Abstract

This paper studies a principal–agent relation in which the principal’s private information about the agent’s effort choice is more accurate than a noisy public performance measure. For some contingencies the optimal contract has to specify ex post inefficiencies in the form of inefficient termination (firing the agent) or wasteful activities that are formally equivalent to third-party payments (money burning). Under the optimal contract, the use of these instruments depends not only on the precision of public information but also on job characteristics. Money burning is used at most in addition to firing and only if the loss from termination is small. The agent’s wage may depend only on the principal’s report and not on the public signal. Nonetheless, public information is valuable as it facilitates truthful subjective evaluation by the principal.

Similar content being viewed by others

Notes

Besides the obvious examples of layoffs and dismissals, also in some option contracts one party keeps the authority to terminate the relationship. See e.g. Lerner and Malmendier (2010) on the use of option contracts in biotechnology research.

An example of literal third-party payments is given by Fuchs (2007): some baseball teams can fine their players, and the fines are not paid to the club, but rather to a charity.

Rajan and Reichelstein (2006) show that this inefficiency decreases with the number of agents when the principal employs multiple agents. Fuchs (2007) and Chan and Zheng (2011) show that the efficiency loss can be mitigated in a (finite) long term relationship: the per-period efficiency loss decreases in the number of periods.

Bester and Krähmer (2012) consider a buyer–seller relation where the buyer observes the seller’s quality choice, but his observation is not verifiable. They show that ‘exit option’ contracts, corresponding to the option of ‘firing’ in the present context, can implement the first-best. Here and in Schmitz (2002) this is not possible because the agent’s (the seller’s) effort is not directly observable.

Obviously, firing might inflict a cost on the agent, and the threat of firing may be used to motivate the agent. The use of non-monetary fines to overcome limited liability has been studied in Chwe (1990) and Sherstyuk (2000). To focus on the implications of firing versus money burning for the principal’s incentives, we assume that firing imposes no costs at all on the agent.

Our assumption that a constant fraction of output is lost upon termination implies that, the higher the output, the more costly it is for the principal to terminate the project. This drives our result that termination is preferred over money burning. We conjecture that similar result will hold in a more general model where the principal’s cost of firing is a strictly monotone increasing function of output.

For subjective evaluations in a different context where monetary transfers are not allowed, see Taylor and Yildirim (2011).

Instead of assuming that the principal loses \(\alpha x\), we could more generally assume that he loses \(\alpha (x)\), where \(\alpha (\cdot )\) is a strictly increasing function. Our simplification allows us to study the comparative statics of the optimal contract for changes in \(\alpha \).

As we show in Sect. 3, however, also wages that do not depend on termination are optimal. The reason is that in our model termination serves to induce truthful reporting by the principal rather than to incentivize the agent.

Note that whether the principal or the agent pays b plays no role because the wage payment can be adjusted accordingly. We assume that \(b \ge 0\) because any third party is covered by limited liability, just as the agent.

More formally, if \(w_{ij}^C\) is the wage when the project is completed and \(w_{ij}^T\) the wage after premature termination, we can simply replace these wages by \(w_{ij} \equiv (1- \theta _{ij}) w_{ij}^C + \theta _{ij} \,w_{ij}^T\).

We assume that the agent faces no risk of termination because he cares only about expected wages. If termination would inflict some cost on the agent, such as e.g. a reputation loss, then the threat of being fired would provide additional effort incentives.

There are contracts that achieve the first-best, where payments depend on the principal’s report, but reporting is not truthful. Formally all four wage parameters could be different, but only two different wages will be paid with positive probability.

The argument for why \(b_{LL} = 0\) is a bit more subtle. However, if \(b_{LL}\) were positive, one could decrease it while simultaneously increasing \(b_{HL}\) and thereby increase the principal’s payoff.

See also our discussion at the end of Sect. 7.

The constraint \(0 \le e \le 1\) can be ignored because it is not binding.

Indeed, if the principal reports after having observed the public signal, any contract that solves the unlimited liability problem must ignore the principal’s information. This immediately follows from (29) because \(b = \theta = 0\).

This can be shown by differentiating them twice and using \(x_{H}>x_{L}\), \( \sigma >1/2\), and \(c^{\prime \prime \prime }\left( e\right) \ge 0\).

This can be shown by differentiating them twice and using \(1/2<\sigma< \bar{\sigma } < x_H/(x_H + x_L)\), \(c^{\prime \prime }\left( e\right) >0\) and \(c^{\prime \prime \prime }\left( e\right) \ge 0\).

