Abstract

This paper finds that participants in the European Central Bank’s Survey of Professional Forecasters have submitted forecasts that are consistent with a (mostly forward-looking) empirical version of the New Keynesian Phillips Curve for the euro area. The estimation technique takes advantage of the panel nature of the Survey of Professional Forecasters’ dataset to exploit both its time series and cross-section dimensions, and to control for unobservable individual heterogeneity across forecasters. The estimation results suggest that euro-area inflation forecasts have reacted less to unemployment forecasts after the start of the financial crisis but another cost measure (energy inflation) remains significant. This finding is consistent with a flatter Phillips Curve in the euro area after 2007. However, the reasons suggested by the International Monetary Fund for this finding, namely a better anchoring of inflation expectations and increases in structural unemployment do not seem to find support in the survey data. Instead, the expectations for compensation per employee submitted by professional forecasters are consistent with the existence of downward real-wage rigidities in euro-area labour markets.

Similar content being viewed by others

Notes

See http://www.ecb.europa.eu/stats/prices/indic/forecast/html/index.en.html for a full description of the survey and a partial list of contributing institutions.

For a microfounded derivation of the NKPC see, for example, Woodford (2003).

These are expectations of headline inflation, as core inflation is not surveyed.

See their Appendix 1 (p. 59) for the mathematical derivation.

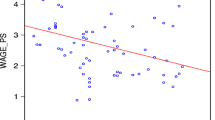

Note that a few forecasts fall outside the box and the whiskers.

See New York Times. 2011. The bank run we knew so little about. 2 April, available at http://www.nytimes.com/2011/04/03/business/03gret.html?_r=0.

This measurement-error bias is also called “attenuation” bias (Wooldridge 2010), as the OLS estimates of the parameters of the regressors measured with error are biased towards zero.

Paloviita and Viren (2015) found a slope coefficient that is statistically different from zero for the full sample, which is consistent with the results reported in the last row of Table 3. However, their estimation method (OLS) is likely to produce inconsistent estimates in the presence of endogeneity and measurement errors.

The value of statistically insignificant estimated parameters is set to zero.

The same results are obtained when the minimum participation requirement is formulated for the full sample, i.e. including in both sub-samples only the forecasters that contributed to at least half of the survey rounds in the full sample. The results are available from the author upon request.

For empirical evidence on downward wage rigidities in the euro area, see the results of the euro-area Wage Dynamics Network: http://www.ecb.europa.eu/home/html/researcher_wdn.en.html.

Ireland, Denmark, France, Belgium, United Kingdom, Switzerland, Austria, Germany, Italy, Netherlands, Finland, Norway, Greece, Sweden, United States and Portugal.

The results of the special questionnaire may be retrieved from http://www.ecb.europa.eu/stats/prices/indic/forecast/shared/files/quest_summary.pdf?8063c5fb1c8002823e72f92c1ecbcd98.

References

Adam K, Padula M (2011) Inflation dynamics and subjective expectations in the United States. Econ Inq 49:13–25

Arellano M (2003) Panel data econometrics. Oxford University Press, Oxford

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68:29–51

Baltagi BH (1995) Econometric analysis of panel data. Wiley, New York

Blanchard O, Galí J (2007) Real wage rigidities and the new Keynesian model. J Money Credit Bank 39:35–65

Bowles C, Friz R, Genre V, Kenny G, Meyler A, Rautanen T (2009) The ECB Survey of Professional Forecasters (SPF)—a review after eight years’ experience. ECB Occasional Paper 59

Branch WA, Evans GW (2005) A simple recursive forecasting model. Econ Lett 91:158–166

Brissimis SN, Magginas NS (2008) Inflation forecasts and the new Keynesian Phillips curve. Int J Cent Bank 4:1–22

Capistran C, Timmermann A (2009) Disagreement and biases in inflation expectations. J Money Credit Bank 41:365–396

Conflitti C, De Mol C, Giannone D (2015) Optimal combination of survey forecasts. Int J Forecast 31:1096–1103

Croushore D (2010) An evaluation of inflation forecasts from surveys using real-time data. BE J Macroecon 10:1–32

Daly MC, Hobijn B (2014) Downward nominal wage rigidities bend the Phillips curve. J Money Credit Bank 46:51–93

Dickens WT, Goette L, Groshen EL, Holden S, Messina J, Schweitzer ME, Turunen J, Ward ME (2007) How wages change: micro evidence from the international wage flexibility project. J Econ Perspect 21:195–214

ECB (2003) Background studies for the ECB’s evaluation of its monetary policy strategy. ECB, Frankfurt am Main

ECB (2014) Fifteen years of the ECB survey of professional forecasters. ECB monthly bulletin, January: pp 55–67

Fendel R, Lis EM, Rülke JC (2011) Do professional forecasters believe in the Phillips curve? Evidence from the G7 countries. J Forecast 30:268–287

Frenkel M, Lis EM, Rülke JC (2011) Has the economic crisis of 2007–2009 changed the expectation formation process in the euro area? Econ Model 28:1808–1814

Fuhrer J, Moore G (1995) Inflation persistence. Q J Econ 110:127–159

Galí J, Gertler M (1999) Inflation dynamics: a structural econometric analysis. J Monet Econ 44:195–222

