Abstract

This paper employs a general equilibrium model with heterogeneous firms to analyze the effect of default risk on production-generated pollution emissions. The model analytically divides the effect of default risk into three distinct effects: the market-size, technology-upgrading, and selection effect. Conceptually, an increase in default risk raises equilibrium borrowing costs, thereby precluding investment in a technology upgrade among a subset of firms (technology-upgrading effect). As a consequence, the economy consists of more numerous (market-size effect) but less productive and more pollution-intensive firms (selection effect). Because the effects are confounding in nature, the effect of default risk on aggregate pollution emissions and emissions intensity is an empirical question. To answer this question, this paper estimates the model’s key parameters using a unique dataset with establishment-level credit scores and a composite measure of pollution emissions for a panel of manufacturing firms in the United States. Using a two-step procedure where default risk is estimated in the first stage, the results indicate that the estimated elasticity of emissions intensity and productivity with respect to default risk is 0.89 and − 0.16, respectively. Next, I use the theoretical model to leverage the coefficient estimates to estimate the effect of economy-wide default risk on aggregate pollution emissions, demonstrating that default risk increases aggregate emissions and emissions intensity, primarily as a consequence of the technology-upgrading effect. Finally, this paper demonstrates that historical changes in economy-wide default risk can generate economically significant changes in pollution emissions.

Similar content being viewed by others

Notes

Default risk is defined as the probability that a firm (1) exits the market (goes out of business) and (2) does not repay borrowed funds in the case that the firm borrowed (or more generally the firm’s creditors are repaid a lesser amount than they otherwise would receive). This paper does not consider default risk arising from other sources, such as asymmetric information (e.g., Stiglitz and Weiss 1981) and contractual incompleteness (e.g., Hart and Moore 1994).

This paper also uses a two-step bootstrap procedure to estimate consistent standard errors for all of the estimated numerical model results.

The expected penalty is equal to the probability of punishment for non-compliance multiplied by the penalty, whereas the enforcement cost is the cost of monitoring polluters. More severe punishments might increase default risk as a consequence of triggering insolvency among liquidity constrained firms.

Evans and Gilpatric (2015) develop a related model to analyze the role of liability and profitability-related risk in precautionary behavior.

Bae (2015) posits that the association between economic downturns and pollution-reduction efforts might be due to weakened community pressure during recessions.

The Dixit and Stiglitz (1977) model has been widely adopted in various economic fields, such as international trade (e.g., Melitz, 2003). Because the theoretical predictions of Melitz (2003) are consistent with empirical regularities in manufacturing sectors, and because many pollution-intensive sectors have become differentiated-good industries (such as chemicals and metals industries) (Konishi and Tarui 2015), several papers have adapted the Melitz (2003) framework to account for pollution emissions (Kreickemeier and Richter 2013; Konishi and Tarui 2015; Shapiro and Walker 2015; Andersen 2016, among others). This model extends the basic framework developed by Andersen (2016) to investigate the role of default risk in aggregate emissions. Besides focusing on default risk instead of credit constraints, the aim of the present analysis is to develop a model that can be taken to the data, wherein the micro-based structural parameters can be identified and leveraged to determine aggregate effects.

Because the model abstracts from endogenous pollution policy responses, I do not consider disutility associated with environmental damage. However, incorporating environmental damage using a weakly-separable utility function (e.g., W(Z, U) where U is given by Eq. (1) and Z is aggregate pollution) would not change the analysis as the marginal rate of substitution (and thus the elasticity of substitution) of two varieties would be independent of pollution.

To be precise, more productive firms will invest in the technology upgrade whenever the additional revenue generated from the upgrade is increasing in productivity, as is the case when upgrading increases productivity by a constant percentage (demonstrated below). Under empirically-relevant parameters, this condition will also hold when upgrading is additive (\(\phi + \delta\)), but the analysis is far less tractable and does not result in closed-form solutions.

While these effects reflect the net effects of upgrading, the model abstracts from embodied emissions generated as a byproduct of production of the upgraded technology.

From a theoretical point of view, expression (6) is a generalization of the Cobb-Douglas pollution-production technology adopted by Copeland and Taylor (2003), in which \(\alpha\) can be interpreted as the cost share of non-pollution inputs (Shapiro and Walker 2015). See Andersen (2016) for an extended discussion of the assumption and interpretation.

