Abstract

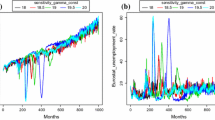

This paper explores the dynamic consequences of variable investment-project size in a global economy consisting of many small open countries that are plagued with domestic credit market frictions. As is customary in the literature, borrowers provide some internal funds, but they also need external funds to implement their investment projects, which are subject to the costly-state-verification problem. Contrary to the literature, the investment-project size increases with the country’s own capital stock. We find that financial market globalization may lead to a process of oscillatory convergence, even in the absence of any exogenous shocks, if the investment-project size is very sensitive to the change in capital stock.

Similar content being viewed by others

Notes

Aghion et al. (2004) also study the role of financial sectors as a source of instability in small open economies. However, fluctuations are driven by external shocks in their model. Other notable works in this line of research include studies by Suarez and Sussman (2007), Kikuchi (2008), Kikuchi and Vachadze (2015) and Kikuchi et al. (2016). Although cycles also emerge in their models, the mechanism that our model relies on to generate cycles is different from theirs.

These 44 countries are the US, Japan, Germany, UK, France, Netherland, Italy, Switzerland, Korea, Sweden, Canada, Finland, Brazil, Australia, Norway, Belgium, South Africa, Spain, Mexico, Turkey, India, Ireland, Taiwan, Austria, Israel, Argentina, New Zealand, Hungary, Denmark, Hong Kong, Malaysia, Chile, Philippines, China, Colombia, Singapore, Thailand, Indonesia, Poland, Portugal, Czech Republic, Greece, Peru and Pakistan.

There are several reasons for working with a small open economy model. First, it is technically more tractable. Second, it is well known that endogenous volatility may arise in Boyd and Smith’s (1997) case due to interest rate movements in the world financial market. Therefore, compared with a two-country case, a small open economy case can help to highlight the mechanism we propose to generate cycles. Third, there are very few, if any, analytical treatments of a small open economy version of Boyd and Smiths (1997) study in the literature. This paper aims to partially fill this gap.

We show that the threshold is smaller than the output elasticity of capital when the production function is in the Cobb–Douglas format.

Some careful readers may notice that this mechanism shares some important features with that in Matsuyama (2007). Specifically, Matsuyama (2007) studies the macroeconomic implications of credit market frictions in a closed economy environment with two heterogeneous investment projects (type-I and type-II projects), which differ in a number of ways. In one case, he assumes that a type-I project produces less physical capital, generates a less pledgeable rate of return and requires less external funding to implement than a type-II project. As a result, credit cycles may appear when a rise in net worth shifts credit to the less productive (type-I) project. In the present paper, whereas type-I projects are based in the poor countries, type-II projects are based in the rich countries. The mechanism we propose to generate cycles can be broadly considered as an open economy application of Matsuyama’s (2007) study.

Based on this assumption, the monitoring cost, \(\gamma (k^{i}_{t})^{\beta }\), is increasing in proportion with the investment project size, \(q(k^{i}_{t})^{\beta }\). When \(\beta = 0\), both investment project size and the monitoring costs are constant independent of \(k^{i}_{t}\) and the environment outlined here collapses to the one in Boyd and Smith (1997).

See Krasa and Villamil (1992) for the case where the intermediary’s incentive is considered.

When \(\beta > \theta \), \(\mu ^{i}_{t}\) decreases with \(k^{i}_{t}\), which implies that borrowers in rich countries are less likely to obtain external funds than those borrowers in poor countries. To view this model implication through the lens of development economics, consider poor countries consisting of mainly traditional light industries, such as textiles that requires relatively small initial start-up funds and rich countries dominated by modern heavy industries, such as steel and electrical equipment that need large initial expenditures.

When \(w_{t} > qk^{\beta }_{t}\), wage income is not fully utilized in producing capital. We can either assume that the unused part of wage income is simply wasted or there exists a default technology that can store the consumption goods from current period to next period of time. The major findings carry over with either assumption.

