Abstract

If an additional competitor reduces output per firm in a homogenous Cournot oligopoly, market entry will be excessive. Taxes can correct the so-called business stealing externality. We investigate how evading a tax on operating profits affects the excessive entry prediction. Tax evasion raises the number of firms in market equilibrium and can alter their welfare-maximising number. In consequence, evasion can aggravate or mitigate excessive entry. Which of these outcomes prevails is determined by the direct welfare consequences of tax evasion and the relationship between evasion and the tax base. We also determine conditions which imply that overall welfare declines with tax evasion.

Similar content being viewed by others

Notes

Note that the costs of evasion could also be specified as increasing with the tax rate, \(\tau \). For a given tax rate, such modification would not alter the main findings because the alteration would primarily affect the impact of the tax rate on evasion activities (see “Impact of higher tax rate” section of Appendix).

It could be argued that tax evasion is easily detectable because all firms are ex-post identical and evade the same amount. Accordingly, authorities could eradicate evasion by auditing all firms. Such an outcome will not occur if either proving evasion activities is required and sufficiently costly to tax authorities such that they cannot establish illegal activities for all firms. Alternatively, one could assume that operating profits are given by \((P(X) - c)x - k\), where k varies across firms. If authorities do not know the value of k, a given tax payment does no longer indicate illegal behaviour. Since the inclusion of such firm-specific operational costs would considerably extend the notation without yielding additional insights, we refrain from doing so.

Besley (1989) considers a unit tax on output in a Cournot oligopoly in the absence of tax evasion. He shows for a setting with constant unit costs that output per firm rises with the tax rate if \(\eta > 0\), while the number of firms declines with the tax rate if \(2 + \eta > 0\), while aggregate output unambiguously falls. Delipalla and Keen (1992) provide comparable predictions and, furthermore, show that the consequences of a higher ad valorem tax are more ambiguous because this tax also reduces marginal revenues and, thus, mitigates the product market imperfection (see also Stern 1987; Hamilton 1999).

The positive impact of the tax rate on tax evasion is a common prediction in models of tax evasion by firms which maximise (expected) profits (see, for example, Cremer and Gahvari 1993). If the objective is defined in terms of utility, risk aversion also plays a role (cf. Yaniv 1995, inter alia), as it is the case with regard to income taxes paid by individuals.

As in a framework without evasion, the tax rate which ensures the constrained-optimal number of firms can be calculated on the basis of Eqs. (7) and (17). For \(\beta = 1\), it is possible to show that the tax rate must satisfy \(\tau (1 - \alpha )- (n^{+,\hbox {opt}}(\tau )+\eta )/(1 + n^{+,\hbox {opt}}(\tau )+\eta ) < 0\), where \(n^{0,\hbox {opt}}(\tau ) = n^{+,\hbox {opt}}(\tau )\) for any given tax rate and \(\hbox {d}n/\hbox {d}\tau < 0\). Hence, the constrained-optimal effective tax rate \(\tau (1- \alpha )\) in the presence of evasion activities must be lower than the second-best optimal tax rate \(\tau \) in a world without evasion. This is the case because the costs of evasion deter entry, ceteris paribus. For \(\beta < 1\), the optimal number of firms generally depends on the extent of tax evasion.

A lower detection probability combines a fall in the absolute costs of tax evasion with a decrease in marginal costs. An increase in tax evasion activities would also come about if either only the marginal costs of evasion decline, while the cost level is held constant, or alternatively if the absolute costs of evasion rise, while marginal costs remain unchanged. In terms of the model, the first type of change would be equivalent to a reduction in the detection probability, q, and a rise in the fixed costs, \(c_\mathrm{fix}\), such that total costs \(T = q\pi (\alpha , \alpha ) + c_\mathrm{fix}\) remain the same. The second type of change would be tantamount to a rise in the fixed costs. We do not explicitly consider the consequences of such alterations in the costs of tax evasion because they are more difficult to implement than a combined decrease in marginal and absolute costs. The relevant derivations can be obtained from the author upon request and are used to some extent to provide intuition for the results relating to a change in q.

