SMPC’s mandate and operations, have never been invited to join it.”

Notably, the Globe and Mail (http://www.theglobeandmail.com/) and the National Post (http://www.nationalpost.com/index.html).

Another distinction is whether the path is purely model-driven or represents the views of the policy making committee members. Several authors (e.g., Kool and Thornton 2012; Karagedikli and Siklos 2013, and references therein) examine the impact of forward interest rate paths on yields and the exchange rate. The evidence of forward guidance on financial market returns is decidedly mixed.

He (2010) found that the policy did move yields in the desired direction, as did Siklos and Spence (2010), while Siklos and Neuenkirch (2014) examined the effect of the BoC’s conditional commitment on the CDHI’s SMPC current policy rate recommendation. They conclude that the conditional commitment has a significantly larger negative effect on the SMPC’s recommendation than on the policy rate set by the GC itself.

The Fed has the advantage in this context of being able to rely on its dual mandate to maintain price stability while striving to support an economy that operates at capacity.

The dove is defined as the SMPC member who recommends the lowest policy rate for the BoC for the upcoming overnight rate setting by the Bank. Obviously, the most hawkish member recommends the highest policy rate. There can be more than one dove or hawk at the conclusion of an SMPC meeting. Also, the individual labelled as dove or hawk can, and does of course, change over time.

Siklos and Neuenkirch (2014) find, in case of the proposal for the upcoming meeting, that differences between the SMPC and GC are partly driven by the fact that the former assumes a higher steady state real interest rate than the latter. In contrast, there are few differences in both committees’ responses to inflation and output shocks.

Undoubtedly, the BoC garners relatively more public attention than the SMPC. Whether this affects the empirical results in this paper or not remains unclear. Nevertheless, as previously mentioned, the SMPC’s recommendations are regularly discussed in the Canadian media.

12-month ahead recommendations are published since January 2010. The resulting small sample (28 observations) makes it unattractive to utilize these data.

Unfortunately, we are unable to obtain a long enough sample for a 6 months ahead BA yield.

Bankers’ acceptances are short-term obligations that are accepted by banks such that there is a guarantee of repayment of principal and interest. For additional details, see http://www.m-x.ca/f_publications_en/BA_en.pdf.

To conserve space, detailed variable definitions are relegated to an unpublished appendix available on request.

Note that forecasting the BoC in the post-conditional commitment period is not feasible since there is no variation in the policy rate.

The sole exception is the interest rate paths recommended by SMPC doves when considering the full sample period.

One obvious difference between the BoC and the Fed studied by Blinder (2004) is that the former follows a numerical inflation target while the latter central bank did not at the time. Differences in outlook (both inflation and real GDP growth, among other variables) could also be a factor resulting in biased forecasts.

As part of our robustness tests, we include the contemporaneous inflation gap in Eq. (2). However, this variable is insignificant in all three specifications. This can be seen as evidence that SMPC members react rather to changes in forward-looking variables than to the contemporaneous inflation gap.

As part of our robustness tests, we include the contemporaneous absolute inflation gap in Eq. (3). However, this variable is insignificant in all three specifications. Consequently, current deviations from target do not significantly increase the diversity of opinions within the SMPC.

For instance, Bhattacharjee and Holly (2010) analyze committee behaviour within the BoE’s Monetary Policy Committee. Such a more detailed analysis of committee decision‐making in the context of forward guidance would be an interesting point for future research.

References

Bank of England (2013) Forward guidance. http://www.bankofengland.co.uk/monetarypolicy/Pages/forwardguidance.aspx

Bhattacharjee A, Holly S (2010) Rational Partisan theory, uncertainty, and spatial voting: evidence for the Bank of England’s MPC. Econ Polit 22:151–179

Blinder A (2004) Quiet revolution: central banking goes modern. Yale University Press, New Haven

Bulir A, Cihak M, Jansen D-J (2013) What drives clarity of Central Bank communication about inflation? Open Econ Rev 24:125–145

Carney M (2013a) “Canada Works”. Speech given to the Board Of Trade of Metropolitan Montreal, 21 May, http://www.bankofcanada.ca/2013/05/publications/speeches/canada-works/

Carney M (2013b). Monetary Policy after the Fall. Eric J. Hanson Memorial Lecture, University of Alberta. http://www.bankofcanada.ca/2013/05/speeches/monetary–policy–after–the–fall/

Coeuré B (2013) The economic consequences of low interest rates. Public Lecture at the International Center for Monetary and Banking Studies, 9 October, http://www.ecb.europa.eu/press/key/date/2013/html/sp131009.en.html

