Abstract

This paper introduces the concept of a Forecast Combination Equilibrium to model boundedly rational agents who combine a menu of different forecasts in a way that mimics the behavior of actual forecasters. The equilibrium concept is consistent with rational expectations under certain conditions, while also permitting multiple, distinct, self-fulfilling equilibria, many of which are stable under least-squares learning. The equilibrium concept is applied to a Lucas-type monetary model and to a Fisherian monetary model with a Taylor rule. The existence of multiple equilibria is shown to depend on the aggressiveness of monetary policy in both models. In the latter, a more aggressive response to inflation is required in the Taylor rule than is typically found in this class of model to ensure a unique and learnable equilibrium. Real-time learning simulations with a constant gain illustrate some appealing properties of this approach including time-varying volatility and sharp movements in inflation, similar to actual data, while assuming only i.i.d. random shocks.

Similar content being viewed by others

Notes

The seminal paper demonstrating the efficacy of forecast combination is Bates and Granger (1969), who showed that weighted averages of competing forecasting methods consistently outperforms any of the individual forecasts considered. Surveys of the literature are found in Clemen (1989), Timmermann (2006), and Wallis (2011).

The timing of expectations in this model differs from most DSGE and asset pricing models. The timing in these models is usually \(E_{t}y_{t+1}\). This case is less analytically tractable so I proceed by analyzing the \(E_{t-1}y_t\) case as done in Evans et al. (2013) to develop the general concept. The Fisherian model explored in Sect. 3 provides an explicit example of the equilibrium concept under the alternative expectation timing assumption and illustrates that the key conclusions are unchanged. Select definitions for the \(E_{t}y_{t+1}\) case are provided in the “Appendix.”

This assumption is not crucial for most of the analysis and the agents’ information set could contain only a portion of \(\mathbf{z}_{t-1}\).

The \(m_{i}\)’s correspond to the number of parameters included in each forecast rule so that \(m_{i}\le n\) for all i. The \(m_{i}\times n+1\) selector matrices are \(n+1\times n+1\) identity matrices with rows that do not correspond to included exogenous variables deleted. An example is given in the “Appendix.” Similar notation is used in Branch and Evans (2006a).

See Hendry and Clements (2004) for a more detailed discussion of the forecast combination puzzle.

See Sturmfels (2002) for further explanation on the complexity of systems of polynomial equations and applications to economic problems.

This is similar to the findings of Evans et al. (2013).

The existence of these biases also does not rule out the existence of multiple equilibria.

A remaining restriction that an econometrician may want to impose is that the weights sum to one. This case is considered in Sect. 3.

An explicit example of how the regressions are stacked is given in the “Appendix.”

The derivation is shown in the “Appendix.” Guse (2008) shows that the technical conditions for the stochastic recursive algorithm theorems that underpin the E-stability principle are satisfied for the block recursive least-squares algorithm.

See Evans and Honkapohja (2001) for a complete analysis and discussion of this result.

The derivation of the following T-map is given in the “Appendix.”

Evans et al. (2013) also find that \(\alpha =\frac{1}{2}\) is the boundary for non-rational equilibria to exist in their simulations.

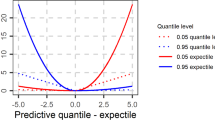

The remaining parameters are \(\zeta _{1}=.9\), \(\zeta _{2}=-.9\), \(E\mathbf{x}_{t}{} \mathbf{x}_{t}'=\mathbf{I}\), and \(\hat{\mathbf{x}}_{t-1}=(1, \ 1)'\). The equilibrium forecasts are constructed as \(E_{t-1}^\mathrm{FCE}y_t =\gamma _1^*(a_1^*+ b_1^*\times 1) + \gamma _2^*(a_2^*+ b_2^*\times 1)\), where \(*\) denotes the OW-FCE values. The range of the figures includes negative values of \(\alpha \) to illustrate the cobweb case for the reduced form model as well as the case of interest. There is a unique OW-FCE if the model exhibits negative feedback. An example in the literature of the cobweb case is Branch and Evans (2006a).

The two assumptions violate A2 and A1, respectively.

The multiple equilibria in this case are different from the unrestricted case because every equilibrium shares a common intercept belief. This is due to the fact that \(\alpha (\gamma _{1}+\gamma _{2})=1\) cannot be satisfied, except trivially when \(\alpha =1\). Therefore, bifurcation of the unique equilibrium as \(\alpha \) increases in this case occurs in the \(b_i\) beliefs.

\(\beta _t = \beta e^{x_{1,t}}\) is the stochastic discount factor where \(x_{1,t}\) is a mean zero AR(1) shock and \(0<\beta <1\).

As is standard in the adaptive learning literature, it is assumed that the agents know \({\rho }\) since \(\mathbf{x}_t\) is an exogenous observable process, which may be learned with probability one using least squares.

The relationship between \(\alpha \) and \({\zeta }\) implied by the underlying model is ignored for the analysis in this section. The relationship does not affect the characteristics or the position with respect to \(\alpha \) of the first bifurcation. Numerical simulations with the relationship imposed show that all equilibrium and E-stability results are qualitatively unchanged, although, the timing of the second round of bifurcations and the onset of multiple equilibria in the constrained weights case is altered relative to the fixed \(\zeta \) case.

Figure 3 parameters are \(\zeta _{1}=.9\), \(\zeta _{2}=-.9\), \(E\mathbf{x}_{t}{} \mathbf{x}_{t}'=\mathbf{I}\), \(\rho _1=0.9\), \(\rho _2=0.9\), and \({\hat{\mathbf{x}}}_{t-1}=(1, \ 1)'\).

See Taylor (1993, 1999) for discussion and background on the Taylor rule. Many other factors can also affect determinacy as shown by Bénassy (2006) or Gliksberg (2009). Cochrane (2011) disputes whether the Taylor principle is sufficient and argues that explosive inflation paths cannot be ruled out. However, Evans and McGough (2015) shows that the explosive paths are in general not learnable.

\(\theta _\pi = 1.5\) corresponds to the value Taylor (1993) argues best describes US monetary policy.

See Evans and Honkapohja (2001) for a thorough treatment of this result.

I do not simulate the decreasing gain case because the E-stability analysis fully characterizes the limiting dynamics. Given a set of initial conditions in a neighborhood of any of the E-stable OW-FCEs, the learning algorithm will converge asymptotically with probability one to the OW-FCE in that neighborhood.

Homogeneity of expectations also implies that no asset trading would take place in equilibrium in an asset trading model. Extending FCE to the heterogeneous agent case is an interesting topic for future research.

Constant gain learning on its own generates some variation in the second moments of inflation even in the case of a unique equilibrium. It can also generate escape dynamics, where trend inflation moves abruptly away from steady-state values as explored by Cho et al. (2002) and McGough (2006). Therefore, FCE is not a necessary condition to generate this type of behavior.

Optimal weights larger than one are a known feature in the actual practice of forecasting and will arise under quite general conditions including when weights are restricted to sum to one. To formally illustrate this argument, I present the derivation of optimal weights given by Timmermann (2006) who considers forecasting a mean zero process with two unbiased forecast rules. Ignoring time, the two forecast rules’ errors can be written as \(fe_1 = \pi - \hat{\pi }_1\) and \(fe_2 = \pi - \hat{\pi }_2\), where \(fe_1 \sim (0, \sigma _1^2)\), \(fe_2 \sim (0, \sigma _2^2)\), \(\sigma _{12}=\rho _{12}\sigma _1\sigma _2\), and \(\rho _{12}\) is the correlation of the forecast errors. The combined forecast error is given by \(fe_c = \gamma _1 fe_1 + (1- \gamma _1) fe_2\), which implies

$$\begin{aligned} \sigma _{c}^2 (\gamma _1) = \gamma _1^2 \sigma _1^2 + (1-\gamma _1)^2 \sigma _2^2 + 2 \gamma _1 (1-\gamma _1) \sigma _{12}. \end{aligned}$$(32)Minimizing Eq. (32) with respect to \(\gamma _1\) yields the optimal weight

$$\begin{aligned} \gamma _1^* = \frac{\sigma _2^2 - \sigma _{12}}{\sigma _1^2 + \sigma _2^2-2 \sigma _{12}}. \end{aligned}$$It is simple to show that \(\sigma _c^2(\gamma _1^*) \le \min (\sigma _1^2, \sigma _2^2)\) and that in general the optimal weights need not be in the unit simplex if \(\rho _{12}>\sigma _2 / \sigma _1\).

Branch and Evans (2006b) find that \(\bar{\kappa }=0.0345\) explains the quarterly forecasts observed in the SPF. I have scaled the number to make it consistent with monthly observations.

The simulated path is a 795 period subsample taken from a larger simulation following a 15,000 period burn-in to illustrate common possible dynamics.

References

Ang, A., Bekaert, G., Wei, M.: Do macro variables, asset markets, or surveys forecast inflation better? J. Monetary Econ. 54(4), 1163–1212 (2007)

Anufriev, M., Hommes, C.: Evolutionary selection of individual expectations and aggregate outcomes in asset pricing experiments. Am. Econ. J. Microecon. 4(4), 35–64 (2012a)

Anufriev, M., Hommes, C.: Evolution of market heuristics. Knowl. Eng. Rev. 27(02), 255–271 (2012b)

Anufriev, M., Assenza, T., Hommes, C., Massaro, D.: Interest rate rules and macroeconomic stability under heterogeneous expectations. Macroecon. Dyn. 17(08), 1574–1604 (2013)

Atkeson, A., Ohanian, L.: Are phillips curves useful for forecasting inflation? Fed. Reserve Bank Minneap. Q. Rev. 25(1), 2–11 (2001)

Bates, J.M., Granger, C.W.J.: The combination of forecasts. Oper. Res. 451–468 (1969)

Bénassy, J.: Interest rate rules, inflation and the Taylor principle: an analytical exploration. Econ. Theory 27(1), 143–162 (2006). doi:10.1007/s00199-004-0551-z

Branch, W.: Restricted Perceptions Equilibria and Learning in Macroeconomics. Post Walrasian Macroeconomics: Beyond the Dynamic Stochastic General Equilibrium Model. Cambridge University Press, Cambridge (2004)

Branch, W., Evans, G.: Intrinsic heterogeneity in expectation formation. J. Econ. Theory 127(1), 207–237 (2006a)

Branch, W., Evans, G.: A simple recursive forecasting model. Econ. Lett. 91(2), 158–166 (2006b)

Branch, W., Evans, G.: Model uncertainty and endogenous volatility. Rev. Econ. Dyn. 10(2), 207–237 (2007)

Branch, W., Evans, G.: Monetary policy and heterogeneous expectations. Econ. Theory 47(2–3), 365–393 (2011a). doi:10.1007/s00199-010-0539-9

Branch, W.A., Evans, G.W.: Unstable inflation targets. Tech. rep., mimeo (2011b)

Branch, W., McGough, B.: Replicator dynamics in a cobweb model with rationally heterogeneous expectations. J. Econ. Behav. Organ. 65(2), 224–244 (2008)

Branch, W., McGough, B.: Dynamic predictor selection in a new Keynesian model with heterogeneous expectations. J. Econ. Dyn. Control 34(8), 1492–1508 (2010)

Brock, W., Hommes, C.: A rational route to randomness. Econometrica 65(5), 1059–1095 (1997)

Brock, W., Hommes, C.: Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J. Econ. Dyn. Control 22(8–9), 1235–1274 (1998)

Brock, W., Hommes, C., Wagener, F.: More hedging instruments may destabilize markets. J. Econ. Dyn. Control 33(11), 1912–1928 (2009)

Bullard, J., Mitra, K.: Learning about monetary policy rules. J. Monetary Econ. 49(6), 1105–1129 (2002)

Chiarella, C., He, X.: Heterogeneous beliefs, risk, and learning in a simple asset-pricing model with a market maker. Macroecon. Dyn. 7(04), 503–536 (2003)

Cho, I., Williams, N., Sargent, T.: Escaping Nash inflation. Rev. Econ. Stud. 69(1), 1–40 (2002)

Clemen, R.: Combining forecasts: a review and annotated bibliography. Int. J. Forecast. 5(4), 559–583 (1989)

Cochrane, J.H.: Determinacy and identification with Taylor rules. J. Polit. Econ. 119(3), 565–615 (2011)