A well-established result in the corporate finance literature posits that, in order to minimize the cost of investment in the context of imperfect information, firms use internal funds first, which are the least-cost source of funds, and use external funds thereafter (Myers and Majluf 1984). While the particular modelling assumption is made for simplicity, the results would be similar under the more general assumption that upgrading increases the share of borrowed funds, implying that an increase in the cost of borrowing would increase the cost of upgrading to a greater extent than it increases the cost of the baseline technology, thus discouraging investment in the technology upgrade.

If, on the other hand, technology upgrading is an upfront, irreversible investment then the effects of changes in default risk would generally be dissimilar among incumbent and entering firms as incumbent firms would be less responsive to changes in the cost of upgrading. Consequently, the short-run effects would generally be smaller in magnitude than the long-run effects of changes in default risk. However, these differences would vanish in the long-run as new entrants supplant incumbent firms.

An absorbing state is one in which it is impossible to leave–that is, firms that exit the market cannot reenter the market in later periods.

Eaton et al. (2011), among others, document that firm size approximately follows this distribution.

In contrast to representative-firm models, the effect on aggregate emissions cannot be directly inferred from firm-level scale and technique effects, as default risk bears on both the number and type of firms in the industry, thereby requiring a more general framework to uncover the underlying mechanisms of the model.

The NETS database is proprietary data compiled by Walls and Associates and covers all establishments in the United States starting in 1990.

While it is beyond the scope of this paper to address the various concerns of the TRI, de Marchi (2006) investigate the accuracy of the TRI and find evidence of misreporting in two, of the twelve investigated, chemicals.

According to D&B, PayDex Scores is a measure of both payment history and default risk, where a score above 80 indicates low risk and below 50 indicates high risk. The model used by D&B to generate scores is proprietary, and the company does not provide information regarding the interpretation of PayDex Scores in terms of the corresponding default probability. For more information on PayDex Scores, see http://paydex.net/.

Establishment-level prices are unavailable and would be endogenous, thereby complicating the analysis.

Labor productivity might vary across industries due to variation in capital intensity. However, the baseline analysis uses log labor productivity and accounts for establishment fixed effects, which implies that variation in productivity is in terms of percentage changes from an establishment’s mean labor productivity. Moreover, the baseline analysis accounts for industry by year fixed effects, and the coefficient estimates do not vary systematically across industries (results available upon request).

The start and end years of the panel are determined by the availability of the NETS database.

Few establishments in these sectors report pollution emissions because they tend to be the least polluting among the manufacturing sector. It is therefore not particularly consequential to omit these establishments.

Firms exiting in period t do not report in that period, precluding estimation of a contemporaneous model. Exiting the market is an “absorbing” state as there are no instances of establishments taking up production in subsequent years.

Alternative specifications also control for 4-digit SIC industry fixed effects and industry by year fixed effects. However, maximum likelihood estimation drops almost all of the additional fixed effects because Death is a relatively rare event, and consequently there is no variation in the dependent variable within these fixed effects categories.

Similarly, the odds ratio in column (3) is 0.989, implying that a 1 unit increase in Credit Score reduces the probability of Death by around 1.1%.

For the remainder of this section, default risk is generated using the probit model. The results are similar using the logit model, and are available upon request.

While the mean default risk is less than the manufacturing sector in general, this observation is not unexpected as the sample is not necessarily representative of the manufacturing sector and polluting establishments tend to be larger and more capital intensive on average.

One explanation is that polluting firms tend to be large and more capital intensive, implying they would be less likely to exit than firms that are less capital intensive and thus have relatively less fixed costs. Moreover, because the sample of analysis ends in 2009, many of the effects of the recession might not have yet been realized.

The results are robust to the inclusion of state by year fixed effects, which are available upon request.

The within transformation implies that the dependent and independent variables are differences from the mean. The establishment-specific effects \(\beta _{i}\) and \(\zeta _{i}\) can also be eliminated using a first-difference specification, wherein the dependent and independent variables are differences between current and lagged periods. The results are consistent using this alternative approach and the coefficients and standard errors are provided in the notes of Table 3.

