Abstract

We examine the efficiency of centralized versus decentralized management of spatially-connected renewable resources when users have heterogeneous preferences for conservation versus extraction. Resource mobility induces a spatial externality, while spatial preference heterogeneity drives a wedge between users’ privately optimal extraction rates. We first address these market failures analytically and show that the first is most efficiently handled with centralized planning while the second is best tackled with decentralized management. Except in special cases, neither approach will be first best, but which arises as second best depends on the relative strength of preference heterogeneity versus spatial mobility of the resource. We illustrate the theory, and test its robustness, with a numerical example.

Similar content being viewed by others

Notes

An exception is Arnason (2009) who accounts for preferences but implicitly assumes an aspatial world. Arnason (2009) shows that an Individual Tradable Quota (ITQ) system between commercial users, recreational users, and conservationists can yield an efficient allocation, assuming each group can internally resolve the free-rider problem.

For example, Oates (1999) states: “By tailoring outputs of such goods and services to the particular preferences and circumstances of their constituencies, decentralized provision increases economic welfare above that which results from the more uniform levels of such services that are likely under national provision.”

For the purposes of exposition, our concept of decentralized management is at the individual resource user, while centralized planning is at some higher level of authority (e.g. state). However, the key insights of our model can be applied to questions of optimal jurisdictions whenever there are potentially different levels of natural resource management (state versus local, national versus state, or international versus national, etc.).

For example, consider the challenge of determining how many elk hunting permits to issue in each of 163 hunting districts in the state of Montana, recognizing that elk migrate and that preferences vary widely across districts from extreme conservationists (who would favor no hunting at all) to avid sportsmen (who might favor managing to population to maximize hunting opportunities).

We note that our analytical treatment of the alternative institutional options is deliberately stylized to focus on the tension between resource mobility and preference heterogeneity and derive the conditions under which CPor DM delivers the greatest social welfare. Nevertheless, there are clearly other factors that may influence why centralization or decentralization may be preferred for natural resource management. For example, the public choice literature raises important concerns about the incentives of centralized bureaucracies and regulators of natural resources (Anderson and Leal 1991). Another strand of literature emphasizes the potential for decentralized cooperation and coordination amongst resource users (Ostrom 1990; Schlager and Ostrom 1992). Our analysis should be viewed as complementary to these established literatures.

Consistent with the previous literature, the growth function satisfies the conditions: \(f_i^{\prime }(e)>0,f_i^{\prime \prime }(e)<0\) and \(f_i(0)=0\). Note that specifying different timing, such as dispersal occurring before growth, or alternativerepresentations of dispersal, for example density-dependent dispersal, would affect analytical tractability. See Costello and Polasky (2008) for further details.

Note that by conservation, we mean conservation for its own sake. In our dynamic context, users who place weight on extraction also have some incentive for conservation to the extent that it increases the discounted stream of future extraction profits.

Crucially, the fact that the optimal choice of residual stock is independent of the state variable is a result of our model structure, and not a direct assumption. The FB decision maker is accounting for all spatial and dynamic consequences in each and every time period when choosing the residual stock level above. That said, alternative model specifications can break this state-independence, and we explore the consequences of alternative specifications in the numerical exercise below.

This may be a generous assumption for how central resource managers actually behave, and whether they explicitly account for the underlying spatial resource heterogeneity is the subject of much debate in the literature (see Sanchirico and Wilen (2005)). This suggests a possible third institutional regime in which the central planner ignores both resource heterogeneity and preference heterogeneity, a point we return to in Sect. 5.2 below.

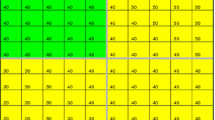

Re-running the analysis for this parameterization with perfect resource information produces a figure nearly identical to the top panel Fig. 1.

One could also consider incentive schemes akin to the Falkinger Mechanism (Falkinger 1996; Falkinger et al. 2000), whereby spatial property right owners are rewarded or penalized based on their residual stock decisions relative to their peers. Further research into designing such a mechanism in the context of spatial and dynamic natural resources may yield important insights for decentralized resource management.

If harvest was the control, then to achieve a desired residual stock would require a state-dependent control by the identity \(e_{it} \equiv x_{it}-h_{it}\).

