Abstract

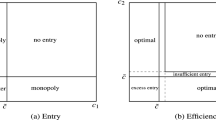

This paper addresses a fundamental identification problem in the structural estimation of dynamic oligopoly models of market entry and exit. Using the standard datasets in existing empirical applications, three components of a firm’s profit function are not separately identified: the fixed cost of an incumbent firm, the entry cost of a new entrant, and the scrap value of an exiting firm. We study the implications of this result on the power of this class of models to identify the effects of different comparative static exercises and counterfactual public policies. First, we derive a closed-form relationship between the three unknown structural functions and the two functions that are identified from the data. We use this relationship to provide the correct interpretation of the estimated objects that are obtained under the ‘normalization assumptions’ considered in most applications. Second, we characterize a class of counterfactual experiments that are identified using the estimated model, despite the non-separate identification of the three primitives. Third, we show that there is a general class of counterfactual experiments of economic relevance that are not identified. We present a numerical example that illustrates how ignoring the non-identification of these counterfactuals (i.e., making a ‘normalization assumption’ on some of the three primitives) generates sizable biases that can modify even the sign of the estimated effects. Finally, we discuss possible solutions to address these identification problems.

Similar content being viewed by others

Notes

Examples of recent applications are: Ryan (2012) on environmental regulation of an oligopoly industry; Suzuki (2013) on land use regulation and competition in retail industries; Kryukov (2010) on the relationship between market structure and innovation; Sweeting (2013) on competition in the radio industry and the effects of copyright fees; Collard-Wexler (2013) on demand uncertainty and industry dynamics; Snider (2009) on predatory pricing in the airline industry; or Aguirregabiria and Ho (2012) on airlines network structure and entry deterrence.

There is some abuse of language in using the term “cost” to refer to this component of a firm’s profit. This fixed component of the profit may include the positive income/profits associated with sales of owned inputs, such as land and buildings. Therefore, in this paper, we sometimes use ”fixed profit” instead of ”fixed cost” to denote this component.

This identification problem is fundamental in that it does not depend on other econometric issues that appear in this class of models, such as the stochastic structure of unobservables, the non-independence between observable and unobservable state variables, or the existence of multiple equilibria in the data. These issues may generate additional identification problems. However, addressing or solving these other identification problems does not help separately identify the three components in the fixed cost function.

Although making the entry cost equal to zero is another possible normalization, this approach has not been common in empirical applications.

In principle, a firm may be active in the market but producing zero output. However, whether we allow for that possibility or not is irrelevant for the (non) identification results in this paper.

The variable profit function is VP t = p t \(D(p_{t}, \mathbf {z} _{t}^{v})-VC(q_{t}, \mathbf {z}_{t}^{v})\), where p t is the firm’s price, \( D(p_{t}, \mathbf {z}_{t}^{v})\) is the demand function, and VC is the variable cost function that depends on output q t . Maximization of variable profit implies the well-known condition of marginal revenue equal to marginal cost, \(D(p_{t}, \mathbf {z}_{t}^{v})+\) p t \([\partial D(p_{t}, \mathbf {z}_{t}^{v})/\partial p_{t}]-\) \(MC(D(p_{t}, \mathbf {z}_{t}^{v}), \mathbf {z}_{t}^{v})\) \([\partial D(p_{t}, \mathbf {z}_{t}^{v})/\partial p_{t}]=0\), where MC represents the marginal cost function. Using this condition we can get the optimal pricing function p t = \(p^{\ast }( \mathbf {z}_{t}^{v})\), and plugging-in this optimal price into the variable profit function, we get the indirect variable profit function \(vp(\mathbf {z} _{t}^{v})\equiv\) \(p^{\ast }(\mathbf {z}_{t}^{v})\) \(D(p^{\ast }(\mathbf {z} _{t}^{v}), \mathbf {z}_{t}^{v})-\) \(VC(D(p^{\ast }(\mathbf {z}_{t}^{v}), \mathbf {z }_{t}^{v}), \mathbf {z}_{t}^{v})\).

