Abstract

In this paper an optimization based decision support model for determining diesel electric machinery system configuration in conceptual ship design is presented. Load distribution on the engines is considered in the model to ensure that required demand is met with sufficient power supply for all future operational states. A method for fuel consumption calculation is presented, based on determining optimal load distribution amongst the engines related to each engines generalized specific fuel consumption curve. Total fuel costs and appropriate NOX taxes are calculated based on the ship’s future operational profiles. A case study is presented to exemplify the use of the model. Results show that the model might be used to obtain valuable insight to expected operational costs and decision support for selecting machinery system configuration.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

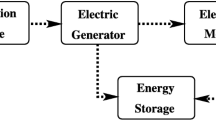

During the last decade there has been an increasing trend towards electrical propulsion of ships, especially for ship types exposed to large variations in power demand during operation. Optimization methods have been widely used in the modeling and control of such systems, e.g. [1, 2], but only a few optimization studies are seen where the engine selection during design phase is the main focus [3–6]. In this work we propose an optimization model for selecting engine configuration for a diesel electric (DE) machinery system in conceptual design of ship building. With engine configuration we denote the engine models and number of engines in the machinery.

DE systems are complex systems, including a number of power generators and components such as switchboards, transformers, frequency converters and electrical motors. The set of feasible solutions is limited by physical, technical, economic and regulatory restrictions. Since there are a large number of possible machinery configurations, we believe an optimization model can be beneficial as decision support to select the optimal one.

Several aspects must be considered when designing the machinery, such as power demands, flexibility, safety and investment and operational costs. Since the installation of a machinery system is normally a onetime event it must provide for the ship’s total demand for propulsion and services over the ship’s lifetime, including steering gear, deck machinery, navigation and communication equipment, hotel load, cargo support and mission requirements [7].

DE machinery is typically considered for ship types exposed to high load variations, such as offshore supply vessels, cruise ships, dynamic positioning drilling vessels, thruster assisted moored floating production facilities, pipe layers, icebreakers, and war ships [8]. With DE machinery an appropriate number of engines can usually be running on loads within the engine’s optimum energy efficiency points, in order to minimize fuel consumption [9]. In addition, DE machinery enables a better hydrodynamic efficiency due to a FP propeller operated by a variable speed drive, higher reliability due to the increased redundancy of multiple engines, and improved space utilization. The drawback is the conversion losses, that can increase the fuel consumption about 10 % compared to a diesel-mechanical solution with the same engine configuration and load. Recently, electric propulsion driven by natural gas engines has also become an alternative, and is especially relevant in emission control areas. The drawbacks of this solution are the current state of LNG infrastructure, the increased volume of fuel tanks, as well as the slower dynamic response (primarily dual-fuel engines and low pressure gas engines) in complex offshore operations. The latter is particularly a problem in low load situations, which implies that taking real operating profiles into account is also important for gas electric machinery system configuration. However, in the remainder of this paper, only DE machinery systems will be considered.

Components to consider when designing machinery systems are investment costs and operational costs, such as fuel costs, manning hours, and maintenance and repair costs. Depending on ship type and sailing areas the operational costs may also include environmental taxes for example on NOX when operating in Norwegian waters [10].

International and national incentives and regulations are enforced to encourage reduction of emission to air from ships. The International Maritime Organization’s (IMO) regulations for SOX Emission Control Areas (SECA) impose an upper limit on the sulphur content of the fuel [11]. With respect to this the fuel type burned must be considered. Reducing CO2 emissions to air can be achieved by reducing fuel consumption [12, 13]. To reduce NOX emissions all engines in newbuilts must comply with a maximum allowable NOX emission limit given by regulation 13 of MARPOL annex VI and be issued an Engine International Air Pollution Prevention (EIAPP)-certification [14]. This regulation will be strengthened in 2016.

Other factors of concern when selecting engines are weight and size, ship owner’s previous knowledge with the system and component manufacturers, need for training of crew, high speed, and good maneuverability and minimum loss of cargo space [15]. The design of a new machinery system is typically done by considering a traditional concept as a base and by careful studies of the operational profile of the ship and the available machinery options.

