Abstract

The paper addresses intergenerational and intragenerational equity in an overlapping generation economy. We aim at defining an egalitarian distribution of a constant stream of resources, relying on ordinal non-comparable information on individual preferences. We establish the impossibility of efficiently distributing resources while treating equally agents with same preferences that belong to possibly different generations. We thus propose an egalitarian criterion based on the equal-split guarantee: this requires all agents to find their assigned consumption bundle at least as desirable as the equal division of resources.

Similar content being viewed by others

Notes

This requirement of “equal treatment of equals” is a weak counterpart of anonymity for frameworks with no comparable information about preferences. In the main economic approach to intergenerational equity, each generation is described by a utility level and the objective is to define how to rank infinite vectors of these utilities (utility streams), based on appealing equity and efficiency conditions. The seminal contribution of Diamond (1965) showed a strong tension between efficiency and equity: a continuous and complete ranking of these utility streams cannot satisfy both Pareto efficiency and “finite anonymity”. The anonymity concept expresses equal concern for all generations by requiring the ranking to be invariant to permutations of the utilities of a finite number of generations. For a survey of this literature, see Asheim (2010).

When periods are differently endowed in terms of resources, treating agents equally might impede to distribute all the resources available during affluent times. This negative conclusion is called “leveling down objection” and opposes equity with efficiency. Parfit (1997) discusses the differences between a pure egalitarian view, that cares only about equality, and a pluralist egalitarian view, that aims at combining equity with efficiency. For an illustration consider the two following alternatives: in A everyone gets 10 units; in B half of the agents get 10, half get 20. According to the first view A is better but incurs in the leveling down; according to the second view B is better, but needs to compromise equity. Our strategy is to consider a model with the most favorable conditions in terms of compatibility between efficiency and equity, i.e. with constant flow of resources. An extension to non constant resources is introduced in Sect. 4.

The authors build on three extensions of the no-envy criterion, introduced by Suzumura (2002) to fit the dynamic overlapping generation framework. The “no-envy in lifetime consumptions” holds when no agent finds the bundle assigned to some other agent more preferable than the own; the “no-envy in overlapping consumptions” holds when at each period no agent finds preferable the consumption bundle assigned for consumption at that period of some other young or old agent; the “no-envy in the lifetime rate of return” requires to equalize agent’s welfare measured according to the concept of lifetime rate of return, due to Cass and Yaari (1966). As in Dubey (2013), we interpret no-envy in terms of lifetime consumptions.

With a slight abuse of notation, we denote by I both for the set of agents and its cardinality.

The convexity requirement is not necessary for our existence result. Nevertheless, we do assume this restriction to avoid that the difficulties with alternative equity conditions originate from it. All impossibility results extend to the case of strictly convex preference.

We denote by \(0_{L}\) and \(1_{L}\) the L-dimensional vector of zeros and ones.

When \(\varepsilon =1\), the axiom of \(\bar{a}-\) equal-split guarantee is obtained; as \(\varepsilon \) decreases the condition becomes weaker and weaker; at the limit for \(\varepsilon =0\), it is vacuous. This requirement is similar to the \(\varepsilon \) version of “individual rationality” introduced by Moulin and Thomson (1988): their axiom requires each agent to be at least as well-off as when consuming a bundle that is the \(\varepsilon \)-share of the aggregate available resources. The idea of introducing a parametrization in the distributional criteria has been further exploited in the literature of fair allocations: similar criteria are defined, among others, in Thomson (1987) and Sprumont (1998); in the dynamic setting it has been adopted by Piacquadio (2014).

We are indebted to Yves Sprumont for highlighting this point.

If only transfers to later periods are allowed, the result of Theorem 2 immediately extends. Transfers to previous periods would equivalently emerge in a richer framework with production, when reducing capital investment.

This resource scarcity effect of production and accumulation is discussed in Piacquadio (2014); it arises already in a model with one-period living representative agent and with linear and time-invariant technology. More positive results are obtained by Fleurbaey (2007), but rely on a one-commodity setting with constant productivity.

The linearity assumption is without loss of generality: the result holds true when a second order term is added.

For example, \(A^{es}\left( 2\right) \equiv \left\{ \bar{a}\in A^{es}\left| \left( \bar{c}^{1},\bar{c}^{2}\right) =\left( a,b\right) \text{ with } a,b\in \left\{ \frac{1}{8},\frac{3}{8},\frac{5}{8},\frac{7}{8}\right\} \right. \right\} \).

