Abstract

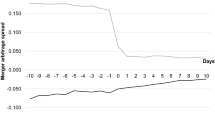

The high separation of ownership from control achieved through the concurrent use of non-voting shares and stock pyramiding could favor acquisitions made to increase private benefits of the controlling shareholders rather than all shareholders’ wealth. A standard event study methodology is carried out on three different samples of Italian acquisitions during the 1989–1996 period in order to test this hypothesis. We find evidence that a worse market reaction characterizes acquiring firms with a higher separation of ownership from control, while more value-enhancing transactions are undertaken by those smaller in size and with higher prior-performance. An entrenchment effect seems to determine a significant U-shaped relationship between the market reaction and the ultimate shareholder ownership. When the sample is restricted to acquiring firms with a dual class equity structure we find that non-voting shares report significantly negative excess returns in contrast to significantly higher positive returns for voting shares. Such evidence seems to indicate that the average acquisition has been overpaid, as suggested by the negative market reaction of the non-voting shares, while it was expected to lead to higher private benefits to the majority shareholders, as suggested by the revaluation of the voting shares. Finally, the market reaction to acquisitions made within pyramidal groups seems to indicate that the price is set so as to transfer wealth towards the companies located at the upper levels, where majority shareholders own greater fractions of the companies’ cash flows.

Similar content being viewed by others

References

Y. Amihud B. Lev (1981) ArticleTitle“Risk Reduction as a Managerial Motive for Conglomerate Mergers” Bell Journal of Economics 12 605–617

P. Asquith (1983) ArticleTitle“Merger bids, Uncertainty, and Stockholder returns” Journal of Financial Economics 11 51–83

E. M. Bigelli Bajo S. Sandri (1998) ArticleTitle“The Stock Market Reaction to Investment Decisions: Evidence from Italy” Journal of Management and Governance 2 1–16

W.J. Baumol (1959) Business Behaviour, Value and Growth McMillan New York

L.A. Bebchuk R. Kraakman G. Triantis (2000) “Stock Pyramids, Crossownership, and Dual Class Equity: The Creation and Agency Costs of Separating Control from Cash Flow Rights” R. Morck (Eds) Concentrated Corporate Ownership 2000, National Bureau of Economic Research Conference Volume University of Chicago Press Chicago

D.A. Belsley E. Kuh R.E. Welsch (Eds) (1980) Regression diagnostics: Identifying influential data and sources of collinearity John Wiley & Sons New York

M. Bianchi M. Bianco L. Enriques (1998) “Pyramidal Groups and the Separation Between Ownership and Control in Italy” F. Barca M. Becht (Eds) The Control of Corporate Europe Oxford University Press Oxford

Bigelli M.: 2004 “Dual Class Stock Unifications and Shareholder Expropriation”, SSRN Working Paper.

F. Brioschi L. Buzzacchi G. Colombo (1989) ArticleTitle“Risk, Capital Financing and the Separation of Ownership and Control in Business Groups” Journal of Banking and Finance 13 747–772

M. Bradley A. Desai E.H. Kim (1988) ArticleTitle“Synergistic Gains from Corporate Acquisitions and Their Division Between the Stockholders of Target and Acquiring Firm” Journal of Financial Economics 21 3–40

Brown, W.O. and M.T. Maloney: 2000, “Exit, Voice, and the Role of Corporate Directors: Evidence from Acquisition Performance”, Working Paper, mimeo

J. Byrd K. Hickman (1992) ArticleTitle“Do outside Directors Monitors Managers? Evidence from Tender Offer Bids” Journal of Financial Economics 32 195–221

A. Buysschaert M. Deloof M. Jegers (2004) ArticleTitle“Equity Sales in Belgian Corporate Groups: Expropriation of Minority Shareholders? A Clinical Study” Journal of Corporate Finance 10 81–103

J.M. Campa I. Hernando (2004) ArticleTitle“Shareholder Value Creation on European M&A” European Financial Management 10 47–81

L. Caprio E. Bertotto (1995) ArticleTitleMercato Azionario e Processo di Crescita Esterna Delle Imprese Italiane in Acquisizioni, Fusioni e Concorrenza 2 51–77

Cheung Y., P.R. Rau and A. Stouraitis: 2004, “Tunneling, Propping and Expropriation – Evidence from Connected Party Transactions in Honk Kong” –, SSRN Working Paper, forthcoming on Journal of Financial Economics.

Claessens, S., S. Djankov, J. Fan and L.H.P. Lang: 1999, “Expropriation of Minority Shareholders in East Asia”, World Bank Working Paper, 2088.

A. Dick L. Zingales (2004) ArticleTitle“Private Benefits of Control: An International Comparison” Journal of Finance 59 537–600

P. Dodd (1980) ArticleTitle“Merger Proposal, Management Discretion, and Stockholder Wealth” Journal of Financial Economics 8 105–138

P. Dodd R. Ruback (1977) ArticleTitle“Tender Offers and Stockholder Returns: An Empirical Analysis” Journal of Financial Economics 5 105–138

M. Faccio L.H.P Lang (2002) ArticleTitle“The Ultimate Ownership of Western European Corporations” Journal of Financial Economics 65 365–395

Faccio, M. and D. Stolin: 2004, “Expropriation vs. Proportional Sharing in Corporate Acquisitions”, Working paper, Vanderbilt University.

Faccio, M., J.J. McConnel and D. Stolin: 2004, “When do Bidders Gain? The Difference in Returns to Acquirers of Listed and Unlisted Targets”, Working Paper, (Vanderbilt University).

