Abstract

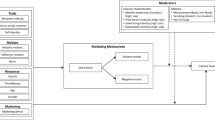

Gambling and gaming is a very large industry in the United States with about one-third of all adults participating in it on a regular basis. Using novel and unique behavioral data from a panel of casino gamblers, this paper investigates three aspects of consumer behavior in this domain. The first is that consumers are addicted to gambling, the second that they act on “irrational” beliefs, and the third that they are influenced by marketing activity that attempts to influence their gambling behavior. We use the interrelated consumer decisions to play (gamble) and the amount bet in a casino setting to focus on addiction using the standard economic definition of addiction. We test for two irrational behaviors, the “gambler’s fallacy” and the “hot hand myth”—our research represents the first test for these behaviors using disaggregate data in a real (as opposed to a laboratory) setting. Finally, we look at the effect of marketing instruments on the both the decision to play and the amount bet. Using hierarchical Bayesian methods to pin down individual-level parameters, we find that about 8% of the consumers in our sample can be classified as addicted. We find support in our data for the gambler’s fallacy, but not for the hot hand myth. We find that marketing instruments positively affect gambling behavior, and that consumers who are more addicted are also affected by marketing to a greater extent. Specifically, the long-run marketing response is about twice as high for the more addicted consumers.

Similar content being viewed by others

Notes

At this point, it should be clarified that we do not make a distinction between habit formation and addiction, both of which are forms of state dependence. Indeed, the literature on addiction itself has often used these terms somewhat interchangeably (Pollak 1970). Further, studies both in economics (Heckman 1981) and in marketing (Roy et al. 1996) have used habit persistence to refer to dependence of current choice on previous propensity to be in a state rather than the actual state itself and have distinguished this from structural state dependence, which is the dependence on the previous state. In our context, what we refer to as addiction is the latter effect. Overall, we are agnostic about whether this effect is termed addiction or habit formation and will use the term addiction henceforth to describe it.

The details of this poll are referred to in Kearney (2005).

Due to confidentiality concerns, we cannot reveal the name of the company and the geographic location of the property.

A comparison of the demographic variables for the estimation sample, the full set of consumers in this casino and for all casinos owned by this firm shows that our estimation sample is representative of the gambling population for this casino chain.

Note that the national average is across all casinos and is therefore expected to be higher than the number of trips to a particular casino, which is the case in our application.

A potentially lower level of aggregation might be the sequence of activities within a play (e.g., each time a consumer puts a coin into the slot machine or places a bet at a game table) but the data are not retained by the firm at this level.

A jackpot win by a consumer in a local store, which is the context of Guryan and Kearney (2008), could lead to a greater awareness about that lottery in the local neighborhood through reports in local media, advertising by the lottery retailer, word of mouth etc. This could explain a positive effect of a jackpot win on subsequent purchases of lottery tickets at the store even in the absence of a lucky store / hot hand effect.

As we describe in the results section, all the individual level intercepts, or fixed effects, are estimated very tightly. This therefore provides empirical support for this control as well.

The casino chain classifies consumers into loyalty program tiers, based on their aggregate gambling volume across properties and over time. The comp plan for each individual is based on the tier that she belongs to. Note that our fixed effect arguments holds if the gambling volume for an individual consumer does not change over time in a manner such that comp plan for that consumer also changes. We were able to obtain this information for a set of representative gamblers at the casino property from which our estimation sample is drawn. We find that virtually all gamblers—94.3%—remain in the same tier over the duration (two years) of our data.

Interestingly, using physical observations of players at a Roulette table for a few hours, Croson and Sundali (2005) document the presence of both the gambler’s fallacy and the hot hand myth. While the evidence for the gambler’s fallacy is quite clear in this study, that for the hot hand myth is less clear as an alternative account of a positive wealth effect of a past win on future bets is not controlled for in the study.

We also confirmed this empirically i.e., we found that the correlation between the time spent in a trip and the amount bet within a play is very small, at 0.0829.

It is important to note here that this specification gives us valid results under the assumption that there is no serial correlation in the unobserved term. If such serial correlation exists, it has potential to bias the results particularly in the case of the bet sub-model, where we have a lagged dependent variable. We rule out autocorrelation in the residuals of the bet sub-model (at the mean levels of the parameters) using Durbin–Watson and Breusch–Godfrey tests, thus mitigating concerns about such a bias.

We report the individual-level parameter estimates for 1,769 out of 2,000 consumers in the estimation sample. For the remaining 231 consumers, the parameters of the bet equation are not defined since these are households for which there were no trips with more than one play. We have play equation parameters for these households, but to ensure consistency, we report play equation parameters also for the same 1,769 consumers.

