Abstract

How much retirement income is needed in order to maintain one’s living standard at old age? As it is difficult to find a firm basis for an empirical treatment of this question, we employ a novel approach to assessing an adequate replacement rate vis-à-vis income in the pre-retirement period. We subject indications regarding satisfaction with current income as collected in the German Socio-Economic Panel to longitudinal analyses, using linear fixed-effects models and fixed-effects ordered logit models as our main analytical tools. We obtain a required net replacement rate of about 87 % for the year of entry into retirement as a rather robust result, while replacement rates keeping the living standard unchanged may slightly decline over the retirement period.

Similar content being viewed by others

Notes

The figure quoted here rests on own calculations for the median household. Scholz et al. (2006) present their results in terms of “social security wealth” plus “optimal wealth targets”.

The authors admit that sampling procedures and the fact that the survey was internet-based may limit representativeness of respondents.

To see this, assume a simple model like that given by Eq. (1) to hold for individual utility \(x^*_{it}\) (which may be a latent variable that is measured only through ordinal indices; see Sect. 4.2 for further details). Given that, model parameters are estimated in one way or another and parameter estimates are utilized to calculate CLS net replacement rates through Eqs. (2) or (3). However, monotonic transformations of \(x^*_{it}\) which should be feasible under a purely ordinal interpretation could change the ratios of parameters and, hence, CLS net replacement rates, so that the latter would not be identified. Therefore, for our identification strategy to work, individual utility must be assumed to be cardinal, and all its representations must be affine transformations of \(x^*_{it}\) by which estimates of single parameters may change, while ratios of parameters remain unaffected.

A particular issue which is related to age in the context of retirement and higher ages is the role of health. We will take this into account as well, but possibilities to provide an in-depth treatment of health are generally limited with our data, and there may be a selection bias linked to it; see footnote 12 below.

doi:10.5684/soep.v28.

Note that we do not differentiate between members of different schemes of old-age provision, such as the Statutory Pension Scheme covering the vast majority of workers, or special schemes for civil servants or the self-employed. Starting from their retirement at age 60 or higher, we follow any of these individuals for several years into their retirement period obtaining a certain number of “respondents” (indexed i) and a higher number of (annual) “observations” (indexed it).

Relevant types of assets are “savings account”, “mortgage savings plan”, “life insurance”, “securities”, and “business assets”.

The assumption of time-invariance of unobserved heterogeneity will be further discussed in Sect. 6.2.

Also, calculations of CLS net replacement rates via (2) require fixed effects of pensioners and non-pensioners to be similar, as they should be for individuals who are tracked over time. Fixed effects implicitly control for sex, education, employment history, birth cohort and so forth, so that this implies no further restrictions for our interpretation of the results.

It appears that better controls for wealth would be desirable. However, replacing assets with capital income, or using the latter in addition to assets has no effects on the estimates. Measuring wealth is difficult in any case, also in most other data-sets, and we fully exploit what our data are providing.

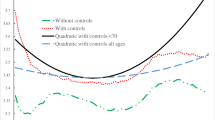

Here, dropping covariates mainly serves as a robustness test. Among other things, it is possible that satisfaction with health is endogenous, so that it is disputable whether it should be included in the regressions or not. Another problem with this variable is a potential selection effect: unhealthy respondents may drop out of the panel with increased probability, while longitudinal weights provided in the SOEP do not control for this problem. Including it in an unbiased fashion may therefore require an additional model for health, or simultaneous modelling.

Parallel estimates for which the sample is divided into three income brackets in a rough fashion (lower quartile, medium quartiles, upper quartile) yield no indications that CLS net replacement rates are declining with income. In fact, results are higher for the upper quartile, while they are basically the same over the three lower quartiles. However, confidence intervals show huge overlaps, and it is possible that lack of better data for assets is particularly relevant for those on higher income.

Using other retirement ages, hence other reference years for the satisfaction with income to be maintained, changes estimates only slightly because age-related differences in satisfaction with income are relatively small for consecutive ages. For example, using a retirement age of 62 instead of 65 and using age 61 instead of age 64 as a reference yields a CLS net replacement rate of 0.86.

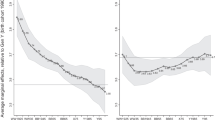

For example, age-specific estimates for ages 70, 75 and 80 in the FEOL are about 0.77, 0.71 and 0.61, respectively. Using mean satisfaction with health to include differences in health results in estimates of 0.79, 0.76 and 0.69. Mean satisfaction with health used for these calculations is 6.14 (age 64, reference), 5.87 (age 70), 5.49 (age 75), and 4.88 (age 80).

Other plausible cut-off points yield similar results (not reported here).

As indicated in footnote 4, cardinality of the underlying notion of individual utility only allows for affine transformations in each way of expressing it. From an applied perspective, this means that using indications regarding satisfaction with income or other measures of individual well-being should leave results for CLS net replacement rates unaffected.

Entry into retirement is mostly restricted to a small age range, so that age and duration of retirement more or less coincide. Including duration in addition to age or substituting age with duration changes results as shown in Fig. 1 only slightly. The same holds for year of retirement, that is, age and year predict timing and vice versa.

Provided that they exist, possible problems of sample selection and endogeneity (see footnote 12) should also be less pronounced than with the full sample.

In addition, we also estimate a binary random effects (RE) model resulting in an estimate of the CLS net replacement rate of 0.95. A Hausman test comparing the binary RE and FE logit models (e.g., Greene 2012) results in a p value of 0.00, providing strong evidence against the RE specification.

Note that the methodology outlined in Sect. 3 only depends on information on income satisfaction which is available in many data sets and does not necessarily require panel data.

