Abstract

We analyze the effect of climate policies using a two-region partial equilibrium model of resource extraction. The regions are heterogeneous in various aspects, such as in their climate policies and resource extraction costs. We obtain analytical and numerical conditions for a Green Paradox to occur as a consequence of a unilateral increase in carbon taxation and backstop subsidy. In order to assess the welfare and climate consequences of unilateral policy changes, we calibrate the model to real world parameter values. We find that forming a ‘climate coalition’ and introducing carbon taxation even in the absence of real climate concerns is the best course of action for the largest fossil fuel-using regions.

Similar content being viewed by others

Notes

The IPCC published its first assessment report in 1990.

Of course, \(b^*<b\) is an alternative assumption. For a justification of our choice see Sect. 3.

The parameter values in this section are arbitrary to a large degree. In contrast, in Sect. 3 we will employ calibrated parameter values.

It is important to note that, in our setting, the amount of cumulative emissions is given. Hence, all fossil fuel resources initially in situ are eventually extracted.

A change in climate policies signifies here a reinforcement of already existing policies, or the introduction of climate policies in case climate policies were absent.

Hoel (2011) considers the consequences of a drop in backstop production costs in both regions and finds that total climate costs increase if the differences in the countries’ carbon tax rates are sufficiently small. The same holds in our setting for initially equal carbon taxes.

The weak/strong Green Paradox does not seem to vary with the relative size of the fuel stocks. Thus, with the stock sizes and all other parameters given, we determined the equilibria for different rates of time preference.

The formal derivation can be found in “Carbon Taxation” Appendix.

The sign of \(\frac{d T_2}{d\tau }\) does not only depend on the relative size of the resource stocks, but also on the discount rate. The higher the discount rate, the more probable is \(\frac{dT_2}{d \tau }>0\), all else held equal. Hence, with a stock size \(Y_0^*\) which is relative scarce as compared to \(X_0\) (e.g. \(Y_0^*=3, X_0=4\)), \(\frac{dT_2}{d\tau }>0\) already for intermediate levels of \(\rho \), wheras for relatively abundant \(Y_0^*\) (such as \(Y_0^*=4, X_0=1\)), \(\frac{dT_2}{d\tau }>0\) occurs only for large enough discount rates.

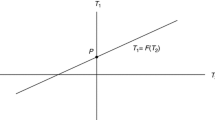

For the ambiguity in the sign of \(\frac{dT_1}{d\tau }\) for non-specified functional forms see also Eq. (40) in the subsection “Carbon Taxation” of Appendix 1. In subsection “Change in \(T_1\) in Response to a Tax Increase” of Appendix 1 we present this ambiguity analytically using linear demand functions, and display a numerical example for \(\frac{dT_1}{d\tau }<0\).

This can be seen already in Eq. (30): if \(T_1\) is to decrease, \((\lambda _y^*-\lambda _x)\) needs to go up as a consequence of the tax increase such that, \((\lambda _y^*-\lambda _x)e^{rT_1}=c_x-c_y>0\) is still satisfied.

Hoel (2011) illustrates this assuming inelastic demand, but his reasoning is valid for cases of various demand elasticities.

The welfare functions are different from the welfare function depicted in (1) as each region accounts only for the climate costs it itself incurs, and its terms of trade.

In the following analysis we abstract from issues of dynamic inconsistency. The policy tools considered here are constant taxes and subsidies. Thus, we implicitly assume that commitment is possible or that a policy path determined at the beginning of the time horizon is enforced at all times.

Note that setting \(G^*=0\) does not imply that the ‘endogenous’ climate policies are also zero in the foreign country. The foreign country might have non-green incentives to pursue climate policies. In this section, however, both the foreign country’s climate concerns and its climate policies are exogenously set to zero to match the setup in the previous sections; only the home country’s policies are endogenized.