E. Fama M.C. Jensen (1983) ArticleTitle“Separation of Ownership and Control” Journal of Law and Economics 26 301–325

M. Goergen L. Renneboog (2004) ArticleTitle“Shareholder Wealth Effects of European Domestic and Cross-Border Takeover Bids” European Financial Management 10 9–45

J. Harford (1999) ArticleTitle“Corporate Cash Reserves and Acquisitions” Journal of Finance 54 1969–1997

C.G. Holderness R.S. Kroszner D.P. Sheehan (1999) ArticleTitle“Where the Good Old Days That Good? Changes in Managerial Stock Ownership Since the Great Depression” Journal of Finance 54 435–469

M. Holmen J.D. Knopf (2004) ArticleTitle“Minority Shareholders Protections and the Private Benefits of Control for Swedish Mergers” Journal of Financial and Quantitative Analysis 39 167–191

G.A. Jarrell J.A. Brickley J.M. Netter (1988) ArticleTitle“The Market for Corporate Control: The Empirical Evidence Since 1980” Journal of Economic Perspectives 2 49–68

M.C. Jensen (1986) ArticleTitle“Agency Costs of Free Cash Flow, Corporate Finance and Takeovers” American Economic Review 76 323–329

M.C. Jensen W. Meckling (1976) ArticleTitle“Theory of the Firm: Managerial Behavior, Agency Cost, and Ownership Structure” Journal of Financial Economics 11 5–50

M.C. Jensen R.S. Ruback (1983) ArticleTitle“The Market for Corporate Control: The Scientific Evidence” Journal of Financial Economics 11 5–50

R. La Porta F. Lopez-de-Silanes A. Schleifer R.W. Vishny (1997) ArticleTitle“Legal Determinants of External Finance” Journal of Finance 52 1131–1150

R. La Porta F. Lopez-de-Silanes A. Schleifer R.W. Vishny (1998) ArticleTitle“Law and Finance” The Journal of Political Economy 106 1113–1155

R. La Porta F. Lopez-de-Silanes A. Schleifer (1999) ArticleTitle“Corporate Ownership Around the World” Journal of Finance 54 471–518

L.H.P. Lang R.M. Stulz R.A. Walkling (1989) ArticleTitle“Tobin’s Q and the Gain from Successful Tender Offers” Journal of Financial Economics 24 137–154

L.H.P. Lang R.M. Stulz R.A. Walkling (1991) ArticleTitle“A Test of the Free Cash Flow Hypothesis: The Case of Bidder Returns” Journal of Financial Economics 29 315–335

W. Lewellen C. Loderer A. Rosenfeld (1985) ArticleTitle“Merger Decisions and Executive Ownership in Acquiring Firms” Journal of Accounting and Economics 7 209–231

T. Loughran A.M. Vijh (1997) ArticleTitle“Do Long-Term Shareholders Benefit from Corporate Acquisitions?” Journal of Finance 5 1765–1790

Manne (1964) ArticleTitle“Some Theoretical Aspects of Share Voting” Columbia Law Review 64 1417–1445

J.J. McConnell H. Servaes (1990) ArticleTitle“Additional Evidence on Equity Ownership and Corporate Value” Journal of Financial Economics 27 595–612

M.L. Mitchell K. Lehn (1990) ArticleTitle“Do Bad Bidders Become Good Targets?” Journal of Political Economy 98 372–398

R. Morck A. Shleifer R.W. Vishny (1988) ArticleTitle“Management Ownership and Market Valuation: An Empirical Analysis” Journal of Financial Economics 20 293–315

R. Morck A. Shleifer R.W. Vishny (1990) ArticleTitle“Do Managerial Objectives Drive Bad Acquisitions?” Journal of Finance 45 31–48

T. Nenova (2003) ArticleTitle“The Value of Corporate Votes and Control Benefits: A Cross-Country Analysis” Journal of Financial Economics 68 325–351

J Neter M.H. Kutner C.J. Nachtsheim W. Wasserman (1996) Applied Linear Statistical Models Irwin Chicago

G. Nicodano (1998) ArticleTitle“Corporate Groups, Dual Class Shares and the Value of Voting Rights” Journal of Banking and Finance 22 1117–1137

T. Opler L. Pinkowitz R. Stulz R. Williamson (1999) ArticleTitle“The Determinants and Implications of Corporate Holdings of Liquid Assets” Journal of Financial Economics 52 3–46

P.R. Rau T. Vermaelen (1998) ArticleTitle“Glamour, Value and the Post-Acquisition Performance of Acquiring Firms” Journal of Financial Economics 49 223–253

R. Roll (1986) ArticleTitle“The Hubris Hypothesis of Corporate Takeovers” Journal of Business 59 197–216

A. Shleifer R.W. Vishny (1997) ArticleTitle“A Survey of Corporate Governance” Journal of Finance 52 737–783

H. White (1980) ArticleTitle“A Heterosckedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heterosckedasticity” Econometrica 48 817–838

L. Zingales (1994) ArticleTitle“The Value of the Voting Right: A Study of Milan Stock Exchange Experience” Review of Financial Studies 7 125–148

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Codes: G34, G14

A previous version of this paper was presented at the 1999 EFMA Conference in Paris, 1999 EFA Conference in Helsinki, and 1999 Australasian Banking and Finance Conference in Sydney. We would like to thank for helpful comments and suggestions, in alphabetical order: Lorenzo Caprio, Mara Faccio, Katiuscia Manzoni, Giovanni Siciliano, Sandro Sandri, the two anonymous referees and the editor. We would also like to thank Mara Faccio for providing ownership data. All remaining errors are ours.

Rights and permissions

About this article

Cite this article

Bigelli, M., Mengoli, S. Sub-Optimal Acquisition Decisions under a Majority Shareholder System. J Manage Governance 8, 373–405 (2004). https://doi.org/10.1007/s10997-004-4896-2

Issue Date:

DOI: https://doi.org/10.1007/s10997-004-4896-2