In this version of the model, there is no “time-to-build” or “time-to-exit” such that the decision of being active or not in the market is taken at period t and it is effective at the same period, without any lag. At the end of this section we discuss variations of the model that involve ”time-to-build” or/and ”time-to-exit”. These variations do not have any incidence in our (non) identification results, though they imply some minor changes in the interpretation of the identified objects.

The distribution of \(\widetilde {\varepsilon }_{t}\) depends on k t if the entry cost and the scrap value contain unobservable components and these unobservables are different, i.e., \(\varepsilon _{t}^{sv}-\varepsilon _{t}^{ec}\neq 0\).

In Ericson and Pakes (1995), there is time-to-build in the timing of firms’ decisions. Here we consider a version of the dynamic game without time-to-build. As described below, all our results on (non-)identification apply similarly to models with or without time-to-build.

Note that f z (z ′|z)= Pr(z mt+1 = z ′ | z mt = z). Under mild regularity conditions, we can consistently estimate these conditional probabilities using a nonparametric method such as a kernel or sieve method.

Note that the expected variable profit \(vp_{j}^{\mathbf {P}}\left (\mathbf {k}, \mathbf {z}\right )\) is equal to \(\sum \nolimits _{\boldsymbol {a} _{-j}}[\prod \nolimits _{i\neq j}P_{i}\left (\mathbf {k}, \mathbf {z}\right ) ^{a_{i}}\) \((1-P_{i}\left (\mathbf {k}, \mathbf {z}\right ) )^{1-a_{i}}\) ] vp j (a − j , z v). Therefore, given vp j and CCPs {P i : i ≠ j}, the expected variable profit function \(vp_{j}^{\mathbf {P} }\) is known.

To the best of our knowledge, there is not yet a proof of identification of these distributions in an infinite horizon model.

The ‘ex-ante’ sunk entry cost is not necessarily equal to the ‘ex-post’ or realized sunk cost because the value of the state variables affecting the scrap value may be different at the entry and exit periods.

Lemma 1 is related but quite different to Proposition 1 in Hotz and Miller (1993). Hotz-Miller Proposition 1 establishes that for every value of the state variables (k, z), there is a one-to-one mapping between CCPs P and differential values \(\widetilde {v}\). In our binary choice model, Hotz-Miller Proposition simply establishes that in equation \(P(k, \mathbf {z})=F_{\widetilde {\varepsilon }|k}(\widetilde {v}(k, \mathbf {z}))\) the distribution function \(F_{\widetilde {\varepsilon }|k}\) is invertible. In contrast, Lemma 1 establishes the invertibility of the mapping between vector \(\widetilde {Q}\) and vector \(\widetilde {P}\). This invertibility is not point-wise because every value Q(k, z) depends on the whole vector \(\widetilde {P}\).

The land price is discretized into 20 equally spaced distinct points between the first and ninety-ninth percentiles.

Note that the “announcement dummy” \( z_{2t}^{c}\) may be correlated with the level of tax at period t. That is, the average property tax at period t in markets in the “experimental” group may be larger (or smaller) than in the “control” group.

This assumption is testable: it implies that the residual price \(\xi \equiv \lbrack R-\mathbb {E}(R|\mathbf {z})]\) should be independent of firms’ entry and exit decisions. In general, unless the dataset is rich enough to include in z all the relevant variables affecting the price of a firm, we should expect that this assumption will be rejected by the data. That is, we expect R = r(z, ε) + ξ, where ε is the vector of state variables observable to firms but unobservable to the researcher. Allowing for this type of unobservables as determinants of the transaction price implies that we should deal with a potential selection problem. We only observe the transaction price for those firm-market-period observations when a firm is sold, but those firms that are sold can be systematically different in terms of unobserved state variables ε from those firms that are not sold, i.e., \( \mathbb {E}(R|\mathbf {z}\), firm is sold )≠\(\mathbb {E}(R|\mathbf {z})\).