If \(E_{\pi } > 0\), higher profits imply that less evasion is needed to cover its costs, since the tax base rises. Accordingly, a fall in the absolute costs of evasion T, holding constant the marginal costs, \(T'\), results in less evasion.

$$\begin{aligned} \frac{d\alpha }{dT_{|dT'=0}}=-E_n\frac{(P'(X)x)^2(2n+\eta )}{nD^+} \end{aligned}$$At the same time, higher profits induce more firms to enter the market. This implies that a fall solely in the cost level reduces evasion and enhances entry.

I am very grateful to an anonymous referee for suggesting this illustration of the main results of the paper.

As profits exceed unity, as shown below, costs of evasion \(T(\alpha , 0) = q\alpha ^{2}\) are substantially lower than in the case of \(T(\alpha , \pi ) = q(\alpha \pi )^{2}\). Consequently, the fraction of taxes evaded will be noticeably higher in the former case, given the same detection probability, q.

References

Amir, Rabah, & Burr, Chrystie. (2015). Corruption and socially optimal entry. Journal of Public Economics, 123, 30–41.

Amir, Rabah, De Castro, Luciano, & Koutsougeras, Leonidas. (2014). Free entry versus socially optimal entry. Journal of Economic Theory, 154, 112–125.

Becker, Gary S. (1968). Crime and punishment: An economic approach. Journal of Political Economy, 76(2), 169–217.

Besfamille, Martin, Philippe, De Donder, & Lozachmeur, Jean Marie. (2009). Tax enforcement may decrease government revenue. Economics Bulletin, 29(4), 2665–2672.

Besfamille, Martin, Philippe, De Donder, & Lozachmeur, Jean Marie. (2013). The political economy of the (weak) tax enforcement of indirect taxes. Journal of Public Economic Theory, 15(6), 856–883.

Besley, Timothy. (1989). Commodity taxation and imperfect competition—A note on the effects of entry. Journal of Public Economics, 40(3), 359–365.

Bundestag. (2016). 4th Committee of inquiry in the 18th electoral period. https://www.bundestag.de/bundestag/ausschuesse18/ua/4untersuchungsausschuss. In German

Cremer, Helmuth, & Gahvari, Firouz. (1993). Tax evasion and optimal commodity taxation. Journal of Public Economics, 50(2), 261–275.

Delipalla, Sophia, & Keen, Michael. (1992). The comparison between ad valorem and specific taxation under imperfect competition. Journal of Public Economics, 49(3), 351–367.

European Commission. (2016). Proposal for a council directive laying down the rules against tax avoidance practices that directly affect the functioning of the common market, COM(2016) 26 final.

Goerke, Laszlo. (2012). The optimal structure of commodity taxation in a monopoly with tax avoidance or evasion. Public Finance Review, 40(4), 519–536.

Goerke, Laszlo, & Runkel, Marco. (2006). Profit tax evasion under oligopoly with endogenous market structure. National Tax Journal, 59(4), 851–857.

Goerke, Laszlo, & Runkel, Marco. (2011). Tax evasion and competition. Scottish Journal of Political Economy, 58(5), 711–736.

Grubert, Harry, & Slemrod, Joel. (1998). The effect of taxes on investment and income shifting to Puerto Rico. The Review of Economics and Statistics, 80(3), 365–373.

Hamilton, Stephen F. (1999). Tax incidence under oligopoly: A comparison of policy approaches. Journal of Public Economics, 71(2), 233–245.

Haruna, Shoji, & Goel, Rajeev K. (2011). R&D free entry, and social inefficiency. Economics of Innovation and New Technology, 20(1–2), 89–101.

