Abstract

We compare auctioning and grandfathering as allocation mechanisms of emission permits when there is a secondary market with market power and firms have private information on their own abatement technologies. Based on real-life cases such as the EU ETS, we consider a multi-unit, multi-bid uniform auction. At the auction, each firm anticipates its role in the secondary market, either as a leader or a follower. This role affects each firms’ valuation of the permits (which are not common across firms) as well as their bidding strategies and it precludes the auction from generating a cost-effective allocation of permits, as it occurs in simpler auction models. Auctioning tends to be more cost-effective than grandfathering when the firms’ abatement cost functions are sufficiently different from one another, especially if the follower has lower abatement costs than the leader and the dispersion of the marginal costs is large enough.

Similar content being viewed by others

Notes

This is in sharp contrast with the first trading period (2005–2007) in which a 5 % limit was set on the amount of allowances that could be auctioned. Moreover, only four countries used auctions at all and only Denmark used up the 5 % limit. The situation in the second trading period (2008–2012) was not very different, with no more than 4 % of all the allowances being auctioned.

See http://ec.europa.eu/clima/policies/ets/cap/auctioning/faq_en.htm, section “Why are allowances being auctioned?”.

For the sake of clarity, we will commonly refer to the secondary market (where firms can trade permits among themselves) to differentiate it from the initial allocation (by auctioning or grandfathering), which can be seen as a primary market. This might be a slight abuse of terminology since only auctioning (not grandfathering) can be considered as a market.

An overview of this literature can be found in Montero (2009).

That is, for example, what Antelo and Bru (2009) conclude in a complete-information model.

Still, it may be argued that information incompleteness is not always equally severe. For example, the environmental authorities in the EU ETS are probably nowadays better informed than they were when the system was set up. Nevertheless, it is unlikely that, even nowadays, the authorities are perfectly informed and also that all the participants are perfectly informed about other companies’ costs and needs for permits.

More precisely, bidders can submit multiple quantity-price pairs; in short, a demand function.

Roughgarden and Talgam-Cohen (2013) use the term “private value” as opposed to “common value” to refer to a situation in which the valuation of the auctioned good is not common across bidders. However, they only consider multi-unit single-bid auctions (each bidder only bids for one unit). An additional complexity in our case is that the firms bid for more than one unit and the marginal valuation of each unit is different.

Examples of multi-unit multi-bid non-common value auctions are presented in Castro and Riascos (2009) and Engelbrecht-Wiggans and Kahn (1998). These papers do not address efficiency and do not justify the value of the units on sale on the basis of a post-auction market as we do. Nyborg and Strebulaev (2001) present a model to analyze ECB money markets, considering both an auction and some secondary market. However, their model is fundamentally different to ours, apart from the application, because the auctioneer participates in the secondary market with selling and buying prices which are ex-ante announced.

For ease of exposition, we consider only two firms. While including more than one leader would imply a qualitative complication, the model would be essentially the same with a competitive fringe of ex-ante identical following firms, instead of a single follower, since the leader is only concerned about the aggregate behaviour of the followers.

For the sake of simplicity, we do not consider output production. One could easily construct a qualitatively equivalent model in which emissions are linked to output production and output is sold in a competitive market at an exogenously given price. On the other hand, we take the leader–follower behavior in the permit market as given, without questioning the reason behind it. One could conjecture that it might reflect a leader–follower behavior in the output market, but we intentionally avoid this discussion to focus on the permit market.

An alternative way to introduce heterogeneity would be to make the slope firm-specific instead. The insight we get is similar, but the calculations become much more cumbersome when \(\beta \) is not constant. For our purposes, the fact that the fixed cost is also firm-specific is inocuous as this part does not play any relevant role in the comparisons we make in the paper.

Following standard auction theory (see e.g. Krishna 2002), the auction will be modelled as a Bayesian game of incomplete information. The pair of types, \((\alpha _{F},\alpha _{L})\), are the fundamental random variables of the model (“types”). With a slight abuse of notation, we denote indistinctly a random variable and an arbitrary realization of it.

In the case of auctioning, one could also conjecture that the bids contribute to revealing the firms’ types.

As an alternative interpretation, we could also understand \( TC _{i}\) as production cost and \( TC _{i}\left( e_{i}\right) - TC _{i}\left( e_{i}^{ BAU }\right) \) as abatement cost. Then, \( TC _{i}\left( e_{i}^{ BAU }\right) \) would represent the production cost if firm \(i\) would not abate at all.

Note that \(h\left( \delta ,\varvec{\alpha }\right) \) is proportional to the difference between \( TC \) and \(\Theta \). From (14) we can interpret \( \Theta \) as the total cost associated with a situation in which the follower receives no permits (\(q_{F0}=0\)), which we can take as a comparison benchmark. Thus, a positive (negative) value of \(h\) means that the realized cost is higher (lower) than that in the benchmark situation.

