Abstract

We consider the signaling role of attorney fees which have been usually assumed as exogenous in literature. We show that there exists an equilibrium in which the informed plaintiff uses both the attorney fee and the settlement demand as signals for his damage amount. If attorney service is not productive, this equilibrium yields higher social welfare than the equilibrium involving solely the settlement demand as a signal. If attorney service is productive, however, social welfare is lower in the former equilibrium. This has a policy implication that regulating attorney fees is socially desirable if the attorney service is productive.

Similar content being viewed by others

Notes

According to Baye et al. (2005), Americans spend more on civil litigation than any other industrialized country, and twice as much on litigation as on new automobiles.

Many legal devices have been designed to reduce court congestion and legal expenditures. These devices include fee-shifting rules such as Rule 68 of the Federal Rules of Civil Procedure, discovery requirements, a shift in a certain tort from a rule of negligence to a rule of strict liability, and Rule 408 of the Federal Rules of Evidence etc. See Sobel (1989), Spier (1994) and Daughety and Reinganum (1995) for an economic analysis of mandatory discovery, Rule 68 and Rule 408 respectively.

For example, California Proposition 106, which was defeated on the November 8, 1988 statewide ballot, was an attempt to limit attorney contingency fees. In 2003, lawyers in 13 states initiated a voluntary campaign to limit the fees on the ground that it is unethical for lawyers to charge unreasonable fees. Also, contingent fees are prohibited in U.K.

For example, sixteen states, including California, Massachusetts and New York, have a statute or court rule that establishes a specific limit on fees attorneys may charge clients who file a medical malpractice claim, and many of these statutes apply to a much broader category of cases than medical malpractice.

In the past, the Korean Attorney-at-Law Act provided that the Korean Bar Association control attorney fees, but the provision was abolished in 2000 on the ground that it violates the spirit of the fair competition law by fostering collusion among lawyers, and thereafter attorney fees have been virtually competitively determined in the free market, although the regulation of attorney fees still remains in criminal cases to protect financially constrained defendants.

Roughly, there are three ways for attorneys to charge for legal services; hourly, fixed fee or contingency fee. Assuming a fixed fee here is simply to accentuate that our result can be driven even by the simplest form of the attorney fee. Considering other forms of the attorney fee does not affect the main insight of the paper.

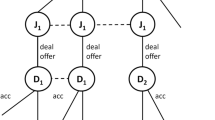

Our model is built upon a discrete-type signaling model of Reinganum and Wilde (1986). However, ours is a two-dimensional signaling model, whereas theirs is a one-dimensional signaling model.

By a “binding” fee contract, the possibility of renegotiation between the plaintiff and his attorney is forbidden. If the fee contract is not binding, the fee cannot have a signaling effect, since the defendant is aware that the fee can be altered later. Thus, commitment is necessary for signaling.

The assumption of observable attorney fees is crucial to our analysis. If an attorney fee is unobservable, it cannot serve as a signal. Without the assumption, a separating equilibrium involving two separating fees could not be sustainable as long as the plaintiff can cut the attorney fee secretly without \(D\)’s awareness. However, due to the long-run nature of attorneys, their individual fees are usually known in the market. For example, services by attorneys in large law firms are known to be expensive. Moreover, this assumption could be justifiable by the unraveling argument of Milgrom (1981), since \(P\ \)will be able to reveal the information strategically if it is beneficial to him.

A trivial equilibrium requires more than that both types earn the same payoff in equilibrium. Additionally, it requires that both types earn the same payoff if they deviate to the equilibrium strategy that the other type is supposed to play.

Since the acceptance probability is not directly affected by \(c\), we suppress the argument \(c\) as \(r(s)\). However, we will use the argument whenever the suppression might cause confusion.

