Abstract

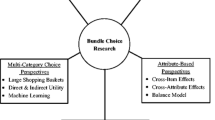

An influential theoretical literature supports a discriminatory explanation for product bundling: it reduces consumer heterogeneity, extracting surplus in a manner similar to second-degree price discrimination. This paper tests this theory and quantifies its importance in the cable television industry. The results provide qualified support for the theory. While bundling of general-interest cable networks is estimated to have no discriminatory effect, bundling an average top-15 special-interest cable network significantly increases the estimated elasticity of cable demand. Calibrating these results to a simple model of bundle demand with normally distributed tastes suggests that such bundling yields a heterogeneity reduction equal to a 4.7% increase in firm profits (and 4.0% reduction in consumers surplus). The results are robust to alternative explanations for bundling.

Similar content being viewed by others

Notes

Negative correlation, however, is not necessary for bundling to be profitable (McAfee et al. 1989).

McAfee et al. (1989) extend the analysis of Adams and Yellen (1976) to consider mixed bundling, the offering of both component and bundled sales, and show it always yields (weakly) greater profits than pure bundling. The reason for this is clear: it maintains the benefits of bundling (if any) and strictly increases the number of prices available to capture surplus. Despite this fact, mixed bundling is relatively uncommon, perhaps due to the added administrative costs associated with offering both bundled and component goods.

Note that in this specification there are no income effects nor any complementarity or substitutability in demand, two issues that we discuss further below.

Bakos and Brynjolfsson (1999, Footnote 21): “A sequence {v i } is called stationary in the wide sense if \(E\{|v_i|^2\} < \infty\) for all i, and the covariance Cov(v s+i, v s ) does not depend on s. This condition is satisfied, for example, if all v i are identically distributed with finite mean and variance, and \(\rho_{i,j} = \rho^{|i-j|}\) for some ρ in (0,1), and for all i and j.”

Strictly speaking, this proposition extends Bakos and Brynjolfsson (1999) Proposition 3 to allow for correlation in tastes. As stated, it is correct, as A4 is strong enough to allow for the more general correlation structure.

This may seem counter-intuitive. For a fixed level of demand (e.g. rotate a linear demand curve around its intersection with the quantity axis), a monopolists profit is higher the more inelastic is demand. Bundling, however, simultaneously shifts out and flattens the aggregate demand curve.

Recent exceptions may include sport networks. We discuss this issue in more detail in the next subsection.

Both Armstrong (1999) and Bakos and Brynjolfsson (1999) note that this assumption might be violated if preferences for components are correlated with one or more underlying variables (esp. income). For example, high-income households might be willing to pay more than low-income households for all cable networks. In this case, