“Passionate lived, reasonable lasted”, Chamfort.

Abstract

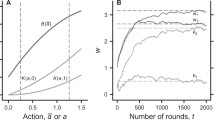

Irrational agents are driven out of the market. This should favor learning: Irrational agents observing that rational agents are being more successful should adopt rational beliefs. We show that the threat of elimination is not sufficient to push agents toward rationality: A shorter “life” might be more rewarding than a longer one. Even if they are eliminated in the long run, irrational agents might rationally stay irrational in the sense that their ex-ante and ex-post welfare levels over their whole life are higher than (1) the welfare level that they would reach if they adopted rational expectations, (2) the welfare level reached by the otherwise identical (same initial wealth and same risk aversion) rational agents, (3) the welfare level that they would have if they were given the optimal allocation of the rational agent. Threat of elimination is not sufficient to push irrational agents toward rationality, and rational and surviving agents’ performances are not sufficiently high to generate learning through an adaptive process based on imitation of successful behaviors. A numerical illustration is provided.

Similar content being viewed by others

Notes

Coury and Sciubba (2012) show that this is no more valid in an incomplete markets setting.

Note that, as underlined by Routledge (1999), all these rational expectations models where agents extract information from prices do not address how agents acquire sufficient knowledge about economic structure, parameters, etc.

It might seem puzzling to have a repeated model where each generation lives infinitely. The infinite horizon has been adopted only for the sake of simplicity in the computations. All results remain valid with a finite horizon T for each generation (see the “Appendix”).

For instance, a procedure that overweighs good news with respect to bad ones.

As chartists are regularly told by fundamentalists that markets are efficient and that there is no rationality behind their heuristics. Nevertheless, we still have a non-negligible proportion of chartists in the economy.

Indeed, as seen in Jouini and Napp (2007), the risk-tolerance-weighted average belief corresponds to the representative agent belief in such an heterogeneous beliefs framework.

References

Alchian, R.: Uncertainty, evolution and economic theory. J. Polit. Econ. 58, 211–221 (1950)

Cootner, P.: The Random Character of Stock Market Prices. MIT Press, Cambridge, MA (1964)

Coury, T., Sciubba, E.: Belief heterogeneity and survival in incomplete markets. Econ. Theory 49, 37–58 (2012)

Fama, E.: The behavior of stock market prices. J. Bus. 38, 34–105 (1965)

Friedman, M.: Essays in Positive Economics. University of Chicago Press, Chicago (1953)

Grossman, S., Stiglitz, J.: On the impossibility of informationally efficient markets. Am. Econ. Rev. 70, 393–408 (1980)

Hvide, H.K.: Pragmatic beliefs and overconfidence. J. Econ. Behav. Organ. 48, 15–28 (2002)

Jouini, E., Napp, C.: Consensus consumer and intertemporal asset pricing under heterogeneous beliefs. Rev. Econ. Stud. 74, 1149–1174 (2007)

Jouini, E., Napp, C., Viossat, Y.: Evolutionary beliefs and financial markets. Rev. Finance 2013(17), 727–766 (2013)

Kyle, A.: Informed speculation with imperfect competition. Rev. Econ. Stud. 56, 317–355 (1989)

Routledge, B.: Adaptive learning in financial markets. Rev. Financ. Stud. 12, 1165–1202 (1999)

Russel, B.: A History of Western Philosophy. Simon and Schuster, New York (1945)

Sandroni, A.: Do markets favor agents able to make accurate prediction. Econometrica 68, 1303–1341 (2000)

Yan, H.: Natural selection in financial markets: does it work? Manag. Sci. 54, 1935–1950 (2008)

Acknowledgments

The financial support of the GIP-ANR (Risk project) and of the Risk Foundation (Groupama Chair) is gratefully acknowledged by the authors.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

The first-order conditions for Agent 1 and Agent 2 are given by

where \(M_{2}=\frac{\hbox {d}Q}{\hbox {d}P}\) and \(M_{1}=1\) is introduced for the symmetry in the formulas and where \(\lambda _{1}\) and \(\lambda _{2}\) are Lagrange multipliers and are such that the budget constraint is saturated for each agent, i.e., \(E\left[ \int _{0}^{T}q_{t}^{*}c_{i,t}^{*}\hbox {d}t\right] =\frac{1}{2}E\left[ \int _{0}^{T}q_{t}^{*}e_{t}^{*}\hbox {d}t\right] ,\quad i=1,2\).

