Abstract

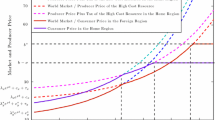

This paper characterizes a sub-global climate coalition’s unilateral policy of reaching a given climate damage reduction goal at minimum costs. Following Eichner and Pethig (J Environ Econ Manag, 2013) we set up a two-country two-period model in which one of the countries represents a climate coalition that implements a binding ceiling on the world’s first-period emissions. The other country is the rest of the world and refrains from taking action. The coalition can make use of production-based carbon emission taxes in both periods, as in Eichner and Pethig (J Environ Econ Manag, 2013), but here we consider consumption-based carbon emission taxes as an additional instrument. The central question is whether and how the coalition employs the consumption-based taxes along with the production-based taxes in its unilateral cost-effective ceiling policy. All cost-effective policies identified analytically and numerically consist of a mix of both types of taxes implying that there is a tax mix which is less expensive for the coalition than stand-alone consumption-based or stand-alone production-based taxes. With full cooperation both taxes are perfect substitutes (in our model), but in case of unilateral action they are imperfect substitutes, because coalition’s total welfare loss from two different but moderate distortions is smaller than that from a single but severe distortion.

Similar content being viewed by others

Notes

Here we are not concerned with the issue of coalition formation and stability (e.g. Finus 2003).

Such a policy reduces the present value of total world climate damage but the coalition’s present value of mitigation costs may exceed its benefits from climate damage reduction. Numerical exercises (not documented here) show that the coalition may be ‘profitable’ (Carraro and Siniscalco 1993, p. 313) in the sense that its net gain may be positive against the benchmark of the no-policy scenario.

Our concept of ceiling policy differs from the so-called carbon budget policy in Chakravorty and Magne (2006) and Kalkuhl and Edenhofer (2010). The ceiling is an upper bound on emissions that have cumulated until some point in time in the medium term, while the carbon budget is an upper bound on total cumulative emissions.

The potential role of consumption taxes as pollution control instruments has been investigated by Albrecht (2006) and others who suggest differentiated rates according to the environmental impact of products. Holland (2012) finds that a consumption tax improves the efficiency of an intensity standard and may prevent leakage. Adopting a CGE approach Elliott et al. (2010) study various scenarios of taxing carbon without overlapping tax instruments and show that adding full border tax adjustment to carbon taxation in Annex B countries eliminates the leakage into developing countries. However, this literature neither studies a mix of p- and c-emission taxes nor does it account for the intertemporal allocation of scarce fossil fuel resources.

Notice that mitigation policies in one-country models are tantamount to fully cooperative climate policies.

In that regard our model is in line e.g. with Sinclair (1992), Sinn (2008), Hoel (2011), Michielsen (2011). A more encompassing approach would be to endogenize cumulative emissions as e.g. in Ploeg and Withagen (2012), Grafton et al. (2010), Kalkuhl and Edenhofer (2010), Gerlagh (2011) and Ritter and Schopf (2013). However, our more restrictive setup suffices for the problem at hand, because we will show that the driving force of our results is the manipulation of the terms of trade via unilateral emission regulation, and that mechanism also works in more complex and more realistic settings.

In (1) the superscript \(s\) indicates quantities supplied. Upper case letters denote functions and subscripts attached to them indicate first partial derivatives. Note that the production functions (1) can be interpreted as being linear homogeneous in fossil fuel and in a domestic production factor, e.g. labor, which is in fixed supply.

To capture total utility one would have to add in (2) a climate damage term. However, we suppress that term without loss of generality, because the climate damage reduction achieved when moving from the no-policy equilibrium to the ceiling-policy equilibrium is a constant.

The extraction of fossil fuel is assumed to be costless and the interest rate is zero. For the rationale (and admissibility) of setting equal to zero the interest rate see Eichner and Pethig (2013).

The proof of Proposition 1(i) is due to Eichner and Pethig (2013) who study a model in which governments have at their disposal p-emission taxes but no c-emission taxes. It is straightforward to prove Proposition 1(ii) by comparing the first-order conditions of the social planner’s solution (Eichner and Pethig 2013, Appendix B) with the first-order conditions of the market agents in Sect. 2 of the present paper.

