Abstract

In this paper, we provide empirical evidence to the effect that strong patent rights may complement competition-increasing product market reforms in fostering innovation. First, we find that the product market reform induced by the large-scale internal market reform of the European Union in 1992 enhanced, on average, innovative investments in manufacturing industries of countries with strong patent rights since the pre-sample period, but not so in industries of countries with weaker patent rights. Second, the positive response to the product market reform is more pronounced in industries where, in general, innovators tend to value patent protection higher than in other industries, except for the manufacture of electrical and optical equipment. The observed complementarity between competition and patent protection can be rationalized using a Schumpeterian growth model with step-by-step innovation. In such a model, better patent protection prolongs the period over which a firm that successfully escapes competition by innovating, actually enjoys higher monopoly rents from its technological upgrade.

Similar content being viewed by others

Notes

To quantify the product market reform we use ex ante expectations of experts regarding changes in product market conditions at the country-industry-year level (Buigues et al. 1990). Note as well that we find similar empirical results when using alternative measures of the product market reform, of patent protection and innovative activity (see Sects. 4 and 5).

To identify these industries, we use two alternative measures. First, we classify industries according to the level of the patent intensity in the corresponding United States (US) industry in the pre-sample period. Second, we build on US survey data provided by Cohen et al. (2000).

In Romer (1990) where innovations are made by outsiders who create a new variety, product market competition reduces the post-innovation rent from innovation, which is equal to the net innovation rent given that the pre-innovation rent is always equal to zero. Patent protection increases the net innovation rent. This is also the case in Aghion and Howitt (1992) where new innovators leap-frog incumbent firms.

More recently, Boldrin and Levine (2008) have argued that patent protection is detrimental to innovation because it blocks product market competition whereas competition is good for innovation because it allows the greatest scope to those who can develop new ideas. Even though Boldrin and Levine (2008) depart here from the early endogenous growth literature, they share the view that product market competition and patent protection are counteracting (or mutually exclusive) forces: namely, whenever one is good for innovation the other is detrimental to innovation.

For related theoretical contributions, see, in particular, Aghion et al. (2001), Acemoglu et al. (2006), Acemoglu (2009), Aghion and Howitt (2009), and Acemoglu and Akcigit (2012). With regard to the related theoretical literature in industrial organization, we refer the reader, among others, to Tirole (1988), Scotchmer (2004), Gilbert (2006), Vives (2008), and Schmutzler (2010).

See also Aghion et al. (2013).

The above logarithmic final good technology, together with the linear production cost structure for intermediate goods, implies that the equilibrium profit flows of the leader and the follower in sector j depend only on the technological gap, \(m_{j}\), between the two firms. See below for the case of \(m_j\le 1\).

As patent systems usually feature multiple policy instruments, the patent literature has developed alternative modeling approaches. Among others, Cozzi (2001) models intellectual appropriability as the probability that inventors are able to prevent their innovations from being stolen by imitators, Li (2001) models patent breadth as the market power of firms in a quality-ladder model, Chu et al. (2012) focus on blocking patents as the share of profits that incumbents are able to extract from entrants, and O’Donoghue and Zweimüller (2004) model the patentability requirement as the minimum quality step size in order for an innovation to be patentable.

We assume that any third firm could compete using the previous best technology, just like a laggard in an unleveled sector.

In an unleveled sector, firms do not collude as the leading firm has no interest in sharing its profit.

Note that all aggregate variables, including firm values, grow at rate g on a balanced growth path, and that all growing variables are normalized by the aggregate output Y. Note also that the left-hand sides of the Bellman equations are originally equal to \(rV_{s}-\dot{V}_{s}\) with \(s=\{-1,0,1\}\). To rewrite these, we use (i) that \(\dot{V}_{s}=gV_{s}\) holds on a balanced growth path and (ii) that the Euler equation is \(g=r-\rho \).

Industries are classified according to the European NACE classification (version 1993, revision 1).

Patent protection is also strong in the United States that we include in one of our alternative samples.

Italy has been a contracting state since 1978, and Denmark since 1990.

We use data on US industries as the US is the technology leader in most industries during the sample period, and not included in our main sample.

See Sect. 5.3 for estimation results based on sub-samples without the non-SMP countries.

For Swedish or Finnish country-industries in our data set, the main SMP measure is, from 1995 onwards, equal to the ex-ante expected share of the affected industry classes on the common list, and zero otherwise.

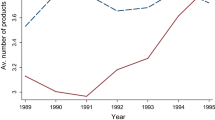

Each of the lines is specific to the country-industry group used in the respective graph, indicating a linear prediction from the group-specific linear regression of R&D intensity on the product market reform measure as the sole explanatory variable.

The group of industries in countries with strong patent protection since the pre-sample period is denoted by G(Protection (P) \(_{c,\,\,ps}^{strong})\); G(P \(_{c,\, \,ps}^{weak})\) denotes the corresponding group with weaker patent protection.

The positive reform effect in country-industries with strong patent rights (0.0875+(-0.0102)=0.773) is significantly different from zero (F-test statistic:17.13, p-value: 0.0001).

We consider the full set of interactions between all country dummies and six indicators for time periods, one for the initial two-year period (1987 to 1988) and five for the consecutive three-year periods between 1989 and 2003. We also consider the corresponding set of industry-time interactions.