This value of the SCC is arbitrary; yet, since we do not compare overall welfare inter-regionally, it does not matter. For intra-regional welfare comparison it is also unimportant as it is just a scaling parameter. In contrast to the numerical exercises of Sects. 2.4 and 2.5, we use a social cost of carbon estimate which corresponds to 30 $ per ton of carbon which is in line with Nordhaus (2008) in the calibration in Sect. 3. The parameters are given in Table 2 in Appendix 2 .

Both, the introduction of a positive tax as compared to \(\tau =0\), and an increase in the carbon tax until the point when \(\tau =12\) entails terms of trade gains for the home country, as can be seen in Fig. 6.

As the foreign region perceives \(G^*=0\), its “total welfare” consists only of non-green welfare.

‘Possible’ or ‘feasible’ tax rates in the numerical exercises in Figs. 5 and 6 are tax rates which correspond to an equilibrium as delineated in Sect. 2.3, where pollution taxes are not too high and renewable cost is not too low, such that in equilibrium there is supply and demand of both fossil fuels.

Despite the fact that the Pigouvian tax already is the ‘optimal tax’ balancing out climate costs and utility losses, optimal endogenous taxes might be lower than the Pigouvian tax rate. The reason is that the Pigouvian tax rate is derived in a Social Planner setting, whereas in the present setting the region maximizes its private welfare containing a terms-of-trade effect which introduces different trade-offs.

Take the initial stocks \(X_0=8\) and \(Y_0^*=2\) as an example: for these endowments, we find that taxes decrease non-green welfare, i.e. the home region with the more abundant resource stock looses from the tax introduction. Green welfare naturally still increases. The resulting optimal tax rate equals \(\tau =2\) and balances out the losses from non-green welfare and green welfare gains and is thus lower than the Pigouvian tax rate amounting to 5 in our example.

As before, we compute overall and the different components of welfare for different subsidy levels and compare the resulting welfare levels.

The functional form of the utility is depicted in Eq. (79) in Appendix 2. A positive change in \(\gamma \) results in higher resource consumption and thus in faster exhaustion of the non-renewable resource. Yet, numerical analyses suggest that the equilibrium properties such as the order of switching, do not change with \(\gamma \), given that an equilibrium with two switching points for both countries exists.

We take an oil density of \(0.85\ \hbox {g}/\hbox {cm}^3\); thus, a barrel (159 l) corresponds to 135 kg of oil. Hence, a barrel contains 118 kg of carbon at the higher end, less for thin and ‘good’ crude oil.

In van der Ploeg (2013) the renewables cost was assumed to be 1.5 times the current market price of fossil fuels.

The backstop price in the climate coalition approximately equals the estimated total system levelized costs of solar thermal and wind offshore energy generation in the U.S. in 2018 (EIA 2013).

A scenario where \(b^*<b\) would not alter the Green Paradox results of the previous section as it has no effect on the first switching point. The welfare analysis, however, would likely be affected. We do not conduct a welfare analysis for the scenario \(b^*<b\) as we focus on the more realistic case of \(b<b^*\) in our calibration, as explicated above.

The costs of 1 ppmv are \(10^{9}*2.13*30 \ {\$}\). Furthermore, we assume \(\psi =\psi ^*=1\).

We calibrate our model’s parameters to the cumulative emissions of the years 2006–2010; thus, we take 2006 as our starting year.

In contrast to the 1,500 ppmv of fossil fuel which are extracted in our calibration, van der Ploeg and Rezai (2013) consider an initial stock of fossil fuel equal to 1,878 ppmv, whereas only 1,178 ppmv are extracted in their no-policy scenario.

BP estimates in its Energy Outlook 2030 that the “World primary energy consumption is projected to grow by 1.6 % p.a. from 2011 to 2030, adding 36 % to global consumption by 2030” (BP 2013).

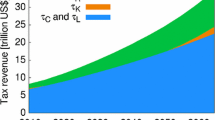

Climate costs are defined as before as \(G+G^{*}\) in Eq. (33) with constant marginal damages \(C^{\prime }=C^{*\prime }=v\).