The aim of this paper is to present an optimization model for the design configuration of complex DE machinery systems that explicitly takes the ship´s lifecycle operational profile into account. Meeting power demands in all operational states and maintaining available power for safety concerns are main constraints, whereas minimizing the net present value of investment and operational costs over the ship’s lifetime is the main objective. The operational costs considered are fuel costs and NOX taxes. To include environmental concerns on SO2 we only consider fuel types allowed by regulations [14]. The proposed model is not ship type dependent and can be used in conceptual design of any ship type where DE propulsion is considered. We consider a library of existing and unique engine models for this selection. Data in this library is taken from open sources and all engines evaluated have been issued an EIAPP certification. We investigate the engines’ specific fuel consumption trend to identify a method to calculate and thereafter optimize engine loads and hence fuel consumption. We carry out a case study on an anchor handling and tug supply ship to exemplify the model.

The remaining part of the paper is organized as follows: mathematical modeling assumptions and definitions are discussed in Sect. 2, while Sect. 3 presents the optimization model for cost-effective DE machinery configuration. A case study to illustrate the use of the model is presented in Sect. 4, whereas conclusive remarks are given in Sect. 5.

2 Modeling assumptions and definitions

In this section we present assumptions and definitions to the mathematical optimization model formulation and methods to measure the four key performance factors of our cost minimizing objective. These are investment costs, fuel costs, NOX emission taxes and area restrictions in the machinery room. Section 2.1 presents the ship’s operational profiles, while area restrictions are discussed in Sect. 2.2. Section 2.3 describes a method for calculating an upper limit on the number of engines to consider when evaluating a homogeneous configuration, i.e. where all engines are of the same engine model. Fuel costs and NOX taxes are defined in Sects. 2.4 and 2.5, respectively.

2.1 Operational profiles

A ship’s lifetime can be defined as a set of operational profiles, where an operational profile can be defined as a set of operational states, for example as transit, loading and stand-by, which are typical operational states for an offshore supply vessel [2, 16]. Each operational state is defined by a power demand and duration. Since we evaluate fuel costs and NOX emission taxes over the ship’s lifetime, all future operational profiles and states must be considered. Depending on type of ship, ship owner’s business strategy and the market situation there can be large variations in operational profiles over this time. In this paper, we assume that the ship’s operations over its lifetime are known or can be estimated reasonably well.

In the following, we associate to a time period t an operational profile, and define T to represent the set of time periods. Further, let the different operational states the ship can be engaged in be represented by the set O indexed by a single index o. For each time period t the ship can undertake a subset of operational states O t , each described by the time in the state, T ot and power demand, P D ot . Figure 1 illustrates the life time, time period and operational state structure. Time periods shown are from \( t = 1, \ldots , m \) and operational states from \( o = 1, \ldots ,n \). The bar chart represents the time and power demands for each operational state in time period T 1, for example is the power demand 2,500 kW in time period T 1 and operational state O 1, named Transit.

The power demand, \( P_{ot}^{D} \), is defined as the power required from the engines. This means that any efficiency losses from power transfer, e.g. from the shaft, propeller or hull, are already taken into account. This applies also to the sea margin, which is used by ship designers, builders and owners to represent an added margin when estimating speed-power relationship.

2.2 Area restrictions

We assume the design of the hull is known, and a given area is available for engines in the machinery room. Since we consider the conceptual phase of ship design we assume that this area restriction can be exceeded, within limitations, if seen cost beneficial. Let the parameter A U represent the initial area designated for engines in the machinery room. This area can be exceeded up to a maximum area violation represented by parameter \( A^{V} \). Violation of the area constraint causes a penalty cost proportional to the lost space. This cost can be attributed to the lost opportunity cost of reduced cargo capacity, and/or the cost of machinery space redesign.

2.3 Configurations

Investigations of existing DE machinery systems on offshore ships show systems configured by several engines, but typically one, sometimes two different unique engine models, and where all engines are made by the same manufacturer [17, 18]. A single engine manufacturer is an advantage regarding complexity and diversity of subsystems, and might also have a positive effect on reduced investment and maintenance costs.