This gives

and since we have \(c_{1}+c_{2}=e^{*}\) we obtain

and from there

where \(C_{i}\) and \(D_{i}\) are as above and where \(E_{i}=\frac{\theta _{i} }{\theta _{1}+\theta _{2}}e_{0}^{*}+\frac{\theta _{1}\theta _{2}}{\theta _{1}+\theta _{2}}\ln \frac{\lambda _{j}}{\lambda _{i}}.\)

Since the agents have the same initial endowment, we have

Simple computations give

with A and B as above. Condition (C) gives us \(-A+\frac{1}{2}B^{2}<0\) and the integral above converges which gives

Equation (2) gives then

with \(F_{1}\) and \(G_{1}\) as above. From the expressions of \(E_{1}\) and \(E_{2}\) we also have

which leads to the desired formula for \(E_{i}\).

Solving for \(c_{1}^{*}=c_{2}^{*}\) leads to \(\left( \delta _{2} ,\theta _{2}\right) =\left( \delta _{1},\theta _{1}\right) \) or to \(\left( \delta _{2},\theta _{2}\right) =\left( -\frac{2\mu }{\sigma } ,\frac{\sigma ^{2}\theta _{1}}{\sigma ^{2}-4\mu \theta _{2}}\right) . \) The second solution is in contradiction with Condition (C). \(\square \)

Proof of Proposition 2

It is immediate that

which is smaller than 1 for \(\theta _{2}<\frac{\mu \theta _{1}}{\mu -\theta _{1}\delta _{2}^{2}}\).

Similarly, we have

The asymptotic behavior is governed by the sign of \(\left( C_{2}+\frac{1}{2}D_{2}^{2}\right) -\left( C_{1}+\frac{1}{2}D_{1}^{2}\right) .\) It is negative for \(\theta _{2}<\frac{2\mu \theta _{1}+\sigma ^{2}\theta _{1}}{2\mu +\sigma ^{2}+2\delta _{2}\theta _{1}\left( \sigma -\delta _{2}\right) }.\)

Similarly,

where \(C_{i}^{\prime }=-\frac{C_{i}}{\theta _{i}},\) \(D_{i}^{\prime }=-\frac{D_{i}}{\theta _{i}}\) and \(E_{i}^{\prime }=-\frac{E_{i}}{\theta _{i}}\) for \(i=1,2.\) We have \(\left( C_{2}^{\prime }+\frac{1}{2}D_{2}^{\prime 2}\right) -\left( C_{1}^{\prime }+\frac{1}{2}D_{1}^{\prime 2}\right) =\delta _{2} \frac{\sigma +\theta _{1}\delta _{2}}{\theta _{1}+\theta _{2}}\) which ends the proof. \(\square \)

Proof of Proposition 3

Let us index by \(\gamma \in \Gamma _{i}\) the individual members of Group i and let us denote respectively by \(c_{i,\gamma }^{*}\), \(\theta _{i,\gamma }\) and \(w_{i,\gamma }\) their optimal consumption, risk tolerance level and endowment share within Group i. By construction, we have \(\sum _{\gamma \in \Gamma _{i}}c_{i,\gamma }^{*} =c_{\gamma }^{*},\) \(\sum _{\gamma \in \Gamma _{i}}\theta _{i,\gamma }=\theta _{i}\) and \(\sum _{\gamma \in \Gamma _{i}}w_{i,\gamma }=1.\) It is easy to check that, at the equilibrium, we have \(c_{i,\gamma }^{*}=\frac{\theta _{i,\gamma }}{\theta _{i}}c_{i,\gamma }^{*}+(w_{i,\gamma }-\frac{\theta _{i,\gamma }}{\theta _{i}})q\cdot c_{i}^{*}\) where \(q\cdot c_{i}^{*}=E\left[ \int _{0}^{\infty }q_{t}c_{i,t}^{*}\hbox {d}t\right] .\) We have then

