Abstract

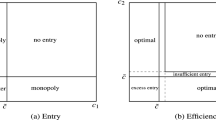

This paper analyzes an entry timing game with uncertain entry costs. Two firms receive costless signals about the cost of a new project and decide when to invest. We characterize the equilibrium of the investment timing game with private and public signals. We show that competition leads the two firms to invest too early and analyze two collusion schemes, one in which one firm pays the other to stay out of the market and one in which this buyout is mediated by a third party. We characterize conditions under which the efficient outcome can be implemented in both collusion schemes.

Similar content being viewed by others

Notes

The analysis would not change if we assumed different probabilities for the high and low costs.

This is similar to results in Thijssen et al. (2006), who analyze the influence of uncertainty and competition on the strategic considerations of a firm’s investment decision, where the firm receives imperfect signals about the profitability of an investment project, and finds that the speed of learning affects preemptive pressure (and therefore welfare) non-monotonically.

The fact that giving a prize to the loser of a contest may be efficient, as it reduces the gap between the winner and the loser and minimizes wasteful expenditures, has long been noted in the literature on contests. See, for example, Moldovanu and Sela (2001).

Remember that, for the entire Sect. 4, we have assumed \(\pi _m -V_{E2}\le \widetilde{\theta }\le \pi _m - V_F\), that is, that we are in case 2 from Theorem 1.

Note that we consider here a deviation of a firm which learns in the current period that its cost is \(\overline{\theta }\). If a firm reported \(\overline{\theta }\) in the past and switches to reporting \(\widetilde{\theta }\) this would lead to an inconsistent history, which we have ruled out in the beginning of the subsection.

The details of the computation can be found in the “Appendix”.

References

Akcigit, U., Liu, Q.: The Role of Information in Innovation and Competition. Department of Economics, University of Pennsylvania, Mimeo (2013)

Athey, S., Segal, I.: An efficient dynamic mechanism. Econometrica 81(6), 2463–2485 (2013)

Chamley, C., Gale, D.: Information revelation and strategic delay in a model of investment. Econometrica 62(5), 1065–1085 (1994)

Choi, J.P.: Dynamic R&D competition under ‘hazard rate’ uncertainty. RAND J. Econ. 22(4), 596–610 (1991)

Copeland, A.: Learning dynamics with private and public signals. Econ. Theory 31(3), 523–538 (2007)

Décamps, J.P., Mariotti, T.: Investment timing and learning externalities. J. Econ. Theory 118(1), 80–102 (2004)

Décamps, J.P., Mariotti, T., Villeneuve, S.: Irreversible investment in alternative projects. Econ. Theory 28(2), 425–448 (2006)

Fudenberg, D., Tirole, J.: Preemption and rent equalization in the adoption of new technology. Rev. Econ. Stud. 52(3), 383–401 (1985)

Gandal, N., Scotchmer, S.: Coordinating research through research joint ventures. J. Pub. Econ. 51(2), 173–193 (1993)

Goldfain, E., Kovac, E.: Financing of Competing Projects with Venture Capital. Department of Economics, University of Bonn, Mimeo (2007)

Gordon, S.: Announcing Intermediate Breakthroughs in an R&D Race. Department of Economics, University of Montreal, Mimeo (2011)

Grossman, G.M., Shapiro, C.: Dynamic R&D competition. Econ. J. 97(386), 372–387 (1987)

Harris, C., Vickers, J.: Perfect equilibrium in a model of a race. Rev. Econ. Stud. 52(2), 193–209 (1985)

Harris, C., Vickers, J.: Racing with uncertainty. Rev. Econ. Stud. 54(1), 1–21 (1987)

Hopenhayn, H., Squintani, F.: Preemption games with private information. Rev. Econ. Stud. 78(2), 667–692 (2011)

Hoppe, H.C., Lehmann-Grube, U.: Innovation timing games: a general framework with applications. J. Econ. Theory 121(1), 30–50 (2005)

Katz, M.L., Shapiro, C.: R&D rivalry with licensing or imitation. Am. Econ. Rev. 77(3), 402–420 (1987)

Keller, G., Rady, S.: Optimal experimentation in a changing environment. Rev. Econ. Stud. 66(3), 475–507 (1999)

Keller, G., Rady, S., Cripps, M.: Strategic experimentation with exponential bandits. Econometrica 73(1), 39–68 (2005)

Laffont, J.J., Martimort, D.: Collusion under asymmetric information. Econometrica 65(4), 875–911 (1997)

Lambrecht, B., Perraudin, W.: Real options and preemption under incomplete information. J. Econ. Dyn. Control 27(4), 619–643 (2003)