Some may doubt the existence of a meaningless equilibrium since a high type might be made better off by making a slightly lower demand inducing a positive acceptance probability. This is not possible, though, if \(q(H-L) >T\), because a high type then prefers his demand being rejected to a lower demand \(qL+C_d\) that is accepted. Therefore, there exists a meaningless SDE if \(q\Delta w >T\).

Formally, two (topological) spaces \(A\) and \(B\) are homeomorphic if and only if there is a continuous one-to-one mapping between \(A\) and \(B\).

By Pareto dominance, we compare the payoffs of the active players, \(P\) and \(D\) in those two equilibria. The attorney is not an active player in this model in the sense that he has no strategy to choose. Thus, the attorney’s payoffs are not compared. This is reasonable since the equilibrium selection is a matter that should be resolved by pre-play communication between active players.

As the concept of social welfare, we use the Benthamite utilitarian social welfare function which measures social welfare as the sum of all individual payoffs. Therefore, all the payoffs of the plaintiff, the defendant and the attorney are summed with equal weights. One consequence is that all monetary transfers between society members are cancelled out. We ignore the possibility of the spill-over effect, for example, that high payoffs of lawyers attract more workers in more productive sectors into the less productive legal service sector.

In addition, we can easily show that D1 criterion excludes all pooling equilibria. This is because a settlement demand slightly higher than a pooling equilibrium demand and a lower acceptance rate (a higher rejection rate) is more beneficial to a high type, making it reasonable to believe that such a demand came from a high type. The analysis of pooling equilibria can be available from the author upon request.

We can easily see from the proof of Proposition 4 that the Intuitive Criterion by Cho and Kreps (1987) does not eliminate SFDE, since \(D(H, \mathbf {m}), D(L, \mathbf {m}) \ne \emptyset \).

This characterizes the optimal expenditure even in the absence of pre-trial settlement.

This equilibrium selection can be partially justified by Proposition 8. Alternatively, we could compare the outcomes for corresponding acceptance rates defined in terms of homeomorphic intervals \(J\) and \(J'\), but the comparison is ambiguous for small \(t\), because \(r^{**}(0)-r^* (0)=\frac{(q_{L}-q_{H}^{*})H+\Delta c^{*}}{T}\gtrless 0\).

We can easily check that no pooling equilibrium satisfies D1 criterion. A formal proof of this claim can be available from the author upon request.

This insight is also valid in an alternative model in which \(P\ \)has private information about the winning probability \(q\) instead of \(w\). In the model, \(P\ \)whose case is strong, will be willing to pay a very high attorney fee, because almost all the fee would be borne by the defendant, especially if \(q\) is almost one in an extreme case.

Unlike in the case of fixed fees, the attorney fee \(\alpha s\) is realized only ex post, and thus observing \(\alpha s\) (ex post) will not help in terms of signaling.

In reality, the contingency percentage for the settlement amount may not be the same as that for the damage award. Here, we are ignoring the possibility because it complicates the analysis significantly.

This feature comes from a specific bargaining mode whereby the plaintiff makes a take-it-or-leave-it demand.

As a referee points out, hiring an attorney for $100 and burning a $100 bill have the same effect on the equilibrium outcome in the case of unproductive services. Although they are equivalent from the viewpoint of \(P\ \)and \(D\), they have different effects on social welfare, since the money does not go to the attorney in the latter case, while it does in the former case. Burning a bill is a pure social waste, but giving it to an attorney is not.