Since \(\frac{\partial ^{2}\psi (k_{t})}{\partial k^{2}_{t}} = \frac{[(1-\beta )k^{\theta -\beta }_{t} - q(1 - \theta +\beta )](\theta -\beta )k^{\theta -\beta -1}_{t}}{[q-(1-\theta )k^{\theta -\beta }_{t}]^{2}}\frac{k_{t+1}}{k_{t}}\), q cannot be large to ensure \(\psi ^{''}(k_{t}) > 0\).

References

Aghion, P., Banerjee, A., Piketty, T.: Dualism and macroeconomic volatility. Q J Econ 114, 1359–1397 (1999)

Aghion, P., Bacchetta, P., Banerjee, A.: Financial development and the instability of open economies. J Monet Econ 51, 1077–1106 (2004)

Azariadis, C., Smith, B.: Financial intermediation and regime switching in business cycles. Am Econ Rev 88, 516–536 (1998)

Beck, T., Demirguc-Kunt, A., Maksimovic, V.: The influence of financial and legal institutions on firm size. J Bank Finance 30, 2995–3015 (2006)

Boyd, J., Smith, B.: Capital market imperfections, international credit markets, and nonconvergence. J Econ Theory 73, 335–364 (1997)

Galor, O.: Discrete Dynamical System: New York: Springer (2007)

Gertler, M., Rogoff, K.: North-south lending and endogenous domestic capital market inefficiencies. J Monet Econ 26, 245–266 (1990)

Herranz, H., Krasa, S., Villamil, A.: Entrepreneurs, risk aversion and firm dynamics. J Polit Econ 123(5), 1133–1176 (2015)

Kiyotaki, N., Moore, J.: Credit cycles. J Polit Econ 105, 211–248 (1997)

Kikuchi, T.: International asset market, nonconvergence, and endogenous fluctuations. J Econ Theory 139, 310–334 (2008)

Kikuchi, T., Stachurski, J.: Endogenous inequality and fluctuations in a two-country model. J Econ Theory 144, 1560–1571 (2009)

Kikuchi, T., Vachadze, G.: Financial liberalization: poverty or chaos. J Math Econ 59, 1–9 (2015)

Kikuchi, T., Stachurski, J., Vachadze G.: Volatile Capital Flows and Financial Integration: The Role of Idiosyncratic Risk. Working paper series, Lee Kuan Yew School of Public Policy, National University of Singapore (2016)

Krasa, S., Villamil, A.: Monitoring the monitor: an incentive structure for a financial intermediary. J Econ Theory 57, 197–221 (1992)

Matsuyama, K.: Financial market globalization, smmetry-breaking and endogenous inequality of nations. Econometrica 72, 853–884 (2004)

Matsuyama, K.: Credit traps and credit cycles. Am Econ Rev 97, 503–516 (2007)

Matsuyama, K.: The good, the bad and the ugly: an inquiry into the causes and nature of credit cycles. Theor Econ 8, 623–651 (2013)

Sakuragawa, M., Hamada, K.: Capital flight, north-south lending, and stages of economic development. Int Econ Rev 42, 1–24 (2001)

Suarez, J., Sussman, O.: Financial distress, bankruptcy law and the business cycle. Ann Finance 3, 5–35 (2007)

Williamson, S.D.: Costly monitoring, financial intermediation, and equilibrium credit rationing. J Monet Econ 18, 159–179 (1986)

Williamson, S.D.: Costly monitoring, loan contracts, and equilibrium credit rationing. Q J Econ 102, 135–145 (1987)

Author information

Authors and Affiliations

Corresponding author

Additional information

I would like to thank Yong Wang, the participants at the Asian Meeting of Econometrics Society (AMES 2013) at National University of Singapore and the 13th Annual Conference of the Association of Public Economic Theory at Institute of Economics, Academia Sinica, Taiwan for helpful comments and suggestions. Any errors are my own.