The coefficient estimate (s.e.) on the excluded instrument in the first stage equation is 0.7382*** (0.1193). The test statistic for the F-test on the irrelevance of the excluded instrument takes a value of 38.26 and the null hypothesis is rejected.

The coefficient estimates on the two sub-groups \(G(P_{c,\,\,ps}^{\,weak},I_{US,\,i,\, \,ps}^{\,>median})\) and \(G(P_{c,\,\,ps}^{\,weak},I_{US,\,i,\, \,ps}^{\, \le median})\) are small, not significantly different from zero, and not significantly different from each other (F-test statistic: 0.14, p-value: 0.7122).

The F-test statistic relevant to the country-industry group with strong patent rights and above median patent relevance is 19.26 (p-value: 0.0000). The other F-test statistic is 8.62 (p-value: 0.0037).

The F-test statistic relevant to the country-industry group with strong patent rights and high patent relevance is 4.19 (p-value: 0.0419). The other relevant F-test statistic is 4.36 (p-value: 0.0381).

The responses are significantly higher than the response in countries with weaker patent rights, reflected by the estimated coefficient on the \(R_{cit}\)-term. In addition, the estimates for the industries with high and low patent relevance in countries with strong patent rights differ significantly (F-test statistic: 4.03, p-value: 0.0461), as well as those for the industries with intermediate and low patent relevance (F-test statistic: 3.51, p-value: 0.0624).

In columns 1 and 2, the industry NACE 30–33 is, instead, part of the respective country-industry groups with highest patent relevance.

They measure the density of patent thickets in the thirty technology areas covered by the patent system, and the seven technologies where their measure scores highest can all be linked to the industry NACE 30–33 in our data: audiovisual technology, telecommunications, semiconductors, information technology, optics, electrical machinery and electrical energy, engines, pumps and turbines. See Table 1 in Von Graevenitz et al. (2011), and see also Hall (2005) and Hall and Ziedonis (2001).

The relevant F-test statistic is 0.03 (p-value: 0.8606).

Here, as well as in case of all other model extensions that we discuss below, we also add controls for the additionally considered \(G(\cdot )_{ci}\)-groups.

As industries with high, low and medium pre-sample capital needs, we classify the industries at or above the 75th percentile of the capital needs measure, the ones below the 25th percentile, and the remaining industries.

We use EU KLEMS 2008 data and trade data from the 2010 edition of the OECD STAN Bilateral Trade Database (BTD) for 1988 to 1990, the earliest years for which the BTD 2010 provides the relevant trade data, although not for all country-industries in our main sample (see Appendix 2.6 for details). The group of the EU 15 member states covers the eleven SMP countries in our main sample, Finland, Sweden, and two non-sampled EU 15 member states (Luxembourg, Austria).

This is also the case if we add an additional reform interaction with high initial exposure to imports from all countries worldwide, except the EU 15 countries, or with high exposure to imports from China. When constructing the indicator for high exposure to imports from China, we average across a longer time period, 1988 to 2003, as imports from China were typically low until the mid 1990s (Bloom et al. 2015).

The perturbations related to the ERM entry of the UK in October 1990, the German currency effectively serving as the base currency of the ERM, the German Bundesbank tightening monetary policy in response to German reunification which succeeded the unexpected fall of the Berlin Wall in November 1989, and the ERM exit of the UK in September 1992.

Note that the product market reform measure is always equal to zero in the US, as well as in the sampled service industries (electricity and gas and water supply, construction, wholesale and retail trade, transport and storage and communication, financial intermediation, real estate and renting and business activities).

The ANBERD database is part of the OECD Structural Analysis (STAN) databases, and we downloaded the ANBERD 2011 edition in its archived version (last updated: January 15, 2013) on January 23, 2015 from http://dx.doi.org/10.1787/data-00556-en. See also http://www.oecd.org/sti/anberd (accessed: January 23, 2015). As Denmark and Sweden are not covered by the ANBERD 2011 edition, we add the relevant data from the ANBERD 2009 edition. We downloaded the ANBERD 2009 edition on January 7, 2010, and August 19, 2010 from http://dx.doi.org/10.1787/data-00032-en. See also the related book publication (Organisation for Economic Co-operation and Development (OECD) 2009).

The EU KLEMS project was a joint initiative of several academic institutions and national economic policy research institutes, supported from various statistical offices and the OECD, and funded by the European Commission (O’Mahony and Timmer 2009). The initiative provided country-industry level panel data designed to ensure international comparability. We downloaded the EU KLEMS 2008 database on October 15, 2009 from http://www.euklems.net/index.html.

We downloaded the patent data of the EU KLEMS Linked Data (October 2008 Release) on February 2, 2012, from http://www.euklems.net/linked.shtml. See O’Mahony et al. (2008).

The industry classification of the EU KLEMS 2008 patent database (see Table 1.1 of O’Mahony et al. (2008)) fits with the classification of the main EU KLEMS 2008 database, and, thus, the one of our main sample, up to one exception: in case of industry “23: coke, refined petroleum and nuclear fuel” the relevant patent count has to be proxied by the count for the more aggregate industry “23 plus 11: “petroleum and natural gas extraction and refining”.

The strength of patent rights and the strength of other forms of IPRs, in particular copyrights and trademarks, tend to be strongly correlated (Rapp and Rozek 1990).