References

Asheim GB (2010) Intergenerational equity. Annu Rev Econ 2(1):197–222

Asheim GB, Bossert W, Sprumont Y, Suzumura K (2010) Infinite-horizon choice functions. Econ Theor 43(1):1–21

Cass D, Yaari ME (1966) A re-examination of the pure consumption loans model. J Polit Econ 74(4):353–367

Diamond PA (1965) The evaluation of infinite utility streams. Econometrica 33:170–177

Dubey R (2013) Fair allocations in an overlapping generations economy. http://ssrn.com/abstract=2323256. Accessed 16 Aug 2014

Fleurbaey M (2007) Intergenerational fairness. In: Roemer J, Suzumura K (eds) Intergenerational equity and sustainability chap 10. Palgrave Publishers Ltd, Basingstoke, pp 155–175

Fleurbaey M, Maniquet F (2011) A theory of fairness and social welfare. Cambridge University Press, Cambridge

Foley DK (1967) Resource allocation and the public sector. Yale Econ Essays 7:45–98

Kolm S (1972) Justice et quit. Editions du CNRS, Paris

Moulin H (1990) Fair division under joint ownership: recent results and open problems. Soc Choice Welfare 7:149–170

Moulin H (1991) Welfare bounds in the fair division problem. J Econ Theory 54(2):321–337

Moulin H, Thomson W (1988) Can everyone benefit from growth?: two difficulties. J Math Econ 17(4):339–345

Parfit D (1997) Equality and priority. Ratio 10(3):202–221

Piacquadio PG (2014) Intergenerational egalitarianism. J Econ Theory 153:117–127

Quiggin J (2012) Equity between overlapping generations. J Public Econ Theory 14(2):273–283

Shinotsuka T, Suga K, Suzumura K, Tadenuma K (2007) Equity and efficiency in overlapping generations economies. In: Roemer J, Suzuzumura K et al (eds) Intergenerational equity and sustainability. Palgrave Macmillan, Basingstoke

Sprumont Y (1998) Equal factor equivalence in economies with multiple public goods. Soc Choice Welfare 15:543–558

Steinhaus H (1948) The problem of fair division. Econometrica 16(1):101–104

Suzumura K (2002) On the concept of intergenerational equity. Mimeo, New York

Thomson W (1983) The fair division of a fixed supply among a growing population. Math Oper Res 8(3):319–326

Thomson W (1987) Individual and collective opportunities. Int J Game Theory 16:245–252

Thomson W (2011) Chapter twenty-one-fair allocation rules. In: Kenneth J, Arrow AS, Suzumura K (eds) Handbook of social choice and welfare, handbook of social choice and welfare vol 2. Elsevier, Amsterdam, pp 393–506

Acknowledgments

The authors thank F. Maniquet and R. Boucekkine for their guidance and three anonymous referees, the editor in charge, and the managing editor for their very helpful suggestions. The comments by J. Davila, C. d’Aspremont, M. Fleurbaey, E. Ramaekers, A. Shadrikova, and particularly W. Thomson, Y. Sprumont, and G. Valletta as well as by seminar participants in Brussels, Louvain-la-Neuve, Paris, Vielsalm are gratefully acknowledged. This paper is part of the research activities at the Centre for the Study of Equality, Social Organization, and Performance (ESOP) at the Department of Economics at the University of Oslo. ESOP is supported by the Research Council of Norway through its Centres of Excellence funding scheme, project number 179552.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs

Appendix: Proofs

1.1 Theorem 4

Proof

Let \(\varepsilon \in \left( 0,1\right] \). Consider a two-goods economy with one agent per generation (each agent is thus identified by its generation).

We shall first show as a lemma that for each \(\bar{a}\in A^{es}\) with \(\bar{a}\gg 0\), there exists an economy \(E\) for which efficiency and no-domination can not be combined with making each agent at least as well-off than the \(\varepsilon \) part of \(\left( \bar{c},\bar{d}\right) \). Such economy requires a specific pattern of preferences for a finite number of periods. To proof the theorem, we then construct an economy with an infinite sequence of such preference patterns, one for each element of a dense grid on \(A^{es}\). \(\square \)

Lemma 1

Let \(\bar{a}\in A^{es}\) with \(\bar{a}\gg 0\). On the domain \(\mathcal{E}\), there exists no rule that satisfies efficiency, no-domination, and such that for each agent \(\left( i,t\right) \in I\times \mathbb {N}_{>0}\), \(a_{i}\left( t\right) \succsim _{i,t}\varepsilon \bar{a}_{i}\left( t\right) =\varepsilon \left( \bar{c},\bar{d}\right) \) and for each agent \(i\in I\), \(a_{i}\left( 0\right) \succsim _{i,0}\varepsilon \bar{a}_{i}\left( 0\right) =\varepsilon \bar{d}\).