Konishi, Hideki, Okuno-Fujiwara, Masahiro, & Suzumura, Kotaro. (1990). Oligopolistic competition and economic welfare: A general equilibrium analysis of entry regulation and tax-subsidy schemes. Journal of Public Economics, 42(1), 67–88.

Mankiw, N. Gregory, & Whinston, Michael D. (1986). Free entry and social inefficiency. The Rand Journal of Economics, 17(1), 48–58.

Mukherjee, Arijit. (2012). Endogenous cost asymmetry and insufficient entry in the absence of scale economies. Journal of Economics, 106(1), 75–82.

Ohkawa, Takao, & Okamura, Makoto. (2003). On the uniqueness of the welfare-maximizing number of firms under Cournot-oligopoly. Bulletin of Economic Research, 55(2), 209–222.

Perry, M. K. (1984). Scale economies, imperfect competition, and public policy. The Journal of Industrial Economics, 32(3), 313–333.

Roine, Jesper. (2006). The political economics of not paying taxes. Public Choice, 126(1–2), 107–134.

Seade, Jesus. (1980). On the effects of entry. Econometrica, 48(2), 479–489.

Seidel, A., & Thum, M. (2016). Tax evasion, corruption and market entry. Scottish Journal of Political Economy, 63(4), 377–398.

Slemrod, Joel. (2001). A general model of the behavioral response to taxation. International Tax and Public Finance, 8(2), 119–128.

Stern, Nicholas. (1987). The effects of taxation, oligopoly and monopolistic competition. Journal of Public Economics, 32, 133–158.

Suzumura, Kotaro. (1995). Competition, commitment, and welfare. Oxford: Clarendon Press.

Suzumura, Kotaro, & Kiyono, Kazuharu. (1987). Entry barriers and economic welfare. Review of Economic Studies, 54(1), 157–167.

Traxler, Christian. (2009). Voting over taxes: The case of tax evasion. Public Choice, 140(1), 43–58.

Varian, Hal. (1995). Entry and cost reduction. Japan and the World Economy, 7(4), 399–410.

von Weizsäcker, Carl Christian. (1980). A welfare analysis of barriers to entry. Bell Journal of Economics, 11(2), 399–420.

Yaniv, Gideon. (1995). A note on the tax evading firm. National Tax Journal, 48(1), 113–120.

Acknowledgements

I am grateful for comments on earlier versions of this paper by Marco de Pinto, Tim Friehe as well as workshop and seminar participants in Brescia, Darmstadt, Marburg and Trier. Moreover, I have received very constructive suggestions by two anonymous referees of this journal which have greatly helped to improve the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Impact of higher tax rate

The derivatives of Eqs. (6), (7) and (8) with respect to the tax rate, \(\tau \), are \(A_{\tau } = 0\) and:

Since, furthermore, \(A_{\alpha } = B_{\alpha } = 0\) holds, tax evasion does not alter the effects of a change in the tax rate on output and the number of firms, such that \(\hbox {d}x^{0}/\hbox {d}\tau = \hbox {d}x^{+}/\hbox {d}\tau = \hbox {d}x/\hbox {d}\tau , \hbox {d}n^{0}/\hbox {d}\tau = \hbox {d}n^{+}/\hbox {d}\tau = \hbox {d}n/\hbox {d}\tau \) and \(\hbox {d}X^{0}/\hbox {d}\tau = \hbox {d}X^{+}/\hbox {d}\tau = \hbox {d}X/\hbox {d}\tau \). The respective derivatives are:

The impact of a higher rate on tax evasion is determined by:

Given \(D^{+} < 0\) from (12) and \(2n^{+}+\eta > 0\) from the second-order condition (4), \(\hbox {d}\alpha /\hbox {d}\tau > 0\) will result if the costs of tax evasion are independent of the tax base, such that \(T(\alpha , \pi ) = T(\alpha , 0)\) and, thus, \(T_{2}(\alpha , \pi ) = T_{12}(\alpha , \pi ) = 0\). \(\hbox {d}\alpha /\hbox {d}\tau > 0\) will also hold if higher operating profits raise the fraction of taxes evaded. This condition implies that \(E_{\pi } > 0\) and, hence, \(\tau > T_{12}(\alpha , \pi )\) (cf. Eq. (11c)). In consequence, we have \(T_{2}(\alpha , \pi ) + (1 - \alpha )T_{12}(\alpha , \pi ) - 1< T_{2}(\alpha , \pi ) + (1 - \alpha )\tau - 1 = -[1 - (1 - \alpha )\tau - T_{2}(\alpha , \pi )] < 0\). If, finally, \(E_{\pi } < 0, \hbox {d}\alpha /d\tau > 0\) will hold if, additionally, \(0 < T_{2}(\alpha , \pi ) + (1- \alpha )T_{12}(\alpha , \pi )\) is not too large in absolute value.

If the cost-of-evasion function increases with the tax rate as well (\(\partial T/\partial \tau > 0\)), \(B_{\tau }\) continues to be negative. Therefore, \(E_{\tau } \ge 0\) is a sufficient condition for \(\hbox {d}\alpha /\hbox {d}\tau > 0\), given \(E_{x} < 0\). In the case of \(E_{x} > 0\), \(E_{\tau } > 0\) becomes a necessary condition for \(\hbox {d}\alpha /\hbox {d}\tau > 0\).

1.2 Proof of Proposition 1

Using \(A_{q} = 0, B_{q} = -S(\alpha , \pi ) < 0\), \(E_{q} = -S_{1}(\alpha , \pi ) < 0\), and given \(T_{1}(\alpha , \pi ) = qS_{1}(\alpha , \pi )\), the impact of the detection probability q on the optimal fraction, \(\alpha \), of the tax burden evaded, is:

Tax evasion will increase with a decline in q if the term in curly brackets is positive, since \(D^{+ }< 0\). This will obviously be the case if higher operating profits decrease the fraction of taxes evaded, \(\alpha \), ceteris paribus, i.e. if \(E_{\pi }=\tau - T_{12}(\alpha , \pi ) < 0\). Moreover, the last line of (24) will be positive if the costs of tax evasion are independent of the tax base, i. e. if \(T = T(\alpha , 0)\) and \(T_{2}(\alpha , \pi ) = T_{12}(\alpha , \pi ) = 0\) holds. In this case, the term in curly brackets in (24) can be rewritten as \((1 - \tau )S_{1}(\alpha , 0) + \tau (S_{1}(\alpha , 0)\alpha - S(\alpha , 0))\), which is greater than zero because \(S_{1}, S_{11} > 0\) and \(S(0, 0) = 0\).

The number of firms characterising the market equilibrium rises with a fall in q.

Consequently, if a fall in q increases the fraction of the tax burden evaded \((\hbox {d}\alpha /\hbox {d}q < 0)\), the number of firms will rise. This proves Proposition 1.

1.3 Proof of Proposition 2

Part (a) of the Proposition is obvious from inspection of Eq. (18).

Note that \(\eta + 2n \ge 1 + n + \eta \) will hold for \(n \ge 1\). If \(\beta < 1\), the derivative in (18) will, hence, be positive if the term in curly brackets subsequent to the last equality sign is greater in absolute value than the positive first summand, \(T(\alpha , \pi )\). The conditions enlisted in part (b) of Proposition 2 imply that the second and third summands in curly brackets are zero because \(T(\alpha , \pi ) = T(\alpha , 0)\) implies that \(T_{2}(\alpha , 0) = T_{12}(\alpha , 0) = 0\). If the costs of tax evasion are given by a second- or higher-order polynomial, they may be expressed as \(T(\alpha , 0) = q\alpha ^{m} + c_\mathrm{fix}\), where \(m \ge 2\). Hence, \(T(\alpha , 0) \le (T_{1}(\alpha , 0))^{2}/T_{11}(\alpha , 0) = q^{2}m^{2}\alpha ^{2m-2}/(qm(m - 1)\alpha ^{m-2}) = qm\alpha ^{m}/(m - 1)\) is a sufficient condition for the derivative in (18) to be positive. The inequality \(q\alpha ^{m} + c_\mathrm{fix} \le qm\alpha ^{m}/(m - 1)\) will be fulfilled if \((m - 1)c_\mathrm{fix} \le q\alpha ^{m}\), i.e. if the fixed costs of tax evasion are zero or not too high. This proves Proposition 2b).

