Abstract

This article examines the establishment and development of a protected ‘green’ niche around the solar manufacturing industry in the United States in the 2000s. The paper uses the case of Solyndra, an innovative solar manufacturing corporation founded in 2005 and that went bankrupt in 2011, as a window into identifying the key factors that led to the failure of Solyndra. Solyndra was, at the time, the largest recipient of loan funding from the US Department of Energy, making it into the main representative of a key strategic industry identified as a target for federal support as part of US stimulus funding after the 2008 financial crisis. The analysis of the Solyndra failure case presented here highlights the need for strategic transitional niches to be shielded longitudinally by a strategic, entrepreneurial state, and considered in light of transnational exogenous factors. The article also argues for the importance of analysing discursive strategies that perform strategic niches as belonging to specific societal pathways.

Similar content being viewed by others

Introduction: the ‘Solar Renaissance’

The article focuses on the rise and fall of Solyndra, a corporation that aimed to take its place in the ‘renaissance’ of the US solar industry from 2005 to 2011. The firm aimed to manufacture and sell innovative thin-film photovoltaic (PV) panels by utilizing new materials not dependent on the then high prices of polysilicon. In 2009 Solyndra received a US$ 535 million loan from the US Department of Energy’s (DOE) Loan Guarantee Program (LGP). This was the largest LGP loan awarded to a renewable energy corporation. It was heralded as a step towards bolstering the US’s solar manufacturing capacity, while also creating jobs in the new ‘green economy’ and lowering the use of carbon-intensive fuels and technologies. Using the theoretical perspectives found within studies of socio-technical transitions, this article conceptualises the LGP’s support of Solyndra as a specific example of state-led support of a niche that promised innovative potential.

While Solyndra was identified as a potential niche success story, by late 2011 the firm had declared bankruptcy and its new manufacturing facilities stood empty. This occurred largely due to several exogenous factors, outlined below, that affected the protected niche within which Solyndra was meant to develop. The case of Solyndra raises important questions concerning how niches are conceptualised and supported in the remit of state-sponsored sustainability transition strategies (Caprotti 2010). Specifically, the article raises the twin issues of: a.) the necessity of partially isolating niches from the vagaries of market pricing (and their political-economic uses, as seen in the recent example of the effect of falling oil prices on the US fracking industry), and b.) the need to envision the protection of innovative niches as a longitudinal strategy which requires sustained and consistent temporal commitment.Footnote 1

The paper examines the rise and fall of Solyndra, and the ways in which the firm was discursively constructed and performed during its brief lifespan. This analysis is based on examination of documentary sources relating to the firm’s development and eventual bankruptcy. A comprehensive study was made of reports and documents from the following sources: the US Congress, the US Bankruptcy Court, the Department of Energy (DOE), and the Department of the Treasury (DOT). Additionally, data from national non-profit organizations, such as the National Renewable Energy Association (NREL), was used. Corporate reports were also analysed, as were market reports from associations and industry bodies such as the Solar Energy Industries Association (SEIA).

Theoretical context: green niches

Solyndra is an example of a single firm that was to become a protected niche around solar manufacturing. As the discussion below shows, while niches are generally conceived as protected envelopes (Geels 2012), protection of the niche around Solyndra was not sufficiently developed. Solyndra is an important case for analysis because while it rose quickly and was constructed and performed as the central actor within the ‘green’ niche around renewable energy in the US in the late 2000s, its failure was also the subject of discursive contestation around the meaning of its bankruptcy for state support of innovative technologies.

The notion of niche utilised here derives from the large body of literature on socio-technical transitions. Specifically, theories of transition attempt to understand the way(s) in which innovative technologies, practices and ‘ways of doing’ emerge and are widely adopted, or fail. To do so, a conceptual perspective known as the multi-level perspective (MLP) is widely used. Briefly, studies of transition informed by the MLP focus on the ways in which innovation is articulated across three separate but porous levels, i.e., the ‘niche’, the broader ‘regime’, and the ‘landscape’. Niches are the level at which innovations can grow and are developed. They are characterised by levels of innovative potential ranging from the highly radical to the simply innovative (Smith 2007). At the next level, socio-technical regimes are broad, dominant sets of rules, agendas, guiding principles, government regulations, and groups of actors (Geels Rip and Kemp 1998). Although regimes tend towards stability, niche innovations have the potential to interact with, and potentially change, the regime. After the regime, the socio-technical landscape constitutes the macro-level, exogenous environment that specific actors cannot modify, but which can be gradually changed through regime modifications (Geels 2005).

Scholars of transition have recently focused on the renewable energy sector, including the solar energy industry, as examples of the emergence of regime-changing innovations within niches. Smith and Raven (2012), for example, described the development of the photovoltaic industry since the 1960s as a result of a succession of niche developments:

‘One can think, for example, of the development of solar photovoltaic cells initially within a ‘protective space’ constituted by satellite programmes in the 1960s, public research programmes in materials science, and policies for developing renewable energy since the 1970s. The protective space was widened further through international aid programmes for PV power systems in remote, off-grid development projects. Since the 1990s, sustainable energy policy in some wealthier countries has opened a market-niche for integrating or retrofitting solar power systems into buildings…’ (Smith and Raven 2012: 1025).

A number of studies focusing on a range of industries and innovative developments, from animal husbandry (Elzen et al. 2011) to institutional niches in the carbon economy (Foxon 2011) have highlighted the need for not only understanding niches in the process of transition, but also managing them (Hoogma et al. 2002; Kemp et al. 1998) as a way of facilitating and directing transitions (Markard et al. 2012). This results from the understanding that although sustainability transitions are path-dependent, pathways encompass broad avenues of possible transition gradients within specific boundaries (a ‘transition envelope’) (Bailey and Wilson 2009). In turn, this envelope is determined by a range of factors, including the discursive context around what is deemed societally possible, or acceptable. Building on this, it is therefore crucial to understand the ways in which niches are protected. Smith and Raven (2012) argue that this occurs through three main mechanisms: shielding, nurturing and empowerment. Shielding involves protecting a niche from external pressures; nurturing practices, such as the construction of networks of relevant actors, are focused on helping niches to develop; and empowerment refers to processes that enable niches to eventually compete either within an unchanged regime, or within a regime that has been modified to some extent by the niche. As will be shown, in the case of Solyndra it is clear that the corporation was not effectively shielded, while nurturing and empowerment practices were in evidence in the US government’s attempts to position Solyndra as a key innovative actor.

The ‘green’ niche of which Solyndra was a central part can be considered as nested within the wider electricity generation and distribution regime (Smith 2007; Smith et al. 2005). The regime level can be considered as the assemblage of the institutions (such as state energy departments, energy corporations), practices (such as political discourses, knowledge production mechanisms, and the like) and materialities (such as specific technologies, materials and networks) that are the basis for the delivery of a societal service such as energy production (Bolton and Foxon 2015). In the specific context of Solyndra, the regime could also be considered in a spatialized manner, by identifying it with the specific US electricity and distribution context, although this definition runs the risk of ignoring the transnational factors, explored below, which contribute to niche emergence and eventual regime change.

Since Solyndra received over 40 % of state-provided loan funds aimed at supporting the solar industry, the corporation can be considered as having constituted a large part of the US solar energy niche. Nonetheless, in analysing the Solyndra ‘story’, it is also key to highlight three additional dimensions which impacted on the niche around Solyndra, namely:

-

(a)

The transnational spatial scale.

There have been recent calls to spatialise studies of transition and, more specifically, to apply a level of spatial and scalar awareness to analyses of niche development (Sengers and Raven 2015; Späth and Rohracher 2012). The article contributes to this awareness by considering transnational factors transnational factors: the paper draws on recent work on solar energy niches which highlight the necessarily transnational character of niche development (Wieczorek et al. 2015). As Gress (2015: 114) has noted with regard to the Chinese solar industry, the nature of the solar market is such that Chinese solar corporations ‘have had no choice but to interact with firms and governments outside of China while at the same time undertaking core business activities in mainland China in an era of progressively market-oriented policy shifts’. With regard to factors key to the Solyndra case, this involved fluctuations in the market price of polysilicon, the Chinese state, European governments and their renewables targets, as well as non-American solar panel manufacturing firms (Caprotti 2015). Furthermore, the article argues that it is important to consider ‘failure cases’ such as Solyndra because of what they highlight in terms of the role of transnational factors in affecting and contributing towards outcomes and development pathways in ‘protected’ niche spaces.