References

Alberini A, Kahn JR (2009) Handbook on contingent valuation. Edward Elgar Publishing, Cheltenham

Alm J, Banzhaf HS (2012) Designing economic instruments for the environment in a decentralized fiscal system. J Econ Surv 26(2):177–202

Anderson TL, Leal DR (1991) Free market environmentalism. Pacific Research Institute for Public Policy, San Francisco

Arnason R (2009) Conflicting uses of marine resources: can ITQs promote an efficient solution? Aust J Agric Resour Econ 53:145–174

Besley T, Coate S (2003) Centralized versus decentralized provision of local public goods: a political economy approach. J Publ Econ 87(12):2611–2637

Bhat M, Huffaker R (2007) Management of a transboundary wildlife population: A self-enforcing cooperative agreement with renegotiation and variable transfer payments. J Environ Econ Manag 53(1):54–67

Brown G, Roughgarden J (1997) A metapopulation model with private property and a common pool. Ecol Econ 22(1):65–71

Cancino JP, Uchida H, Wilen JE (2007) TURFs and ITQs: collective vs. individual decision making. Mar Resour Econ 22:391–406

Carson RT, Flores NE, Meade NF (2001) Contingent valuation: controversies and evidence. Environ Resour Econ 19(2):173–210

Clark C (1990) Mathematical bioeconomics. Wiley, New York

Costello C, Quérou N, Tomini A (2015) Partial enclosure of the commons. J Publ Econ 121:69–78

Costello C, Polasky S (2008) Optimal harvesting of stochastic spatial resources. J Environ Econ Manag 56(1):1–18

Eichner T, Runkel M (2012) Interjurisdictional spillovers, decentralized policymaking, and the elasticity of capital supply. Am Econ Rev 102(5):2349–2357

Falkinger J (1996) Efficient private provision of public goods by rewarding deviations from average. J Publ Econ 62(3):413–422

Falkinger J, Fehr E, Gächter S, Winter-Ebmer R (2000) A simple mechanism for the efficient provision of public goods: experimental evidence. Am Econ Rev 90(1):247–264

García-Quijano C (2009) Managing complexity: ecological knowledge and success in Puerto Rican small-scale fisheries. Hum Organ 68(1):1–17

Hannesson R (1997) Fishing as a supergame. J Environ Econ Manag 32(3):309–322

Hastings A, Botsford LW (1999) Equivalence in yield from marine reserves and traditional fisheries management. Science 284(5419):1537–1538

Hayek FA (1945) The use of knowledge in society. Am Econ Rev 35(4):519–530

Hilborn R, Walters C (1999) Quantitative fisheries stock assessment: choice, dynamics, and uncertainty. Chapman & Hall, London

Janmaat J (2005) Sharing clams: tragedy of an incomplete commons. J Environ Econ Manag 49(1):26–51

Kaffine DT, Costello C (2011) Unitization of spatially connected renewable resources. BE J Econ Anal Policy 11(1):1–11

Kapaun U, Quaas MF (2013) Does the optimal size of a fish stock increase with environmental uncertainties? Environ Resour Econ 54(2):293–310

Levhari D, Mirman LJ (1980) The great fish war: an example using a dynamic Cournot-Nash solution. Bell J Econ 11(1):322–334

Libecap GD, Wiggins SN (1985) The influence of private contractual failure on regulation: the case of oil field unitization. J Polit Econ 93(4):690–714

List JA, Mason CF (2001) Optimal institutional arrangements for transboundary pollutants in a second-best world: evidence from a differential game with asymmetric players. J Environ Econ Manag 42(3):277–296

Oates WE (1999) An essay on fiscal federalism. J Econ Lit 37:1120–1149

Ostrom E (1990) Governing the commons. Cambirdge Universtiy Press, Cambridge

Reed WJ (1979) Optimal escapement levels in stochastic and deterministic harvesting models. J Environ Econ Manag 6(4):350–363

Sanchirico JN, Malvadkar U, Hastings A, Wilen JE (2006) When are no-take zones an economically optimal fishery management strategy? Ecol Appl 16(5):1643–1659

Sanchirico JN, Wilen JE (2005) Optimal spatial management of renewable resources: matching policy scope to ecosystem scale. J Environ Econ Manag 50(1):23–46

Schlager E, Ostrom E (1992) Property-rights regimes and natural resources: a conceptual analysis. Land Econ 68(3):249–262

Wiggins S, Libecap G (1985) Oil field unitization: contractural failure in the presence of imperfect information. Am Econ Rev 75:368–385

Wilen JE, Cancino J, Uchida H (2012) The economics of territorial use rights fisheries, or TURFs. Rev Environ Econ Policy 6(2):237–257