Mason, R., Weeds, H.: Investment, uncertainty and pre-emption. Int. J. Ind. Org. 28(3), 278–287 (2010)

Moldovanu, B., Sela, A.: The optimal allocation of prizes in contests. Am. Econ. Rev. 91(3), 542–558 (2001)

Moscarini, G., Squintani, F.: Competitive experimentation with private information: the survivor’s curse. J. Econ. Theory 145(2), 639–660 (2010)

Murto, P., Välimäki, J.: Learning and information aggregation in an exit game. Rev. Econ. Stud. 78(4), 1426–1461 (2011)

Reinganum, J.F.: A dynamic game of R&D: patent protection and competitive behavior. Econometrica 50(3), 671–688 (1982)

Rosenberg, D., Solan, E., Vieille, N.: Social learning in one-arm bandit problems. Econometrica 75(6), 1591–1611 (2007)

Spatt, C.S., Sterbenz, F.P.: Learning, preemption, and the degree of rivalry. RAND J. Econ. 16(1), 84–92 (1985)

Thijssen, J.J.J., Huisman, K.J.M., Kort, P.M.: The effects of information on strategic investment and welfare. Econ. Theory 28(2), 399–424 (2006)

Weeds, H.: Strategic delay in a real options model of R&D competition. Rev. Econ. Stud. 69(3), 729–747 (2002)

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to the editor, an anonymous referee, Rossella Argenziano, Federico Boffa, Jay Pil Choi, Richard Cornes, Nisvan Erkal, Emeric Henry, Helios Herrera, John Hillas, Leo Fulvio Minervini, Hodaka Morita, Igor Muraviev, John Panzar, José A. Rodrigues-Neto, Carlos Oyarzun, Francisco Ruiz-Aliseda, Matthew Ryan, Konrad Stahl and Rabee Tourky for their helpful comments. We also thank seminar participants at Ecole Polytechnique, Massey University, Erasmus University Rotterdam, Queen Mary University of London, University of Auckland, Australian National University, University of Macerata, University of New South Wales, and participants in the 29th Australasian Economic Theory Workshop, the 2nd Workshop ’Industrial Organization: Theory, Empirics and Experiments’, the 11th Society for the Advancement of Economic Theory Conference, the 40th Australian Conference of Economists, the 4th Transatlantic Theory Workshop at the Paris School of Economics, the 1st Microeconomics Workshop at Victoria University of Wellington, the 2012 International Industrial Organization Conference, the 2012 Meeting of the European Association for Research in Industrial Economics, the 4th Summer Workshop of the Centre for Mathematical Social Science at the University of Auckland, the Workshop on Dynamic Decisions at the 2013 Barcelona GSE Summer Forum, the 10th CRESSE Conference, and the 1st ATE Symposium. Support by the Royal Society of New Zealand (Marsden Grant MAU0804 to Fabrizi and UOO0821 to Lippert) is gratefully acknowledged.

Appendix: Proofs

Appendix: Proofs

1.1 Proof of Lemma 1

Clearly, if the other firm has already entered, it is a dominant strategy to enter immediately as \(\pi _d > \underline{\theta }\). Suppose that the other firm has not entered yet, and consider a firm which learns that its cost is low at period \(t\). By delaying investment to period \(t+1\), the firm loses the positive profit made between \(t{\varDelta }\) and \((t+1){\varDelta }\), equal to \((1-{\delta })\pi _d\) or \((1-{\delta }) \pi _m\), depending on whether the other firm invests at period \(t\) or not. In addition, let \({\varDelta }g(t)\) be the probability that a firm which did not learn its cost invests between \(t {\varDelta }\) and \((t+1) {\varDelta }\). Recall that by the dominance argument spelled out in the text, a firm that has not learned its cost never enters after the other firm has entered. Hence, by investing at period \(t\) a low-cost firm will block the entry of the competitor which has not yet learned its cost, resulting in an expected payoff of

By contrast, if the firm waits until period \(t+1\) and the competitor invests, it will get an expected payoff of \(\pi _d - \underline{\theta }\). Hence, by delaying investment, the firm loses an expected payoff of

1.2 Proof of Proposition 1

We focus attention on the optimal strategy of a firm when the other firm has not received any signal yet. For \({\varDelta }\rightarrow 0^+\), the probability that the other firm has received a signal between period \(t-1\) and period \(t\) goes to 0. In that case, the investment game played by the two firms is given by the following bi-matrix game, where \(W(t+1)\) denotes the continuation value for both players of entering into period \(t+1\) Table 5.