If \(T(\alpha , \pi ) = T(\alpha \pi )\) holds, \(T_{1}(\alpha \pi ) = T'\pi , T_{11}(\alpha \pi ) = T''\pi ^{2}\), and \(T_{2}(\alpha \pi ) = T'\alpha \). Equation (8) is given by \(E = \tau \pi - T_{1}(\alpha \pi )=\tau \pi - T'\pi = 0\), such that \(E_{\pi } = -T''\alpha \pi \). Replacing \(T_{1}, T_{11}, T_{2}\) and \(E_{\pi }\) in the second line of (18) shows that the term in curly bracket is zero. This proves part c.

1.4 Proof of Proposition 4

Employing (24), (25), (13), and \(\partial n/\partial q = -(\partial x/\partial q)(A_{x}/A_{n})\), the impact of a rise in the parameter q can be calculated as:

Hence, welfare rises with a decline in the parameter q, i.e. the derivative in (26) is negative if, for example, \(\hbox {d}W^{+}/\hbox {d}n > 0\) and \(\beta = 1\) hold. This establishes part a. Assuming \(\beta < 1\), the derivative in (26) is positive if \(\hbox {d}W^{+}/\hbox {d}n < 0\) and \((S_{1}(\alpha , \pi ))^{2}/S_{11}(\alpha , \pi ) - S(\alpha , \pi ) > 0\) apply. The inequality \((S_{1}(\alpha , \pi ))^{2}/S_{11}(\alpha , \pi )- S(\alpha , \pi ) > 0\) holds if \(T(\alpha , \pi ) = T(\alpha , 0)\) or \(T(\alpha , \pi ) = T(\alpha \pi )\), and \(T(\alpha , \pi )\) is given by a second- or higher-order polynomial. For \(T(\alpha , \pi ) = (\alpha \pi )^{m }+ c_\mathrm{fix}\), where \(m \ge 2, (S_{1}(\alpha , \pi ))^{2}/S_{11}(\alpha , \pi )- S(\alpha , \pi ) = (\alpha \pi )^{m}/(m - 1) > 0\) results such that the restriction is fulfilled. If the costs of evasion are a function of the fraction of taxes evaded, such that \(T(\alpha , 0) = \alpha ^{m} + c_\mathrm{fix}\), we have \((S_{1}(\alpha , 0))^{2}/S_{11}(\alpha , 0) - S(\alpha , 0) = \alpha ^{m}/(m - 1) > 0\).

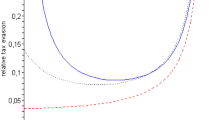

1.5 Numerical example

We denote market outcomes in the absence of taxation with the superscript ‘−’, in the presence of taxes but absence of evasion by ‘0’ and in the presence of tax evasion by ‘+’. Constrained-optimal solutions are indexed with the additional superscript ’opt’. Further, we set \(c = K = 1, q = 0.4, c_\mathrm{fix} = 0\), \(P(X) = 10 - X\) and \(\tau \) = 0.2, unless there is no taxation (\(\tau \) = 0).

1.5.1 Market outcome in the absence of taxation (Table 1, row 1)

The market outcome in the absence of taxes is, setting \(\tau = 0\), determined by Eqs. (6′) and (7) and, thus, by \(P - X - x - c = 9 - X - x = 0\) and \((9 - X)x = 1\). Combining both equalities yields \(x^{- }= 1, n^{- }= X^{- }= 8\) and \(W^{- }= (10 - P(X))X/2 + (P(X) - c)X - n = X^{2}/2 + X - n = 32\).