Proof

There are two-goods and one agent per generation. Let \(\bar{a}\in A^{es}\) be an equal-split allocation such that \(\bar{a}\left( t\right) =\left( \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right) \gg 0\).

Step 1. Let the preferences of agents \(t-1,t,t+1\in \mathbb {N}_{>0}\) be represented by the following linear functions:Footnote 12

where \(0<\gamma <\delta <\zeta <\frac{\varepsilon }{3}\min \left[ \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right] <1\). For each agent \(i=t-1,t,t+1\) we denote by \(U_{i}^{ES}\) the utility level achieved at the equal-split bundle. The \(\varepsilon \) equal-split guarantee requires that \(U_{i}\left( a_{i}\right) \ge \varepsilon U_{i}^{ES}\).

Part a) The distribution of goods available at time \(t\) is represented in the Edgeworth box of Fig. 1a, where agent \(t-1\)’s origin is the bottom-left corner and agent \(t\)’s origin is the top-right corner. The equal-split bundle is denoted \(ES\); its \(\varepsilon \) component is \(\varepsilon ES^{d}\) for consumption when old and \(\varepsilon ES^{c}\) for consumption when young. By efficiency, the contract curve for the goods to distribute at period \(t\) (among consumption when young of \(t\) and consumption when old of \(t-1\)) is such that either \(d_{t-1}^{1}=1\) or \(d_{t-1}^{2}=0\) (this corner solution follows from the linearity of preferences with \(\delta <\zeta \)).

When \(d_{t-1}^{2}=0\), it is not possible to assign to agent \(t-1\) a bundle that satisfies the \(\varepsilon \) equal-split guarantee: the maximum utility when \(d_{t-1}^{1}=c_{t-1}^{1}=c_{t-1}^{2}=1\) and \(d_{t-1}^{2}=0\) is \(U_{t-1}^{\max }=2\gamma +\zeta <\varepsilon \min \left[ \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right] \le \varepsilon \bar{d}^{2}<\varepsilon U_{t-1}^{ES}\). This is represented in the graph by \(U_{t-1}^{\max }\); whereas, the indifference level satisfying the \(\varepsilon \) equal-split guarantee, when consumption when young is maximum (\(c_{t-1}^{1}=c_{t-1}^{2}=1\)), is \(\bar{U}_{t-1}^{d}\); since this is higher than the \(U_{t-1}^{\max }\), the efficient allocations that guarantee to agent \(t-1\) the equity constraint lie on the segment \(\overline{F0_{t}^{c}}\): where \(d_{t-1}^{1}=1\) and \(d_{t-1}^{2}>0\).

Part b) The distribution of goods available at time \(t+1\) is represented in the Edgeworth box of Fig. 1b, where agent \(t\)’s origin is the bottom-left corner and agent \(t+1\)’s origin is the top-right corner. The equal-split bundle is denoted \(ES\); its \(\varepsilon \) component is \(\varepsilon ES^{d}\) for consumption when old and \(\varepsilon ES^{c}\) for consumption when young. By efficiency, the contract curve for the goods to distribute at period \(t+1\) (among consumption when young of \(t+1\) and consumption when old of \(t\)) is such that either \(c_{t+1}^{1}=0\) or \(c_{t+1}^{2}=1\) (this corner solution follows from the linearity of preferences with \(\delta <\zeta \)).

When \(c_{t+1}^{1}=0\), it is not possible to assign to agent \(t+1\) a bundle that satisfies the \(\varepsilon \) equal-split guarantee: the maximum utility when \(c_{t+1}^{2}=d_{t+1}^{1}=d_{t+1}^{2}=1\) and \(c_{t+1}^{1}=0\) is \(U_{t+1}^{\max }=2\gamma +\zeta <\varepsilon \min \left[ \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right] \le \varepsilon \bar{c}^{2}<\varepsilon U_{t+1}^{ES}\). This is represented in the graph by \(U_{t+1}^{\max }\); whereas, the indifference level satisfying the \(\varepsilon \) equal-split guarantee, when consumption when old is maximum (\(d_{t+1}^{1}=d_{t+1}^{2}=1\)), is \(\bar{U}_{t+1}^{c}\); since this is higher than the \(U_{t+1}^{\max }\), the efficient allocations that guarantee to agent \(t+1\) the equity constraint lie on the segment \(\overline{0_{t}^{d}G}\): where \(c_{t+1}^{1}>0\) and \(c_{t+1}^{2}=1\).

