Abstract

This paper considers an entry-deterrence game in which environmental policy is set without perfectly observing the incumbent firm’s costs. We investigate if regulators, who can have an informational advantage relative to the potential entrant, support entry-deterring practices. The paper demonstrates that, while entry-deterring equilibria only emerge under restrictive conditions when the regulator is perfectly informed, these equilibria arise under larger settings as he becomes uninformed. Furthermore, we show that the regulator is willing to support the incumbent’s entry-deterring practices regardless of his degree of information if entry costs are sufficiently high. However, when entry costs are lower, the regulator only sustains this type of practices if he is poorly informed.

Similar content being viewed by others

Notes

See, for instance, Weitzman (1974), Roberts and Spence (1976), Farrell (1987), Segerson (1988), Xepapadeas (1991), Stavins (1996), and Lewis (1996). In addition, Thomas (1995) empirically analyzes the regulation of industrial wastewater pollution in France when the local regulatory agency has imperfect information.

The entry-deterring role of environmental regulation could explain the lack of entry in the HFCs industry. When the Montreal Protocol sequentially limited the use of CFCs, DuPont was one of the few firms producing substitutes (e.g., HFCs), which helped this firm continue to be a controlling force in the market of refrigerants; as reported in Maxwell and Briscoe (1997). While HFCs were not included in the Montreal Protocol, which regulated ozone depleters, they are regulated by the Kyoto Protocol. In addition, Norway introduced taxes on HFCs since 2003 (and increased them in subsequent years), and other European countries and the U.S. also regulate the use of this refrigerant; see Naess and Smith (2009) and Greenpeace Report (2009). DuPont’s leading position in this market can be rationalized on their superior technology. However, our results suggest that, even in the absence of cost differentials among firms, the setting of stringent environmental regulation could explain DuPont’s market power in this industry.

In addition, Milgrom and Roberts (1986) study an entry-deterrence model in which a firm uses two signals, price and advertising, to convey the quality of its product to consumers. They show that firm’s separating effort shrinks because of the presence of an additional signal. We also examine how two different signals (emission fees and output level) convey information to the potential entrant. However, signals originate from two different informed agents in our model: the regulator and the incumbent. Schultz (1999) also analyzes a setting where a potential entrant observes two signals, stemming from two firms competing in a duopoly market which might have different incentives regarding entry.

Denicolò (2008) examines environmental policy in a context in which an uninformed regulator observes whether a firm acquires a superior technology, in order to signal its cost of regulatory compliance to the government, or an inferior technology. However, two firms are always active in his model, thus neither allowing for firms to practice entry deterrence nor for the regulator to facilitate or hinder these practices. In addition, Denicolò (2008) does not allow for the regulator to sustain different degrees of information.

Using this inverse demand function provides relatively compact equilibrium results, facilitates their interpretation, and their comparison across complete and incomplete information settings. Nonetheless, for generality “Appendix 1” extends our model to an inverse demand function \(p(q)=a-bq\), showing that our qualitative results are essentially unaffected.

This assumption can be rationalized by the fact that entrants lack experience in the industry; or alternatively, they still ignore some of the administrative details of complying with the environmental regulation.

Intuitively, if \(d\le 1/2\), the market failure from the insufficient production under monopoly is more significant than that from pollution, ultimately leading the regulator to set a subsidy, rather than a tax, in order to induce an increase in output levels.

In the equilibrium of the complete information game, entry only occurs if the incumbent’s costs are high, and thus the regulator sets a duopoly fee \(t_{2}^{H,E}\) in the second period upon entry. However, if the incumbent’s costs are low and, by mistake, the potential entrant joins the industry (off-the-equilibrium path), the regulator still needs to set a duopoly fee \(t_{2}^{L,E}\). As shown in Espinola-Arredondo and Munoz-Garcia (2013), such a fee is \(t_{2}^{L,E}=\frac{(1+2d)(1-c_{inc}^{H})-(2-2d)(1-c_{inc}^{L})}{2(1+2d)}\). Importantly, both of these fees are positive as long as firms’ costs are not extremelly asymmetric, i.e., \(c_{inc}^{L}<c_{inc}^{H}<\frac{1+2dc_{inc}^{L}}{1+2d}\equiv \alpha \), a condition we consider throughout the paper.

Note that in the extreme cases in which \(p=0\) or \(p=1\), both the regulator and the entrant are fully informed about the incumbent’s type, and thus their priors coincide, making the value of parameter \(\beta \) inconsequential.

Note that \(RIC\equiv \frac{\int _{0}^{1}\left( p^{\beta }-p\right) dp}{1/2}=\frac{2}{1+\beta }-1\), which originates at \(1\) when \(\beta =0\), and decreases in \(\beta \), ultimately reaching \(-1\) when \(\beta \rightarrow +\infty \).

For more details about the calculation of this deadweight loss, see the proof of Proposition 1.

In addition, output decision \(q^{A}(t_{1})\) implies the smallest deviation from the low-cost incumbent’s action under a complete information setting, i.e., it is the least-costly separating equilibrium that survives the Cho and Kreps’ (1983) Intuitive Criterion, as shown in the proof of Proposition 1.

These two results, whereby the regulator perfectly observes the incumbent’s type, hence embody those in Espinola-Arredondo and Munoz-Garcia (2013) as special cases.

Unlike standard signaling games in which the agent sending a particular message is perfectly informed, the regulator, when being as uninformed about the incumbent’s costs as the potential entrant, is unable to condition emission fees on the incumbent’s type.

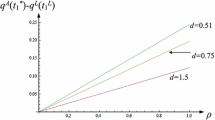

The figure assumes no discounting, production costs \(c_{inc}^{H}=9/20\) and \(c_{inc}^{L}=1/4\), and environmental damage \(d=3/4\). Other parameter combinations yield similar results, and can be provided by the authors upon request.

A similar result applies if one follows the notion of “unprejudiced beliefs” by Schultz (1999), whereby the entrant’s beliefs would be compatible with the strategy of the non-deviating player, the regulator. Thus, the entrant would assign full probability to the incumbent’s costs being low, deterring it from the industry. While these beliefs would eliminate the low-cost incumbent’s need to separate from its complete-information strategy in order to prevent entry, it would not affect the high-cost firm’s strategy. Furthermore, note that when both regulator and incumbent select pooling strategies, as the following section analyzes, the use of unprejudiced beliefs (or the consistent beliefs discussed above) do not restrict the entrant’s beliefs. In such a setting, we apply Cho and Kreps’ (1983) Intuitive Criterion to limit the set of pooling equilibria with sensible beliefs.

For consistency, the figure also considers parameter values \(c_{inc}^{H}=9/20 \), \(c_{inc}^{L}=1/4\) and \(p=1/2\). These are admissible parameter conditions in the pooling equilibrium. In particular, cutoff \(\alpha _{2}\) increases in \(\beta \) but decreases in \(d\), thus reaching its minimum, \(0.46\), at \(\beta =0\) and \(d=1\), which still satisfies \(c_{inc}^{H}=9/20<\alpha _{2}\).

When priors are sufficiently high, the regulator anticipates that the separating PBE ensues and, as shown in Fig. 3, he prefers to be perfectly informed. In this context, he can induce socially optimal output levels, thus hindering the emergence of inefficiencies.

Note that this result is different from that in the paper, whereby firms’ symmetry leads the regulator to induce duopolists to produce the same output level \(q_{SO}^{K}\) as a monopolist would, ultimately generating the same welfare level with and without entry.