In the sequel we are not solving for the Nash equilibrium of a climate policy game; this would be beyond the scope of this paper. However, we elucidate incentives that are very likely to be crucial when solving for Nash equilibrium strategies.

Introducing a non-zero carbon tax in the climate coalition is, however, more effective than a tax in the OPEC countries. The decrease in total climate costs naturally is higher for the same tax because the total consumption of fossil fuels in the climate coalition exceeds the total consumption in the OPEC countries multiple times.

We employ a subsidy of \(\sigma =0.3\) which amounts a subsidy of 24.5 % of the original backstop production cost of \(b=1.278\), but neither higher nor lower subsidies have significantly different effects.

References

Archer D (2005) Fate of fossil fuel \(\text{ CO }_2\) in geologic time. J Geophys Res 110(C9):1–6

BP (2013) World Energy Outlook 2030—Booklet. http://www.worldenergyoutlook.org/media/weowebsite/2008-1994/weo2008.pdf

EIA (2013) Levelized cost of new generation resources in the Annual Energy Outlook 2013. http://www.eia.gov/forecasts/aeo/er/pdf/electricity_generation.pdf

Eichner T, Pethig R (2013) Flattening the carbon extraction path in unilateral cost-effective action. J Environ Econ Manag 66(2):185–201

Fischer C, Salant SW (2013) Limits to limiting greenhouse gases: effects of intertemporal leakage, spatial leakage, and negative leakage. Discussion paper

Gerlagh R (2011) Too much oil. CESifo Econ Stud 57(1):79–102

Hoel M (2011) The supply side of CO\(_2\) with Country Heterogeneity*. Scand J Econ 113(4):846–865

IEA (2008) World Energy Outlook 2008. http://www.worldenergyoutlook.org/media/weowebsite/2008-1994/weo2008.pdf

IEA (2011) World Energy Outlook 2011. http://www.iea.org/publications/freepublications/publication/WEO2011_WEB.pdf

Karp L, Siddiqui S, Strand J (2013) Dynamic climate policy with both strategic and non-strategic agents: taxes versus quantities. Policy Research Working Paper Series 6679, The World Bank

Nordhaus W (2008) A question of balance: weighing the options on global warming policies. Yale University Press, New Haven

Oilprice.com (2012) Oil Production in the 21st Century and Peak Oil. http://oilprice.com/Energy/Crude-Oil/Oil-Production-in-the-21st-Century-and-Peak-Oil.html

Rauscher M (1994) On ecological dumping. Oxf Econ Pap 46:822–840

Rezai A, van der Ploeg F, Withagen C (2012) The optimal carbon tax and economic growth: additive versus multiplicative damages. OxCarre Working Papers 093, Oxford Centre for the analysis of resource rich economies, University of Oxford

Sinn H-W (2008) Public policies against global warming: a supply side approach. Int Tax Public Finance 15(4):360–394

Strand J (2013) Strategic climate policy with offsets and incomplete abatement: carbon taxes versus cap-and-trade. J Environ Econ Manag 66(2):202–218

Ulph A (1997) International trade and the environment: a survey of recent economic analysis. In: Folmer H, Tietenberg T (eds) The international yearbook of environmental and resource economics 1997/1998r. Edward Elgar, Gloucester, pp 205–244

van der Ploeg F (2013) Cumulative carbon emissions and the green paradox. OxCarre Working Papers 110, Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford

van der Ploeg F, Withagen C (2013) Global Warming and the Green Paradox. OxCarre Working Papers 116, Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford. Review of Environmental Economics and Policy (forthcoming)

van der Ploeg R, Rezai A (2013) Abandoning fossil fuel: how fast and how much? OxCarre Research Paper 12, Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford

van der Werf E, Di Maria C (2012) Imperfect environmental policy and polluting emissions: the green paradox and beyond. Int Rev Environ Resour Econ 6:153–194

