Abstract

This paper develops a semi-endogenous growth model for analysing the intertemporal effects of structural reforms in Southern European countries (Italy, Spain, Portugal and Greece). The model follows the product-variety paradigm in a semi-endogenous setting, and includes a disaggregation of labour into different skill groups. We use a comprehensive set of structural indicators in order to calibrate the model to important macroeconomic ratios and levels of productivity and employment. Our results show that structural reforms yield significant economic gains in the medium and long run. The results point to the importance of product market reforms and labour market related education and tax reforms as the most promising areas of structural policy interventions. This paper also argues for placing more emphasis on education policy which is key in upgrading the labour force, especially in these countries where the share of low skilled labour is among the highest in the euro area.

Similar content being viewed by others

Notes

It is important to note that in a semi-endogenous model the number of intermediate goods varieties (A t ) can be interpreted in multiple ways. It corresponds to the total number of designs (or patents) invented by the R&D sector but at the same time it can be interpreted as the stock of ideas or as the stock of knowledge (or intangible) capital in the economy. Also, as shown in Appendix 2, it can be considered as an endogenous total factor productivity element.

Households only make a decision about the level of employment but there is no distinction on the part of households between unemployment and non-participation. It is assumed that the government makes a decision how to classify the non-working part of the population into unemployed and non-participants. The non-participation rate (NPART) must therefore be seen as a policy variable characterising the generosity of the benefit system.

The mark-up depends on the intratemporal elasticity of substitution between differentiated labour services within each skill groups (σ s ) and fluctuations in the mark-up arise because of wage adjustment costs and the fact that a fraction (1 − sfw) of workers is indexing the growth rate of wages \( \pi_{W} \) to wage inflation in the previous period \( \eta_{s,t} = 1 - 1/\sigma_{s} - \gamma_{W} /\sigma_{s} (\beta (sfw\pi_{W,t + 1} - (1 - sfw)\pi_{W,t - 1} ) - \pi_{W,t} ). \)

Note that η is inversely related to the net mark-ups in the final goods sector (mkp f ): η = 1/(1 + mkp f ).

The average of the best three indicators will be the benchmark in each of the simulation scenarios respectively.

The shocks were calibrated based on the relevant tax-bases from Eurostat (2012 data), consumption and wage shares respectively in an ex-ante budgetary neutral setting.

Indexation of transfers to consumer price inflation would mean that non-wage income is compensated for the consumption tax increase, which would result in less positive employment and GDP effect.

Note that the results of individual reform scenarios are additive. Long-run effects correspond to the new steady states. As Fig. 7 in Appendix 1 shows, the share of the income gap explained by these reforms is fairly robust to the various sensitivity scenarios we perform. See Appendix 1 for an example calculation of accounting for the gap.

Our analysis uses the economy-wide implicit labour tax rates while in the OECD study the average tax wedge on labour is defined only for the average worker earnings of one-earner married couple with two children.

In this calibration, high-skilled wages are approximated by the annual earnings of scientists and engineers defined as employees working as professionals or associate professionals in physical, mathematical, engineering, life science or health occupations (ISCO-08 occupations 21, 22, 31, 32) irrespective of their educational attainment. Annual earnings of non-science and engineering employees working in high-skilled or skilled occupations were taken as proxies for the medium-skilled and finally, low skilled wages are accounted as earnings of employees working in elementary occupations, in all of these cases irrespective of their educational attainment.

References

Acemoglu D (1998) Why do new technologies complement skills? Directed technical change and wage inequality. Q J Econ 113(4):1055–1089

Acemoglu D (2002) Directed technical change. Rev Econ Stud 69(4):781–809

Acemoglu D (2007) Equilibrium bias of technology. Econometrica 75(5):1371–1410

Acemoglu D, Autor D (2011) Skills, tasks and technologies: implications for employment and earnings. In: Handbook of labour economics, vol 4b

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press, Cambridge, MA

Aghion P, Howitt P (2006) Joseph Schumpeter lecture appropriate growth policy: a unifying framework. J Eur Econ Assoc 4:269–314

Alesina A, Ardagna S, Nicoletti G, Schiantarelli F (2005) Regulation and investment. J Eur Econ Assoc 3(4):791–825

Almeida V, Castro G, Félix R (2010) Improving competition in the non-tradable goods and labour markets: the Portuguese case. Port Econ J 9(3):163–193