As a robustness check, we added another randomly chosen 2000 customers to our estimation sample and ran the model. We find that over 80% of the customers who were identified as addicted in the estimation sample were also classified as addicted based on the results obtained using the augmented sample.

See, for instance, Potenza et al. (2001) who use survey data and report prevalence rates for addiction of about 5% amongst casino gamblers. Our results provide some support for these estimates via the use of behavioral data.

These two coefficients exhibit a negative correlation in the bet sub-model. However, we focus on the play sub-model as many more of the LastBet parameters are significant in that sub-model relative to the bet sub-model.

An alternative approach would be to specify a hazard model, where the probability of visiting the casino given that the consumer has not visited it in the weeks since the previous trip is modeled as a hazard function, with the hazard being modified by the consumption level (i.e. total amount bet) in the previous trip. We chose the linear model because of its simplicity and its ability to directly test for the addiction effect. Furthermore, the hazard model would need us to specify the unit of time for an observation of whether the consumer visited the casino or not. In the case of grocery products, it is reasonable to assume that consumers plan their shopping on a weekly basis, and hence the natural observation is at a weekly level. However, in the case of casinos, it is unclear what this unit of observation should be. Trips extend across multiple days in many cases, and hence a day cannot be a reasonable unit of analysis. In addition, a single trip may spill over the weekly boundary.

We also conducted a within-trip analysis for the sample of frequent gamblers. We found that, for this sample, 19.1% of consumers are classified as displaying addictive behaviors based on the “play” equation and 6.3% based on the “bet” equation. Detailed results for this model are available from the authors on request.

The topmost line in Eq. 29.

References

Ayton, P., & Fischer, I. (2004). The hot hand fallacy and the gambler’s fallacy: Two faces of subjective randomness? Memory and Cognition, 32(8), 1369–1378.

Becker, G. S., Grossman, M., & Murphy, K. M. (1994). An empirical analysis of cigarette addiction. American Economic Review, 84(3), 396–418.

Becker, G. S., & Murphy, K. M. (1988). A theory of rational addiction. Journal of Political Economy, 96(4), 675–700.

Chaloupka, F. (1991). Rational addictive behavior and cigarette smoking. Journal of Political Economy, 99(4), 722–742.

Chib, S., & Greenberg, E. (1995). Understanding the metropolis Hastings algorithm. American Statistician, 49, 327–335.

Clotfelter, C. T., & Cook, P. J. (1993). The gambler’s fallacy in lottery play. Management Science, 39(12), 1521–1525.

Croson, R., & Sundali, J. (2005). The gambler’s fallacy and the hot hand: Empirical data from casinos. Journal of Risk and Uncertainty, 30(3), 195–209.

Gelfand, A. E., & Smith, A. F. M. (1990). Sampling-based approaches to calculating marginal densities. Journal of the American Statistical Association, 85(410), 398–409.

Gilovich, T., Vallone, R., & Tversky, A. (1985). The hot hand in basketball: On the misperception of random sequences. Cognitive Psychology, 17, 295–314.

Gruber, J., & Koszegi, B. (2001). Is addiction rational? Theory and evidence. Quarterly Journal of Economics, 116(4), 1261–1303.

Guryan, J., & Kearney, M. S. (2005). Lucky stores, gambling and addiction: Empirical evidence from state lottery sales. NBER Working Paper 11287.

Guryan, J., & Kearney, M. S. (2008). Gambling at lucky stores: Empirical evidence from state lottery sales. American Economic Review, 98(1), 458–473.

Heath, C., Larrick, R. P., & Wu, G. (1999). Goals as reference points. Cognitive Psychology, 38, 79–109.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Heckman, J. J. (1981). Statistical models for discrete panel data. In C. F. Manski & D. L. McFadden (Ed.), Structural analysis of discrete data and econometric applications. MIT Press.

Jones, J. (2004). Profile of the American gambler. Available at http://www.harrahs.com/about_us/survey/2004_Survey.pdf. Last accessed on 15 June 2006.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–291.

Kearney, M. S. (2005). The economic winners and losers of legalized gambling. National Tax Journal, 58, 281–302.

Metzger, M. (1984). Biases in betting: An application of laboratory findings. Psychological Reports, 56, 883–888.

Mullainathan, S. (2002). Thinking through categories. Working Paper, Harvard University.

