Abstract

We study the transmission of monetary policy to macroeconomic variables with structural time-varying coefficient vector autoregressions in the Czech Republic, Hungary and Poland, in comparison with that in the euro area. These three countries have experienced changes in monetary policy regimes and went through substantial structural changes, which call for the use of a time-varying parameter analysis. Our results indicate that the impact on output of a monetary shock changed over time. At the point of the last observation of our sample, the fourth quarter of 2011, among the three countries, monetary policy was most powerful in Poland and not much less strong than the transmission in the euro area. We discuss various factors that can contribute to differences in monetary transmission, such as financial structure, labour market rigidities, industry composition, exchange rate regime, credibility of monetary policy and trade openness.

Similar content being viewed by others

Notes

For example, the vector autoregression (VAR) methodology is perhaps the most common econometric tool for the study of the transmission mechanism to key macroeconomic variables (see Christiano, Eichenbaum and Evans, 1999), which is a linear model.

For more information on the exchange rate systems of these countries, see Darvas and Szapáry (2010).

The post-1997 unchanged monetary regime of the Czech Republic prompted Borys, Horváth and Franta (2009) to use fixed parameter models for the sample period of 1998-2006. Given the still somewhat limited length of their sample, they decided to work at monthly frequency and interpolate GDP and output gap figures that are available at the quarterly frequency, using a quadratic-match procedure. As they acknowledge, interpolation has disadvantages.

See Darvas and Pisani-Ferry (2010).

See Chapter 13 of Hamilton (1994) for an excellent exposition of Kalman-filtering and the maximum likelihood estimation of the parameters of a state-space system.

To be more precise, Ciccarelli and Rebucci (2006) did not use a VAR but adopted a two-stage approach. In the first stage they measured monetary policy by estimating a system of reaction functions, and in the second stage they estimated output equations using the first stage estimates of monetary policy. Consequently, they do not model exchange rates and inflation rates.

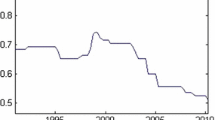

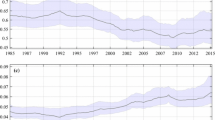

The impulse responses were calculated on the basis of the time-varying parameters derived from the Kalman-smoother. We show only the point estimates, but not confidence bands, because confidence bands tend to be too wide and therefore not very helpful.

It is worthwhile comparing these TVC-results with the results of a fixed parameter VAR using the same identification technique for the Czech Republic. Since the Czech koruna was let to float in May 1997 and inflation targeting was introduced in January 1998, 1998Q1 could be a reasonable start of the sample period. For the 1998Q1-2011Q4 sample period the strongest output response was minus 0.09 percent after a year, which then declined (in absolute terms) to minus 0.05 percent. In the case of a one-year later start of the sample period, 1999Q1-2011Q4, output response reached minus 0.31 percent after about a year and the long-run response remained at this level. The 0.31 percent contraction from the fixed parameter VAR is not the average of the TVC-VAR estimates, but close to strongest impact, suggesting that a fixed-parameter VAR may not be able to capture the average behaviour during a period when parameters are changing. The sample sensitivity of the fixed parameter VAR estimates also lends a further support to our TVC analysis.

See Égert and MacDonald (2009) for a nice exposition of the credit channel.

It is interesting to observe that the US, which is also included in Table 3 for comparison, has net interest margins well above the values of the euro area, the United Kingdom and the Czech Republic.

Moreover, panel econometric analysis using data for the Czech Republic, Hungary, Poland and Slovakia of Brzoza-Brzezina et al. (2010) showed that restrictive monetary policy leads to a decrease in domestic currency lending, but simultaneously accelerates foreign currency denominated loans, which complicates the conduct of monetary policy.

See more details in Szapáry and Jakab (1998).

Jarocinski (2010), who uses a fixed-parameter panel VAR identified with a mixture of contemporaneous and sign restrictions, also hypothesize that the level and variability of inflation may have a role in determining the strength of monetary transmission.

