Abstract

US inflation and output developments since the 1970s are considered using the P-star model and the VAR-based Diebold–Yilmaz spillover index approach. Shocks to monetary variables explain a substantial share of US GDP deflator inflation shocks over time, particularly in the late 1980s and early 1990s but also in recent years, a time when quantitative easing was employed by the Federal Reserve. Monetary factors, and not oil shocks, underlie price developments in the 1970s and early 1980s. Monetary shocks’ influence on oil prices has become noticeably stronger over the past ten years or so, supporting the greater attention being paid of late to the impact of the monetary environment on commodity markets. Shocks to the velocity-of-money variable affect output developments, with the exception of the 1970s and early 1980s when inflation shocks and, to a lesser extent, oil inflation shocks dominate the cross-variance share of output gap shocks. After the Volcker disinflation, the influence of both inflation and oil price shocks on the output gap wane and those of velocity gap shocks increase.

Similar content being viewed by others

Notes

The relevance of monetary conditions to commodity price changes was highlighted in the financial press during the mid-2000s; see, for example, Clover and Fifield (2004) and Fifield (2004). Academic contributions that have considered the influence of monetary conditions on commodity markets include Frankel (2008) and Browne and Cronin (2010).

Humphrey (1989) identifies precursors to the P-star approach in the early economics literature, stretching as far back as David Hume.

Note that the two gap variables are mostly usually stated as and in regression specifications with the estimated sign on both expected to have a positive value in explaining inflation, or changes in it.

Variants of the P-star model have been presented over the years. For example, Gerlach and Svensson (2003) put forward a real money gap, i.e. the gap between the current real money stock and the long-run equilibrium money stock, alongside the output gap in a model of inflation, and find it to have significant predictive power for inflation in the euro area. Trecroci and Vega (2002) present a model of inflation where both a money gap and an output gap are explanatory variables.

Carlson et al. also use M2M as a third money aggregate in their study. It is not available over a sufficiently long period (data are available from 1967 to 2013 only) for the rolling-window estimations used here.

This atheoretical approach to estimating an equilibrium value from a series is often applied to real output data, with the difference between the two series providing measures of the output gap.

The GDP implicit deflator, velocity and real GDP series are all seasonally adjusted, while those of potential real GDP and oil prices are not.

The 22.9% value is arrived at by dividing the sum of the “directional from others” entries for each of the four variables (located above it in that column and totalling 91.4%) by four (the number of variables in the VAR).

In the appendix, robustness tests of the impact on the TSI values of different choices of lag length, forecast horizon, window size, form of shocks, and number of variables used are considered.

They point out that only two of the five major oil price shocks between 1970 and the time of their study were followed by significant changes in GDPD inflation rates.

When M2 is the money stock used, the velocity gap accounts for an average 21% of the inflation decomposition over all the windows, compared to 17% for the output gap. When MZM is used, the velocity gap has a 21% average share, while that of the output gap is 14%.

The definition and refinement of the broad money stock has been an important feature of studies relating the real money to economic activity since, at least, Goldfeld (1976). The particular money stock affecting the results at different junctures here is then unsurprising.

The effects of quantitative easing on asset prices more generally are considered in Cronin (2014).

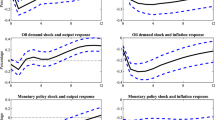

The remaining two panels of Fig. 4 (vii) and (viii) show the impact of GDPD inflation rate shocks to oil price inflation. It is generally low but does pick up in the windows ending in the 1990s and has a share of the forecast error variance decomposition of over 20% for most of the second half of that decade, before falling off thereafter.

For example, the price of West Texas Crude tripled between 1998Q4 and 2000Q3. It fell sharply from a value of $133 per barrel in 2008Q2 to €41 per barrel two quarters later. The lesser impact of oil market developments on the output gap in recent decades, however, should not be unexpected given its diminished role in economic activity compared to, say, the 1970s.

References

Arezki R, Blanchard O (2014) Seven questions about the recent oil price slump. iMF direct, December 2014

Bank for International Settlements (2015) A wave of further easing. BIS Q Rev 1–12

Barsky RB, Kilian L (2000) A monetary explanation of the Great Stagflation of the 1970s. NBER working paper 7547

Barsky RB, Kilian, L (2002) Do we really know that oil caused the Great Stagflation? A monetary alternative. In: Bernanke BS, Rogoff K (eds) NBER Macroecon Ann 16:137-195

Batini N, Nelson E (2001) The lags from monetary policy actions to inflation: Friedman revisited. Int Financ 4:381–400

Bernanke BS, Gertler M, Watson MW (1997) Systematic monetary policy and the effects of oil price shocks. Brookings Pap Econ Act 1:91–148

Blanchard O, Simon J (2001) The long and large decline in US output volatility. Brookings Pap Econ Act 1:135–164

Bohi DR (1989) Energy price shocks and macroeconomic performance. Resources for the Future, Washington, DC

Borio C (2014) The financial cycle and macroeconomics: what have we learnt? J Bank Financ 45:182–198

Borio C, Lowe P (2002) Asset prices, financial and monetary stability: exploring the nexus. BIS working paper 114

Borio C, White W (2004) Whither monetary and financial stability? The implications of evolving policy regimes. BIS working paper 147

Browne F, Cronin D (2008) A monetary perspective on the relationship between commodity and consumer prices. Cent Bank Irel Q Bull 1:78–90

Browne F, Cronin D (2010) Commodity prices, money and inflation. J Econ Bus 62:331–345

Carlson JB, Hoffman DL, Keen BD, Rasche RH (2000) Results of a study of the cointegrating relations comprised of broad monetary aggregates. J Monetary Econ 46:345–383

