Abstract

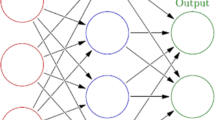

Earnings per share (EPS) is one of the main financial ratio that is considering by managers, investors and financial analysts. It is usually using in investment decisions, profitability evaluation, profit risk, and stock price estimation. Therefore, EPS forecasting is a valuable and attractive task for managers and investors. This paper examines EPS forecasting using multi-layer perceptron (MLP) neural network and rule extraction from neural network by genetic algorithm technique and determined an optimal model between MLP and RE technique by evaluating their forecasting accuracy. For this purpose, we use 990 listed firms in Tehran Stock Exchange in the period of 2000–2010. The results show that the RE technique is significantly more accurate than the MLP model.

Similar content being viewed by others

References

Abarbanell, J. S., & Bushee, B. J. (1997). Fundamental analysis, future EPS, and stock prices. Journal of Accounting Research, 35(1), 1–24.

Ahmet Serdar, Yilmaz, & Zafer, ozer. (2009). Pitch angle control in wind turbines above the rated wind speed by multi-layer perceptron and radial basis function neural networks. Expert Systems with Applications, 36, 9767–9775.

Andrews, R., Diederich, J., & Tickle, A. (1996). BA survey and critique of techniques for extracting rules from trained artificial neural networks. Knowledge-Based Systems, 8, 373–389.

Beaver, William H., Eger, Carol E., Ryan, Stephen G., & Wolfson, Mark A. (1989). Financial reporting, supplemental disclosures, and the structure of bank prices. Journal of Accouning Research, 21(2). http://www.jstor.org/stable/i342816.

Bologna, G. (2004). Is the worth generating rules from neural network ensembles? Journal of Applied Logic, 2, 325–348.

Cui, G., Wong, M. L., & Lui, H. K. (2006). Machine learning for direct marketing response models: Bayesian networks with evolutionary programming. Management Science, 52(4), 597–612.

Finger, A. (1994). The ability of earning to predict future earnings and cash flow. Journal of Accounting Research (autumn), 32(2), 210–223.

Gonedes, N. (1974). Capital market equilibrium and annual accounting numbers: Empirical evidence. Journal of Accounting Research (spring, 12, 26–62.

Huang, S. J., Chiu, N. H., & Chen, L. W. (2008). Integration of the grey relational analysis with genetic algorithm for software effort estimation. European Journal of Operational Research, 188(3), 898–909.

Huang, S. H., & Xing, H. (2002). Extract intelligible and concise fuzzy rules from neural networks. Fuzzy Sets and Systems, 132, 233–243.

Kim, Y., Street, W. N., Russell, G. J., & Menczer, F. (2005). Customer targeting: A neural network approach guided by genetic algorithms. Management Science, 51(2), 264–276.

Kuflik, T., Boger, Z., & Shoval, P. (2006). Filtering search results using an optimal set of terms identified by an artificial neural network. Information Processing and Management, 42(2), 469–483.

Kuldeep, K., & Sukanto, B. (2006). Artificial Neural Network vs. Linear Discriminate Analysis in Credit Ratings Forecast: A Comparative Study of Prediction Performances. Review of Accounting and Finance, 5(3), 216–227.

Landajo, M., de Andres, J., & Lorca, P. (2007). Robust neural modeling for the cross-sectional analysis of accounting information. European Journal of Operational Research, 177(2), 1232–1252.

Mantas, C. J., Puche, J. M., & Mantas, J. M. (2006). Extraction of similarity based fuzzy rules from artificial neural networks. International Journal of Approximate Reasoning, 43, 202–221.

Mashayekh, S., & Shahrokhi, S. S. (2008). Review predict of earnings forecast by management and influence factors on this forecast. The Iranian Accounting and Auditing Review, 50, 65–82.

Morton, R. M. (1998). Predicting stock returns using alternative time series models of earnings. Journal of Financial Statement Analysis, 3(4, (summer)), 16–26.

Cao, Qing, & Parry, Mark E. (2009). neural network earnings per share forecasting models: A comparison of backward propagation and the genetic algorithm. Decision Support Systems, 47, 32–41.

Richard, R. M. (1977). An examination of the accuracy of the earnings forecasts. Financial Management, 78–84. http://www.jstor.org/stable/i342816.

Thieme, R. J., Song, M., & Calantone, R. J. (2000). Artificial neural network decision support systems for new product development project selection. Journal of Marketing Research, 37(4), 499–507.

Wang, K. J., Chen, J. C., & Lin, Y. S. (2005). A hybrid knowledge discovery model using decision tree and neural network for selecting dispatching rules of a semiconductor final testing factory. Production Planning and Control, 16(7), 665–680.

Zhang, W., & Cao, Q. (2004). Schniederjans. Neural network earnings per share forecasting models: A comparative analysis of alternative methods. Decision Sciences, 35(2), 205–237.

Wu, R. C., Chen, R. S., & Chian, S. S. (2006). Design of a product quality control system based on the use of data mining techniques. IIE Transactions, 38(1), 39–51.

Lu, J., Tokinaga, S., & Ikeda, Y. (2006). Explanatory rule extraction based on the trained neural network and the genetic programming. Journal of the Operations Research Society of Japan, 49(1), 66–82.

Ebrahim Elalfi, A., Haque, R., & Esmel Elalami, M. (2004). Extracting rules from trained neural network using GA for managing E-business. Applied Soft Computing, 4, 65–77.

Khotanzad, A., & Chung, C. (1998). Application of multi-layer perceptron neural networks to vision problems. Neural Computing & Application., 7, 249–259.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Etemadi, H., Ahmadpour, A. & Moshashaei, S.M. Earnings Per Share Forecast Using Extracted Rules from Trained Neural Network by Genetic Algorithm. Comput Econ 46, 55–63 (2015). https://doi.org/10.1007/s10614-014-9455-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-014-9455-6