Acknowledgements

We thank participants at the 15th Occasional California Workshop on Environmental and Natural Resource Economics (UCSB), seminar participants at Colorado State University, and the 2016 Payne Institute Conference for useful comments. We acknowledge the financial support of the Waitt Foundation and the PERC Lone Mountain Fellowship. This research benefitted from helpful conversations with the Environmental Defense Fund, where Costello serves as a trustee.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Proposition 1

Proof

Per Assumptions 1 and 2 and by using residual stock (\(\mathbf {e_t}\)) (rather than harvest) as the control variable, this complicated dynamic optimization problem has a special structure, called “state independent control,” for which the first-order conditions are independent of stock, \(x_{it}\) (Costello and Polasky 2008).Footnote 14 This allows us to separate the problem temporally, and implies that residual stock is location-specific, but time-independent (consistent with Proposition 1 in Costello and Polasky (2008)). This result accords with, but extends, existing resource models with perfectly elastic demand for which a bang-bang solution is implemented to achieve an optimal residual stock (see Costello et al. 2015). Because optimal residual stock in patch i is constant, additional units of stock are simply harvested, so the shadow value on stock is just the value of an additional unit of harvest: \(\frac{\partial V_{t+1}(\mathbf {x_{t+1}})}{\partial x_{jt+1}}=\alpha _jp_j\; \forall j\). The final term, \(\frac{\partial x_{jt+1}}{\partial e_{it}}\) equals \(f_i^{\prime }(e_{it})D_{ij}\) by rewriting Equation 1 in terms of \(x_{jt+1}\) and differentiating with respect to \(e_{it}\). Thus, what would otherwise be an extremely complicated spatial temporal optimization problem has a first order condition that compactly reduces from Eq. 4 to:

Rearranging yields the residual stock rule in Proposition 1. \(\square \)

Appendix 2: Proof of Corollary 1

Proof

We wish to show that \(\frac{d e^{FB}_i}{d D_{ii}}>0\), \(\frac{d e^{FB}_i}{d D_{ij}}>0\), \(\frac{d e^{FB}_i}{d \alpha _i}<0\), and \(\frac{d e^{FB}_i}{d \alpha _j}>0\). Let \(\phi (D_{ii}, D_{ij}, \alpha _i,\alpha _j)=\frac{1}{\delta }\left[ \frac{\alpha _ip_i-k(1-\alpha _i)}{\sum _{j=1}^N\alpha _jp_jD_{ij}}\right] \), which is the right-hand side of Equation 5. Rearranging Eq. 5 such that \(f_i^{\prime }(e^{FB}_i)-\phi (D_{ii}, D_{ij}, \alpha _i,\alpha _j)=0\), then by the implicit function theorem, \(\frac{d e^{FB}_i}{d D_{ii}} = \frac{\partial \phi / \partial D_{ii}}{f_i^{\prime \prime }(e_i)}\), and similarly for \(D_{ij}\), \(\alpha _i\), and \(\alpha _j\). Thus, we have:

\(\square \)

Appendix 3: Proof of Lemma 1

Proof

Rewriting utility to show the dependence on \(\alpha _i\), \(U_{it}(x_{it},e_{it};\alpha _i)\), reveals that it is linear in the random variable, \(\alpha _i\), so \(E_{\alpha _i}\left[ U_{it}(x_{it},e_{it};\alpha _i)\right] =U_{it}(x_{it},e_{it};\bar{\alpha })\). \(\square \)

Appendix 4: Proof of Proposition 2

Proof

By Lemma 1, the expected utility when only the distribution of \(\alpha _i\) is known is equivalent to the utility of the expected value \(\bar{\alpha }\equiv \sum \alpha _i/N\). Thus, the Dynamic Programming Equation is given by:

with first-order conditions:

By the proof for Proposition 1, the first-order conditions can be expressed as:

Rearranging yields the residual stock rule in Proposition 2. \(\square \)

Appendix 5: Proof of Corollary 2

Proof

The proof to part (a) hinges on the comparison of Equations 5 and 6. If \(\alpha _i=\bar{\alpha }\; \forall i\), then the right-hand side of Equation 6 equals the right-hand side of Equation 5, which confirms the result.