References

Aguirregabiria, V. (2010). Another look at the identification of dynamic discrete decision processes: An application to retirement behavior. Journal of Business & Economic Statistics, 28(2), 201–218.

Aguirregabiria, V., & Ho, C.-Y. (2012). A dynamic oligopoly game of the US airline industry: Estimation and policy experiments. Journal of Econometrics, 168(1), 156–173.

Aguirregabiria, V., & Mira, P. (2007). Sequential estimation of dynamic discrete games. Econometrica, 75(1), 1–53.

Barwick, P. J., & Pathak, P. (2012). The costs of free entry: An empirical study of real estate agents in greater boston. Cornell University Working Paper.

Berry, S., Levinsohn, J., Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63(4), 841–890.

Berry, S. T., Gandhi, A., Haile, P. A. (2013). Connected substitutes and invertibility of demand. Econometrica, 81(5), 2087–2111.

Berry, S. T., & Haile, P. A. (2010). Nonparametric identification of multinomial choice demand models with heterogeneous consumers. Cowles Foundation Discussion Paper No. 1718.

Bollinger, B. (Forthcoming). Green technology adoption: An empirical study of the southern california garment cleaning industry. Quantitative Marketing and Economics.

Bresnahan, T. F., & Reiss, P. C. (1990). Entry in monopoly markets. Review of Economic Studies, 57(4), 531–553.

Bresnahan, T. F., & Reiss, P. C. (1991). Empirical models of discrete games. Journal of Econometrics, 48(1), 57–81.

Bresnahan, T. F., & Reiss, P. C. (1991). Entry and competition in concentrated markets. Journal of Political Economy, 99(5), 977–1009.

Bresnahan, T. F., & Reiss, P. C. (1994). Measuring the importance of sunk costs. Annals of Economics and Statistics, 34, 181–217.

Collard-Wexler, A. (2011). Productivity dispersion and plant selection. NYU Stern Working Paper.

Collard-Wexler, A. (2013). Demand fluctuations in the ready-mix concrete industry. Econometrica, 81(3), 1003–1007.

Das, S., Roberts, M. J., Tybout, J. R. (2007). Market entry costs, producer heterogeneity, and export dynamics. Econometrica, 75(3), 837–873.

Doraszelski, U., & Satterthwaite, M. (2010). Computable markov-perfect industry dynamics. RAND Journal of Economics, 41, 215–243.

Dunne, T., Klimek, S., Roberts, M., Xu, D. (2013). Entry, exit and the determinants of market structure. RAND Journal of Economics, 44(3), 462–487.

Ellickson, P., Misra, S., Nair, H. (2012). Repositioning dynamics and pricing strategy. Journal of Marketing Research, 49(6), 750–772.

Ericson, R., & Pakes, A. (1995). Markov-perfect industry dynamics: A framework for empirical work. Review of Economic Studies, 62(1), 53–82.

Hotz, V. J., & Miller, R. A. (1993). Conditional choice probabilities and the estimation of dynamic models. Review of Economic Studies, 60(3), 497–529.

Igami, M. (2013). Estimating the innovator’s dilemma: Structural analysis of creative destruction in the hard disk drive industry. Yale University Working Paper.

Kalouptsidi, M. (Forthcoming). Time to build and fluctuations in bulk shipping. American Economic Review.

Kryukov, Y. (2010). Dynamic R&D and the effectiveness of policy intervention in the pharmaceutical industry. Carnegie Mellon University Working Paper.

Lin, H. (2012). Quality choice and market structure: A dynamic analysis of nursing home oligopolies. Indiana University Working Paper.

Magnac, T., & Thesmar, D. (2002). Identifying dynamic dscrete decision processes. Econometrica, 70(2), 801–816.

Manski, C. F. (1995). Identification problems in the social sciences. Cambridge: Harvard University Press.

Matzkin, R. (1992). Nonparametric and distribution-free estimation of the binary choice and the threshold crossing models. Econometrica, 60, 239–270.