-

(b)

political discourses and narratives

Discourses, narratives and debates are key to niche development trajectories. The development of renewable energy innovations is often presented as a ‘technical’ narrative of incremental developments in knowledge, know-how and product offerings. However, research into the development of solar power in Europe from the late twentieth century onwards, from the UK (Smith et al. 2014), to Finland (Haukkala 2015) and the Netherlands (Verhees et al. 2013) has highlighted the need to consider green niches as the result not only of processes of technological and other forms of innovation, but also of discursive and political contestation and debate (Karimi and Komendatova 2015; Petrova et al. 2013; Späth and Rohracher 2010, 2012). In addition, as Hess (2013) has shown in the case of solar innovations, oppositional strategies are key in shaping transitional pathways to adoption or non-adoption of solar technologies. This article engages with these aspects of niche development by focusing on the ways in which Solyndra was discursively defined and opposed by a range of actors. As Verhees et al. (2013) noted in their study of the ‘survival’ of the Dutch PV industry, niches exist within, and interact with, contexts which involve discursive arenas and agendas linked to a broad range of issues, from energy security to economic development (Fischhendler et al. 2015). As is shown below, Solyndra was similarly deployed as a discursive focus for narrative strategies which were deeply political. Between 2005, when it was incorporated, and 2011, when it was declared bankrupt, Solyndra’s discursive identity ranged from being depicted as a provider of ‘clean and economical solar power’ (Solyndra 2012), to a firm which Mitt Romney, 2012 Republican presidential candidate, decried as an example of wasteful use of public funds to construct a ‘‘symbol not of success, but of failure’ (Romney, in Friedman 2012). The terrain of discursive performance in a context of international economic and energy geopolitics (Hommel and Murphy 2013; Joshi 2014; McCarthy et al. 2014), then, becomes a key locus for debate over transitional trajectories. This also highlights the intersection between discourses, many of which (such as those which performed Solyndra in the US) are national in character and context, and the transnational spatial scale that is key in influencing the development of these more nationally rooted discourses.

-

(c)

The state.

Finally, the role of the state is thrown into prominence when considering the Solyndra case. Political tensions around the funding of renewable energy innovations in the 2000s and early 2010s were central to the firm’s trajectory and eventual failure. Nonetheless, the state was also a key actor enabling the rise of the solar niche in the first place (Olson and Biong 2015). In part, this is because of its earlier role in supporting (through programmes from the space programme, to research and development funding) the various technical and scientific components which emerged into Solyndra’s specific innovative offering. As Mazzucato (2013) argues, the state can be considered entrepreneurial in its backing of early-stage technologies and innovations which eventually gain market dominance, or are incorporated (perhaps with a time lag of decades) within different innovative solutions. What the paper will also show is that the role of other states is crucial because the US government’s support for Solyndra intersected with the actions of other governments in supporting domestic technology firms, or in changing subsidy regimes.

Therefore, protected ‘green’ niches can be understood as emerging in and through the interaction of material, discursive, political and geopolitical dimensions. This highlights the importance of transnational scale at the same time as the key role of discourses that are much more national in character, but which emerge (at least in part) as a response to transnational and global economic and other concerns. The role of the state, in turn, is confirmed as central both to niche development, and to niche failure when the state is unable to design and guarantee mechanisms which shield niches, as seen below. In the context of the production of protected niches, then, it becomes key to consider the specific mechanisms through which niches are produced on the one hand, and protected on the other. These mechanisms include, among others, the role of international state and corporate actors as well as the agency of calculative market factors such as raw material prices; the discursive identification and performance of selected niches; a public and private financially enabling environment (from state-backed loans to ease of access to venture finance); a potentially protective regulatory context; political stability and longevity in backing strategic niche developments longitudinally; and an emergent socio-technical assemblage of technologies and knowledge that contributes to the innovations central to a specific niche.

The US solar energy industry

The global solar industry emerged rapidly in the 2000s, mirroring the rise in environmental technology investments more broadly over the same time period. Globally, solar power investments grew from US$ 66 million in 2000, to US$ 2.5 billion in 2005, to US$ 136.6 billion by the end of 2011 (Jennings et al. 2008; McCrone 2012). The US solar market mirrored these rapid investment inflows, especially since 2005: while capital investments in solar energy (including government-funded R&D) increased slightly in 2000–2004, from US$ 164 million to US$ 215 million per annum, there was a rapid increase in yearly investment by 2007, to US$ 3.2 billion. By 2007, over 95 % of solar investments in the US originated from the private sector, predominantly from public and private equity and venture capital (Jennings et al. 2008).

Rapid growth in investment meant that by the end of 2011, the US solar market was worth over US$ 8.4 billion (SEIA 2012b). This stimulated the expansion of the solar manufacturing sector, the specific industry in which Solyndra operated. Between 2010 and June 2012, 59 new solar manufacturing facilities commenced operations across the US (SEIA 2012a): these were largely located in California. Both the predominance of California in the landscape of the US solar industry, and the growth in US installed capacity were due to a multiplicity of factors that cannot be fully explored here.Footnote 2 However, the overall picture is of a national but highly spatially concentrated market that saw a significant ‘take-off’ period in the 2000s, albeit from a modest starting point. California was the main geographical location in which attempts to define and protect a solar energy niche were focused.

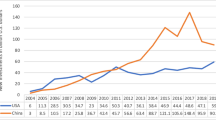

While the Solyndra case is nested within the context of a rapidly emergent US solar industry, a further contextual factor is the wider globalization of renewable energy industries in the 2000s. While the solar energy industry, and indeed the whole renewable energy sector, was developing rapidly in the US, the period 2000–2012 was also marked by a notable shift in market power and market share away from the US. While the US controlled 43 % of global solar manufacturing in 1995, this had declined to 27 % by 2000, and to 7 % in 2010 (DOE 2012e). In particular, China emerged as the global centre of solar manufacturing: in 2010 and 2011, the US produced solar cells for a cumulative total capacity of less than 2GW in 2010 and 2011, while China produced cells for a total of c.11GW of capacity in 2010 alone (DOE 2012h, i). By the end of 2010, Chinese firms controlled 17 % of the global silicon market, which is of central importance to solar manufacturing (DOE 2012f; Casey and Koleski 2011).

The global, transnational context has had clear spatial and market consequences within the US market. While California remained the largest solar-manufacturing state in the US in 2010, by the fourth quarter of the same year, Chinese solar firms overtook US-based counterparts in accounting for the largest stake of the state’s installed solar power (31 %, as opposed to the 25 % installed by US firms) (Wesoff 2011). This was mainly due to the Chinese government’s subsidy programmes for solar energy (World Bank 2010), part of a national attempt to promote a domestic solar niche that, in turn, had significant effects on the US solar niche. It is within this transnational niche context that the Solyndra case can be set.

Solyndra and the Loan Guarantee Program

Solyndra (originally Gronet Technologies) was incorporated on 10 May 2005, and renamed Solyndra in January 2006.Footnote 3 The firm’s future was staked on its thin-film tubular solar module technology. In turn, projected demand for its solar products was based on the low price of Solyndra’s modules vis-à-vis the price of more conventional PV modules. The price of Solyndra’s modules was thus determined by the price of the material used to produce the modules, which was the central pivot of Solyndra’s innovation. This material (a combination of copper, indium, gallium and diselenide, commonly referred to as CIGS) was different to the single crystal silicon or more commonly used polycrystalline silicon (hereinafter referred to as polysilicon) utilised in most solar manufacturing at the time. Polysilicon prices experienced a steady rise from 2005, reaching a decadal high in 2008. This pushed the price of standard solar panels increasingly higher. By betting on a technology not reliant on polysilicon, Solyndra was attempting to leverage the cost of CIGS against the higher cost of polysilicon on the global market.

Solyndra’s thin-film modules were organized in cylindrical tubes around one metre in length to protect the panel from thin film degradation. The firm’s panels were mostly aimed at the rooftop installation market, focusing on utilising the large amounts of roof space available on commercial and other buildings. Its major installations included a 7000 module, 1.28 MW array in Tolouse, France, for Nazca (a subsidiary of the GSE Group, a global building, civil engineering and construction conglomerate) (Solyndra 2010). Solyndra’s largest project was a 3 MW installation in Belgium that incorporated 17,000 rooftop solar modules on a distribution centre, owned by the Delhaize supermarket corporation (Solyndra 2011). The firm was therefore using innovative technology to open up a new market, capitalising on commercial rooftop space.