An alternative common format is the discriminatory auction, in which every awarded unit pays its bid. See, e.g., Chapter 12 in Krishna (2002) for a detailed explanation.

As a plausible rationale, the leader’s ability to set the price in the secondary market could be absent (or, at least, weaker) in the auction; first, because the auctioneer has the duty to guarantee that all the participants in the auction are treated evenly while there is no such guarantee in the secondary market, and second, because the anonymity of the bidders in the auction make it more difficult to emit effective price signals.

From the value function, it is particularly easy to notice that we are not faced with a common-value auction. A common-value auction would require \( v_{i}\left( q_{i0},p_{0}\right) =f\left( \varvec{\alpha }\right) q_{i0}\), where \(f\left( \varvec{\alpha }\right) \) is an arbitrary function of the types that is common for both bidders, i.e., the marginal valuation of permits should be constant across units and across players. Using the definition of \(v_{i}\left( q_{i0},p_{0}\right) \) and inspecting (12) and (13), it is obvious that this is not the case in our model.

As the coefficient of \(\alpha _{F}\) in (21) is higher (in absolute value) than that of \(E\{\alpha _{L}\mid \alpha _{F}\}\), the follower tends to react mostly driven by the first effect, whereas it is the other way around for the leader.

The main technical difficulty arises from the fact, under type-3 equilibrium, that there is rationing and therefore the permits are distributed according to the relative demand of both players, which is a ratio involving non-independent stochastic variables in both the numerator and the denominator.

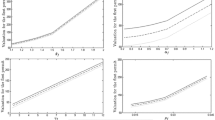

Although \(\bar{Q}\) is not properly a parameter, we treat it as such seeing as it is taken as exogenously fixed. In terms of cost, only the product \( \beta \bar{Q}\) turns out to be relevant, rather than \(\beta \) and \(\bar{Q}\) separately.

The number of realizations is chosen to have a sample that is relatively dense in the support of types. We have experimented with different sample sizes and the results remain basically unchanged.

Alternatively, using (9) it can be obtained as \( TC =-\left( \pi _{L}+\pi _{F}\right) \), by noting that \( q_{F0}\,+\,q_{L0}=q_{F1}\,+\,q_{L1}=\bar{Q}\).

There is a slight abuse of notation in what follows seeing as we are computing density rather than a probability.

Details are available upon request.

Formally, we can consider the linear programming problem of choosing \( (r_{F},r_{L})\) to minimize the coefficient of \(\sigma \) in (45) subject to \(0\le r_{L}\le r_{F}\le 1\), which can be solved by simply evaluating the objective functions at the corners of the feasible set.

This statement is justified using a linear programming problem analogous to the one outlined in the proof of the previous proposition.

References

Alvarez F, Mazón C (2012) Multi-unit auctions with private information: an indivisible unit continuous price model. Econ Theory 51:35–70

Antelo M, Bru L (2009) Permits markets, market power, and the trade-off between efficiency and revenue raising. Resource and Energy Economics 31:320–333

Burtraw D, Goeree J, Holt CA, Myers E, Palmer K, Shobe W (2009) Collusion in auctions for emission permits: an experimental analysis. Journal of Policy Analysis and Management 28:672–691

de Castro LI, Riascos A (2009) Characterization of bidding behavior in multi-unit auctions. Journal of Mathematical Economics 45:559–575

Ellerman AD, Convery FJ, de Perthuis C (2010) Pricing carbon: the European emissions trading scheme. Cambridge University Press, Cambridge

Engelbrecht-Wiggans R, Kahn CM (1998) Multi-unit pay-your-bid auctions with variable awards. Games Econ Behav 23:25–42

Godby R (1999) Market power in emission permit double auctions. In: Isaac RM, Holt C (eds) Research in experimental economics (Emissions permit trading), vol 7. JAI Press, Greenwich, CT, pp 121–162

Godby R (2000) Market power and emission trading: theory and laboratory results. Pac Econ Rev 5:349–364

Hahn RW (1984) Market power and transferable property rights. Q J Econ 99(4):753–765

Hepburn C, Grubb M, Neuhoff K, Matthes F, Tse M (2006) Auctioning of EU ETS phase II allowances: How and why? Clim Policy 6:137–160

Hinterman B (2011) Market power, permit allocation and efficiency in emission permit markets. Environ Resour Econ 49:327–349

Ehrhart KM, Hoppe EC, Löschel R (2008) Abuse of EU emissions trading for tacit collusion. Environ Resour Econ 41:347–361

Krishna V (2002) Auction theory. Academic Press, San Diego, USA

Ledyard JO, Szakaly-Moore K (1994) Designing organizations for trading pollution rights. J Econ Behav Organ 25:167–196

Macho-Stadler I (2008) Environmental regulation: choice of instruments under imperfect compliance. Span Econ Rev 10:1–21