Italy has been a contracting state since 1978, and Denmark since 1990. The EPOrg is the intergovernmental organization that was created for granting patents in Europe under the European Patent Convention of 1973; the European Patent Office (EPO) acts as the executive body and the first patent applications were filed in 1978. A European patent is a set of essentially independent patents with national enforcement, national revocation, and central revocation or narrowing via two alternative unified, post-grant procedures.

Our calculations are based on the index data that we downloaded on January 18, 2011, from http://www.american.edu/cas/econ/faculty/park.html. The downloaded data coincides with the data published in Table 1 of Park (2008a) in case of all the countries in our Table 1. See also http://nw08.american.edu/~wgp/ (accessed: February 17, 2015).

Cohen et al. (2000) mention an initial piloting of the questionnaire according to which respondents interpreted the term “competitive advantage from those innovations” as referring to returns realized via commercialization or licensing, not as referring to returns of a more general, less direct or less conventional nature. Note also that the part of the CMS questionnaire regarding appropriation mechanisms builds on the Yale questionnaire (Levin et al. 1987).

For Luxembourg, the twelfth EU member state in 1992, data on R&D expenditures are missing. Germany is part of our main sample in the years after German reunification (from 1991 onwards). Finland and Sweden joined the EU, as well as the SMP, in 1995, and these countries are also covered by our main sample.

For country-industries in Sweden or Finland, the main SMP measure is, from 1995 onwards, equal to the share of the 4-digit industry classes that were ex ante expected to be affected according to the common list of Buigues et al. (1990), and zero otherwise.

Note that the employment share data of Buigues et al. (1990) is lacking for all additions to the common list. Therefore, we consider all the industry codes on the common list for the alternative measure, but none of the country-specific changes to the common list. As employment shares are also lacking for several country-industries on the common list, we have to exclude these from the estimation sample. All Swedish and Finnish country-industries are excluded as Buigues et al. (1990) provide no employment share data for these.

Note that the procedure for calculating the employment shares involves using two data sources and two industry classifications. This can lead to the alternative reform measure, \(R^{a}_{cit}\), taking values that are larger than one, and we eliminate these cases.

We downloaded the November 2010 version of the FDSD on December 28, 2011 from http://econ.worldbank.org/WBSITE/EXTERNAL/EXTDEC/EXTRESEARCH/0,,contentMDK:20696167~pagePK:64214825~piPK:64214943~theSitePK:469382,00.html. See also the permanent ULR: http://go.worldbank.org/X23UD9QUX0 (accessed: February 15, 2015).

Even for these years, we have no data for five countries in our main sample (Czech Republic, Hungary, Ireland, Poland, Slovak Republic).

We use the data on all countries in our main sample, except the five countries where data on stock market capitalization is missing.

Thus, we classify the five countries where we have no data stock market capitalization and, in parts, no data on the relevant private credit ratio as countries with weakly developed financial sector. This reflects the common view regarding the financial sector development of Ireland during the 1980s, and the fact that the Czech Republic, Hungary, Poland and the Slovak Republic were planned economies at that time. Note, in addition, that the main estimation results in Table 7, columns 1 and 2, remain stable if we exclude these five countries from the sample.

The BTD database is part of the OECD Structural Analysis (STAN) databases, and we downloaded the BTD 2010 edition in its archived version (last updated: October 2011) on February 20, 2015 from http://dx.doi.org/10.1787/data-00028-en. See also http://www.oecd.org/sti/btd (accessed: February 20, 2015).

Note that the coefficient estimates on the trade-related terms in Table 7, columns 3 and 4, turn insignificant if we use the alternative indicator, EU 15 import penetration \(^{>median}_{ci,1988-90}\), which is coded one for all industries i in countries c where the initial EU 15 import penetration is above the relevant median, and zero otherwise.

In case of country-industries with two separate series with at least five observations, we select the earlier one.

References

Acemoglu, D. (2009). Introduction to modern economic growth. Princeton, NJ: Princeton University Press.

Acemoglu, D., Aghion, P., & Zilibotti, F. (2006). Distance to frontier, selection, and economic growth. Journal of the European Economic Association, 4(1), 37–74.

Acemoglu, D., & Akcigit, U. (2012). Intellectual property rights policy, competition and innovation. Journal of the European Economic Association, 10(1), 1–42.

Acemoglu, D., & Linn, J. (2004). Market size in innovation: Theory and evidence from pharmaceutical industry. Quarterly Journal of Economics, 119(3), 1049–1090.

Aghion, P., Akcigit, U., & Howitt, P. (2014). What do we learn from Schumpeterian growth theory? In P. Aghion & S. Durlauf (Eds.), Handbook of economic growth (Vol. 2B, Chap. 1, 1st ed., pp. 515–563). Oxford: Elsevier (North Holland).

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. Quarterly Journal of Economics, 120(2), 701–728.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. Review of Economics and Statistics, 91(1), 20–32.

Aghion, P., Burgess, R., Redding, S. J., & Zilibotti, F. (2008). The unequal effects of liberalization: Evidence from dismantling the License Raj in India. American Economic Review, 98(4), 1397–1412.

Aghion, P., Harris, C., Howitt, P., & Vickers, J. (2001). Competition, imitation and growth with step-by-step innovation. Review of Economic Studies, 68(3), 467–492.

Aghion, P., Harris, C., & Vickers, J. (1997). Competition and growth with step-by-step innovation: An example. European Economic Review, 41(3–5), 771–782.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351.