A key part of Solyndra’s business plan was the construction of manufacturing plants that could produce high volumes of thin-film modules at lower cost than rival polysilicon-based plants (Neilson 2012). This would have enabled Solyndra to outcompete other firms in the US solar market and present a considerable challenge to Chinese polysilicon-based solar manufacturers. In order to produce large quantities of these modules, Solyndra needed a large, advanced production facility. Although the firm had already attracted significant amounts of private funding, a sizeable public investment was sought in order to enable the construction of Solyndra’s new advanced manufacturing plant. In March 2009, Solyndra became the first corporation to receive funding from the DOE’s loan guarantee scheme, the LGP (DOE 2009, 2011a, 2012b; Solyndra 2009). The loan was directed at funding the construction of a high-tech manufacturing facility in Fremont, California, named ‘Fab. 2’. The facility aimed to produce modules capable of generating a cumulative 230 MW per annum (Executive Office of the President 2010), and of initially creating 3000 construction jobs, followed by 1000 long-term manufacturing, ‘green collar’ jobs once the facility was fully operational (Office of the Vice President, press release, 4 September 2009). This manufacturing and job-creation target was championed at the highest levels. In president Obama’s 2010 State of the Union address, the loan was discursively directly linked to job creation:

‘You can see the results of last year’s investments in clean energy […] in the California business that will put a thousand people to work making solar panels’ (Obama 2010a, np)

The US$ 535 million loan secured by Solyndra was granted under Title XVII (‘Incentives for Innovative Technologies’) of the 2005 Energy Policy Act (EPA). The EPA defined innovative technologies as those that can be readily exploited in a ‘commercial’ setting, thus implicitly linking a potential domestic niche to the wider global market, and constructing a need for niche innovations to immediately compete and soon shed any shielding they may have had from market forces (EPA 2005). Solyndra’s technology was thus constructed as blending innovation and commercial potential. It was also depicted as providing a key example of the rebirth of skilled manufacturing in the new context of the ‘green economy’ (Bailey and Caprotti 2014; Caprotti and Bailey 2014). As Energy Secretary Chu stated regarding the Solyndra project loan:

‘This investment is part of a broad, aggressive effort to spark a new industrial revolution that will put Americans to work, end our dependence on foreign oil and cut carbon pollution’ (Office of the Vice President, press release, 4 September 2009, 1).

The Solyndra loan was thus crucially situated at the interface between concerns over the US’ sliding market share in renewable technologies and tensions over the economic and political response to the 2008 financial crisis. The government act that tackled the latter concern most directly was the 2009 American Recovery and Reinvestment Act (ARRA), which introduced a range of stimulus funding. Title XVII of the EPA, which mandated innovative technology incentives as seen above, was amended by Section 1705 of the ARRA, to focus specifically on renewable energy and electric power transmission projects (ARRA 2009). This availed US$ 16.15 billion to projects, including solar power manufacturing and generation. The importance of the emerging solar energy niche in the US can be seen by the fact that 82 % (US$ 13.27 billion) of the loans offered under Section 1705 were directed to solar energy projects. Of this, solar manufacturing projects accounted for US$ 1.28 billion, including the Solyndra deal (see Table 1), with the remainder awarded to solar generation projects (Brown 2011).Footnote 4

The stimulus funding target most relevant to Solyndra was that of doubling domestic renewable manufacturing capacity from 6 GW to 12 GW by the end of 2011. This was discursively framed as a way of generating ‘green collar jobs’ at home, and responding to market pressures originating overseas:

‘Three decades ago, the U.S. led the world in the development of renewable energy, such as wind, solar, and geothermal power. Since then, markets for renewable energy have grown predominantly overseas due to strong, consistent foreign government incentives and policies. As a result, manufacturing… has grown largely overseas as well. Recovery Act investments are helping the U.S. re-establish leadership in innovation, manufacturing, and deployment in these fast-growing industries, which will create new jobs, increase access to clean energy, and reduce greenhouse gas emissions’ (Executive Office of the President 2010, 17).

Thus, the Solyndra LGP award was discursively constructed as a way of establishing a green niche around solar manufacturing. This strategy spanned political terms: even though the Obama administration took office in January 2009, the loan was duly approved in March. The Solyndra loan was also the first loan to be financed through the DOT’s Federal Financing Bank (FFB).Footnote 5 FFB only funds loans which are 100 % guaranteed by the DOE, which means that the financial risk associated with the Solyndra failure was directly tied to the DOE and, therefore, to the American taxpayer:

‘Because loans under DOE’s LGP are guaranteed, FFB has not, and will not incur any direct credit-related losses associated with the program. All credit losses under the LGP are the responsibility of DOE, and are ultimately borne by the American taxpayers’ (DOT 2012, 4).

This was an important consideration in terms of defining the Solyndra niche, because one of the conditions for the loan was that the first creditor to be repaid in case of a bankruptcy was to be the government. Although this was subsequently partially changed (in 2011, US$ 75 million of private loans were prioritised as ‘senior debt’ over the much larger federal loan amount), this contributed to the inhibition of private investors from granting Solyndra a financial lifeline at the time of the bankruptcy. Nonetheless, before gaining federal funding, the firm was highly successful in attracting private capital from a range of sources. Table 2 is based on a 2009 filing with the Securities and Exchange Commission (SEC), which only detailed investors holding 5 % or more in the firm, or directors’ investments: over US$ 598 million were committed by this category of investor (DOE 2012d). By the time of the bankruptcy, the total amount of private equity invested in Solyndra was over US$ 1.2 billion (Neilson 2012).

Solyndra was widely celebrated as a flagship example of American solar technology innovation. In 2010 MIT’s Technology Review chose Solyndra as one of the top 50 most innovative companies globally. In the same year, the Wall Street Journal named Solyndra as one of its top 50 venture-backed companies. An informal poll by Reuters of venture capital investors’ picks for companies with potential for acquisition or being floated on the stock market ranked Solyndra as second, behind social networking firm Linkedin (DOE 2012c). Solyndra was clearly constructed as an embodiment of the market potential of solar energy technologies in the US and on the international market. Solyndra’s development, in terms of amount of capital invested in the firm’s fixed assets, as well as in its human capital and inventory, was both rapid and highly public, indicative of the successful initial promotion of a green niche. Its demise was even more expeditious and publicly displayed and debated. It is to the Solyndra bankruptcy that the paper now turns.

The fall of Solyndra

Solyndra’s collapse was partly written in the fluctuations of the market price of polysilicon. Throughout 2005, the spot price of polysilicon was below US$ 100/kg. By August 2008, this had risen to a decadal high of US$ 450/kg, making Solyndra’s products very competitive. However, from August 2008 to June 2009, the spot price declined rapidly, to below US$ 100/kg. By December 2011, the price had declined further, to US$ 30/kg (GTM Research 2012). By mid-2013, prices hit an all-time low of US$ 16.9/kg. This represented a price decline of over 90 % in 2008–2013: a fatal hindrance to a corporation founded on the assumption of the persistence of high polysilicon prices. The global market price of polysilicon was affected in large part by Chinese solar subsidies, which had the effect of depressing prices.Footnote 6

The effect of the drop in the price polysilicon on Solyndra was significant and quickly felt (Fig. 1). The polysilicon price decrease led to reduced panel prices (SEIA 2012a), leading to a drop in the price of solar installations by 14 % (for residential installations) and 20 % (for commercial installations) in 2010 alone (Sherwood 2011). This contributed to Solyndra’s financial woes. Ironically, at the same time, it also signified a greater competitiveness for solar vis-à-vis other, more traditional energy sources. The decreased competitiveness of Solyndra’s products affected the firm’s ability to attract private investment.