In a DE machinery system the power generated by an engine can be utilized by any consumer when the engines are operating on the same power grid. For this to be a reality the bus ties used to separate the power grids need to be open. We consider the bus ties open, which allows us to reduce the physical component connection logic concerning power transfer from producer to consumer that for example appears in a conventional direct driven machinery system with shaft generator and auxiliary engines.

Based on the area restrictions (including maximum allowed violation) in the machinery room and the operational power demands we can calculate an upper limit on how many engines of each engine model there will be necessary to consider installed in the same configuration. This number will be needed in the mathematical model definition in Sect. 3.1.1.

Let M represent the set of engine manufacturers to choose from. Let the set E represent unique engine models and the subsets E m be the set of engine models produced by manufacturer m. To enable the possibility of installing several engines of the same unique engine model e we introduce the subsets J e . The cardinality of this subset represents an upper limit on the number of engines of model e that can be selected. For each engine model e we use Eq. 1 to find the size of the set,

where A e is the occupied area, A V is the maximum area violation, and \( P_{e}^{R} \) the rated power of each engine model e.

The first term in Eq. 1 limits the number of engines by area restrictions, while the second term is based on the class requirements for DP redundancy, allowing one engine to malfunction in the most demanding operational state. The parameter representing occupied area per engine should include a factor accounting for additional required space around engines (for accessibility, pipe connections, etc.). If the two terms in Eq. 1 differ in calculated value the minimum of the two define the size of subset J e .

2.4 Fuel costs

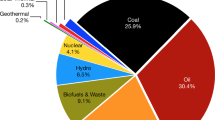

In order to calculate the net present value of the fuel costs over the ship’s lifetime, we need to consider the operation of each engine, referring to the load on each engine during each operational state. We further refer to load distribution as the scheme for how each engine in the configuration is loaded in order to satisfy the power demand of the given operational state. We have studied a collection of more than one hundred engines in the power range of 400–11,600 kW to determine a method for load distribution, and hence for fuel consumption calculation. The data was taken from open sources and all engines have been issued EIAPP certification, based on appropriate test cycle [11]. The EIAPP data includes rated power, manufacturer, and fuel type during testing, specific fuel consumption (sfoc) and specific NOX emissions (snox).

Fuel consumption can be presented as a function of the engine load. The engine load and sfoc are assumed constant within one operational state. For an engine of model e in operational state o of time period t these are defined by \( \beta_{eot} \) and \( s_{eot}^{SFOC} \), respectively. Let f eot be the total fuel consumption of one engine of model e with rated power \( P_{e}^{R} \), in operational state o in time period t calculated as follows:

The engine’s sfoc is a function of the load and typically given by the generalized Eq. 3

where parameters \( A_{e} , B_{e} , C_{e} \) and D e represent engine specific curve constants.

Two examples illustrating the relation between sfoc and the engine load are presented in Fig. 2, where the solid curves illustrate the sfoc curves for two diesel engines of rated power 455 and 645 kW, respectively. As can be seen, engine operations on low loads usually result in higher sfoc than operations within the engine’s optimal operating interval, which typically is between 70 and 90 % loads.

When combining Eqs. 2 and 3 we see that the fuel consumption, f eot , will be in the power of four with respect to the engine load, β eot . For the following we refer to the multiplication of s SFOC eot and β eot from Eq. 2 as the specific fuel oil performance (sfop). In Fig. 2. The sfop curves for the two diesel engines are given by dotted lines. Both curves look close to linear. If one interprets the sfop curve as linear the fuel consumption expression can be simplified and the mathematical formulation linearized.

The forms of the sfoc and sfop curves are typical for most engines. We grouped the investigated engines based on their rated power and group intervals of 1,000 kW. For each group we calculated the average sfoc and sfop curves, and a linear approximation of the average sfop curve. Comparisons to the unique engine specific curves showed that for power ranges over 60 % the linear approximated average sfop curve was off with −1.75 to 0.7 %. For loads less than 60 % it showed that the linear approximated average sfop curve underestimated the engine specific curves from 2 % to as much as 30 %.