Aghion, P., & Howitt, P. (2009). The economics of growth. Cambridge, MA: MIT Press.

Aghion, P., Howitt, P., & Prantl, S. (2013). Revisiting the relationship between competition, patenting, and innovation. In D. Acemoglu, M. Arellano, & E. Dekel (Eds.), Advances in economics and econometrics (Vol. 1 of Econometric Society Monographs (No. 49), Chap. 15, pp. 451–455). Cambridge, MA: Cambridge University Press.

Badinger, H. (2007). Has the EU’s Single Market Programme fostered competition? Testing for a decrease in mark-up ratios in EU industries. Oxford Bulletin of Economics and Statistics, 69(4), 497–519.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2007). Enhanced routines for instrumental variables/generalized methods of moments estimation and testing. Stata Journal, 7(4), 465–506.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2000). A new database on the structure and development of the financial sector. World Bank Economic Review, 14(3), 597–605.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2009). Financial institutions and markets across countries and over time: Data and analysis. World Bank Policy Research Working Paper 4943.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2010a). Financial development and structure database (November 2010 version), http://econ.worldbank.org/WBSITE/EXTERNAL/EXTDEC/EXTRESEARCH/0,,contentMDK:20696167~pagePK:64214825~piPK:64214943~theSitePK:469382,00.html, accessed 28 Dec 2011, and http://go.worldbank.org/X23UD9QUX0, accessed 15 Feb 2015.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2010b). Financial institutions and markets across countries and over time: The updated financial development and structure database. World Bank Economic Review, 24(1), 77–92.

Bloom, N., Draca, M., & Van Reenen, J. (2015). Trade-induced technical change? The impact of Chinese imports on innovation, IT and productivity. Review of Economic Studies (forthcoming).

Boldrin, M., & Levine, D. K. (2008). Against intellectual monopoly. Cambridge, MA: Cambridge University Press.

Bottasso, A., & Sembenelli, A. (2001). Market power, productivity and the EU single market program: Evidence from a panel of Italian firms. European Economic Review, 45(1), 167–186.

Branstetter, L. G., Fisman, R., & Foley, C. F. (2006). Do stronger intellectual property rights increase international technology transfer? Empirical evidence from U.S. firm-level panel data. Quarterly Journal of Economics, 121(1), 321–349.

Budish, E., Roin, B. N., & Williams, H. (2015). Do firms underinvest in long-term research? Evidence from cancer clinical trials. American Economic Review (forthcoming).

Buigues, P., Ilzkovitz, F., & Lebrun, J.-F. (1990). The impact of the internal market by industrial sector: The challenge for the member states. Commission of the European Communities, European Economy: Social Europe, Special Edition.

Chu, A. C., Cozzi, G., & Galli, S. (2012). Does intellectual monopoly stimulate or stifle innovation? European Economic Review, 56(4), 727–746.

Cohen, W., Nelson, R., & Walsh J. P. (2000). Protecting their intellectual assets: Appropriability conditions and why U.S. manufacturing firms patent (or not). National Bureau of Economic Research (NBER) Working Paper 7552.

Cozzi, G. (2001). Inventing or spying? Implications for growth? Journal of Economic Growth, 6(1), 55–77.

EU KLEMS. (2008). The EU KLEMS Database (March 2008 Release) and EU KLEMS Linked Data (October 2008 Release), see Marcel Timmer, Mary O’Mahony & Bart Van Ark, The EU KLEMS Growth and Productivity Accounts: An Overview, University of Groningen & University of Birmingham, http://www.euklems.net, accessed 15 Oct 2009, and http://www.euklems.net/linked.shtml, accessed 2 Feb 2012.

European Patent Organization (EPOrg). (2010). List of contracting states sorted according to the date of accession (last updated 18 August 2010). http://www.epo.org/about-us/organisation/member-states/date.html, accessed 2 Oct 2012.

Galasso, A., & Schankerman, M. (2015). Patents and cumulative innovation: Causal evidence from the courts. Quarterly Journal of Economics, 130(1), 317–369.

Gilbert, R. (2006). Looking for Mr. Schumpeter: Where are we in the competition-innovation debate? In A. B. Jaffe, J. Lerner & S. Stern (Eds.), Innovation policy and the economy (Vol. 6, Chap. 6, pp. 159–215). Cambridge, MA: MIT Press.

Ginarte, J. C., & Park, W. G. (1997). Determinants of patent rights: A cross-national study. Research Policy, 26(3), 283–301.

Griffith, R., Harrison, R., & Simpson, H. (2010). Product market reform and innovation in the EU. Scandinavian Journal of Economics, 112(2), 389–415.

Guimaraes, P., & Portugal, P. (2010). A simple feasible alternative procedure to estimate models with high-dimensional fixed effects. Stata Journal, 10(4), 628–649.

Hall, B. H. (2005). Exploring the patent explosion. Journal of Technology Transfer, 30(1/2), 35–48.

Hall, B. H., Jaffe, A. B., & Trajtenberg M. (2001). The NBER patent citations data file: lessons, insights and methodological tools. National Bureau of Economic Research (NBER) Working Paper 8498.

Hall, B. H., & Ziedonis, R. H. (2001). The patent paradox revisited: An empirical study of patenting in the U.S. semiconductor industry, 1979–1995. RAND Journal of Economics, 32(1), 101–128.