We first consider a symmetric equilibrium where both firms invest with positive probability \(p \in (0,1)\). In that equilibrium,

and

Letting the time between two successive periods go to 0, as the strategies are right continuous, the value function is right continuous and we find

showing that an equilibrium with preemption exists if and only if \(V_L - V_F = \pi _m - V_{E1} > \widetilde{\theta }\).

Next, suppose that \(V_L - V_F = \pi _m - V_{E1} \le \widetilde{\theta }\). We construct a symmetric equilibrium where both firms choose to delay investment. By delaying investment by one period when the other firm does not invest, a firm obtains an expected payoff of:

Letting \({\varDelta }\rightarrow 0^+\),

Now compute

and, as \(V_F < V_L - \widetilde{\theta }, \)

establishing that \(\frac{\lambda \varDelta }{2}(V_L + V_F - \underline{\theta }+V_{E1}) -(r+2{\lambda }){\varDelta }(V_L - \widetilde{\theta }) \ge 0\) and hence, as \({\varDelta }\rightarrow 0^+\), \(W'(T)>0\), so that firms always have an incentive to wait.

1.3 Proof of Theorem 1

As in the proof of Proposition 1, we first consider a symmetric equilibrium where both firms invest with positive probability \(p(t) \in [0,1]\) at period \(t\). Taking \({\varDelta }\rightarrow 0^+\), the probability that the rival firm has received a low-cost signal between two consecutive periods goes to 0, and we compute the expected value of a firm which invests at period \(t\) as:

and the expected value of a firm which does not invest as

In a symmetric equilibrium with positive exit probabilities, \(W(t)=U(0)=U(1)\) and as \({\varDelta }\rightarrow 0^+\), because the value function is right continuous, \(W(t+1) \rightarrow W(t)\), resulting in an exit probability at date \(T\)

This equilibrium exists if and only if \(V_L(T) \ge V_F - \widetilde{\theta }\). As \(V_L(0)-V_F=\pi _m-V_{E1}\), this shows that in case (i), preemption arises at time zero and in case (ii), firms rush to invest at time \(\tilde{T}\). We now consider a situation where \(V_L(T) < V_F - \widetilde{\theta }\) and show that firms have an incentive to wait. Suppose that the other firm does not invest and compute the expected utility of waiting one period before investing:

As \({\varDelta }\rightarrow 0^+\),

Next,

where the last inequality stems from the assumption \(\pi _d < \widetilde{\theta }\). This implies that \(W(t+1) > W(t)\), so that the firm has an incentive to wait.

1.4 Proof of Proposition 2

In order to implement the cooperative benchmark, two conditions must be satisfied: (i) no firm must be willing to enter the market at \(T < T^*\) if it has not learned its cost and (ii) a firm which learns that it has a low cost must be willing to enter the market immediately. The first condition will hold as long as:

As \(U_L(T)=\pi _m - U_F(T)\), this results in

For the second condition to hold, we characterize the conditions under which an equilibrium where a firm immediately invests after it observes that its cost is low exists. The discounted expected payoff of investing at period \(t\) when the other firm does not invest is:

whereas by waiting one period the firm will obtain a discounted expected payoff of

For \(\varDelta \) small enough and assuming that utilities are differentiable,

so that the firm has an incentive to enter immediately if and only if:

1.5 Derivation of expected payoffs when \({\varDelta }\rightarrow 0^+\)

Recall that, as \({\varDelta }\rightarrow 0^+\),

and that the instantaneous probability that the signal is received between two periods \(t{\varDelta }\) and \((t+1) {\varDelta }\) converges to \({\lambda }\). Hence, we compute the expected payoff of a firm with high cost as

Similarly,

Finally, we compute \(IC (\underline{\theta }\rightarrow \widetilde{\theta })\) as \({\varDelta }\rightarrow 0^+\) using the fact that \(\sigma _{T+1} \rightarrow \sigma _T\) and \(\delta = e^{-r{\varDelta }} \equiv 1 - r {\varDelta }\),

Focusing on the terms in the first order in \({\varDelta }\), this inequality becomes

1.6 Proof of Proposition 3

When \(\sigma _T=0\) for all \(T\), the only binding constraint is the constraint \(IC (\widetilde{\theta }\rightarrow \underline{\theta })\) which reads:

As

this condition is hardest to satisfy at \(T=0\) when \(\gamma _T(\widetilde{\theta })=1\), so that the incentive condition is satisfied for all \(T\) if and only if

Rights and permissions

About this article

Cite this article

Bloch, F., Fabrizi, S. & Lippert, S. Learning and collusion in new markets with uncertain entry costs. Econ Theory 58, 273–303 (2015). https://doi.org/10.1007/s00199-014-0814-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-014-0814-2