De Grauwe, P.: Animal spirits and monetary policy. Econ Theory 47(2–3), 423–457 (2011). doi:10.1007/s00199-010-0543-0

Evans, G., Honkapohja, S.: Learning and Expectations in Macroeconomics. Princeton University Press, Princeton (2001)

Evans, G., Honkapohja, S., Sargent, T., Williams, N.: Bayesian model averaging, learning, and model selection. In: Sargent, T., Vilmunen, J. (eds.) Macroeconomics at the Service of Public Policy. Oxford University Press, Oxford (2013)

Evans, G.W., McGough, B.: Observability and equilibrium selection. University of Oregon, mimeo (2015)

Gliksberg, B.: Monetary policy and multiple equilibria with constrained investment and externalities. Econ. Theory 41(3), 443–463 (2009). doi:10.1007/s00199-008-0405-1

Granger, C., Ramanathan, R.: Improved methods of combining forecasts. J. Forecast. 3(2), 197–204 (1984)

Guse, E.: Learning in a misspecified multivariate self-referential linear stochastic model. J. Econ. Dyn. Control 32(5), 1517–1542 (2008)

Harvey, D., Newbold, P.: Tests for multiple forecast encompassing. J. Appl. Econ. 15(5), 471–482 (2000)

Hendry, D., Clements, M.: Pooling of forecasts. Econom. J 7(1), 1–31 (2004)

Hommes, C.: The heterogeneous expectations hypothesis: some evidence from the lab. J. Econ. Dyn. Control 35(1), 1–24 (2011)

Hommes, C.: Behavioral Rationality and Heterogeneous Expectations in Complex Economic Systems. Cambridge University Press, Cambridge (2013)

Lucas, R.: Some international evidence on output-inflation tradeoffs. Am. Econ. Rev. 63(3), 326–334 (1973)

McGough, B.: Shocking escapes. Econ. J. 116(511), 507–528 (2006)

Muth, J.: Rational expectations and the theory of price movements. Econometrica 29(3), 315–335 (1961)

Orphanides, A., Williams, J.: The decline of activist stabilization policy: natural rate misperceptions, learning, and expectations. J. Econ. Dyn. Control. 29(11), 1927–1950 (2005)

Orphanides, A., Williams, J.: Monetary policy with imperfect knowledge. J. Eur. Econ. Assoc. 4(2–3), 366–375 (2006)

Preston, B.: Learning about monetary policy rules when long-horizon expectations matter. Int J. Cent Bank. 1(2), 81–126 (2005)

Robertson, J.: Central bank forecasting: an international comparison. Econ. Rev. Fed. Reserve Bank Atlanta 85(2), 21–32 (2000)

Sargent, T.: The Conquest of American inflation. Princeton University Press, Princeton (2001)

Smith, J., Wallis, K.: A simple explanation of the forecast combination puzzle*. Oxf. Bull. Econ. Stat. 71(3), 331–355 (2009)

Stock, J., Watson, M.: Combination forecasts of output growth in a seven-country data set. J. Forecast. 23(6), 405–430 (2004)

Stock, J., Watson, M.: Why has U.S. inflation become harder to forecast? J. Money Credit Bank 39, 3–33 (2007)

Sturmfels, B.: Solving Systems of Polynomial Equations, vol. 97. American Mathematical Society, Providence (2002)

Taylor, J.B.: Discretion versus policy rules in practice. In: Carnegie-Rochester conference series on public policy, vol. 39, pp. 195–214. Elsevier (1993)

Taylor, J.B.: A historical analysis of monetary policy rules. In: Monetary Policy Rules, pp. 319–348. University of Chicago Press (1999)

Timmermann, A.: Forecast combinations. Handb. Econ. Forecast. 1, 135–196 (2006)

Wallis, K.: Combining forecasts-forty years later. Appl. Finan. Econ. 21(1–2), 33–41 (2011)

Wieland, V., Wolters, M.H.: The diversity of forecasts from macroeconomic models of the US economy. Econ. Theory. 47(2–3), 247–292 (2011). doi:10.1007/s00199-010-0549-7

Wiggins, S.: Introduction to applied nonlinear dynamical systems and chaos, vol. 1. Springer (1990)