It was confirmed that the most severe errors were located at the same low loads after we calculated and studied a linear approximation for each unique engine separately. One of the single best estimates was found for a 645 kW engine, see left chart of Fig. 3. The worst estimation, an underestimation of 44 %, was found for a 455 kW engine, see right chart of Fig. 3. The error is presented on the right axis and with dotted curve. Be aware that the axis values are not the same between the two figures.

A linear approximation would be sufficient with little or no low load operations. However, low load operations are common, and we thus need a better approximation to avoid a too low fuel cost estimate. Thus, to improve the accuracy we approximate the engine specific sfop by piecewise linear functions. This can be done since Eq. 2 satisfies the separable function requirement of being expressed as the sum of functions of a single value [19]. Here each term is a function of the engine load. Our problem is not convex and to obtain global and not only local optimum a special ordered set of type 2 (sos2) is used. The sos2 method introduces a set W of weight variables which can take on a value between zero and one. The sum of these variables must be exactly one. For each weight variable there is a corresponding engine load and sfop value. In Fig. 4 these values are represented by γ i and \( S_{i}^{F} \), where γ i represent the load, while S F i represent the sfop value respectively. With the sos2 method at most two weight variables can be non-zero and these two must be adjacent. These variables represent the distance between the weights’ corresponding constant values and the linear approximated values of the engine load and sfop between these two points.

The estimation error of the sfop, will depend on the number of weights in the grid. How refined the grid should be depends on the original sfop curve of each individual engine. The dotted line in Fig. 4 illustrates an underestimation from the generalized curve and the sfop value found using the sos2 method.

We have now defined how to estimate the specific fuel performance for an engine depending on the engine load, and presented a formula for fuel consumption calculation. Fuel costs can be found by multiplying the fuel consumption with the fuel price. The fuel price is here assumed known for each time period and operational state considered. Furthermore, the fuel price is area dependent since SECA approved fuel types are distillates and more expensive than fuel normally used outside of SECAs. Thus, if an operational state is executed both in and outside of a SECA we split the state in two. For example, if the operational state Transit is undertaken in both areas we define the two states Transit and Transit SECA, both with the same power demand but with area appropriate time. This enables us to consider fuel switch between inside and outside a SECA, which is relevant since fuel types for operations inside SECA are restricted by the upper sulphur content cap [14]. Low sulphur content fuel types are generally higher priced than non-distilled fuel types. A fuel switch can hence be cost beneficial. To calculate net present values we use an annual discount rate to decide the fuel cost of future operations.

2.5 NOX emission taxes

Regional, national and operational dependent NOX taxes can add to the operational costs of a ship. In Norwegian waters there is an NOX tax of approximately 965 USD per ton emitted. Whether the NOX tax applies depends on ship type, the origin, transition and destination ports, and type of operational state [10].

There is a strong connection between the temperature in the engine, the fuel/air ratio and the NOX emission, hence, the emitted NOX is typically calculated as a function of the peak combustion temperatures and oxygen concentration or just air/fuel ratio dependent [20–22]. The Norwegian Maritime Authority gives two alternatives for NOX tax calculations, both based on specific NOX equivalents (g NOX/g burned fuel). The first method for deciding the NOX equivalent is by the EIAPP certificate and NOX Technical File of the engine, whereas the second uses onboard measurements approved by the Norwegian Maritime Authority. The Norwegian Maritime Authority does not approve of direct measuring of the emission due to the lack of international guidelines and standards on equipment for continuous onboard NOX measuring [23].

We further refer to the specific NOX equivalent as the snox parameter and calculate it by use of EIAPP data. The parameter is found by dividing snox (g/kWh × 1,000) by sfoc (g/kWh), when both are measured at 70 % engine loads [10, 23]. The estimated NOX emission of the ship is hence fuel consumption dependent. To find the costs we multiply with given tax and assume the tax level over the ship’s life time as known in advance. The same procedure as for the fuel costs is used to take net present values into account.