To keep focused we mention only in passing that ‘convex combinations’ of the first period p-emission taxes and first-period c-emission taxes also do the job as well as policies that consist of p-emission taxes [c-emission taxes] only which differ from Policy I [Policy II] of Proposition 1 in that the tax rate in each period is shifted up or down by a constant (see Eichner and Pethig 2013). The crucial feature of all these hybrid policies is that they sustain one and the same equilibrium allocation.

Recall that we specified the base of the c-emission tax by approximating the emission intensity \(Q(e_{Bt})\) by \(Q(e_{At})\). In case of unilateral action that simplification receives additional support from the concept of ‘best available technology’ for border carbon adjustment (Ismer and Neuhoff 2007; Jakob and Marschinski 2013) which proceeds on the plausible assumption that the taxing country \(A\) uses the best available technology with regard to the emissions intensity in production, i.e. \(Q(e_{At}) \le Q(e_{Bt})\). In that case country \(A\) does not overestimate country \(B\)’s emission intensity and thus observes the WTO principle of non-discrimination (in addition to avoiding high costs of collecting information on \(Q(e_{Bt})\)).

Note that \((\pi _1, \pi _2, \tau _1, \tau _2) \in \mathbb {R}^4\) encompasses ceiling policies with stand-alone p-emission taxes, \((\pi _1, \pi _2, \tau _1 = 0, \tau _2 = 0)\), with stand-alone c-emission taxes, \((\pi _1 = 0, \pi _2 = 0, \tau _1, \tau _2)\) and with mixed taxes exhibiting \(\pi _t \ne 0\) and \(\tau _t \ne 0\) for \(t = 1\), and/or \(t=2\).

Proposition 2 does not determine the sign of \(F(0)\). The only information we have from Eichner and Pethig (2013) is that there are feasible ceiling policies satisfying \(F(0) = 0\).

That welfare loss is a partial welfare effect, because the benefits from reduced climate damage are not accounted for.

In a broader sense, country \(A\) acts as a Stackelberg leader. The deviation from the standard Stackelberg approach is that in our model country \(B\), the Stackelberg follower, does not play Nash. Note also that country \(A\)’s unilateral cost-effective policy is one that maximizes country \(A\)’s welfare rather than the sum of both countries’ welfare.

Laissez-faire levels are indicated with the superscript “\(o\)”.

The parameter values used in this section are not based on calibration exercises.

Interestingly, the stick \(\tau _1>0\) can be replaced by a carrot \(\tau _2 < 0\), as established in Proposition 3. In contrast, the p-emission tax sticks and carrots are no perfect substitutes.

For convenience of simple wording we refer to every specific numerical parameter constellation of our model as an ’economy’. Each row in Table 2 corresponds to such an economy.

We are grateful to one of the anonymous reviewers for the following intuition.

If (30) is satisfied, the second-period market for good \(X\) is also in equlibrium owing to Walras law.

In (37) the equality signs are important because they may force the tax rates \(\pi _{1}\), \(\pi _{2}\) to take on negative values.

References

Albrecht J (2006) The use of consumption taxes to re-launch green tax reforms. Int Rev Law Econ 26:88–103

Biermann F, Brohm R (2005) Implementing the Kyoto protocol without the USA: the strategic role of energy tax adjustments at the border. Clim Policy 4:289–302

Carraro C, Siniscalco D (1993) Strategies for the international protection of environment. J Public Econ 52:309–328

Chakravorty U, Magne B, Moreaux M (2006) A Hotelling model with a ceiling on the stock of pollution. J Econ Dyn Control 30:2875–2904

Davis SJ, Caldeira K (2010) Consumption-based accounting CO\(_2\) emissions. Proc Natl Acad Sci 107:5687–5693

Eichner T, Pethig R (2011) Carbon leakage, the green paradox and perfect future markets. Int Econ Rev 52:767–805

Eichner T, Pethig R (2013) Flattening the carbon extraction path in unilateral cost-effective action. J Environ Econ Manag 66:185–201

Elliott J, Foster I, Kortum S, Munson T, Perez Cervantes F, Weisbach D (2010) Trade and carbon taxes. Am Econ Rev Pap Proc 100:465–469

Elliott J, Foster I, Kortum S, Khun Jush G, Munson T, Weisbach D (2012) Unilateral carbon taxes, border tax adjustments and carbon leakage. Argonne National Laboratory, Mathematics and Computer Science Division, Preprint ANL/MCS-P1711-0110