Olekalns, N., & Bardsley, P. (1996). Rational addiction to caffeine: An analysis of coffee consumption. Journal of Political Economy, 104(5), 1100–1104.

Peele, S. (1985). The meaning of addiction: Compulsive experience and its interpretation. Lexington, Mass.

Pollak, R. A. (1970). Habit formation and dynamic demand functions. Journal of Political Economy, 78(4), 745–763.

Potenza, M. N., Kosten, T. R., & Rounsaville, B. J. (2001). Pathological gambling. Journal of the American Medical Association, 286(2), 141–144.

Roy, R., Chintagunta, P. K., & Haldar, S. (1996). A Framework for investigating habits: “The Hand of the Past,” and heterogeneity in dynamic demand choice. Marketing Science, 15(3), 280–299.

Stigler, G. J., & Becker, G. S. (1977). De Gustibus Non Est Disputandum. American Economic Review, 67(2), 76–90.

Tanner, T., & Wong, W. (1987). The calculation of posterior distributions by data augmentation. Journal of the American Statistical Association, 82, 528–549.

Terrell, D. (1994). A test of the gambler’s fallacy: Evidence from parimutuel games. Journal of Risk and Uncertainty, 8, 309–317.

Tversky, A., & Kahneman, D. (1971). Belief in the law of small numbers. Psychological Bulletin, 76, 105–110.

Acknowledgements

The authors are grateful to Wes Hartmann, Harikesh Nair, Subrata Sen, Katherine Burson, Scott Rick, seminar participants at Dartmouth’s Tuck School, Duke University, London Business School, National University of Singapore, Rotterdam School of Management, Texas A&M University, University of British Columbia, University of Guelph, University of Iowa, University of Maryland, University of Michigan, University of Notre Dame, University of Texas at Austin, University of Toronto, University of Wisconsin at Madison and Yale School of Management, and the participants of the 2006 Summer Institute of Competitive Strategy and the 2009 Marketing Science Conference for comments and feedback and an anonymous company for providing the data and institutional insights. Manchanda would like to acknowledge the Kilts Center for Marketing and the True North Faculty Fund at the University of Chicago, and Narayanan would like to acknowledge the Coulter Family fellowship for providing research support.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Likelihood function

For ease of exposition, we use the following abbreviations in this appendix

Also, define the following

The likelihood function can be written as follows

The joint posterior distribution of all parameters is proportional to the product of the likelihood and the prior densities and is given by

Appendix B: Full conditional distributions

The full conditional distributions for each parameter vector is obtained by taking out all the terms from the joint posterior distribution in Eq. 29, since the other terms affect only the proportionality constant. We inspect these terms to see if they are from known distribution families. The joint posterior in our case is somewhat atypical because of the selection problem. It may appear that the full conditional distributions of α i and β i as well as those for \(P_{it}^{*}\) are not from known distribution families if we just inspect them. However, on closer inspection, it turns out that they can be written as normal distributions.

In order to see this, it is useful to apply a simple trick of converting the joint density of d it Footnote 19 into the product of conditional density of \(\left(b_{it}|P_{it}^{*}\right)\) and the marginal density of \(P_{it}^{*}\) when writing the full conditional density for α i . Similarly, we write this joint density as the product of the conditional density of \(\left(P_{it}^{*}|b_{it}\right)\) and the marginal density of b it when writing the full conditional density for β i .

For this purpose, it is useful to note that if

then

Note also that

Thus

and

Thus, we can write the density of d it (i.e. the joint density of b it and \(P_{it}^{*}\)) in the first line of Eq. 29 in the following two ways

and

Then, the full conditional distributions of α i and β i start looking like the familiar normal distribution kernels. Thus, we have the following full conditional distributions for the parameters

-

1.

α i |·

In order to derive the full conditional distribution of α i , we first rewrite the joint posterior density in Eq. 29 using Eqs. 33 and 35 and then select all the terms that contain α i . We can ignore the other terms since they affect only the proportionality constant and not the kernel of the density.

