Abstract

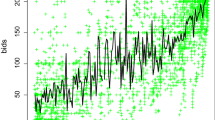

We propose an econometric model of the price processes of online auctions. Since auction bids monotonically increase within individual auctions but can differ considerably across auctions, we construct a monotone series estimator with a common relative price growth curve and auction-specific slopes. Furthermore, because the impacts of auction-specific attributes may evolve along the course of auctions, we employ a varying coefficient approach to accommodate these possibly time-varying effects. We present an algorithm to solve the proposed partially linear panel model with a nonparametric monotone component. We apply the proposed model to eBay auctions of a Palm personal digital assistant. The estimates capture closely the overall pattern of online auction price processes, in particular, the bidding drought midway through auctions and the bid acceleration associated with bid sniping (last-minute bidding) at the end of auctions.

Similar content being viewed by others

Notes

See Lucking-Reiley (2000) for some early adopters of the second price auctions, and a fascinating account of the history of the second price auction.

eBay also uses some variations of the hard-closed auction. For example, some auctions offer a “Buy It Now” price. In this kind of auction, bidders have the option to purchase the auctioned item at a posted “Buy It Now” price, which terminates the auction.

To recover the underlying common continuous price processes, researchers often rely on a large number of similar auctions with usually small number of bids, which results in an unbalanced panel of bids. The consequences of this particular nature of pooled bid histories on model construction and estimation are discussed below.

Instead of submitting their maximum willingness to pay, many bids submit their current willingness to pay and increase their bids as the auction progresses as in ascending price auctions.

For example, consider an auction with a reserve price of $10 and a minimum increment of $1. Suppose bidder A is the first bidder and his proxy bid is $20. Then, eBay displays $10 as the current highest bid. Next, bidder B enters the auction with a proxy bid of $15. eBay automatically raises the current bid to $16, which is one bid increment above the second highest bid. If a third bidder C submits a proxy bid of $23, he will become the highest bidder while the displayed highest bid will be raised to $21. The process continues until the auction ends.

Note that in \(w(\cdot )\), we do not have the usual constant term \(\phi _0\). This is because that \(\phi _0\) and \(\beta \) cannot be identified separately.

As suggested by an associate editor, another possibility to model the individual effects is to allow them to depend on the day of the auctions. This approach is not considered in this study due to the fact that we model the effects of auction specific attributes as smooth functions of time. Further incorporating time dependent individual effects may introduce the problem of multicollinearity.

On eBay, a buyer can rate a seller by giving him a positive (+1), neutral (0), or negative (-1) score, along with a text comment. eBay records and displays all of these comments, including the ID of the person making the comment. eBay also displays some summary statistics of user feedback.

Higher order terms for the time-varying coefficients are not statistically significant.

Almost all of the feedback on eBay is positive. One interpretation can be that users are hesitant to leave negative feedback for fear of retaliation. Another factor limiting the potential usefulness of feedback, reported by Resnick et al. (2006), is that feedback provision is an arguably costly activity that is completely voluntary, and that not all buyers (52.1 %) actually provide reviews about their sellers.

References

Ackerberg D, Benkard L, Berry S, Pakes A (2007) Econometric tools for analyzing market outcomes. In: Heckman J, Leamer E (eds) Handbook of econometrics, vol 6A. North Holland

Athey S, Haile P (2006) Empirical models for auctions. In: Blundell R, Newey W, Persson T (eds) Advances in economics and econometrics, the theory and application: ninth world congress, vol II. Cambridge University Press, Cambridge, pp 1–45

Athey S, Haile P (2007) Nonparametric approaches to auctions. In: Heckman J, Leamer E (eds) Handbook of econometrics, vol 6A. Elsevier, Amsterdam, pp 3847–3966

Ba S, Pavlou PA (2002) Evidence of the effect of trust building technology in electronic markets: price premiums and buyer behavior. MIS Q 26(3):243–268

Bajari P, Hortaçsu A (2003) The winner’s curse, reserve prices, and endogenous entry: empirical insights from eBay auctions. RAND J Econ 34(2):329–355