The inefficiencies of setting an entry-deterring emission fee can be evaluated by the elasticity of the monopolist’s output function to a marginal increase in emission fees above the socially optimal level. In particular, under convex costs this elasticity is \(\varepsilon _{q^{K}(t_{1}),t_{1}}=\frac{1-2d}{2\left( 1+c_{inc}^{K}\right) }\), whereas under linear costs it only is \(\varepsilon _{q^{K}(t_{1}),t_{1}}=\frac{1}{2}-d\). For more details, see “Appendix 2”.

References

Bagwell K, Ramey G (1991) Oligopoly limit pricing. RAND J Econ 22:155–172

Buchanan JM (1969) External diseconomies, corrective taxes and market structure. Am Econ Rev 59:174–177

Cho I, Kreps D (1983) Signaling games and stable equilibrium. Quart J Econ 102:179–222

Denicolò V (2008) A signaling model of environmental overcompliance. J Econ Behav Organ 68:293–303

Espinola-Arredondo A, Munoz-Garcia F (2013) When does environmental regulation facilitate entry-deterring practices? J Environ Econ Manag 65(1):133–152

Espinola-Arredondo A, Munoz-Garcia F, Bayham J (2014) The entry-deterring effects of inflexible regulation. Can J Econ 47(1):298–324

Farrell J (1987) Information and the Coase theorem. J Econ Perspect 1(2):113–129

Greenpeace Report (2009) HFCs: a growing threat to the climate Report 58801, December.

Harrington JE Jr (1986) Limit pricing when the potential entrant is uncertain of its cost function. Econometrica 54:429–437

Harrington JE Jr (1987) Oligopolistic entry deterrence under incomplete information. RAND J Econ 18(2):211–231

Lewis TR (1996) Protecting the environment when costs and benefits are privately known. RAND J Econ 27:819–847

Maxwell J, Briscoe F (1997) There’s money in the air: the CFC Ban and DuPont’s regulatory strategy. Bus Strateg Environ 6:276–286

Milgrom P, Roberts J (1982) Predation, reputation, and entry deterrence. J Econ Theory 27:280–312

Milgrom P, Roberts J (1986) Price and advertising signals of product quality. J Polit Econ 94:796–821

Naess E, Smith T (2009) Environmentally related taxes in Norway Statistics Norway/Division for Environmental Statistics. Report 2009/5

Ridley David B (2008) Herding versus hotelling: market entry with costly information. J Econ Manag Strateg 17(3):607–631

Roberts MJ, Spence M (1976) Effluent charges and licenses under uncertainty. J Public Econ 5:193–208

Schoonbeek L, Vries FP (2009) Environmental taxes and industry monopolization. J Regul Econ 36:94–106

Schultz C (1999) Limit pricing when incumbents have conflicting interests. Int J Ind Organ 17:801–825

Segerson K (1988) Uncertainty and incentives for nonpoint pollution control. J Environ Econ Manag 15:87–98

Stavins RN (1996) Correlated uncertainty and policy instrument choice. J Environ Econ Manag 30(2):218–232

Thomas A (1995) Regulating pollution under asymmetric information: the case of industrial wastewater treatment. J Environ Econ Manag 28(3):357–373

Weitzman M (1974) Prices vs. quantities. Rev Econ Stud 41:477–491

Xepapadeas AP (1991) Environmental policy under imperfect information: incentives and moral hazard. J Environ Econ Manag 20:113–126

Author information

Authors and Affiliations

Corresponding author

Additional information

We greatly appreciate the suggestions of the editor, Hassan Benchekroun, and three reviewers. We also thank the insightful comments of Derek Kellenberg, Matthew Taylor, and the seminar participants at the University of Montana.

Appendix

Appendix

1.1 Appendix 1: General Linear Demand Function

Let us separately analyze the complete information setting, and afterwards the separating and pooling equilibria in the incomplete information environment.

Complete information. First period. In this period, the incumbent monopolist maximizes \((a-bq)q-c_{inc}^{K}q-t_{1}q\), and thus produces according to an output function \(q^{K}(t_{1})=\frac{a-\left( c_{inc}^{K}+t_{1}\right) }{2b}\). This output function increases in the vertical intercept of the inverse demand function, \(a\), and as the demand function becomes steeper (larger values of \(b\), graphically implying an inward pivoting effect on the demand function). The regulator’s maximizes the social welfare function

which yields a socially optimal output \(q_{SO}^{K}=\frac{a-c_{inc}^{K}}{2d+b} \), which is decreasing in the environmental damage of pollution, \(d\), and on the incumbent’s cost parameter, \(c_{inc}^{K}\). Anticipating the production described in output function \(q^{K}(t_{1})=\frac{a-\left( c_{inc}^{K}+t_{1}\right) }{2b}\), the regulator sets a first-period emission fee, \(t_{1}^{K}\), that solves \(\frac{a-\left( c_{inc}^{K}+t_{1}\right) }{2b}=\frac{a-c_{inc}^{K}}{2d+b}\), i.e., \(t_{1}^{K}=(2d-b)\frac{a-c_{inc}^{K}}{2d+b}=(2d-b)q_{SO}^{K}\), which is strictly positive as long as pollution is relatively damaging, i.e., \(d>b/2\). Intuitively, note that as demand becomes flatter (low values of \(b\)), condition \(d>b/2\) holds for most values of \(d\), while if the demand is relatively steeper, such a condition is more difficult to satisfy. In this case, the market failure arising from the monopolist’s market power becomes large and the regulator would have incentives to subsidize the monopolist’s production in order to increase output for most values of \(d\). However, the regulator would set emission fees if the environmental damage from pollution imposes a more severe welfare loss than the monopolist’s market power, i.e., \(d>b/2\).

Second period. In the second period, entry only occurs when the incumbent’s costs are high. In this setting, incumbent and entrant simultaneously and independently maximize profits, thus selecting output function \(x_{j}^{H}(t_{2})=\frac{a-\left( c_{j}^{H}+t_{2}\right) }{3b}\) for every firm \(j=\{inc,ent\}\) and emission fee \(t_{2}\). Anticipating such output functions, the regulator sets \(t_{2}\) in order to induce a socially optimal aggregate production, \(X_{SO}^{H}\), which coincides with \(q_{SO}^{H}=\frac{a-c_{inc}^{H}}{2d+b}\), i.e., fee \(t_{2}^{H,E}\) solves

In particular, \(t_{2}^{H,E}=\frac{\left( 4d-1\right) \left( a-c_{inc}^{H}\right) }{2(2d+b)}\), which can also be represented as \(t_{2}^{H,E}=\left( 4d-1\right) \frac{X_{SO}^{H}}{2}\). This fee induces every firm to produce half of the socially optimal output, i.e., \(x_{j}^{H}(t_{2}^{H,E})=\frac{X_{SO}^{H}}{2}\). (If the incumbent’s costs are low, then entry does not ensue, and the incumbent maintains its monopoly power producing according to output function \(x_{inc}^{L}(t_{2})=\frac{a-\left( c_{inc}^{L}+t_{2}\right) }{2b}\). In this setting, the regulator sets a second-period emission fee that coincides with the first-period fee under monopoly, i.e., \(t_{2}^{L,NE}=t_{1}^{L}\).)

Incomplete information-I. Separating equilibrium. As described in the proof of Proposition 1, the low-cost incumbent chooses an output level output function \(q^{A}(t_{1})\) that solves the incentive compatibility condition 6, thus yielding \(q^{A}(t_{1})=\frac{\left( a-c_{inc}^{H}\right) \left[ (2d+b)-b\sqrt{3\delta }\right] }{2b}-\frac{t_{1}(2d+b)}{2b}\).