Kleibergen, F., & Paap, R. (2006). Generalized reduced rank tests using the singular value decomposition. Journal of Econometrics, 133(1), 97–126.

Lerner, J. (2000). 150 years of patent protection. National Bureau of Economic Research (NBER) Working Paper 7478.

Lerner, J. (2002). Patent protection and innovation over 150 years. National Bureau of Economic Research (NBER) Working Paper 8977.

Lerner, J. (2009). The empirical impact of intellectual property rights on innovation: Puzzles and clues. American Economic Review, 99(2), 343–348.

Levin, R. C., Klevorick, A. K., Nelson, R. R., & Winter, S. G. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economics Activity, 3, 783–820.

Li, C.-W. (2001). On the policy implications of endogenous technological progress. The Economic Journal, 111(471), C164–C179.

Maskus, K. E. (2000). Intellectual property rights in the global economy. Washington, DC: Insitute for International Economics.

Maskus, K. E., & Penubarti, M. (1995). How trade-related are intellectual property rights? Journal of International Economics, 39(3–4), 227–248.

Moser, P. (2005). How do patent laws influence innovation? Evidence from nineteenth-century world’s fairs. American Economic Review, 95(4), 1214–1236.

O’Donoghue, T., & Zweimüller, J. (2004). Patents in a model of endogenous growth. Journal of Economic Growth, 9(1), 81–123.

O’Mahony, M., Castaldi, C., Los, B., Bartelsman, E., Maimaiti, Y., Peng, F. (2008). EUKLEMS - Linked data: Sources and methods. Mimeo, University of Birmingham, http://www.euklems.net, accessed 18 Feb 2015.

O’Mahony, M., & Timmer, M. P. (2009). Output, input and productivity measures at the industry level: The EU KLEMS database. The Economic Journal, 119(538), F374–F403.

Organisation for Economic Co-operation and Development (OECD). (2009). Research and development expenditure in industry 2009: Analytical business enterprise research and development (ANBERD). Paris: OECD Publishing. doi:10.1787/rd_exp-2009-en-fr, accessed 23 Jan 2015.

Organisation for Economic Co-operation and Development (OECD). (2010). STAN Bilateral Trade Database (BTD, edition 2010, archived version, last updated October 2011), http://dx.doi.org/10.1787/data-00028-en and http://www.oecd.org/sti/btd, accessed 20 Feb 2015.

Organisation for Economic Co-operation and Development (OECD). (2011). STAN R&D Expenditure in Industry (ISIC Rev. 3.1) - Analytical business enterprise research and development (ANBERD) database (edition 2011, archived version, last updated 15 Jan 2013). doi:10.1787/data-00556-en and http://www.oecd.org/sti/anberd, accessed 23 Jan 2015.

Park, W. G. (2008a). International patent protection: 1960–2005. Research Policy, 37(4), 761–766.

Park, W. G. (2008b). Patent protection index. http://www.american.edu/cas/econ/faculty/park.html, accessed 18 Jan 2011, and http://nw08.american.edu/~wgp/, accessed 17 Feb 2015.

Qian, Y. (2007). Do national patent laws stimulate domestic innovation in a global patenting environment? Review of Economics and Statistics, 89(3), 436–453.

Rapp, R. T., & Rozek, R. P. (1990). Benefits and costs of intellectual property protection in developing countries. Journal of World Trade, 24(5), 75–102.

Romer, P. M. (1990). Endogenous technical change. Journal of Political Economy, 98(5), S71–S102.

Sakakibara, M., & Branstetter, L. G. (2001). Do stronger patents induce more innovation? Evidence from the 1988 Japanese patent law reforms. RAND Journal of Economics, 32(1), 77–100.

Schmutzler, A. (2010). Is competition good for innovation? A simple approach to an unresolved question. Foundations and Trends in Microeconomics, 5(6), 355–428.

Scotchmer, S. (2004). Innovation and incentives. Cambridge, MA: MIT Press.

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in linear IV Regressions. In D. W. K. Andrews & J. H. Stock (Eds.), Identification and inference for econometric models: Essays in honor of Thomas J. Rothenberg (pp. 80–108). Cambridge, MA: Cambridge University Press.

Tirole, J. (1988). The theory of industrial organization. Cambridge, MA: MIT Press.

Vives, X. (2008). Innovation and competitive pressure. Journal of Industrial Economics, 56(3), 419–469.

Von Graevenitz, G., Wagner, S., & Harhoff, D. (2011). How to measure patent thickets - A novel approach. Economics Letters, 111(1), 6–9.

World Intellectual Property Organization. (2012). WIPO Lex, http://www.wipo.int/wipolex/en/, accessed 15 Mar 2012 and 30 Sept 2014.