While the two-step procedure generates consistent estimates of the parameters in the second-stage regression, it is well known that failing to account for the presence of imputed regressors yields inconsistent estimates of their standard errors. To remedy this issue, this study employs a two-step bootstrapping procedure to correct the standard errors in the estimated elasticities as well as the numerical model results, which I discuss in more detail in the subsequent section.

Similar to (40), I estimate the following model \(\text {Prob}( \text {Death}_{i s t+1} = 1 | {\mathbf {x}}_{ist} ) =\)\(\varvec{\Phi } (\alpha _t + \alpha _s + \alpha _1 \text {Credit Score}_{ist} + \alpha _2 \text {Credit Score}_{ist}\times \text {Public Facility}_{is} + \alpha _3\text {Public Facility}_{is} )\).

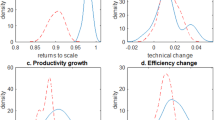

Figures A1 and A2 in the supplementary web appendix B plot the kernel density distributions of default risk for public and private establishments generated using probit (A1) and logit (A2) regressions.

The statistical significance of the interaction term \({\text {Credit Score}}_{ist}\times \text {Public Facility}_{is}\) demonstrates that the difference between the coefficient estimates is significant at the 1% significance level.

For comparison, the average log change in Default Risk over the period is − 0.05, while the average absolute-value log change over the period is 0.56.

Precisely, \(\Delta \ln {\text {Productivity}}_{ist}\)=\(\ln {\text {Productivity}}_{is1999} - \ln \text {Productivity}_{is1998}\), and \(\Delta \ln {\text {Default Risk}}^{-i}_{st} = \ln \text {Default Risk}^{-i}_{s1999} - \ln {\text {Default Risk}}^{-i}_{s1998}\), where \(\text {Default Risk}^{-i}_{s1999}\) is the average Default Risk of industry i in year 1999 (and similar for 1998), excluding establishment i.

The corresponding p values are \(p=0.00\) and \(p=0.02\).

In this case, the following first-stage model \(\Delta \ln \text {Default Risk}^{-i}_{st} = {{\tilde{\alpha }}} \Delta \ln \text {Default Risk}_{ist} + u_{ist},\) is estimated using OLS.

In particular, the Productivity DID estimate (standard error) is − 0.283 (0.037) in 06/07 and 0.017 (0.016) in 02/03.

In particular, the Emissions Intensity DID estimate (standard error) is 0.653 (0.316) in 06/07 and 0.360 (0.266) in 02/03.

To illustrate the approach using a stylized example, one might estimate the elasticity of labor supply with respect to marginal tax rates, and couple this with an aggregate production function with assumed parameter values, in order to numerically simulate the effect of a change in tax policy on aggregate output.

The details of the bootstrap procedure are provided in Appendix C of the supplementary web appendix. See the table notes for the correspondence between the numerical-model coefficients and the equations in the theoretical model.

In particular, I assume that the elasticity of productivity and the elasticity of emissions intensity are − 0.16 and 0.89. These coefficients correspond to the baseline model as reported in Table 3, column (1), which are representative of the various model specifications.

Consistent with this paper, Leibovici and Wiczer (2019) document that default risk increased during the Great Recession, as evidenced by changes in credit ratings and exit behavior.

References

Andersen DC (2016) Credit constraints, technology upgrading, and the environment. J Assoc Environ Resour Econ 3:283–319

Andersen DC (2017) Do credit constraints favor dirty production? Theory and plant-level evidence. J Environ Econ Manag 84:189–208

Bae H (2015) Do plants decrease pollution reduction efforts during a recession? Evidence from upstate New York chemical plants during the US Great Recession. Environ Resour Econ 66:671–687

Bartelsman Eric J, Gray Wayne B (1996) The NBER manufacturing productivity database. NBER technical working paper series, pp 1–31

Becker GS (1968) Crime and punishment: an economic approach. J Polit Econ 76:169–217

Bustos P (2011) Trade liberalization, exports, and technology upgrading: evidence on the impact of MERCOSUR on Argentinian firms. Am Econ Rev 101:304–340

Cole MA, Elliott RJR, Shimamoto K (2005) Industrial characteristics, environmental regulations and air pollution: an analysis of the UK manufacturing sector. J Environ Econ Manag 50:121–143