Matzkin, R. (1994). Restrictions of economic theory in nonparametric methods. In Hand book of Econometrics, 4th edn. Amsterdam: Elsevier.

Pakes, A., Ostrovsky, M., Berry, S. (2007). Simple estimators for parameters of discrete dynamic games (with entry/exit examples). Rand Journal of Economics, 38(2), 373–399.

Rust, J. (1994). Structural estimation of markov decision processes, of handbook of econometrics, (Vol. 4, pp. 3081–3143): Elsevier.

Ryan, S. (2012). The costs of environmental regulation in a concentrated industry. Econometrica, 80(3), 1019–1061.

Santos, C.D. (2013). Sunk costs of R&D, trade and productivity: The moulds industry case. Tilburg University Working Paper.

Snider, C. (2009). Predatory incentives and predation policy: The American Airlines Case. UCLA Working Paper.

Suzuki, J. (2013). Land use regulation as a barrier to entry: Evidence from the Texas lodging industry. International Economic Review, 54(2), 495–523.

Sweeting, A. (2013). Dynamic product positioning in differentiated product industries: The effect of fees for musical performance rights on the commercial radio industry. Econometrica, 81(5), 1763–1803.

Varela, M. (2013). The costs of growth: estimating entry costs during rollouts. University of Arizona Working Paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Andrew Ching, Matt Grennan, and Steve Stern, as well as seminar participants at Keio, Minnesota, Sophia, Toronto, Tokyo, Tsukuba, Virginia, and Wisconsin-Madison, for helpful comments and suggestions.

Appendices

A. Extensions of the basic model

1.1 A.1 Model with no re-entry after market exit and no waiting before market entry

Some models and empirical applications of industry dynamics assume that a new entrant has only one opportunity to enter and an incumbent can not reenter after exit from the market (e.g., Ryan (2012)). This model is practically the same as the basic model presented in section 2.1, with the only difference that the value of not entering for apotential entrant is 0 and the value of exiting for an incumbent is the scrap value, i.e., v(0, 0, z t ) = 0 and v(0, 1, z t ) = \( sv(\mathbf {z}_{t}^{c})+\varepsilon _{t}^{sv}\).

1.2 A.2 Model with time-to-build and time-to-exit

In this version of the model, it takes one period to make entry and exit decisions effective, though the entry cost is paid at the period when the entry decision is made, and similarly the scrap value is received at the period when the exit decision is taken. Now, a t is the binary indicator of the event “the firm will be active in the market at period t+1”, and k t = a t−1 is the binary indicator of the event “the firm is active in the market at period t”. For this model, the one-period profit function is:

Given this structure of the profit function, we have that the Bellman equation, optimal decision rule, and CCP function are defined exactly the same as above in Equations (6), (9), and (10), respectively.

1.3 A.3 Model with investment

The basic model and the previous extensions assume that the only dynamic decision of a firm is to be active or not in the market. However, our (non) identification results extend to more general models where incumbent firms make investments in product quality, capacity, etc. Here we present a relatively simple model with investment. Suppose that there is a quasi-fixed input, say capital, and the firm decides every period the amount of capital to use. Let a t ∈ {0, 1, ⋯ , K} denote the firm’s decision at period t where K is the largest possible capital level. When a t is zero, the firm is inactive in the current period. The firm’s variable profit depends on the current amount of capital a t , e.g., the amount of capital may affect the quality of the product and therefore demand, and also variable costs. The fixed profit depends both on current capital a t and on the amount of capital installed at previous period, k t ≡ a t−1. The one-period profit function of this firm is:

where \(ic\left (a_{t}, k_{t}, \mathbf {z}_{t}^{c}\right )\) is the investment cost function, which represents the cost the firm incurs to change its capital level from k to a taking \(\mathbf {z}_{t}^{c}\) as given. We assume \(ic\left (a_{t}, k_{t}, \mathbf {z}_{t}^{c}\right ) =0\) when a t = k t . In this specification, \(ic\left (a, 0, \mathbf {z}_{t}^{c}\right )\) represents the entry cost for a firm that decides to enter in the market with an initial level of capital equal to a. Similarly, \(-ic\left (0, k, \mathbf {z}_{t}^{c}\right )\) represents the scrap value of an incumbent firm with installed capital equal to k. It is clear that our baseline model is a special case of this general model when K = 1.