Barkbu B, Rahman J, Valdes R et al. (2012) Fostering growth in Europe Now, IMF Staff Note, SDN/12/07

Bayoumi T, Laxton D, Pesenti P (2004) Benefits and spillovers of greater competition in Europe: a macroeconomic Assessment. ECB Working Paper, No. 341

Bloom N, Griffith R, Van Reenen J (2002) Do R&D tax credits work? Evidence from a panel of countries 1979–1997. J Public Econ 85(1):1–31

Bottazzi L, Peri G (2007) The international dynamics of R&D and innovation in the long run and in the short run. Econ J 117(March):486–511

Bouis R, Duval R (2011) Raising potential growth after the crisis: a quantitative assessment of the potential gains from various structural reforms in the OECD area and beyond. OECD Economics Department Working Papers, No. 835

Butler A, Pakko MR (1998) R&D spending and cyclical fluctuations: Putting the “technology” in technology shocks. Working paper. No. 020A. Federal Reserve Bank of St. Louis

Buttner B (2006) Entry barriers and growth. Econ Lett 93(1):150–155

Cacciatore M, Duval R, Fiori G (2012) Short-term gain or pain? A DSGE model-based analysis of the short-term effects of structural reforms in labour and product markets. OECD Economics Department Working Papers, No. 948

Chetty R (2012) Bounds on elasticities with optimization frictions: a synthesis of micro and macro evidence on labor supply. Econometrica 80(3):969–1018

D’Auria F, Pagano A, Ratto M, Varga J (2009). A comparison of structural reform scenarios across the EU member states—simulation-based analysis using the QUEST model with endogenous growth. European Economy—Economic Papers 392

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308

Eble S, Maliszewski W, Shamloo M, Petrova I (2013). Greece. Selected issues. IMF Country Report No. 13/155

Garcia-Escribano M, Mehrez G (2004). The impact of government size and the composition of Revenue and expenditure on growth. IMF Article IV Review of Austria, Selected Issues, Washington DC

Grossman G, Helpman E (1991) Innovation and growth in the global economy. The MIT Press, Cambridge, MA

Guellec D, van Pottelsberghe de la Potterie B (2003) The impact of public R&D expenditure on business R&D. Econ Innov New Technol 12(3):225–243

Hanushek EA, Woessmann L (2012) The economic benefit of educational reform in the European Union. CESifo Econ Stud 58(1):73–109

Jones CI (1995) R&D-based models of economic growth. J Polit Econ 103(4):759–784

Jones CI (2002) Source of U.S. economic growth in a world of ideas. Am Econ Rev 92(1):220–239

Jones CI (2005) Growth and Ideas. In: Aghion P, Durlauf S (eds) Handbook of economic growth, part B, vol 1. North-Holland, Amsterdam, pp 1063–1111

Katz LF, Murphy KM (1992) Changes in relative wages, 1963–1987: supply and demand factors. Q J Econ 107(1):35–78

Kilponen J, Ripatti A (2006) Labour and product market competition in a small open economy, simulation results using a DGE model of the Finnish economy. Research Discussion Papers 5/2006, Bank of Finland

Lusinyan L, Muir D (2013). Assessing the macroeconomic impact of structural reforms: the case of Italy. IMF Working Paper, WP/13/22

Nicoletti G, Scarpetta S (2003) Regulation, productivity and growth: OECD evidence. Econ Policy 18(36):9–72

OECD (2013) Science and technology scoreboard 2013. Innovation for growth. OECD Publishing, Paris

Pessoa A (2005) ‘Ideas’ driven growth: the OECD evidence. Port Econ J 4(1):46–67

Ratto M, Roeger W, in‘t Veld J (2009) QUEST III: an estimated DSGE model of the euro area with fiscal and monetary policy. Econ Model 26(1):222–233

Roeger W (1995) Can imperfect competition explain the difference between primal and dual productivity? J Polit Econ 103(2):316–330

Roeger W, Varga J, in’t Veld J (2008). Structural reforms in the EU: a simulation-based analysis using the QUEST model with endogenous growth. European Economy Economic Paper no.351. http://ec.europa.eu/economy_finance/publications/publication13531_en.pdf

Romer P (1990) Endogenous technological change. J Polit Econ 98(5):S71–S102

Thursby J, Thursby M (2006). Here or there? A survey on the factors in multinational R&D location. National Academies Press, www.nap.edu/catalog/11675.html

Warda J (2009) An update of R&D tax treatment in OECD countries and selected emerging economies, 2008–2009, mimeo. In: OECD Science, technology and industry scoreboard 2009, OCED, Paris

Acknowledgments

We thank Katarzyna Budnik and other participants and discussants for their comments. We would also like to thank the two anonymous referees for their insightful comments and Christoph Maier for his valuable statistical assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the authors and not necessarily those of the European Commission.