Appendix: Proofs of Propositions

Appendix: Proofs of Propositions

Proof of Proposition 2

To prove (i), note that according to (23),

Obviously, \(\psi ^{'}({\hat{k}})|_{k_{t+1} = k_{t}= {\hat{k}}} > 1\) if \({\hat{k}} > (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\) where \({\hat{k}}\) is given by (25). Or equivalently,

and it is easy to see that \({\hat{\beta }} < \theta \) holds. This condition requires the map of (23) cutting (24) from below with a slope bigger than one at \({\hat{k}}\). Now consider the situation when \({\hat{k}} = (\frac{\theta A}{r})^{\frac{1}{1-\theta }}\) holds with \({\hat{k}}\) given by (25). Solving it for r gives

This condition is graphically described by the locus labeled with \(r = {\bar{r}}\) in Fig. 4. Decreasing (increasing) r slightly below (above) \({\bar{r}}\) shifts the locus labeled with \(r = {\bar{r}}\) upward (downward). Note that, when the value of r is equal to \({\bar{r}}\), \({\hat{k}} = {\tilde{k}}\) holds. However, when \(r < {\bar{r}}\), \({\hat{k}} > {\tilde{k}}\) and when \(r > {\bar{r}}\), \({\hat{k}} < {\tilde{k}}\).

Obviously, \(\frac{\partial k_{t+1}}{\partial k_{t}}|_{k_{t+1}=k_{t}} = \psi ^{'}(k_{t})|_{k_{t+1}=k_{t}} =1\) when \(k_{t} = (\frac{q}{1-\beta })^{\frac{1}{\theta - \beta }}\). Substituting \(k_{t} = (\frac{q}{1-\beta })^{\frac{1}{\theta - \beta }}\) into (23) yields:

When \([ \frac{\theta {\bar{z}}(1-\beta )(1-\frac{\gamma }{q{\bar{z}}})^2}{2r(\theta -\beta )}]^{\frac{1}{1-\theta }} = (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\), the locus tangents to the 45 degree line. Solving this equation for r gives:

(the locus associated with \({\underline{r}} = r < {\bar{r}}\) is not shown in Fig. 4). If \(\psi ^{'}({\hat{k}})|_{k_{t+1}=k_{t}={\hat{k}}} > 1\) holds and for any r satisfying \({\underline{r}}< r < {\bar{r}}\), \(\psi (k_{t})\) will cut the 45 degree line at \(k^{l}\) and \({\tilde{k}}\). It is easy to verify that \(\psi ^{''}(k) > 0\). If \(\psi ^{'}(k^{l}) < 1\), \(\psi ^{'}(\frac{q}{1-\beta }) = 1\) and \(\psi ^{'}({\tilde{k}}) > 1\), \(k^{l}< (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }} < {\tilde{k}}\) must hold. Furthermore, \({\tilde{k}}\) is unstable because \(\psi (k_{t})\) cuts the 45 degree line from below at \({\tilde{k}}\) and \(k^{l}\) is stable because \(\psi (k_{t})\) cuts the 45 degree line from above at \(k^{l}\). Furthermore, if \(r < {\bar{r}}\), \({\hat{k}} < k^{h}\) and \({\tilde{k}} < {\hat{k}}\) must be satisfied. It immediately follows that \(k^{l}< (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}< {\tilde{k}}< {\hat{k}} < k^{h}\). Finally, \(k^{h}\) is stable because (24) cuts the 45 degree line form above. When \(r < {\underline{r}}\), the locus is above the one associated with \({\underline{r}} = r\) and hence the economy produces at \({\bar{k}}^{h}\) which is stable and satisfies \({\bar{k}}^{h} > {\hat{k}}\). On the other hand, when \(r > {\bar{r}}\), the locus shifts below the one associated with \(r = {\bar{r}}\). As a result, it cuts the 45 degree line at \({\underline{k}}^{l}\) which is also stable and satisfies \({\underline{k}}^{l} < {\hat{k}}\).