1.4 A.4 Identification of the model with no re-entry after market exit and no waiting before market entry

In this extension, v(0, k, z t ) is equal to k sv(z t ). The system of equations corresponding to (19) is:

Define the function Q(k, z) ≡ \(\tilde {v}(k, \mathbf {z})-\beta \sum _{\mathbf {z}^{\prime }\in \mathbf {Z}}f_{z}(\mathbf {z}^{\prime }|\mathbf {z })\) \(S(\tilde {v}\left (1, \mathbf {z}^{\prime }\right ) , F_{\widetilde { \varepsilon }|1})\). With this new definition of Q(k, z), we have exactly the same system of equations as (20). The relationship reported in Table 1 is directly applicable to this extension.

1.5 A.5 Identification of the model with time-to-build and time-to-exit

Most of the expressions for the basic model still hold for this extension, except that now the one-period payoff π(a, k, z) has a different form. In particular, now π(1, k, z) − π(0, k, z)= − k sv(z c)−(1 − k) ec(z c), and this implies that the expression for the differential value function \(\tilde {v}(k, \mathbf {z})\) is:

Also, now we have that v(0, 1, z) − v(0, 0, z)=π(0, 1, z) − π(0, 0, z)=vp(z v) − fc(z c) + sv(z c). Therefore, the system of identifying restrictions (20) becomes:

where Q(k, z) has exactly the same definition as before in the model without time-to-build. Given this system of equations, Proposition 2 also applies to this model with the only difference that now we have the following relationship between true functions and identified objects:

The first equation is exactly the same as in the model without time to build. The second equation is slightly different: instead of current value of variable profit minus the fixed cost, vp(z v) − fc(z c), now we have the discounted and expected value of this function at the next period, i.e., \(\beta \sum _{\mathbf {z}^{\prime }\in \mathbf {Z}}f_{z}(\mathbf {z}^{\prime }|\mathbf {z})\) [vp(z v′) − fc(z c′)]. Table 3 reports the relationship between estimated functions and unknown structural functions.

1.6 A.6 Identification of the model with investment

Under mild regularity conditions the CCPs P(a|k, z) are identified, and given CCPs we can also identify the differential value function \(\tilde {v}(a, k, \mathbf {z})\equiv\) v(a, k, z)− v(0, k, z). The model implies the following restrictions:

The same logic used to derive (18 ) implies that \(\bar {V}\left (k, \mathbf {z}\right ) =\) v(0, k, z)+\(S(\tilde {v}\left (., k, \mathbf {z}\right ) , \) \(F_{\widetilde { \varepsilon }|k})\) where \(S(\tilde {v}\left (., k, \mathbf {z}\right ) , \) \(F_{ \widetilde {\varepsilon }|k})\equiv\) v(0, k, z)+\(\int \max _{a>0}\{0\) , \(\tilde {v}\left (a, k, \mathbf {z}\right ) -\widetilde { \varepsilon }(a)\}\) \(dF_{\widetilde {\varepsilon }|k}\left (\widetilde { \varepsilon }\right )\). Using the definition of v(a, k, z), we have that v(0, k, z) − v(0, 0, z)= π(0, k, z) − π(0, 0, z)= − ic(0, k, z c), that is the scrap value of a firm with k units of capital. Therefore, we have that \(\bar {V}\left (a, \mathbf {z}\right ) -\bar {V}\left (0, \mathbf {z}\right ) =\) − ic(0, k, z c)+\(S(\tilde {v}\left (., k, \mathbf {z}\right ) , \) \(F_{ \widetilde {\varepsilon }|k})-\) \(S(\tilde {v}\left (., 0, \mathbf {z}\right ) , \) \( F_{\widetilde {\varepsilon }|0})\). Define the function Q(a, k, z)≡\(\tilde {v}\left (a, k, \mathbf {z}\right ) -\) \(\beta \sum _{ \mathbf {z}^{\prime }}f_{z}\left (\mathbf {z}^{\prime }|\mathbf {z}\right )\) \( [S(\tilde {v}\left (., k, \mathbf {z}\right ) , F_{\widetilde {\varepsilon }|k})-\) \( S(\tilde {v}\left (., k, \mathbf {z}\right ) , \) \(F_{\widetilde {\varepsilon }|k})]\) , that is identified from the data. Then, the restrictions shown in (27) can be written as:

Note that Q(k, z) in Equation (20) is a special case when K = 1 and a = 1. Using this expression, we can also obtain a system of equations that correspond or extend the ones in (21). For any a>0 and any (k, z):

The same logic used to prove Proposition 2 implies no identification of structural cost functions fc(a, z c) and ic(a, k, z c). However, we can still identify the difference between entry cost (ic(a, 0, z c)) and scrap value ( − ic(0, k, z c)) for the same z as we have

The relationship between estimated functions under some normalization and structural cost functions is similar to that of the baseline model. For example, when we normalize scrap value (i.e., \(\widehat {ic}\left (0, k, \mathbf {z}^{c}\right ) =0\)), our estimates of investment cost function \( \widehat {ic}\left (a, k, \mathbf {z}^{c}\right )\) and fixed cost function fc(k, z c) are written as

B. Proofs of Lemmas and Propositions

Proof of Lemma 1.

By definition Q(k, z) is equal to \(\tilde {v}(k, \mathbf {z})-\) \(\beta \sum _{\mathbf {z}^{\prime }}f_{z}(\mathbf {z}^{\prime }|\mathbf {z})\) [\(S(\tilde {v}\left (1, \mathbf {z}\right ) , F_{\widetilde {\varepsilon }|1})-\) \(S(\tilde {v}\left (0, \mathbf {z}\right ) , F_{\widetilde {\varepsilon }|0})\) ], where \(\tilde {v}\left (k, \mathbf {z} \right ) =F_{\widetilde {\varepsilon }|k}^{-1}\left (P(k, \mathbf {z})\right )\) and \(S(\tilde {v}\left (k, \mathbf {z}\right ) , F_{\widetilde {\varepsilon } |k})\equiv\) \(\int _{-\infty }^{\tilde {v}(k, \mathbf {z})}[\tilde {v}(k, \mathbf {z })-\widetilde {\varepsilon }]\mathbf {\ }dF_{\widetilde {\varepsilon }|k}\left (\widetilde {\varepsilon }\right )\). These expressions imply the mapping in Equation (23). We can describe mapping \(\widetilde {q}(\widetilde {P};\beta , f_{z})\) as the composition of two mappings: (1) the mapping from CCPs to differential values, i.e., \(\tilde {v}\left (k, \mathbf {z} \right ) =F_{\widetilde {\varepsilon }|k}^{-1}\left (P(k, \mathbf {z})\right )\); and (2) the mapping from differential values to Q ′ s, i.e., Q(k, z)=\(\tilde {v}(k, \mathbf {z})-\beta \sum _{\mathbf {z}^{\prime }}f_{z}(\mathbf {z}^{\prime }|\mathbf {z})\) \([S(\tilde {v}\left (1, \mathbf {z} \right ) , F_{\widetilde {\varepsilon }|1})-\) \(S(\tilde {v}\left (0, \mathbf {z} \right ) , F_{\widetilde {\varepsilon }|0})]\). The first mapping is point-wise for every value of (k, z), and in our binary choice model it is obviously invertible. Proposition 1 in (Hotz and Miller 1993) establishes the invertibility of that mapping for multinomial choice models. Therefore, we should prove the invertibility of the second mapping, between the vector \( \widetilde {v}\equiv \{\widetilde {v}(k, \mathbf {z}):\) for all (k, z)} and the vector \(\widetilde {Q}\equiv \{Q(k, \mathbf {z}):\) for all (k, z)}. Define this mapping as \(\widetilde {Q}=\widetilde {g}(\widetilde {v})\) where \(\widetilde {g}(\widetilde {v})\equiv \{g(k, \mathbf {z}, \widetilde {v}):\) for all (k, z)} and:

In vector form, we can express this mapping as:

where F z is the transition probability matrix with elements f z (z ′|z), and \(\widetilde {e}(\widetilde {v} )\equiv \{\widetilde {e}(\mathbf {z};\widetilde {v}):\) for all z} with \(\widetilde {e}(\mathbf {z};\widetilde {v})=\) \(\int \nolimits _{-\infty }^{ \widetilde {v}(1, \mathbf {z})}[\widetilde {v}(1, \mathbf {z})-\widetilde { \varepsilon }]\mathbf {\ }dF_{\widetilde {\varepsilon }|1}\left (\widetilde { \varepsilon }\right ) -\) \(\int \nolimits _{-\infty }^{\widetilde {v}(0, \mathbf {z })}[\widetilde {v}(0, \mathbf {z})-\widetilde {\varepsilon }]\mathbf {\ }dF_{ \widetilde {\varepsilon }|0}\left (\widetilde {\varepsilon }\right )\). The mapping \(\widetilde {g}(\widetilde {v})\) is globally invertible if and only if its Jacobian matrix \(\mathbf {J}(\widetilde {v})\equiv \partial \widetilde {g}(\widetilde {v})/\partial \widetilde {v}^{\prime }\) is non-singular for every value of \(\widetilde {v}\). It is simple to show that this Jacobian matrix has the following form:

where I is the identity matrix. Given the form of function \( \widetilde {e}(\mathbf {z};\widetilde {v})\), it is straightforward to show that \(\partial \widetilde {e}(\mathbf {z};\widetilde {v})/\partial \widetilde {v}(0, \mathbf {z})=\) \(F_{\widetilde {\varepsilon }|0}(\widetilde {v}(0, \mathbf {z}))=\) − P(0, z), and \(\partial \widetilde {e}(\mathbf {z};\widetilde {v} )/\partial \widetilde {v}(1, \mathbf {z})=\) \(F_{\widetilde {\varepsilon }|1}(\widetilde {v}(1, \mathbf {z}))=\) P(1, z). Therefore,

where diag{P(k, .)} is diagonal matrix with elements {P(k, z)} for every value of z. The Jacobian matrix \(\mathbf {J}(\widetilde {v })\) is invertible for every value of \(\widetilde {v}\).

Proof of Proposition 1.

The proof of this Proposition 1 is a direct application of Proposition 4 in Aguirregabiria (2010) to our model of market entry and exit. Proposition 4 in Aguirregabiria (2010) applies to a general class of binary choice dynamic structural models with finite horizon, and it builds on previous results by Matzkin (1992, 1994).

Proof of Proposition 2.

(i) No identification. Let ec, fc, and sv be the true values of the functions in the population. Based on these true functions, define the functions: ec ∗(z c)=ec(z c) + λ(z c); sv ∗(z c)=sv(z c) + λ(z c), and \(fc^{\ast }\left (\mathbf {z}^{c}\right ) =fc\left (\mathbf {z}^{c}\right ) -\lambda \left (\mathbf {z}^{c}\right ) +\beta \sum _{\mathbf {z}^{c\prime }\in \mathbf {Z}^{c}}f_{z}(\mathbf {z}^{c\prime }|\mathbf {z})\) λ(z c′), where λ(z c)≠0 is an arbitrary function. It is clear that ec ∗, sv ∗, and fc ∗ also satisfy the system of Equations (20). Therefore, ec, fc, and sv cannot be uniquely identified from the restrictions in Equations (20). (ii) Identification of two combinations of the three structural functions.We can derive equations in Equations (21) after simple operations in the system (20).