References

Banks J, Sobel J (1987) Equilibrium selection in signalling games. Econometrica 55:647–662

Baye M, Kovenock D, de Vries CG (2005) Comparative analysis of litigation systems: an auction-theoretic approach. Econ J 115:583–601

Bebchuck LA (1984) Litigation and settlement under imperfect information. Rand J Econ 15:404–415

Cho I, Kreps D (1987) Signalling games and stable equilibria. Q J Econ 102:179–221

Clermont KM, Currivan JD (1978) Improving onthe contingent fee. Cornell Law Rev 63:529–639

Dana JD, Spier KE (1993) Expertise and contingent fees: the role of asymmetric information in attorney compensation. J Law Econ Organ 9:349–367

Daughety A, Reinganum J (1995) Keeping society in the dark: on the admissibility of pretrial negotiations as evidence in court. RAND J Econ 26:203–221

Danzon PM (1983) Contingent fees for personal injury litigation. Bell J Econ 14:213–224

Emons W (2007) Conditional versus contingent fees. Oxford Econ Papers 59:89–101

Emons W, Garoupa N (2006) US-style contingent fees and UK-style conditional fees: agency problems and the supply of legal services. Manag Decision Econ 27:379–385

Fong Y-F, Xu Z (2011) Defense attorney’s fee structure: a signaling explanation, Mimeo

Milgrom P (1981) Good news and bad news: representation theorems and applications. Bell J Econ 12:380–391

Reinganum J, Wilde L (1986) Settlement, litigation, and the allocation of litigation costs. RAND J Econ 17:557–566

Rubinfeld D, Sappington D (1987) Efficient awards and standards of proof in judicial proceedings. RAND J Econ 18:308–315

Rubinfeld D, Scotchmer S (1993) Contingent fees for attorneys: an economic analysis. RAND J Econ 24:343–356

Shavell S (1982) A theoretical analysis under alternative methods for the allocation of legal costs. J Legal Stud 11:55–81

Sobel J (1989) An analysis of discovery rules. Law Contemp Problems 52:133–160

Spier K (1994) Pretrial bargaining and the design of fee-shifting rules. RAND J Econ 25:197–214

Acknowledgments

This research was begun when I was visiting ISER, Osaka University in 2012. I am grateful to seminar audiences at Shandong University and participants in the monthly workshop of Korean Law and Economics Association and the 8th annual conference of Asian Law and Economics Association, and, in particular, Kathy Spier for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1: If \(D\ \)rejects \(s>s_H\), his loss is at most \(qH+C_d \equiv s_H\), which is strictly better than accepting \(s>s_H\). On the other hand, if \(D\ \)rejects \(s<s_L\), his loss at court is at least \(qL+C_d \equiv s_L\), which is strictly worse than accepting \(s<s_L\).

Proof of Lemma 2: First, it is not possible that \(s^{*}(L)<s_{L}\) because any \(s\) such that \(s^{*}(L)<s< s_{L}\) would be better, since it is also accepted with probability one by Lemma 1. If \(s^*(L)>s_{L}\), his equilibrium demand is rejected and he gets \(qL-c_p <s_{L}\). Consider a deviation to \(s_L\). Under the most pessimistic belief, \(\hat{\lambda }(s_L )=0\). \(D\ \)is indifferent between accepting \(s_{L}\) and not. Thus, the payoff that the low-type \(P\ \)is expected to get by deviating to \(s_L\) is \(rs_L (1-r)(qL-c_p )\ge qL-c_p\) for all \(r\in [0, 1]\) with equality if and only if \(r=0\). So, the deviation to \(s_{L}\ \)is profitable. Contradiction. Now, suppose \(c^* (L)>0\). A deviation to zero always saves the cost at least without affecting the posterior belief. Therefore, it must be that \(c^* (L)=0\). It remains to show that \(s^* (L)=s_L\) is supported by \(r=1\). If \(r(s_L )<1\), it is always better for a low type to demand \(s_L -\epsilon \), which will be accepted with probability 1, since \(s_L -\epsilon >rs_L +(1-r)(qL-c_p )\) for some small \(\epsilon (>0)\). This completes the proof.

Proof of Lemma 3: Suppose that \(r(s_1 )\le r(s_2 )\). Then, the type of \(P\ \)who demands \(s_1\) in equilibrium would have an incentive to deviate to \(s_2\).

