Abstract

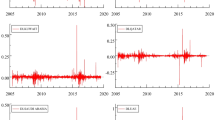

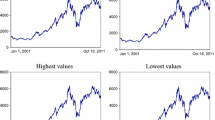

Long memory has been widely documented for realized financial market volatility. As a novelty, we consider daily realized asset correlations and we investigate whether the observed persistence is (i) due to true long memory (i.e. fractional integration) or (ii) artificially generated by some structural break processes. These two phenomena are difficult to be distinguished in practice. Our empirical results strongly indicate that the hyperbolic decay of the autocorrelation functions of pair-wise realized correlation series is indeed not driven by a truly fractionally integrated process. This finding is robust against user specific parameter choices in the applied test statistic and holds for all 15 considered time series. As a next step, we apply simple models with deterministic level shifts. When selecting the number of breaks, estimating the breakpoints and the corresponding structural break models we find a substantial degree of co-movement between the realized correlation series hinting at co-breaking. The estimated structural break models are interpreted in the light of the historic economic and financial development.

Similar content being viewed by others

Notes

For definitions and details regarding construction of realized (co-)variances we refer the interested reader to Chiriac and Voev (2011).

Here and in the following tables we give only the results for General Electrics as the reference series to safe space. The results are similar for all other series as reference series but for General Electrics we find the highest heterogeneity showing best the properties of the data.

References

Andersen TG, Bollerslev T, Diebold FX, Labys P (2003) Modeling and forecasting realized volatility. Econometrica 71:579–625

Aslandis N, Christiansen C (2012) Smooth transition patterns in the realized stockbond correlation. J Empir Finance 19:454–464

Audrino F, Corsi F (2010) Modeling tick-by-tick realized correlations. Comput Stat Data Anal 54: 2372–2382

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econ 18:1–22

Baillie RT (1996) Long memory processes and fractional integration in econometrics. J Econ 73:5–59

Barndorff-Nielsen OE, Shephard N (2004) Econometric analysis of realized covariation: high frequency based covariance, regression, and correlation in financial economics. Econometrica 72:885–925

Beran J (1994) Statistics for long-memory processes. Chapman & Hall, London

Berkes I, Horvath L, Kokoszka P, Shao Q-M (2006) On discriminating between long-range dependence and changes in mean. Ann Stat 34:1140–1165

Chiriac R, Voev V (2011) Modelling and forecasting multivariate realized volatility. J Appl Econ 26:922–947

Davidson J, Sibbertsen P (2009) Tests of bias in log-periodogram regression. Econ Lett 102:83–86

Diebold FX, Inoue A (2001) Long memory and regime switching. J Econ 105:131–159

Doukhan P, Oppenheim G, Taqqu MS (2003) Theory and applications of long-range dependence. Birkhuser, Boston

Granger CWJ, Joyeux R (1980) An introduction to long-range time series models and fractional differencing. J Time Ser Anal 1:15–30

Guegan D (2005) How can we define the concept of long memory? An econometric survey. Econ Rev 24:113–149

Hendry DF, Massmann M (2007) Co-breaking: recent advances and a synopsis of the literature. J Bus Econ Stat 25:33–51

Hurst HE (1951) Long-term storage of capacity of reservoirs. Trans Am Soc Civil Eng 116:770–799

Krämer W, Ploberger W, Alt R (1988) Testing for structural change in dynamic models. Econometrica 56:1355–1369

Krämer W, Sibbertsen P (2002) Testing for structural change in the presence of long memory. Int J Bus Econ 1:235–242

Krämer W, Sibbertsen P, Kleiber C (2002) Long memory vs. structural change in financial time series. Allg Stat Arch 86:83–96

Morana C (2007) Multivariate modelling of long memory with common components. Comput Stat Data Anal 52:919–934

Ohanissian A, Russel JR, Tsay RS (2008) True or spurious long memory? A test. J Bus Econ Stat 26:161–175

Perron P (2006) Dealing with structural breaks. In: Mills T, K Patterson (eds) Palgrave handbook of econometrics, vol 1. Econometric theory. Palgrave MacMillan, Basingstoke, pp 278–352.

Ploberger W, Krämer W (1992) The CUSUM-test with OLS-residuals. Econometrica 60:271–286

Ploberger W, Krämer W (1996) A trend-resistent test for structural change based on OLS-residuals. J Econ 70:175–185

Qu Z (2011) A test against spurious long memory. J Bus Econ Stat 29(3):423–438

Robinson PM (1994) Efficient tests of nonstationary hypotheses. J Am Stat Assoc 89:1420–1437

Shimotsu K (2007) Gaussian semiparametric estimation of multivariate fractionally integrated processes. J Econ 137:277–310

Sibbertsen P (2004) Long-memory versus structural change: an overview. Stat Pap 45:465–515

Wied D, Krämer W, Dehling H (2012) Testing for a change in correlation at an unknown point in time using an extended functional delta method. Econ Theory 28(3):1–20.

Yau CY, Davis RA (2012) Likelihood inference for discriminating between long-memory and change-point models. J Time Ser Anal 33:649–664

Zeileis A, Kleiber C, Krämer W (2003) Testing and dating of structural changes in practice. Comput Stat Data Anal 44:109–123

Acknowledgments

The authors thank two anonymous referees for carefully reading the paper. Robinson Kruse gratefully acknowledges financial support from CREATES funded by the Danish National Research Foundation. The financial support by the Deutsche Forschungsgemeinschaft (DFG) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

This article is dedicated to Walter Krämer, a most inspiring econometrician, teacher and friend.

Rights and permissions

About this article

Cite this article

Bertram, P., Kruse, R. & Sibbertsen, P. Fractional integration versus level shifts: the case of realized asset correlations. Stat Papers 54, 977–991 (2013). https://doi.org/10.1007/s00362-013-0513-2

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00362-013-0513-2