Abstract

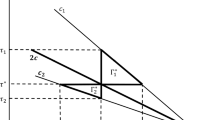

With over 17 emissions trading systems (ETSs) now in place across four continents, interest in linking ETSs is growing. Linking ETSs offers economic, political, and administrative benefits. It also faces major challenges. Linking can affect overall ambition, financial flows, and the location and nature of investments, reduces regulatory autonomy, and requires harmonization of ETS design elements. This article examines three options that could help overcome challenges by restricting the flow of units among jurisdictions through quotas, exchange rates, or discount rates. We use a simple model and three criteria—abatement outcome, economic implications, and feasibility—to assess these ‘restricted linking’ options. Quotas can enhance cost-effectiveness relative to no linking and allow policy-makers to retain control on the extent of unit flows. Exchange rates can create abatement and economic benefits or unintended adverse implications for cost-effectiveness and total abatement, depending on how rates are set. Due to information asymmetries between the regulated entities and policy-makers setting the exchange rate, as well as uncertainties about future developments, setting exchange rates in a manner that avoids such unintended consequences could prove difficult. Discount rates, in contrast, can ensure that both cost-effectiveness and total abatement are enhanced. Overall, restricted linking options do not achieve the benefits of full linking, but also avoid some major pitfalls, as well as offering levers that can be adjusted, should linking concerns prove to be more significant than anticipated.

Similar content being viewed by others

Notes

One-way linking, which refers to the situation in which units from one jurisdiction are recognized in another jurisdiction but not vice versa, could be seen as a special case of quotas where one jurisdiction introduces a quota of zero, whereas the other jurisdiction does not apply a quota.

Burtraw et al. (2013) evaluated an exchange rate of 3 between California-Québec and RGGI. The findings are similar to our simplified model, though our model does not account for the presence of floor prices.

References

Bakker, S., Haug, C., van Asselt, H., Saïdi, R., & Gupta, J. (2011). The future of the CDM: Same same, but differentiated? Climate Policy, 11, 752–767.

Bodansky, D., Hoedl, S. A., Metcalf, G. E., & Stavins, R. N. (2015). Facilitating linkage of climate policies through the Paris outcome. Climate Policy, 16, 956–972. doi:10.1080/14693062.2015.1069175.

Burtraw, D., Palmer, K. L., Munnings, C., Weber, P., & Woerman, M. (2013). Linking by degrees: Incremental alignment of cap-and-trade markets. In RFF discussion paper 13-04. Washington, DC: Resources for the Future. http://www.rff.org/Publications/Pages/PublicationDetails.aspx?PublicationID=22167.

Chung, R. K. (2007). A CER discounting scheme could save climate change regime after 2012. Climate Policy, 7, 171–176.

Comendant, C., & Taschini, L. (2014) Submission to the inquiry by the house of commons select committee on energy and climate change on ‘linking emissions trading systems’. Centre for Climate Change Economics and Policy and Grantham Research Institute on Climate Change and the Environment. http://www.lse.ac.uk/GranthamInstitute/wp-content/uploads/2014/10/Comendant-and-Taschini-policy-paper-April-2014.pdf.

Doda, B., & Taschini, L. (2016). Carbon dating: When is it beneficial to link ETSs? Centre for climate change economics and policy. In Working Paper No. 234. http://www.lse.ac.uk/GranthamInstitute/wp-content/uploads/2015/09/Working-Paper-208-Doda-and-Taschini-August2016.pdf.

Erickson, P., Lazarus, M., & Spalding-Fecher, R. (2014). Net climate change mitigation of the Clean Development Mechanism. Energy Policy, 72, 146–154. doi:10.1016/j.enpol.2014.04.038.

Flachsland, C., Marschinski, R., & Edenhofer, O. (2009a). Global trading versus linking: Architectures for international emissions trading. Energy Policy, 37, 1637–1647. doi:10.1016/j.enpol.2008.12.008.

Flachsland, C., Marschinski, R., & Edenhofer, O. (2009b). To link or not to link: Benefits and disadvantages of linking cap-and-trade systems. Climate Policy, 9, 358–372. doi:10.3763/cpol.2009.0626.

Fuessler, J., Wunderlich, A., & Taschini, L. (2016). International carbon asset reserve. Prototyping for instruments reducing risks and linking carbon markets. Zurich: INFRAS.