Proof of Lemma 4: (i) If \(r(s_L )<1\), it is always better for \(P\ \)to demand \(s<s_L\) by Lemma 1. (ii) In a separating equilibrium, it must be that \(s^* (H) >s_L\). If \(r^* (s^* (H) )=1\), it violates Lemma 3 due to Lemma 4(i).

Proof of Lemma 5: Since \(0<r^* (s^* (H))<1\) in the first case, \(D\ \)is indifferent between accepting \(s^* (H)\) and rejecting it, implying that \( s^* (H) =qH+C_d \equiv s_H \). Suppose \(s^* (H)<s_H\) when \(r^* (s^* (H))=0\). If \(D\ \)rejects it, his loss at court is \(qH+C_d =s_H\). Therefore, \(D\ \)strictly prefers \(s^* (H)\) being accepted to his demand being rejected since \(s^* (H)< s_H\). This is a contradiction to \(r^* (s^* (H))=0\).

Proof of Proposition 1: First, we will find the range of equilibrium values for \(r(s_H )\). If the low-type \(P\ \)prefers demanding \(s_L\) to \(s_H\), the following must be satisfied. Inequality (1) implies that \(r^* (s_H )\le \frac{c_{p}+C_{d}}{s_{H}-qL+c_{p}}=\frac{T}{q\Delta w +T}<1\). Also, inequality (2) implies that \(r^{**}(s_H )\ge \frac{T-q\Delta w}{T}\). The two incentive compatibility conditions imply that

We have \(I\ne \emptyset \), since \(\frac{T-q\Delta w}{T}<\frac{T}{q\Delta w +T}\) and \(0<\frac{T}{q\Delta w +T}<1\). Hence, the proof is completed.

Proof of Lemma 6: We will show that if \(r(c^* (H), s^* (H))=1\), the incentive compatibility conditions for the low type (\(IC_{L}\)) and the high type (\(IC_{H}\)) are contradictory to each other except when \(s^{*}(H)-s_{L}=c^{*}(H)\). When \(r(c^* (H), s^* (H))=1\), the two incentive compatibility conditions are given by

Since both equilibrium demands are accepted with probability one, equilibrium payoffs do not depend on the true type at all in this case. Therefore, both (\(IC1_{L}\)) and (\(IC1_{H}\)) can be satisfied only when \(s_{L}=s^{*}(H)-c^{*}(H)\), i.e., \(s^{*}(H)-s_{L}=s^{*}(H)\). This corresponds to the trivial equilibrium. However, (\(IC2_L\)) and (\(IC2_H\)) at the demand stage require that \(s_L \ge s^* (H)\) and that \(s^* (H)\ge s_L\) simultaneously, which means that \(s^* (H)=s_L\). This is a contradiction to \(c^* (H)>0\). Therefore, \(r^* (c^{*}(H), s^{*}(H))<1\).

Proof of Lemma 7: Since \(D\)’s decision is not affected by \(c^* (H)\), the proof of Lemma 5 is exactly carried over to Lemma 7.

Proof of Proposition 2: For \(I'\ne \emptyset \), \(\frac{T+c^* (H) }{q\Delta w +T}>0\) or \(\frac{T-q\Delta w +c^* (H) }{T}\le 1\). Also, Lemma 6 implies that \(r^* =\frac{T+c^* (H) }{q\Delta w +T}<1\). Therefore, \(c^{*}(H)< q\Delta w\).

Proof of Proposition 3: Let \(r^*\) and \(r^{**}\) be \(D\)’s equilibrium acceptance probability in SDE and in SFDE respectively. The difference in the equilibrium payoffs of a high-type \(P\ \)is

Since \(I\) and \(I'\) are not single-valued, let us evaluate the sign of difference at the corresponding \(r^*\) and \(r^{**}\). Then, we have

Therefore, \(\psi (t) =(r^{**}(t)-r^* (t))T-\Delta c^{*}\le \Delta c^{*}-\Delta c^{*} =0\) for all \(t\in [0, 1]\).