Given output function \(q^{A}(t_{1})\), we can replicate the regulator’s problem about selecting emission fee \(t_{1}^{*}\) under incomplete information about the incumbent’s costs (minimizing inefficiencies, as described in problem 5) which yields a relatively intractable expression for fee \(t_{1}^{*}\). Nonetheless, for the parameters considered in the paper, its expression becomes

This emission fee behaves as the analogous fee under linear production costs (and depicted in Fig. 2 of the paper): it increases in parameter \(\beta \), and shifts upwards as the regulator becomes more certain about the incumbent’s costs being low (i.e., as his prior \(p\) decreases). Figure 5 depicts emission fee \(t_{1}^{*}\), and emphasizes the similarities with the setting in which the demand function is \(p(q)=1-q\). However, relative to such a setting, fee \(t_{1}^{*}\) becomes more stringent as the demand function is more elastic. In particular, when parameter \(b\) decreases, the indirect demand function becomes flatter (for a given intercept \(a\)), thus increasing the monopolist’s incentives to produce larger output levels. In order to curb such additional pollution, the regulator responds setting a more stringent fee \(t_{1}^{*}\); as depicted in Fig. 5 with the upward shift in the emission fee from the case in which \(b=1\) to that in which \(b=1/8\).

Incomplete information-II. Pooling equilibrium. As described in Proposition 2, in the pooling equilibrium of the game the regulator sets on the high-cost incumbent the fee corresponding to the low-cost firm, \(t_{1}^{L}\), and the high-cost firm responds mimicking the output level of the low-cost firm, \(q^{L}\left( t_{1}^{L}\right) \), which ultimately conceals its type from the potential entrant and thus deters entry. The welfare benefit from deterring entry, namely, the savings in entry costs \(F\), coincide in the model where the inverse demand function is \(p(q)=1-q\) and that in which \(p(q)=a-bq\). Hence, only the welfare cost from deterring entry, i.e., the inefficiencies arising from setting fee \(t_{1}^{L} \), differ across models. We can therefore analyze the regulator’s incentives to set a higher-than-optimal fee on the high-cost incumbent (higher than the fee \(t_{1}^{H}\) that would induce this firm to produce the socially optimal amount, i.e., \(q^{H}\left( t_{1}^{H}\right) =q^{H,SO}\)) by evaluating the incumbent’s output reduction, i.e., its deviation from socially optimal production levels. Specifically, we can measure this inefficiency by using the elasticity of the monopolist’s output function to a marginal increase in emission fees above the socially optimal level \(q^{H,SO}=q^{H}\left( t_{1}^{H}\right) \), i.e.,

In particular, under inverse demand function \(p(q)=a-bq\), this elasticity becomes \(\varepsilon _{q^{H}(t_{1}),t_{1}}=\frac{1}{2}-\frac{d}{b}\), whereas under \(p(q)=1-q\) it is \(\varepsilon _{q^{K}(t_{1}),t_{1}}=\frac{1}{2}-d\). Comparing these expressions, we can observe that, for demand functions steeper than \(1-q\), i.e., \(b<1\), the monopolist responds more strongly to a given increase in taxes when facing demand function \(a-bq\) than \(1-q\). That is, cutoff \(\overline{F}(\beta )\) experiences an upward shift, thus shrinking the entry-deterring region \(F>\overline{F}(\beta )\). As a consequence, the regulator becomes less willing to facilitate the incumbent’s entry-deterring practices. However, when the demand function is flatter than \(1-q\), i.e., \(b>1\), the monopolist responds by reducing its output to a lesser degree when facing demand function \(a-bq\). In this case, cutoff \(\overline{F}(\beta )\) shifts downwards, thus expanding the region for which the regulator supports the incumbent’s entry-deterring behavior, i.e., \(F>\overline{F}(\beta )\).

1.2 Appendix 2: Convex Production Costs

We next examine how our equilibrium results would be affected by the consideration of convex, rather than linear, production costs, i.e., every firm \(j\)’s costs become \(c_{j}^{K}\cdot q^{2}\) where \(c_{j}^{H}>c_{j}^{L}>0\) and \(j=\{inc,ent\}\). Let us separately analyze the complete information setting, and afterwards the separating and pooling equilibria in the incomplete information environment.

Complete information. First period. In this period, the incumbent monopolist maximizes \((1-q)q-c_{inc}^{K}q^{2}-t_{1}q\), and thus produces according to an output function \(q^{K}(t_{1})=\frac{1-t_{1}}{2(1+c_{inc}^{K})}\) Comparing this output function with that under linear costs, \(\frac{1-(c_{inc}^{K}+t_{1})}{2}\), we find the difference

which is positive for all parameter values. In particular, marginal costs are lower when the firm faces convex than linear costs, i.e., \(2c_{inc}^{K}q<c_{inc}^{K}\) holds for all output levels satisfying \(q<\frac{1}{2}\). Since, in addition, the profit maximizing output under both convex and linear costs satisfy \(\frac{1}{2}>\frac{1-t_{1}}{2(1+c_{inc}^{K})}>\frac{1-(c_{inc}^{K}+t_{1})}{2}\), then we can conclude that, for every emission fee \(t_{1}\), the incumbent captures a larger profit from each of the inframarginal units produced under convex costs, and thus has incentives to produce a larger output when its costs are convex than when they are linear.

The regulator’s maximizes the social welfare function

which yields a socially optimal output \(q_{SO}^{K}=\frac{1}{1+2d+2c_{inc}^{K}}\), which is decreasing in the environmental damage of pollution, \(d\), and on the incumbent’s cost parameter, \(c_{inc}^{K}\). Anticipating the (relatively large) production described in output function \(q^{K}(t_{1})=\frac{1-t_{1}}{2\left( 1+c_{inc}^{K}\right) }\), the regulator sets a first-period emission fee, \(t_{1}^{K}\), that solves \(\frac{1-t_{1}}{2\left( 1+c_{inc}^{K}\right) }=\frac{1}{1+2d+2c_{inc}^{K}}\), i.e., \(t_{1}^{K}=\frac{2d-1}{1+2d+2c_{inc}^{K}}=(2d-1)q_{SO}^{K}\), which is strictly positive given the initial assumption \(d>1/2\). Comparing this emission fee with that under linear costs, \((2d-1)\frac{1-c_{inc}^{K}}{1+2d}\), we observe that the difference

is positive since \(d>1/2\) by definition. Intuitively, the regulator anticipates a larger output (and pollution) if the monopolist is left unregulated in the convex costs context and, as a consequence, sets a more stringent fee than when costs are linear in output.

Second period. In the second period, entry only occurs when the incumbent’s costs are high. In this setting, incumbent and entrant simultaneously and independently maximize profits, thus selecting output function \(x_{j}^{H}(t_{2})=\frac{1-t_{2}}{3+2c_{j}^{H}}\) for every firm \(j=\{inc,ent\}\) and emission fee \(t_{2}\). Similarly as in the first period, output functions yield a larger production level under convex than linear costs, for all emission fee \(t_{2}\) since the difference \(\frac{1-t_{2}}{3+2c_{inc}^{H}}-\frac{1-\left( c_{inc}^{H}+t_{2}\right) }{3}=\frac{c_{inc}^{H}\left( 1+2c_{inc}^{H}+2t_{2}\right) }{9+6c_{inc}^{H}}\) is positive under all parameters.