Appendices

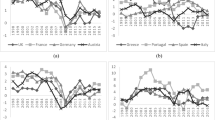

Appendix 1: Sensitivity analysis

We checked the robustness of the results with respect to the elasticity of substitution between skills (μ), changing wage-premium ratios, which are crucial to determine the skill-efficiencies, the Frisch labour supply elasticity \( \left( {\left( {1 - L_{t} } \right)/(\kappa L_{t} )} \right) \) and the ratio of elasticity between domestic and foreign stock of knowledge in the knowledge production function (φ and \( \varpi \)). The following tables compare the central scenario (S0) with five alternative scenarios: (S1) decreasing the elasticity of substitution between skill groups to μ = 1.4 as estimated by Katz and Murphy (1992); (S2) imposing an occupational based wage-premiumFootnote 10 (S3) increasing wage-premiums for high and medium-skilled unilaterally by 10 pp.; (S4) imposing 10 pp. lower Frisch labour supply elasticity (from 0.4 to 0.3) which is closer to the lower bound of the estimates in the literature (Chetty, 2012), and finally by increasing the weight of foreign intangible capital relative to domestic one by 10 % in the R&D production function (scenario S5). The simulations suggest that under the empirically plausible range of the elasticity of substitution between skill groups, alternative wage-premium definitions, the elasticity of labour supply, and higher domestic knowledge elasticities, our results are fairly robust (see Tables 6, 7, 8 and 9). The driving forces behind the sensitivity scenarios are the following. Decreasing the elasticity of substitution between skill-types weakens the long-run GDP effect from shifting the share of labour force from low to medium-skilled, but strengthens the effect of shifting labour skills from medium to high-skilled. The reason is that lower substitution possibilities make a skill-shift less effective since the excess labour skill is less readily employable. Naturally, this is less of a limiting factor in case of increasing the share of high-skilled since the excess supply of high-skilled can be also be employed in the R&D sector as opposed to the medium-skilled workers which are only employable in the final goods sector. A high-skilled biased shift therefore can further increase productivity and final output in this scenario. The effect of alternative wage-premium settings is more direct: the higher the wage-premium, the higher is the implied efficiency of the higher skilled labour force, therefore increasing its share will further benefit the economy. Intuitively, the first three sensitivity scenarios mainly affect the skills upgrading scenarios. Our next sensitivity scenario, lowering the Frisch elasticity has the strongest effect on the tax-shift reforms because it lowers the responsiveness of labour supply w.r.t. changes in after-tax labour income, which is a crucial explanatory factor behind the positive output and employment effect of shifting the burden of taxation from labour to consumption. Our last sensitivity scenario has its largest influence on the achievable gains from R&D subsidies. Countries with higher dependence on foreign R&D spillovers experience somewhat less positive GDP gains from increasing R&D subsidies. As Fig. 7 shows, the share of the income gap explained by the reform measures is fairly robust to the various sensitivity scenarios.

Accounting for the GDP per capita gap. The figure shows that the new steady state GDP levels under the different scenarios could account for a substantial part of the existing GDP per capita gap between the average of the best three euro area countries and the Southern member states. We take the difference between the projected and the current (2012) GDP per capita by multiplying the total output effect of our country-specific growth rates with the current GDP per capita values and divide it by the current GDP per capita gap. E.g. the weighted average of the best three euro area GDP per capita figures was 33.921 PPS in 2012 (Luxembourg, Austria, Netherlands), therefore for Spain the corresponding ratio is: (24.850 × 0.36)/(33.921 − 24.850) = 0.986. Note that this calculation serves as an illustration for the large potential gains of these reforms expressed in terms of the current GDP per capita gap, it does not take into account that in the future, GDP per capita will be higher for the best three euro area countries as well

Appendix 2: A simplified version of the model

It is useful to describe a simplified version of our model in order to see how the key ingredients of structural reform measures fit together to provide an explanation of long-run productivity. To reduce the model, we ignore international spillovers and set up a closed economy growth model with a simple fiscal rule; these features are introduced in the extended framework of Sect. 2. Nevertheless the simplified model is already richer compared to Jones (2005) along several dimensions. The Jones (2005) model is a closed economy semi-endogenous model with only one type of households supplying labour services for final and R&D goods production. In order to assess the impact of structural reforms like greater competition in the final goods sector, reducing administrative entry barriers in the intermediate sector, skill-upgrading of the labour force and increasing R&D subsidies, we will introduce additional features into our simplified model. This version introduces mark-ups for the final goods sector and entry costs for the intermediate sector, it features two types of labour: low- and high-skilled offered by households with inelastic labour supply. We introduce a fiscal authority which collects lump-sum taxes from which it pays R&D subsidies.

