Abstract

The basic two-noncooperative-equilibrium-point model of Diamond and Dybvig is considered along with the work of Morris and Shin utilizing the possibility of outside noise to select a unique equilibrium point. Both of these approaches are essentially nondynamic. We add an explicit replicator dynamic from evolutionary game theory to provide for a sensitivity analysis that encompasses both models and contains the results of both depending on parameter settings.

Similar content being viewed by others

Notes

The replicator dynamic is equivalent to Bayesian learning from repeated samples (Shalizi 2009), so this formulation captures a wide range of cognitive as well as population-level processes for convergence to equilibria.

The simplification of the utility consists of omitting explicit time-discounting structure which increases the appeal of the narrative particular to bank runs but can be replaced by general conditions on the saturation of a single utility of payouts. The continuous variables removed include amounts of the endowment invested, and amounts withdrawn, which in the original model (Diamond and Dybvig 1983) took binary boundary solutions anyway.

Diamond and Dybvig (1983) characterize the surprise signal that one must withdraw early as “private information” to justify the lack of Arrow–Debreu securities within a General Equilibrium framework. The model interpretation extends, however, to many other reasons for incomplete contracts.

The more general case, maximizing ex ante expected utility for agents who are required to deposit, maximizes the function

$$\begin{aligned} \left\langle \theta \right\rangle u \! \left( r \right) + \left( 1 - \theta \right) u \! \left( \frac{ \left( 1 - \left\langle \theta \right\rangle r \right) R }{ \left( 1 - \left\langle \theta \right\rangle \right) } \right) \end{aligned}$$over \(r\). The result is the condition reported in Diamond and Dybvig (1983), Diamond (2007), that

$$\begin{aligned} u^{\prime } \! \left( r \right) = R u^{\prime } \! \left( \frac{ \left( 1 - \left\langle \theta \right\rangle r \right) R }{ \left( 1 - \left\langle \theta \right\rangle \right) } \right) \!. \end{aligned}$$In Morris and Shin (1998) imperfect observation is discussed in a wider context of formalizing information and beliefs. Here our concern is with the mechanistic consequences of dispersing population responses, which may be given comparable analyses in many contexts of inference, reinforcement learning, or population updating.

Here for brevity we pass over how the negotiation is performed. Because a unique equilibrium value will be computable for the cases we consider, at the equilibrium it will be sufficient for all agents to declare it independently. In a larger discussion of convergence toward equilibrium, many mechanisms could be specified, along lines similar to those we describe below for the selection of threshold strategies, and the convergence of these mechanisms to deposit- or no-deposit-equilibria could be pursued in a more elaborate dynamical model.

Because the replicator dynamic with utility as fitness is equivalent to Bayesian updating (Shalizi 2009), the dynamics described here apply equally well to reinforcement learning by Bayesian updating or to literal population-dynamic processes.

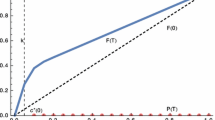

We use the value \(r = 1.2\), which is larger than the equilibrium payout value \(r \approx 1.1\), because its interesting transitions occur in the center of the \(\theta \) range where they are easier to view in graphs. We also use a distribution \({\rho }^{*} \! \left( {\theta }^{*} \right) \) in the first two panels of Fig. 3, to illustrate population structure and the qualitative behavior of relative utility, which is 10x wider than the distribution used to identify the replicator-dynamic velocity and to closely approximate the Nash fixed points in the third panel and later figures.

This restriction on \(u\) says that the utility increases more slowly than the logarithm on \(1 < r < R\). Combining this requirement with a lower bound \(u^{\prime } \! \left( 0 \right) > -\infty \) motivates the form of utility shown in Fig. 2. In the original model of Diamond and Dybvig (1983) the same effect was achieved by discounting period-two payouts in the utility relative to period-one payouts, but apart from some narrative appeal to the case of bank runs, the method used is not critical to the result. The reason such a strong requirement exists on utility, however, is that early withdrawal reduces period-two payout proportionally, to \(\left( 1 - f_{\theta } r \right) R\), amplifying the second marginal utility in Eq. (14) by \(R\).