Summing up, the lifetime consumption of agent \(t\), \(a\left( t\right) \), satisfies \(c_{t}^{1}=0, c_{t}^{2}<1\), \(d_{t}^{1}<1\), and \(d_{t}^{2}=0\).

Step 2. Let the preferences of agents \(\tau -1,\tau ,\tau +1,\tau +2\in \mathbb {N}_{>0}\) with \(\tau =t+4\) be represented by the following utilities:

where \(0<\gamma <\delta <\zeta <\frac{\varepsilon }{3}\min \left[ \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right] <1\). For each agent \(i=\tau -1,\tau ,\tau +1,\tau +2\), \(U_{i}^{ES}\) denotes the utility level at the equal-split bundle; then, the \(\varepsilon \) equal-split condition requires that \(U_{i}\left( a_{i}\right) \ge \varepsilon U_{i}^{ES}\).

Part a) The distribution of goods available at time \(\tau \) is represented in the Edgeworth box of Fig. 2a, where agent \(\tau -1\)’s \(\tau -1\)’s origin is the bottom-left corner and agent \(\tau \)’s top-right corner. The equal-split bundle is denoted \(ES\); its \(\varepsilon \) component is \(\varepsilon ES^{d}\) for consumption when old and \(\varepsilon ES^{c}\) for consumption when young. By efficiency, the contract curve for the goods to distribute at period \(\tau \) (among consumption when young of \(\tau \) and consumption when old of \(\tau -1\)) is such that either \(c_{\tau }^{1}=0\) or \(c_{\tau }^{2}=1\) (this corner solution follows from the linearity of preferences with \(\delta <\zeta \)).

When \(c_{\tau }^{1}=0\), it is not possible to assign to agent \(\tau \) a bundle that satisfies the \(\varepsilon \) equal-split guarantee: the maximum utility when \(c_{\tau }^{2}=d_{\tau }^{1}=d_{\tau }^{2}=1\) and \(c_{\tau }^{1}=0\) is \(U_{\tau }^{\max }=\gamma \left( 1+\delta \right) +\zeta <\varepsilon \min \left[ \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right] \le \varepsilon \bar{c}^{1}<\varepsilon U_{\tau }^{ES}\). This is represented in the graph by \(U_{\tau }^{\max }\); whereas, the indifference level satisfying the \(\varepsilon \) equal-split guarantee, when consumption when old is maximum (\(d_{\tau }^{1}=d_{\tau }^{2}=1\)), is \(\bar{U}_{\tau }^{c}\); since this is higher than the \(U_{\tau }^{\max }\), the efficient allocations that guarantee to agent \(\tau \) the equity constraint lie on the segment \(\overline{0_{\tau -1}^{d}G'}\): where \(c_{\tau }^{1}>0\) and \(c_{\tau }^{2}=1\).

Part b) The distribution of goods available at time \(\tau +2\) is represented in the Edgeworth box of Fig. 2b, where agent \(\tau +1\)’s origin is the bottom-left corner and agent \(\tau +2\)’s origin is the top-right corner. The equal-split bundle is denoted \(ES\); its \(\varepsilon \) component is \(\varepsilon ES^{d}\) for consumption when old and \(\varepsilon ES^{c}\) for consumption when young. By efficiency, the contract curve for the goods to distribute at period \(\tau +2\) (among consumption when young of \(\tau +2\) and consumption when old of \(\tau +1\)) is such that either \(d_{\tau +1}^{1}=1\) or \(d_{\tau +1}^{2}=0\) (this corner solution follows from the linearity of preferences with \(\delta <\zeta \)).