References

Baetschmann G, Staub KE, Winkelmann R (2011) Consistent estimation of the fixed effects ordered logit model. IZA Discussion Paper 5443

Bellemare C, Melenberg B, van Soest A (2002) Semi-parametric models for satisfaction with income. Port Econ J 1:181–203

Binswanger J, Schunk D (2008) What is an adequate standard of living during retirement? MEA Discussion Paper 171-2008

Blundell R, Lewbel A (1991) The information content of equivalence scales. J Econom 50:49–68

Boskin M, Shoven J (2009) Concept and measures of earnings replacement rates during retirement. In: Bodie Z, Shoven J, Wise D (eds) Pensions and retirement in the United States. NBER, University of Chicago Press, Chicago, pp 113–141

Chamberlain G (1979) Analysis of covariance with qualitative data. NBER Working Paper 325

Charlier E (2002) Equivalence scales in an intertemporal setting with an application to the former West Germany. Rev Income Wealth 48:99–126

Das M, van Soest A (1999) A panel data model for subjective information on household income growth. J Econ Behav Organ 40:409–426

Deaton A, Muellbauer J (1980) Economics and consumer behavior. Cambridge University Press, Cambridge

Deaton A, Muellbauer J (1986) On measuring child costs: with application to poor countries. J Polit Econ 94:720–744

Ferrer-i-Carbonell A, Frijters P (2004) How important is methodology for the estimates of the determinants of happiness? Econ J 114:641–659

Greene W (2012) Econometric analysis, international edn. Pearson, Harlow

Hagenaars AJM, de Vos K, Zaidi MA (1994) Poverty statistics in the late 1980s: research based on microdata. Office for Official Publications of the European Communities, Luxembourg

Hamermesh D (1984) Consumption during retirement: the missing link in the life cycle. Rev Econ Stat 66:1–7

Haveman R, Holden K, Romanov A, Wolfe B (2007) Assessing the maintenance of savings sufficiency over the first decade of retirement. Int Tax Public Finance 14:481–502

Heckman JJ, Robb R (1985) Using longitudinal data to estimate age, period, and cohort effects in earnings equations. In: Mason WM, Fienberg S (eds) Cohort analysis in social research. Springer, New York

Hsiao C (2003) Analysis of panel data. Cambridge University Press, Cambdrige

Jones AM, Koolman X, Rice M (2006) Health-related non-response in the British Household Panel Survey and European Community Household Panel: using inverse-probability-weighted estimators in non-linear models. J R Stat Soc (Ser A) 169:543–569

Kapteyn A (1994) The measurement of household cost functions. Revealed preference versus subjective measures. J Popul Econ 7:333–350

Kohn K, Missong M (2003) Estimation of quadratic expenditure systems using German household budget data. Jahrb Nationalökon Stat 223:422–448

Koulovatianos C, Schröder C, Schmidt U (2005) On the income dependence of equivalence scales. J Public Econ 89:967–996

Layard R (2011) Happiness: lessons from a new science, 2nd edn. Penguin, London

Merz J, Faik J (1995) Equivalence scales based on revealed preference consumption expenditures. The case of Germany. Jahrbücher für Nationalökonomie und Statistik 214:425–447

Mitchell O, Moore J (1998) Can Americans afford to retire? New evidence on retirement savings adequacy. J Risk Insur 65:371–400

Mitchell O, Utkus S (eds) (2004) Pension design and structure: new lessons from behavioral finance. Oxford University Press, Oxford

Modigliani F, Brumberg R (1954) Utility analysis and the consumption function: an interpretation of cross-section data. In: Kurihara K (ed) Post-Keynesian economics. Rutgers University Press, New Brunswick, pp 388–436

Riedl M, Geishecker I (2012) Ordered response models and non-random personality traits: Monte carlo simulations and a practical guide. CEGE Discussion Paper 116

Schnabel R (2003) Die neue Rentenreform: Die Nettorenten sinken. Deutsches Institut für Altersvorsorge, Köln

Scholz J, Seshadri A, Khitatrakun S (2006) Are Americans saving ‘optimally’ for retirement? J Polit Econ 114:607–643

Schulz J, Carrin G (1972) The role of savings and pension systems in maintaining living standards in retirement. J Hum Resour 7:343–365

Schwarze J (2003) Using panel data on income satisfaction to estimate equivalence scale elasticity. Rev Income Wealth 49:359–372

Stewart MB (2002) Pensioner financial well-being, equivalence scales and ordered response models. Discussion Paper, University of Warwick

Stewart MB (2009) The estimation of pensioner equivalence scales using subjective data. Rev Income Wealth 55:907–929

van Praag BMS (1991) Ordinal and cardinal utility. An integration of the two dimensions of the welfare concept. J Econom 50:69–89

van Praag BMS, Ferrer-i-Carbonell A (2004) Happiness quantified. A satisfaction calculus approach. Oxford University Press, Oxford

van Praag BMS, Kapteyn A (1973) Further evidence on the individual welfare function of income. Eur Econ Rev 4:32–62

Wagner GG, Frick J, Schupp J (2007) The German Socio-Economic Panel Study (SOEP) - Scope, evolution and enhancements. Schmollers Jahrbuch 127:139–169

Winkelmann L, Winkelmann R (1998) Why are the unemployed so unhappy? Evidence from panel data. Economica 65:1–15

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to FIL Pensions Services, Kronberg/Taunus, Germany, for generously supporting our research, while leaving us ample scope as to the theme and contents of our work. We would like to thank an anonymous referee for kindly pointing us to possible extensions of our discussion and empirical analyses.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Dudel, C., Ott, N. & Werding, M. Maintaining one’s living standard at old age: What does that mean?. Empir Econ 51, 1261–1279 (2016). https://doi.org/10.1007/s00181-015-1042-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-1042-8