References

Diamond, D.W.: Banks and liquidity creation: a simple exposition of the Diamond–Dybvig model. Econ Q 93, 189 (2007)

Diamond, D.W., Dybvig, P.H.: Bank runs, deposit insurance, and liquidity. J Pol Econ 91, 401–419 (1983)

Freidlin, M.I., Wentzell, A.D.: Random Perturbations in Dynamical Systems, 2nd edn. New York: Springer (1998)

Fudenberg, D., Maskin, E.: The folk theorem in repeated games with discounting or with incomplete information. Econometrica 54, 533–554 (1991)

Fudenberg, D., Tirole, J.: Game Theory. MIT Press, Cambridge, MA (1991)

Hofbauer, J., Sigmund, K.: Evolutionary Games and Population Dynamics. New York: Cambridge University Press (1998)

Hofbauer, J., Sigmund, K.: Evolutionary game dynamics. Bull Am Math Soc 40, 479–519 (2003)

Kajii, A., Morris, S.: The robustness of equilibria to incomplete information. Econometrica 65, 1283–1309 (1997)

Kandori, M., Mailath, G.J., Rob, R.: Learning, mutation, and long run equilibria in games. Econometrica 61, 29–56 (1993)

Kindleberger, C.: Manias, Panics, and Crashes: A History of Financial Crises. New York: Wiley (1978)

MacKay, C.: Extraordinary Population Delusions and the Madness of Crowds. New York: Harmony Books [with a foreword by Andrew Tobias (1841)] (1980)

Maier, R.S., Stein, D.L.: Escape problem for irreversible systems. Phys Rev E 48, 931–938 (1993)

Maynard Smith, J., Price, G.R.: The logic of animal conflict. Nature 246, 15–18 (1973)

Minsky, H.: Stabilizing an Unstable Economy. New York: McGraw Hill (2008)

Morris, S., Shin, H.S.: Unique equilibrium in a model fo self-fulfilling currency attacks. Am Econ Rev 88, 587–597 (1998)

Rubinstein, A., Wolinsky, A.: Remarks on infinitely repeated extensive-form games. Games Econ Behav 9, 110–115 (1995)

Shalizi, C.R.: Dynamics of bayesian updating with dependent data and misspecified models. Electron J Stat 3, 1039–1074 (2009)

Smith, E.: Large-deviation principles, stochastic effective actions, path entropies, and the structure and meaning of thermodynamic descriptions. Rep Prog Phys 74, 046601 (2011)

Smith, E., Krishnamurthy, S.: Symmetry and collective fluctuations in evolutionary games. Santa Fe Institute Working paper # 11-03-010 (2011). http://www.santafe.edu/research/working-papers/abstract/d49ae327d6f56ce1d45bf5f012b13915/

Smith, E., Shubik, M.: Endogenizing the provision of money: costs of commodity and fiat monies in relation to the valuation of trade. J Math Econ 47, 508–530 (2011)

Wright, S.: Evolution and the Genetics of Populations: Genetics and Biometric Foundations, vol. 1. Chicago, IL: University of Chicago Press (1984a)

Wright, S.: Evolution and the Genetics of Populations: Genetics and Biometric Foundations, vol. 2 (The theory of gene frequencies). Chicago, IL: University of Chicago Press (1984b)

Wright, S.: Evolution and the Genetics of Populations: Genetics and Biometric Foundations, vol. 3 (Experimental results and evolutionary deductions). Chicago, IL: University of Chicago Press (1984c)

Wright, S.: Evolution and the Genetics of Populations: Genetics and Biometric Foundations, vol. 4 (Variability within and among natural populations). Chicago, IL: University of Chicago Press (1984d)