References

Baker, G.P.: Incentive contracts and performance measurement. J. Polit. Econ. 100, 598–614 (1992)

Baker, G.P., Gibbons, R., Murphy, K.J.: Subjective performance measures in optimal incentive contracts. Q. J. Econ. 109, 1125–1156 (1994)

Bester, H., Krähmer, D.: Exit options in incomplete contracts with asymmetric information. J. Econ. Theory 147, 1947–1968 (2012)

Bolton, P., Scharfstein, D.S.: Optimal debt structure and the number of creditors. J. Polit. Econ. 104, 1–25 (1996)

Chan, J., Zheng, B.: Rewarding improvement: optimal dynamic contracts with subjective evaluation. RAND J. Econ. 42, 758–775 (2011)

Chwe, M.S.-Y.: Why were workers whipped? Pain in a principal-agent model. Econ. J. 100, 1109–1121 (1990)

Fuchs, W.: Contracting with repeated moral hazard and private evaluations. Am. Econ. Rev. 97, 1432–1448 (2007)

Gale, D., Hellwig, M.: Incentive-compatible debt contracts: the one-period problem. Rev. Econ. Stud. 52, 647–663 (1985)

Grossmann, S., Hart, O.: An analysis of the principal agent problem. Econometrica 51, 7–46 (1983)

Harris, M., Raviv, A.: Optimal incentive contracts with imperfect information. J. Econ. Theory 20, 231–259 (1979)

Hayes, R.M., Schaefer, S.: Implicit contracts and the explanatory power of top executive compensation for future performance. Rand J. Econ. 31, 273–293 (2000)

Holmstrom, B.: Moral hazard and observability. Bell J. Econ. 10(1979), 74–91 (1979)

Kahn, C., Huberman, G.: Two-sided uncertainty and ‘up-or-out’ contracts. J. Labor Econ. 6, 423–444 (1988)

Khalil, F., Lawaree, J., Scott, T.: Private monitoring, collusion, and the timing of information. RAND J. Econ. 46, 872–890 (2015)

Kwon, S.: Relational contracts in a persistent environment. Econ. Theory 61(1), 183–205 (2015)

Lang, M.: Contracting with Subjective Evaluations and Communication. Working paper, MPI, Bonn (2013)

Lerner, J., Malmendier, U.: Contractibility and the design of research agreements. Am. Econ. Rev. 100, 214–246 (2010)

Levin, J.: Relational incentive contracts. Am. Econ. Rev. 93, 835–857 (2003)

Lewis, T.R., Sappington, D.E.: Information management in incentive problems. J. Polit. Econ. 105, 796–821 (1997)

MacLeod, B.: Optimal contracting with subjective evaluation. Am. Econ. Rev. 93, 216–240 (2003)

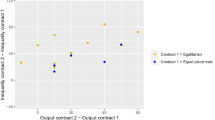

MacLeod, B., Parent, D.: Job characteristics and the form of compensation. Res. Labor E. 18, 177–242 (1999)

MacLeod, B., Parent, D.: Introduction to job characteristics and the form of compensation. Res. Labor E. 35, 603–606 (2012)

Murphy, K.J.: Executive compensation. In: Ashenfelter, O., Card, D. (eds.) Handbook of Labor Economics, vol. 3, pp. 2485–2563. Elsevier, Amsterdam (1999)

Myerson, R.: Incentive compatibility and the bargaining problem. Econometrica 47, 61–73 (1979)

Myerson, R.: Multistage games with communication. Econometrica 54, 323–58 (1986)

Pearce, D.G., Stacchetti, E.: The interaction of implicit and explicit contracts in repeated agency. Game. Econ. Behav. 23, 75–96 (1998)

Prendergast, C.: The provision of incentives in firms. J. Econ. Lit. 37, 7–63 (1999)

Rajan, M.V., Reichelstein, S.: Subjective performance indicators and discretionary bonus pools. J. Account. Res. 44, 585–618 (2006)

Rajan, M.V., Reichelstein, S.: Objective versus subjective indicators of managerial performance. Account. Rev. 84, 209–237 (2009)

Sappington, D.E.: Limited liability contracts between principal and agent. J. Econ. Theory 29, 1–21 (1983)

Schmitz, P.: On the interplay of hidden action and hidden information in simple bilateral trading problems. J. Econ. Theory 103, 444–460 (2002)

Sherstyuk, K.: Performance standards and incentive pay in agency contracts. Scand. J. Econ. 102, 725–736 (2000)

Sonne, M., Sebald, A.: Personality and Conflict in Principal-Agent Relations Based on Subjective Performance Evaluations. Working paper, University of Copenhagen (2012)

Taylor, C.R., Yildirim, H.: Subjective performance and the value of blind evaluation. Rev. Econ. Stud. 78, 762–794 (2011)

Zabojnik, J.: Subjective evaluations with performance feedback. RAND J. Econ. 45, 341–369 (2014)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank an associate editor and a referee for helpful comments. We also thank Jörg Budde, Daniel Krähmer, Matthias Lang, Bentley MacLeod, Patrick Schmitz, Roland Strausz, Peter Vida, and seminar participants at Freie Universität Berlin, Humboldt Universität Berlin, University of Cologne, University of Copenhagen, and WHU Vallendar for comments and interesting discussions. Support by the German Science Foundation (DFG) through SFB/TR 15 is gratefully acknowledged.