Egert B (2010) The impact of monetary and commodity fundamentals, macro news and central bank communication on the exchange rate: evidence from South Africa. Open Econ Rev 21:655–677

Filardo A, Hofmann B (2014) Forward guidance at the zero lower bound. BIS Quarterly Review, March, 37–53

Hayo B, Mazhar U (2013) Monetary policy committee transparency: measurement, determinants, and economic effects. Open Econ Rev, forthcoming

He Z (2010) Evaluating the effect of the Bank of Canada’s conditional commitment policy. Bank of Canada Discussion Paper 2010–11

Karagedikli OÖ, Siklos PL (2013) A bridge too far? RBNZ communication, the forward interest rate track, and the exchange rate. In: Siklos PL, Sturm JE (eds) Central bank transparency, decision-making, and governance: the issues, challenges, and case studies. MIT Press, Cambridge, pp 273–309

Kool C, Thornton D (2012) “How effective is central bank forward guidance?” Federal Reserve Bank of St. Louis Working Paper 2012-063A

Laidler DEW (1991) “How shall we govern the governor? A critique of the governance of the Bank of Canada”, The Canada Round 1 (Toronto: C.D. Howe Institute)

Maier P (2010) How Central Banks Tae decisions: an analysis of monetary policy meetings. In: Siklos P, Bohl M, Wohar M (eds) Challenges in Central Banking. Cambridge University Press, Cambridge, pp 320–356

Manley J, Dorin M (1992) The mandate and governance of the Bank of Canada: First Report of the Sub-Committee on the Bank of Canada. 8th Report of the Standing Committee on Finance, Ottawa: Government of Canada

Neuenkirch M, Siklos PL (2013) What’s in a second opinion? Shadowing the ECB and the Bank of England. Eur J Polit Econ 32:135–148

Newey W, West K (1987) A simple, positive semi-definite, Heteroskedasticity and autocorrelation-consistent covariance matrix. Econometrica 55:703–708

Sibert A (2006) Central banking by committee. Int Financ 9:145–168

Siklos PL, Neuenkirch M (2014) How monetary policy is made: two Canadian Tales. Int J Cent Bank, forthcoming

Siklos PL, Spence A (2010) “Face-off: should the Bank of Canada release its projections of the interest rate path”, C.D. Howe Backgrounder No. 139

Taylor J (1993) Discretion versus policy rules in practice. Carn-Roch Conf Ser Public Policy 39:195–214

Thornton D, Wheelock D (2000) A history of the asymmetric policy directive. Rev Fed Reserv Bank St Louis 82:1–16

Weale M (2013) Forward guidance and its effects. Speech given at the National Institute of Economic and Social Research, London, 11 December. http://www.bankofengland.co.uk/publications/Pages/speeches/2013/697.aspx

White H (1980) A Heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48:817–838

Williams JC (2013) “Forward guidance at the federal reserve”, in: Forward guidance: perspectives from Central Bankers, scholars and market participants. Centre for Economic Policy Research (CEPR), London

Woodford M (2012) Methods of policy accommodation at the interest-rate lower bound. Presented at: “The Changing Policy Landscape”, 2012 FRB Kansas City Economic Policy Symposium, Jackson Hole, WY

Author information

Authors and Affiliations

Corresponding author

Additional information

Research for this paper was carried out in part while the first author visited the Viessmann Centre. Siklos gratefully acknowledges financial assistance from a CIGI-INET research grant. Comments on an earlier draft by three anonymous referees, Ted Carmichael, Stephen Ferris, Stéphane Marion, Avery Shenfeld, and George S. Tavlas (the Editor) are much appreciated. An earlier version was presented at the 2014 Public Choice Society Conference in Charleston, SC. The first author has been a member of the C.D. Howe’s Monetary Policy Council (SMPC) since 2008 (the SMPC exists since 2002) but receives no direction or funding from the C.D. Howe for participating in this group. All members of the SMPC, including the second author, provide an independent opinion on monetary policy issues.

Rights and permissions

About this article

Cite this article

Neuenkirch, M., Siklos, P.L. When is Lift-Off? Evaluating Forward Guidance from the Shadow. Open Econ Rev 25, 819–839 (2014). https://doi.org/10.1007/s11079-014-9328-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-014-9328-6

Keywords

- Bank of Canada

- Central bank communication

- Forward guidance

- Monetary policy committees

- Shadow councils

- Taylor rules