$$ \begin{aligned} f\left(\alpha_{i}|\cdot\right)\propto\begin{array}{c} \displaystyle\prod\nolimits_{t=1}^{T_{i}}\left[\exp\left(-\frac{1}{2\sigma^{2}\left(1-\rho^{2}\right)}\left(b_{it}-X_{it}\alpha_{i}-\sigma\rho\left(P_{it}^{*}-Y_{it}\beta_{i}\right)\right)^{2}\right)\right]^{P_{it}}\\ \exp\left(-\frac{1}{2}\left(\alpha_{i}-M_{\alpha}z_{i}\right)'V_{\alpha}^{-1}\left(\alpha_{i}-M_{\alpha}z_{i}\right)\right) \end{array}\\ \end{aligned} $$(37)By rearranging terms in the above expression, we can show that

$$ \begin{aligned}[b] \alpha_{i}|&\cdot\sim N\left[\tilde{\alpha}_{i},\left(\tilde{X}_{i}'\tilde{X}_{i}+V_{\alpha}^{-1}\right)^{-1}\right]\\ \tilde{\alpha}_{i}&=\left(\tilde{X}_{i}'\tilde{X}_{i}+V_{\alpha}^{-1}\right)^{-1}\left(\tilde{X}_{i}'\tilde{b}_{i}+V_{\alpha}^{-1}M_{\alpha}z_{i}\right) \end{aligned} $$(38)where \(\tilde{b}_{i}\) is the vector obtained by stacking \(\frac{\left[b_{it}-\sigma\rho\left(P_{it}^{*}-Y_{it}\beta_{i}\right)\right]}{\sqrt{\sigma^{2}\left(1-\rho^{2}\right)}}\) for all t for which P it = 1, and \(\tilde{X}_{i}\) is the matrix obtained by stacking \(\frac{X_{it}}{\sqrt{\sigma^{2}\left(1-\rho^{2}\right)}}\) for all t for which P it = 1.

-

2.

β i |·

The derivation of the full conditional distribution of β i is similar to that for α i . However, there is one significant difference. In the case of α i , the full conditional was affected only by those observations where P it = 1. In the case of the full conditional distribution of β i , observations where P i t = 0 also enter, but differently from those where P it = 0. Rewriting the joint posterior density in Eq. 29 using Eqs. 34 and 36 and selecting the terms that contain β i gives us the following full conditional density

$$ \begin{aligned} f\left(\beta_{i}|\cdot\right)\propto\begin{array}{c} \displaystyle\prod\nolimits_{t=1}^{T_{i}}\left\{\! \begin{array}{c} \left[\!\exp\left(-\frac{1}{2\left(1-\rho^{2}\right)}\left(P_{it}^{*}-Y_{it}\beta_{i}-\frac{\rho}{\sigma}\left(b_{it}-X_{it}\alpha_{i}\right)\right)^{2}\right)\!\right]^{P_{it}}\\[12pt] \left[\exp\left(-\frac{1}{2}\left(P_{it}^{*}-Y_{it}\beta_{i}\right)\right)\right]^{1-P_{it}} \end{array}\!\right\} \\[12pt] \exp\left(-\frac{1}{2}\left(\beta_{i}-M_{\beta}z_{i}\right)'V_{\beta}^{-1}\left(\beta_{i}-M_{\beta}z_{i}\right)\right) \end{array}\\ \end{aligned} $$(39)The full conditional distribution of β i can be shown to be

$$ \begin{aligned}[b] \beta_{i}|\cdot&\sim N\left[\tilde{\beta}_{i},\left(\tilde{Y}_{i}'\tilde{Y}_{i}+\ddot{Y}_{i}'\ddot{Y}_{i}+V_{\beta}^{-1}\right)^{-1}\right]\\ \tilde{\beta}_{i}&=\left(\tilde{Y}_{i}'\tilde{Y}_{i}+\ddot{Y}_{i}'\ddot{Y}_{i}+V_{\beta}^{-1}\right)^{-1}\left(\tilde{Y}_{i}'\tilde{P}_{i}^{*}+\ddot{Y}_{i}'\ddot{P}_{i}^{*}+V_{\beta}^{-1}M_{\beta}z_{i}\right) \end{aligned} $$(40)where \(\tilde{P}_{i}^{*}\) is the vector obtained by stacking \(\frac{\left[P_{it}^{*}-\frac{\rho}{\sigma}\left(b_{it}-X_{it}\alpha_{i}\right)\right]}{\sqrt{1-\rho^{2}}}\) for all t for which P it = 1, \(\tilde{Y}_{i}\) is the matrix obtained by stacking \(\frac{Y_{it}}{\sqrt{1-\rho^{2}}}\) for all t for which P it = 1, \(\ddot{P}_{it}^{*}\) is the vector of stacked \(P_{it}^{*}\) for all t for which P it = 0 and \(\ddot{Y}_{it}\) is the matrix obtained by stacking Y it for all t for which P it = 0.

-

3.