Finus M (2003) Stability and design of international environmental agreements: the case of transboundary pollution. In: Folmer H, Tietenberg T (eds) The international yearbook of environmental and resource economics 2003/2004. Edward Elgar, Cheltenham

Gerlagh R (2011) Too much oil. CESifo Econ Stud 57:25–43

Grafton RQ, can Long N, Kompas T (2010) Biofuels subsidies and the green paradox. CESifo Working Paper No. 2960

Hoel M (1994) Efficient climate policy in the presence of free riders. J Environ Econ Manag 27:259–274

Hoel M (2011) Climate change and carbon tax expectations. CESifo Working Paper No. 2966

Holland SP (2012) Emission taxes versus intensity standards: second-best environmental policies with incomplete regulation. J Environ Econ Manag 63:375–387

Ismer R, Neuhoff K (2007) Border tax adjustment: a feasible way to support stringent emission trading. Eur J Law Econ 24:137–164

Jakob M, Marschinski R, Hübler M (2013) Between a rock and a hard place: a trade-theory analysis of leakage under production- and consumption-based policies. Environ Resour Econ. doi:10.1007/s10640-013-9638-y

Kalkuhl M, Edenhofer O (2010) Prices vs. quantities and the intertemporal dynamics of the climate rent. Conference Paper WCERE 2010

Michielsen T (2011) Brown backstops versus the green paradox. CentER discussion paper No. 2011-076

Monjon S, Quirion P (2010) How to design a border adjustment for the European Union Emissions Trading System? Energy Policy 38:5199–5207

Peters GP, Minx JC, Weber CL, Edenhofer O (2011) Growth in emission transfer via international trade from 1990 to 2008. Proc Natl Acad Sci 108:8903–8908

Ritter H, Schopf M (2013) Unilateral climate policy: harmful or disastrous? Environ Resour Econ. doi:10.1007/s10640-013-9697-0

Sinclair P (1992) High does nothing and rising is worse: carbon taxes should be kept declining to cut harmful emissions. Manch Sch 60:41–52

Sinclair P (1994) On the optimum trend of fossil fuel taxation. Oxf Econ Pap 46:869–877

Sinn H-W (2008) Public policies against global warming: a supply side approach. Int Tax Public Finance 15:360–394

Van der Ploeg F, Withagen C (2012) Is there really a green paradox? J Environ Econ Manag 64:342–363

Whalley J, Wigle R (1991) The international incidence of carbon taxes. In: Dornbusch R, Poterba JM (eds) Global warming. Economic policy responses. MIT Press, Cambridge, pp 233–270

Wiedmann T (2009) A review of recent multi-region input–output models used for consumption-based emissions and resource accounting. Ecol Econ 69:211–222

Zhang Z (2010) Climate change meets trade in promoting green growth: potential conflicts and synergies. FEEM Working Paper Series 408.2010

Zhang Z (2012) Competitiveness and leakage concern and border carbon adjustments. FEEM Working Paper Series 80.2012

Author information

Authors and Affiliations

Corresponding author

Additional information

An earlier version of this paper was circulated under the title “The carbon budget approach to climate stabilization: Cost-effective subglobal versus global action”. CESifo sponsorship for presenting the paper at the CESifo Area Conference on Energy and Climate Economics, October 2010, is gratefully acknowledged. We thank an associate editor and two referees for helpful comments. Remaining errors are the authors’ sole responsibility.

Appendix

Appendix

1.1 Proof of Proposition 2

Observe that (4), (5), (13) and the first-order conditions

determine \(e_{A1}, e_{A2}, p_e\) and \(p_x\) for given \(\bar{e}_1\). Hence country \(B\)’s income

is fixed and so are the levels of consumption, \(x_{B1}\) and \(x_{B2}\). From the market clearing condition \(x_{A1}^s + x_{B1}^s = x_{A1} + x_{B1}\) therefore follows that the equilibrium value

is uniquely determined by \(\bar{e}_1\). Consider next country \(A\)’s demand functions for the consumption good derived from CES utility (14)