Malik A (1990) Markets for pollution control when firms are noncompliant. J Environ Econ Manag 18:97–106

Montero JP (2009) Market power in pollution permit markets. Energy J 30(special issue 2):115–142

Montgomery WD (1972) Markets in licences and efficient pollution control programs. J Econ Theory 5(3):395–418

Muller RA, Mestelman S, Spraggon J, Godby R (2002) Can Double auctions control monopoly and monopsony power in emissions trading markets? J Environ Econ Manag 44:70–92

Nyborg KG, Strebulaev IA (2001) Collateral and short squeezing of liquidity in fixed rate tenders. J Int Money Financ 20:769–792

Roughgarden T, Talgam-Cohen I (2013) Optimal and near-optimal mechanism design with interdependent values. Conference on Electronic Commerce, EC’ 13, Philadelphia, PA, USA, June 16–20,2013, pp 767–784. doi:10.1145/2482540.2482606

Stranlund J, Dhanda KK (1999) Endogenous monitoring and enforcement of a transferable emissions permit system. J Environ Econ Manage 38:267–282

Sturn B (2008) Market power in emissions trading markets ruled by a multiple unit double auction: further experimental evidence. Environ Resour Econ 40:467–487

Wang JJD, Zender JF (2002) Auctioning divisible goods. Econ Theory 19:673–705

Wilson R (1979) Auctions of shares. Q J Econ 93:675–698

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has greatly benefited from comments and fruitful discussion with Michael Finus as well as the useful suggestions from Carmen Arguedas and two anonymous referees. We also thank the organizers and participants at the VIII Conference of the Spanish Association for Energy Economics (AEEE), Valencia 2013 and the 5th World Congress of Environmental and Resource Economists, Istanbul 2014. Francisco J. André acknowledges financial support from the research Projects ECO2012-39553-C04-01 (Spanish Ministry of Science and European Regional Development Fund, ERDF), SEJ 04992 and SEJ-6882 (Andalusian Regional Government).

Appendices

Appendix 1: Notations

Fundamentals | |

\(\bar{Q}\) | Total amount of permits to be shared, exogenous |

\(i,j\in \left\{ F,L\right\} \) | Firms: \(F\) and \(L\) denote follower and leader, respectively |

\( MC _{i}\left( e\right) =\alpha _{i}-\beta e\) | Marginal abatement cost of firm \(i\), where \(e\) is the emission level |

\(\alpha _{i}\), \(\varvec{\alpha }=\left( \alpha _{F},\alpha _{L}\right) \) | Firms’ types, random. The support of \(\varvec{\alpha }\) belongs to \(\Omega := \left[ \theta ,\theta +\sigma \right] ^{2}\) |

\(D\) | Diagonal of \(\Omega \), i.e., \(D:=\left\{ \left( \alpha , \alpha \right) \in \Omega \right\} \) |

\(\kappa :=\frac{\beta \bar{Q}}{\sigma }\) | Ratio market size to across-firm heterogeneity |

\(E\{\alpha _{i}\mid \alpha _{j}\}=\mu _{j}+\lambda _{j}\alpha _{j}\) | Expectation of \(\alpha _{i}\) conditional on \(\alpha _{j}\), assumed linear with coeffs. \(\mu _{j},\lambda _{j}\) |

\(e_{i}^{ BAU }\), \(e_{i}^{CE}\) | Business as usual and cost-effective emissions of \(i\), respectively |

\(\xi ,\Theta ,\Theta _{L},\Theta _{F}\) | Auxiliary coefficients |

Secondary market | |

\(q_{i1},\) \(p_{1}\) | Post-market holdings of permits for firm \(i\) and market price, respectively |

\(\Pi _{i}\left( q_{i1},p_{1},\varvec{\alpha }\right) \) | Realized profit of firm \(i\) |

\(\pi _{i}\left( q_{i0},\varvec{\alpha }\right) :=\Pi _{i}\left( q_{i1}^{*},p_{1}^{*},\varvec{\alpha }\right) \) | Realized profit of firm \(i\) (under eq. in the secondary market) (the asterisk denotes equilibrium value) |

\(v_{i}\left( q_{i0},\alpha _{i}\right) \) | Value function for firm \(i\) (valuation of initially getting \(q_{i0}\) permits) |

Primary market (auctioning or grandfathering) | |

\(q_{i0}\) | Initial allocation of permits for firm \(i\) (under grand. or auctioning) |

\(p_{0}\) | Price of permits at the auction |

\(\delta :=\frac{q_{F0}}{\bar{Q}}\) | \(F^{\prime }\)s share of permits (\( \delta ^{A}\), \(\delta ^{G}\) under auctioning or grandf., respectively) |

\(h\left( \delta ,\varvec{\alpha }\right) \) | Monotone transformation of total abatement cost (incorporates secondary-market behavior) |

