Abstract

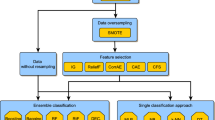

The paper aims to develop an early warning model that separates previously rated banks (337 Fitch-rated banks from OECD) into three classes, based on their financial health and using a one-year window. The early warning system is based on a classification model which estimates the Fitch ratings using Bankscope bank-specific data, regulatory and macroeconomic data as input variables. The authors propose a “hybridization technique” that combines the Extreme learning machine and the Synthetic Minority Over-sampling Technique. Due to the imbalanced nature of the problem, the authors apply an oversampling technique on the data aiming to improve the classification results on the minority groups. The methodology proposed outperforms other existing classification techniques used to predict bank solvency. It proved essential in improving average accuracy and especially the performance of the minority groups.

Similar content being viewed by others

Notes

The concept of soundness is commonly used to denote, for example, an ability to withstand adverse events. Solvency is reflected in the positive net worth of a bank, as measured by the difference between the assets and liabilities (excluding capital and reserves) in its balance sheet. The likelihood of remaining solvent will depend, inter alia, on banks’ being profitable, well managed, and sufficiently well capitalized to withstand adverse events. In a dynamic and competitive market economy, efficiency and profitability are linked, and their interaction will indicate the prospects for future solvency. Inefficient banks will make losses and will eventually become insolvent and illiquid. Undercapitalized banks, that is, those with low net worth, will be fragile in the sense of being more prone to collapse when faced with a destabilizing shock, such as a major policy change, a sharp asset price adjustment, financial sector liberalization, or a natural disaster (Lindgren et al. 1996).

Fitch evaluates the current banks’ solvency however our intention is to develop an early waning model in which we predict the solvency in a future time.

In the Appendix we explain how all these indexes-variables, which are proxies of regulatory aspects, are constructed.

In support of this view, Sironi (2003) finds that credit ratings outperform the balance sheet variables in predicting spreads on bank subordinated notes and debentures in Europe. Other studies have shown that changes in credit ratings cause changes in equity prices of banks in the United States (Billett et al. 1998; Schweitzer et al. 1992) and in Europe (Gropp and Richards 2001), indicating that rating agencies are believed by the market to have superior information.

This is a comprehensive, global database containing information on public and private banks commercialized by the Bureau van Dijk Group. The database is updated to December 6, 2012 (version number 1349).

The class which reports the minimum sensitivity value.

References

Akbani, R., Kwek, S., & Japkowicz, N. (2004). Applying support vector machines to imbalanced datasets. In European conference on machine learning, Springer, pp. 39–50.

Barth, J.R., Caprio, G., & Levine, R. (2001). The regulation and supervision of banks around the world—A new database, Policy Research Working Paper Series 2588, The World Bank.

Barth, J. R., Caprio, G., & Levine, R. (2001). The regulation and supervision of banks around the world: A new database (Vol. 2588). Washington: World Bank Publications.

Barth, J. R., Caprio, G, Jr., & Levine, R. (2008). Bank regulations are changing: For better or worse? Comparative Economic Studies, 50(4), 537–563.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2000). A new database on the structure and development of the financial sector. The World Bank Economic Review, 14(3), 597–605.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2006). Bank concentration, competition, and crises: First results. Journal of Banking & Finance, 30(5), 1581–1603.

Billett, M. T., Garfinkel, J. A., & O’Neal, E. S. (1998). The cost of market versus regulatory discipline in banking. Journal of Financial Economics, 48(3), 333–358.

Bongini, P., Claessens, S., & Ferri, G. (2001). The political economy of distress in east asian financial institutions. Journal of Financial Services Research, 19(1), 5–25.

Caballero, J. C. F., Martínez, F. J., Hervás, C., & Gutiérrez, P. A. (2010). Sensitivity versus accuracy in multiclass problems using memetic pareto evolutionary neural networks. IEEE Transactions on Neural Networks, 21(5), 750–770.

Castaño, A., Fernández-Navarro, F., & Hervás-Martínez, C. (2013). Pca-elm: A robust and pruned extreme learning machine approach based on principal component analysis. Neural Processing Letters, 37(3), 377–392.

Chawla, N. V., Bowyer, K. W., Hall, L. O., & Kegelmeyer, W. P. (2002). Smote: Synthetic minority over-sampling technique. Journal of Artificial Intelligence Research, 16, 321–357.