When \(d_{\tau +1}^{2}=0\), it is not possible to assign to agent \(\tau +1\) a bundle that satisfies the \(\varepsilon \) equal-split guarantee: the maximum utility when \(d_{\tau +1}^{1}=c_{\tau +1}^{1}=c_{\tau +1}^{2}=1\) and \(d_{\tau +1}^{2}=0\) is \(U_{\tau +1}^{\max }=\gamma \left( 1+\zeta \right) +\zeta <\varepsilon \min \left[ \bar{c}^{1},\bar{c}^{2},\bar{d}^{1},\bar{d}^{2}\right] \le \varepsilon \bar{d}^{2}<\varepsilon U_{\tau +1}^{ES}\). This is represented in the graph by \(U_{\tau +1}^{\max }\); whereas, the indifference level satisfying the \(\varepsilon \) equal-split guarantee when consumption when young is maximum (\(c_{\tau +1}^{1}=c_{\tau +1}^{2}=1\)) is \(\bar{U}_{\tau +1}^{d}\); since this is higher than the \(U_{\tau +1}^{\max }\), the efficient allocations that guarantee to agent \(\tau +1\) the equity constraint lie on the segment \(\overline{F'0_{\tau +2}^{c}}\): \(d_{\tau +1}^{1}=1\) and \(d_{\tau }^{2}>0\).

Step 3. The efficient distribution of resources available at \(\tau +1\) requires that either:

- (i) :

-

\(c_{\tau +1}^{1}=0\) (and \(d_{\tau }^{1}=1\)); or

- (ii) :

-

\(c_{\tau +1}^{2}=1\) (and \(d_{\tau }^{2}=0\)).

From Step 1, \(a\left( t\right) \) satisfies \(c_{t}^{1}=0\), \(c_{t}^{2}<1, d_{t}^{1}<1\), and \(d_{t}^{2}=0\).

From Step 2, in case i), \(a\left( \tau \right) \) is such that \(c_{\tau }^{1}>0, c_{\tau }^{2}=1\), \(d_{\tau }^{1}=1\) and \(d_{\tau }^{2}\ge 0\): thus, \(a\left( \tau \right) \) dominates \(a\left( t\right) \).

In case ii), \(a\left( \tau +1\right) \) is such that \(c_{\tau +1}^{1}\ge 0, c_{\tau +1}^{2}=1, d_{\tau +1}^{1}=1\), and \(d_{\tau +1}^{2}>0\): thus, \(a\left( \tau +1\right) \) dominates \(a\left( t\right) \). \(\square \)

In two dimensions, each allocation in \(A^{es}\) can be mapped into a square with the proportion of each resource assigned to consumption when young on the two axes. We construct a dense grid over this square. First consider the center of the square, i.e. \(\bar{a}\in A^{es}\) such that \(\left( \bar{c}^{1},\bar{c}^{2}\right) =\left( \frac{1}{2},\frac{1}{2}\right) \). Second, by imaginary folding the square, once vertically and once horizontally, \(4\) smaller (overlapping) squares are obtained; the center of each is such that \(\left( \bar{c}^{1},\bar{c}^{2}\right) =\left( a,b\right) \) with \(a,b\in \left\{ \frac{1}{4},\frac{3}{4}\right\} \). Folding these squares again, once vertically and once horizontally, \(16\) smaller (overlapping) squares are obtained; the center of each is such that \(\left( \bar{c}^{1},\bar{c}^{2}\right) =\left( a,b\right) \) with \(a,b\in \left\{ \frac{1}{8},\frac{3}{8},\frac{5}{8},\frac{7}{8}\right\} \). Repeating this folding operation, a cell-centered coarsening method is described.

Let \(A^{es}\left( \nu \right) \) be the set of equal-split bundles that are a center of the squares obtained after \(\nu \) folding iterations.Footnote 13 For each \(\nu \ge 1\), we can order the elements of \(A^{es}\left( \nu \right) \) lexicographically (good \(1\) first): for each \(\bar{a},\tilde{a}\in A^{es}\left( \nu \right) \), \(\bar{a}\) is ranked before \(\tilde{a}\) if \(\bar{c}^{1}<\tilde{c}^{1}\) or if \(\bar{c}^{1}=\tilde{c}^{1}\) and \(\bar{c}^{2}<\tilde{c}^{2}\). Let \(lex\left( \bar{a};\nu \right) \) denote the rank of \(\bar{a}\) in the set \(A^{es}\left( \nu \right) \). Then each \(\bar{a}\) in the grid is uniquely identified by a function \(k\) that associates to it a number \(n\in \mathbb {N}_{>0}\) such that \(k\left( \bar{a}\right) =1\) for \(\nu =0\) and \(k\left( \bar{a}\right) =\frac{4^{\nu }-1}{4-1}+lex\left( \bar{a};\nu \right) \) for \(\nu \ge 1\).

