Abstract

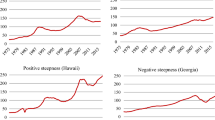

In the last decades, the interest in the relationship between crime and business cycle has widely increased. It is a diffused opinion that a causal relationship goes from economic variables to criminal activities, but this causal effect is observed only for some typology of crimes, such as property crimes. In this work we examine the possibility of the existence of some common factors (interpreted as cyclical components) driving the dynamics of Gross Domestic Product and a large set of criminal types by using the nonparametric version of the dynamic factor model. A first aim of this exercise is to detect some comovements between the business cycle and the cyclical component of some typologies of crime, which could evidence some relationships between these variables; a second purpose is to select which crime types are related to the business cycle and if they are leading, coincident or lagging. Italy is the case study for the time span 1991:1–2004:12; the crime typologies are constituted by the 22 official categories classified by the Italian National Statistical Institute. The study finds that most of the crime types show a counter-cyclical behavior with respect to the overall economic performance, and only a few of them have an evident relationship with the business cycle. Furthermore, some crime offenses, such as bankruptcy, embezzlement and fraudulent insolvency, seem to anticipate the business cycle, in line with recent global events.

Similar content being viewed by others

Notes

It is important to note that in Italy, unlike the United States, such crime does not include intentional damages, like vandalism.

This form of illegal activity is generally associated with false accounting by managers in order to divert resources for personal use and gain.

SAF offences are connected with the sales of adulterated foodstuffs. They include any undesirable adulteration in foodstuffs or reduction or extraction of any natural quality or utility from foodstuffs in order to maintain health and convenience of the general public.

We use (2m + 1) values for ω, with \(\omega_k=1-\frac{|k|}{m+1}\), with \(k=-m, \ldots,m\) and \(m=\hbox{round}(\frac{\sqrt{T}}{4})\), as suggested in Forni et al. (2000).

To save space we do not show these results, that are available on request.

Correlations from lag (lead) 6 to 12 are less than 0.01, so, to save space, we do not report them.

We are in debt to an anonymous referee for this interpretation.

Such choice of a threshold value for the common component correlations and for the variance ratio is quite subjective. The values used here are proposed by Fiorentini and Planas (2003).

The analysis has been performed using different threshold values of the explained variance; remarkably, the results do not change up to a threshold value of 65%, showing a good level of robustness.

References

Altissimo F, Marchetti DJ, Oneto GP (2000) The Italian business cycle: coincident and leading indicators and some stylized facts. Temi di Discussione del Servizio Studi-Banca d’Italia 377

Altissimo F, Bassanetti A, Cristadoro R, Forni M, Lippi M, Hallin M, Reichlin L, Veronese G (2001) Eurocoin: a real time coincident indicator of the Euro area business cycle. CEPR Discussion Paper 3108

Arvanites TM, Defina RH (2006) Business cycles and street crime. Criminology 44:139–164

Bauwens L, Laurent S, Rombouts JVK (2006) Multivariate GARCH models: a survey. J Appl Econom 21:79–109

Becker G (1968) Crime and punishment: an economic approach. J Polit Econ 76:169–217

Box S (1987) Recession, crime and punishment. Palgrave Macmillan, London

Brillinger DR (1981) Time series data analysis and theory. Holden-Day, San Francisco

Bruno G, Otranto E (2008) Models to date the business cycle: the Italian case. Econ Model 25:899–911

Buonanno P (2003) The socioeconomic determinants of crime: a review of the literature. Working papers 63, University of Milano-Bicocca, Department of Economics

Cantor D, Land K (1985) Unemployment and crime rates in the post World War II United States: a theoretical and empirical analysis. Am Sociol Rev 50:317–332

CEPR (2009) Euro area business cycle dating committee: determination of the 2009 Q2 trough in economic activity. CEPR Document

Cohen LE, Felson M (1979) Social change and crime rate trends: a routine activity approach. Am Sociol Rev 44:588–608

Cook PJ, Zarkin GA (1985) Crime and the business cycle. J Legal Stud 14:115–128

Corman H, Joyce T, Lovitch N (1987) Crime, deterrence, and the business cycle in New York: a VAR approach. Rev Econ Stat 69:695–700

Delli Gatti D, Gallegati M, Greenwald BC, Russo A, Stiglitz JE (2009) Business fluctuations and bankruptcy avalanches in an evolving network economy. J Econ Interact Coord 4:195–212