3 Mathematical model

In this section a mathematical model representation of the DE machinery configuration is formulated. Section 3.1 presents the notations, while the mathematical optimization model formulation is given in Sect. 3.1.1. Cuts added to reduce the solution time are given in Sect. 3.2 (Table 1).

3.1 Model notations

3.1.1 Model formulation

Subject to:

The objective function (4) minimizes the sum of investment and operational costs over the ship’s lifetime. The four terms represent the investment costs, the fuel, the NOX tax for operations undertaken in areas where this is required, and the penalty cost that occurs if the designated machinery area is exceeded, respectively. The investment costs in the first version of the model are assumed proportional to the rated power of the engine based on previous studies on diesel engines [25], but in our computational study in Sect. 4.2 we will discuss how an exponential investment cost function, as found in [24], will influence the results.

Constraint (5) ensures that only one manufacturer is chosen, whereas constraints (6) require that the selected engines are produced by the chosen manufacturer. Constraints (7)–(9), in combination with (22), ensure proper use of the sos2 method for deciding fuel performance factors, engine loads and weight variables. Power demands met at all times are guaranteed by constraints (10), while compliance with safety restrictions on power capacity if one of the engines malfunctions is ensured by constraints (11). Constraint (12) ensures that the area restriction in the machinery room is respected.

If an engine is ever in use it must also be included in the machinery configuration, which is ensured by constraints (13). Upper and lower limits for load variables, binary restrictions and non-negativity constraints are given by (14)–(21). The output of the model is a set of engines to install based on a cost minimization over the ship’s lifetime, while ensuring power demand met at all times. The engines can be of different sizes or of the same engine model, but are all produced by the same manufacturer.

3.2 Additional cuts

The model described in Sect. 3.1.1 will be solved by a commercial solver by means of the branch and bound technique. A high solution time might limit the practical use of the model by restricting the problem size, which amongst others includes number of engine types, time periods and operational states concerned. In order to avoid such limitations we tighten the model formulation by adding cuts considering the subsets J e . Remember that these subsets consist of identical engines of model e. If an engine j of J e is not included in the configuration then engine j + 1 will for the same reason neither be. The following anti-symmetry cuts (23)–(25) are added to the model described in Sect. 3.1.1.

The total number of engines to be tested for installation is \( {\hat{\text{E}}} = \sum\nolimits_{{m \in M, e \in E_{m} }} {J_{e} } \). These engines can be combined in a large amount of different configurations which all need to be evaluated regarding feasibility and total costs.

4 Case study

A case study considering a small size anchor handling tug support vessel (AHTS) has been carried out to exemplify how the model can assist ship designers and owners in selecting the diesel electric machinery configuration in conceptual design. Section 4.1 presents the input data, while the computational tests and their results are described in Sect. 4.2.

4.1 Input data

The operational profiles used in the case study are based on data from Radan et al. [2] on a small size AHTS and from Hovland and Gudmestad [27] on offshore support vessel operations in the North Sea. We consider a lifetime of 20 years, divided in time periods and operational states presented in Fig. 5. Each time period has a length of 10 years, where the first represents operations outside the northern coast of Norway. The second period represents operations in the North Sea, which is a SECA [11] and hence only low sulphur fuels can be used. Seven unique operational states are considered: harbour, transit supply, transit towing, DP/standby low, DP/standby high, anchor handling and bollard pull (BP) condition. In Fig. 5 TP1 and TP2 refer to time period 1 and 2, respectively. The power demand of the operational state DP/standby high is in TP1 4,100 kW, whereas it is reduced to 3,600 kW in TP2. This difference reflects change of operational area to one with less harsh environment. In TP2 the ship spends no time in the operational states Transit towing, Anchor handling and BP condition, which reflects a change in its assigned contract.

