Abstract

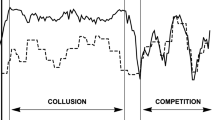

Regression methods are commonly used in competition lawsuits for, e.g., determining overcharges in price-fixing cases. Technical evaluations of these methods’ pros and cons are not necessarily intuitive. Appraisals that are based on case studies are descriptive but need not be universally valid. This paper opens up the black box called econometrics for competition cases. This is done by complementing theoretical arguments with estimation results. These results are obtained for data that is generated by a simulation-model of a collusive industry. Using such data leaves little room for debate about the quality of these methods because estimates of, e.g., overcharges can be compared to their true underlying values. This analysis provides arguments for demonstrating that thoroughly conducted econometric analyses yield better results than simple techniques such as before-and-after comparisons.

Similar content being viewed by others

Notes

The mentioned cases were investigated by the European Commission under the following case numbers: Bathroom fittings and fixtures 39.091, Belgian beer market 37.614.

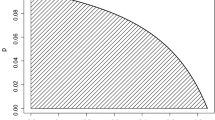

For μ = ∞ goods are perfect substitutes. For μ = 0 goods are independent. As this paper is interested in analyzing (imperfect) substitutes, μ is set at values greater than 0.

For readers interested in reproducing the below regressions and calculations, I will be happy to provide the data in EViews-format on request. Please send an email to johannes.paha@wirtschaft.uni-giessen.de.

It can be shown that firms' reaction function is \( p_{i} = {\frac{{c_{i} }}{2}} + {\frac{{n\nu + \mu \sum\nolimits_{(j = 1)\backslash i}^{n} {p_{j} } }}{2 \cdot (n + n\mu - \mu )}} \) (see, e.g., Paha (2010)).

To see this even more clearly, one may choose arbitrary values for n and μ, and consider an arbitrary composition of the cartel. Then, writing Eq. (9) in non-matrix notation for collusive periods, competitive periods, and transition-periods supports the above statements.

The calculation is done as follows: One observes that firm 1 sets a collusive price p 1,42 = 31.994 in period 42 and a collusive price of p 1,43 = 31.173 in period 43. The common cost-shock in period 43 is s 43 = −1.354. Applying the above regression, one predicts a hypothetical competitive price of \( \hat{p}_{c,1,43} = - 11.070 + (1 + 0.194) \cdot p_{1,42} + 0.717 \cdot s_{43} = 26.16 \). From the industry-simulation, one can infer the true competitive price p c,1,43 = 25.956 that would be unknown in a real case. Therefore, the predicted price is found to be a good predictor for its true underlying.

In particular, I started with a specification that closely resembled the final specification in Table 3 but included firm-specific interaction effects for all firms. By successively applying F-tests it was possible to show that the fringe firm is the only one for whom the coefficients of p i,t−1 D t−1 and D t differ from those of the other firms in a statistically significant sense. Including the prices of competitors and the Herfindahl–Hirschman-Index supports the above proposition of biased estimates as these variables are correlated with the error term. The consequence can be seen particularly well in the coefficient of p i,t−1 that is biased away from its economically plausible value of one.

Suppose that the above cartel was found to have been active in periods 21–24, 39–73, and 82–100. This specification only neglects one cartel-period and three price war periods in times, where short price wars interrupt longer cartel-periods. Estimating Eq. (10) with this faint misspecification results in a downwards biased overcharge estimate of 4.55%.

Please note that the last column presents the regression-results of Eq. (13) for firm 2 in periods t = 1–20. The last four rows summarize the results of tests for structural breaks. These results are not interpreted here, as they are used further below.

References

Baker JB (1999) Empirical methods in antitrust litigation: review and critique. Am Law Econ Rev 1(1/2):386–435

Chow GC (1960) Tests of equality between sets of coefficients in two linear regressions. Econometrica 28(3):591–605

Clark E, Hughes M, Wirth D (2004) Study on the conditions of claims for damages in case of infringement of EC competition rules. http://ec.europa.eu/competition/antitrust/actionsdamages/comparative_report_clean_en.pdf

Connor JM (2008) Forensic economics: an introduction with special emphasis on price fixing. J Compet Law Econ 4(1):31–59

Connor JM, Lande RH (2008) Cartel overcharges and optimal cartel fines. In: Issues in competition law and policy. ABA section of antitrust law. ABA Book Publishing, Chicago