Appendix

Appendix

Proof of Proposition 1

Suppose that \(\theta =b=0\), \(w_{HH}=w_{HL}\), and \(w_{LH}=w_{LL}\). Then the principal’s incentive constraints (8) are obviously satisfied. Let the difference of the wages satisfy

Then by (13) the agent will choose the first-best effort \(\tilde{e}\). In addition, by unlimited liability one can choose the wage \(w_{LL}\) such that the agent’s individual rationality constraint holds with equality:

This contract implements the first-best effort \(\tilde{e}\). Moreover, the principal’s payoff is equal to the first-best surplus \(S\left( \tilde{e}\right) \) because the agent receives his outside option payoff. Obviously, the payoff of the principal cannot be higher; thus the contract considered here is optimal. Moreover, any optimal contract must implement the first-best effort \(\tilde{e}\), for otherwise the principal’s payoff must be lower than the first-best surplus \(S\left( \tilde{e}\right) \).

It remains to show that \(\theta =b=0\) in any optimal contract. By assumption (1), \(\tilde{e}\in \left( 0,1\right) \). Since \(\sigma <1\), this implies that all four possible combinations of output and the public signal occur with positive possibility. Therefore, whenever \(\theta \not =0\) or \(b\not =0\), total surplus is below the first-best surplus \(S\left( \tilde{e}\right) \), and hence the principal’s payoff is below \(S\left( \tilde{e} \right) \) as well. \(\square \)

Proof of Proposition 2

The agent’s utility is

Since \(w\ge 0\) and \(c\left( 0\right) =0\), \(U\left( \gamma ,0\right) \ge 0\). Thus, in what follows we can ignore constraint (14) because it is automatically satisfied.

If \(\left( \gamma ,e\right) \) solves problem (16), then obviously \(\gamma \) must maximize \(V(\gamma ,e)\) subject to the constraints in (16) when e is treated as a fixed parameter. The latter is a linear optimization problem since \(V\left( \gamma ,e\right) \) and all constraints are linear in \(\gamma \), and the Kuhn–Tucker conditions are both necessary and sufficient for a maximum. Following a standard method, we temporarily ignore that \(\gamma \) has to satisfy the inequality \(V_{L}\left( \gamma , \hat{x}_{L}\right) \ge V_{L}\left( \gamma ,\hat{x} _{H}\right) \) in (8), and show below that this constraint is automatically satisfied. Consider the Lagrangian

with \(\lambda \ge 0\). Note that \(\mu >0\) as the agent’s incentive constraint must be binding.

Straightforward differentiation shows that \(w_{HL}= w_{LL} = 0\) because

Moreover, \(\theta _{HH}=b_{HH}=\theta _{LH}=b_{LH}=0\) because

Finally, \(b_{LL}=0\) because \(\sigma > 1/2\) implies that

The above arguments prove part (b) of the proposition. To complete the proof of part (a), note that the agent’s incentive constraint (13) reduces to (17), because \(w_{HL}= w_{LL} = 0\). Changing \(w_{HH}\) and \(w_{LH}\) such that Eq. (17) continues to hold leaves the principal’s payoff constant and does not interfere with any of the constraints. Therefore, the optimal wages \(w_{HH}\) and \(w_{LH}\) are not unique.

To prove part (c), note that \(b_{HL}>0\) implies

and thus \(\lambda = {\left( 1-e\right) \left( 1-\sigma \right) }/{\sigma }\). This implies

Therefore \(b_{HL}>0\) implies \(\theta _{HL}=1\).

We now show that, as claimed above, only the second inequality in the ICP constraints (8) is binding. By parts (a) and (b), the principal’s incentive constraint \(V_{H}(\gamma ,\hat{x} _{H})\ge V_{H}(\gamma ,\hat{x}_{L})\) in (8) simplifies to

Suppose this constraint is not binding. Then \(\theta _{HL}\) must be strictly positive, since by limited liability the left hand side of (44) is non-negative, and by part (c) the right hand side can be positive only if \(\theta _{HL}>0\). Thus one must have \({\partial L}/{\partial \theta _{HL}} \ge 0\), and by (42) this implies \(\lambda > 0\). This proves that the constraint (44) must be binding and \(V_{H}(\gamma ,\hat{x}_{H}) \ge V_{H}(\gamma ,\hat{x}_{L})\) must hold with equality.

Using part (a) and (b) the inequality \(V_{L}(\gamma ,\hat{x}_{L})\ge V_{L}(\gamma ,\hat{x}_{H})\) in (8) reduces to

Since (44) is binding,

where the inequality follows from \(w_{LH}\ge 0\). Subtracting the left hand side of (45) shows that

If \(\theta _{LL}=0\), this implies that (45) is satisfied. Similarly, if \(\left( 1-\sigma \right) ^{2}x_{H}/\sigma \ge \sigma x_{L}\), (45) is satisfied. To complete the argument, we show that one cannot have that \(\left( 1-\sigma \right) ^{2}x_{H}/\sigma <\sigma x_{L}\) and \(\theta _{LL}>0\). Indeed, \(\theta _{LL}>0\) implies

and so

By the first equality in (41) this implies

where the second inequality holds if \(\left( 1-\sigma \right) ^{2}x_{H}/\sigma <\sigma x_{L}\). Since this would imply \(b_{HL} = \infty \), we have shown that \(\theta _{LL} = 0\) if \(\left( 1-\sigma \right) ^{2}x_{H}/\sigma <\sigma x_{L}\).