Proof of Proposition 3.

Under the conditions of Proposition 3, we have that Equation (24) becomes:

The researcher knows all the elements in the right-hand-side of this equation, and therefore Q(k, z; 𝜃 0 + Δ 𝜃 ) is identified. Given \(\widetilde {\mathbf {Q}}(\mathbf {\theta }^{0}+\Delta _{\theta })\), we can use the inverse mapping \(\widetilde {q}^{-1}\) to get \( \widetilde {\mathbf {P}}(\mathbf {\theta }^{0}+\Delta _{\theta })=\) \(\widetilde { q}^{-1}(\widetilde {\mathbf {Q}}(\mathbf {\theta }^{0}+\Delta _{\theta });\beta ^{0}, f_{z}^{\ast })\).

Proof of Proposition 4.

Under the conditions of Proposition 4 (and making Δ vp = Δ fc = Δ ec = Δ sv = \(\Delta _{sv}=\Delta _{f_{z_{,nosv}}}=0\), for simplicity but without loss of generality), Equation (24) becomes:

Since the scrap value sv 0 is not identified, none of the terms that form Q(k, z; 𝜃 0 + Δ 𝜃 ) − Q 0(k, z) are identified.

Proof of Proposition 5.

It follows simply from equation (25).

Proof of Proposition 6.

Suppose \(\mathbf {z}_{2}^{c}\) enters only in the entry cost ec(z c). Under the conditions of Proposition 6, the system of Equations (21) becomes:

The difference between this equation evaluated at \(\mathbf {z}_{2}^{c1}\) and at \(\mathbf {z}_{2}^{c0}\) is:

In matrix form, we can express this system of equations as

Note that matrix \(\mathbf {F}_{{z_{1}^{c}}}(\mathbf {z}_{2}^{c1})-\mathbf {F} _{{z_{1}^{c}}}(\mathbf {z}_{2}^{c0})\) does not have full column rank because any matrix that is a difference of transition matrices is singular. However, the rank of \(\mathbf {F}_{{z_{1}^{c}}}(\mathbf {z}_{2}^{c1})-\mathbf {F} _{{z_{1}^{c}}}(\mathbf {z}_{2}^{c0})\) can be \(|\mathcal {Z}_{1}^{c}|-1\). If that is the case, we can combine the system of Equations (31) with a normalization assumption on one single element of the vector s v (e.g., \(sv(\mathbf {z} _{1}^{c0})=0\) for some value \(\mathbf {z}_{1}^{c0}\)) to uniquely identify the vector s v.

Proof of Proposition 7.

The identified function \(\widehat { sv}\left (\mathbf {z}^{c}\right )\) is such that \(\widehat {sv}\left (\mathbf {z} ^{c}\right ) =\) sv 0(z c) + κ where sv 0(z c) is the true scrap value function and κ is an unknown constant. Given Δ β = 0, we can write Equation (29) as

where the last equality holds as we always have \(\sum \nolimits _{\mathbf {z} ^{sv\prime }\in \mathbf {Z}}\Delta _{f_{z, sv}}(\mathbf {z}^{sv\prime }|\mathbf { z})=0\). Therefore, we can calculate Q(k, z; 𝜃 0 + Δ 𝜃 ), and the effect of the counterfactual experiment on CCPs is identified.

Rights and permissions

About this article

Cite this article

Aguirregabiria, V., Suzuki, J. Identification and counterfactuals in dynamic models of market entry and exit. Quant Mark Econ 12, 267–304 (2014). https://doi.org/10.1007/s11129-014-9147-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-014-9147-5

Keywords

- Dynamic structural models

- Market entry and exit

- Identification

- Fixed cost

- Entry cost

- Exit value

- Counterfactual experiment

- Land price