Wirl F (2012) Global warming: prices versus quantities from a strategic point of view. J Environ Econ Manag 64(2):217–229

Acknowledgments

We gratefully acknowledge financial support from FP7-IDEAS-ERC Grant No. 269788.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Analysis

1.1 Carbon Taxation

In order to obtain analytical results, we make some simplifying assumptions. In particular, we work with a demand function \(D(p_i)\), satisfying \( U^\prime (D(p_i))=p_i\), \(i=y,x\), with \(p_i\) being the consumer price of the resource or the substitute. Note that the demand functions \(D_i\) and \(D_i^*\) , \(i=x,y\) can vary between the two regions. We also suppose that \(r=\rho \), i.e. the world market interest rate equals the rate of time preference as in Sect. 2.3.

With the possibility of different taxes \(\tau _y, \tau _x, \tau _y^*\) and \( \tau _x^*\) the first-best equilibrium is characterized by six equations, comprising two stock conditions and four transition equations.

Equations (35) and (36) are equivalent; one of them can be thus dropped. Following Hoel (2011), we differentiate the equation system (34) to (39) which gives:

where

and

and:

Adjusting this general framework to our baseline case of no taxes and no subsidy in the foreign country (\(\tau _{x}^{*}=\tau _{y}^{*}=\sigma ^*=0) \), a uniform tax in the home country (\(\tau _{x}=\tau _{y}=\tau >0)\) and a positive subsidy (\(\sigma >0)\) we get

We have then 5 equations and 5 unknowns (\(\lambda _{y}^{*},\lambda _{x}\), \(T_{1},T_{2}^{*},T_{2}).\) They all depend on the tax \(\tau \). From these Eqs. (42) to (46) we derive the direction of change of our Green Paradox variables of interest.

The effect of an increased tax \(\tau \) on the resource rents is:

where:

and abbreviating \(D_y(\lambda ^*_y e^{rT_1}+ c^*_y+ \tau )\) with \(D_y\), \( D_y^*(\lambda ^*_y e^{rT_1^*}+c_y^*+\tau ^*)\) with \(D_y^*\), \(D_x(\lambda _x e^{rT_2}+c_x+ \tau )\) with \(D_x\) and \(D_x(\lambda _x e^{rT_x^*}+ c_x+\tau ^*)\) with \(D_x^*\).

Thus, both \(\frac{d\lambda ^*_y}{d\tau }<0\) and \(\frac{d\lambda _x}{d\tau }<0\).

The effect of an increase in \(\tau \) on the first switching point \(T_1\) equals:

where:

Whereas the denominator is unambigously negative, the nominator is also negative but for the first and second terms \(\left( -B_x+\frac{D_x}{ r\lambda _x e^{rT_2}}\right) >0\). Thus, in order to have \(\frac{dT_1}{d \tau }<0\) , it needs to hold that:

The effect of an increase in \(\tau \) on the second switching point of the home region is:

with

Whereas the denominator is unambigously positive, the sign of the nominator depends on the parameter values.

For \(\frac{dT_2}{d\tau }>0\) it must hold that:

The effect of an increase in \(\tau \) on the second switching point of the foreign region is:

with:

This expression is unambigously positive.

1.2 Proofs for Propositions 1 and 2

Proof of Proposition 1

The home country increases its subsidy \(\sigma \). Suppose then that the scarcity rent of the low cost resource would increase, i.e. \(\frac{d\lambda _y^*}{d \sigma }>0\). Then the first switching point \(T_1\) occurs later and the low resource cost extraction period is prolonged because demand decreases in the intervall \([0, T_1)\). It holds that \((\lambda _y^*-\lambda _x)e^{rT_1}=c_x-c_y^*+\tau \). Hence, if \(T_1\) increases and \(\lambda _y\) increases, then also \(\lambda _x\) must increase. As a consequence, both \(T_2\) and \(T_2^*\) have to decrease, since at the transition to the backstop it has to hold that:

Yet, this is impossible since then there is not enough demand for the high cost resource. Hence, both \(T_1\) and \(\lambda _y^*\) have to decrease. Moreover \((\lambda _y^*-\lambda _x)\) has to increase, hence, also \(\lambda _x\) decreases. From (54) we know that \(T_2^*\) has to increase then. The increased demand for the high cost resource from the part of the foreign region is matched by less demand in the home region. The home region’s non-renewable resource usage period is shortened and \(T_2\) goes down. \(\square \)

Proof of Proposition 2

The home country increases its tax \(\tau \). Suppose then that the scarcity rent \(\lambda _x\) of the high cost resource increases. Then both \(T_2^*\) and \(T_2\) would fall as the backstop becomes competitive earlier.

It holds that \((\lambda _y^*-\lambda _x)e^{rT_1}=c_x-c_y^*+\tau \). If \(\lambda _y^*\) would decrease then \(T_1\) goes up. An increase in \(T_1\) while \(T_2^*\) and \(T_2\) decrease is impossible because there is not enough demand for the expensive resource.

An increase in \(\lambda _y^*\) can have two effects: the term \((\lambda _y^*-\lambda _x)\) can decrease or increase if the increase in \(\lambda _y^*\) is larger than the rise in \(\lambda _x\). In the latter case \(T_1\) increases; yet, this is not possible for the reasons described above. In the former case \(T_1\) needs to decrease. Due to the shorter low cost resource usage period and the higher price there is not enough demand for the low cost resource. An equilibrium is hence impossible.

If \(\lambda _x\) now decreases in response to a rise in \(\tau \), \(T_2^*\) has to increase due to (54). Also \(\lambda _y^*\) needs to decrease, otherwise there was not enough demand for the low cost resource (due to a drop in \(T_1\)).

For an equilibrium to exist, both scarcity rents have to decrease in response to a tax increase. However, \(T_1\) can increase or decrease: in case the high cost resource rent decreases more than the low cost rent, i.e. \(\frac{d\lambda _x}{d\tau }>\frac{d\lambda _y^*}{d\tau }\), \(T_1\) goes down. \(\square \)

1.3 Change in \(T_1\) in Response to a Tax Increase

1.3.1 Analytical Example with Linear Demand

In this appendix we demonstrate the ambiguity of the sign in the change of the date of exhaustion of the cheap resource following an increase in the tax rate. To that end we assume linear demand, identical across the two countries:

with \(\alpha >b^*>b\). In an equilibrium we must have that:

Let us, for the sake of notation, define:

Then, inserting the linear demand functions into Eqs. (58) and (59) and solving the integrals, (55) to (59) boil down to:

For a given \(\tau \), the unknowns in this system of three equations are \(v,w\) and \(z\).

Next, we compare the outcome under a no-tax regime with a tax regime where the home country never uses its own (expensive) resource. For \(\tau =0\) we find \(\tilde{v}\) and \(\tilde{w}\) from (61) and (62) by inserting \(\tau =0\). Then \(\tilde{z}\) follows from (60) upon insertion of \(\tilde{v}\).

In the second regime we impose \(\hat{v}=0\). Then \(\hat{w}\) follows from (61), with \(v=\hat{v}=0\). The corresponding tax \(\hat{\tau }\) follows from (62). Finally, \(\hat{z}\) is found from (60) with \(\hat{\tau }\) and \(\hat{v}=0\) inserted. We now need to compare \(\tilde{z}\) and \(\hat{z}\). In the zero tax regime we have, using (62):

In the tax regime we have, using (62):

Evidently, it holds that:

It also holds that:

because \(\hat{\tau }>0\) and \(\hat{w}>\tilde{w}\). Moreover, \(\hat{\tau }, \hat{w}\) and \(\tilde{w}\) are determined by (61) and (62) and do not depend on \(Y_0\). Note also that \(1-e^{-z}\) is increasing in \(z\). Hence, \(\hat{z}<\tilde{z}\) is only possible for small \(Y_0^*\), which results in small \(z\) and hence makes \((1-e^{-{z}})\) small and the right hand side of (63) and (64) less important.