Detotto C, Otranto E (2010) Does crime affect economic growth? Kyklos 63:330–345

Detotto C, Vannini M (2010) Counting the cost of crime in Italy. Glob Crime 11:421–435

Favero CA, Marcellino M, Neglia F (2005) Principal components at work: the empirical analysis of monetary policy with large data sets. J Appl Econ 20:603–620

Fernandez RB (1981) A methodological note on the estimation of time series. Rev Econ Stat 63:471–478

Field S (1990) Trends in crime and their interpretation: a study of recorded crime in post-war England and Wales. Home Office Research Study 119. Home Office, London

Field S (1999) Trends in crime revisited. Home Office Research Study 195. Home Office, London

Fiorentini G, Planas C (2003) Busy program user manual. Joint Research Centre of European Commission Document

Forni M, Hallin M, Lippi M, Reichlin L (2000) The generalised dynamic factor model: identification and estimation. Rev Econ Stat 82:540–554

Forni M, Hallin M, Lippi M, Reichlin L (2001) Coincident and leading indicators for the Euro area. Econ J 111:62–85

Fougre D, Kramarz F, Pouget J (2007) Youth unemployment and crime in france. CREST-INSEE working paper, 33

Gomez V, Maravall A (1997) Program TRAMO (Time Series Regression with ARIMANoise, Missing Observations, and Outliers) and SEATS(SignalExtraction in ARIMA Time Series) Instructions for the User. Madrid, Secretaria de Estado de Hacienda

Gould D, Mustard D, Weinberg B (2002) Crime rates and local labour market opportunities in the United States: 1979–1997. Rev Econ Stat 84:45–61

Greenberg DF (2001) Time series analysis of crime rates. J Q Criminol 17:291–327

Hale C (1998) Crime and the business cycle in post war Britain revisited. Br J Criminol 38:681–698

Hale C (1999) The labour market and post-war crime trends in England and Wales. In: Carlen P, Morgan R (eds) Crime unlimited: questions for the 21st century. Macmillan, London, pp 30–56

Istat (2004) La Sicurezza dei Cittadini. Reati, Vittime, Percezione della Sicurezza e Sistemi di Protezione. Istat, Rome

Mansour JM (2003) Do national business cycles have an international origin? Empir Econ 28:223–247

Mariano RS, Murasawa Y (2003) A new coincident index of business cycles based on monthly and quarterly series. J Appl Econ 18:427–443

Mauro P (1995) Corruption and growth. Q J Econ 110:681–712

Otranto E (2005) Extracting a common cycle from series with different frequency: an application to the Italian economy. J Bus Cycle Meas Anal 2:407–430

Paternoster R, Bushway SD (2001) Theoretical and empirical work on the relationship between unemployment and crime. J Q Criminol 17:391–407

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Pyle DJ, Deadman DF (1994) Crime and business cycle in post-war Britain. Br J Criminol 34:339–357

Rosenfeld R (2009) Crime is the problem: homicide, acquisitive crime, and economic conditions. J Q Criminol 25:287–306

Sargent TJ, Sims CA (1977) Business cycle modelling without pretending to have too much a priori economic theory. In: Sims CA (eds) New methods in business research. Federal Reserve Bank of Minneapolis, Minneapolis

Stock JH, Watson MW (1993) A probability model of the coincident economic indicators. In: Lahiri K, Moore GH (eds) Leading economic indicators: new approaches and forecasting records. Cambridge University Press, New York, pp 63–89

Stock JH, Watson MW (2002) Diffusion indexes. J Bus Econ Stat 20:147–162

Taylor I (2002) Liberal markets and the Republic of Europe: contextualizing the growth of transnational organized crime. In: Berdal MR, Serrano M (eds) Transnational organized crime and international security: business as usual? Lynne Rienner Publisher, London, pp 119--153

Acknowledgements

We would like to thank the three anonymous referees for their detailed reading of the paper and many comments which led to a clearer focus of the paper. We also thank Christophe Planas, Alessio Scano and Marco Vannini for their useful suggestions. Financial support from Italian MIUR under Grants 20087Z4BMK_002 and 2006137221_001 are gratefully acknowledged

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Detotto, C., Otranto, E. Cycles in Crime and Economy: Leading, Lagging and Coincident Behaviors. J Quant Criminol 28, 295–317 (2012). https://doi.org/10.1007/s10940-011-9139-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10940-011-9139-5