Abstract

This paper investigates the impact of exchange rate volatility on the trade flows among ASEAN-4 countries (Indonesia, Malaysia, Singapore and Thailand) as well as to their five main trading partners. External volatility is included in the models to study the ‘third country’ effect on the trade flows. We employ annual import and export data over the period of 1980–2012. The results from the bounds testing approach to cointegration and error-correction model reveal that the real exchange rate volatility does play a significant role in 15 export and four import models in short-run and long-run. Moreover, in both import and export models, the effects of exchange rate volatility on trade flows are negative rather than positive. Finally, the effects of volatility from the ASEAN-4’s currency/yuan rate dominate the third country effect on the ASEAN-4’s trade.

Similar content being viewed by others

Notes

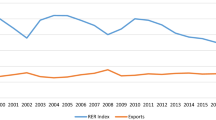

Sources: Association of South East Asian Nations, ASEAN Statistical Yearbook 2013, Table V.3 and V.4, page 58.

However there are also several studies that employed industry trade data to estimate the effect of exchange rate fluctuations on trade flows. These studies either investigate currency depreciation effect on trade flows (Soleymani and Chua 2014b) or they estimated the effect of exchange rate fluctuations (volatility or currency depreciation) on bilateral trade between the US and one of these four ASEAN countries (Bahmani-Oskooee and Satawatananon 2012; Bahmani-Oskooee and Harvey 2014; Bahmani-Oskooee and Harvey 2015).

Data for Hong Kong started in 1981.

The significance of the normalized long run coefficients is evaluated by the t-statistics which are calculated from their standard errors. However, in Microfit statistical package, the standard errors of the normalized coefficients are computed using the nonlinear least square technique and the Delta method (Bahmani-Oskooee and Fariditavana 2015).

The ARDL procedure is valid when all the variables in the model are integrated of order zero, I(0) or order one, I(1). In order to confirm to this condition, Augmented Dickey-Fuller (ADF) test will be conducted on all the variables to eliminate the possibility of I(2) or higher.

Except for Singapore with her seven major trading partners.

The Augmented Dickey-Fuller (ADF) test is conducted on first differences of all variables to eliminate the possibility that any of the variables is I(2) or higher. In both import and export models, ADF test results show that all test statistics are below the critical values (at least 10 % levels of significance) without or with trend. The ADF test results are available upon request.

Given the relatively small sample size in this study, we used Narayan’s (2005) specific calculation of critical values for small sample size.

References

Asseery A, Peel DA (1991) The effects of exchange rate volatility on exports: some new estimates. Econ Lett 37(2):173–177

Baak SJ, Al-Mahmood MA, Vixathep S (2007) Exchange rate volatility and exports from East Asian countries to Japan and the USA. Appl Econ 39(8):947–959

Baek J (2014) Exchange rate effects on Korea-U.S. bilateral trade: a new look. Res Econ 68(3):214–221

Bahmani-Oskooee M, Fariditavana H (2015) Nonlinear ARDL approach, asymmetric effects and the J-curve. J Econ Stud 42(3):519–530

Bahmani-Oskooee M, Gelan A (2006) Black market exchange rate and the productivity bias hypothesis. Econ Lett 91(2):243–249

Bahmani-Oskooee M, Harvey H (2014) US-Indonesia trade at commodity level and the role of the exchange rate. Appl Econ 46(18):2154–2166

Bahmani-Oskooee M, Harvey H (2015) Exchange rate sensitivity of the USA-Singapore trade flows: evidence from industry data. Int J Trade Glob Mark 8(2):152–179

Bahmani-Oskooee M, Hegerty SW (2007) Exchange rate volatility and trade flows: a review article. J Econ Stud 34(3):211–255

Bahmani-Oskooee M, Hegerty SW (2009) The effects of exchange-rate volatility on commodity trade between the United States and Mexico. South Econ J 76:1019–1044

Bahmani-Oskooee M, Satawatananon K (2012) The impact of exchange rate volatility on commodity trade between the US and Thailand. Int Rev Appl Econ 26(4):515–532

Bahmani-Oskooee M, Xu J (2012) Impact of exchange rate volatility on commodity trade between US and China: is there a third country effect. J Econ Financ 36(3):555–586

Bahmani-Oskooee M, Hegerty SW, Xu J (2013) Exchange rate volatility and US-Hong Kong industry trade: is there evidence of a ‘third country’ effect? Appl Econ 45(18):2629–2651

Chit MM (2008) Exchange rate volatility and exports: evidence from the ASEAN-China Free Trade Area. J Chin Econ Bus Stud 6(3):261–277

Chit MM, Judge A (2011) Non‐linear effect of exchange rate volatility on exports: the role of financial sector development in emerging East Asian economies. Int Rev Appl Econ 25(1):107–119

Chit MM, Rizov M, Willenbockel D (2010) Exchange rate volatility and exports: new empirical evidence from the emerging East Asian Economies. World Econ 33(2):239–263

Choudhry T, Hassan SS, Papadimitriou FI (2014) UK imports, third country effect and the global financial crisis: evidence from the asymmetric ARDL method. Int Rev Financ Anal 32:199–208

Côté A (1994) Exchange rate volatility and trade. Bank of Canada

Curran L, Zignago S (2012) Trade in East Asia in ASEAN+3: Structure and dynamics of intermediates and final-goods trading activity by technology. Asia Pac Bus Rev 18(3):373–389

Cushman D (1986) Has exchange risk depressed international trade? The impact of third-country exchange risk. J Int Money Financ 5(3):361–379