Finally, the difference in social welfare is \(\Delta W (t)= \psi (t) +\Delta c^{*} = (r^{**}(t)-r^* (t))T> 0\).

Proof of Proposition 4: To apply D1 criterion, define the following two sets for an off-the-equilibrium message \((c, s)\);

\(D(w, c, s )\) is the set of \(D\)’s strategies that make \(w\)-type \(P\ \)it profitable to demand \(s\), and \(D_0 (w, c, s )\) is the set of \(D\)’s strategies that make \(w\)-type \(P\ \)indifferent between the equilibrium combination of fee and demand \((c^* , s^* )\) and the off-the-equilibrium combination \((c, s)\). If there exists a type \(w'\ne w\) such that \(D(w, c, s )\cup D_0 (w, c, s )\subset D(w', c, s )\), type \(w'\) is more likely to deviate to \((c, s)\) than type \(w\) and assign the posterior belief zero to type \(w\).

Now, we will apply D1 criterion to separating equilibria.

Claim 1

Vacuous SDE do not satisfy D1 criterion.

Proof of Claim 1. Consider vacuous demand equilibria. For a deviant demand \(s=s_H -\epsilon \), define \(r_0 (H, s)\) by the value of \(r\) satisfying

This holds for \(r=0\) and for all other values of \(r\), the left-hand side is greater than the right-hand side. Thus, \(r_0 (H, s)=0\). On the other hand, \(r_0 (L, s)\) is determined by

It is easy to see that \(r_0 (L, s) \in (0, 1)\). Therefore, it directly follows that \(D(L, c, s)\cup D_0 (L, c, s)\subset D(H, c, s)\), implying that \(s\) comes from a high type. This subverts the equilibrium. This completes the proof.

Claim 2

No SFDE satisfy D1 criterion.

Proof of Claim 2: Consider an out-of-equilibrium message \(\mathbf {m'}=(s_H , 0)\). Similarly, \(r_0 (H, \mathbf {m'})\) and \(r_0 (L, \mathbf {m'})\) can be found from

respectively. If \(r^* =\frac{T+c^{*}(H)}{q\Delta w+T}\) is the upper bound of \(I'\) so that the low-type \(P\ \)is indifferent between the two equilibrium strategies, we have

By using Eqs. (21), (20) can be rewritten as

Comparing Eqs. (19) and (22) yields \(r_0 (L, \mathbf {m'})>r_0 (H, \mathbf {m'})\). Thus, D1 criterion requires that \(\hat{\lambda }(\mathbf {m'})=1\). This implies that a high-type \(P\ \)has an incentive to deviate from the equilibrium by cutting the attorney fee to \(0\). Therefore, the equilibria do not satisfy D1 criterion. If \(r^* =\frac{T-q\Delta w +c^{*}(H)}{T}\) is the lower bound of \(I'\) so that the high-type \(P\ \)is indifferent between two equilibrium strategies, we can easily check that \(r_0 (L, \mathbf {m'})>r_0 (H, \mathbf {m'})\) in a similar way. Since Eqs. (19) and (20) are linear in \(r\) and \(r^*\), this inequality holds for all \(r^* \in I\).

It remains to show that only the meaningful demand equilibrium with \(r^* =\frac{T}{q\Delta w +T}\) survives D1 criterion. Consider an off-the-equilibrium demand \(s\in (s_L , s_H )\). Similarly defined \(r_0 (H, s)\) and \(r_0 (L, s)\) can be found by

respectively, yielding \(r_0 (H, s)=\frac{r^{*}T}{s-qH+c_{p}}\) and \(r_0 (L, s)=\frac{T}{s-qL+c_{p}}\). Now, to support the equilibrium, the belief must be that \(s\) comes from a low type and, accordingly rejected. Thus, according to D1 criterion, this requires \(r_0 (H, s)>r_0 (L, s)\), i.e., \(r^* \ge \frac{s-qH+c_{p}}{s-qL+c_{p}}\equiv h(s)\) for all \(s\in (s_L , s_H )\). Since \(h'(s)>0\), \(r^* \ge h(s_H )=\frac{T}{q\Delta w+C_{d}}\). This means that \(r^* = h(s_H )=\frac{T}{q\Delta w+C_{d}}\) is the only equilibrium acceptance probability that survives D1 criterion.