References

Angeloni I, Anil KK, Benoît M (eds) (2003) Monetary policy transmission in the Euro area: a study by the eurosystem monetary transmission network. Cambridge University Press, Cambridge

Beck T, Demirgüç-Kunt A (2009) Financial institutions and markets across countries and over time: data and analysis. World Bank Policy Research Working Paper No. 4943, May 2009

Boivin J, Giannoni MP, Mojon B (2008) How has the euro changed the monetary transmission? NBER Working Paper No. 14190

Borys M, Horváth R, Franta M (2009) The effects of monetary policy in the Czech Republic: an empirical study. Empirica 36(4):419–443

Brzoza-Brzezina M, Chmielewski T, Niedźwiedzińska J (2010) Substitution between domestic and foreign currency loans in Central Europe. Do central banks matter? ECB Working Paper no 1187

Canova F, De Nicolo G (2002) Monetary disturbances matter for business cycles fluctuations in the G7. J Monet Econ 49:1131–1159

Canova F, Gambetti L (2006) Structural changes in the US economy. Bad luck or bad policy? CEPR discussion paper No. 5457

Cecioni M, Neri S (2011) The monetary transmission mechanism in the euro area: has it changed and why? Working Paper 808, Banca d’Italia

Christiano LJ, Eichenbaum M, Evans CL (1999) Monetary policy shocks: what have we learned and to what end? In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, vol 1A. Elsevier Science, New York, pp 65–148

Ciccarelli M, Rebucci A (2006) Has the transmission mechanism of european monetary policy changed in the run-up to EMU? Eur Econ Rev 50:737–776

Cogley T, Sargent TJ (2005) Drifts and volatilities: monetary policies and outcomes in the post WWII US. Rev Econ Dyn 8:262–302

Darvas Z (2001) Exchange rate pass-through and real exchange rate in EU candidate countries. Deutsche Bundesbank Discussion Paper 10/2001

Darvas Z (2012) Real effective exchange rates for 178 countries: a new database. Bruegel Working Paper 2012/5

Darvas Z, Pisani-Ferry J (2010) The threat of ‘currency wars’: A European perspective. Bruegel Policy Contribution 2010/12

Darvas Z, Szapáry G (2000) Financial contagion in five small open economies: does the exchange rate regime really matter? Int Financ 3(1):25–51

Darvas Z, Szapáry G (2010) Euro area enlargement and Euro adoption strategies. In: Buti M, Servaas D, Vitor G, João Nogueira M (eds) Euro-the first decade. Cambridge University Press, Cambridge, pp 823–869

Égert B, MacDonald R (2009) Monetary transmission mechanism in central and eastern Europe: surveying the surveyable. J Econ Surv 23(2):277–327

Faust J, Leeper EM (1997) When do long-run identifying restrictions give reliable results? J Bus Econ Stat 15(3):345–353

Francis N, Owyang MT (2005) Monetary policy in a Markov-Switching vector error-correction model: implications for the cost of disinflation and the price puzzle. J Bus Econ Stat 23(3):305–313

Franta M, Horváth R, Rusnák M (2011) Evaluating changes in the monetary transmission mechanism in the Czech Republic. Czech National Bank Working Paper 13/2011

Fry R, Pagan A (2011) Sign restrictions in structural vector autoregressions: a critical review. J Econ Lit 49(4):938–960

Georgiadis G (2012) Towards an explanation of cross-country asymmetries in monetary transmission. Deutsche Bundesbank Discussion Paper 07/2012

Granger CWJ (2008) Non-linear models: where do we go next—time varying parameter models? Stud Nonlinear Dynam Econom 12(3). The Berkeley Electronic Press

Hamilton JD (1994) Time series analysis. Princeton University Press, Princeton

Hanson MS (2004) The “price-puzzle” reconsidered. J Monet Econ 51:138–1413

He C, Teräsvirta T, González A (2009) Testing parameter constancy in stationary vector autoregressive models against continuous change. Econom Rev 28(1–3):225–245