We further evaluated a total of 54 unique diesel engines, where 15 engine models were made by manufacturer referred to as M1, 23 by manufacturer M2 and 16 by manufacturer M3. The rated power of these engines ranged from 455 to 8,000 kW. For normal operations the lower and upper bounds on the engines’ load were set to 20 and 90 % of max rating, respectively. The upper load limit is only exceeded in an emergency situation. With our redundancy requirements we prepare for emergencies, but we do not consider any emergency operations as part of the operating profile. The fuel consumption curve was approximated by a sos2 set containing ten linear segments represented by eleven weights.

The fuel price at the beginning of TP1 was set to 698 USD/ton for operations outside SECA and 931 USD/ton inside SECA [28]. A discount rate of 8 % was used to find averaged net present values for the two time periods. The NOX tax was set to 965 USD/ton [10] and the similar procedure as for the fuel costs was used to average the net present value. The investment costs for the engines were set to 172 USD/kW [25]. The machinery room area restriction and violation cost were estimated based on reference ship designs and time charter rates [2, 17, 18, 29].

The problems were solved with the commercial software IVE Xpress in Windows 7, clock speed of 2.60 GHz and 8 GB of memory.

4.2 Computational study

Solving the problem with the model (4)–(25), the optimal solution gave an expected net present value lifecycle cost of 46.70 mill USD, with a fuel cost of 42.56 mill USD, 1.57 mill USD in investment costs, 1.04 mill USD in NOX taxes, and an area violation penalty of approximately 1 mill USD. This shows that fuel costs dominate the investment costs, indicating that even small percentage improvements in the fuel efficiency of the ship’s machinery system can offset a considerable percentage increase in the ship price.

When running this test, the anti-symmetry cuts described in Sect. 3.2 were used, as this proved to have a positive effect on the solution time. The optimal solution was found after approximately 70 s.

The optimal configuration consisted of five engines made by manufacturer M2, all different models ranging from a rated power of 760 kW to about 2,600 kW. The advantage of this combination of engines is the flexibility it gives for fuel optimization for the complete operational profile by allowing different subsets of the engines to run close to their optimal settings while meeting the power requirements of each state. However, common practice is to limit the number of engine models to one or two, due to spare parts, maintenance and cost of operation [17, 18]. Thus, an additional upper bound of two different engine models is added to the mathematical model:

where the binary variable \( \delta_{em} \) is 1 if engine model e of manufacturer m is selected, and zero otherwise. Constraint (26) ensures that no more than two unique engine models are installed, while constraints (27) and (28) are coupling constraints and variable binary restrictions, respectively.

Another aspect is that the investment costs are estimated to be proportional to the engines’ rated power, and thus do not take into consideration the economy of size. The investment costs are among others a function of engine model and size, number of engines, and possibly relationships between shipbuilder and manufacturer. What is not included in the investment costs when assuming these to be linear to the engines rated power are the costs of the subsystems and additional components needed. To include this, we assumed the marginal investment costs to be decreasing for increasing rated power, based on the investment costs of gas turbines used by Frangopoulos [30].

By adding constraints (26)–(28) and a nonlinear engine cost function, the optimal engine configuration was still selected from manufacturer M2, but now consisting of two engines of 2,000 kW and two of size 2,600 kW. The expected net present value life cycle cost was slightly reduced, from 46.70 to 46.1 mill USD. This reduction is mainly caused by a lower investment costs due to the introduction of a nonlinear cost function, accounting for economy of size (and is thus not directly comparable). There was a small reduction in the area penalty cost, now 0.40 mill USD, while fuel cost and NOx cost had a minor increase, to 42.62 mill USD and 1.05 mill USD, respectively. The optimal solution was found in approximately 65 s.

Often, the choice of engine manufacturers is restricted by the Makers List provided by the ship owner. The presented model can still be used for configuration optimization. To illustrate this, we preselected the manufacturer to be M3. The expected net present value life cycle cost are 49.63 mill USD, where 1.10 mill USD of these are investment costs and fuel costs 46.67 mill USD. The NOx cost did not change significantly from the former runs, and the area penalty cost was now 0.79 mill USD. The engines in this configuration are one with rated power of approximately 1,600 kW and two with a rated power of 5,200 kW. It should be noted that we also here used nonlinear investment costs and an upper limit of two unique engine models. The solution time was now only 2.2 s. The presented model can easily be adapted to consider this separation of the problem, such that the optimal configuration can be found for each manufacturer and then these results can be compared. The model can also easily be adapted to consider mixed manufacturer configurations, which might occur in some cases.

