Abstract

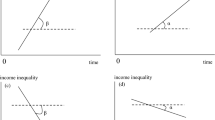

Literature on convergence in inequality is sparse and has almost entirely focused on the notion of testing beta convergence in the Gini indices. In this paper, for the first time, we test for sigma convergence in decile income shares across countries. We compile panel data on decile income shares for more than 60 countries over the last 25 years. Regardless of the level of development, within-country inequality increased; income shares of the poorest deciles declined and those of the top decile increased significantly. Importantly, the decile income shares exhibited a statistically significant decline in dispersion between 1985 and 2011, providing strong evidence of sigma convergence in inequality. Convergence was more prominent among developing countries and less so among developed countries. The findings are robust to an array of sensitivity tests. Our analysis suggests that cross-country income distributions became more unequal but noticeably similar over time.

Similar content being viewed by others

Notes

Apart from these recent publications, there is an extensive literature chronicling inequality trends across countries. For a literature review of inequality trends, see chapters by Morelli et al. (2015) for rich and middle-income countries and Alvaredo and Gasparini (2015) for developing countries, in the recently released second volume of the Handbook of Income Distribution.

There are important differences between income and expenditure surveys; see Smeeding and Latner (2015) for a detailed discussion. Mean income levels are much higher than expenditure levels, and often the ratio of these two is used as a scaling factor. Unfortunately, for decile shares, there is no systematic relation between observations based on income or expenditure surveys. We follow Lakner and Milanovic (2013) who also use data on income or expenditure decile shares without making any adjustments. Measurement errors are unavoidable in panel data on any inequality measures including decile income shares. This is especially true regarding data from developing countries. However, there is insufficient information to rectify the data and avoid any bias stemming from these measurement errors.

PovcalNet is the online tool for poverty measurement developed by the Development Research Group of the World Bank: http://iresearch.worldbank.org/PovcalNet/index.htm. We use the latest version of PovcalNet dated October 9, 2014. The WYD dataset is available at http://go.worldbank.org/IVEJIU0FJ0.

Note that the data are separated into rural and urban areas for the People’s Republic of China and Indonesia, so we have 64 countries but 66 cross-sectional units. Table 10 in the “Appendix” lists the number of observations available for each country in each period.

Data on population are compiled from the World Bank’s World Development Indicators. We also considered income weights, but the resulting weighted means differed very little from those reported in Table 2.

According to Beach and Davidson (1983), their test is valid for “testing for differences in shares between two alternative distributions corresponding to different time periods, regions, or demographic groups” (p. 731).

For each of the ten income deciles, Fan (1994) tests were performed on the beginning (period 1) and ending (period 5) decile share distributions. The null hypothesis of normality was weakly rejected for decile 6 (both periods 1 and 5) and decile 9 (period 1) at the 10 % level of significance.

The one exception is population weighted decile 8. This suggests that the “homogenous middle” phenomenon is most pronounced in the higher population countries in our sample.

Equation (8) captures country-specific heterogeneity, including population differences, vis-a-vis the fixed effect parameter, thus precluding the use of population weights in the GMM weighting matrices. Our results are therefore, implicitly, for the equally weighted income deciles.

Due to the dynamic specification of Eq. (8), we cannot derive a residual series for the first two periods. Because we employ the Arellano and Bond (1991) GMM estimator, which requires a first differencing of Eq. (8), subsequent tests of declining dispersion will compare the volatility of period 3 and period 5 residuals.

We follow the World Bank country classification: http://data.worldbank.org/about/country-and-lending-groups. “As of 1 July 2014, low-income economies are defined as those with a GNI per capita, calculated using the World Bank Atlas method, of $1045 or less in 2013; middle-income economies are those with a GNI per capita of more than $1045 but less than $12,746; high-income economies are those with a GNI per capita of $12,746 or more. Note that low- and middle-income economies are sometimes referred to as developing economies.”

Although income shares of the poorest two deciles declined among developed countries, the decline was not statistically significant. In some countries such as Denmark, France, Ireland, Sweden and Switzerland, the income share of these two deciles in fact slightly increased over time.

The bootstrap procedure draws a sample of size \(N=45\) from the maximum likelihood calibrated Gaussian distribution \((g\left( {x,\hat{\theta } } \right) )\) and calculates the corresponding test statistic \((\hat{T}_n)\). This sample estimation procedure is repeated 5000, enabling the calculation of empirical critical values and p values. Henderson and Parmeter (2015) provide an R-based implementation of the test which we use to conduct the test: http://www.the-smooth-operators.com/code.