Chen, Y.-S., & Cheng, C.-H. (2012). A soft-computing based rough sets classifier for classifying ipo returns in the financial markets. Applied Soft Computing, 12(1), 462–475.

Chortareas, G. E., Girardone, C., & Ventouri, A. (2012). Bank supervision, regulation, and efficiency: Evidence from the european union. Journal of Financial Stability, 8(4), 292–302.

Čihák, M., & Poghosyan, T. (2009). Distress in European banks: An analysis based on a new data set, Technical report, IMF Working Paper.

Davis, E. P., & Karim, D. (2008). Comparing early warning systems for banking crises. Journal of Financial Stability, 4, 89–120.

Demirgüç-Kunt, A., & Detragiache, E. (1998). The determinants of banking crises in developing and developed countries. IMF Staff Papers, 45(1), 81–109.

Demirguc-Kunt, A., Detragiache, E., et al. (1997). The determinants of banking crises: evidence from industrial and developing countries, Technical report. The World Bank.

Demirgüç-Kunt, A., Detragiache, E., & Gupta, P. (2006). Inside the crisis: An empirical analysis of banking systems in distress. Journal of International Money and Finance, 25(5), 702–718.

Demirgüç-Kunt, A., Detragiache, E., & Tressel, T. (2008). Banking on the principles: Compliance with basel core principles and bank soundness. Journal of Financial Intermediation, 17(4), 511–542.

Demšar, J. (2006). Statistical comparisons of classifiers over multiple data sets. Journal of Machine Learning Research, 7, 1–30.

Demyanyk, Y., & Hasan, I. (2010). Financial crises and bank failures: A review of prediction methods. Omega, 38(5), 315–324.

DeYoung, R., & Torna, G. (2013). Nontraditional banking activities and bank failures during the financial crisis. Journal of Financial Intermediation, 22(3), 397–421.

Duttagupta, R., & Cashin, M.P. (2008). The anatomy of banking crises. IMF Working Paper, International Monetary Fund, 93, 1–37.

Estrella, A., Park, S., & Peristiani, S. (2000). Capital ratios as predictors of bank failure. Economic Policy Review, 6(2), 33–52.

Fernández-Navarro, F., Hervás-Martínez, C., & Gutiérrez, P. A. (2011). A dynamic over-sampling procedure based on sensitivity for multi-class problems. Pattern Recognition, 44(8), 1821–1833.

Foos, D., Norden, L., & Weber, M. (2010). Loan growth and riskiness of banks. Journal of Banking & Finance, 34(12), 2929–2940.

Friedman, M., & Schwartz, A. J. (2008). A monetary history of the United States, 1867–1960 (2nd ed.). Princeton: Princeton University Press.

Gaganis, C., Pasiouras, F., & Zopounidis, C. (2006). A multicriteria decision framework for measuring banks’ soundness around the world. Journal of Multi-Criteria Decision Analysis, 14(1–3), 103–111.

González-Hermosillo, B., Pazarbaşioğlu, C., & Billings, R. (1997). Determinants of banking system fragility: A case study of mexico. Staff Papers, 44(3), 295–314.

González-Hermosillo, M. B. (1999). Determinants of ex-ante banking system distress: A macro-micro empirical exploration of some recent episodes. Washington: International Monetary Fund.

Gramlich, D., Miller, G., Oet, M. V., & Ong, S. J. (2010). Early warning systems for systemic banking risk: Critical review and modeling implications. Banks and Bank Systems, 5, 199–211.

Gropp, R., & Richards, A. J. (2001). Rating agency actions and the pricing of debt and equity of european banks: What can we infer about private sector monitoring of bank soundness? Economic Notes, 30(3), 373–398.

Gutiérrez, P., Segovia-Vargas, M., Salcedo-Sanz, S., Hervás-Martínez, C., Sanchis, A., Portilla-Figueras, J., et al. (2010). ybridizing logistic regression with product unit and rbf networks for accurate detection and prediction of banking crises. Omega, 38(5), 333–344.

Huang, G. B., Zhu, Q., & Siew, C. (2006a). Extreme learning machine: Theory and applications. Neurocomputing, 70(1–3), 489–501.