To prove (ii), note that when \(\theta > \beta \ge {\hat{\beta }}\), \({\hat{k}} \le (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\) holds and \(\psi ^{'}({\hat{k}})|_{k_{t+1} = k_{t}={\hat{k}}} \le 1\) follows. Therefore, the map of (23) cuts (24) from below with a slope less than or equal to 1 at \({\hat{k}}\), as shown in Fig. 5. In such case, \({\bar{r}}\) is still equal to \(\frac{\theta A}{{\hat{k}}^{1-\theta }}\). Reducing r shifts the locus with \(r = {\bar{r}}\) upward and the economy produces at steady state \({\bar{k}}^{h}\). \({\bar{k}}^{h}\) is stable and satisfies \({\bar{k}}^{h} > {\hat{k}}\). To the contrary, increasing r shifts this locus downward and the economy produces at steady state \({\underline{k}}^{l}\). \({\underline{k}}^{l}\) is stable and satisfies \({\underline{k}}^{l} < {\hat{k}}\).

For (iii), the proof is evident from inspection of Fig. 6.

To prove (iv), note that

from (i). Since \(q > (1 - \theta )k^{\theta -\beta }_{t}\) and \(\theta < \beta \), \(\frac{\partial k_{t+1}}{\partial k_{t}} < 0\) holds. Therefore, the map of \(k_{t}\) is decreasing with \(k_{t+1}\). Furthermore, as \(k_{t} \rightarrow \infty \), \(k_{t+1} = [\frac{\theta {\bar{z}}(1-\frac{\gamma }{q{\bar{z}}})^2}{2r}]^{\frac{1}{1-\theta }}\) and as \(k_{t} \rightarrow (\frac{1-\theta }{q})^{\frac{1}{\beta -\theta }}\), \(k_{t+1} \rightarrow \infty \) according to (23). Hence it must intersect the 45 degree line only once at \(k^{v}\), which proves the first half of (iv). To prove the second half, note that using Taylor series expansion yields:

where k is the steady state value and

Since \(\beta > \theta \), it follow that \(q - (1-\theta )k^{\theta - \beta } > (\theta - \beta )k^{\theta - \beta }\) holds. Therefore, the absolute value of \(\psi ^{'}(k)\) is smaller than 1. As a result, the unique steady state, \(k^{v}\), is locally stable (see Galor 2007). Obviously, \(k^{v} > {\hat{k}}\) is satisfied. \(\square \)

Proof of Proposition 3

(i) Inspecting (30) gives \(f(0) = 0\) and \(f({\hat{k}}) = {\hat{k}}\). Furthermore, it is easy to verify that

Therefore, when \(0< k^{l} < (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\), \(\frac{\partial k^{h}}{\partial k^{l}} > 0\) whereas when \((\frac{q}{1-\theta })^{\frac{1}{\theta -\beta }}> k^{l} > (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\), \(\frac{\partial k^{h}}{\partial k^{l}} < 0\). The curve of \(k^{h} = f(k^{l})\) is shown in Fig. 8 as locus SS. The sets of \((k^{h}, k^{l})\) that satisfy \(k^{l}< {\hat{k}} < k^{h}\) are shown as the segment of the curve SS with dash in Fig. 8.

Now what remains is to trace out the locus of Eq. (31). According to (31), we obtain

and \(\frac{dk^{h}}{dk^{l}}|_{k^{h} = k^{l}} = -\frac{1-\phi }{\phi }\).

Define \({\underline{k}}\) as \(\frac{dk_{t+1}}{dk_{t}}|_{k_{t} ={\underline{k}}} = 1\) using (21) (see Fig. 2). It follows that \({\underline{k}} = [A\theta (1-\theta )]^{\frac{1}{1-\theta }}\). Obviously, \(\frac{dk^{h}}{dk^{l}} \ge 0\) iff \(k^{h} \in [{\underline{k}}, \infty ]\) and \(k^{l} \in [0, {\underline{k}}]\) or \(k^{h} \in [0, {\underline{k}}]\) and \(k^{l} \in [{\underline{k}}, \infty ]\). Hence the locus defined by (31) has the configuration as locus RR described in Fig. 8. Point B, which is the intersection of the loci SS and RR defined by (30) and (31) respectively, is the steady state of (\(k^{h}\), \(k^{l}\)). Obviously, \(k^{h} > {\hat{k}}\) and \(k^{l} < {\hat{k}}\). The value of \(k^{*}\) satisfies \(k^{l}< (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}< k^{*}< {\hat{k}} < k^{h}\).