where

Note that the above definition of \(y_A\) holds irrespective of the sign and size of \(\pi _1\) and \(\pi _2\). In (18) and (19) we have already accounted for all conditions of market clearing other than that of the second-period market for the consumption good. The latter is taken care of by Walras Law which is why we disregard Eq. (21). Closer inspection of (20) reveals that keeping the equilibrium values of \(\pi _1, \pi _2\) and \(p_x\) constant the equilibrium value \(x_{A1}\) can be attained through various combinations of \(\tau _1\) and \(\tau _2\). Formally speaking, there is a function \(F: \, \, ]-p_x, \infty [\, \, \longrightarrow \, \,] -1, \infty [\) such that the right-hand side of \(\frac{U^A_{x_{A2}}}{U^A_{x_{A1}}} = \frac{p_x + \tau _2}{1 + \tau _1}\) is unchanged for all \((\tau _1, \tau _2)\) satisfying \(\tau _1 = F(\tau _2)\). In order to specify the properties of that function \(F\) rearrange terms in (20) to obtain

Differentiate (22) and account for \({\mathrm {d}}x_{A1} = {\mathrm {d}}x_{A2} = {\mathrm {d}}y_{Ao}\) and \({\mathrm {d}}q_1 = {\mathrm {d}}q_2 ={\mathrm {d}}p_x = 0\) to get

Next turn (23) into

Account for \(\frac{x_{A1}}{x_{A2}} = \bar{\gamma }_A \left( \frac{p_x + \tau _2 q_2}{1 + \tau _1 q_1} \right) ^{\sigma _A}\) or \(\left( \frac{p_x + \tau _2 q_2}{1 + \tau _1 q_1} \right) ^{-\sigma _A} = \bar{\gamma }_A \frac{x_{A2}}{x_{A1}}\) in (24) to reach

We conclude that \(F_{\tau _2} > 0\) because \(q_1>0\), \(q_2>0\), \(1+ \tau _1q_1 > 0\) and \(p_x + \tau _2 q_2> 0\) and that

Hence \(F_{\tau _2 \tau _2} = 0\).

1.2 Proof of Proposition 3

Consider first the supply-side partial equilibrium established by the equations

These equations determine \(p_e\), \(p_x\), \(\pi _{1}\), \(\pi _{2}\) and \(x_{it}^s\) for \(i=A,B\) and \(t=1,2\) for every \((e_{A1}, e_{A2}) \in [0, \bar{e}_1] \times [0, \bar{e}_2]\). That equilibrium is partial, because the demand for good \(X\) still needs to be specified in order to establish equilibrium on the commodity markets,Footnote 23

The CES utility functions yield the demands

where \(y_{Ao}\) and \(y_B\) are incomes (see (11)) with \(y_{Ao}\) representing income before the tax revenue \(\tau _1 x_{A1}\) is recycled to the consumer. Note that if \(\sigma >0\) and \(\tau _1 \in \mathbb {R}\), \(x_{A1}\) in (31) and \(x_{B1}\) in (32) are fully determined for every \((e_{A1}, e_{A2}) \in [0, \bar{e}_1] \times [0, \bar{e}_2]\).

We first investigate how \(x_{B1}\) varies with \(\sigma \). Since utility maximization implies

the straightforward conclusion from (33) and constant \(y_B\) is

Consequently, disregarding the knife-edge case \((\gamma _1 p_x/\gamma _2)=1\) we find that for every \((e_{A1}, e_{A2})\) there is some set \(S \subset \mathbb {R}\) with non-empty interior such that

Since \(x_{A1} \ge 0\), (35) is clearly a necessary condition for (30). Given (35), sufficient for (30) is \(x_{A1} = x^s_{A1} + x^s_{B1} - x_{B1}\). For \(\tau _1=0\) this equality will not hold, in general. But \(x_{A1}\) varies with \(\tau _1\). Differentiation of (31) with respect to \(\tau _1\) yields

It follows that if \(\sigma \in S\) and \(x_{A1} \ne x^s_{A1} + x^s_{B1} - x_{B1}\) for \(\tau _1=0\), one can change the magnitude of \(x_{A1}\) by an appropriate choice of \(\tau _1\) such that (30) is satisfied. This completes the proof of Proposition 3.