We assume that monopolistically competitive firms in the final goods sector use an A t variety of intermediates (x m,t ). These intermediate goods enter the production function through a CES aggregator with an elasticity of substitution between intermediate goods given by 1/(1 − θ) > 1. The production function employs the idea of product-variety framework proposed by Dixit and Stiglitz (1977) and applied in the literature of international trade and R&D diffusion,Footnote 11 and we will explicitly model the underlying development of R&D by the semi-endogenous framework of Jones (1995, 2005).Footnote 12

In addition to intermediate goods an aggregate (L Y,t ) of the low- and high-skilled labour types (L LY,t and L HY,t respectively) is employed in the production process:

with unit elasticity of substitution between skills

High-skilled workers can work in the final goods and the R&D sector as well, therefore the total number of high-skilled (L H,t ) should be equal to the number of high-skilled employed in the final goods (L HY,t ) and in the R&D sector respectively (L RD,t ):

and the total labour force grows exogenously at rate n:

Invention in the model corresponds to the discovery of a new design by the R&D sector which is used to produce a new variety of intermediate good. Intermediate goods producers rent tangible (physical) capital (K t ) at rate r and purchase the design from the R&D sector which enables them to transform one unit of tangible capital into one unit of intermediate input. This implies the following resource constraint:

Tangible and intangible capital accumulation constraints are given by:

Equation (38) is the standard accumulation equation for tangible capital, defined by output (Y t ) less consumption (C t ), assuming a depreciation rate of δ on capital. Equation (39) is the production function for new ideas. As in Jones (2005), new ideas are produced by research labour (L RD,t ) and the existing stock of knowledge, where parameters ϕ and λ measure the elasticity of new ideas with respect to existing stock of knowledge and the number of researchers respectively. What distinguishes our specification from Jones (2005) is that we have two types of skills and only the high-skilled can work in the R&D sector which makes our specification more suitable to examine the positive effects but also the possible limits of skill-upgrading.

The arbitrage condition of entering into the intermediate sector is

or

where P A,t is the price of designs, \( g_{{P_{A} }} = \tfrac{{\dot{P}_{t}^{A} }}{{P_{t}^{A} }}, \) fc a is the (constant) proportion of entry costs in terms of P A,t , and \( \tau > 0 \) is the subsidy rate on profit (\( PR_{{int ,t}} \)) financed from taxes. To give an economic intuition behind Eq. (40), it states that the present discounted value of profits exactly meets the required initial investment in intangible capital. Finally, the government collects lump-sum taxes (t lump ) which is fully spent on R&D subsidies (τ) at each period:

2.1 BGP growth rates

To solve for the balanced growth path growth rate of idea (intangible capital) production (g A ), rewrite (39) and use the time-derivatives

In order to obtain the growth rate of output (g Y ), note that from the symmetric structure of the model it follows that for all varieties

Therefore the aggregate production function can be rewritten as

where \( A_{t}^{\sigma } \)can be interpreted as endogenous total factor productivity. The constancy of the capital-output ratio then implies that the growth rate of output (g Y ) is given by

Along the balanced growth path the share of R&D in output, s A , is constant, therefore:

or equivalently

which allows us to solve for the balanced growth rate of intangible capital prices (\( g_{{P_{A} }} \)):

2.2 Intermediate sector’s profit

The profit-maximization of the intermediate sector requires the following first order condition:

where mkp f denotes the mark-up in the final goods sector. From the symmetric structure of the model (Eq. 43) follows that

and the intermediate sector’s profit is given by

2.3 Steady state R&D intensity in output

Along the balanced growth path the share of R&D in output (s A ) can be obtained by substituting (40′), (47) and (50) into (46)