Young, H.P.: The evolution of conventions. Econometrica 61, 57–84 (1993)

Young, H.P.: The economics of conventions. J Econ Perspect 10, 105–122 (1996)

Young, H.P.: Conventional contracts. Rev Econ Stud 65, 776–792 (1998)

Young, H.P., Burke, M.A.: Competition and custom in economic contracts: a case study of Illinois agriculture. Am Econ Rev 91, 559–573 (2001)

Acknowledgments

D.E.S. thanks Insight Venture Partners for support of this work.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of existence of interior threshold strategies

Lemma

If the utility satisfies \(r u^{\prime } \! \left( r \right) \) monotone decreasing on \(r \ge 1\), then the expected utility (11) along the subgame-perfect \(\left( r , {\theta }^{*} \right) \) contour has an interior maximum.

Proof

Existence follows from the signs of derivatives of \(\left\langle u \right\rangle \) at \(r = 1\) and \(r = R\).

For \(r = 1\), there is never an incentive to run, while for all \(\theta < 1\) there is an incentive to wait, so the subgame-perfect \({\left. {\theta }^{*} \right| }_{r \rightarrow 1} > 1\) and \(f_{\theta } = \theta \) everywhere. Then the expected utility becomes

and the marginal expected utility may be computed and shown to be

As long as \(R > 1\) and \(r u^{\prime } \! \left( r \right) \) is monotone decreasing on \(r \ge 1\), this quantity is always positive.Footnote 10

Conversely, if \(r = R\), The payout \(R \left( 1 - f_{\theta } r \right) / \left( 1 - f_{\theta } \right) < R\) for all \(\theta \), so there is never an incentive to wait, making \({\left. {\theta }^{*} \right| }_{r \rightarrow R} < 0\) and \(f_{\theta } \rightarrow 1\) everywhere. The utility therefore becomes

and the marginal expected utility becomes

For any concave utility, \(\left[ u \! \left( r \right) - u \! \left( 0 \right) \right] - r u^{\prime } \! \left( r \right) > 0\), so the derivative (16) is negative and \(\left\langle u \right\rangle \) has an interior maximum.

Appendix 2: Efficiency of threshold equilibria in relation to competitive equilibria

To illustrate the inefficiency of the threshold equilibria without reference to the detailed form of the utility, we consider the risk-minimizing equilibrium. Readers of Diamond (2007) will recognize that the competitive equilibrium for utilities of our form with \(\alpha = 1\) are recovered in the following results by replacing \(R \rightarrow \sqrt{R}\), and the same efficiency arguments go through.

In the risk-minimizing competitive equilibrium of Sect. 1.2, Type-2 agents never ran and the payout to those waiting until period-two to withdraw, in any population state \(\theta \), was

In contrast, for the threshold strategy used here, the inflection point of the function \(f^{\left( {\theta }^{*} \right) }_{\theta }\) occurs at \(\theta = {\theta }^{*}\), where \(f = \left( 1 + {\theta }^{*} \right) / 2\) (shown as the line with slope \(1/2\) in the left panel of Fig. 3). When this inflection point closely approximates the subgame-perfect threshold \({\theta }^{*}\), as it does in the numerical examples, the payout to agents who withdraw early is

For the sake of comparison, considering a narrow distribution where \({\theta }^{*} \approx \left\langle \theta \right\rangle \approx \theta \) for almost-all samples \(\theta \), the threshold equilibrium is less efficient than the competitive equilibrium by

One half of Type-2 agents withdraw “needlessly” to implement the mechanism of regulation, reducing their own payouts because they decrease the total production relative to a competitive equilibrium.

Rights and permissions

About this article

Cite this article

Smith, E., Shubik, M. Runs, panics and bubbles: Diamond–Dybvig and Morris–Shin reconsidered. Ann Finance 10, 603–622 (2014). https://doi.org/10.1007/s10436-013-0231-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-013-0231-8