By the end of 2010, barely a year after its LGP loan was authorized, it was clear that Solyndra faced increasingly adverse market conditions, and that polysilicon prices were but one of the firm’s problems. Another difficulty was Solyndra’s cost base: the solar arrays it manufactured cost around US$ 4 for every watt of power output, but the firm could only sell them for US$ 3.24 per watt. This was in stark comparison to US competitor First Solar, which produced cadmium telluride-based thin film panels at around a quarter of Solyndra’s cost (Chernova 2011). Similarly low-priced offerings were also available from polysilicon-based Chinese manufacturers (DOE 2012g). These difficulties led the firm to cancel an Initial Public Offering (IPO) in June 2010. By November 2010, it started laying off employees. Its auditors had already noted the corporation’s ‘recurring losses’ and ‘negative cash flows’. Recounting this, in a hearing of the House of Representatives’ Committee on Energy and Commerce before the Subcommittee on Oversight and Investigations on 24 June 2011, Tennessee Representative Marsha Blackburn stated that:

‘I thought it was interesting 6 months after the loan guarantee was approved, Solyndra’s auditor, PricewaterhouseCoopers, stated that the company had suffered recurring losses from operations, negative cash flow since inception, and has a net stockholder’s deficit that, among other concerns, raised substantial doubt about its ability to continue as a going concern’ (Blackburn 2011: 18).

It was later found, as reported by the DOE in 2015 following an investigation into the loan awaerd, that Solyndra officials had potentially misled the DOE as to the strength of orders and the market outlook for its panels, before the loan award (DOE 2015). Issuance of the LGP loan undoubtedly provided oxygen for the continued survival of the firm, predicated in part on increased production: Solyndra produced nearly 17 times more modules in 2009 than it did in 2008. Its revenues rose from US$ 6.01 million in 2008–2009 to a peak of US$ 140 million in 2010–2011. These revenues, however, were lower than the firm’s liabilities.

In addition to the drop in polysilicon prices, the global 2008 financial crisis was deleterious for the solar manufacturer. In a post-bankruptcy report by the Chief Restructuring Officer in the Solyndra case, the effects of the crisis were judged to have been ‘overwhelmingly negative for Solyndra’ (Neilson 2012: 43). This is because, firstly, the crisis stifled attempts by the firm to raise capital through IPO or by attracting additional infusions of private capital. Secondly, Solyndra’s own customers faced difficulties obtaining funding for their solar installation projects due to the broader crisis in liquidity and the accompanying credit freeze. Thirdly, government assistance for the solar industry was drastically reduced in countries such as Spain and Italy, some of Solyndra’s main target markets (DOE 2012g). These countries were increasingly facing large budget deficits. Government programs such as Feed-in Tariffs (FiTs) to support renewables were crucial to Solyndra’s business plan, as it is estimated that over 75 % of all PV installations are a direct result of policies such as FiTs (Couture et al. 2010). Thus, polysilicon price fluctuations and the wider, global financial crisis created a transnational economic context which Solyndra found it hard to survive in, even with the help of more than half a billion dollars in LGP financing. The green niche around Solyndra was, clearly, not effectively shielded against short-term market fluctuations.

Within the context of rapid economic and political deterioration, Solyndra’s bankruptcy took less than a year to develop. While the firm sought alternative private financing opportunities in early 2011, its management reported in May 2011 that increased financing was needed in order for operations to continue for more than a month. Although the DOE and some of Solyndra’s main private investors provided US$ 29.2 million in last-minute funding, this was insufficient, and the firm commenced selling off inventory to lenders to provide liquidity. By the end of August 2011, failure to structure a bridging finance arrangement left Solyndra with no option other than to file for Chapter 11 bankruptcy. On 31 August, Solyndra ceased operations and most of its workforce was laid off (Neilson 2012). Solyndra owned US$ 854 million in assets, but owed US $ 863 million (US Bankruptcy Court 2012). This meant that several of Solyndra’s financial backers became unsecured creditors (US Bankruptcy Court 2011). The firm was not the only LGP-funded enterprise to fail.Footnote 7 However, the bankruptcy quickly became a discursive and symbolic rallying point for narratives aimed at constructing green energy initiatives in specific, mainly negative ways. This was augmented by the fact that in addition to bankruptcy proceedings, Solyndra became the centrepiece of an investigation into the events around its collapse, involving the FBI as well as the DOE’s Inspector General’s Office (Leone 2011).

Solyndra’s spectacular fall was accompanied by discursive strategies that leveraged the firm’s collapse to question the viability of government support for green energy firms. At the same time, other discursive strands focused on attempting to salvage the image and identity of Solyndra and the solar niche. However, the firm was, before its collapse, the centrepiece of markedly different discursive strategies which posited Solyndra as an example of the productive and positive union of government and the private sector in generating cleaner, greener futures while solving the problems caused by economic crisis. The following section critically investigates these different but coexisting narratives.

Discussion

Solyndra’s bankruptcy served as a temporal separator between two main discursive trends. The first trend, referred to below as promotion discourses, situated the rise of Solyndra within a wider context in which green energy was constructed as the repository of solutions to economic crisis, job creation, and climate change. In so doing, a positive vision of the green niche around solar manufacturing was constructed. These discourses were challenged, in turn, by discursive strategies arising around the time of Solyndra’s collapse, herein referred to as discourses of resistance. While both discursive strategies coexisted to some extent throughout Solyndra’s lifetime, the first set was most prominent before the bankruptcy, and were then superseded by discourses of resistance.

Promotion discourses

In the period to 2011, discursive strategies supporting Solyndra focused on promoting the firm by constructing it as: (a) an example of the financing of a market-based ‘solution’ to climate crisis; (b) a catalyst for the creation of ‘green collar jobs’ light of the financial crisis; (c) a model of state-led green energy investment which could successfully grow a key domestic corporate player in light of an increasing amount of international competition in renewable energy manufacturing.

Firstly, Solyndra was constructed as an innovative response to concerns about climate change, and one that could also provide positive returns on investment. These twin, ecologically modernising strategies can be seen in statements made by Solyndra’s CEO, Chris Gronet, following the LGP loan:

‘The leadership and actions of President Barack Obama, Energy Secretary Steven Chu and the U.S. Congress were instrumental in concluding this offer for a loan guarantee […] The DOE Loan Guarantee Program funding will enable Solyndra to achieve the economies of scale needed to deliver solar electricity at prices that are competitive with utility rates. This expansion is really about creating new jobs while meaningfully impacting global warming’ (Solyndra, 2009, emphasis added).

LGP financing was further presented as enabling the corporation to both avoid CO2 emissions, and promote economic growth through innovation and job creation:

‘Over the life of the project, Solyndra estimates that Fab 2 will produce solar panels sufficient to… avoid 300 million metric tons of carbon dioxide emissions. Further, Solyndra estimates that the construction of this complex will employ approximately 3000 people, the operation of the facility will create over 1000 jobs, and hundreds of additional jobs will be created for the installation of Solyndra PV systems, in the U.S.’ (Solyndra 2009).

Secondly, the justification of green energy financing projects was also carried out through the discursive strategy of depicting green energy technology manufacturing as a solution to economic crisis through provision of ‘green’ job opportunities. Narratives linking solar power’s low-carbon and job-creation potential were deployed by Solyndra executives in email communications with high-ranking DOE staff, in order to push for rapid approval of LGP financing. In an email from Chris Gronet to Steve Isakowitz, DOE Chief Financial Officer, this discursive strategy is clear:

‘Jobs are at stake this time. […] My understanding is that our objective in this program is to create Green jobs and promote carbon reducing technology like Solyndra’s. I hope and trust that the result is not just the opposite because of our lack of ability to execute according to commitments’ (Gronet to Isakowitz, 12 January 2009).

The focus on linking Solyndra and job creation can also be seen in a speech made by president Obama during a visit (on 26 May 2010) to Solyndra’s Fremont facility. Obama’s comments were made in the context of the creation of ‘green collar jobs’ through funding key innovators such as Solyndra:

‘[No]t only would this spur hiring by businesses, it would create jobs in sectors with incredible potential to propel our economy for years, for decades to come. There is no better example than energy’ (Obama 2010b).

During the same speech, he also stressed that:

‘[Th]ose guys in the back…have been building this facility so that we can put more people back to work and build more solar panels to send all across the country’ (Obama 2010b).