\(\square \)

Proof of Claim 4

From the first-order conditions, we have

We know that \(E_{i}=\frac{\theta _{i}}{\theta _{1}+\theta _{2}}e_{0}^{*} +\frac{\theta _{1}\theta _{2}}{\theta _{1}+\theta _{2}}\ln \frac{\lambda _{j} }{\lambda _{i}}\) which gives

A direct computation gives

where the convergence of the integral is insured by Condition (C). \(\square \)

Proof of Claim 5

We have

as far as \(b_{1}\ \)and \(b_{2}\) are positive. These conditions, respectively, correspond to Conditions (C) and (C1).

Furthermore, \(b_{1}-b_{2}=\delta _{2}\frac{\sigma +\theta _{1} \delta _{2}}{\theta _{1}+\theta _{2}}\) and we have then \(b_{1}>b_{2}\) for \(\delta _{2}>0\) which means that \(U_{2}^{\text {ex-post}}(c_{2}^{*} )>U_{1}^{\text {ex-post}}(c_{1}^{*}).\) \(\square \)

Proof of Claim 6

Since both agents have the same initial endowment, \(c_{1}^{*}\) satisfies then the budget constraint of Agent 2. By optimality, we have \(U_{2}(c_{1}^{*})\le U_{2}(c_{2}^{*})\). We even have \(U_{2}(c_{2}^{*})>U_{2}(c_{1}^{*})\) as far as \(c_{2}^{*}\ne c_{1}^{*}\) which is the case as far as \(\left( \delta _{1},\theta _{1}\right) \ne \left( \delta _{2},\theta _{2}\right) \).

Let us now derive explicit expressions for \(U_{2,t}(c_{1}^{*})\) for all t. We have

which converges under Condition (C2) and leads to

Similarly, we have

which converges under Condition (C3) and leads to

\(\square \)

Proof of Claim 7

Under Condition (C4) , \(\widetilde{c} _{2}^{*}\) is obtained through the formulas above for \(\delta _{2}=0.\) We have then

The corresponding ex-ante and ex-post welfare levels for Agent 2 are then given, as above, by

Note that \(U_{2}^{\text {ex-post}}(\widetilde{c}_{2}^{*})\) is well defined by construction and \(U_{2}(\widetilde{c}_{2}^{*})\) is well defined under Condition (C5). \(\square \)

Finite horizon In a finite horizon setting T, under the same conditions and with the same notations as above, the different formulas above become

and we have \(a_{1}=a_{2}\) which means that comparing \(U_{1}\left( c_{1} ^{*}\right) \) and \(U_{2}\left( c_{2}^{*}\right) \) in a finite horizon setting amounts to comparing them in an infinite horizon setting. Furthermore, for \(\delta _{2}>0,\) we have \(b_{1}>b_{2}\) which means that if \(U_{2}^{\text {ex-post}}(c_{2}^{*})>U_{1}^{\text {ex-post}}(c_{1}^{*})\) in an infinite horizon setting and if \(\delta _{2}>0\) then the inequality pertains for all T.

Finally, it is immediate that all the inequalities obtained in the numerical examples above pertain for T large enough.

Rights and permissions

About this article

Cite this article

Jouini, E., Napp, C. Live fast, die young. Econ Theory 62, 265–278 (2016). https://doi.org/10.1007/s00199-015-0894-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-015-0894-7