Abstract

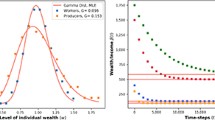

We present and analyze a model for the evolution of the wealth distribution within a heterogeneous economic environment. The model considers a system of rational agents interacting in a game theoretical framework, through fairly general assumptions on the cost function. This evolution drives the dynamic of the agents in both wealth and economic configuration variables. We consider a regime of scale separation where the large scale dynamics is given by a hydrodynamic closure with a Nash equilibrium serving as the local thermodynamic equilibrium. The result is a system of gas dynamics-type equations for the density and average wealth of the agents on large scales. We recover the inverse gamma distribution as an equilibrium in the particular case of quadratic cost functions which has been previously considered in the literature.

Similar content being viewed by others

References

Aumann, R.: Existence of competitive equilibria in markets with a continuum of traders. Econometrica 32, 39–50 (1964)

Bachelier, L.: Théorie de la spéculation. Ann. Sci. Éc. Norm. Super. 3, 21–86 (1900)

Benaïm, M., Rossignol, R.: A modified Poincaré inequality and its application to First Passage Percolation (2006). Preprint. arXiv:math/0602496

Benaïm, M., Rossignol, R.: Exponential concentration for first passage percolation through modified Poincaré inequalities. Ann. Inst. Henri Poincaré Probab. Stat. 44, 544–573 (2008)

Blanchet, A., Carlier, G.: Optimal transport and Cournot-Nash equilibria (2012). Preprint. arXiv:1206.6571

Blanchet, A., Mossay, P., Santambrogio, F.: Exsitence and uniqueness of equilibrium for a spatial model of social interactions (2012). Preprint

Bouchaud, J.-P., Mézard, M.: Wealth condensation in a simple model of economy. Physica A 282, 536–545 (2000)

Cardaliaguet, P.: Notes on Mean Field Games (from P.-L. Lions’ lectures at Collège de France) (2012)

Chakrabarti, B.K., Chakraborti, A., Chatterjee, A.: Econophysics and Sociophysics: Trends and Perspectives. Wiley, Berlin (2006)

Cordier, S., Pareschi, L., Toscani, G.: On a kinetic model for a simple market economy. J. Stat. Phys. 120, 253–277 (2005)

Corneo, G., Jeanne, O.: Status, the distribution of wealth, and growth. Scand. J. Econ. 103, 283–293 (2001)

Degond, P., Liu, J.-G., Ringhofer, C.: Large-scale dynamics of mean-field games driven by local Nash equilibria. J. Nonlinear Sci. (2013, to appear). doi:10.1007/s00332-013-9185-2

Düring, B., Toscani, G.: Hydrodynamics from kinetic models of conservative economies. Physica A 384, 493–506 (2007)

Edgeworth, F.Y.: Mathematical Psychics: An Essay on the Application of Mathematics to the Moral Sciences. Kegan Paul, London (1881)

Fershtman, C., Weiss, Y.: Social status, culture and economic performance. Econ. J. (Lond.) 103, 946–959 (1993)

Galor, O., Zeira, J.: Income distribution and macroeconomics. Rev. Econ. Stud. 60, 35–52 (1993)

Garip, F.: The impact of migration and remittances on wealth accumulation and distribution in rural Thailand. Report, Department of Sociology, Harvard University, USA

Lasry, J.-M., Lions, P.-L.: Mean field games. Jpn. J. Math. 2, 229–260 (2007)

Ledoux, M.: Deviation inequalities on largest eigenvalues. In: Geometric Aspects of Functional Analysis. Lecture Notes in Mathematics, vol. 1910, pp. 167–219. Springer, Berlin (2007)

Maldarella, D., Pareschi, L.: Kinetic models for socio-economic dynamics of speculative markets. Physica A 391, 715–730 (2012)

Mas-Colell, A.: On a theorem of Schmeidler. J. Math. Econ. 13, 201–206 (1984)

Mckenzie, D., Rapoport, H.: Network effects and the dynamics of migration and inequality: theory and evidence from Mexico. J. Dev. Econ. 84, 1–24 (2007)

Monderer, D., Shapley, L.S.: Potential games. Games Econ. Behav. 14, 124–143 (1996)

Naldi, G., Pareschi, L., Toscani, G. (eds.): Mathematical Modeling of Collective Behavior in Socio-Economic and Life Sciences. Birkhauser, Boston (2010)

Nash, J.F.: Equilibrium points in n-person games. Proc. Natl. Acad. Sci. USA 36, 48–49 (1950)

Øksendal, B.: Stochastic Differential Equations, An Introduction with Applications, 5th edn. Springer, Berlin (2010)