These discursive strategies were part of a highly successful attempt to attract attention and investment capital. With a total of over US$ 1.2 billion in private capital invested in the firm in 2005–2011, the solar manufacturer attracted over four times the average amount of private equity (US$ 300 million) invested in other US solar firms (Neilson 2012).Footnote 8 These investments were a response to the potential of Solyndra’s technology, and helped to construct solar power as a marketable and economically successful source of energy (Lorenz et al. 2008). In identifying solar energy as part of a wider, clean energy-fuelled recovery from economic crisis, Obama stated, in the same speech cited above, that:

‘So we recognized that we’ve got to go back to basics. We’ve got to go back to making things. We’ve got to go back to exports. We’ve got to go back to innovation. And we recognized that there was only so much government could do. The true engine of economic growth will always be companies like Solyndra, will always be America’s businesses. But that doesn’t mean the government can just sit on the sidelines. […] So that’s why, even as we’ve cut taxes and provided emergency relief over the past year, we also invested in […] clean energy’ (Obama 2010b).

Thirdly, the Solyndra loan was discursively performed as an example of the successful promotion, by the state, of firms in key strategic industries. In part, this meant that Solyndra was described as a response to transnational threats to US industry. During his visit to the Solyndra site, Obama identified one of these threats as non-US competitor corporations and foreign subsidy and incentive regimes:

‘Around the world, from China to Germany, our competitors are waging a historic effort to lead in developing new energy technologies. There are factories like this being built in China, factories like this being built in Germany. Nobody is playing for second place. These countries recognize that the nation that leads the clean energy economy is likely to lead the global economy. And if we fail to recognize that same imperative, we risk falling behind’ (Obama 2010b).

This was also the case with other governmental actors involved in the Solyndra loan. In a response to the bankruptcy, for example, the DOE published a page on its website reiterating the need to back solar energy firms as a response to threats from international competition:

‘When it comes to clean energy, we have a choice to make. We can compete in the global marketplace – creating American jobs and selling American products – or we can buy the technologies of tomorrow from abroad […]. Our loan programs are today supporting a diverse portfolio of more than 40 projects that plan to employ 60,000 Americans and give us a chance to compete and succeed in the global clean energy race’ (DOE 2012a).

Solyndra was therefore discursively constructed and performed as a sign and symbol of the narratives of support outlined above. Specifically, constructions of Solyndra justified the need for a state-supported niche around solar manufacturing. It is clear from the discourses above, however, that the resulting green niche was conceptualised as not only responding to market concerns, but existing within domestic and international market parameters. As Newfield and Boudreaux (2014) have shown, after LGP financing, Solyndra’s niche was left to float or sink on the open market, and the discursive narratives explored in the remainder of this section highlight the co-constitution of narrative strategies and the niche pathways that led to bankruptcy.

Discourses of resistance

The events surrounding Solyndra’s collapse heralded the emergence of an oppositional set of discursive strategies. These signified the rise to prominence of a different but still heterogeneous network of actors interested in discursively constructing the bankruptcy in specific ways. Both discursive strategies of promotion and resistance were political strategies, predicated on different visions of energy futures, economic crisis, climate change, the role of the US in the international technology arena, and the level of state involvement with the private sector in supporting socio-technical niches. While the paper does not argue that discourses of resistance existed exclusively in 2011 (indeed, narratives of promotion and resistance can be seen as constituting a discursive whole), the temporal bracket surrounding the bankruptcy meant that the prominence of one set of discursive strategies over another significantly changed after 2011. While both sets of discursive strategies were co-constituted, the bankruptcy heralded a change in their geometry. The discursive strategies of resistance examined here constructed and performed Solyndra’s bankruptcy as: (a) evidence that state financing of green niches was inherently flawed; (b) proof that ‘green’ firms cannot compete on the open market; (c) indication of the continued desirability of fossil-fuel based ‘solutions’ to energy security concerns.

Firstly, Solyndra’s failure was constructed as confirmation of the logic that using government subsidies to promote green niches was not a viable strategy. For example, in a hearing of the congressional Committee of Energy and Natural Resources in June 2011, Lisa Murkowski, Republican Senator from Alaska, reiterated that:

‘I think the Solyndra case demonstrates that our problems can’t be solved by just pouring money on the problems. All of the Loan Guarantees and subsidies in the world will eventually be for naught if the technology can’t stand on its own 2 feet in the marketplace. That means competing on cost which requires lower energy costs. Our economy needs abundant, inexpensive energy to thrive. So when we’re talking about green energy and creating green jobs, it’s important to note that those jobs could be counterproductive for the overall economy if it results in increased energy costs’ (Murkowski 2011: 2).

Although Murkowski’s statements need to be contextualised within her broader support for expanding oil and gas production (including onshore drilling in the Arctic National Wildlife Refuge and in Arctic waters) (Rampton and Rascoe 2012), and her cautious support for the LGP after the Solyndra bankruptcy, they paint a negative picture of government support for green energy firms. Her statement also expresses an assumption that niches, and the innovations they are meant to foster, should not be shielded from ‘the marketplace’. Another example of oppositional narratives that depict the green niche around Solyndra as economically unsustainable is the Wikipedia page titled The Solyndra Loan Controversy. The page became a discursive battleground in the aftermath of the bankruptcy (Wikipedia 2012).Footnote 9 Created shortly after the bankruptcy, the webpage was subject to over 250 revisions by different users in the year to January 2012. Some of these edits negatively highlighted the links between the Obama administration and Solyndra, and bemoaned the administration’s support for the firm. This highlights the bankruptcy’s role as a catalyst which enabled the emergence of discursive strategies of opposition. One of the most prominent actors in constructing Solyndra as an example of the failure of state support for a green niche was presidential candidate Mitt Romney. Romney made a surprise visit to Solyndra’s shuttered Fab. 2 manufacturing facility in Fremont, California, on 31 May 2012, echoing Obama’s visit to the same facility 2 years earlier. However, Romney mobilised the bankruptcy event to depict state investments in green energy as unfeasible and wasteful:

‘You look at this building behind us; this is not the kind of building that is built by private enterprise… This is the kind of enterprise – the kind of building – that’s built with half a billion dollars of taxpayers’ money. It’s not just the Taj Mahal of corporate headquarters. You probably also heard that inside there are showers that have LCD displays that tell what the temperatures are of the shower water. And the robots inside actually provide Disney music tunes’ (Romney, in Friedman 2012).

The second discursive strand examined here depicted Solyndra’s collapse as evidence that green energy niches cannot survive on the open market without government support. Again, this strategy was promoted most strongly by political actors in opposition. Following the bankruptcy, the Republican National Committee (RNC) produced a report linking the DOE loan with the Obama administration (RNC 2012). This was part of a discursive strategy of resistance because it highlighted the main discursive justifications and constructions (outlined above) for government support for Solyndra, and then presented 15 pages of quotes from a range of actors (news media, politicians, investors), most of whom argued against state support. One of the key ways in which Solyndra (and by association, green technology firms) was depicted by the RNC was as a corporation unable to compete under ‘normal’ market conditions. For example, the report cited a solar analyst stating that ‘to think they could compete on any basis, that took a very big leap of faith’ (Misra, in RNC 2012: 5). In the report, the funding of similar corporations was described as being the Obama administration’s attempt to engineer a ‘Sputnik moment’: a landmark achievement defined by deep-pocketed state support. The use of the term ‘Sputnik’ (as opposed to a perhaps more appropriate use of ‘Apollo’ in relation to the US’ own costly space program) refers to Soviet funding of a space programme which had overarching political-ideological aims but which was wholly based on arbitrary and non-transparent state funding. It also highlights a deeper assumption: that socio-technical innovations need to be exposed to the bracing winds of free market competition from the outset, notwithstanding the fact that several of the most well-known and most innovative US technology firms (from Tesla to Google) actively provide internal, protected ‘niches’ in which innovations can develop, succeed or fail, or gain further traction before being introduced to the market.

The oppositional strategy detailed above elicited significant discursive resistance from actors involved with Solyndra. Notably, the negative portrayal of government support for green energy firms was countered by a June 2012 DOE report that aimed to defend the LGP: two out of 14 pages focused on ‘recognition and validation from the private sector’ (DOE 2012i). In so doing, the DOE cited private sector sources such as Project Finance Magazine, Renewable Energy World, and Bloomberg Businessweek: the latter was prominently cited as writing that ‘Solar is now bankable…[it’s] becoming part of a much broader capital market’ (in DOE 2012i: 14). The emphasis was clearly on showcasing the solar market, and associated government support for green technologies, as examples of the proven innovative solutions that could generate profits on the domestic and international market. It is clear that DOE felt a need to justify its support of Solyndra through recourse to the narratives of support employed by other actors.