Garcia JA, Manzanares A (2007) Reporting biases and survey results—evidence from European professional forecasters. ECB Working Paper 836

Genre V, Kenny G, Meyler A, Timmermann A (2013) Combining expert forecasts: can anything beat the simple average? Int J Forecast 29:108–121

Gujarati DN, Porter DC (2009) Basic econometrics. McGraw-Hill/Irvin, New York

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57:357–384

Harvey DI, Newbold P (2003) The non-normality of some macroeconomic forecast errors. Int J Forecast 19:635–653

IMF (2013) The dog that didn’t bark: has inflation been muzzled or was it just sleeping? World Economic Outlook, April, chapter 3:1–17

Ireland PN (2007) Changes in the Federal Reserve’s inflation target: causes and consequences. J Money Credit Bank 36:969–984

Keane MP, Runkle DE (1992) On the estimation of panel-data models with serial correlation when instruments are not strictly exogenous. J Bus Econ Stat 10:1–9

Kirchner M, Cimadomo J, Hauptmeier S (2010) Transmission of government spending shocks in the euro area: time variation and driving forces. ECB Working Paper 1219

Koop G, Onorante L (2012) Estimating Phillips curves in turbulent times using the ECB’s survey of professional forecasters. ECB Working Paper 1422

Krause MU, Lopez-Salido D, Lubik TA (2008) Inflation dynamics with search frictions: a structural econometric analysis. J Monet Econ 55:892–916

Linde J (2005) Estimating new Keynesian Phillips curves: a full information maximum likelihood approach. J Monet Econ 52:1135–1149

López-Pérez V (2015) Measures of macroeconomic uncertainty for the ECB’s survey of professional forecasters. In: Donduran M, Uzunöz M, Bulut E, Çadirci TO, Aksoy T (eds) Proceedings of the 1st annual international conference on social sciences, pp 600–614

Manzan S (2011) Differential interpretation in the Survey of Professional Forecasters. J Money Credit Bank 43:993–1017

Mavroeidis S, Plagborg-Møller M, Stock J (2014) Empirical evidence on inflation expectations in the new Keynesian Phillips curve. J Econ Lit 52:124–188

Mazumder S (2011) The empirical validity of the new Keynesian Phillips curve using survey forecasts of inflation. Econ Model 28:2439–2450

Nelson E (2003) The future of monetary aggregates in monetary policy analysis. J Monet Econ 54:1472–1479

Paloviita M, Viren M (2015) What’s behind the survey values? An analysis of individual forecasters’ behaviour. OECD J J Bus Cycle Meas Anal 12:25–43

Paradiso A, Rao BB (2012) Flattening of the Phillips curve and the role of the oil price: an unobserved component model for the USA and Australia. Econ Lett 117:259–262

Pierdzioch C, Rülke JC, Stadtmann G (2010) New evidence of anti-herding of oil-price forecasts. Energ Econ 32:1456–1459

Poncela P, Rodriguez J, Sanchez-Mangas R, Senra E (2011) Forecast combination through dimension reduction techniques. Int J Forecast 27:224–237

Raftery A, Karny M, Ettler P (2010) Online prediction under model uncertainty via dynamic model averaging: application to a cold rolling mill. Technometrics 52:52–66

Roberts JM (2001) How well does the new Keynesian sticky price model fit the data? FRB FEDS Discussion Paper 2001-13

Rossi B, Sekhposyan T (2015) Forecast rationality test in the presence of instabilities, with applications to Federal Reserve and survey forecasts. J Appl Econom. doi:10.1002/jae.2440

Rubaszek M, Skrzypcznski P (2008) On the forecasting performance of a small-scale DSGE model. Int J Forecast 24:498–512

Sbordone A (2006) US wage and price dynamics: a limited information approach. Int J Cent Bank 2:155–191

Sims CA, Zha T (2006) Were there regime switches in U.S. monetary policy? Am Econ Rev 96:54–81

Smith GW (2009) Pooling forecasts in linear rational expectations models. J Econ Dyn Control 33:1858–1866

Wang YY, Lee TH (2014) Asymmetric loss in the Greenbook and the Survey of Professional Forecasters. Int J Forecast 30:235–245

Wieland V, Wolters MH (2011) The diversity of forecasts from macroeconomic models of the US economy. Econ Theory 47:247–292

Woodford M (2003) Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton

Woodford M (2008) How important is money in the conduct of monetary policy? J Money Credit Bank 40:1561–1598

Wooldridge JM (2010) Econometric analysis of cross section and panel data, 2nd edn. MIT Press, Cambridge

Acknowledgments

I thank Maximo Camacho, Rutger Poldermans, Enrique Sentana, Oreste Tristani, Thomas Westermann, Marcin Zamojski, participants at the 30th European Economic Association Annual Congress (Mannheim, 2015), the 21st International Panel Data Conference (Budapest, 2015), the XVIII Applied Economics Meeting (Alicante, 2015), and three anonymous referees for their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

López-Pérez, V. Do professional forecasters behave as if they believed in the New Keynesian Phillips Curve for the euro area?. Empirica 44, 147–174 (2017). https://doi.org/10.1007/s10663-016-9314-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-016-9314-x

Keywords

- New Keynesian Phillips Curve

- Inflation

- Unemployment

- Panel data

- Survey of Professional Forecasters

- Downward wage rigidities