\(q_{i}^{b}\left( \alpha _{i},p_{0}\right) \) | Firm \(i\)’s bid (mapping from support of \(\alpha _{i}\) to set of demand funct.) |

\(\Omega _{l},\) \(l=1,2,3\) | Set of types’ values such that type-\(l\) equilibrium occurs |

\(\left( p_{L},p_{Fu},p_{Fd}\right) \) | Auxiliary variables to define equilibrium strategies at the auction |

Appendix 2: Proofs

1.1 Proof of Proposition 1

Let us initially assume that the solution is interior (which we check below). The optimal behavior of the follower is derived by maximizing (9) for \(i=F\) while taking \(p_{1}\) as given. From the first-order condition (FOC), we get the follower’s net demand for permits:

where \(d\) stands for “demand”. The leader’s problem is to maximize (9) for \(i=L\) including the market clearance condition, \( q_{L1}+q_{F1}=\bar{Q}\), and the follower’s demand, (23), as constraints. The (interior) solution to this problem is given by (10). Using the market clearing condition and (23), we get the equilibrium price in the secondary market,

and using (24) in (23) we obtain the equilibrium number of permits for the follower, given by (11). Using (10), (11) and (24) in the expressions for \(F\)’s and \(L\)’s profits and rearranging, we get (12) and (13), where \(\Theta _{L}\) and \(\Theta _{F}\) include the terms that do not depend on the initial allocation.

To show that the solution satisfies \(q_{i1}\in [0,\min \{\bar{Q} ,e_{i}^{ BAU }\}]\) w.p.1, note first that, by construction, \(0\le q_{F1}\le \bar{Q}\) ensures \(0\le q_{L1}\le \bar{Q}\) and using (23) we have that \(0\le q_{F1}\le \bar{Q}\iff \alpha _{F}\ge p_{1}\ge \alpha _{F}-\beta \bar{Q}\), which, using (24), can be written as \(\frac{\alpha _{F}-\alpha _{L}}{\beta } +2\bar{Q}\ge q_{L0}\ge \frac{(\alpha _{F}-\alpha _{L})}{\beta }-\bar{Q}\). As \(q_{L0}\in [0,\bar{Q}]\), the previous inequalities are ensured for any initial allocation iff \(\frac{\alpha _{F}-\alpha _{L}}{\beta }+2\bar{Q} \ge \bar{Q}\) and\(\ 0\ge \frac{(\alpha _{F}-\alpha _{L})}{\beta }-\bar{Q}\) hold at the same time. The intersection of these inequalities is: \(\bar{Q} \ge \frac{1}{\beta }|\alpha _{L}-\alpha _{F}|\), which is guaranteed if

as the maximum value of \(|\alpha _{L}-\alpha _{F}|\) is \(\sigma \).

Firm \(i\) makes a strictly positive abatement effort iff \(q_{i1}\le e_{i}^{ BAU }=\frac{\alpha _{i}}{\beta }\). If we particularize this inequality for \(i=F\), using (23), we have \(p_{1}\ge 0\) , which, using (24), can be written as \(\alpha _{L}+2\alpha _{F}\ge \beta (2\bar{Q}-q_{L0})\). As \(q_{L0}\in [0,\bar{Q}]\) and the minimum value for each type is \(\theta \), the latter equality is guaranteed under (4). For \(i=L\), using (10), \(q_{L1}\le \frac{\alpha _{L}}{\beta }\) can be written as

The most adverse values for the fulfilment of (26) are \(\alpha _{L}=\alpha _{F}=\theta \), \(q_{L0}= \bar{Q}\). To ensure that (26) holds w.p.1, we plug these values to conclude \(\theta \ge \frac{2}{3}\beta \bar{Q}\). Combining this inequality with (25), we get (4), which holds by assumption.

1.2 Proof of Corollary 1

Total cost can be computed by inserting (10) and (11) in (1).Footnote 26 Substituting \(q_{L0}\) by \(\bar{Q} -q_{F0}\) and rearranging, we get (14), where \(\Theta \) includes the terms that do not depend on the initial allocation.

1.3 Proof of Proposition 2

Using (13), \(v_{F}\left( q_{F0},\alpha _{F}\right) \) can be written as

As \(v_{F}\) is strictly concave in \(q_{F0}\) for every \(\alpha _{F}\), an interior solution to \(F\)’s problem (if it exists) follows easily from the first-order condition, which can be solved to get

where, for simplicity of exposition, we have denoted as \(\tau _{F}\left( q_{F0},\alpha _{F}\right) \), the right-hand side of the previous equality. Since the submitted demand must lie in \([0,\bar{Q}]\), and given the concavity of \(v_{F}\) on \(q_{F0}\), we conclude that \(q_{F}^{b}=0\) and \( q_{F}^{b}=\bar{Q}\) whenever \(\tau _{F}\left( p_{0},\alpha _{F}\right) \le 0\) and \(\tau _{F}\left( p_{0},\alpha _{F}\right) \ge \bar{Q}\), respectively. Note also that \(\tau _{F}\left( p_{0},\alpha _{F}\right) \) is strictly decreasing in \(p_{0}\) for every \(\alpha _{F}\), hence \(p_{Fu}\) and \(p_{Fd}\) are defined by \(\tau _{F}(p_{Fu},\alpha _{F})=0\) and \(\tau _{F}(p_{Fd},\alpha _{F})=\bar{Q}\), respectively. Thus, we have