The third oppositional discursive strategy constructed the green niche around renewable energy technologies as not containing solutions to issues of energy security. Rather, the niche was depicted as deflecting political attention and capital flows from fossil fuel-based technologies, described as the real providers of energy security, jobs, and potential for sustainable operation and vigorous competition on the ‘open market’. An example of this is an article published by the Washington, DC-based Institute for Energy Research (IER), a non-profit organization broadly supportive of ‘free energy markets’ and largely critical of green energy initiatives. The article was authored by Mark Morabito (Chief Executive Officer of Canadian firm The Exploration Group, which specialises in developing resource opportunities, especially mining).Footnote 10 It is an example of the attempt to discursively define green energy niches, such as the one around Solyndra, as dead-end investments:

‘We all fell in love with the dangling carrot of a clean energy future where our electricity would come from nature herself […]. The idea that…renewable technologies are here to free us from pumping carbon dioxide into the atmosphere while they generate the electricity required to keep our advanced societies functioning is patently false. But it’s a seductive vision that environmentalists, governments, politicians, entrepreneurs, media, and the public bought into. Fast forward to Solyndra’s ‘cool solar technology/no sustainable market for it’ failure. What we must start to realize is that no matter how sleek, shiny, sexy and loved the solar and wind energy technologies are, they are doomed to fail’ (Morabito 2011: 1).

This discursive strategy was echoed and augmented by political actors: Katie Brown, writing for the US Senate Committee on Environment and Public Works, decried the ‘Solyndra fantasy’ as an example of the failure of heavily subsidised green energy firms to move towards guaranteeing energy security:

‘Of course, oil and gas companies don’t receive checks, grants, or direct payments from the federal Treasury, as companies like Solyndra did. This is simply an effort to make the development of oil and gas more expensive… It will also result in less domestic oil production, putting our energy security even more at risk’ (Brown 2012: 1).

The discursive construction above failed to mention the historical and contemporary state subsidies and incentives that the oil, gas, coal and nuclear industries have enjoyed over the past 200 years (Pfund and Healey 2011). Nonetheless, what is evident is that discursive strategies of resistance focused on the bankruptcy as a way of challenging and undermining the use of green niches. Although these constructions were national in character and rooted in US domestic politics (for example, discourses of resistance did not consider the transnational effects of protected niches in countries such as China on the development of innovation in the US) they nonetheless expose the political and contested nature of niche development (Späth and Rohracher 2010, 2012) which is integral to national transition strategies and policies.

Discussion and conclusion

Daniel Poneman, US Deputy Secretary of Energy, called the multiple factors that contributed to the bankruptcy of Solyndra the ‘perfect storm’ which sank the firm (DOE 2011b). The rise and fall of Solyndra was a collection of events which, over the course of half a decade, involved a range of actors, both human and non-human. These included fluctuations in polysilicon prices; the politics of the 2012 US presidential election; tensions between Democrat and Republican approaches to issues of energy security, state involvement in the renewables sector, and job creation; the entry of Chinese firms in the global and US solar manufacturing market; the positioning of solar power as central to concerns over climate crisis by industry bodies, NGOs and other actors; and changes in subsidy and incentive regimes in China, Spain, Italy and other countries where solar power was in demand in 2006–2011. However, it can also be said that no individual event among these was the single central phenomenon that led to the rise and/or fall of Solyndra. In this conclusion, the argument is that a.) the root cause for the failure of Solyndra was the way(s) in which the green strategic niche around solar manufacturing was conceived and deployed, and that b.) this holds important lessons for the promotion of transitional niches in the future. Although this paper focused on Solyndra as the main case through which to investigare these issues, it is worthy of note that of the four solar manufacturing firms funded under the LGP, two (Solyndra, Abound Solar) went bankrupt (see Table 1). A third, SoloPower, suspended operations in 2013, announced plans to lay off its workforce, and eventually transferred its technology to a new corporate entity, Solopower Systems, Inc. This is indicative of the fact that Solyndra was not a failure case in and of itself, but an exemplar of niche failure.

This article focused on the Solyndra bankruptcy as a way of exploring the institution of a protected niche around a particular part of the green economy: solar manufacturing. Several lessons can be drawn from the Solyndra case, in terms of learning from niche failure. Firstly, the Solyndra collapse is important because it highlights a need for innovative niches to be appropriately shielded. This is especially so in situations where transnational and political processes of pricing may hinder or destroy innovative technologies that may have long-range transitional benefits. In this sense, it could be expected that other firms and technologies experiencing the same market and political conditions as Solyndra would likely fail: as seen above, two of the four solar manufacturers awarded an LGP loan went bankrupt, and a third was radically restructured to prevent the same outcome. Furthermore, the Solyndra failure occurred within a wider landscape of failure in solar manufacturing during a phase of market consolidation in the early to mid-2000s. As well as Solyndra, large solar manufacturers (including China’s Suntech and LDK Solar) were among the hundreds of solar firms that declared bankruptcy in 2010–2015.Footnote 11 The need for shielding is based on the recognition that the market does not necessarily know best, as eloquently shown in the case of the 2008 financial crisis. It is also based on the recognition that the Solyndra case was not isolated or exceptional: although the firm was found to have potentially misled DOE officials in the loan award process, the same cannot be said of the other two solar manufacturing corporations supported with an LGP loan and which also ran into problems. Nonetheless, it is also true that Solyndra’s tubular technology was seen as innovative and potentially disruptive by a wide range of actors, as shown above. The lack of longitudinal shielding can be seen as part and parcel of a process which, while it did not result in the failure of the solar industry more generally, did have the consequence of ‘shutting out’ (at least temporarily) a potentially breakthrough technology. As the history of technological innovations has shown, for example in the movement from state-led to industrial space flights and ‘space tourism’, a period of secured and shielded innovative development, including the acceptance of failure, is often necessary in forging societal pathways to new socio-technical futures.

The argument for the necessity of appropriate niche shielding is therefore, also based on recognition of the need for shielding of socio-technical niches to be more consistent than the scant protection offered to Solyndra after the LGP loan award. Had Solyndra been more carefully protected, with a decadal as opposed to the quarter-on-quarter performance emphasis within which its management, investors, and the LGP operated, then the sort of thin-film tubular technology with which the firm aimed to use to turn commercial rooftops into energy-generating spaces could have been a more likely target of wider adoption. In the context of current US neoliberal economic-environmental policy, this may be a lesson that is only learnt as a result of what can be predicted to be continuous and consistent setbacks due to the long-term approach taken by countries such as China in terms of strategic, transition-focused industrial–environmental investments (Yi and Liu 2015). What is clear is the need for longitudinal support of green niches, designed with sensitivity to the transnational dimensions of existing regimes. The paper has shown that in the Solyndra case, the regime had clearly important spatial characteristics found in the Chinese and US energy contexts, but that the regime cannot be considered as fully bounded by national borders and geopolitical territorialisation.

Secondly, the bankruptcy highlights the requisite for niche protection strategies to focus less on market forces and more on ‘visionary industrial policy’ (Newfield and Boudreaux 2014, 69). A corollary of this is that less emphasis should be placed on VC investment as the financial lifeblood of protected niches. Rather, a focus on strategic, mostly public investment, needs to replace the current assumption that private financing is the main mechanism with which innovations should be supported. This means recognising the need for niche-focused policies characterised by longevity, high tolerance of failure cases, and rapid adoption of exogenous, innovative ideas and approaches. In the Solyndra case, the fact that the US government itself became an investor and creditor of Solyndra rather than its strategic partner heightened the pressure felt by the corporation, and increased the failure risk as soon as loan repayment started to look unlikely in the short term. This can be seen through the discursive analysis outlined above: while the LGP loan was promoted as an example of the need for state support of green energy corporations, what the promotional discourses hid from view was the fact that the construction of Fab. 2 was a significant factor in Solyndra’s subsequent failure to attract sufficient private investment, despite the fact that company executives working in the CIGS market point to a lack of new production facilities, not CIGS technologies in themselves, as a key determinant of the failure of many CIGS-based solar manufacturers since 2010, including Solyndra (Wesoff 2015). Furthermore, and at least until January 2011, private investment was inhibited by the US government’s demand for creditor priority in the event of company failure. This deterred private investors from taking stakes in Solyndra, as it would have resulted in their taking on default risk (Chernova 2011). Thus, the way in which the loan was structured contributed to the generation of a higher risk profile for would-be investors, who became unwilling to commit capital to a corporation that may not have been able to return it in the event of failure, because the first recipient of funds was to be the state. In this light, the loan was both a necessity (for the upgrading of manufacturing facilities) and a significant hindrance (through a raising of Solyndra’s risk profile) to Solyndra’s economic viability. What is clear is the desirability of agencies of the state (such as the DOE) becoming strategic investors rather than creditors.