Finally, statement (d) directly follows by combining (17) with (44), which holds with equality as shown above. \(\square \)

Proof of Lemma 1

(a) As shown in the last part of the proof Proposition 2, \(\theta _{LL} = 0\) if \(\left( 1-\sigma \right) ^{2}x_{H}/\sigma <\sigma x_{L}\). As this inequality is equivalent to \(\sigma > \bar{\sigma }\), this proves part (a).

(b) Let \(b_{HL}>0\) and \(\sigma <\bar{\sigma }\). Then \({\partial L}/{\partial b_{HL}} = 0\) and so by the second equality in (36)

By the equality in (48) this implies

where the last inequality holds because \(\sigma <\bar{\sigma }\). Therefore, \(\theta _{LL}=1\).

As shown in the proof of Proposition 2, \(\theta _{LL}>0\) implies (49). Therefore, by (42)

Therefore \(\theta _{LL}>0\) implies \(\theta _{HL}=1\). \(\square \)

Proof of Proposition 3

We substitute out all choice variable except e from the principal’s problem, and then optimize with respect to e. By parts (a) and (b) of Proposition 2, the principal’s profit \(V\left( e,\gamma \right) \) equals

By Lemma 1, \(\theta _{LL}=0\) and hence by (19),

There are two possible cases. First, suppose that \(\sigma \alpha x_{H}\ge c^{\prime }\left( e\right) \). This is equivalent to \(e \le \hat{e}\), where \(\hat{e} \equiv c^{\prime -1}\left( \sigma \alpha x_{H}\right) \). In this case, (57) and Proposition 2 (c) imply that \(b_{HL}=0\) and \(\theta _{HL}=c^{\prime }\left( e\right) /\left( \sigma \alpha x_{H}\right) \). Profit equals

Second, suppose that \(\sigma \alpha x_{H} < c^{\prime }\left( e\right) ,\ \)or, equivalently, \(e>\hat{e}\). Then \(\theta _{HL}=1\) and so by (57) \(b_{HL} = {c^{\prime }(e)}/{\sigma }-\alpha x_{H}>0\). In this case, the principal’s payoff is

Note that \(\phi _{1}\left( e\right) \le \phi _{2}\left( e\right) \) if and only if \(c^{\prime }\left( e\right) \le \sigma \alpha x_{H}\). Therefore, the principal’s payoff as a function of e can be written as

The functions \(\phi _{1}\) and \(\phi _{2}\) are strictly concave in e.Footnote 26 The minimum of two strictly concave functions is strictly concave, hence \(\tilde{V}\) is strictly concave.

Differentiating \(\phi _{2}\) yields

Define \(e_{2}^{*}\) implicitly by \(\phi _{2}^{\prime }\left( e_{2}^{*}\right) =0\). Since \(\phi _{2}\) is strictly concave, \(e_{2}^{*}\) is unique. Since \(c^{\prime \prime \prime }(e) \ge 0\) and \(c^{\prime }(0) = 0\), \(e c^{\prime \prime }(e) \ge c^{\prime }(e)\) for all e. By (1) therefore \(c^{\prime \prime }(1) \ge c^{\prime }(1) > x_H - x_L\). This implies \(\phi _{2}^{\prime }\left( 1\right) <0\) and so \(e_{2}^{*}<1\).

If \(e_{2}^{*}>\hat{e}\), then \(e_{2}^{*}\) maximizes the principal’s payoff \(\tilde{V}\left( e\right) \). Moreover, if the optimal contract involves \(b_{HL}>0\), then \(e_{2}^{*}> \hat{e}\). We use the intermediate value theorem to show that \(e_{2}^{*}> \hat{e}\) if and only if \(\alpha \) is strictly smaller than a critical value \(\bar{\alpha }\in \left( 0,1\right) \). The argument proceeds in three steps:

-

1.

At \(\alpha =0\), \(\phi _{2}^{\prime }\left( 0\right) >0\) by assumptions (1) and (2). Moreover, if \(\alpha =0\), the critical value \(\hat{e}\) equals zero. Therefore, if \(\alpha =0\), then \(e_{2}^{*} > \hat{e}\).

-

2.

The critical value \(\hat{e}\) is continuous and strictly increasing in \(\alpha \). Moreover, \(e_{2}^{*}\) is continuous and strictly decreasing in \(\alpha \):

$$\begin{aligned} \frac{de_{2}^{*}}{\mathrm{d}\alpha }=-\frac{{\partial \phi _{2}^{\prime } \left( e_{2}^{*}\right) }/{\partial \alpha }}{\phi _{2}^{\prime \prime } \left( e_{2}^{*}\right) }=\frac{\left( 1-\sigma \right) \left( x_{H}-x_{L}\right) }{\phi _{2}^{\prime \prime }\left( e_{2}^{*}\right) } <0. \end{aligned}$$(62) -

3.