\(m_{\alpha}=\mbox{vec}\left(M_{\alpha}\right)|\cdot\) and \(m_{\beta}=\mbox{vec}\left(M_{\beta}\right)|\cdot\)

$$ \begin{aligned}[b] m_{\alpha}|\cdot&\sim n\left[\tilde{m}_{\alpha},\left(Z'Z+A\right)^{-1}\right]\\ \tilde{m}_{\alpha}&=\mbox{vec}\left(\tilde{M}_{\alpha}\right)\mbox{ where }\tilde{M}_{\alpha}=\left(Z'Z+A\right)^{-1}\left(z'\alpha+A\bar{M}_{\alpha}\right) \end{aligned} $$(41)Z is the matrix formed by stacking z i for all i, α is the matrix formed by stacking all α i and \(\bar{M}_{\alpha}\) is formed by stacking \(\bar{\alpha}\) a column at a time.

Similarly,

$$ \begin{aligned}[b] m_{\beta}|\cdot&\sim N\left[\tilde{m}_{\beta},\left(Z'Z+B\right)^{-1}\right]\\ \tilde{m}_{\beta}&=\mbox{vec}\left(\tilde{M}_{\beta}\right)\mbox{ where }\tilde{M}_{\beta}=\left(Z'Z+B\right)^{-1}\left(Z'\beta+B\bar{M}_{\beta}\right) \end{aligned} $$(42)Z is the matrix formed by stacking z i for all i, β is the matrix formed by stacking all β i and \(\bar{M}_{\beta}\) is formed by stacking \(\bar{\beta}\) a column at a time.

-

4.

V α |· and V β |·

$$ \begin{aligned}[b] V_{\alpha}|\cdot&\sim\mbox{Inverse Wishart}\left(\mu_{\alpha}+N,S_{\alpha}+E_{\alpha}'E_{\alpha}\right)\\ E_{\alpha}&=\alpha-Z\tilde{M}_{\alpha}+\left(\tilde{M}_{\alpha}-\bar{M}_{\alpha}\right)^{-1}A\left(\tilde{M}_{\alpha}-\bar{M}_{\alpha}\right) \end{aligned} $$(43)\(\tilde{M}_{\alpha}\) and \(\bar{M}_{\alpha}\) have already been defined in Eq. 41 and N is the total number of consumers.

Similarly,

$$ \begin{aligned}[b] V_{\beta}|\cdot&\sim\mbox{Inverse Wishart}\left(\mu_{\beta}+N,S_{\beta}+E_{\beta}'E_{\beta}\right)\\ E_{\beta}&=\beta-Z\tilde{M}_{\beta}+\left(\tilde{M}_{\beta}-\bar{M}_{\beta}\right)^{-1}B\left(\tilde{M}_{\beta}-\bar{M}_{\beta}\right) \end{aligned} $$(44) -

5.

\(P_{it}^{*}|\cdot\)

Using data augmentation (Tanner and Wong 1987), we can treat the vector of \(P_{it}^{*}\) as parameters and make draws for them from their full conditional distribution like in the case of the other parameters Note that when P it = 1, \(P_{it}^{*}\) is drawn from a left-truncated normal distribution, while it is drawn from a right-truncated normal distribution when P it = 0. Where our specific formulation differs from the standard binomial probit model is that the since we have a bivariate distribution of the errors, there are further restrictions placed on \(P_{it}^{*}\).

$$ P_{it}^{*}|\cdot\sim\begin{array}{cc} N\left[Y_{it}\beta_{i}+\frac{\rho}{\sigma}\left(b_{it}-X_{it}\alpha_{i}\right),1-\rho^{2}\right]1\left(P_{it}^{*}>0\right) & \mbox{ when }P_{it}=1\\ \\ N\left[Y_{it}\beta_{i},1\right]1\left(P_{it}^{*}<0\right) & \mbox{ when }P_{it}=0 \end{array} $$(45) -

6.

σ 2|· and ρ|·

The full conditional distributions of these two parameters are not from known distribution families and hence we cannot draw from them directly. We use the Random Walk Metropolis Hastings algorithm (Chib and Greenberg 1995) to make draws from these distributions. We use normal candidate densities for this purpose, using standard errors from likelihood estimates of these parameters and a scaling/tuning parameter that was set by maximizing the relative numerical efficiency to fix the variances of these candidate densities. More details are available from the authors on request.

Rights and permissions

About this article

Cite this article

Narayanan, S., Manchanda, P. An empirical analysis of individual level casino gambling behavior. Quant Mark Econ 10, 27–62 (2012). https://doi.org/10.1007/s11129-011-9110-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-011-9110-7