Let economy \(E\in \mathcal{E}\) be such that for each \(n\in \mathbb {N}_{>0}\) and the corresponding \(\bar{a}=k^{-1}\left( n\right) \), preferences of agents \(\theta -1,\theta ,\theta +1\in \mathbb {N}_{>0}\) with \(\theta =2+10n\) are as the ones of \(t-1,t,t+1\) in Step 1 of the above Lemma and preferences of agents \(\theta +5,\theta +6,\theta +7,\theta +8\in \mathbb {N}_{>0}\) are as the ones of \(\tau -1,\tau ,\tau +1,\tau +2\) in Step 2 of the Lemma (note that these preferences depend on the choice of \(\bar{a}\) through the parameters \(\gamma ,\delta ,\zeta \) that depend on it).

Assume by contradiction that there exists an equal-split allocation \(\bar{a}\in A^{es}\) with \(\bar{a}\gg 0\) that satisfies the axioms for economy \(E\). Since the grid is dense and preferences are continuous, there exists an \(n\in \mathbb {N}_{>0}\) such that for agents \(\theta -1,\theta ,\theta +1,\theta +5,\theta +6,\theta +7,\theta +8\in \mathbb {N}_{>0}\) with \(\theta =2+10n\) the clash of the Lemma holds.

1.2 Theorem 6

Proof

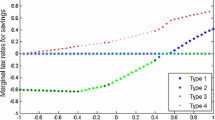

We construct an economy \(E\in \mathcal{E}^{\kappa }\) for which no allocation satisfies efficiency and equal treatment of equals. Let \(L=2\) and \(\kappa \in \left( 0,1\right] \). Agents are of two kinds, \(\alpha \) and \(\beta \), with preferences represented by the following functions, with \(\gamma >1\) and \(\zeta \in \left( 0,1\right) \):

Let generations \(t\in \left\{ 1,2,3,4,5\right\} \) consist of an \(\alpha \) and a \(\beta \) agent; let generations \(t\in \left\{ 7,9,11,\ldots \right\} \) consist of two type \(\alpha \) agents and generations \(t\in \left\{ 8,10,12,\ldots \right\} \) consist of two type \(\beta \) agents.

By equal treatment of equals, the \(\alpha \) agents of generations \(t\in \left\{ 7,9,11,\ldots \right\} \) should achieve the same utility level, say \(\bar{U}_{\alpha }\). Similarly, the \(\beta \) agents of generations \(t\in \left\{ 8,10,12,\ldots \right\} \) should achieve the same utility level, say \(\bar{U}_{\beta }\). The largest such utilities that can be feasibly assigned to these agents need to satisfy both the following constraints: \(\bar{U}_{\alpha }\le \frac{1+\gamma }{2}+\zeta \left( \frac{1+\gamma }{2}-\bar{U}_{\beta }\right) \) and \(\bar{U}_{\beta }\le \frac{1+\gamma }{2}+\zeta \left( \frac{1+\gamma }{2}-\bar{U}_{\alpha }\right) \). When generations \(t\in \left\{ 1,2,3,4,5\right\} \) are efficiently assigned only the goods that cannot be assigned to other generations (generation \(0\) and generation \(6\)), at least one agent (\(\alpha \) or \(\beta \)) of these generations achieves a utility level larger than \(U^{min}\equiv \gamma \frac{\zeta +\zeta ^{2}+\zeta ^{3}+\zeta ^{4}}{1+\zeta +\zeta ^{2}+\zeta ^{3}+\zeta ^{4}}\). Clearly, when \(\zeta \) is close to \(1\) and \(\gamma \) is sufficiently large, \(U^{\min }\) is larger than the utility level agents of generations \(t\ge 7\) can equally achieve, i.e. \(\gamma \frac{\zeta +\zeta ^{2}+\zeta ^{3}+\zeta ^{4}}{1+\zeta +\zeta ^{2}+\zeta ^{3}+\zeta ^{4}}>\frac{1+\gamma }{2}\). \(\square \)

Rights and permissions

About this article

Cite this article

Isaac, T., Piacquadio, P.G. Equity and efficiency in an overlapping generation model. Soc Choice Welf 44, 549–565 (2015). https://doi.org/10.1007/s00355-014-0848-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-014-0848-1