Yang, Y.: Combining forecasting procedures: some theoretical results. Econom. Theory 20(01), 176–222 (2004)

Acknowledgments

I wish to thank George Evans, Bruce McGough, Jeremy Piger, James Morley, Mikhail Anufriev, Valentyn Panchenko, the University of Oregon Macro Group; participants of the 2013 Expectations in Dynamic Macroeconomic Models Conference hosted by the Federal Reserve Bank of San Francisco; seminar participants at Washington State University, Bank of Canada, US Naval Academy, Trinity College, Franklin and Marshall College; and multiple anonymous referees for valuable insights and comments on previous versions of this paper. All remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Selector matrix example The selector matrices given by the \(\mathbf{u}_{i}\)’s are \(m_{i}\times n+1\) matrices that can be thought of as identity matrices, which have the rows that do not correspond to included exogenous variables deleted. As an example, consider the case where \(\mathbf{z}_{t-1} = ( 1, x_{1,t-1}, x_{2,t-1}, x_{3,t-1})'\) and the misspecified model is given by

The model can be written as \(\hat{y}_{1,t}={\mathbf{M}}_{1}'\mathbf{u}_{1}{} \mathbf{z}_{t-1}\), where \({\mathbf{M}}_{i}=(a_{1}, b_{1}, b_{3})'\) and

Definitions for the alternative timing of expectations Many DSGE models and asset pricing models have the following reduced form

where \(x_t\) is vector of mean zero autoregressive processes. The unique REE of this model is

where \(\varvec{\Omega }= (\mu , \mathbf{\zeta }')'\), \({\rho }_{\mathbf{z}}\) is square diagonal matrix with the elements of \((1, {\rho }')\) on the diagonal, and \(\mathbf{z}_t = (1,\mathbf{x}_t')'\). The misspecified forecast rule in this case are given by

which implies

The corresponding condition for an FCE parameter belief given by Eq. (8) is

The corresponding condition for an optimal weight belief given by Eq. (11) is

where \(\varvec{\chi } =\mathbf{M}_{i}'{} \mathbf{u}_{i}{\rho }_{\mathbf{z}} \varvec{\Sigma }_{z}{\rho }_{\mathbf{z}}'(-\alpha {\rho }_{\mathbf{z}} +\mathbf{I})\mathbf{u}_{i}'{} \mathbf{M}_{i}\).

Recursive least-squares learning example and the derivation of T-map For the Lucas-type monetary model example, the agents’ recursively estimates three regressions: two regressions to estimate the coefficients of \(\hat{\pi }_{1,t}\) and \(\hat{\pi }_{2,t}\) and a third to estimate \(\varvec{\Gamma }\). The estimation can be written jointly and recursively as

where the first equations governs the evolution of the belief and weight coefficients, \(\varvec{\Theta }_{t}=({\hat{\mathbf{M}}}_{1,t}',{\hat{\mathbf{M}}}_{2,t}',\hat{{\varvec{\Gamma }}}_{t}')'\), and the second equation is the estimated second moments matrix. The recursive form uses a block matrix structure to estimate all coefficients simultaneously, where \(\mathbf{y}_{t}=(\pi _{t} \ \pi _{t} \ \pi _{t})'\), the regressors are stacked into the matrix

and \(\varvec{\Pi }_{t} = (\hat{\pi }_{1,t}, \hat{\pi }_{2,t})'\).

The derivation of the T-map follows Chapter 13 of Evans and Honkapohja (2001) and can be computed by calculating

The nesting of the equilibrium conditions (8) and (11) can be seen by multiplying the \(\bar{\mathbf{z}}_{t-1}\) through the brackets to yield

and then pushing through the expectations operator, rearranging terms, and factoring out \(E\bar{\mathbf{z}}_{t-1} \bar{\mathbf{z}}_{t-1}'=\bar{{\varvec{\Sigma }}}_\mathbf{z}\) to arrive at

The associated differential equation of the system can then be written as

where since \(\mathbf{R}^{-1}\bar{{\varvec{\Sigma }}}_\mathbf{z}=\mathbf{I}\) at a fixed point, the appropriate equation to analyze a given equilibrium is