For high \(Y_0\) is must be the case that \(\hat{z}>\tilde{z}\). Hence, for high \(Y_0\), \(T_1\) increases with a higher tax. However, for low \(Y_0\) the effect may be reversed, due to (64).

The intuition is straightforward: The high cost producers are faced with an immense drop in demand as the home country basically ceases to demand the expensive resource due to \(\hat{\tau }\). They have to adjust their scarcity resource more than the low cost resource producers who still face demand from both regions, even though the home region’s demand is reduced. Hence, \(\frac{d\lambda _x}{d\tau }>\frac{d\lambda _y^*}{d\tau }\) and the switching point \(T_1\) occurs earlier.

1.3.2 Numerical Example with Linear Demand

We illustrate the analytical possibility of a weak Green Paradox as a consequence of a tax increase by a numerical example. For the linear demand case presented in the previous For the linear case presented in the previous subsection Analytical Example with Linear Demand in Appendix 1, we use the parameter values displayed in Table 1.

For the first scenario of the subsection Analytical Example with Linear Demand in Appendix 1, when \(\tau =0\), the resulting switching points amount to \(T_1=0.01126\), \(T_2=269.68938\) and \(T_2^*=470.40049\) (i.e. \(\tilde{w}=0.470389\), \(\tilde{v}=0.269678\) and \(\tilde{z}=0.00001126\) ).

Setting \(v=0\) results in a positive \(\hat{\tau }=16.19972\). Whereas the foreign region switches now much later, namely at \(T_2^*=647.11838\), the first switching point occurs much earlier at \(T_1=0.004894\) (i.e. \(\hat{w}=0.647113486\) and \(\hat{z}=0.000004894\)).

A Green Paradox is likely to occur if \(Y_0^*\) is low and \(X_0\) relatively high. Furthermore, the world interest rate has to be relatively low, since it lowers \(z\) and hence the importance of the term \((1-e^{-z})\) of Eqs. (63) and (64). Also the parameters of the linear demand function play a role: a Green Paradox is likely to occur if \(\alpha \) is relatively small, but \(\beta \) relatively large. Extraction costs, as long as they are not equal to zero, do not seem to play a major role: for \(c_y^*=0.5\) and \(c_x=1\), the switching points do not change much, only \(\hat{\tau }\) decreases significantly.

1.3.3 Climate Damage and Social Cost of Carbon

We define \(h(t)=\psi (x_c+x_c^*)+\psi ^*(y_c+y_c^*)\). The total damage from atmospheric \(\hbox {CO}_2\) in both regions and constant marginal damages \(\nu \) equals:

We need to solve for the last term in Eq. (69):

Bringing the right term of Eq. (73) on the left of Eq. (71), we solve for \(\int _0^\infty e^{-\rho s}S_2(s) ds\):

Inserting this into (69), total damages equal:

Disregarding the given initial carbon stock in the atmosphere, the first two terms of Eq. (77) disappear. Tables 2 and 3 summarize the parameter values used in the numerical exercises and the calibration exercise respectively.

Appendix 2: Numerical Analysis and Calibration

We assume the home (foreign) region’s utility function to be of a standard CRRA form:

where \(A (A^*)\) is a scaling parameter. From the first order condition we know that the home (foreign) region’s demand equals (with \(i=y,x\)) (Table 2):

As noted above, we use logarithmic utility in most of the numerical exercises and set \(\gamma =\gamma ^*=1\). Yet, the calibration requires us to use the flexibilities provided by the functional forms we assumed. Table 3 summarizes the parameter values used.

Rights and permissions

About this article

Cite this article

Ryszka, K., Withagen, C. Unilateral Climate Policies: Incentives and Effects. Environ Resource Econ 63, 471–504 (2016). https://doi.org/10.1007/s10640-014-9867-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9867-8