Pareto, V.: La Courbe de la Repartition de la Richesse (Originally published in 1896). In: Busino, G. (ed.) Oeuvres Complètes de Vilfredo Pareto, pp. 1–5. Droz, Geneva (1965)

Robson, A.J.: Status, the distribution of wealth, private and social attitudes to risk. Econometrica 60, 837–857 (1992)

Schmeidler, D.: Equilibrium points of nonatomic games. J. Stat. Phys. 7, 295–300 (1973)

Shapiro, N.Z., Shapley, L.S.: Values of large games. I: A limit theorem. Math. Oper. Res. 3, 1–9 (1978)

Silver, J., Slud, E., Takamoto, K.: Statistical equilibrium wealth distributions in an exchange economy with stochastic preferences. J. Econ. Theory 106, 417–435 (2002)

Takayasu, H.: Application of Econophysics. Springer, Tokyo (2004)

Takayasu, H.: Practical Fruits of Econophysics. Springer, Tokyo (2005)

Toscani, G., Brugna, C., Demichelis, S.: Kinetic models for the trading of goods. J. Stat. Phys. 151, 549–566 (2013)

Weiss, Y., Fershtman, C.: Social status and economic performance: a survey. Eur. Econ. Rev. 42, 801–820 (1998)

Yakovenko, V.M., Rosser, J.B. Jr.: Colloquium: statistical mechanics of money, wealth, and income. Rev. Mod. Phys. 81, 1703–1725 (2009)

Acknowledgements

This work has been supported by KI-Net NSF RNMS grant No. 1107291. J.-G. Liu and C. Ringhofer are greatful for the opportunity to stay and work at the Institut de Mathématiques de Toulouse in fall 2012, under the sponsorship of Centre National de la Recherche Scientifique and University Paul–Sabatier. The authors wish to thank A. Blanchet from University Toulouse 1 Capitole for enlighting discussions.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Proof of Lemma 3.5

(i) Introducing the change of variables (3.17) into (3.15) and using Green’s formula, we find (3.16). Green’s formula is applicable and the boundary terms disappear because of the assumptions of smoothness made on f and g.

(ii) We just let σ=φ in (3.16).

(iii) Taking σ=Constant in (3.16), the left-hand side vanishes. Therefore, if (3.18) is not satisfied, there cannot exist a solution. Supposing now that (3.18) is satisfied, we can restrict the set of test functions σ to \({\mathcal{H}}_{\varXi0}\) in the weak formulation (3.16). Indeed, from \(\sigma \in{\mathcal{H}}_{\varXi0}\), we can construct an arbitrary test function in \({\mathcal{H}}_{\varXi}\) by simply adding a constant. But, because (3.18) is satisfied, the weak formulation (3.16) is still true for this test function. Now, because of the assumed Poincaré inequality (3.14), the left-hand side of (3.16) is a coercive bilinear form on \({\mathcal{H}}_{\varXi0}\) while, because of the assumption that \(\psi\in{\mathcal{X}}_{\varXi}\), the right-hand side is a continuous linear form on \({\mathcal{H}}_{\varXi0}\). Therefore, Lax-Milgram’s theorem applies and there exists a unique solution \(\varphi\in{\mathcal{H}}_{\varXi0}\) to problem (3.16). The most general solution is of the form φ+Constant because of point (ii). This ends the proof.

Appendix B: Proof of Lemma 3.13

Let v: \(z \in{\mathbb{R}}_{+} \mapsto v(z) \in{\mathbb{R}}\) such that

where γ α,β (z) is the gamma distribution defined at (3.37). Then, formula (10) of [3] states that there exists a constant C α,β >0 such that

where

Then, we make the change of variables z=1/y in (B.1), (B.2), (B.3). We denote by u(y)=v(z) and use (3.38). We remark that ∂ z v(z)=−y 2 ∂ y u(y). Therefore, we have, denoting by C α,β generic constants only depending only on α and β:

and

and finally,

Now, letting \((\alpha,\beta) = (\frac{\kappa+d}{d}, \frac{\kappa \varUpsilon}{d})\), we notice that v satisfies (B.1) (with α shifted to α+2) if and only if \(u \in{\mathcal{H}}_{\varUpsilon}\). Furthermore, \(\bar{v} = 0\) if and only if \(u \in{\mathcal{H}}_{\varUpsilon0}\). Now, the Poincaré inequality (B.2) (with α shifted to α+2) leads to (3.14).

Rights and permissions

About this article

Cite this article

Degond, P., Liu, JG. & Ringhofer, C. Evolution of the Distribution of Wealth in an Economic Environment Driven by Local Nash Equilibria. J Stat Phys 154, 751–780 (2014). https://doi.org/10.1007/s10955-013-0888-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10955-013-0888-4