Green, J. F., Sterner, T., & Wagner, G. (2014). A balance of bottom-up and top-down in linking climate policies. Nature Climate Change, 4, 1064–1067. doi:10.1038/nclimate2429.

Haites, E. (2014). Lessons learned from linking emissions trading systems: General principles and applications. In Technical Note 7. Washington: Partnership for Market Readiness.

Harrison, D., Klevnäs, P., Radov, D., & Foss, A. (2006). Interactions of cost-containment measures and linking of greenhouse gas emissions cap-and-trade programs. Palo Alto, CA: Electric Power Research Institute. http://www.epri.com/abstracts/Pages/ProductAbstract.aspx?ProductId=000000000001013315&Mode=download.

Helm, C. (2003). International emissions trading with endogenous allowance choices. Journal of Public Economics, 87, 2737–2747.

ICAP. (2016). Emissions trading worldwide: ICAP status report 2016. Berlin: International Carbon Action Partnership.

Kachi, A., Unger, C., Böhm, N., Stelmakh, K., Haug, C., & Frerk, M. (2015). Linking emissions trading systems: A summary of current research. Berlin: International Carbon Action Partnership.

Marcu, A. (2015). Mitigation value, networked carbon markets and the paris climate change agreement. Brussels: CEPS.

Mehling, M., & Görlach, B. (2016). Multilateral linking of emissions trading systems. MIT Center for Energy and Environmental Policy Research. http://ceepr.mit.edu/files/papers/16-009.pdf.

Mehling, M., & Haites, E. (2009). Mechanisms for linking emissions trading schemes. Climate Policy, 9, 169–184. doi:10.3763/cpol.2008.0524.

Mendelsohn, R. (1986). Regulating heterogeneous emissions. Journal of Environmental Economics and Management, 13, 301–312. doi:10.1016/0095-0696(86)90001-X.

Pizer, W. A., & Yates, A. J. (2015). Terminating links between emission trading programs. Journal of Environmental Economics and Management, 71, 142–159.

Ranson, M., & Stavins, R. N. (2016). Linkage of greenhouse gas emissions trading systems: learning from experience. Climate Policy, 16, 284–300.

Schneider, L. (2009). A clean development mechanism with global atmospheric benefits for a post-2012 climate regime. International Environmental Agreements: Politics, Law and Economics, 9, 95–111.

Sterk, W., Braun, M., Haug, C., Korytarova, K., & Scholten, A. (2006). Ready to link up? Implications of design differences for linking domestic emissions trading schemes. Berlin: German Federal Ministry of Education and Research (BMBF).

Sterk, W., & Schüle, R. (2009). Advancing the climate regime through linking domestic emission trading systems? Mitigation and Adaptation Strategies for Global Change, 14(5), 409–431. doi:10.1007/s11027-009-9178-5.

Tuerk, A., Sterk, W., Haites, E., Mehling, M., Flachsland, C., Kimura, H., et al. (2009). Linking emissions trading schemes. Synthesis report. London: Climate Strategies.

Warnecke, C., Wartmann, S., Höhne, N., & Blok, K. (2014). Beyond pure offsetting: Assessing options to generate net-mitigation-effects in carbon market mechanisms. Energy Policy, 68, 413–422.

Acknowledgements

This article was produced based on an input to the ICAP Technical Dialogue on linking emissions trading systems. The authors would like to thank Michel Frerk, Constanze Haug, Aki Kachi and Marissa Santikarn from the ICAP Secretariat as well as several ICAP members for their constructive comments on a draft version of this paper. Bianca Sylvester and Luca Taschini also provided valuable feedback. An earlier version of the paper was presented at the workshop ‘Comparison and Linkage of Mitigation Efforts in a New Paris Regime’, organized by the International Emissions Trading Association, the Harvard Project on Climate Agreements, and the World Bank Group’s Networked Carbon Markets Initiative. Findings and opinions expressed in this study are those of its authors and do not necessarily reflect the views of ICAP or its members.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Schneider, L., Lazarus, M., Lee, C. et al. Restricted linking of emissions trading systems: options, benefits, and challenges. Int Environ Agreements 17, 883–898 (2017). https://doi.org/10.1007/s10784-017-9370-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10784-017-9370-0