(ii) If \(\theta > \beta \ge {\hat{\beta }}\) and each small open economy produces at \(\bar{k^{h}} > {\hat{k}}\), the world economy steady state equilibrium will be determined by (31) and (32). Therefore, \(k^{h} = k^{l} = k^{*} > {\hat{k}}\) must satisfy and then we can use (29) to find out the world interest rate. On the other hand, if the world economy produces at \(\underline{k^{l}} < {\hat{k}}\), the steady state equilibrium is described by (31) and (33). In Fig. 9, (31) is represented as locus RR and (33) is locus NN. To derive point E in this figure, we totally differentiate (33) to obtain:

Let \(\frac{dk^{h}}{dk^{l}} = -1\) (to represent the downward sloping 45 degree line) and assume \(k^{h} = k^{l}\) (the upward sloping and the downward sloping 45 degree lines intersect at point E). Then it is easy to obtain \(k^{h} = k^{l} = (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\) at point E. Furthermore, \((\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }} > k^{*}\) must hold because \({\hat{k}} > k^{h} = k^{l} = k^{*}\) and based on \(\theta > \beta \ge {\hat{\beta }}\), we have \({\hat{k}} \le (\frac{q}{1-\beta })^{\frac{1}{\theta -\beta }}\). Of course, the world interest rate can be found through (29).

(iii) If \(\beta = \theta > {\hat{\beta }}\), the steady state equilibrium of the world economy is determined by (31) and (33) with \(\beta = \theta \). Apparently, all countries have the same steady state capital stock per capita \(k^{*}\) and the world interest rate is given by (28) with \(\beta = \theta \).

(iv) When \(\beta> \theta > {\hat{\beta }}\), all countries produce the same level of k at steady state and hence \(k^{h} = k^{l} = k^{*}\) must satisfy. Likewise, the world economy equilibrium is determined by (31) and (33) under the assumption that \(\beta \) is bigger than \(\theta \). Figure 10 is used to show this equilibrium graphically. It is straightforward to show that \(k^{h} = k^{l} = (\frac{1-\beta }{q})^{\frac{1}{\beta - \theta }}\) at point F. Moreover, \(k^{*} > (\frac{1-\beta }{q})^{\frac{1}{\beta - \theta }}\) must hold in this case because \(k^{v} = k^{*} \ge (\frac{1-\theta }{q})^{\frac{1}{\beta - \theta }} > (\frac{1-\beta }{q})^{\frac{1}{\beta -\theta }}\). To show that the steady state of this world economy is locally stable and is approached cyclically, we need to work with the following two equations:

and

Let \(d_{t} \equiv \frac{k^{h}_{t}}{k^{l}_{t}}\). Then, the above two equations can be rewritten as:

To proceed, we linearize these two equations in a neighborhood of the steady state to obtain:

where \(k^{l}\) and d are the steady state values and J is the Jacobian matrix:

with partial derivatives evaluated at the steady state. Now we display the expressions for these partial derivatives at the steady state in below:

At the (symmetric) steady state, \(d = 1\) and \(k^{l} = k^{*}\). Substituting them into the above expressions gives:

The eigenvalues of the matrix J are given by \(\lambda _{1} = \frac{\partial k^{l}_{t+1}}{\partial k^{l}_{t}}\) and \(\lambda _{2} = \frac{\partial d_{t+1}}{\partial d_{t}}\). It is easy to see that \(\lambda _{1}\) is positive and less than one but \(\lambda _{2}\) is negative (recall that \(\beta > \theta \) and \(k_{t} > (\frac{1-\theta }{q})^{\frac{1}{\beta - \theta }}\)) and less than one in absolute value. Therefore, this dynamical system is locally stable in the neighborhood of the (symmetric) steady state and it is approached oscillatory. \(\square \)

Rights and permissions

About this article

Cite this article

Ho, WH. Financial market globalization, nonconvergence and credit cycles. Ann Finance 13, 153–180 (2017). https://doi.org/10.1007/s10436-017-0293-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-017-0293-0