Anticipating such output functions, the regulator sets \(t_{2}\) in order to induce a socially optimal aggregate production, \(X_{SO}^{H}\), which coincides with \(q_{SO}^{H}=\frac{1}{1+2d+2c_{inc}^{H}}\), i.e., fee \(t_{2}^{H,E}\) solves

In particular, \(t_{2}^{H,E}=\frac{4d-1+2c_{inc}^{H}}{4d+2+4c_{inc}^{H}}\), thus inducing every firm to produce half of the socially optimal output, \(x_{j}^{H}(t_{2}^{H,E})=\frac{X_{SO}^{H}}{2}\). Alike under monopoly, in the case of duopoly the regulator also needs to set a more stringent emission fee when firms’ costs are convex rather than linear in output since the difference

is positive for all parameter values. (If the incumbent’s costs are low, then entry does not ensue, the incumbent maintains its monopoly power producing with output function \(x_{inc}^{L}(t_{2})=\frac{1-t_{2}}{2\left( 1+c_{inc}^{L}\right) }\); while the regulator sets a second-period emission fee that coincides with the first-period fee under monopoly, i.e., \(t_{2}^{L,NE}=t_{1}^{L}\).)

Incomplete information-I. Separating equilibrium. As described in the proof of Proposition 1, the low-cost incumbent increases its output level, from \(q^{L}(t_{1})\) under complete information to \(q^{A}(t_{1})>q^{L}(t_{1})\), in order to guarantee that the high-cost incumbent does not have incentives to mimic it. In particular, output function \(q^{A}(t_{1})\) solves the incentive compatibility condition

where \(M_{inc}^{H}(q(t_{1}),t_{1})\) denotes its first-period monopoly profits when producing any output level \(q(t_{1})\); \(D_{inc}^{H}\) represents its second-period duopoly profits evaluated at the socially optimal emission fee \(t_{2}^{H,E}\); and \(\overline{M}_{inc}^{H}\) denotes the incumbent’s second-period monopoly profits evaluated at the optimal fee \(t_{2}^{H,NE}\). Solving for output function \(q^{A}(t_{1})\) yields \(q^{A}(t_{1})=\frac{\left( 1-t_{1}\right) \left( 1+2d+2c_{inc}^{H}\right) +\left( 1+c_{inc}^{H}\right) \sqrt{3\delta }}{2\left( 1+c_{inc}^{H}\right) \left( 1+2d+2c_{inc}^{H}\right) }\).

Given output function \(q^{A}(t_{1})\), we can replicate the regulator’s problem about selecting emission fee \(t_{1}^{*}\) under incomplete information about the incumbent’s costs (minimizing inefficiencies, as described in problem 5) which yields a relatively intractable expression for fee \(t_{1}^{*}\). Nonetheless, for the parameters considered in the paper, its expression becomes \(t_{1}^{*}=\frac{34+435\sqrt{3}+\left( 136-435\sqrt{3}\right) p^{\beta }}{68\left( 15+2p^{\beta }\right) }\). This emission fee behaves as the analogous fee under linear production costs (and depicted in Fig. 2 of the paper): it increases in parameter \(\beta \), and shifts upwards as the regulator becomes more certain about the incumbent’s costs being low (i.e., as his prior \(p\) decreases). Figure 6a, which depicts emission fee \(t_{1}^{*}\), emphasizes the similarities with the setting in which production costs are linear. However, relative to such a setting, fee \(t_{1}^{*}\) is more stringent when costs are convex since, following a similar argument as in the complete information context, the regulator seeks to curb the stronger incentives of the incumbent to produce when its costs are convex than when they are linear. Figure 6b depicts emission fee \(t_{1}^{*}\) under both linear and convex costs, illustrating its higher stringency when costs are convex.

Incomplete Information-II. Pooling equilibrium. Similarly as in the proof of Proposition 2, the high-cost incumbent might have incentives to mimic the higher production level of the low-cost firm during the first-period game (and thus conceal its type from the potential entrant, which is deterred from the industry). In particular, this occurs if, for emission fee \(t_{1}^{L}\), the high-cost incumbent’s profits from deterring entry, by choosing output level \(q^{L}(t_{1}^{L})\), are larger than its profits from selecting the complete-information output level \(q^{H}(t_{1}^{L})\) that, while attracting entry, maximizes its first-period profits. That is, if \(M_{inc}^{H}(q^{L}(t_{1}^{L}),t_{1}^{\prime })+\delta \overline{M}_{inc}^{H}\ge M_{inc}^{H}(q^{H}(t_{1}^{L}),t_{1}^{L})+\delta D_{inc}^{H}\).

Regarding the uninformed regulator, he yields a welfare \(SW^{H,NE}(t_{1}^{L},t_{2}^{H,NE})\) by selecting a fee \(t_{1}^{L}\). If, instead, he deviates to any off-the-equilibrium fee \(t_{1}^{\prime \prime }\ne t_{1}^{L}\), the incumbent anticipates it will not be able to conceal its type from the potential entrant, thus responding with its complete-information output, \(q^{H}(t_{1}^{\prime \prime })\), and entry ensues. In this context, the regulator obtains \(SW^{H,E}(t_{1}^{\prime \prime },t_{2}^{H,E})\), which is maximized at the emission fee \(t_{1}^{\prime \prime }=t_{1}^{*}\) that minimizes the regulator’s informational inefficiencies (from problem 5). Solving for entry costs, \(F\), in \(SW^{H,NE}(t_{1}^{L},t_{2}^{H,NE})=SW^{H,E}(t_{1}^{*},t_{2}^{H,E})\) yields an intractable expression for cutoff \(\overline{F}(\beta )\). However, in order to facilitate the comparison with the environment in which costs are linear, Fig. 6c depicts this cutoff evaluated at the parameter values considered throughout the paper.

Figure 6c indicates that the region of entry costs in which the regulator facilitates the incumbent’s entry-deterring practices by setting an emission fee \(t_{1}^{L}\), i.e., \(F>\overline{F}(\beta )\), is smaller when production costs are convex (dark shaded area) than when they are linear (sum of dark and light shaded areas). Intuitively, this occurs because setting a larger-than-optimal emission fee, such as \(t_{1}^{L}\) on the high-cost incumbent, produces a larger reduction in this firm’s output when its production costs are convex than when they are linear. As a consequence, the use of environmental policy as an entry-deterring tool yields larger inefficiencies under convex costs, and ultimately limits the regulator’s willingness to deter entry.

We can more formally prove the above result under all parameter conditions by examining the elasticity of the monopolist’s output function to a marginal increase in emission fees above the socially optimal level \(q^{K,SO}=q^{K}\left( t_{1}^{K}\right) \), i.e.,

In particular, under convex costs, this elasticity becomes \(\varepsilon _{q^{K}(t_{1}),t_{1}}=\frac{1-2d}{2\left( 1+c_{inc}^{K}\right) }\), whereas under linear costs it is \(\varepsilon _{q^{K}(t_{1}),t_{1}}=\frac{1}{2}-d\), with the difference \(\frac{1-2d}{2\left( 1+c_{inc}^{K}\right) }-\left( \frac{1}{2}-d\right) =\frac{\left( 2d-1\right) c_{inc}^{K}}{2\left( 1+c_{inc}^{K}\right) }\) being positive under all parameter values given that \(d>1/2\) by assumption. Therefore, for a given deviation from the emission fee \(t_{1}^{K,SO}\) that in the first period yields the socially optimal output \(q^{K,SO}\), the regulator entails larger deviations from \(q^{K,SO}\) (and thus larger inefficiencies) when firms’ costs are convex than when they are linear.