To prove the inequality cases in part (b), note that \(de_i^{FB} = \frac{de_i^{FB}}{d\alpha _i}d\alpha _i+\sum _{j\ne i}\frac{de_i^{FB}}{d\alpha _j}d\alpha _j\). From Corollary 1, \(\frac{de_i^{FB}}{d\alpha _i}<0\), and under Condition 1, \(\frac{de_i^{FB}}{d\alpha _j}=-\frac{Q(\alpha _ip-k(1-\alpha _i))}{\delta (Q(N\bar{\alpha }-\alpha _i)+D\alpha _i)^2f_i^{\prime \prime }(e_i)}>0\). Because \(\frac{de_i^{FB}}{d\alpha _j}\) is constant (under Condition 1) across all \(j\ne i\), then \(de_i^{FB} = \frac{de_i^{FB}}{d\alpha _i}d\alpha _i+\frac{de_i^{FB}}{d\alpha _j}\sum _{j\ne i}d\alpha _j\). Finally, if \(\alpha _i>\bar{\alpha }\), CP is analogous to setting \(d\alpha _i<0\), which also implies that \(\sum _{j\ne i}d\alpha _j>0\), which allows us to unambiguously sign \(de_i^{FB}>0\). Thus, if \(\alpha _i>\bar{\alpha }\), then \(e_i^{CP}>e_i^{FB}\). The reverse is true if \(\alpha _i<\bar{\alpha }\).

For part (c), set Equations 5 and 6 equal for all i and invoke Condition 1. Rearranging implies:

The left hand side is an implicit function that defines \(\alpha _i\) as a function of all model parameters. The equivalent expression for a different patch, say j, is found by simply replacing \(\alpha _i\) by \(\alpha _j\) in Eq. 17. Thus \(\alpha _i=\alpha _j\; \forall i,j\), which implies that \(\alpha _i=\bar{\alpha }\; \forall i\).

For part d), the Conditions ensure that all patches are symmetric in all aspects except \(\alpha _i\). From Equation 5, residual stock can be written as \(e^{FB}_i(\phi (\alpha _i))\), suppressing the notation for other parameters. If \(e^{FB}_i(\phi (\alpha _i))\) is convex, then by Jensen’s Inequality, the residual stock at the average preference (under CP) is less than the average residual stock when considering the full range of preferences (FB). In order to show that \(e^{FB}_i(\phi (\alpha _i))\) is convex, we first note that from the proof of Corollary 1, \(\phi ^{\prime }(\alpha _i)>0\) and \(\phi ^{\prime \prime }(\alpha _i)<0\). Next, rearrange Equation 5 such that \(f^{\prime }(e^{FB}_i)-\phi (\alpha _i)=0\). The total differential is given by \(f^{\prime \prime }(e_i)de_i-\phi ^{\prime }(\alpha _i)d\alpha _i=0\). Thus, \(de_i=\frac{\phi ^{\prime }(\alpha _i)d\alpha _i}{f^{\prime \prime }(e_i)}\). Taking the total differential again gives \(d^2e_i=-\frac{\phi ^{\prime }(\alpha _i)d\alpha _if'''(e_i)}{\left( f^{\prime \prime }(e_i)\right) ^2} de_i+\frac{\phi ^{\prime \prime }(\alpha _i)d\alpha _i}{f^{\prime \prime }(e_i)}d\alpha _i\). Substituting \(de_i\) from above gives:

and thus \(e^{FB}_i(\phi (\alpha _i))\) is convex, which proves the result. \(\square \)

Appendix 6: Proof of Proposition 3

Proof

We assume that all model parameters, contemporaneous residual stocks, and contemporaneous stocks are common knowledge to all patch owners. Similar to Kaffine and Costello (2011), we consider a dynamic Cournot–Nash model in which owners simultaneously choose residual stocks in period t knowing that this procedure will be repeated every year into the future. Following the classic paper by Levhari and Mirman (1980), we solve for the subgame perfect Nash equilibrium by analytical backward induction on the Bellman equation for each owner i.

We proceed by backward induction for each patch owner. At the end of time the value function is zero: \(V_{iT+1}=0\) for all i. Thus the period T Bellman equation for owner i is simply

whose interior solution is straightforward: \(e^*_{iT}=0\), as \(\alpha _ip_i>(1-\alpha _i)k\). In the final period, each patch owner finds it optimal to harvest his entire stock, regardless of decisions made by other patch owners. Note that the patch-i value function has an analytical solution:

which simplifies analysis in the penultimate period. Employing this result, the period \(T-1\) patch i Bellman equation is:

Taking \(e_{jT-1}\) as given (for \(j \ne i\)), the first order condition for owner i implies

Notice that this best response function for owner i is independent of both other owners’ choices (\(e_{jT-1}\)) and of the state variable (\(\mathbf {x_{T-1}}\)). In other words, period \(T-1\) decisions can be written as a set of pre-determined numbers, \(e^*_{1T-1}\), \(e^*_{2T-1}\), ..., that are independent of decisions made prior to period \(T-1\).