2.4 Steady state R&D labour share

To calculate the share of high-skilled labour devoted R&D (s RD ) we can use the assumption that high-skilled wages \( (W_{H,t} ) \) are equal across sectors therefore the first order condition with respect to high-skilled labour in the final goods and R&D sector respectively must satisfy that

From (52) it follows that the share of high-skilled labour devoted R&D (s RD )

which can be expressed in terms of the steady state R&D intensity (s A ):

and using (52)

Equation (54′) already reveals some key characteristics of the model. Intuitively, higher R&D subsidies (τ), higher mark-ups in the intermediate sector (1 − θ), and lower entry costs (fc a ) make entering into the intermediate goods sector more profitable. As increasing product varieties require more ideas to be produced by the R&D sector and it raises the demand for high-skilled to be employed in the R&D sector i.e. increases the steady state share of high-skilled employed in the R&D sector (s RD ). Finally, let us see how the different elements of structural reforms influence labour productivity.

2.5 Labour productivity

First we determine the capital stock from the first order condition of the intermediate sector (49):

Therefore labour productivity (y t ) is given by

where s H is the share of high-skilled in total labour, s H = L H,t /L t .

Along the balanced growth path, the stock of knowledge can be obtained from (42)

Finally, combining (46) and (57) we obtain that labour productivity along the balanced growth path is

We can now study the effect of structural reforms on labour productivity with respect to product market competition in the final goods sector, i.e. lowering final goods mark-ups, lower entry costs and higher R&D subsidies in the intermediate sector and skill-upgrading via increasing the share of high-skilled. Decreasing the final good mark-up (decreasing mkp f ) will always lead to higher output per capita because it directly affects the steady state level of capital. However, the effect of entry costs, R&D subsidies and skill-upgrading is more involved. Increasing the share of high-skilled (s H ) increases the available stock of human resources in both the final goods sector and in the R&D sector. On the other hand, it equivalently decreases the share of low skilled (1 − s H ) whose work is also needed to produce final goods, therefore the overall effect is uncertain.

Proposition 1

Increasing the share of high-skilled in the model will increase labour productivity if

Proof

Note that the derivative of labour productivity w.r.t. s H is proportional to

After rearranging the derivative, one arrives at (59).

Note that (59) sets a limit above which increasing high-skilled share will not increase labour productivity. Intuitively since not only high-skilled but also low skilled are needed to produce final output, this limit is higher the larger the elasticity of final goods production with respect to the high-skilled employed in the final goods sector and in the R&D sector respectively \( \left( {\tfrac{\lambda \sigma }{1 - \varphi } , {\text{ and }}\alpha_{H} } \right) \) and equivalently, the smaller is the elasticity of final goods production w.r.t the low skilled employment.

The effect of entry costs and R&D subsidies is slightly more involved and it is linked to the trade-off of allocating resources between the final and R&D goods sector. Note that entry costs and R&D subsidies influence labour productivity via the steady state high-skilled share of R&D labour. As we have seen from Eq. (54′) earlier, higher R&D subsidies (τ) and lower entry costs (fc a ) make entering into the intermediate goods sector more profitable thereby stimulating more R&D and inducing higher R&D labour share. Equation (59) also reveals another important trade-off in our model, one can increase the share of R&D labour only on the cost of decreasing the share of high-skilled available for the final goods sector which in turn can reduce labour productivity.

Proposition 2

Increasing the share of high-skilled employed in the R&D sector by decreasing entry costs or increasing R&D subsidies will increase labour productivity if

Proof

Note that the derivative of labour productivity w.r.t. s RD is proportional to

After rearranging the derivative, one arrives at (59).

In parallel with increasing the share of high-skilled, higher proportion of R&D-employment does not necessary lead to higher labour productivity because high-skilled labour force is also required to produce final goods. The threshold below which increasing R&D subsidies and decreasing entry costs will stimulate R&D employment so that labour productivity is increasing depends on the relative elasticity of R&D labour versus high-skilled workers in the final goods sector: \( \alpha_{H} /\tfrac{\lambda \sigma }{1 - \varphi }. \)

Rights and permissions

About this article

Cite this article

Varga, J., Roeger, W. & in’t Veld, J. Growth effects of structural reforms in Southern Europe: the case of Greece, Italy, Spain and Portugal. Empirica 41, 323–363 (2014). https://doi.org/10.1007/s10663-014-9253-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-014-9253-3

Keywords

- Productivity differences

- Endogenous growth

- R&D

- Market structure

- Skill composition

- Dynamic general equilibrium modelling