Finally, Fig. 6d depicts how cutoff \(\overline{F}(\beta )\) decreases in \(\beta \), thus exhibiting a similar pattern as when production costs are linear (illustrated in Fig. 4), i.e., the pooling equilibrium can be sustained under larger parameter values when the regulator has access to less accurate information.

1.3 Proof of Proposition 1

Incumbents. We next demonstrate that, for a given fee \(t_{1}\), the high-cost incumbent selects the same output function as under complete information, \(q^{H}(t_{1})\), since its overall profits exceed those from deviating towards the low-cost incumbent’s output \(q^{L,sep}(t_{1})\), given that \(M_{inc}^{H}(q^{H}(t_{1}),t_{1})+\delta D_{inc}^{H}\ge M_{inc}^{H}(q^{L,sep}(t_{1}),t_{1})+\delta \overline{M}_{inc}^{H}\), where \(M_{inc}^{H}(q(t_{1}),t_{1})\) denotes its first-period monopoly profits when producing any output level \(q(t_{1})\). \(D_{inc}^{H}\) represents its second-period duopoly profits evaluated at the socially optimal emission fee \(t_{2}^{H,E}\) since the regulator perfectly observes the incumbent’s costs in the second period and can redesign his environmental policy. Similarly, \(\overline{M}_{inc}^{H}\) denotes the incumbent’s second-period monopoly profits evaluated at the optimal fee \(t_{2}^{H,NE}\). Rewriting the above incentive compatibility condition, we obtain

The low-cost incumbent, however, produces an output level, \(q^{L,sep}(t_{1})\), larger than under complete information, \(q^{L}(t_{1})\), in order to reveal its type to the potential entrant and deter entry. Since any deviations from \(q^{L,sep}(t_{1})\) induce entry, the most profitable deviation is \(q^{L}(t_{1})\). Therefore, the low-cost incumbent obtains larger profits from \(q^{L,sep}(t_{1})\) than \(q^{L}(t_{1})\) when \(M_{inc}^{L}(q^{L,sep}(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\ge M_{inc}^{L}(q^{L}(t_{1}),t_{1})+\delta D_{inc}^{L}\), or equivalently,

Conditions 6 and 7 hence identify a set of output functions \(q^{L,sep}(t_{1})\in \left[ q^{A}(t_{1}),q^{B}(t_{1})\right] \), where \(q^{A}(t_{1})\) solves 6 and \(q^{B}(t_{1})\) solves 7 with equality.

Regulator. If conditions 6–7 are satisfied, the regulator, despite not perfectly observing the incumbent’s type, is able to anticipate that the high-cost firm produces according to \(q^{H}(t_{1})\) while the low-cost incumbent chooses \(q^{L,sep}(t_{1})\). (In addition, it is easy to show that the low-cost firm selects the output function, \(q^{L,sep}(t_{1})=q^{A}(t_{1})\), that entails the smallest deviation from its first-period output under complete information, \(q^{L}(t_{1})\), where \(q^{A}(t_{1})>q^{L}(t_{1})\), and that \(q^{A}(t_{1})\) is indeed the only equilibrium output level that satisfies the Cho and Kreps’ (1983) Intuitive Criterion; as we demonstrate below.) Hence, the regulator selects emission fee \(t_{1}\) that minimizes the deadweight loss associated to his inaccurate information,

Let us first focus on the inefficiencies arising when the incumbent’s type is high, as captured by \(DWL_{H}(t_{1})\equiv \int \nolimits _{q^{H}(t_{1})}^{q_{SO}^{H}}\left[ MB^{H}(q)-MD(q)\right] dq\). As described in Sect. 3, \(q_{SO}^{H}\equiv \frac{1-c_{inc}^{H}}{1+2d}\) represents the socially optimal output level, and \(q^{H}(t_{1})=\frac{1-c_{inc}^{H}-t_{1}}{2}\) denotes the output function that maximizes the high-cost incumbent’s profits. In addition, the benefit from a marginal increase in output is \(MB^{H}(q)=(1-q)-c_{inc}^{H}\), whereas its associated marginal environmental damage is \(MD(q)=2dq\). Integrating, we obtain

where \(\rho \equiv 1+2d\). Similarly operating for the case in which the incumbent’s costs are low, where \(q_{SO}^{L}\equiv \frac{1-c_{inc}^{H}}{1+2d} \), we find

where \(\gamma \equiv \sqrt{3\delta }\). Taking into account that \(DWL_{H}(t_{1})\) and \(DWL_{L}(t_{1})\) are both positive, the regulator can now find the expected deadweight loss \(p^{\beta }DWL_{H}(t_{1})+\left( 1-p^{\beta }\right) DWL_{L}(t_{1})\). Taking first order conditions with respect to \(t_{1}\), we find

Emission fee \(t_{1}^{*}\) yields the minimum of the objective function \(p^{\beta }\left| DWL_{H}(t_{1})\right| +\left( 1-p^{\beta }\right) \left| DWL_{L}(t_{1})\right| \) since such function is convex in \(t_{1}\), i.e., \(\frac{\partial ^{2}\left[ p^{\beta }\left| DWL_{H}(t_{1})\right| +\left( 1-p^{\beta }\right) \left| DWL_{L}(t_{1})\right| \right] }{\partial t_{1}^{2}}=\frac{\rho }{4}>0\) for all parameter values. Furthermore, fee \(t_{1}^{*}\) can be expressed as a linear combination of the socially optimal fees that the regulator would select if he was perfectly informed about the incumbent’s costs being high, \(t_{1}^{H}\), where \(t_{1}^{H}\) solves \(q^{H}(t_{1})=q_{SO}^{H}\), and its costs being low, \(t_{1}^{A}\), where fee \(t_{1}^{A}\) solves \(q^{A}(t_{1})=q_{SO}^{L}\). Specifically, the weights on fees \(t_{1}^{H}\) and \(t_{1}^{A}\) can be found by solving for \(\alpha \) in \(t_{1}^{*}=\alpha t_{1}^{H}+(1-\alpha )t_{1}^{A}\), where weight \(\alpha =p^{\beta }\), thus implying \(t_{1}^{*}=p^{\beta }t_{1}^{H}+\left( 1-p^{\beta }\right) t_{1}^{A}\). Therefore, emission fee \(t_{1}^{*}\) satisfies \(t_{1}^{H}<t_{1}^{*}<t_{1}^{A}\). From the analysis of emission fee \(t_{1}^{A}\) in Lemma 2 in Espinola-Arredondo and Munoz-Garcia (2013), we know that it induces positive output levels as long as firms’ costs are not extremely asymmetric, i.e., \(c_{inc}^{L}<c_{inc}^{H}<\frac{\gamma +\rho c_{inc}^{L}}{\gamma +\rho }\). Hence, a less stringent fee \(t_{1}^{*}\) must also yield positive production levels. Finally, note that evaluating \(t_{1}^{*}\) at \(\beta =1\) (when the regulator is as uninformed as the entrant), we find \(t_{1}^{U}\equiv \frac{2d-1+\left[ p(2+\gamma )-\rho -\gamma \right] c_{inc}^{H}+\left( 2c_{inc}^{L}+\gamma \right) (1-p)c_{inc}^{L}}{\rho }\).