This pattern turns out to hold in all preceding periods, and following Kaffine and Costello (2011) it is the case that the solution in all previous time periods is equal to Eq. 22. Because the optimal choice of \(e_{it}\) is independent of both \(e_{jt}\) (for \(j \ne i\)) and of \(\mathbf {x_t}\), this is both an open loop and a feedback control rule.

What happens if owner l deviates, so \(e_{lt}\) is given by some value \(\tilde{e}_{lt}\) where \(f_l^{\prime }(\tilde{e}_{lt}) \ne \frac{1}{\delta }\left[ \frac{\alpha _lp_l-k(1-\alpha _l)}{\alpha _lp_lD_{ll}}\right] \)? There may be two effects on owner i’s choices. First, it may affect his period t choices. Second, because future stock depends on owner l’s period t choice, it may affect owner i choices in periods \(t+1\), \(t+2\), ...We showed above that \(e_{it}\) was independent of period t choices by all other patch owners, so we can rule out contemporaneous effects on patch owner i. But we also showed that in any period \(t<T\), the optimal choice for owner i was independent of the state \(\mathbf {x_t}\), which is the only conduit through which \(\tilde{e}_{lt}\) affects owner i into the future. Thus, the deviation by owner l has no effect on owner i’s future choices. Thus, under the assumptions of this model: (1) patch owner i’s best response in period t is independent of period t choices by other patch owners and (2) patch owner i’s optimal choice of residual stock in period \(t+1\) is independent of choices made by any owner prior to period t.

With the time and patch independence established, we now return to the Dynamic Programming Equation for patch i under decentralized management:

with first-order condition for patch i of:

By the above, the best response function for any given patch owner is independent of other patch decisions. As such, the first-order conditions can be expressed as:

Rearranging yields the residual stock rule in Proposition 3. \(\square \)

Appendix 7: Proof of Corollary 3

Proof

The proof for part (a) follows from the comparison of Eqs. 5 and 7. Setting \(D_{ij}=0, \forall j \ne i\) in Eq. 5, the right-hand side of Eq. 5 is identical to the right-hand side of Eq. 7, and residual stock in patch i under DM is equivalent to FB. To prove necessity, suppose \(D_{ij}>0\) for some \(j \ne i\). Then the two expressions differ (the numerators are equivalent, but denominators differ).

The proof for part (b) also follows from the comparison of Eqs. 5 and 7. By Corollary 1, \(\frac{d e_i}{d D_{ij}}>0\), and thus DM (equivalent to selecting \(e_i\) as if \(D_{ij}=0\)) leads to strictly less residual stock than FB.

The proof for part (c) follows from the fact that as long as any patch k has \(D_{kl}>0\) for \(k\ne l\), residual stock under DM in that patch will be strictly less than FB, and thus global residual stock under DM will be strictly less than FB. \(\square \)

Appendix 8: Proof of Proposition 4

Proof

The proof for part (a) follows from Corollaries 2c and 3a. The proof for part (b) follows from Corollaries 2a and 3b. \(\square \)

Appendix 9: Proof of Proposition 5

Proof

Define \(\varepsilon _i=\alpha _i-\bar{\alpha }\) as the measure of preference heterogeneity for patch i. For part (a), because aggregate welfare over space and time is a continuous function of continuous functions of \(D_{ij}\), aggregate welfare is continuous in \(D_{ij}\). By Proposition 4, for any level of preference heterogeneity (\(\varepsilon _i>0\) for some i), welfare under DM is equivalent to FB when \(D_{ij}=0, \forall i\ne j\), and both strictly dominate CP. Because \(DM \succ CP\) when \(D_{ij}=0, \forall i\ne j\), then by continuity, within a local neighborhood there exists a strictly positive level of emigration \(D_{ij}>0\) for some \(i\ne j\) where \(DM \succ CP\).