References

Alvaredo F, Gasparini L (2015) Recent trends in inequality and poverty in developing countries. In: Atkinson A, Bourguignon F (eds) Handbook of income distribution, vol 2. Elsevier-North Holland, Amsterdam

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Bao Y, Dhongde S (2009) Testing convergence in income distribution. Oxf Bull Econ Stat 71(2):295–302

Barro R, Sala-i-Martin X (1992) Convergence. J Polit Econ 100(2):223–251

Beach C, Davidson R (1983) Distribution-Free statistical inference with Lorenz curves and income. Rev Econ Stud 50(4):723–735

Bénabou R (1996) Inequality and growth. In: Bernanke BS, Rotemberg JJ (eds) NBER macroeconomics annual, vol 11. MIT Press, Cambridge, pp 11–73

Bishop J, Formby J, Thistle P (1992) Convergence of the South and non-South income distributions, 1969–1979. Am Econ Rev 82:262–272

Fan Y (1994) Testing the goodness-of-fit of a parametric density function by Kernel method. Econom Theory 10:316–356

Friedman M (1992) Do old fallacies ever die? J Econ Lit 30:2129–2132

Henderson D, Parmeter C (2015) Applied nonparametric econometrics. Cambridge University Press, Cambridge

Hotelling H (1933) Review of ‘The triumph of mediocrity in business’ by Horace Secrist. J Am Stat Assoc 28:463–65

Lakner C, Milanovic B (2013) Global income distribution: from the fall of Berlin Wall to the Great Recession. World Bank policy research working paper 6719

Lichtenberg FR (1994) Testing the convergence hypothesis. Rev Econ Stat 76:576–579

Lin P, Huang H (2012) Convergence in income inequality? Evidence from panel unit root tests with structural breaks. Empir Econ 43:153–174

Morelli S, Smeeding T, Thompson J (2015) Handbook of income distribution. In: Atkinson A, Bourguignon F (eds) Post-1970 trends in within-country inequality and poverty: rich and middle income countries, vol 2. Elsevier-North Holland, Amsterdam

Palma J (2011) Homogeneous middles vs. heterogeneous tails, and the end of the “inverted-U”: the share of the rich is what it’s all about. Cambridge working papers in economics 1111

Piketty T (2014) Capital in the twenty-first century. Belknap Press, Cambridge

Quah D (1993) Galton’s fallacy and tests of the convergence hypothesis. Scand J Econ 95:427–443

Ravallion M (2003) Inequality convergence. Econ Lett 80:351–356

Smeeding T, Latner J (2015) PovcalNet, WDI and ‘All the Ginis’: a critical review. J Econ Inequal 1–26, Published Online, 22 July 2015

Solow R (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Swan T (1956) Economic growth and capital accumulation. Econ Rec 32:334–361

Tselios V (2009) Growth and convergence in income per capita and income inequality in the regions of the EU. Spat Econ Anal 4:343–370

UNDP (2013) Humanity divided: confronting inequality in developing countries, United Nations Development Program, Bureau for Development Policy, New York

Wilkinson R, Pickett K (2007) The problems of relative deprivation: why some societies do better than others. Soc Sci Med 65(9):1965–1978

Young A, Higgins M, Levy D (2007) Sigma convergence versus beta convergence: evidence from U.S. country-level data. J Money Credit Bank 40(5):1083–1093

Author information

Authors and Affiliations

Corresponding author

Additional information

We wish to thank the editor as well as two anonymous referees for providing useful comments and suggestions that improved significantly the quality of the paper.

Appendices

Appendix

See Table 10.

Testing normality of the distribution of decile income shares

To formally test normality, we employ a nonparametric bootstrap test, developed by Fan (1994). It states that the unknown empirical distribution of the data \((f\left( x \right) )\) equals a given parametric distribution \((g\left( {x,\theta } \right) )\), against the alternative that these distributions are unequal:

The test compares the two distributions by way of their integrated squared errors (ISE):

Equation (10) is estimated by replacing \(f\left( x \right) \) with the kernel density of x and substituting \(g\left( {x,\theta } \right) \) with the kernel-smoothed maximum likelihood estimate of g. For the case of a Gaussian distribution under the null, Eq. (10) can be estimated by the following closed-form representation:

where N is the sample size, h is the nonparametric window width, and \(\hat{\mu }\) and \(\hat{\sigma }^{2}\) are the maximum likelihood estimates of the first and second moments of g.Footnote 16 Using Eq. (11), the resulting test statistic (for univariate x) equals

Although Eq. (12) has a standard normal limiting distribution, we follow Henderson and Parmeter (2015) and use bootstrap-based critical values when conducting the test.Footnote 17 Table 11 shows results of the Fan (1994) tests performed on both time period 1 and period 5 for each of the ten deciles. In every instance, we fail to reject the null hypothesis that the distribution of a given decile share of income for a given time period is normally distributed.

Rights and permissions

About this article

Cite this article

Chambers, D., Dhongde, S. Are countries becoming equally unequal?. Empir Econ 53, 1323–1348 (2017). https://doi.org/10.1007/s00181-016-1170-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1170-9