If \(\alpha =1\), \(e_{2}^{*}\) solves

$$\begin{aligned} \frac{2\sigma -1}{\sigma }c^{\prime }\left( e_{2}^{*}\right) +\left[ e_{2}^{*}+\left( 1-e_{2}^{*}\right) \frac{\left( 1-\sigma \right) }{ \sigma }\right] c^{\prime \prime }\left( e_{2}^{*}\right) =\sigma \left( x_{H}-x_{L}\right) . \end{aligned}$$(63)Since \(c^{\prime \prime \prime }\left( e\right) \ge 0 = c^{\prime }\left( 0\right) \), we have \(ec^{\prime \prime }\left( e\right) \ge c^{\prime }\left( e\right) \) and thus

$$\begin{aligned} \left[ \frac{2\sigma -1}{\sigma }+1\right] c^{\prime }\left( e_{2}^{*}\right) <\sigma \left( x_{H}-x_{L}\right) . \end{aligned}$$(64)By \(\sigma >1/2\), it follows that \(c^{\prime }\left( e_{2}^{*}\right) <\sigma x_{H}\). We conclude that, if \(\alpha =1\), \(c^{\prime }\left( e_{2}^{*}\right) <\sigma \alpha x_{H}\) and thus \(e_{2}^{*}<\hat{e}\).

From steps 1–3, it follows that there exists a critical value \(\bar{\alpha } \in \left( 0,1\right) \) such that \(e^{*}>\hat{e}\) holds if and only if \(\alpha <\bar{\alpha }\). As argued above, this implies that \(b_{HL} > 0\) if and only if \(\alpha <\bar{\alpha }\). \(\square \)

Proof of Proposition 4

There are three cases corresponding to statements (a), (b) and (c). First, suppose that \(c^{\prime }\left( e\right) \le \sigma \alpha x_{H}\), or equivalently, \(e\le \hat{e}=c^{\prime -1}\left( \alpha \sigma x_{H}\right) \). Then, by Proposition 2 (c) and (d), \(\theta _{HL}=c^{\prime }\left( e\right) /\left( \sigma \alpha x_{H}\right) \) and \(\theta _{LL}=b_{HL}=0\). Profit equals \(\phi _{1}\left( e\right) \), as defined in the proof of Proposition 3. Second, suppose that \(\sigma \alpha x_{H}<c^{\prime }\left( e\right) \le \alpha x_{H}\). This is equivalent to \( e\in \left( \hat{e},\bar{e}\right] ,\ \)where \(\bar{e}:=c^{\prime -1}\left( \alpha x_{H}\right) \). In this case \(\theta _{HL}=1\), and \(b_{HL}=0\), and \( \theta _{LL}=\left[ c^{\prime }(e)-\sigma \alpha x_{H}\right] /\left[ \left( 1-\sigma \right) \alpha x_{H}\right] \). Using (56), the principal’s profit is

Third, suppose that \(c^{\prime }\left( e\right) >\alpha x_{H}\), or, equivalently, \(e>\bar{e}\). Then \(\theta _{LL}=\theta _{HL}=1\) and \( b_{HL}=\left( c^{\prime }(e)-\alpha x_{H}\right) /\sigma \), and profit equals

Note that \(\phi _{1}\left( e\right) \le \phi _{3}\left( e\right) \) if and only if \(c^{\prime }(e) \le \sigma \alpha x_H\). Moreover \(\phi _{3}\left( e\right) \le \phi _{4}\left( e\right) \) if and only if \(c^{\prime }(e) \le \alpha x_H\). Thus \(c^{\prime }\left( e\right) \le \alpha \sigma x_{H}\) if and only if \(\phi _{1}\left( e\right) =\min \left\{ \phi _{1}\left( e\right) ,\phi _{3}\left( e\right) ,\phi _{4}\left( e\right) \right\} \). Moreover, \(\sigma \alpha x_{H}<c^{\prime }\left( e\right) \le \sigma x_{H}\) if and only if \(\phi _{3}\left( e\right) <\phi _{1}\left( e\right) \) and \(\phi _{3}\left( e\right) \le \phi _{4}\left( e\right) \). Therefore, the principal’s payoff can be written

The functions \(\phi _{1}\), \(\phi _{3}\), and \(\phi _{4}\) are strictly concave in e.Footnote 27 Therefore, \(\tilde{V}\) is strictly concave in e.

Define \(e_{4}^{*}\) implicitly by \(\phi _{4}^{\prime }\left( e_{4}^{*}\right) =0\). Since \(\phi _{4}\) is strictly concave, \(e_{4}^{*}\) is unique. By assumption (1), \(e_{4}^{*}<1\). If \(e_{4}^{*} > \bar{e}\), then \(e_{4}^{*}\) maximizes \(\tilde{V}\left( e\right) \). Moreover, if the optimal contract involves \(b_{HL}>0\), then \(e_{4}^{*}>\bar{e}\).

We use the intermediate value theorem to show that \(e_{4}^{*}>\bar{e}\) if and only if \(\alpha \) is strictly smaller than a critical value \(\bar{\alpha } _{1}\in \left( 0, 1\right) \). The argument proceeds in three steps:

-

1.

If \(\alpha =0\), \(\phi _{4}^{\prime }\left( 0\right) >0 = \bar{e}\). Thus if \(\alpha =0\), \(e_{4}^{*}>\bar{e}\).