Let us now consider \(L\)’s problem, which is \(max_{q_{L0}}\{v_{L}\left( q_{L0},\alpha _{L}\right) -p_{0}q_{L0}\}\) where

Clearly \(v_{L}\left( q_{L0},\alpha _{L}\right) \) is strictly convex in \( q_{L0}\) for every \(\alpha _{L}\), and therefore the leader’s problem only has corner solutions, i.e., \(q_{L}^{b}\in \{0,\bar{Q}\}\) with \(q_{L}^{b}=\bar{Q} \iff v_{L}\left( \bar{Q},\alpha _{L}\right) \ge v_{L}\left( 0,\alpha _{L}\right) \). Given that \(v_{L}\left( 0,\alpha _{L}\right) =E\left\{ \Theta _{L}\mid \alpha _{L}\right\} \), \(L\) chooses \(q_{L0}=\bar{Q}\) whenever \( v_{L}\left( \bar{Q},\alpha _{L}\right) \ge E\left\{ \Theta _{L}\mid \alpha _{L}\right\} +p_{0}\bar{Q}\) holds. Let us denote as \(p_{L}\) the maximum value of \(p_{0}\) such that this inequality holds, i.e., \(p_{L}=\frac{ v_{L}\left( \bar{Q},\alpha _{L}\right) -E\left\{ \Theta _{L}\mid \alpha _{L}\right\} }{\bar{Q}}\). Using the expression for \(v_{L}\) we have that

1.4 Proof of Proposition 3

Given that the support of \(\alpha _{L}\) and \(\alpha _{F}\) is \(\left[ \theta ,\theta +\sigma \right] \), from (29) we know \(p_{L}>\theta -\frac{1}{2 }\beta \bar{Q}>0\), where the latter inequality follows from (4). Thus, there exists at least one positive price (\(p_{L}\)) at which the demanded quantity is not smaller than supply, which guarantees the existence of an equilibrium in the auction. Uniqueness follows from the fact that each firm’s demand is non-increasing in \(p_{0}\) for every possible pair \(\left( \alpha _{F},\alpha _{L}\right) \). Seeing as \(p_{Fu}>p_{Fd}\) and \(p_{L}>0\) hold w.p.1, there are just three possible cases.

-

First case: \(p_{L}<p_{Fd}\). In this case, the stop-out price cannot be \(p_{0}>p_{Fd}\) because there would be excess supply (i.e., some units would not be awarded). As all the permits would be awarded for any \(p_{0}\le p_{Fd}\), the opt-out price must be \(p_{Fd}\). At this price, \(F\) bids \(\bar{Q} \), \(L\) bids zero and hence \(F\) gets all the permits and \(L\) gets nothing. This corresponds to type-1 equilibrium.

-

Second case: \(p_{Fu}<p_{L}\). In this case, for any \(p_{0}>p_{L}\) there would be excess supply and all the permits would be awarded for any \( p_{0}\le p_{L}\). Therefore, the opt-out price must be \(p_{L}\). At this price, \(L\) bids \(\bar{Q}\) and \(F\) bids zero. Thus, \(L\) gets all the permits, which corresponds to type-2 equilibrium.

-

The third case is \(p_{Fd}\le p_{L}\le p_{Fu}\), which corresponds to type-3 equilibrium, in which permits are shared between \(F\) and \(L\). The equilibrium price is \(p_{L}\), at which \(F\) and \(L\) demand \(\tau _{F}(p_{L},\alpha _{F})\in \left[ 0,\bar{Q}\right] \) and \(\bar{Q}\), respectively, and rationing is required. Using (28) and (29), straightforward algebra leads to \(p_{L}<p_{Fd}\iff \xi <-1\), \( p_{Fu}<p_{L}\iff \xi >1\) and \(p_{Fd}\le p_{L}\le p_{Fu}\iff -1\le \xi \le 1\).

1.5 Proof of Proposition 4

We split the proof into the following parts:

Part i)

Under independent types, using (5), (6), (21) and the definition of \(\kappa \), the conditions given in Proposition 3 for type-1 and type-2 equilibria collapse to

For any pair in \(D\), (30) and (31) become, respectively

none of which, under (4), holds for any admissible values of \( \kappa \) and \(a\). Thus, we only have type-3 equilibria in \(D\), which proves the first statement in the proposition.