Proposition 1

To prove existence first note that by construction \(\mathbf{u}_{i}\mathbf{u}_{i}'=\mathbf{I}\), where \(\mathbf{I}\) is an \(m_{i} \times m_{i}\) identity matrix, and consider the following two lemmas:

Lemma 3

If \(\varvec{\Sigma }_{z}\) is diagonal (A2), then \(\mathbf{u}_{i}\varvec{\Sigma }^{-1}_{z}{} \mathbf{u}_{i}'\mathbf{u}_{i}\varSigma _{z}{} \mathbf{u}_{i}'=\mathbf{I}\)

Proof

By assumption \(\varvec{\Sigma }_{z}\) is a diagonal matrix and by construction \(\mathbf{u}_{i}'{} \mathbf{u}_{i}=\varPsi \) is a square diagonal matrix with only ones and zeros on the diagonal. Matrix multiplication of diagonal matrices implies that \(\varvec{\Sigma }^{-1}_{z}{} \mathbf{u}_{i}'\mathbf{u}_{i}\varvec{\Sigma }_{z}\) can be computed as

Therefore, \(\mathbf{u}_{i}\varSigma ^{-1}_{z}{} \mathbf{u}_{i}'\mathbf{u}_{i}\varSigma _{z}{} \mathbf{u}_{i}'=\mathbf{u}_{i}\varPsi \mathbf{u}_{i}'=\mathbf{u}_{i}{} \mathbf{u}_{i}'{} \mathbf{u}_{i}{} \mathbf{u}_{i}'=\mathbf{I}\). \(\square \)

Lemma 4

If \(\varvec{\Sigma }_{z}\) is diagonal (A2), then \((\mathbf{u}_{i}\varvec{\Sigma }_{z}{} \mathbf{u}_{i}')^{-1}\mathbf{u}_{i}\varvec{\Sigma }_{z}=\mathbf{u}_{i}\)

Proof

Suppose that \((\mathbf{u}_{i}\varvec{\Sigma }_{z}\mathbf{u}_{i}')^{-1}{} \mathbf{u}_{i}\varvec{\Sigma }_{z}=\mathbf{A}\), such that \(\mathbf{A}\ne \mathbf{u}_{i}\), then

Thus, either \(\mathbf{u}_{i}=\mathbf{0}\), or \(\mathbf{A}=\mathbf{u}_{i}\) and a contradiction is established. \(\square \)

Now consider the equation for the equilibrium parameter beliefs given by

using Lemmas 3 and 4 this can be simplified to

where \(\mathbf{u}_{i}{} \mathbf{u}_{j}'=\mathbf{A}_{i,j}\). Now assuming A1, A3, and \(\alpha \ne \frac{1}{\omega }\), it follows that \(\mathbf{A}_{i,j}\mathbf{M}_{j}=0\) for all j in the above sum. To see this, recall that \(\mathbf{u}_{i}\) and \(\mathbf{u}_{j}\) may only share the first row in common by A3. Therefore, everywhere \(\mathbf{A}_{i,j}\) has a nonzero value corresponds to the intercept parameter belief. However, due to A1 (\(\mu =0\)) and \(\alpha \ne \frac{1}{\omega }\), the equilibrium parameter belief must also be zero. Thus, \(\mathbf{M}_i =(1-\alpha )^{-1}{} \mathbf{u}_{i}\varvec{\Omega }\) and \(\varvec{\Gamma }=(1,\ldots , 1)'\) are EW-FCE beliefs.

Finally, to verify that the EW-FCE is equivalent to the REE, substitute in the equilibrium beliefs, weights, and A3 into the ALM

Now using A1 such that \(\varvec{\Omega }=(0, \zeta ')'\), it follows that the above expression simplifies to

To show that proposed FCE is unique it must be the case that

is invertible. Applying Lemma 4 it follows that

which is invertible as long as \(\alpha \ne 1\) and \(\alpha \omega \ne 1\). \(\square \)