-

2.

\(e_{4}^{*}\) is continuous and strictly decreasing in \(\alpha \). Moreover, \(\bar{e}=c^{\prime -1}\left( \alpha x_{H}\right) \) is continuous and strictly increasing in \(\alpha \).

-

3.

At \(\alpha =1\), \(e_{4}^{*}\) solves

$$\begin{aligned} x_{H}=c^{\prime }\left( e_{4}^{*}\right) + \left[ e_{4}^{*}\sigma +\left( 1-e_{4}^{*}\right) \left( 1-\sigma \right) \right] c^{\prime \prime }\left( e_{4}^{*}\right) \frac{\sigma }{2 \sigma -1}. \end{aligned}$$(68)Therefore, at \(\alpha =1\), \(\alpha x_{H}>c^{\prime }\left( e_{4}^{*}\right) \) and so \(e_{4}^{*} < \bar{e}\).

Thus there exists an \(\bar{\alpha }_{1}\in \left( 0,1\right) \) such that if \(\alpha =\bar{\alpha }_{1}\), \(e_{4}^{*}\) \(=\bar{e}\). For all \(\alpha <\bar{\alpha }_{1}\), the optimal effort is \(e_{4}^{*}>\bar{e};\) moreover \( b_{HL}>0\) and \(\theta _{HL}=\theta _{LL}=1\). On the other hand, for all \(\alpha \ge \bar{\alpha }_{1}\), \(b_{HL}=0\).

It remains to show that there exists \(\bar{\alpha }_{2}\in \left( \bar{\alpha } _{1},1\right) \) such that \(\theta _{LL}>0\) if and only if \(\alpha <\bar{\alpha }_{2}\). Note that \(\theta _{LL}>0\) if and only \(\phi _{3}^{\prime }\left( \hat{e}\right) >0\). To see this, first suppose that \(\phi _{3}^{\prime }\left( \hat{e}\right) \le 0\). Then \(\tilde{V}\left( e\right) < \tilde{V}\left( \hat{e}\right) \) for all \(e>\hat{e}\) since \(\tilde{V}(\cdot )\) is strictly concave. Hence the optimal effort is no larger than \(\hat{e}\) and \(\theta _{LL}=0\). Second, if \(\phi _{3}^{\prime }\left( \hat{e}\right) >0\), then the optimal effort is strictly bigger than \(\hat{e}\) and \(\theta _{LL}>0\).

We use the intermediate value theorem to show that there exists \(\bar{\alpha }_{2} \in \left( \bar{\alpha }_{1}, 1\right) \) such that \(\phi _{3}^{\prime }\left( \hat{e}\right) >0\) if and only if \(\alpha <\bar{\alpha }_{2}\). The argument proceeds in three steps:

-

1.

By definition of \(\bar{\alpha }_{1}\), if \(\alpha =\bar{\alpha }_{1}\), then \(\phi _{4}^{\prime }\left( e_{4}^{*}\right) =\phi _{4}^{\prime }\left( \bar{e}\right) =0\). Since \(\phi _{3}\) and \(\tilde{V}\) are strictly concave, and \(\bar{e}>\hat{e}\), it follows that \(\phi _{4}^{\prime }\left( \bar{e} \right) \le \phi _{3}^{\prime }\left( \bar{e}\right) <\phi _{3}^{\prime }\left( \hat{e}\right) \). Therefore, if \(\alpha =\bar{\alpha }_{1}\), then \(\phi _{3}^{\prime }\left( \hat{e}\right) >0\).

-

2.

\(\phi _{3}^{\prime }\left( \hat{e}\right) \) is continuous and strictly decreasing in \(\alpha :\)

$$\begin{aligned} \frac{\mathrm{d}}{\mathrm{d}\alpha }\phi _{3}^{\prime }\left( \hat{e}\right) =\left[ \frac{ \partial }{\partial \alpha }\phi _{3}^{\prime }\left( e\right) \right] _{e= \hat{e}}+\phi _{3}^{\prime \prime }\left( \hat{e}\right) \frac{\mathrm{d}\hat{e}}{ \mathrm{d}\alpha }<0. \end{aligned}$$(69) -

3.

Suppose \(\alpha =1\). Since \(e c^{\prime \prime }\left( e\right) \ge c^{\prime }\left( e\right) \),

$$\begin{aligned} \phi _{3}^{\prime }\left( \hat{e}\right)= & {} x_{H}-x_{L}-x_{L}\frac{2\sigma -1}{1-\sigma }-\left[ 1-\frac{\sigma x_{L}}{\left( 1-\sigma \right) x_{H}} \right] c^{\prime }\left( \hat{e}\right) \end{aligned}$$(70)$$\begin{aligned}&-\left[ \hat{e}+\left( 1-\hat{e}\right) \frac{\sigma x_{L}}{\left( 1-\sigma \right) x_{H}}\right] c^{\prime \prime }\left( \hat{e}\right) \end{aligned}$$(71)$$\begin{aligned}< & {} x_{H}-x_{L}-x_{L}\frac{2\sigma -1}{1-\sigma }-\left[ 2-\frac{\sigma x_{L} }{\left( 1-\sigma \right) x_{H}}\right] \sigma x_{H} \end{aligned}$$(72)$$\begin{aligned}= & {} x_{H}-2\sigma x_{H}-\sigma x_{L}<0. \end{aligned}$$(73)Hence if \(\alpha =1\), then \(\phi _{3}^{\prime }\left( \hat{e}\right) <0\).