Parts ii) and iii)

The results in these parts straightforwardly follow from the fact that conditions (30) and (31) define two convex sets, that \(\left( \alpha _{F},\alpha _{L}\right) =\left( \theta +\sigma ,\theta \right) \), is the most favorable pair to satisfy (30) and that \(\left( \alpha _{F},\alpha _{L}\right) =\left( \theta ,\theta +\sigma \right) \), is the most favorable pair to satisfy (31).

Part iv)

To compute the probabilities of type-1 and type-2 equilibria, notice first that the pair \(\left( \alpha _{F},\alpha _{L}\right) =\left( \theta +\sigma ,\theta \right) \), which is the most favorable pair to satisfy (30), satisfies it if and only if \(\kappa <2\) holds. Similarly, the pair \(\varvec{\alpha }=\left( \theta ,\theta +\sigma \right) \) , which is the most favorable pair to satisfy (31), satisfies it if and only if \(\kappa <2\) holds. Contrarily, if \(\kappa \ge 2\) holds, (30) and (31) never hold and hence \(\Pr (\Omega _{1})=\Pr (\Omega _{2})=0\).

Let us now consider the \(\kappa <2\) case. Under the uniform distribution assumption, the probability of type-\(i\) equilibria is proportional to the area of \(\Omega _{i}\) (for \(i=1,2\)).

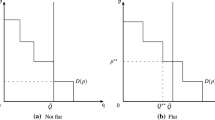

Regarding \(\Omega _{1}\), as shown in Fig. 2, this area is a triangle in the bottom right corner of \(\Omega \). To compute the size of this triangle, we first compute the infimum value for \(\alpha _{F}\) in \(\Omega _{1}\), which can be obtained by taking \(\alpha _{L}=\theta \) in (30) and solving for \(\alpha _{F}\) to obtain

Similarly, the supremum value for \(\alpha _{L}\) in \(\Omega _{1}\) is obtained by taking \(\alpha _{F}=\theta +\sigma \) in (30) and solving to obtain

Using these values, we can obtain the area of \(\Omega _{1}\):

and bearing in mind that the size of the square \(\Omega \) is equal to \( \sigma ^{2}\), the probability of type-1 equilibrium is \(\Pr (\Omega _{1})= \frac{1}{\sigma ^{2}}A(\Omega _{1})\).

Regarding \(\Omega _{2}\), as shown in Fig. 2, this region is a triangle in the top left corner of \(\Omega \). Proceeding as above, from (30) we can compute the infimum value of \(\alpha _{L}\) and the supremum value of \(\alpha _{F}\) within \(\Omega _{2}\):

Using the relevant expressions, it is straightforward to check that \(\theta +\sigma -\alpha _{F}^{Inf}=\alpha _{F}^{Sup}-\theta \) and \(\alpha _{L}^{Sup}-\theta =\theta +\sigma -\alpha _{L}^{Inf}\), i.e., \(\Omega _{2}\) is simply a \(180 {{}^o} \)-rotation of \(\Omega _{1}\) and, therefore, both areas are identical, which, jointly with the uniform distribution assumption, implies \(\Pr (\Omega _{1})=\Pr (\Omega _{2})\).

Part v)

Notice that, if both types are independent, under grandfathering we always have

Let us first consider type-1 equilibria. In this case we know that the follower gets all the permits and, therefore, \(\delta ^{A}=1\). Using \(\kappa \sigma =\beta \bar{Q}\) and the values of \(\delta ^{G}\) and \(\delta ^{A}\) in (15), we have that

and direct comparison reveals that

Therefore, to determine the relative expected costs we need to compute \( E\left\{ \alpha _{L}-\alpha _{F}\mid \Omega _{1}\right\} \). The first step is to obtain the conditional distributions of \(\alpha _{F}\mid \Omega _{1}\) and \(\alpha _{L}\mid \Omega _{1}\). As regards \(\alpha _{F}\mid \Omega _{1}\), note that the relevant support is the interval \([\alpha _{F}^{Inf},\theta +\sigma ]\). For any arbitrary value of \(\alpha _{F}\) in that interval, say \( \alpha \), according to (30) we know that \(\alpha _{L}\) ranges (within \(\Omega _{1}\)) from \(\theta \) to \(\hat{\alpha }_{L}(\alpha ):= \frac{7\alpha -4\theta }{3}-\frac{\left( 4+5\kappa \right) \sigma }{6}\). Thus, the joint probability of the events “\(\alpha _{F}=\alpha \)” and “type-1 equilibrium occurring” isFootnote 27

We now apply Bayes’ rule to obtain the conditional density

where \(k_{0}^{F}=\left( 3A(\Omega _{1})\right) ^{-1}\). The corresponding conditional expectation is

which, after some straight-forward algebra, results in

We proceed analogously with \(\alpha _{L}\mid \Omega _{1}\). Its support is \( [\theta ,\alpha _{L}^{Sup}]\). For any arbitrary \(\alpha \) in that interval, from (30) we conclude that \(\alpha _{F}\) ranges (within \(\Omega _{1}\)) from \(\hat{\alpha }_{F}(\alpha ):=\frac{3}{7}\alpha + \frac{4}{7}\theta +\frac{1}{7}\left( 2+\frac{5}{2}\kappa \right) \sigma \) to \(\theta +\sigma \).