In particular, when \(t_{1}^{*}<t_{1}^{U}\), the high-cost incumbent anticipates that if it deviates from \(q^{H}(t_{1})\) to \(q^{A}(t_{1})\) then the entrant’s beliefs are \(\mu \left( c_{inc}^{H}|q^{A}(t_{1}^{*}),t_{1}^{*}\right) =\mu ^{\prime }\). Therefore, entry is deterred if

solving for \(\mu ^{\prime }\), we obtain \(\mu ^{\prime }<\frac{F-D_{ent}^{L}}{D_{ent}^{H}-D_{ent}^{L}}\equiv \overline{p}\). In contrast, when \(t_{1}^{*}>t_{1}^{U}\), a deviation from \(q^{H}(t_{1})\) to \(q^{A}(t_{1})\) makes the entrant believe that the incumbent’s costs are low, thus deterring entry. Similarly, when \(t_{1}^{*}=t_{1}^{U}\), the entrant only relies on the incumbent’s output level in order to infer its costs. Hence, after observing \(q^{A}(t_{1})\) it stays out.

Intuitive Criterion: Let us now show that the separating equilibrium where the low-cost incumbent chooses any first-period output function \(q^{L,sep}(t_{1})\ne q^{A}(t_{1})\) violates the Cho and Kreps’ (1983) Intuitive Criterion, and afterwards demonstrate that only \(q^{L,sep}(t_{1})=q^{A}(t_{1})\) survives this equilibrium refinement. Consider the case where the low-cost incumbent chooses a first-period output function of \(q^{B}(t_{1})\). Let us check if a deviation towards \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\) is equilibrium dominated for either type of incumbent. On one hand, the high-cost incumbent can obtain the highest profit by deviating towards \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\) when entry does not follow. In such a case, the high-cost incumbent obtains \(M_{inc}^{H}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{H}\) which exceeds its equilibrium profits if \(M_{inc}^{H}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{H}>M_{inc}^{H}(q^{H}(t_{1}),t_{1})+\delta D_{inc}^{H}\). However, condition 6 guarantees that this inequality does not hold for any \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\). Hence, the high-cost incumbent does not have incentives to deviate from \(q^{H}(t_{1})\) to \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\).

On the other hand, the low-cost incumbent can obtain the highest profit by deviating towards \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\) when entry does not follow. In such case, the low-cost incumbent’s payoff is \(M_{inc}^{L}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\), which exceeds its equilibrium profits of \(M_{inc}^{L}(q^{B}(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\) since \(M_{inc}^{L}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\) reaches its maximum at \(q^{L}(t_{1})\) and \(q^{L}(t_{1})<q^{B}(t_{1})\). Therefore, the low-cost incumbent has incentives to deviate from \(q^{B}(t_{1})\) to \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\). Hence, the entrant concentrates its posterior beliefs on the incumbent’s costs being low, i.e., \(\mu (c_{inc}^{H}|q(t_{1}),t_{1})=0\), and does not enter after observing a first-period output of \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1}))\). Thus, the low-cost incumbent deviates from \(q^{B}(t_{1})\), and the informative equilibrium in which it selects \(q^{B}(t_{1})\) violates the Intuitive Criterion. A similar argument is applicable for all informative equilibria in which the low-cost incumbent selects \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1})]\), concluding that all of them violate the Intuitive Criterion.

Finally, let us check if the informative equilibrium in which the low-cost incumbent chooses \(q^{A}(t_{1})\) survives the Intuitive Criterion. If the low-cost incumbent deviates towards \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1})]\), the highest profit that it can obtain is \(M_{inc}^{L}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\), which is lower than its equilibrium payoff of \(M_{inc}^{L}(q^{A}(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\). If instead, it deviates towards \(q(t_{1})<q^{A}(t_{1})\), it obtains \(M_{inc}^{L}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\), which exceeds it equilibrium profit for all \(q(t_{1})\in [q^{L}(t_{1}),q^{A}(t_{1}))\). Hence, the low-cost incumbent has incentives to deviate. Let us now examine whether the high-cost incumbent also has incentives to deviate. The highest profit that it can obtain by deviating towards \(q(t_{1})\in (q^{A}(t_{1}),q^{B}(t_{1})]\) is \(M_{inc}^{H}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{H}\), which exceeds its equilibrium profit if \(M_{inc}^{H}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{H}>M_{inc}^{H}(q^{H}(t_{1}),t_{1})+\delta D_{inc}^{H}\). This condition can be rewritten as

which is satisfied for all \(q(t_{1})<q^{A}(t_{1})\) from condition 6. Hence, the high-cost incumbent also has incentives to deviate towards \(q(t_{1})\in [q^{L}(t_{1}),q^{A}(t_{1}))\).

This implies that, after a deviation in \(q(t_{1})\in [q^{L}(t_{1}),q^{A}(t_{1}))\), the entrant cannot update its prior beliefs, and chooses to enter if its expected profit from entering satisfies \(p\times D_{ent}^{H}+(1-p)\times D_{ent}^{L}-F>0\) or \(p\ge \frac{F-D_{ent}^{L}}{D_{ent}^{H}-D_{ent}^{L}}\equiv \overline{p}\), where \(\overline{p}>0\) for all \(F>D_{ent}^{L}\) and \(\overline{p}<1\) for all \(F<D_{ent}^{H}\). Hence, if \(p\ge \overline{p}\), entry occurs, yielding profits of \(M_{inc}^{L}(q(t_{1}),t_{1})+\delta D_{inc}^{L}\) for the low-cost incumbent. Such profits are lower than its equilibrium profits \(M_{inc}^{L}(q^{A}(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\). Therefore, the low-cost incumbent does not deviate from \(q^{A}(t_{1})\). Regarding the high-cost incumbent, it obtains profits \(M_{inc}^{H}(q(t_{1}),t_{1})+\delta D_{inc}^{H}\) by deviating towards \(q(t_{1})\), which are below its equilibrium profits \(M_{inc}^{H}(q^{H}(t_{1}),t_{1})+\delta D_{inc}^{H}\) since \(q^{H}(t_{1})\) is the argmax of \(M_{inc}^{H}(q(t_{1}),t_{1})+\delta D_{inc}^{H}\). Hence, the high-cost incumbent does not deviate towards \(q(t_{1})\) either, and this equilibrium survives the Intuitive Criterion for \(p>\overline{p}\). In contrast, if \(p<\overline{p}\), then entry does not occur, yielding profits \(M_{inc}^{L}(q(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\) for the low-cost incumbent, which exceed its equilibrium profits \(M_{inc}^{L}(q^{A}(t_{1}),t_{1})+\delta \overline{M}_{inc}^{L}\) since \(q(t_{1})\in [q^{L}(t_{1}),q^{A}(t_{1}))\). Then, the separating equilibrium in which the low-cost incumbent selects \(q^{A}(t_{1})\) violates the Intuitive Criterion if \(p<\overline{p}\). \(\square \)

1.4 Proof of Corollary 1

Differentiating \(t_{1}^{*}\) with respect to \(\beta \), we obtain

and, since \(p^{\beta }>0\), \(\ln (p)<0\), and \(\rho >0\), \(\frac{\partial t_{1}^{*}}{\partial \beta }\) becomes positive if and only if \(2(c_{inc}^{H}-c_{inc}^{L})-(1-c_{inc}^{H})\gamma <0\) or, alternatively, \(c_{inc}^{H}<\frac{2+\gamma -2(1-c_{inc}^{L})}{2+\gamma }\). Comparing this condition with that on positive output levels and emission fees under complete information, i.e., \(c_{inc}^{H}<\frac{1+2dc_{inc}^{L}}{\rho }\), we obtain that both cutoffs reach \(c_{inc}^{H}=1\) when \(c_{inc}^{L}=1\), but \(\frac{2+\gamma -2(1-c_{inc}^{L})}{2+\gamma }\) originates at \(\frac{\gamma }{2+\gamma }\), while \(\frac{1+2dc_{inc}^{L}}{\rho }\) originates at \(\frac{1}{\rho }\), which is equivalent to \(\frac{1}{1+2d}\). Since \(\frac{\gamma }{2+\gamma }>\frac{1}{1+2d}\) for all \(d>\frac{1}{\sqrt{3}}\simeq 0.57\), then cutoff \(\frac{2+\gamma -2(1-c_{inc}^{L})}{2+\gamma }\) lies above \(\frac{1+2dc_{inc}^{L}}{\rho }\) for all \(d\in \left( \frac{1}{\sqrt{3}},1\right] \), but below otherwise.