Proposition 2

From the proof of Proposition 1 it follows that

and that the beliefs are equivalent to the REE in aggregate. Substituting these beliefs into the optimal weights condition yields

where \(\varvec{\Psi } =\varvec{\Omega }'{} \mathbf{u}_{i}'\mathbf{u}_{i}\varvec{\Sigma }_{z}{} \mathbf{u}_{i}'\mathbf{u}_{i}\varvec{\Omega }\), \(\varvec{\Xi }=\varvec{\Omega }'{} \mathbf{u}_{i}'\mathbf{u}_{i}\varvec{\Sigma }_{z}\varvec{\Omega }\), and

Assuming A1, it follows that intercept belief are zero, which implies \(\varvec{\Lambda }_{j}=0\) for all \(j\ne i\). Now noting that \({{\varvec{\Xi }} }\varvec{\Psi }^{-1}=1\), it follows that

which implies the optimal weight is \(\gamma _{i}=1\).

Lemma 1

The methods presented follow Wiggins (1990). A bifurcation may be characterized by deriving an approximation to the center manifold of the dynamic system. The dynamic behavior of the system on the center manifold determines the dynamics in the larger system. To demonstrate the derivation of the center manifold, consider the following dynamic system

The system has n eigenvalues such that \(s+c+u=n\), where s is the number of eigenvalues with negative real parts, c is the number of eigenvalues with zero real parts, and u is the number eigenvalues with positive real parts. Suppose that \(u=0\), then the system can be written as

where

A and B are diagonal matrices with the corresponding eigenvalues on the diagonal, and \(\epsilon \in \mathbb {R}\) is the bifurcation parameter. Suppose that the system has a fixed point at (0, 0, 0). The center manifold is defined locally as

The graph of \(h(\mathbf{x}, \epsilon )\) is invariant under the dynamics generated by the system, which gives the following condition:

The equation can be used to approximate \(h(x,\epsilon )\) to form \(f(x, h(x,\epsilon ), \epsilon )\), which gives the dynamics of the system on the center manifold and allows for a bifurcation to be identified. The conditions for the existence of a supercritical pitchfork bifurcation at (0,0,0) are

To apply the center manifold reduction technique to the T-map given by Eqs. (20) and (19) it must be put into the normal form of (35). This is done by translating the fixed point \(a_{i}=0, b_{i}=\zeta _{i}/(1-\alpha ),\) and \(\gamma _{i}=1\) for \(i=1, 2\) to lie at the origin and finding a linear transformation V to put the eigenvalues of the system into the matrices A and B. Let the translated fixed point at the origin be represented by \(\varTheta ^*\). Then calculating \((DT-I)|_{\varTheta ^*}\), the Jacobian of the T-map at the fixed point, let V be a linear transformation such that

where A is a zero matrix and B is a diagonal matrix with the stable eigenvalues on the diagonal. The T-map in normal form is thus

where f and g are the terms of order two and higher. Now that it is in normal form, the center manifold can be approximated using a Taylor expansion by taking derivatives of Eq. (36). The second order approximation of the center manifold is

The above equation satisfies the conditions for a supercritical pitchfork bifurcation. The explicit derivation of this center manifold approximation is available on the author’s website (http://christopherggibbs.weebly.com/).

Proposition 4

The result follows directly from Lemma 1 and Proposition 3. The existence of a supercritical pitchfork bifurcation of the fundamental OW-FCE steady state at \(\alpha =\frac{1}{2}\) implies that steady state is stable under learning for \(\alpha <\frac{1}{2}\) and that two new E-stable equilibria have come into existence.

Lemma 2

See Lemma 1 for explanation of the center manifold reduction technique. The second order approximation of center manifold in this case is

\(f(u,h(u,\epsilon ),\epsilon )\) satisfies the conditions for a supercritical pitchfork bifurcation. The explicit derivation of this center manifold approximation is available on the author’s website (http://christopherggibbs.weebly.com/).

Proposition 5

The result follows directly from Lemma 2 and Proposition 3. The existence of a supercritical pitchfork bifurcation of the fundamental OW-FCE steady state at \(\alpha =\frac{1}{2}\) implies that steady state is stable under learning for \(\alpha <\frac{1}{2}\) and that two new E-stable equilibria have come into existence.

Rights and permissions

About this article

Cite this article

Gibbs, C.G. Forecast combination, non-linear dynamics, and the macroeconomy. Econ Theory 63, 653–686 (2017). https://doi.org/10.1007/s00199-016-0951-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-0951-x