Cole MA, Elliott RJR, Shanshan WU (2008) Industrial activity and the environment in China: an industry-level analysis. China Econom Rev 19:393–408

Copeland BR, Taylor MS (2003) Trade and the environment. Princeton University Press, Princeton

de Marchi S (2006) Assessing the accuracy of self-reported data: an evaluation of the toxics release inventory. J Risk Uncertain 32:57–76

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Earnhart D, Lizal L (2006) Effects of ownership and financial performance on corporate environmental performance. J Comp Econ 34:111–129

Earnhart D, Lizal L (2010) Effect of corporate economic performance on firm-level environmental performance in a transition economy. Environ Resour Econ 46:303–329

Earnhart D, Segerson K (2012) The influence of financial status on the effectiveness of environmental enforcement. J Public Econ 96:670–684

Eaton J, Kortum S, Kramarz F (2011) An anatomy of international trade: evidence from French firms. Econometrica 79:1453–1498

Evans MF, Gilpatric SM (2015) Abatement, care, and compliance by firms in financial distress. Environ Resour Econ 66:765–794

Fischer C, Heutel G (2013) Environmental macroeconomics: environmental policy, business cycles, and directed technical change. Annu Rev Resour Econ 5:197–210

Fischer C, Springborn M (2011) Emissions targets and the real business cycle: intensity targets versus caps or taxes. J Environ Econ Manag 62:352–366

Gray WB, Deily ME (1996) Compliance and enforcement: air pollution regulation in the US steel industry. J Environ Econ Manag 31:96–111

Greenstone M, List JA, Syverson C (2012) The effects of environmental regulation on the competitiveness of U.S. manufacturing. NBER working paper 18392, National Bureau of Economic Research, Cambridge, MA

Hart O, Moore J (1994) A theory of debt based on the inalienability of human capital. Q J Econ 109:841–879

Heutel G (2012) How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Rev Econ Dyn 15:244–264

Konishi Y, Tarui N (2015) Emissions trading, firm heterogeneity, and intra-industry reallocations in the long run. J Assoc Environ Resour Econ 2:1–42

Kreickemeier U, Richter PM (2013) Trade and the environment: the role of firm heterogeneity. Rev Int Econ 22:209–225

Leibovici F, Wiczer D (2019) Firm-level credit ratings and default in the Great Recession: theory and evidence. 2019 meeting papers 1389, Society for Economic Dynamics

Maynard LJ, Shortle JS (2001) Determinants of cleaner technology investments in the U.S. bleached kraft pulp industry. Land Econ 77:561–576

Melitz M (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Murphy KM, Topel RH (1985) Estimation and inference in two-step econometric models. J Bus Econ Stat 3:370–379

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13:187–221

Neumark D, Wall B, Zhang J (2011) Do small businesses create more jobs? New evidence for the United States from the National Establishment Time Series. Rev Econ Stat 93:16–29

Pagan A (1984) Econometric issues in the analysis of regressions with generated regressors. Int Econ Rev 25:221–247

Shadbegian RJ, Gray WB (2005) Pollution abatement expenditures and plant-level productivity: a production function approach. Ecol Econ 54:196–208

Shapiro JS, Walker R (2015) Why is pollution from U.S. manufacturing declining? The roles of trade, regulation, productivity, and preferences. Unpublished manuscript, Department of Economics, Yale University

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71:393–410

Tong D, Pan L, Weiwei C, Lamsal L, Lee P, Youhua T, Hyuncheol K, Kondragunta S, Stajner I (2016) Impact of the 2008 Global Recession on air quality over the United States: implications for surface ozone levels from changes in \(\text{ NO }_{x }\) emissions. Geophys Res Lett 43:9280–9288

Acknowledgements

I thank Ian Sue Wing (the Editor), Sophie Bernard, and two anonymous referees for valuable comments and suggestions. I am also grateful to audience participants at the 2018 Canadian Resource and Environmental Economics Study Group Annual Meeting.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Andersen, D.C. Default Risk, Productivity, and the Environment: Theory and Evidence from U.S. Manufacturing. Environ Resource Econ 75, 677–710 (2020). https://doi.org/10.1007/s10640-020-00404-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-020-00404-5