Clover C, Fifield A (2004) More to oil shocks than Middle East. Financial Times, 29 July

Cronin D (2014) The interaction between money and asset markets: a spillover index approach. J Macroecon 39:185–202

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ J 119:158–171

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Estrella A, Mishkin FS (1997) Is there a role for monetary aggregates in the conduct of monetary policy? J Monetary Econ 40:279–304

Feldstein M, Stock JH (1994) The use of a monetary aggregate to target nominal GDP. In: Mankiw NG (ed) Monetary Policy. The University of Chicago Press, pp 7–69

Fifield A (2004) Too much money to blame for rising price of oil, economists claim. Financial Times, 29 July

Frankel JA (2008) The effect of monetary policy on real commodity prices. In: Campbell JY (ed) Asset prices and monetary policy. University of Chicago Press, Chicago, pp 291–333

Friedman BM, Kuttner KN (1992) Money, income, prices, interest rates. Am Econ Rev 82:472–492

Friedman M (1961) The lag in effect of monetary policy. J Polit Econ 69:447–466

Friedman M (1972) Have monetary policies failed? Am Econ Rev (Pap Proc) 62:11–18

Friedman M, Schwartz AJ (1963) A monetary history of the United States, pp 1867–1960. National Bureau of Economic Research

Gattini L, Pill H, Schuknecht L (2015) A global perspective on inflation and propagation channels. J Bank Financ Econ 1:50–76

Gerlach S, Svensson LO (2003) Money and inflation in the Euro area: a case for monetary indicators? J Monetary Econ 50:1649–1672

Goldfeld S (1976) The case of the missing money. Brook Pap Econ Act 1976(3):683–730

Hallman JJ, Porter RD, Small DH (1991) Is the price level tied to the M2 monetary aggregate in the long run? Am Econ Rev 81:841–858

Hodrick RJ, Prescott EC (1997) Postwar US business cycles: an empirical investigation. J Money Credit Bank 29:1–16

Humphrey TM (1989) Precursors of the P-star model. Fed Reserve Bank Richmond Econ Rev 75:3–9

Koo R (2011) Commodity price increases have speculative and structural roots. Mimeo

Orphanides A, Porter RD (2001) Money and inflation: the role of information regarding the determinants of M2 behavior. In: Klockers HJ, Willeke C (eds) Monetary analysis: tools and applications. European Central Bank, Frankfurt-am-Main, pp 77–95

Stock JH, Watson MW (2003) Has the business cycle changed? Evidence and explanations. In: Monetary policy and uncertainty. Federal Reserve Bank of Kansas, Kansas, pp 9–56

Tatom JA (1990) The P-star approach to the link between money and prices. Federal Reserve Bank of St. Louis working paper 1990-008A

Trecroci C, Vega JL (2002) The information content of M3 for future inflation in the euro area. Rev World Econ 138:22–53

Acknowledgements

The author would like to thank Frank Browne, Kevin Dowd and an anonymous referee for their comments. The views expressed in this article, nevertheless, are those of the author and do not necessarily reflect those of the Central Bank of Ireland or the European System of Central Banks.

Author information

Authors and Affiliations

Corresponding author

Appendix: Robustness tests

Appendix: Robustness tests

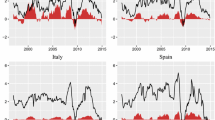

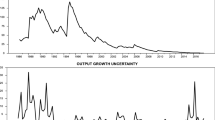

Tests of the sensitivity of the TSI to the choices required in estimating the VAR model are reported in Figs. 6, 7, 8, 9 and 10. In each figure, the solid line represents that found in the same column of Fig. 2, where (a) the VAR lag length is 4, (b) the forecast horizon is 10 quarters, (c) the estimation window is 60 quarters, (d) the forecast error variance decomposition is of the orthogonalised form, and (e) there are four variables. In turn, each of these five settings is changed in turn in Figs. 6, 7, 8, 9 and 10 while holding the other four unchanged.

The lag length of the VAR was allowed vary from 4 lags, to 3, 5 and 6 lags. The minimum and maximum TSI value at each window from the four lag options, 3–6, is then plotted in Fig. 6. The TSI moves in a similar pattern for all three lines in that chart, albeit with some variation in values. Figure 7 reports minimum and maximum values where the forecast horizon varies between 8 quarters ahead and 12 quarters ahead. The TSI values are in a narrow range. This is reassuring as it indicates variance shares being broadly unchanging at longer forecast horizons.

In Fig. 8, the rolling windows are 40 quarters, 60 quarters and 80 quarters in size. One feature of the 40-quarter rolling-window TSI series is that there are many windows where no TSI is generated. That arises when there is a lack of convergence in decomposition shares as the forecast horizon lengthens. This supports the selection of the longer, 60-quarter window (where only 1 or 3 windows out of the estimated 164 windows do not provide decompositions) over the shorter window. The differences in TSI values between the 60-quarter windows and the 80-quarter windows are relatively small. An advantage of using 60 quarters over 80 quarters for the window size is that with the latter the first TSI value is not provided until a sample period ending in 1980Q3, thus excluding the 1970s. Figure 9 shows that the TSI is not particularly sensitive to the choice of orthogonalised or generalised decompositions. Finally, in Fig. 10, a comparison is made with a five-variable system where the additional variable is a measure of the openness of the US economy. It is the quarterly change in a ratio, that of the sum of US exports and imports divided by US GDP (shown in panel (viii) of Fig. 1). The addition of this variable does not have any noticeable effect on the pattern of the TSI over time.

Rights and permissions

About this article

Cite this article

Cronin, D. US inflation and output since the 1970s: a P-star approach. Empir Econ 54, 567–591 (2018). https://doi.org/10.1007/s00181-017-1229-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1229-2