Fang W, Lai Y, Miller SM (2009) Does exchange rate risk affect exports asymmetrically? Asian evidence. J Int Money Financ 28(2):215–239

Grier KB, Smallwood AD (2007) Uncertainty and export performance: evidence from 18 countries. J Money Credit Bank 39(4):965–979

Halicioglu F (2007) The J-curve dynamics of Turkish bilateral trade: a cointegration approach. J Econ Stud 34(2):103–119

Hall S, Hondroyiannis G, Swamy PAVB, Tavlas G, Ulan M (2010) Exchange-rate volatility and export performance: do emerging market economies resemble industrial countries or other developing countries? Econ Model 27(6):1514–1521

Hayakawa K, Kimura F (2009) The effect of exchange rate volatility on international trade in East Asia. J Jpn Int Econ 23(4):395–406

Hudson A, Straathof B (2010) The declining impact of exchange rate volatility on trade. De Economist 158(4):361–372

Jantarakolica T, Chalermsook P (2012) Thai export under exchange rate volatility: a case study of textile and garment products. Procedia Soc Behav Sci 40:751–755

Kremers JJ, Ericsson NR, Dolado JJ (1992) The power of cointegration tests. Oxf Bull Econ Stat 54(3):325–348

McKenzie MD (1999) The impact of exchange rate volatility on international trade flows. J Econ Surv 13(1):71–106

Mohammadi H, Cak M, Cak D (2008) Wagner’s hypothesis: new evidence from Turkey using the bounds testing approach. J Econ Stud 35(1):94–106

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990

Naseem NAM, Tan HB, Hamizah MS (2009) Exchange rate misalignment, volatility and import flows in Malaysia. Int J Econ Manag 3(1):130–150

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Qian Y, Varangis P (1994) Does exchange rate volatility hinder export growth? Empir Econ 19(3):371–396

Soleymani A, Chua SY (2014a) Effect of exchange rate volatility on industry trade flows between Malaysia and China. J Int Trade Econ Dev 23(5):626–655

Soleymani A, Chua SY (2014b) How responsive are trade flows between Malaysia and China to the exchange rate? Evidence from industry data. Int Rev Appl Econ 28(2):191–209

Tang HC (2011) Intra-asia exchange rate volatility and intra-asia trade: evidence by type of goods, paper number 90. Asian Development Bank

Tenreyro S (2007) On the trade impact of nominal exchange rate volatility. J Dev Econ 82(2):485–508

Thorbecke W (2008) The effect of exchange rate volatility on fragmentation in East Asia: evidence from the electronics industry. J Jpn Int Econ 22(4):535–544

Thursby JG, Thursby MC (1987) Bilateral trade flows, the Linder hypothesis, and exchange risk. Rev Econ Stat 69(3):488–495

Tuck CT (2007) Money demand function for Southeast Asian countries: an empirical view from expenditure components. J Econ Stud 34(6):476–496

Wong KN, Tang TC (2008) The effects of exchange rate variability on Malaysia’s disaggregated electrical exports. J Econ Stud 35(2):154–169

Wong KN, Tang TC (2011) Exchange rate variability and the export demand for Malaysia’s semiconductors: an empirical study. Appl Econ 43(6):695–706

Wong YS, Ho CM, Dollery B (2012) Impact of exchange rate volatility on import flows: the case of Malaysia and the United States. Appl Financ Econ 22(24):2027–2034

Acknowledgments

The authors acknowledge the funding by Universiti Sains Malaysia, Short Term Grant (1001/PSOCIAL/6313020). The usual disclaimer applies. Any remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Data definition and sources

Annual data over the period 1980–2012 were used in the analysis. The data were obtained from the following sources:

-

a)

World Bank.

-

b)

International Monetary Fund (IMF), International Financial Statistics.

-

c)

International Monetary Fund (IMF), Direction of Trade Statistics.

1.2 Variables

- X ij :

-

is the value of export of country j (ASEAN-4) to trading partner i (in US dollar), from source (c).

- M ij :

-

is the value of import of country j (ASEAN-4) from trading partner i (in US dollar), from source (c).

- LnY j :

-

real GDP of country j (ASEAN-4), from source (a)

- LnY i :

-

real GDP of trading partner i, from source (a)

- REX ij :

-

Real bilateral exchange rate defined as ((P j * NEX ij )/P i , where NEX is the nominal bilateral exchange rate (end of period) defined as the number of partner i’s currency and per country j’s currency (from source (b)). P i is the trading partner i’s price level measured by CPI (from source (b)), and P j is the country j’s price level, also measured by CPI, from source (b).

- VOL ij :

-

Variability measure of real bilateral exchange rate of country j’s currency/trading partner i’s currency. For each year we define it as the standard deviation of 12 monthly REX ij within that year. Monthly CPI data and nominal exchange rate data come from source (b).

- VOL Cj :

-

Variability measure of real bilateral exchange rate of country j’s currency/yuan. For each year we define it as the standard deviation of 12 monthly real bilateral of REX Cj rate within that year. Monthly CPI data and nominal exchange rate data come from source (b).

- VOL USj :

-

Variability measure of real bilateral exchange rate of country j’s currency/US dollar. For each year we define it as the standard deviation of 12 monthly real bilateral of REX USj rate within that year. Monthly CPI data and nominal exchange rate data come from source (b).

Rights and permissions

About this article

Cite this article

Soleymani, A., Chua, S.Y. & Hamat, A.F.C. Exchange rate volatility and ASEAN-4’s trade flows: is there a third country effect?. Int Econ Econ Policy 14, 91–117 (2017). https://doi.org/10.1007/s10368-015-0328-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-015-0328-9