1.5.2 Market outcome in the presence of taxation but without evasion (Table 1, row 2)

We next turn to a world with taxes but without evasion. Following the same approach as above, that is, using \(9 - X = x\) and \((1 - \tau )(9 - X)x = 1\), taxation can be shown to reduce the number of firms in market equilibrium to \(n^{0} \approx 7.05\), while output per firm increases to \(x^{0} \approx 1.118\), resulting in an aggregate output of \(X^{0} \approx 7.882\) and a welfare level of \(W^{0} \approx 32.82\).

1.5.3 Market outcome in the presence of taxation and evasion (Table 1, rows 3, 4)

Initially, we assume that the costs of tax evasion are a function of the product of profits and the share of the tax burden evaded, namely \(\alpha \pi \). To ensure that restrictions on the functional form for T imposed in Sect. 2.1 hold, we specify T as \(T(\alpha , \pi ) = q(\alpha \pi )^{2}\). This assumption implies that \(E_{\pi }=\tau - T_{12}(\alpha , \pi )=\tau - 4q\alpha \pi \). As an alternative, we consider \(T(\alpha ) = q\alpha ^{2}\), resulting in \(E_{\pi }=\tau > 0\). Outcomes in a setting in which \(T(\alpha , \pi ) = q(\alpha \pi )^{2 }[T(\alpha , 0) = q\alpha ^{2}]\) holds are subsequently denoted by the additional superscript 1 [2]. This way of differentiating results is used for market and constrained-optimal outcomes.

Given \(T^{+,1 }= q(\alpha \pi )^{2}\), the first-order condition for the optimal choice of \(\alpha \) (cf. Eq. (8)) yields \(\alpha \pi =\tau /(2q) = 1/(10q) = 0.25\). Hence, the costs of tax evasion are constant and equal \(T^{+,1 }= q(\alpha \pi )^{2 }= 0.025\). Using this information, it is possible to solve the zero-profit condition (6) to obtain \(\alpha ^{+,1 }= 8/(100q - 1) \approx 0.205\). Since \(\pi = x^{2}\) from (13a) and using the definition of \(\pi \), we, furthermore, find \(x^{2} = 1/(10\alpha q) = (100q - 1)/(80q)\), such that x rises in q, while \(n = 9/x - 1\) declines in the detection probability, q (see Proposition 1). Solving for x, we obtain \(x^{+,1 }\approx 1.104\). Inserting this value into \(n = 9/x - 1 ~\mathrm{yields}~~n^{+,1 }\approx 7.15\), such that \(X^{+,1 }\approx 7.896\). Furthermore, welfare can be computed as \(W^{+,1 }\approx 32.65\).

Under the alternative assumption of \(T^{+,2 }= q\alpha ^{2}\), the firm’s optimal evasion choice (cf. Eq. (8)) results in \(\pi = 10q\alpha \). Using this information in the zero-profit constraint allows for the derivation of the optimal evasion decision, which is given by \({\alpha }^{+,2}=\sqrt{16+1/{q}}-4{}\approx {}0.301\). This implies \(T^{+,2 }\approx 0.036\). Combining \(\pi = x^{2}\) from (13a) and \(\pi = 10q\alpha \) yields \(x^{+,2 }\approx 1.098\) and \(n^{+,2 }\approx 7.2\), such that \(X^{+,2 }\approx 7.903\). Note that an increase in q reduces \(\alpha \) and raises profits, \(\pi = 10q\alpha (q)\), and hence, output per firm, x. This, in turn, implies that the number of firms—which declines in output per firm—becomes smaller if tax evasion is reduced. Conversely, a decline in q implies a rise in the number of entrants (see Proposition 1). Finally, welfare can be computed as \(W^{+,2 }\approx 32.57\).