Furthermore, evaluating the emission fee \(t_{1}^{*}\) at \(\beta =0\), we obtain \(\frac{(2d-1)(1-c_{inc}^{H})}{\rho }\), while evaluating it at \(\beta =1\), we find \(\frac{2d-1+\left[ p(2+\gamma )-\rho -\gamma \right] c_{inc}^{H}+\left( 2c_{inc}^{L}+\gamma \right) (1-p)c_{inc}^{L}}{\rho }\). Finally, \(\underset{\beta \rightarrow +\infty }{\lim }t_{1}^{*}=\frac{(1-c_{inc}^{H})\left( \rho +\gamma \right) -2(1-c_{inc}^{L})}{\rho }\). \(\square \)

1.5 Proof of Corollary 2

Separating Equilibrium Versus Complete Information. When the incumbent’s costs are low, the regulator induces the socially optimal output under complete information by setting the fee \(t_{1}^{L}\) that solves \(q^{L}(t_{1})=q_{SO}^{L}\). However, under the separating equilibrium, the low-cost incumbent produces according to output function \(q^{A}(t_{1})\), which satisfies \(q^{A}(t_{1})>q^{L}(t_{1})\) for all \(t_{1}\). If the regulator was perfectly informed about facing a low-cost incumbent, he would set a fee \(t_{1}^{A}\) that solves \(q^{A}(t_{1})=q_{SO}^{L}\). However, since the regulator is uninformed about the exact costs of the incumbent, he sets a fee that solves problem (5), i.e., \(t_{1}^{*}\), which is less stringent than \(t_{1}^{A}\), since it can be alternatively expressed as \(t_{1}^{*}=p^{\beta }t_{1}^{H}+\left( 1-p^{\beta }\right) t_{1}^{A}\). Hence, the output level in the separating equilibrium, \(q^{A}(t_{1}^{*})\), exceeds the socially optimal output, \(q_{SO}^{L}\), and entails inefficiencies.

When the incumbent’s costs are high, the regulator also induces the socially optimal output \(q_{SO}^{H}\) by setting the fee \(t_{1}^{H}\) that solves \(q^{H}(t_{1})=q_{SO}^{H}\). In the separating equilibrium, while the high-cost firm also produces according to \(q^{H}(t_{1})\), the regulator does not set fee \(t_{1}^{H}\), which would induce a socially optimal output, but instead sets fee \(t_{1}^{*}\), which is more stringent than \(t_{1}^{H}\), given that \(t_{1}^{*}=p^{\beta }t_{1}^{H}+\left( 1-p^{\beta }\right) t_{1}^{A}\). As a consequence, output level \(q^{H}(t_{1}^{*})\) arises, which lies below \(q^{H}(t_{1}^{H})=q_{SO}^{H}\), thus entailing inefficiencies. Therefore, the introduction of incomplete information yields first-period output inefficiencies both when the incumbent’s costs are high and low, thus entailing an overall welfare loss. In the second period, however, no inefficiencies arise, given that the regulator becomes perfectly informed about the incumbent’s costs.

Separating Equilibrium with and Without Regulator. Without regulation, the low-cost incumbent sets its first-period output function at \(q^{A}(0)\). When the regulator is present, however, first-period output decreases to \(q^{A}(t_{1}^{*})\), where

while when the incumbent’s costs are high, this firm sets a first-period output of \(q^{H}(0)\), while the regulator would set a fee \(t_{1}^{*}\) that induces this firm to produce a lower output level \(q^{H}(t_{1}^{*})\), since \(q^{H}(t_{1}^{*})<q^{H}(t_{1}^{H})=q_{SO}^{H}<q^{H}(0)\).

In the second period, output is \(x_{inc}^{K,NE}(t_{2}^{K,NE})\), which is socially optimal since fee \(t_{2}^{K,NE}\) solves \(x_{inc}^{K,NE}(t_{2})=q_{SO}^{K}\). Therefore, the presence of the regulator ameliorates the environmental externality in the first period, and fully corrects inefficiencies in the second period, ultimately implying that his presence entails a welfare improvement. \(\square \)

1.6 Proof of Proposition 2

In the pooling strategy profile, the regulator sets a type-independent emission fee \(t_{1}^{\prime }\) and the incumbent chooses a type-independent first-period output function \(q(t_{1})\) for any emission fee \(t_{1}\). After observing equilibrium fee \(t_{1}^{\prime }\) and output level \(q(t_{1}^{\prime })\) entrant’s equilibrium beliefs cannot be updated, i.e., \(\mu (c_{inc}^{H}|q(t_{1}^{\prime }),t_{1}^{\prime })=p\), which leads the potential entrant to enter as long as its expected profit from entering satisfies \(p\times D_{ent}^{H}+(1-p)\times D_{ent}^{L}-F>0\) or \(p>\frac{F-D_{ent}^{L}}{D_{ent}^{H}-D_{ent}^{L}}\equiv \overline{p}\), where \(\overline{p}\in \left( 0,1\right) \) by definition. Note that if \(p>\overline{p}\), entry occurs when \(t_{1}^{\prime }\) and \(q(t_{1}^{\prime })\) are selected, which cannot be optimal for both types of incumbent, inducing them to select \(q^{K}(t_{1}^{\prime })\). But since \(q^{H}(t_{1}^{\prime })\ne q^{L}(t_{1}^{\prime })\) this strategy cannot be a pooling equilibrium. Thus, it must be that \(p\le \overline{p}\), inducing the entrant to stay out.

Hence, the high-cost incumbent responds to emission fee \(t_{1}^{\prime }\) with output level \(q(t_{1}^{\prime })\), as prescribed, if and only if its profits from deterring entry are larger than the profits it would make by selecting output level \(q^{H}(t_{1}^{\prime })\) that, while attracting entry, maximizes its first-period profits. That is, if \(M_{inc}^{H}(q(t_{1}^{\prime }),t_{1}^{\prime })+\delta \overline{M}_{inc}^{H}\ge M_{inc}^{H}(q^{H}(t_{1}^{\prime }),t_{1}^{\prime })+\delta D_{inc}^{H}\), or alternatively

and similarly for the low-cost incumbent, who selects output level \(q(t_{1}^{\prime })\), rather than deviating to its complete information output \(q^{L}(t_{1}^{\prime })\), if \(M_{inc}^{L}(q(t_{1}^{\prime }),t_{1}^{\prime })+\delta \overline{M}_{inc}^{L}\ge M_{inc}^{L}(q^{L}(t_{1}^{\prime }),t_{1}^{\prime })+\delta D_{inc}^{L}\), or alternatively

Let us now examine the regulator’s incentives to choose a type-independent emission fee \(t_{1}^{\prime }\). When the incumbent’s costs are high, the uninformed regulator yields a welfare \(SW^{H,NE}(t_{1}^{\prime },t_{2}^{H,NE})\) by selecting \(t_{1}^{\prime }\). If, instead, he deviates to any off-the-equilibrium fee \(t_{1}^{\prime \prime }\ne t_{1}^{\prime }\), the incumbent selects \(q^{H}(t_{1}^{\prime \prime })\) and entry ensues. Hence, he obtains \(SW^{H,E}(t_{1}^{\prime \prime },t_{2}^{H,E})\), which is maximized at the emission fee \(t_{1}^{\prime \prime }=t_{1}^{*}\) that minimizes the regulator’s informational inefficiencies. Thus, the regulator chooses the equilibrium fee \(t_{1}^{\prime }\) if

which holds if the savings in entry costs that arise from setting fee \(t_{1}^{\prime }\) offset its associated inefficiency (relative to fee \(t_{1}^{*}\)).