Huang, G.-B., Chen, L., & Siew, C. K. (2006). Universal approximation using incremental constructive feedforward networks with random hidden nodes. IEEE Transactions on Neural Networks, 17(4), 879–892.

Huang, G.-B., Zhou, H., Ding, X., & Zhang, R. (2012). Extreme learning machine for regression and multiclass classification. IEEE Transactions on Systems, Man, and Cybernetics, Part B (Cybernetics), 42(2), 513–529.

Ioannidis, C., Pasiouras, F., & Zopounidis, C. (2010). Assessing bank soundness with classification techniques. Omega, 38(5), 345–357.

Kumar, P. R., & Ravi, V. (2007). Bankruptcy prediction in banks and firms via statistical and intelligent techniques-a review. European Journal of Operational Research, 180(1), 1–28.

Liang, N. (1989). Bank profits, risk, and local market concentration. Journal of Economics and Business, 41(4), 297–305.

Lindgren, C.-J., Garcia, G. G., & Saal, M. I. (1996). Bank soundness and macroeconomic policy. Washington: International Monetary Fund.

Martin, D. (1977). Early warning of bank failure: A logit regression approach. Journal of banking & finance, 1(3), 249–276.

Miche, Y., Sorjamaa, A., Bas, P., Simula, O., Jutten, C., & Lendasse, A. (2010). OP-ELM: Optimally pruned extreme learning machine. IEEE Transactions on Neural Networks, 21(1), 158–162.

Moore, J. (2011). Bank performance prediction during the’great recession’of 2008-’09: A pattern-recognition approach. Academy of Banking Studies Journal, 10(2), 87.

Olmeda, I., & Fernández, E. (1997). Hybrid classifiers for financial multicriteria decision making: The case of bankruptcy prediction. Computational Economics, 10(4), 317–335.

Porath, D. (2006). Estimating probabilities of default for german savings banks and credit cooperatives. Schmalenbach Business Review, 58, 214–233.

Rong, H.-J., Ong, Y.-S., Tan, A.-H., & Zhu, Z. (2008). A fast pruned-extreme learning machine for classification problem. Neurocomputing, 72(1–3), 359–366.

Rose, A. K., & Spiegel, M. M. (2012). Cross-country causes and consequences of the 2008 crisis: Early warning. Japan and the World Economy, 24(1), 1–16.

Schweitzer, R., Szewczyk, S. H., & Varma, R. (1992). Bond rating agencies and their role in bank market discipline. Journal of Financial Services Research, 6(3), 249–263.

Sironi, A. (2003). Testing for market discipline in the european banking industry: Evidence from subordinated debt issues. Journal of Money, Credit, and Banking, 35(3), 443–472.

Tam, K. Y., & Kiang, M. (1990). Predicting bank failures: A neural network approach. Applied Artificial Intelligence an International Journal, 4(4), 265–282.

Thomson, J. (1991). Predicting bank failures in the 1980s. Economic Review, 27(1), 9–20.

Wheelock, D. C., & Wilson, P. W. (2000). Why do banks disappear? The determinants of us bank failures and acquisitions. Review of Economics and Statistics, 82(1), 127–138.

Yu, Q., Miche, Y., Séverin, E., & Lendasse, A. (2014). Bankruptcy prediction using extreme learning machine and financial expertise. Neurocomputing, 128, 296–302.

Zhao, D., Huang, C., Wei, Y., Yu, F., Wang, M., & Chen, H. (2016). An effective computational model for bankruptcy prediction using kernel extreme learning machine approach. Computational Economics, 49(2), 325–341.

Acknowledgements

The research work of F. Martínez-Estudillo and F. Fernández-Navarro was partially supported by the TIN2014-54583-C2-1-R project of the Spanish Ministry of Economy and Competitiveness (MINECO).

Author information

Authors and Affiliations

Corresponding author

Appendix A: Definition of Regulatory Variables

Appendix A: Definition of Regulatory Variables

See Table 6.

Rights and permissions

About this article

Cite this article

Fernández-Arias, D., López-Martín, M., Montero-Romero, T. et al. Financial Soundness Prediction Using a Multi-classification Model: Evidence from Current Financial Crisis in OECD Banks. Comput Econ 52, 275–297 (2018). https://doi.org/10.1007/s10614-017-9676-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9676-6