The solutions found in the previous three runs are all different in configuration, whereas the net present value costs were only significantly increased by forcing manufacturer M3. This indicates that the objective function typically is close to flat when a manufacturer’s engine model specter is large, as for manufacturer M2 in this case, while for manufacturers with as smaller specter, as for M3, the objective function can be more strongly convex (speaking of cost minimization). Presenting the overall optimal configuration or per manufacturer can give the decision maker valuable information on expected operational costs, and also show to what extent flexibility is valued regarding the combination of fuel efficiency and operational profiles of the ship.

5 Discussion and conclusion

In this work we have presented an optimization model to use in conceptual phase of ship design for decision support on selecting configuration of diesel engines in a DE machinery system. The model aims at minimizing investment and operational costs over the ship’s lifetime when the ship’s operational profiles are assumed known.

The investment costs of the machinery are modeled as engine model dependent and relevant cost data for installation of engines and subsystems should be obtained in cooperation with stakeholders. The operational costs accounted for in the model are fuel costs and NOX taxes. In addition, a cost of violating the designated machinery room area is included, corresponding to the potential value of the lost cargo capacity. We have presented a method for calculating fuel consumption and costs when power demand is given. The method is based on engine model specifications and load distribution amongst the engines to optimize the fuel efficiency. Costs for NOX tax are included for operations in areas where such environmental regulations are enforced.

The use of the model has been illustrated with a case study based on an anchor handling tug support vessel (AHTS), where the results show that investment costs are dominated by fuel costs. For an AHTS in general the investment and operating costs are usually not paid by the same stakeholder, but separated between ship owner and contractor. The presented case study indicates that increased investment costs, if resulting in reduced fuel consumption, can give lifetime savings, and therefore it can be economically beneficial to consider investment and operational costs simultaneously. Decision makers often use a pay-back period of 5 years instead of a life time perspective when evaluating new builds. The model can be adjusted to consider a 5 years pay-back period and the shorter time horizon might alter the findings.

We believe that this model can give valuable decision support for DE machinery system configuration in conceptual design. The model can be used to give information on expected operational costs and level of flexibility preferred regarding the ship’s future operational profiles. Other criteria than those considered here can be important for the decision maker. The model can then be used to obtain a set of alternative configurations that can be evaluated by the decision maker.

References

Hansen JF (2000) Modelling and control of marine power systems. Ph.D. thesis, Department of Engineering Cybernetics, Norwegian University of Science and Technology, Trondheim

Radan D, Johansen TA, Sørensen AJ, Ådnanes AK (2005) Optimization of load dependent start tables in marine power management systems with blackout prevention. WSEAS Trans Circuits Syst 4(12):1861–1866

Dimopoulos GG, Frangopuolos CA (2009) Optimization of propulsion system for modern LNG carriers considering multiple technology and design alternatives. In: Proceedings of IMDC 2009 (10th international marine design conference), Trondheim, Norway, 26–29 May 2009

Davey K (2005) Ship component in hull optimization. Mar Technol Soc J 39(2):39–46

Dimopoulos GG, Frangopoulos CA (2008) Optimization of energy systems based on evolutionary and social metaphors. Energy 33(2):171–179

Dimopoulos GG, Kougioufas AV, Frangopoulos CA (2008) Synthesis, design and operation optimization of a marine energy system. Energy 33(2):180–188

Rowen AR (2003) Machinery considerations. In: Lamb T (ed) Ship design and construction, vol 24. The Society of Naval Architects and Marine Engineers (SNAME), Jersey City, pp 24–27

Ådnanes AK, Sørensen AJ, Hackman T (1997) Essential characteristics of electrical propulsion and thruster drives in DP vessels. In: Proceedings of dynamic positioning conference 1997, Houston, Texas, 21–22 October