Jarociński M (2010) Responses to monetary policy shocks in the east and the west of Europe: a comparison. J Appl Econ 25(5):833–868

Lucas RE (1976) Econometric policy evaluation: a critique. Carnegie-Rochester Conf Ser Public Policy 1(1):19–46

Peersman G (2005) What caused the early millennium slowdown? Evidence based on vector autoregressions. J Appl Econ 20:185–207

Primiceri GE (2005) Time varying structural vector autoregressions and monetary policy. Rev Econ Stud 72(3):821–852

Sims CA (1992) Interpreting macroeconomic time series facts: the effects of monetary policy. Eur Econ Rev 36(5):975–1000

Sims CA, Zha T (2006) Were there regime switches in US monetary policy? Am Econ Rev 96(1):54–81

Stock JH, Watson MW (2005) Understanding changes in international business cycle dynamics. J Eur Econ Assoc 3(5):968–1006

Szapáry G, Jakab ZM (1998) Exchange rate policy in transition economies: the case of Hungary. J Comp Econom 26(4):691–717

Uhlig H (2005) What are the effects of monetary policy: results from an agnostic identification approach. J Monet Econ 52:381–419

Várpalotai V (2003) Numerical method for estimating GDP data for Hungary. Magyar Nemzeti Bank Working Paper No 2003/2

Weber AA, Gerke R, Worms A (2011) Changes in euro area monetary transmission? Appl Financ Econ 21(3):131–145

Acknowledgments

I am thankful to Fabio Canova, Peter van Els, Leo de Haan, Benoît Mojon, András Simon, Peter Vlaar, three anonymous referees, seminar participants at De Nederlandsche Bank, Magyar Nemzeti Bank and Oesterreichische Nationalbank, and conference participants at the Annual Congress of the European Economic Association and at the ECOMOD for comments and suggestions on earlier versions of this article. Part of this research was conducted while I was a visiting scholar at De Nederlandsche Bank, whose hospitality is gratefully acknowledged. The views expressed in this article do not necessarily represent those of De Nederlandsche Bank. Financial support from OTKA grant No. K76868 is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix: setting initial conditions

Appendix: setting initial conditions

Since the time-varying parameters are assumed to follow random walks, they do not have means that could be used as initial conditions. For this reason we estimated a fixed parameter VAR, equation by equation, with OLS for the first sixteen (effective) observations and used these estimates to form initial conditions for the time varying parameters and their covariance matrix, which is assumed to be block diagonal. For example, when the lag length is 1 and an intercept is not included, the first equation is:

Let \( \hat{\Upphi }_{1} \) denote the estimated coefficient vector, that is, \( \hat{\Upphi }_{1} = \left[ {\begin{array}{*{20}c} {\hat{\phi }_{11}^{(1)} } & {\hat{\phi }_{12}^{(1)} } & {\hat{\phi }_{13}^{(1)} } & {\hat{\phi }_{14}^{(1)} } \\ \end{array} } \right]^{\prime } \) and \( \hat{\Upomega }_{1} \) the OLS covariance matrix of this estimation. Let us denote the parameter estimates and their covariance matrices similarly (with different subscripts) for the other three equations.

a 0, the initial condition for the time-varying parameters is set to:

P 0, the initial condition for the covariance matrix of a 0 is set equal to the block diagonal matrix formed from the OLS covariance matrices of the four equations:

where 0 indicates an appropriately sized null-matrix, e.g a 4 × 4 matrix when the lag length is 1 and an intercept is not included.

Rights and permissions

About this article

Cite this article

Darvas, Z. Monetary transmission in three central European economies: evidence from time-varying coefficient vector autoregressions. Empirica 40, 363–390 (2013). https://doi.org/10.1007/s10663-012-9197-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-012-9197-4