Lastly, the article’s focus on the discursive construction of the Solyndra case underlines the importance of considering niches, and their development pathways (including eventual failure), as results of a complex process which is discursive, and therefore politically, culturally and socially performed and produced (Caprotti 2012; Levin 2008; Pryke and du Gay 2007). Polysilicon prices were clearly directly related to the political, transitional strategy enacted by the Chinese government in terms of its solar manufacturing subsidies. The reduction in support for solar installations by European governments (key customers in Solyndra’s operational planning) was the result of national austerity policies enacted as a result of the 2008 financial crisis. Specific actors’ discursive performance and framing of Solyndra as a ‘failure’ and an example of the need for entrepreneurial corporations to be left to sink or swim in the ‘free market’ also exposes the important role of discourse in constructing green niches and, more importantly, the role of the state vis-à-vis these niches. In the context of this paper, it can be argued that it was in fact the state (and specifically the DOE) that can be considered, in part at least, as an entrepreneurial, activist actor, investing in a corporation with a high risk-return profile. What was lacking was long-range niche support and protection as a requirement for success. What is at stake is, at heart, the balance between the socialisation of risk and the privatisation of reward.

Notes

In analysing the Solyndra case in light of these issues, it is key to acknowledge and remain sensitive to the fact that multiple factors (such as those related to management and decision-making and adverse market conditions) contribute to bankruptcy, and that the paper’s focus is on bankruptcy as a means with which to interrogate the protection and management of niches.

These factors include ARRA funding, federal incentive policies such as tax credits through 2016; state Renewable Portfolio Standard requirements, state financial incentives, and improved liquidity in capital markets.

More than ten subsidiary firms carrying the Solyndra name were subsequently incorporated in 2006–2011 and focused on specific tasks, such as holding the assets for the manufacturing plant made possible by the DOE’s loan guarantee (the subsidiary was called Fab. 2 LLC), or operating in the European market (Solyndra GmbH), were subsequently founded. The subsidiaries were operational until the firm’s restructuring in 2011 (Neilson 2012).

Overall, the US$ 13.27 billion awarded to solar projects under Section 1705 of the LGP was the lion’s share, compared to the amounts given to other project areas: wind generation (US$ 1687.9 million); geothermal (US$ 545.5 million), transmission (US$ 343 million) biofuel (US$ 132.4 million) energy storage (US$ 43 million) (DOE Loans Programs Office 2012a, b, c, d, e, f, g, h, i).

The FFB is a government corporation set up by the Congress in 1973: one of its main remits is the coordination of ‘federal and federally assisted borrowing programs with the overall economic and fiscal policies of the Government’ (DOT 2012: 3).

The international political economy of polysilicon pricing is not treated here, as this topic could not be adequately covered within the limited space afforded here (but see Lo 2014).

In October 2011, Beacon Power, which had received a US $ 43 million loan under the LGP, declared bankruptcy (DOT 2012: 4).

Furthermore, Solyndra was not the largest attractor of private equity in the solar energy field, but the fourth largest (Neilson 2012).

At the time of writing, the page redirected to the Wikipedia entry on Solyndra: see Wikipedia (2012).

Known as Forbes West since February 2012.

From 2009 to 2014, 112 solar energy corporations in the USA and EU declared bankruptcy (Bastasch 2014).

References

ARRA. (2009). American Recovery and Reinvestment Act of 2009. Public Law 111-5, 123 Stat. 115, 516, 19 February 2009.

Bailey, I., & Caprotti, F. (2014). The green economy: Functional domains and theoretical directions of enquiry. Environment and Planning A, 46(8), 1797–1813.

Bailey, I., & Wilson, G. (2009). Theorising transitional pathways in response to climate change: Technocentrism, ecocentrism and the carbon economy. Environment and Planning A, 41(10), 2324–2341.

Bastasch, M. (2014) Solar eclipse: 112 solar companies have closed their doors in 5 years. The Daily Caller, 8 December 2014. http://dailycaller.com/2014/12/08/112-solar-companies-have-closed-their-doors-in-5-years/. Accessed January 4, 2016.

Blackburn, M. (2011) Opening statement to the House, Committee on Energy and Commerce. Hearing, 24 June 2011. OMB’s Role in the DOE Loan Guarantee Process. Serial 112-68. Washington, DC: US Government Printing Office. http://www.gpo.gov/fdsys/pkg/CHRG-112hhrg72270/pdf/CHRG-112hhrg72270.pdf. Accessed January 4, 2016.

Bolton, R., & Foxon, T. J. (2015). Infrastructure transformation as a socio-technical process: Implications for the governance of energy distribution networks in the UK. Technological Forecasting and Social Change, 90(B), 538–550.

Brown, P. (2011). U.S. Solar Projects: DOE Section 1705 Guarantees. Congressional Research Service. R42059, October 25, 2011. http://www.ourenergypolicy.org/wp-content/uploads/2013/08/CRSSolar.pdf. Accessed January 4, 2016.

Brown, K. (2012). Obama in Oklahoma: Rhetoric vs. reality. US Senate Committee on Environment & Public Works website, 21 March 2012. http://epw.senate.gov/public/index.cfm?FuseAction=Minority.Blogs&ContentRecord_id=377408f3-802a-23ad-4d6c-821a1eebb732. Accessed January 4, 2016.

Casey, J., & Koleski, K. (2011). Backgrounder: China’s 12th five-year plan. http://origin.www.uscc.gov/sites/default/files/Research/12th-FiveYearPlan_062811.pdf. Accessed January 4, 2016.

Caprotti, F. (2010). From finance to green technology: Activist states, geopolitical finance, and hybrid neoliberalism. In T. Lagoarde-Segot (Ed.), The financial crisis: Thinking otherwise (pp. 81–100). New York: Nova Science Publishers.

Caprotti, F. (2012). The cultural economy of cleantech: Environmental discourse and the emergence of a new technology sector. Transactions of the Institute of British Geographers, 37(3), 370–385.

Caprotti, F. (2015). Golden Sun, green economy: Market security and the US/EU-China ‘Solar Trade War’. Asian Geographer, 32(2), 99–115.

Caprotti, F., & Bailey, I. (2014). Making sense of the green economy. Geografiska Annaler, Series B: Human Geography, 96(3), 195–200.

Chernova, Y. (2011). Loan was Solyndra’s undoing. The Wall Street Journal, 16 September 2011. http://online.wsj.com/article/SB10001424053111904491704576572872256772948.html. Accessed January 4, 2016.

Couture, T. D., Cory, K., Kreycik, C. & Williams, E. (2010) A Policymaker’s Guide to Feed-in Tariff Policy Design. NREL Technical Report NREL/TP-6A2-44849, July 2010. Golden, CO: NREL.

DOE. (2009). Vice President Biden announces finalized $ 535 million loan guarantee for Solyndra. Press release, 4 September 2009. http://energy.gov/articles/vice-president-biden-announces-finalized-535-million-loan-guarantee-solyndra. Accessed January 4, 2016.

DOE. (2011a). Timeline of the Energy Department’s review and approval process for the Solyndra loan. http://energy.gov/sites/prod/files/SOLYNDRA_FINAL.jpg. Accessed January 4, 2016.

DOE. (2011b). ‘Perfect storm’ sank Solyndra. Press release, 14 September 2011. http://energy.gov/articles/perfect-storm-sank-solyndra. Accessed January 4, 2016.

DOE. (2012a). Key facts: Solyndra Solar. DOE website. http://energy.gov/key-facts-solyndra-solar. Accessed January 4, 2016.

DOE. (2012b). Solar background document 1: Timeline of DOE’s review of the Solyndra Loan Guarantee Application. http://energy.gov/sites/prod/files/Solar%20Background%20Document%201.pdf. Accessed January 4, 2016.