1.3 Proof of Proposition 4

Based on our results in Proposition 3 we set \(\tau _2 = 0\) and treat the quantities \(e_{A1}\) and \(e_{A2}\) as the regulator’s decision variables for analytical convenience while the tax rates \(\pi _1\) and \(\pi _2\) adjust endogenously in order to sustain \(e_{A1}\) and \(e_{A2}\). The consumption tax rate \(\tau _1\) is implied by the solution of the regulator’s optimization problem. In her optimization procedure she takes into account

-

the equilibrium conditions (3) for the commodity markets,

-

the fuel/emission constraintsFootnote 24

$$\begin{aligned} e_{A1} + e_{B1} = \bar{e}_1 \quad \text{ and } \quad e_{A2} + e_{B2} = \bar{e}_2 := \bar{e} - \bar{e}_1, \end{aligned}$$(37) -

the input demand and output supply functions of all producers,

-

and the consumption demand functions of the consumer in country \(B\).

Ad (i): For the quadratic production functions (15) the supply-side partial equilibrium (25) – (29) turns into

and

Next, we determine \(x_{A1}\) and \(x_{A2}\) with the help of country \(B\)’s demand

and with

Observe that

From \(e_{At}^2 + e_{Bt}^2=\left( e_{At}+e_{Bt} \right) ^2 - 2 e_{At}e_{Bt}\) follows \(x_t^s=x_t^{s*}- b \left( \frac{\bar{e}_t^2}{4}-e_{At}e_{Bt} \right) \) with \(x_t^{s*}:=a\bar{e}_t-\frac{b \bar{e}_t^2}{4}\). Combined with (45) we get

Making use of (44) and inserting (47) into the Cobb–Douglas utility function yields

We differentiate \(u_A\) in (48) with respect to \(e_{A1}\) and \(e_{A2}\) and account for (42), (43) and

to obtain, after rearrangement of terms,

Next, we use (51), (52) and \(\frac{x_{A1} (1-\gamma )}{x_{A2} \gamma }=\frac{p_x}{1+\tau _1 q_1}\) in \(\frac{{\mathrm {d}}u_A}{{\mathrm {d}}e_{A1}} = 0\) and \(\frac{{\mathrm {d}}u_A}{{\mathrm {d}}e_{A2}} = 0\), respectively, to get

From summation of (53) and (54), we obtain

Then we make use of (38)–(41) and get

Observe that (45) for \(t=1\), (51) and (56) determine the cost-effective policy \((e_{A1},e_{A2},\tau _1)\). Total differentiation of (56) yields

For the laissez faire values \(\tau _1=0\), \(e_{A1}^o=e_{B1}^o=\bar{e}_1^o\), \(\Delta e_A^o=0,\) (57) simplifies to

Next we account for \(x_{B1} = \gamma y_B\) and \(x_{A1} = \underbrace{\frac{1}{1 + \tau _1 q_1 (1 - \gamma )}}_{=:\check{\tau }_1}\gamma \underbrace{[X(e_{A1}) + p_x X(e_{A2}) + p_e \Delta e_A ]}_{=: y_{Ao}}\) and obtain after total differentiation of the equation

Assessing (60) at laissez faire, which is characterized by \(\tau _1=0\), \(X_{e_{A1}} = p_e\), \(p_x X_{e_{A2}} = p_e\), \(X_{e_{A1}}= X_{e_{B1}}\), \(\Delta e_A = \Delta e_B=0\), \(\gamma y_A = X(e_{A1})= x_{A1}^s = x_{B1}^s\), \(x_{B2}^s = x_{A2}^s\), we get

Finally, we differentiate (53) to get

Assessing (62) at laissez-faire, (62) turns into

(58), (61) and (63) jointly determine \({\mathrm {d}}e_{A1}\), \({\mathrm {d}}e_{A2}\) and \({\mathrm {d}}\tau _1\). In matrix notation, these equations read

where \(a:=\frac{\gamma b p_x x_{B2}^s}{p_e}\). Solving the equation system (64) by means of Cramer’s rule yields

The associated changes of the prices \(\pi _1\), \(\pi _2\), \(p_e\) and \(p_x\) follow from making use of (65) and (66) in (40)–(43).

Ad (ii): In case of \(\tau _1 ={\mathrm {d}}\tau _1=0\), (61) and (63) jointly determine \({\mathrm {d}}e_{A1}\) and \({\mathrm {d}}e_{A2}\). In matrix notation, these equations read

Solving the equation system (68), we obtain

Rights and permissions

About this article

Cite this article

Eichner, T., Pethig, R. Unilateral Climate Policy with Production-Based and Consumption-Based Carbon Emission Taxes. Environ Resource Econ 61, 141–163 (2015). https://doi.org/10.1007/s10640-014-9786-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9786-8