Acknowledgments

We are grateful to the Editor, Oded Galor, and the anonymous referees for very valuable and constructive suggestions. We also thank Ufuk Akcigit, Richard Blundell, Rachel Griffith, Bronwyn Hall, Jonathan Haskel, Martin Hellwig, Benjamin Jones, Johannes Münster, Armin Schmutzler, Michelle Sovinsky, John Van Reenen, Georg von Graevenitz, Joachim Winter, seminar participants at the ASSA Annual Meetings in Chicago (ES) and Philadelphia (AEA), Annual Conference of the EPIP Association in Bruxelles, Frankfurt School of Finance and Management, Heinrich-Heine University Duesseldorf, MPI for Research on Collective Goods in Bonn, UNU Merit in Maastricht, University of Cologne, University of Munich (LMU), University of Zurich, and the VfS Annual Conference in Frankfurt.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Additional tables

Appendix 2: Data sources and variables

1.1 Appendix 2.1: Research and development expenditures

Our main measure of innovation is R&D intensity, that is nominal R&D expenditures as a percentage of nominal value added. For calculating that measure we use country-industry level panel data on nominal research and development expenditures from the OECD Analytical Business Enterprise Research and Development (ANBERD) database (edition 2011).Footnote 50

In addition, we use data on nominal value added from the EU KLEMS database (March 2008 release), adapting the set of national currencies in the EU KLEMS 2008 database to the one of the ANBERD 2011 database.Footnote 51 We also use ANBERD 2011 data on real R&D expenditures in US dollar purchasing power parities at constant prices of the year 2005 (in billion).

1.2 Appendix 2.2: Patenting

For several purposes, we use country-industry-year-specific US patent counts constructed by the EU KLEMS consortium.Footnote 52 The patent counts are based on the NBER patent data (edition 2002, http://elsa.berkeley.edu/~bhhall/patents.html), specifically on the patents granted by the US Patent and Trademark Office after 1962 and applied for before 2000 (O’Mahony et al. 2008; Hall et al. 2001). Each US patent was assigned to a year according to the application date recorded in the patent document and to a country according to the country of the first inventor. For our main empirical analysis we use the fractional patent counts where each patent is counted in all n OTAF classes it was assigned to with a weight of 1 / n. The patents were assigned to up to 7 OTAF classes per patent and all classes (41 OTAF classes, plus one “other industries” class) were mapped into EU KLEMS 2008 industry classes.Footnote 53

To construct the knowledge stock built up during the pre-sample period per country-industry we use the US patent data for the pre-sample period, 1980–1986. Applying the perpetual inventory method, we calculate the knowledge stock as the sum of all pre-sample fractional patent counts (in 1000 patents) that are depreciated to the last year of the pre-sample period with an annual knowledge depreciation rate of 20 percent.

1.3 Appendix 2.3: Patent rights

To measure the strength of patent protection, that is intellectual property rights (IPRs) as laid down in patent laws,Footnote 54 we distinguish between different country groups. To do so, we use information on patent law reforms, as well as related regulation, and data on a time period with high variation of patent protection across European Countries, that is a time period before international harmonization of patent systems started to dominate.Footnote 55 The following countries had strong patent protection regimes already in the pre-sample period, 1980–1986, and maintained strong regimes throughout the whole sample period, 1987 to 2003: Belgium, Denmark, France, Germany, Italy, Netherlands, Sweden, and the United Kingdom (plus the United States). The countries with weaker patent protection regimes completed the major patent law reform preparing the ground for a strong patent protection regime in 1992, or later: Czech Republic, Finland, Greece, Hungary, Ireland, Poland, Portugal, Spain, and the Slovak Republic.

All European countries that we classified as having strong patent rights, except for Denmark and Italy, were among the initial contracting states of the European Patent Organisation (EPOrg) in October 1977.Footnote 56 All the countries classified as having weaker patent rights joined the EPOrg between October 1986 and March 2004 (European Patent Organization (EPOrg) 2010) and none of these countries completed the reforms preparing the ground for a strong patent protection regime before 1992 (Branstetter et al. 2006; Qian 2007; World Intellectual Property Organization 2012). Our classification is consistent with the groupings in Branstetter et al. (2006) or Qian (2007). It also fits with the patent right index of Maskus and Penubarti (1995) and Rapp and Rozek (1990): the patent laws of all the countries that we classify as countries with strong patent rights were fully conforming to the minimum standards of the US Chamber of Commerce Intellectual Property Task Force in 1984; all other countries lacked fully conforming patent laws in 1984.

For robustness checks, we also use the index of patent protection that was developed by Ginarte and Park (1997), and updated by Park (2008a, (2008b). Walter Park provides the index for more than 100 countries, updating it quinquennially for the years from 1960 onwards.Footnote 57 The index takes values between zero and five and higher values indicate patent laws with stronger IPRs. The index coding scheme aggregates information on 1) membership in international treaties (Paris Convention, International Convention for the Protection of New Varieties of Plants, Patent Cooperation Treaty, Budapest Treaty, Agreement on Trade Related Aspects of Intellectual Property Rights), 2) enforcement mechanisms (preliminary injunctions, contributory infringement pleadings, burden of proof reversal), 3) restrictions on patent rights (working requirements, compulsory licensing, revocation of patents), 4) duration of protection and 5) extent of coverage (pharmaceuticals, chemicals, food, surgical products, microorganisms, utility models, software, plant and animal varieties). Relevant in the context of our study is the updated coding scheme as described by Park (2008a); Ginarte and Park (1997) give details on the original coding scheme.