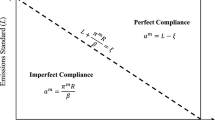

In addition, using a similar argument as in Lemma 3 of Espinola-Arredondo and Munoz-Garcia (2013), it is straightforward to show that only the output function \(q(t_{1})=q^{L}(t_{1})\), entailing an output level \(q^{L}(t_{1}^{\prime })\), survives the Cho and Kreps’ (1983) Intuitive Criterion. Given this output function, it is also easy to show that the only equilibrium fee \(t_{1}^{\prime }\) that, satisfying condition 10, survives the Intuitive Criterion, i.e., entails the minimum separation for the regulator, is fee \(t_{1}^{\prime }=t_{1}^{L}\). In particular, for the functional forms in the paper, condition 8 for the high-cost incumbent (evaluated at the equilibrium fee \(t_{1}^{L}\) and output level \(q^{L}(t_{1}^{L})\)) holds for all \(c_{inc}^{H}<\alpha _{1}\). Similarly, condition 10 for the regulator (evaluated at the equilibrium fee \(t_{1}^{L}\) and output \(q^{L}(t_{1}^{L})\)) holds for all entry costs \(F>\frac{\sqrt{\delta }\lambda \left( 4\sqrt{3}\omega -3\sqrt{\delta }\lambda \right) +\left( 2p^{\beta }-p^{2\beta }\right) \left( \gamma ^{2}\lambda ^{2}-4\gamma \lambda \omega +4\omega ^{2}\right) }{8\delta \rho }\equiv \overline{F}(\beta )\), where \(\lambda \equiv \left( 1-c_{inc}^{H}\right) \) and \(\omega \equiv \left( c_{inc}^{H}-c_{inc}^{L}\right) \). This condition on entry costs is, however, compatible with the set of admissible entry costs, \(D_{ent}^{H}>F>D_{ent}^{L}\), if \(D_{ent}^{H}>\overline{F}(\beta )\), which is satisfied when \(c_{inc}^{H}<\frac{2\left( 1-c_{inc}^{L}\right) \left[ \rho \left( 3+\eta +6d\tau \right) \delta \right] ^{1/2}+4\rho \eta c_{inc}^{L}+2\gamma \rho \tau (1+c_{inc}^{L})}{4\gamma \rho +\left( 5+6d\right) \delta -\rho p^{\beta }\left( 4+4\gamma +3\delta \right) \left( 2-p^{\beta }\right) }\equiv \alpha _{2}\), where \(\eta \equiv p^{\beta }\left( p^{\beta }-2\right) \) and \(\tau \equiv \left( p^{\beta }-1\right) ^{2}\). In addition, \(\alpha _{2}<\alpha _{1}\) implying that the condition \(c_{inc}^{H}<\alpha _{2}\) is more restrictive than \(c_{inc}^{H}<\alpha _{1}\) for all \(d>1/2\). \(\square \)

1.7 Proof of Corollary 3

Pooling Equilibrium Versus Complete Information. When the incumbent’s costs are low, the regulator induces the socially optimal output under complete information by setting the fee \(t_{1}^{L}\) that solves \(q^{L}(t_{1})=q_{SO}^{L}\). Under the pooling equilibrium, the regulator sets the type-independent fee \(t_{1}^{L}\) and the low-cost incumbent responds producing according to output function \(q^{L}(t_{1})\), which yields a socially optimal output.

When the incumbent’s costs are high, the regulator sets a fee \(t_{1}^{H}\) under a complete information setting, and the incumbent responds with output function \(q^{H}(t_{1})\), which entails \(q^{H}(t_{1}^{H})=q_{SO}^{H}\), generating a social welfare of \(W_{PE}^{H,R}\equiv \frac{1-\left( c_{inc}^{L}\right) ^{2}+\delta \left[ 1+\left( c_{inc}^{H}\right) ^{2}\right] -2c_{inc}^{H}\left( 1+\delta -c_{inc}^{L}\right) }{2\rho }\). However, in the pooling equilibrium, the regulator chooses the type-independent fee \(t_{1}^{L}\) and the firm responds with \(q^{L}(t_{1})\), which generate an output level \(q^{L}(t_{1}^{L})\ne q_{SO}^{H}\), thus giving rise to inefficiencies that are partially offset by the saving in entry costs. In particular, social welfare in this context is \(W_{CI}^{H,R}\equiv \frac{(1+\delta )\left[ 1+(c_{inc}^{H}-2)c_{inc}^{H}\right] -2F\delta \rho }{2\rho }\). Comparing \(W_{PE}^{H,R}\) and \(W_{CI}^{H,R}\), we obtain that \(W_{PE}^{H,R}>W_{CI}^{H,R}\) for all \(F>\frac{\omega ^{2}}{2\delta \rho }\), where \(\frac{\omega ^{2}}{2\delta \rho }\) coincides with cutoff \(\overline{F}(\beta =0)\).

Pooling Equilibrium with and Without Regulator. Without regulation, the low-cost incumbent sets its first-period output function at \(q^{L}(0)\). When the regulator is present, however, first-period output decreases to \(q^{L}(t_{1}^{L})\). When the incumbent’s costs are high, this firm sets a first-period output of \(q^{L}(0)\), while the regulator would set a fee \(t_{1}^{L}\) that induces this firm to produce a lower output level \(q^{L}(t_{1}^{L})\). In addition, since \(q_{SO}^{H}=q^{H}(t_{1}^{H})<q^{L}(t_{1}^{L})<q^{L}(0)\), first-period output with regulator, \(q^{L}(t_{1}^{L})\), is closer to the socially optimal output \(q_{SO}^{H}\) than when the regulator is absent, \(q^{L}(0)\). In the second period, output is \(x_{inc}^{K,NE}(t_{2}^{K,NE})\), which is socially optimal since fee \(t_{2}^{K,NE}\) solves \(x_{inc}^{K,NE}(t_{2})=q_{SO}^{K}\), which holds with and without regulator since entry does not ensue in the pooling equilibrium. Therefore, the presence of the regulator ameliorates the environmental externality in the first period, and fully corrects inefficiencies in the second period, ultimately implying that his presence entails a welfare improvement. \(\square \)

Rights and permissions

About this article

Cite this article

Espínola-Arredondo, A., Muñoz-García, F. Can Poorly Informed Regulators Hinder Competition?. Environ Resource Econ 61, 433–461 (2015). https://doi.org/10.1007/s10640-014-9801-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9801-0