Proof of Lemma 8: Comparing the maximum payoff of a high-type \(P\ \)and a low-type \(P\), we have

implying that \(q(c_{H}^{f})H-q(c_{L}^{f})L>c_{H}^{f}-c_{L}^{f}\).

Proof of Proposition 5: It suffices to show that a high-type \(P\ \)has no incentive to deviate from \(c_L\). The most profitable deviation given his demand is accepted is to maximize \(q(c)L+C_d -c\) which is to choose \(c^* (L)=c_L\). This is a contradiction to \(c^* (L)\ne c_L\). Thus, his demand must be rejected and the most profitable deviation is to maximize \(q(c)H-c_p -c\) as to choose \(c_H\) and then demand, say, \(q_H H+C_d\) that will be rejected. Then, he gets \(q_H H-c_p - c_H\). Since he gets \(q_L H+C_d -c_L\) in equilibrium, he does not deviate if \(q_L H+C_d -c_L \ge q_H H-c_p -c_H\), i.e., \(T\ge q_H H-q_L H -\Delta c >0\).

Proof of Proposition 6: A high-type \(P\ \)can deviate to \(c_H\) most profitably and is perceived to be a low-type. Then, the incentive compatibility conditions require

The right hand side of inequality (25) is \(q_L L +C_d \) if \(q_L L +C_d \ge q_H H -c_p \), i.e., \(q_H H -q_L L \ge T\), and \( q_H H -c_p\) otherwise. In the former case, a high-type \(P\ \)asks \(s^* (L)=q_L L +C_d\) which is accepted with probability one, and in the latter case, he asks any \(s>s^* (L)\) which is rejected with probability one. In the former case, these imply that

Then, due to Lemma 8, \(0<r^* <1\) in any equilibrium. Non-emptyness of \(J'\) requires that \(\frac{T-(q_{H}^* H-q_{L}L)+c^{*}(H)-c^{*} (L) }{T}<1\), i.e., \(q_{H}^* H-c^{*}(H)>q_L L-c^* (L)\). This implies that \(c^* (H)<\hat{c}\). Therefore, it must be \(c^* (H)\in (c_L , \hat{c})\) in a SFDE. In the latter case, we obtain

Since \(\lim _{T\rightarrow 0}\hbox {LHS}=0\) and \(\lim _{T\rightarrow 0}\hbox {RHS}=\frac{ q_{L}L-c^{*} (L) -(q_{H}^{*}L -c^{*}(H))}{q_{H}^* (H-L)} >0\), there exists \(\underline{T}>0\) such that \(\hbox {LHS}<\hbox {RHS}\) so that \(J'\ne \emptyset \), and thus \(J''\ne \emptyset \) for all \(T\ge \underline{T}\).

Proof of Proposition 7: (i) First, we compare the upper bound of the equilibrium acceptance probability. The difference is

where \(y=H-L\), \(\phi (w)=(\Delta q)w-\Delta c^{*}\) and \(\Delta q=q_{H}^{*}-q_L\).

(ii) Let \(P\)’s payoff in SFDE and in SDE be \(\pi ^{**}\) and \(\pi ^*\). Then, we have

since \(\frac{T}{q_{L}y+T}<1\). Comparison of \(D\)’s payoffs can be similarly made.

(iv) The social welfare can be defined by \(W=U_P +U_D +U_A\) where \(U_A\) is the attorney’s payoff. Considering that the attorney fee and the settlement demand are of zero-sum nature, the result is immediate from (i).