We classify industries according to the extent to which innovators consider the strength of patent rights as relevant, and rely on patenting in appropriating returns to invention. To do so, we form industry groups with different levels of patent relevance. For our main measure of patent relevance, we first calculate the nominal patent intensity for US industries in the pre-sample years, 1980–1986, dividing the fractional EU KLEMS patent counts by nominal value added in million US dollars, determine the ranking of US industries based on the intensity variable in each year, and average across the pre-sample years. Then, we generate different sets of industry groups. First, we define the group with high patent relevance as covering the industries at or above the 75th percentile of the average pre-sample US patent intensity ranking. These are the four sampled industries that constitute in all the relevant pre-sample years the industries with the highest patent intensities, reflecting the fact that the ranking is very persistent across these years. The group with low patent relevance covers three industries, two rank below the 25th percentile in all the relevant pre-sample years, and one ranks below in 5 of 7 years. The intermediate group covers all remaining industries. Second, we distinguish between the group of industries with average pre-sample US patent intensity rankings above the median (these 6 industries constitute in all relevant pre-sample years the industries with the highest patent intensities), and the complementing group with rankings below or at the median.

Our alternative measure of patent relevance builds on Cohen et al. (2000) who present survey-based evidence on the importance of patenting in appropriating returns to invention from the Carnegie Mellon Survey (CMS) on Industrial R&D in the US manufacturing sector. In the survey, which was conducted in 1994, about 1100 R&D unit or laboratory managers reported, among others, the percentage of their innovations for which patenting had been effective in protecting the firm’s “competitive advantage from those innovations” during the prior three years, 1991 to 1993.Footnote 58 For 34 manufacturing industries, Tables 1 and 2 in Cohen et al. (2000) provide the mean shares of product and process innovations for which the survey respondents judged patenting to be effective. We aggregate these shares to the level of the 13 industries in our main data set (1993 NACE, revision 1), weighting by the respective numbers of respondents. Then, we generate different sets of industry groups. First, we define the group with high patent relevance as covering the industries at or above the 75th percentile of the share of innovations with effective patent protection, the group with low patent relevance as covering the industries below the 25th percentile, and the intermediate group covering all remaining industries. Second, we distinguish between the group of industries above the median of the share variable, and the complementing group with share values below or at the median.

1.4 Appendix 2.4: Product market reform

The product market reform that we consider is part of the large-scale internal market reform of the European Union (EU) in 1992, named the Single Market Program (SMP). The SMP was designed by the European Commission and, thus, a supra-national institutional body. It was meant to bring down internal barriers to the free movement of products and production factors within the EU in order to foster competition, innovation and economic growth. Recent empirical evidence supports the view that the product market reform increased product market competition in manufacturing industries.Footnote 59 The SMP was officially implemented in 1992 in all EU member countries in 1992: Belgium, Denmark, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal, Spain, United Kingdom, and Luxembourg. Eleven of these countries are included in our main sample, and all these had joined the EU much earlier, at the latest in 1986.Footnote 60

For all initial SMP countries, the European Commission report by Buigues et al. (1990) provides a common list of 40 three-digit manufacturing industries that researchers expected ex ante to be affected by the product market reform. Country-specific additions to and removals from the common list are also reported. These additions and removals reflect recommendations of experts, who were asked whether they expected the reform to change the product market conditions in an individual industry in a specific SMP country differently than in the corresponding average industry. In country-industries that were ex ante expected to be affected the initial level of competition was typically low. The information in Buigues et al. (1990) allows for constructing reform measures that vary across industries within countries, across countries and across time. We exploit that fact for identifying the reform impact from confounding influences.

To generate our main product market reform measure, \(R_{cit}\), we first link the 40 three-digit industry codes (1970 NACE) that are on the common list of Buigues et al. (1990) to the corresponding 109 four-digit industry codes (1993 NACE, revision 1). Then, we link the 39 three-digit codes (1970 NACE) of the additions to the corresponding 119 four-digit codes (1993 NACE, revision 1). Finally, we aggregate the four-digit industry codes on the common list, as well as the data on country-specific removals and additions of industry codes, to the country-industry level of our data-set:

For each of the 13 manufacturing industries i in each of the 11 SMP countries c in our main sample (see Tables 1 and 2), the main reform measure \(R_{cit}\) is set equal to zero in all years t before the implementation of the SMP. From 1992 onwards, it is equal to the share of the four-digit industry classes k per country-industry that were ex ante expected to be affected by the SMP.Footnote 61 The dummy variable \(A_{kct}\) is coded one from 1992 onwards if a four-digit industry k in country c was ex ante expected to be affected, and zero otherwise. The number of four-digit industry codes per industry i is denoted by \(n_{i}\). For non-SMP-countries, as well as for service industries, the main reform measure is always equal to zero.

We also apply an alternative measure of the product market reform. To construct it, we follow Griffith et al. (2010) in using employment shares, including those that are reported in Buigues et al. (1990), for weighting purposes. First, we link each of the three-digit industry codes (1970 NACE) that are on the common list to the main corresponding industry among the 13 industries (1993 NACE, revision 1) in our main sample and, then, aggregate as follows:Footnote 62

For each three-digit industry j in country c, the weight \(w_{jic}\) indicates the share that industry j contributes to the employment in industry i in country c, averaged over the years 1985 to 1987. For constructing weight \(w_{jic}\), we divide the employment share \(w_{jc}\), as directly reported by Buigues et al. (1990), by the appropriate employment share \(w_{ic}\). The weight \(w_{jc}\) of Buigues et al. (1990) indicates the share of the tree-digit industry j in total manufacturing employment in country c, averaged over the years 1985 to 1987. The weight \(w_{ic}\) is constructed from EU KLEMS data and indicates the share of industry i in total manufacturing employment in country c, averaged over the years 1985 to 1987.