The joint probability of the events “\(\alpha _{L}=\alpha \)” and “type-1 equilibrium occurring” is

and using Bayes’ rule,

where \(k_{0}^{L}=3\left( 7\sigma ^{2}\Pr (\Omega _{1})\right) ^{-1}\). The corresponding conditional expectation is

Using (33) and (34), we have that

and using (35) in (32) we conclude

where the latter inequality is trivially true if \(\Omega _{1}\) is nonempty (which requires \(\kappa <2\)).

Under type-2 equilibrium, we know that the leader obtains all the permits and, therefore, \(\delta ^{A}=0\). Using this value and \(\delta ^{G}=\frac{1}{2 }\) in (15), we have that

and comparing both expressions,

To compute \(E\{\alpha _{L}-\alpha _{F}\mid \Omega _{2}\}\), we can proceed as we did for equilibrium one (obtaining the conditional distributions and then computing the conditional expectations of \(\alpha _{L}\) and \(\alpha _{F}\) ). However, it is possible to exploit the rotational symmetry property between areas \(\Omega _{1}\) and \(\Omega _{2}\) (see part iii) above) to show Footnote 28

and using this value in (36), we conclude that

and the last inequality is trivially true because \(\kappa \) is positive by construction.

1.6 Proof of Corollary 2

Our strategy to prove the corollary is to show that, provided that \(\kappa \ge 2\) holds, for any arbitrary realization \(\varvec{\alpha }:=(\alpha _{F},\alpha _{L})\), we have \(\delta ^{A}<\delta ^{CE}=\frac{\alpha _{F}\,-\,\alpha _{L}\,+\,\beta \bar{Q}}{2\beta \bar{Q}}\), where the last equality comes directly from (3).

Under type-3 equilibrium, the auction allocation is given by \(\delta ^{A}:= \frac{\tau _{F}\left( q_{F0},\alpha _{F}\right) }{\tau _{F}\left( q_{F0},\alpha _{F}\right) \,+\,\overline{Q}}\), where \(\tau _{F}\left( q_{F0},\alpha _{F}\right) \) is defined in (27). Using this expression for \(\delta ^{A}\), we have that

We now evaluate \(\tau _{F}\left( q_{F0},\alpha _{F}\right) \) in the equilibrium price \(p_{0}^{*}\), which, under type-3 equilibrium is equal to \(p_{L}\), where \(p_{L}\) is given by (29). Using the expression for \( \delta ^{CE}\) together with (5) and, using (6), (37) can be written as

Notice that we can write \(\alpha _{i}=\theta +r_{i}\sigma \) for \(i\in \{F,L\} \), where \(r_{i}\) is uniformly distributed in \([0,1]\), and there is a one-to-one mapping between \(\alpha _{i}\) and \(r_{i}\). Additionally, we use the definition of \(\kappa \) to write \(\beta \overline{Q}=\kappa \sigma \). Making these substitutions in the latter inequality, we get rid of \(\theta \) and \(\sigma \) to obtain

To check that this inequality holds for any pair \((\alpha _{F},\alpha _{L})\) or, equivalently, for any pair \((r_{F},r_{L})\), we distinguish between two cases. Let us first consider first \(r_{F}\ge r_{L}\). Notice that \( 7r_{F}-3r_{L}-2\le 3(r_{F}-r_{L})+2\) and that

where we have used \(\kappa \ge 2\). Thus, a sufficient condition for (38) to hold is

If \(r_{F}\ge r_{L}\), the left-hand side of (39) is positive and we can divide both sides by \(3(r_{F}-r_{L})+2\) and rearrange to get \(\frac{3}{2}\kappa >r_{L}-r_{F}\), which trivially holds when \(\kappa \ge 2\) and \(r_{F}\ge r_{L}\).

Let us now consider \(r_{F}<r_{L}\). Notice that the right-hand side in (38) increases with \(\kappa \), so it suffices to prove the inequality for \(\kappa =2\). Introducing this value of \(\kappa \) and rearranging, we have that

A sufficient condition for (40) to hold is that both of the following inequalities hold:

given that, if both (41) and (42) hold, (40) follows from the sum of them both. Clearly, (41) holds as \(r_{F}\), \(r_{L}\in [0,1]\). To prove ( 42), we define \(s:=\frac{r_{F}}{r_{L}}\), where \(s\in [0,1]\) and rewrite (42) as \( (-7s^{2}-3+10s)r_{L}^{2}-6<0\). For any \(r_{L}\), the expression inside the parenthesis attains its maximum at \(s=5/7\). For this value of \(s\), the latter inequality becomes \(\frac{4}{7}r_{L}^{2}-6<0\), which clearly holds true for any \(r_{L}\in [0,1]\).