Proof of Proposition 8: (i) First, we will show that no SDE satisfies D1 criterion. Consider a deviation to \(\mathbf {m}= ( c_H , q_H H+C_d )\). Similarly, \(r_0 (H, \mathbf {m})\) and \(r_0 (L, \mathbf {m})\) can be defined from

respectively. Since the low-type \(P\ \)is indifferent between \(\mathbf {m_H} = (c_L , q_L H+C_d )\) and \(\mathbf {m_L} =(c_L , q_L L+C_d )\) in the equilibrium with the highest equilibrium \(r^*\), Eq. (31) can be rewritten as

To compare \(r_{0} (H, \mathbf {m})\) and \(r_0 (L, \mathbf {m})\), Eqs. (30) and (32) can be rewritten as

where \(w=H, L\). To compare \(r_{0} (H, \mathbf {m})\) and \(r_0 (L, \mathbf {m})\), first note that \(r<r^*\) for \(w=H\) because \(q_H H-c_H >q_L H -c_L\) i.e., \(q_H H >q_L H +\Delta c\). If \(r\ge r^* \) for \(w=L\), clearly \(r_{0}(H, \mathbf {m})<r_0 (L, \mathbf {m})\). If \(r<r^*\), differentiating (33) yields \(\frac{dr}{dw}=\frac{(1-r^{*})q_{L}-(1-r)q_{w}}{T}<0\), implying that \(r_{0}(H, \mathbf {m})<r_0 (L, \mathbf {m})\). Thus, D1 criterion requires that \(\hat{\lambda }(\mathbf {m})=1\). This implies that a high-type \(P\ \)has an incentive to deviate from the equilibrium by increasing the attorney fee to \(c^f (H)\). Therefore, the equilibria do not satisfy D1 criterion.

(ii) We will show that any fee-demand equilibrium cannot satisfy D1 criterion unless \(c^* (H)=c_H\). Consider an off-the-equilibrium message \(\mathbf {m}=(c_H , q_H H+C_d )\). The borderlines \(r\) of each type, \(r_0 (H, \mathbf {m})\) and \(r_0 (L, \mathbf {m})\) are defined by

respectively, where we abuse the notation of \(c=c^* (H)\). Similarly, by using the indifference condition of the low-type \(P\), Eq. (35) can be rewritten as

Equations (34) and (36) can be rewritten as

where \(w=H, L\). Since \(q_H H>q(c)H +c_H - c\) for any \(c\ne c_H\), \(r<r^*\) for \(w=H\). If \(r\ge r^*\) for \(w=L\), it directly follows that \(r_{0}(H, \mathbf {m})<r_0 (L, \mathbf {m})\). If \(r< r^*\) for \(w=L\), differentiation of (37) yields

This implies that \(r_{0}(H, \mathbf {m})<r_0 (L, \mathbf {m})\). Thus, D1 criterion requires that \(\hat{\lambda }(\mathbf {m})=1\). Therefore, the equilibria do not satisfy D1 criterion unless \(c^* (H)=c_H\).

Proof of Proposition 9: It is sufficient to focus on the case of productive legal services. Two incentive compatibility conditions are given by

Simplifying (12) and (13) by using \(s^* (L)=q_L (L+c^* (L)+T)\) and \(s^* (H)=q_{H}^{*} (H+c^* (H) +T)\), we have

where \(\nabla =q_{H}^{*}(C^{*}(H)+T)-q_{L}(c^{*}(L)+T)\). Since \(\nabla >0\), we can conclude that \(r^* (s^* (H))\) is lower under the British fee system by comparing (40) with (29).

Rights and permissions

About this article

Cite this article

Kim, JY. An attorney fee as a signal in pretrial negotiation. J Econ 114, 75–102 (2015). https://doi.org/10.1007/s00712-014-0395-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-014-0395-3