Ådnanes AK (2003) Maritime electrical installations and diesel electric propulsion (Tutorial Report/Textbook) ABB Marine AS, Oslo

TOLL Customs (2012) Avgift på utslipp av NOx 2012 Rundskriv nr. 14/2012 S. Særavgiftsavdelingen, Toll- og avgiftsdirektoratet, Oslo (Norwegian)

IMO (2008) Sulphur oxides (SOX) and particulate matter (MARPOL/MEPC.176(58)). International Maritime Organization, London

Balland O, Erikstad SO, Fagerholt K (2012) Optimized selection of air emission controls for vessels. Mar Policy Manag 39(4):387–400

Buhaug Ø, Corbett JJ, Endresen Ø, Eyring V, Faber J, Hanayama S, Lee DS, Lee D, Lindstad H, Markowska AZ, Mjelde A, Nelissen J, Nilsen J, Pålsson C, Winebrake JJ, Wu W, Yoshida K (2009) Prevention of air pollution from ships, Second IMO GHG Study 2009. International Maritime Organization, London

IMO-VEGA. Virtual Publications International Maritime Organization [cited 7 March 2012]. https://vp.imo.org/Customer/MyProducts.aspx

Pounder CC, Woodyard DF (2004) Marine diesel engines, 8th edn. Elsevier Butterworth Heinemann, Oxford Burlington, MA

Gaspar H, Erikstad SO (2009) Extending the energy efficiency design index to handle non-transport vessels. In: Proceedings of COMPIT’09 (8th international conference on computer applications and information technology in the Maritim Industries), Budapest, Hungary, 10–12 May 2009

Sea-Web [cited 6 March 2012] http://www.sea-web.com/seaweb_welcome.aspx

DNV Exchange (cited 6 March 2012) https://exchange.dnv.com/DNVX/Login.aspx?ReturnUrl=%2fdnvx%2fdefault.aspx

Williams HP (1999) Model building in mathematical programming, 4th edn. Wiley, West Sussex

Pundir BP (2010) IC engines: combustion and emissions, 1st edn. Alpha Science International, Oxford

EPA (2000) Analysis of commercial marine vessels emissions and fuel consumption data (EPA420-R-00-002). Office of Transportation and Air Quality U.S. Environmental Protection Agency, USA

Turns SR (1996) An introduction to combustion: concepts and applications, 1st edn. McGraw-Hill, New York

Norwegian Maritime Directorate (2012) Veiledning om NOx-avgift. Norwegian Maritime Authority, Haugesund (Norwegian)

Benford H (2003) Engineering economics. In: Lamb T (ed) Ship design and construction, vol 6. The Society of Naval Architects and Marine Engineers (SNAME), Jersey City, pp 6.1–6.36

de Jonge E, Christoph H, David C (2005) Service contract on ship emissions: assignment, abatement and market-based instruments task 2b–NOX abatement. Entec UK Limited, Northwich

Atamtürk A, Savelsbergh M (2005) Integer-programming software systems. Ann Oper Res 140(1):67–124

Hovland E, Gudmestad OT (2008) Selection of support vessels for offshore operations in harsh environments. Explor Prod Oil Gas Rev 6(2):52–57

Bunkerworld [cited 7 March 2012] http://www.bunkerworld.com/prices/

Marcon (2011) Supply & tug supply boat market report, November 2011. Marcon International, Inc., Coupeville

Frangopoulos CA, Dimopoulos GG (2004) Effect of reliability considerations on the optimal synthesis, design and operation of a cogeneration system. Energy 29(3):309–329

Acknowledgments

The research was carried out with the financial support from the Ship4C Project, partly funded by the Research Council of Norway. We will also thank the three anonymous reviewers for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Solem, S., Fagerholt, K., Erikstad, S.O. et al. Optimization of diesel electric machinery system configuration in conceptual ship design. J Mar Sci Technol 20, 406–416 (2015). https://doi.org/10.1007/s00773-015-0307-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00773-015-0307-4