For part (b), because aggregate welfare over space and time is a continuous function of continuous functions of \(\alpha \), total welfare is continuous in \(\alpha \) and thus \(\varepsilon \). By Proposition 4, for any level of emigration \(D_{ij}>0\) for some \(i\ne j\), welfare under CP is equivalent to FB when \(\varepsilon _i=0, \forall i\), and both strictly dominate DM. Because \(CP \succ DM\) when \(\varepsilon _i=0, \forall i\), then by continuity, within a local neighborhood there exists a strictly positive level of preference heterogeneity (\(\varepsilon _i>0\) for some i) where \(CP \succ DM\). \(\square \)

Appendix 10: Proof of Proposition 6

Proof

With the change to the utility function in Eq. 8, the Dynamic Programming Equations under FB, CP, DM are now respectively:

Following the procedure in the proofs to Propositions 1, 2, and 3 yields the optimal residual stock rules in Proposition 6. \(\square \)

Appendix 11: Proof of Corollary 4

Proof

For part (a), compare the residual stock rules for DM and FB in Proposition 6 with the residual stock rules in Propositions 1 and 3. Note that DM does not change her residual stock when adopting global preferences, so \(e^{DM}_i=\hat{e}^{DM}_i\). Examining the numerator of the optimal residual stock for FB reveals that optimal residual stock always increases under global preferences, so \(e^{FB}_i<\hat{e}^{FB}_i\). By Corollary 3b, \(e^{DM}_i<e^{FB}_i\). Putting these statements together yields: \(\hat{e}^{DM}_i=e^{DM}_i<e^{FB}_i<\hat{e}^{FB}_i\), which establishes the result.

For part (b), we proceed with a proof by example. We invoke Condition 1, and assume \(\delta =1\), and \(f_i(e_i)\) is quadratic, so \(f_i^{\prime }(e_i)=A_i-B_ie_i\). We then compare the residual stock rules for CP and FB in Proposition 6 with those in Propositions 1 and 2. Evaluating the residual stock for patch i, these rules become:

Thus, \(e_i=\frac{A_i-\phi _i}{B_i}\) for the \(\phi \)’s defined above. Consider a patch i for which \(\alpha _i<\bar{\alpha }\), which implies that \(e^{CP}_i<e^{FB}_i\) and \(\hat{e}^{CP}_i<\hat{e}^{FB}_i\).Footnote 15 Define \(\Delta _i\) as the difference in the difference in residual stocks under FB and CP under global versus local preferences, such that \(\Delta _i=(\hat{e}^{FB}_i-\hat{e}^{CP}_i)-(e^{FB}_i-e^{CP}_i)\). Both terms in parentheses are positive, so \(\Delta _i>0\) implies the wedge between residual stocks is larger under global preferences, while \(\Delta _i<0\) implies the wedge is smaller under global preferences. After some algebraic simplification,

The denominator is unambiguously positive, so the sign hinges on the numerator. The first term in parenthesis \((\alpha _i-\bar{\alpha })\) is negative given the assumption \(\alpha _i<\bar{\alpha }\). This negative term is multiplied by the second term in parenthesis \(((N-1)(Q-D)+DN\bar{\alpha })\), which can be positive or negative. For example, if \(Q=D\), then this term is positive and \(\Delta _i<0\), while if \(Q=0\) and \(\bar{\alpha }<\frac{N-1}{N}\), then this term is negative and \(\Delta _i>0\). Thus, \(\Delta _i\lessgtr 0\), and central planning residual stock in patch i may be closer or farther from first-best. \(\square \)

Appendix 12: Proof of Proposition 7

Proof

First note that following the preceding proofs, the golden rule for residual stock under an assumed common growth function \(f(e_i)\) for CP is:

For part (a), compare the residual stock rule above with the residual stock rules for FB and DM in Propositions 1 and 3 when \(\alpha _i=\bar{\alpha } \quad \forall i\) and \(D_{ij}=0 \quad \forall i \ne j\). Residual stocks under FB and DM are identical, while residual stock under CP will differ from FB due to the differences between \(f^{\prime }\) and \(f_i^{\prime }\). As such, \(DM \succ CP\). Next, following the proof to Proposition 5 and by continuity, within a local neighborhood there exists a strictly positive level of emigration \(D_{ij}>0\) for some \(i\ne j\) where \(DM \succ CP\).

For part (b), we prove via example in Sect. 5.3. \(\square \)

Rights and permissions

About this article

Cite this article

Costello, C., Kaffine, D. Natural Resource Federalism: Preferences Versus Connectivity for Patchy Resources. Environ Resource Econ 71, 99–126 (2018). https://doi.org/10.1007/s10640-017-0138-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0138-3