DOE. (2012c). Solar background document 2: Independent commentators repeatedly cited Solyndra as an innovative and promising company. http://energy.gov/sites/prod/files/Solar%20Background%20Document%202.pdf. Accessed January 4, 2016.

DOE. (2012d). Solar background document 3: A list of private sector investment in Solyndra. http://energy.gov/sites/prod/files/Solar%20Background%20Document%203.pdf. Accessed January 4, 2016.

DOE. (2012e). Solar background document 4: US must regain lead in solar manufacturing. http://energy.gov/sites/prod/files/Solar%20Background%20Document%204.pdf. Accessed January 4, 2016.

DOE. (2012f). Solar background document 5: Graph illustrating Chinese Development Bank financing to Chinese solar companies. http://energy.gov/sites/prod/files/Solar%20Background%20Document%205.pdf. Accessed January 4, 2016.

DOE. (2012g). Solar background document 6: Energy surge. http://energy.gov/sites/prod/files/Solar%20Background%20Document%206.pdf. Accessed January 4, 2016.

DOE. (2012h). Solar background document 7: Global solar market—2009 vs. today. http://energy.gov/sites/prod/files/Solar%20Background%20Document%207.pdf. Accessed January 4, 2016.

DOE. (2012i). Beyond Solyndra. Report, 21 June 2012. http://energy.gov/articles/beyond-solyndra-how-energy-department-s-loans-are-accelerating-america-s-transition-clean. Accessed January 4, 2016.

DOE. (2015). Special report: The Department of Energy’s Loan Guarantee to Solyndra, Inc. Report 11-0078-I, August 24, 2015. http://www.energy.gov/sites/prod/files/2015/08/f26/11-0078-I.pdf. Accessed January 4, 2016.

DOT. (2012). Aufit report: Consultation on Solyndra loan guarantee was rushed. https://www.treasury.gov/about/organizational-structure/ig/Agency%20Documents/OIG%20Audit%20Report%20%20-%20Consultation%20on%20Solyndra%20Loan%20Guarantee%20Was%20Rushed.pdf. Accessed January 4, 2016.

Elzen, B., Geels, F., Leeuwis, C., & van Mierlo, B. (2011). Normative contestation in transitions ‘in the making’: Animal welfare concerns and system innovation in pig husbandry. Research Policy, 40(2), 263–275.

EPA. (2005). Energy Policy Act of 2005. Public Law 109-58, 8 August 2005. US Government Printing Office, Washington, DC. http://www.gpo.gov/fdsys/pkg/PLAW-109publ58/pdf/PLAW-109publ58.pdf. Accessed January 4, 2016.

Executive Office of the President. (2010). The Recovery Act: Transforming the American Economy Through Innovation. Report, August 2010. http://www.whitehouse.gov/sites/default/files/uploads/Recovery_Act_Innovation.pdf. Accessed January 4, 2016.

Fischhendler, I., Nathan, D., & Boymel, D. (2015). Marketing renewable energy through geopolitics: Solar farms in Israel. Global Environmental Politics, 15(2), 98–120.

Foxon, T. (2011). A coevolutionary framework for analysing a transition to a sustainable low carbon economy. Ecological Economics, 70(12), 2258–2267.

Friedman, M. (2012) Mitt Romney visits Solyndra amid attack on Obama jobs record. ABCNews, 31 May 2012. http://abcnews.go.com/blogs/politics/2012/05/mitt-romney-visits-solyndra-amid-attack-on-obama-jobs-record/. Accessed January 4, 2016.

Geels, F. W. (2005). Co-evolution of technology and society: The transition in water supply and personal hygiene in the Netherlands (1850–1930)—A case study in multi-level perspective. Technology in Society, 27(3), 363–397.

Geels, F. W. (2012). A socio-technical analysis of low-carbon transitions: Introducing the multi-level perspective into transport studies. Journal of Transport Geography, 24(September 2012), 471–482.

Gress, D. (2015). Enrolling in global networks and contingencies for China’s solar PV industry. Asia Pacific Business Review, 21(1), 113–129.

Gronet, C. & Isakowitz, S. (2009). Urgent: Solyndra application. Email, 12 January 2009. http://energy.gov/sites/prod/files/CreditCommitteeEmailCorrespondence_Jan09.pdf. Accessed January 4, 2016.

Haukkala, T. (2015). Does the sun shine in the High North? Vested interests as a barrier to solar energy deployment in Finland. Energy Research & Social Science, 6(March 2015), 50–58.

Hess, D. J. (2013). Industrial fields and countervailing power: The transformation of distributed solar energy in the United States. Global Environmental Change, 23(5), 847–855.

Hommel, D., & Murphy, A. B. (2013). Rethinking geopolitics in an era of climate change. GeoJournal, 78(3), 507–524.

Hoogma, R., Kemp, R., Schot, J., & Truffer, B. (2002). Experimenting for sustainable transport: The approach of strategic niche management. London: Spon Press.

Jennings, C. E., Margolis, R. M. & Bartlett, J. E. (2008) A Historical Analysis of Investment in Solar Energy Technologies (2000–2007). NREL Technical Report NREL/TP-6A2-43602, December 2008. Golden, CO: NREL.

Joshi, S. (2014). Environmental justice discourses in Indian climate politics. GeoJournal, 79(6), 677–691.

Karimi, F., & Komendatova, N. (2015). Understanding experts’ views a dnd risk perceptions on carbon capture and storage in three European countries. GeoJournal,. doi:10.1007/s10708-015-9677-8.

Kemp, R., Schot, J., & Hoogma, R. (1998). Regime shifts to sustainability through processes of niche formation: The approach of strategic niche management. Technology Analysis & Strategic Management, 10(2), 175–195.

Leone, S. (2011). FBI raids Solyndra headquarters. Renewable Energy World, 8 September 2011. http://www.renewableenergyworld.com/rea/news/article/2011/09/fbi-raids-solyndra-headquarters. Accessed January 4, 2016.

Levin, P. (2008). Culture and markets: How economic sociology conceptualizes culture. Annals of the American Academy of Political and Social Science, 619(1), 114–129.

Lo, K. (2014). A critical review of China’s rapidly developing renewable energy and energy efficiency policies. Renewable and Sustainable Energy Reviews, 29(January 2014), 508–516.

Lorenz, P., Pinner, D. & Seitz, T. (2008) The economics of solar power. The McKinsey Quarterly, June 2008. http://ceodifference.org/clientservice/sustainability/pdf/Economics_of_Solar.pdf. Accessed January 4, 2016.

Markard, J., Raven, R., & Truffer, B. (2012). Sustainability transitions: An emerging field of research and its prospects. Research Policy, 41(6), 955–967.

Mazzucato, M. (2013). The entrepreneurial state: Debunking public vs. private sector myths. London: Anthem Press.

McCarthy, J., Chen, C., López-Carr, D., & Endemaño-Walker, B. L. (2014). Socio-cultural dimensions of climate change: Charting the terrain. GeoJournal, 79(6), 665–675.

McCrone, A. (2012) Solar surge drives record clean energy investment in 2011. Bloomberg New Energy Finance. Press release, 12 January 2012. http://www.bnef.com/Downloads/pressreleases/180/pdffile/. Accessed January 4, 2016.

Morabito, M. (2011) Solyndra symbolizes the big green lie. Institute for Energy Research website, 11 October 2011. http://www.instituteforenergyresearch.org/2011/10/11/solyndra-symbolizes-the-big-green-lie. Accessed January 4, 2016.

Murkowski, L. (2011). Statement to the Senate, Committee on Energy and Natural Resources. US Senate Hearing, 15 September 2011. Woods, Danielson and Harris Nominations. S. Hrg. 112-140. Available at: Accessed 4 January 2016.

Neilson, R. T. (2012). Solyndra: Report of R Todd Neilson, Chief Restructuring Officer. Report, 21 March 2012. http://www.slideshare.net/tashtiot/ss-12240832. Accessed January 4, 2016.

Newfield, C., & Boudreaux, D. (2014). Learning from Solyndra: Changing paradigms in the US innovation system. In S. V. Ramani (Ed.), Nanotechnology and development: What’s in it for emerging countries? (pp. 39–72). Cambridge: Cambridge University Press.