Bajari P, Horta̧csu A (2004) Economic insights from internet auctions. J Econ Lit 42(2):457–486

Bapna R, Goes P, Gupta A (2004) User heterogeneity and its impact on electronic auction market design: an empirical exploration. MIS Q 28(1):21–43

Brunk HD (1955) Maximum likelihood estimator of monotone parameters. Ann Math Stat 26:606–616

Box GEP, Cox DR (1964) An analysis of transformation (with discussion). J R Soc Stat Ser B 26:211–252

Cotton C (2009) Multiple bidding in auctions as bidders become confident of their private valuations. Econ Lett 104(3):148–150

Du P, Parmeter C, Racine JS (2013) Nonparametric kernel regression with multiple predictors and multiple shape constraints. Stat Sin 23:1343–1372

Eubank R (1999) Nonparametric regression and spline smoothing, 2nd edn. Marcel Dekker, New York

Fan J, Zhang W (1999) Statistical estimation in varying coefficient models. Ann Stat 27(5):1491–1518

Hastie T, Tibshirani R (1993) Varying-coefficient models. J R Stat Soc Ser B 55(4):757–796

Henderson DJ, Parmeter CF (2009) Imposing economic constraints in nonparametric regression: survey, implementation and extension. Adv Econom 25:433–469

Jank W, Shmueli G (2006) Functional data analysis in electronic commerce research. Stat Sci 21:155–166

Krishna V (2002) Auction theory. Academic Press, London

Li Q, Racine JS (2007) Nonparametric econometrics: theory and practice. Princeton University Press, Princeton

Lucking-Reiley D (2000) Vickrey auctions in practice: from nineteenth-century philately to twenty-first-century e-commerce. J Econ Perspect 14:183–192

Milgrom PR, Weber RJ (1982) A theory of auctions and competitive bidding. Econometrica 50(5): 1089–1122

Nikipelov D (2008) Essays on continuous-time models of industrial organization, dissertation. Duke University, Durham

Ockenfels A, Roth AE (2002) The timing of bids in internet auctions: market design, bidder behavior, and artificial agents. Pap Strateg Interact 23(3):79–87

Ockenfels A, Roth AE (2006) Late and multiple bidding in second price internet auctions: theory and evidence concerning different rules for ending an auction. Games Econ Behav 55(2):297–320

Ramsay JO (1998) Estimating smooth monotone functions. J R Stat Soc Ser B 60(2):365–375

Resnick P, Zeckhauser R, Swanson J, Lockwood K (2006) The value of reputation on eBay: a controlled experiment. Exp Econ 9(2):79–101

Roth AE, Ockenfels A (2002) Last-minute bidding and the rules for ending second-price auctions: evidence from ebay and Amazon auctions on the internet. Am Econ Rev 92(4):1093–1103

Sarin R, Zhang YY (2011) Two-stage buy-it-now auctions. working paper

Shmueli G, Jank W (2005) Visualizing online auctions. J Comput Graph Stat 14:299–319

Shmulei G, Jank W, Aris A, Plaisant C, Shneiderman B (2006) Exploring auction databases through interactive visualization. Decis Support Syst 42:1521–1538

Shmueli G, Russo RP, Jank W (2007) The BARISTA: a model for bid arrivals in online auctions. Ann Appl Stat 1(2):412–441

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Finance 16(1):8–37

Wang S, Jank A, Shmueli G (2008) Explaining and forecasting online auction prices and their dynamics using functional data analysis. J Bus Econ Stat 26(2):144–160

Wooldridge J (2002) Econometric analysis of cross section and panel data. MIT press, Cambridge

Wooldridge J (2005) Fixed effects and related estimators for correlated random-coefficient and treatment effect panel data models. Rev Econ Stat 87:385–390

Zhang YY, Gu J, Li Q (2011) Nonparametric panel estimation of online auction price processes. Empir Econ 40(1):51–68

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Liu, W., Zhang, Y.Y. & Li, Q. A semiparametric varying coefficient model of monotone auction bidding processes. Empir Econ 48, 313–335 (2015). https://doi.org/10.1007/s00181-014-0857-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-014-0857-z