In all years t before the implementation of the SMP, the alternative reform measure is set equal to zero. From 1992 onwards, it is equal to the share of the employment-weighted three-digit industry classes per industry i that were ex ante expected to be affected by the SMP. The dummy variable \(A_{jt}\) is coded one from 1992 onwards if a three-digit industry j was ex ante expected to be affected according to the common list of Buigues et al. (1990), and zero otherwise.Footnote 63

1.5 Appendix 2.5: Financial conditions

The financial variables which we use in Sect. 5.3 are based on data from the EU KLEMS 2008 database and from the November 2010 version of the Financial Development and Structure Database (FDSD) by Beck et al. (2000, (2009, (2010a, (2010b).Footnote 64

First, we measure financial sector development at the country-level using data from the Financial Development and Structure Database on stock market capitalization and on the channeling of savings to investors via financial intermediaries, relative to the size of the economy. Our proxy of stock market capitalization is the value of listed shares, relative to gross domestic product (GDP). As values of listed shares are hardly available before 1989, we determine the country ranking based on stock market capitalization for the years 1989 and 1990, and then we average across both years.Footnote 65 The channeling of savings to investors via financial intermediaries is captured by the following private credit ratio: claims on the private sector by deposit money banks and other financial institutions, relative to GDP. We use the ratio values between 1980 and 1990 to determine a country ranking per year, and then we average across all years.Footnote 66 Finally, we generate our financial development measure by averaging across both the average stock market and private credit ranking and classify countries with averages above the median rank as having a highly developed financial sector in the time period 1980–1990. These countries are France, Germany, the Netherlands, Spain, Sweden, and the UK. All other countries in our main sample are classified as having a weakly developed financial sector up to 1990.Footnote 67

Second, we classify industries according to their capital needs, proxied by the capital intensity of production in the corresponding US industries in the pre-sample period, 1980–1986. To that aim we use the relevant EU-KLEMS 2008 industry-level data on the ratio of capital relative to labor compensation in the pre-sample years, determine the respective industry ranking in each year, average across the pre-sample period, and generate different sets of industry groups. First, we define the group with high US pre-sample capital intensity as covering the industries at or above the 75th percentile of the average pre-sample US capital intensity ranking. The group with low capital intensity covers the industries below the 25th percentile and the intermediate group covers all remaining industries. Second, we distinguish between the group of industries above the median of the average pre-sample US capital intensity ranking, and the complementing group.

1.6 Appendix 2.6: Import penetration

For constructing the measures of import penetration which we use in Sect. 5.3, we start by calculating the EU 15 import penetration for industry i in country c in year t,

where \(M^{EU \; 15}_{cit}\) denotes the nominal value of imports from EU 15 member countries, \(M_{cit}\) represents the nominal value of imports from all countries worldwide, and \(X_{cit}\) represents the nominal value of exports to all countries worldwide. Domestic production is denoted by \(Q_{cit}\). We take data on \(M^{EU \; 15}_{cit}\), \(M_{cit}\), and \(X_{cit}\), as well as on all other trade measures mentioned below, from the OECD STAN Bilateral Trade Database (BTD, edition 2010).Footnote 68 From the EU KLEMS 2008 database, we take data on \(Q_{cit}\), that is nominal gross output. When calculating the import penetration ratios, we harmonize the set of national currencies in the BTD 2010 database and the EU KLEMS 2008 database.

Then, we average the country-industry-year specific ratios across the years 1988 to 1990 to generate a measure of the initial EU 15 import penetration. The years 1988 to 1990 are the earliest years for which BTD 2010 provides the relevant trade data, although not for all country-industries in our main sample. The group of the EU 15 member states covers the eleven SMP countries in Table 1, Finland, Sweden, and two non-sampled EU 15 member states (Luxembourg and Austria).

Finally, we set the indicator EU 15 import penetration \(^{high}_{ci,1988-90}\) equal to one for all industries i in countries c where the initial EU 15 import penetration is at or above the relevant 75th percentile, and zero otherwise.Footnote 69

To generate an indicator for high exposure to imports from all countries worldwide, except the EU 15 countries, we proceed analogously, using \(M^{World \; \setminus \; EU \; 15}_{cit}\) instead of \(M^{EU \; 15}_{cit}\). In case of the indicator for high exposure to imports from China, we average across a longer time period, 1988 to 2003, taking into account that imports from China were typically low until the mid-1990s (Bloom et al. 2015).

Appendix 3: Construction of main estimation sample

Our main estimation sample is an unbalanced panel of 2736 observations on 13 manufacturing industries in 17 countries between 1987 and 2003.

We apply the following standard data cleaning routines. We drop country-industry-year observations with missing values of variables that are relevant to our main regression analysis (see Tables 3, 4, 5 and 6). In addition, we eliminate all observations with absolute growth of more than 200 percent in R&D intensity, or in real R&D expenditures. Finally, we eliminate all country-industries where we observe less than five consecutive years during the time period from 1987 to 2003.Footnote 70

Rights and permissions

About this article

Cite this article

Aghion, P., Howitt, P. & Prantl, S. Patent rights, product market reforms, and innovation. J Econ Growth 20, 223–262 (2015). https://doi.org/10.1007/s10887-015-9114-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-015-9114-3