\(\square \)

Proof of Proposition 5

The principal’s expected payoff \(\tilde{V}\left( e\right) \) defined in (60) and (67) is strictly increasing in \(\sigma \) because the functions \(\phi _1, \phi _2, \phi _3\) and \(\phi _4\) are strictly increasing in \(\sigma \). If \(\theta _{HL} < 1\), then \(\tilde{V}\left( e\right) = \phi _1(e)\), as defined in (58), and therefore \(\partial \tilde{V}\left( e\right) /\partial \alpha = 0\). If \(\theta _{HL} = 1\), then \(\tilde{V}\left( e\right) = \phi _2(e)\) in the case of Proposition 3 and \(\partial \tilde{V}\left( e\right) /\partial \alpha > 0\) because \(\phi _2\) is strictly increasing in \(\alpha \). In the case of Proposition 4, \(\tilde{V}\left( e\right) = \min \left\{ \phi _3(e), \phi _4(e)\right\} \). As \(\sigma < \bar{\sigma }\), \(\phi _3\) and \(\phi _4\) are strictly increasing in \(\alpha \) and so \(\partial \tilde{V}\left( e\right) /\partial \alpha > 0\). \(\square \)

Proof of Proposition 6

Suppose \(\sigma >\bar{\sigma }\). By Proposition 3, \(b_{HL}\) is strictly positive if and only if \(\alpha <\bar{\alpha }\). Moreover, the proof of Proposition 3 establishes that, when \(\alpha <\bar{\alpha }\), the profit maximizing effort is equal to \(e_{2}^{*}\) which is strictly decreasing in \(\alpha \) [see Eq. (62)], and \(\theta _{HL}=1\) and \(\theta _{LL}=0\). By Eq. (19) it follows that

which is strictly decreasing in \(\alpha \).

By the proof of Proposition 3, the principal’s profit from implementing effort e is \(\tilde{V}\left( e\right) =\phi _{1}\left( e\right) \) if \(e\le \hat{e}\equiv c^{\prime -1}\left( \sigma \alpha x_{H}\right) \), and \(\tilde{V}\left( e\right) =\phi _{2}\left( e\right) \) if \(e>\hat{e}\). We show that there exists an \(\varepsilon ^{\prime }>0\) such that, if \(\alpha \in \left( \bar{\alpha },\bar{\alpha }+\varepsilon ^{\prime }\right) \), the profit maximizing effort is equal to \(\hat{e}\) and thus strictly increasing in \(\alpha \).

Since \(\tilde{V}\left( e\right) \) is strictly concave in e, it is sufficient to prove that \(\phi _{1}^{\prime }\left( \hat{e}\right)>0>\phi _{2}^{\prime }\left( \hat{e}\right) \) if \(\alpha \in \left( \bar{\alpha } ,\bar{\alpha }+\varepsilon ^{\prime }\right) \) for some \(\varepsilon ^{\prime }>0\). Straightforward calculations show that

Since \(\phi _{1}\left( \hat{e}\right) =\phi _{2}\left( \hat{e}\right) \),

Moreover, if \(\alpha =\bar{\alpha }\), then \(\phi _{2}^{\prime }\left( \hat{e}\right) =0\) by construction of \(\bar{\alpha }\). Thus \(\alpha =\bar{\alpha }\) implies

By continuity, there exists \(\varepsilon ^{\prime }>0\) such that \(\phi _{1}^{\prime }\left( \hat{e}\right) >0\) when \(\alpha \in \left( \bar{\alpha },\bar{\alpha }+\varepsilon ^{\prime }\right) \). It remains to show that \(\phi _{2}^{\prime }\left( \hat{e}\right) <0\) when \(\alpha \in \left( \bar{\alpha },\bar{\alpha }+\varepsilon ^{\prime }\right) \). Equation (61) implies that \(\phi _{2}^{\prime }\left( e\right) \) is strictly decreasing in \(\alpha \) (holding e constant). Moreover, \(\hat{e}\) is strictly increasing in \(\alpha \), and \(\phi _{2}^{\prime \prime }\left( e\right) <0\). Since \(\alpha =\bar{\alpha }\) implies \(\phi _{2}^{\prime }\left( \hat{e}\right) =0\), it follows that \(\phi _{2}^{\prime }\left( \hat{e}\right) <0\) when \(\alpha \in \left( \bar{\alpha },\bar{\alpha }+\varepsilon ^{\prime }\right) \).

Suppose \(\sigma <\bar{\sigma }\). By Proposition 4, \(b_{HL}\) is strictly positive if and only if \(\alpha <\bar{\alpha }_{1}\). Moreover, the proof of Proposition 4 establishes that, when \(\alpha <\bar{\alpha }_{1}\), the profit maximizing effort is equal to \(e_{4}^{*}\) which is strictly decreasing in \(\alpha \), and \(\theta _{LL}=\theta _{HL}=1\). By Eq. (19), it follows that

which is strictly decreasing in \(\alpha \).