1.5.4 Second-best outcome in the absence of tax evasion (Table 1, row 5)

The second-best outcomes are the same in settings in which there are either no taxes or, alternatively, taxes cannot be evaded because taxation has no impact on the firm’s output choice. Hence, \(9 - X - x = 0\) holds. The second-best outcome results from the maximisation of welfare, W, subject to the adjustment in output to the number of firms. Combining (15) and (13a) yields:

Substituting, for example, \(X = xn\) into this equation and into \(9 - X = x\) and solving the system, we obtain \(x^{0,\hbox {opt} }\!=\! 9^{1/3 }\!\approx \! 2.08\), \(n^{0,\hbox {opt} }\approx 3.327\), \(X^{0,\hbox {opt} }\!=\! 6.92, \pi ^{0,\hbox {opt} }= 4.32\) and \(W^{0,\hbox {opt} }\approx 35\).

1.5.5 Second-best outcome in the presence of tax evasion (Table 1, rows 6, 7)

Using Eq. (13a), the constrained optimum can be defined as:

Assuming \(T^{+,1 }= q(\alpha \pi )^{2}\), using the specific values employed for the numerical example, and also taking into account (13b) and (13c), (28) can be rewritten as:

Using the definition of \(E_{\pi }\) (cf. Eq. (11b)) and \(\alpha \pi =\tau /(2q)\) from (8) clarifies that last two terms in square brackets sum to zero. Replacing \(\alpha \pi \) by \(\tau /(2q) = 0.25\) and \((9 - X)x = \pi = x^{2}\), we can solve (29) for n.

Combining this expression with the first-order condition for the firm’s output choice and replacing \(\beta \) by 0.5, we obtain:

Solving this equation yields \({x}^{+,1,\hbox {opt}}=\root 3 \of {9.1125}\approx 2.089\). From this output level per firm, we can calculate \(n^{+,1,\hbox {opt} }\approx 3.309\), \(X^{+,1,\hbox {opt} }\approx 6.912\) and \(\pi ^{+,1,\hbox {opt} }\approx 4.36\). Given \(\alpha \pi = 0.25\), the fraction of the tax base evaded equals \(\alpha ^{+,1,\hbox {opt} }= 1/(4\pi ) \approx 0.057\). Welfare can, using the standard approach outlined above, be computed as \(W^{+,1,\hbox {opt} }\approx 34.97\).

Finally, we calculate \(\hbox {d}W/\hbox {d}n = 0\) for \(T^{+,2 }= q\alpha ^{2}\). This derivative is given by:

Since \(\pi = (9 - X)x = x^{2}\) and \(\alpha =\tau x^{2}/(2q)\) from (8) and \(\pi = x^{2}\), we obtain:

Solving this expression for n, yields:

Combining (34) and \(n = (9 - X)x\), and substituting for q and \(\tau \), we obtain a fifth-order polynomial.

Solving this expression for x, we obtain \(x^{+,2,\hbox {opt} }\approx 1.837\). Further solutions to (35) lie outside the range \(0< x < 4.5\). Since \(x > 4.5\) implies that \(n < 1\), we can ignore such solutions. Accordingly, the constrained-optimal number of firms equals \(n^{+,2,\hbox {opt} }\approx 3.899\), and aggregate output and profits are given by \(X^{+,2,\hbox {opt} }\approx 7.164\) and \(\pi ^{+,2,\hbox {opt} }\approx 3.37\). The fraction of taxes evaded is \(\alpha ^{+,2,\hbox {opt} }\approx 0.844\). Finally, welfare equals \(W^{+,2,\hbox {opt} }\approx 34.36\).

Rights and permissions

About this article

Cite this article

Goerke, L. Tax evasion in a Cournot oligopoly with endogenous entry. Int Tax Public Finance 24, 754–779 (2017). https://doi.org/10.1007/s10797-016-9434-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-016-9434-z