Directorate General Competition (2010) Best practices for the submission of economic evidence and data collection in cases concerning the application of articles 101 and 102 TFEU and in merger cases. http://ec.europa.eu/competition/consultations/2010_best_practices/best_practice_submissions.pdf

Fershtman C, Pakes A (2000) A dynamic oligopoly with collusion and price wars. Rand J Econ 31(2):207–236

Finkelstein MO, Levenbach H (1983) Regression estimates of damages in price-fixing cases. Law Contemp Probl 46(4):145–169

Friedman JW (1971) A non-cooperative equilibrium for supergames. Rev Econ Stud 38(113):1–12

Harrington JE (2008) Detecting cartels. In: Buccirossi P (ed) Handbook of antitrust economics. The MIT Press, Cambridge, MA

Hausmann WJ (1984) Cheap coals or limitation of the vend? The London coal trade, 1770–1845. J Econ Hist 44(2):321–328

Heij C, de Boer P, Franses PH, Kloek T, van Dijk HK (2004) Econometric methods with applications in business and economics. Oxford University Press, Oxford

Monopolkommission (2010) Mehr Wettbewerb, wenig Ausnahmen. Achtzehntes Hauptgutachten der Monopolkommission gemäß § 44 Abs. 1 Satz 1 GWB. http://www.monopolkommission.de/haupt_18/mopoko_volltext_h18.pdf

Oxera (2009) Quantifying antitrust damages. Towards non-binding guidance for courts. Study prepared for the European Commission. http://ec.europa.eu/competition/antitrust/actionsdamages/quantification_study.pdf

Paha J (2010) Endogenous cartel formation with heterogeneous firms and differentiated products. MAGKS discussion paper No. 07-2010. http://www.uni-marburg.de/fb02/makro/forschung/magkspapers/07-2010_paha.pdf

Prokop J (1999) Process of dominant-cartel formation. Int J Ind Organ 17(2):241–257

Reiss PC, Wolak FA (2007) Structural econometric modeling: rationales and examples from industrial organization. In: Heckman JJ, Leamer EE (eds) Handbook of econometrics, vol 6A. Elsevier North-Holland, Amsterdam

Rotemberg JJ, Saloner G (1986) A supergame-theoretic model of price wars during booms. Am Econ Rev 76(3):390–407

Shubik M, Levitan R (1980) Market structure and behavior. Harvard University Press, Cambridge, MA

Acknowledgments

I would like to thank Oliver Budzinski, Henning Fischer, Georg Götz, Maarten Janssen, Peter Winker, my colleagues in Giessen, and the participants of the 35th Hohenheimer Oberseminar for their valuable comments on this paper.

Author information

Authors and Affiliations

Corresponding author

Appendix 1: Generating a collusive industry

Appendix 1: Generating a collusive industry

The dataset that is used in the above regressions is generated by running the simulation model with the parameter values given in Table 5. Except for the number of cartelists m, these parameter values are randomly determined from uniform distributions within the bounds provided by Table 5.

Choosing n ∈ [7,15] is reasonable because, first, all firms would join the cartel with probability 1 if the number of firms was too small. Second, the time for calculating the participation-equilibrium rises exponentially in the number of firms and, thus, would be undesirably long for n > 15. From the viewpoint of economic theory, the size of ν is irrelevant as it only affects the size of prices and quantities but does not have an impact on the ratio of profit-measures. Using μ upper = 100 as an upper bound is reasonable as it suffices to produce rather homogeneous goods. Choosing a 1 ∈ [0.05, 1.0] is reasonable because values below 0.05 would indicate that marginal costs are quite negligible. The production of such firms may be supposed to rather generate fixed costs that, however, are beyond the scope of this model. Choosing a 4 ∈ [0.05, 0.15] gives economically meaningful yet not unrealistically large cost shocks. Drawing P from the wide interval [0.05, 0.4] reflects our lack of knowledge about the effectiveness of competition authorities. This is because one knows the number of discovered cartels but can hardly determine the number of undiscovered ones. The interval encloses the 15–20% detection probability that some studies suggest. Choosing r ∈ [0.05, 0.25] suggests that firms’ discount rate is somewhere between the return of government bonds and some (ambitious) firms’ target value of their return on equity. The number of cartelists m is determined endogenously as the mixed-strategy Nash-equilibrium of the cartel-formation game.

Rights and permissions

About this article

Cite this article

Paha, J. Empirical methods in the analysis of collusion. Empirica 38, 389–415 (2011). https://doi.org/10.1007/s10663-010-9160-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-010-9160-1