By the proof of Proposition 4, the principal’s profit from implementing effort e is \(\tilde{V}\left( e\right) =\phi _{1}\left( e\right) \) if \(e\le \hat{e}\), \(\tilde{V}\left( e\right) =\phi _{3}\left( e\right) \) if \(\hat{e}<e\le \bar{e}\equiv c^{\prime -1}\left( \alpha x_{H}\right) \), and \(\tilde{V}\left( e\right) =\phi _{4}\left( e\right) \) if \(e>\bar{e}\). We show that there exists an \(\varepsilon ^{\prime \prime }>0\) such that, if \(\alpha \in \left( \bar{\alpha }_{1},\bar{\alpha }_{1} +\varepsilon ^{\prime \prime }\right) \), the profit maximizing effort is equal to \(\bar{e}\) and thus strictly increasing in \(\alpha \).

Since \(\tilde{V}\left( e\right) \) is strictly concave in e, it is sufficient to prove that \(\phi _{3}^{\prime }\left( \bar{e}\right)>0>\phi _{4}^{\prime }\left( \bar{e}\right) \) if \(\alpha \in \left( \bar{\alpha } _{1},\bar{\alpha }_{1}+\varepsilon ^{\prime \prime }\right) \) for some \(\varepsilon ^{\prime \prime }>0\). Straightforward calculations show that

Since \(\phi _{3}\left( \bar{e}\right) =\phi _{4}\left( \bar{e}\right) \),

Suppose that \(\alpha =\bar{\alpha }_{1}\). Then \(\phi _{4}^{\prime }\left( \bar{e}\right) =0\) by construction of \(\bar{\alpha }_{1}\). Thus

which is strictly positive since \(\sigma <\bar{\sigma }\). By continuity, there exists some \(\varepsilon ^{\prime \prime }>0\) such that \(\phi _{3}^{\prime }\left( \bar{e}\right) >0\) when \(\alpha \in \left( \bar{\alpha }_{1},\bar{\alpha }_{1}+\varepsilon ^{\prime \prime }\right) \). It remains to show that \(\phi _{4}^{\prime }\left( \bar{e}\right) <0\) when \(\alpha \in \left( \bar{\alpha }_{1},\bar{\alpha }_{1}+\varepsilon ^{\prime \prime }\right) \). Equation (66) implies that \(\frac{\partial }{\partial \alpha }\phi _{4}^{\prime }\left( e\right) =x_{L}-\frac{1-\sigma }{\sigma }x_{H}<0\), where the inequality follows from \(\sigma <\bar{\sigma }\). That is, \(\phi _{4}^{\prime }\left( e\right) \) is strictly decreasing in \(\alpha \) (holding e constant). Moreover, \(\bar{e}\) is strictly increasing in \(\alpha \), and \(\phi _{4}^{\prime \prime }\left( e\right) <0\). Since \(\alpha =\bar{\alpha }_{1}\) implies \(\phi _{4}^{\prime }\left( \bar{e}\right) =0\), it follows that \(\phi _{4}^{\prime }\left( \bar{e}\right) <0\) when \(\alpha \in \left( \bar{\alpha }_{1},\bar{\alpha }_{1}+\varepsilon ^{\prime \prime }\right) \).

Setting \(\varepsilon :=\min \left\{ \varepsilon ^{\prime },\varepsilon ^{\prime \prime }\right\} \) concludes the proof. \(\square \)

Proof of Proposition 7

Since \((\gamma , e)\) solves problem (16), \(\gamma \) satisfies (18) and \(w_{LL} = w_{HL} = 0\) by Proposition 2 (a). This reduces the constraints in (29) to

By (85) \(w_{LH} \le \alpha \theta _{LL} x_H\). Suppose that this inequality is strict, i.e. \(w_{LH} < \alpha \theta _{LL} x_H\). Then (86) implies that \(w_{HH} > \alpha \,\theta _{HL}\, x_H + b_{HL}\), a contradiction to (84). This proves that the constraints in (29) cannot be satisfied if \(w_{LH} \ne \alpha \theta _{LL} x_H\).

Now let \(w_{LH} = \alpha \theta _{LL} x_H\). Then (82) and (85) hold because \(x_L < x_H\). As \(w_{LH} = \alpha \theta _{LL} x_H\), (86) implies

Thus the equality holds in (84), and the strict inequality holds in (83) because \(x_L < x_H\). This proves that (82)–(85) are satisfied if \((\gamma , e)\) solves problem (16) with \(w_{LH} = \alpha \theta _{LL} x_H\) and \(w_{HH} = \alpha \,\theta _{HL}\, x_H + b_{HL}\). \(\square \)

Rights and permissions

About this article

Cite this article

Bester, H., Münster, J. Subjective evaluation versus public information. Econ Theory 61, 723–753 (2016). https://doi.org/10.1007/s00199-016-0953-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-0953-8