1.7 Proof of Proposition 5

As shown in Proposition 3, the condition for type-1 and type-2 equilibria to arise are, respectively, \(\xi <-1\) and \(\xi >1\). Using (21), (5), (7) and the definition of \(\xi \) we obtain, respectively:

As for type-1 equilibria, particularizing (43) in the diagonal, we have \(5\kappa \le 4a-6\), which clearly does not hold for any admissible value of \(a\). In addition, the most favorable pair of realizations for type-1 equilibrium is \(\alpha _{F}=\theta +\sigma \) and \( \alpha _{L}=\theta \), under which the condition \(\xi <-1\) becomes \(\kappa <2\). Thus, there is a positive probability of obtaining type-1 equilibrium if and only if this latter inequality holds and, if it holds, the pair \(\left( \alpha _{F}=\theta +\sigma \text {, }\alpha _{L}=\theta \right) \) leads to type-1 equilibrium. This proves part (i), whereas part (ii) follows from the convexity of the half-space defined by (43) whenever it is nonempty.

Notice that any pair \(\varvec{\alpha }\) can be written as \(\left( \theta +r_{F}\sigma ,\theta +r_{L}\sigma \right) \), with \(r_{F}\), \(r_{L}\in \left[ 0,1\right] \). Moreover, as \(\alpha _{L}\le \alpha _{F}\), we must have \( r_{L}\le r_{F}\). Using this notation, (44) becomes

To identify the feasible value of \(\varvec{\alpha }\) that is more favorable for type-2 equilibrium, we minimize the left-hand side of (45) subject to \(0\le r_{L}\le r_{F}\le 1\) Footnote 29 and obtain \((r_{F},r_{L})=(0,0)\), or, equivalently, \( \varvec{\alpha }=(\theta ,\theta )\). Under this value, (45) becomes \(\kappa \le \frac{6}{5}\). This proves (iii), whereas part (iv) follows from the convexity of the half-space defined by (44) whenever it is nonempty. To prove part (v) it suffices to note that, under (4), at \(\varvec{\alpha }=(\theta +\sigma ,\theta +\sigma )\) we have \(\xi =\frac{2\sigma }{5\beta \bar{Q}}\), which belongs to \(\left( -1,1\right) \) under (4) and, by continuity, this is true for some non-empty interval around \(\left( \theta +\sigma ,\theta +\sigma \right) \).

1.8 Proof of Proposition 6

In case 3, using (5) and (8) we conclude that the condition for type-1 and type-2 equilibria to occur are given by

Consider (46). We use the same notation as in the proof of proposition 5 to write any pair \(\varvec{\alpha }\) as \((\theta +r_{L}\sigma ,\theta +r_{F}\sigma )\) with \(0\le r_{F}\le r_{L}\le 1\). Using this notation, (46) becomes

For (46), the most favorable feasible value is \( (r_{F},r_{L})=(1,1)\),Footnote 30 or, equivalently, \(\varvec{\alpha }=(\theta +\sigma ,\theta +\sigma )\). Under this value, (48) becomes \(\ \kappa \le \frac{6}{ 5}\). This proves (i), whereas part (ii) follows from the convexity of the half-space defined by (46) whenever it is nonempty. Now consider (47). Using the previous notation, it can be written as

Notice that any \(\varvec{\alpha }\) in \(D\) is characterized by \(r_{F}=r_{L}=r\) with \(r\in [0,1]\), and (49) fails to hold for any of these values. In addition, the most favorable value of the pair \( (r_{F},r_{L})\) for (49) within \(0\le r_{F}\le r_{L}\le 1\) is \((r_{F},r_{L})=(0,1)\) or, equivalently, \(\varvec{\alpha } =(\theta ,\theta +\sigma )\), under which (49) becomes \(\kappa <2\). This proves (iii), whereas part (iv) follows from the convexity of the half-space defined by (47) whenever it is nonempty. To prove part (v) it suffices to note that, at \(\varvec{\alpha }=(\theta ,\theta )\), we have \(\xi =\frac{2\sigma }{5\beta \bar{Q}}\), which belongs to \(\left( -1,1\right) \) under (4) and, by continuity, this is true for some non-empty interval around \(\left( \theta ,\theta \right) \).

Rights and permissions

About this article

Cite this article

Álvarez, F., André, F.J. Auctioning Versus Grandfathering in Cap-and-Trade Systems with Market Power and Incomplete Information. Environ Resource Econ 62, 873–906 (2015). https://doi.org/10.1007/s10640-014-9839-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9839-z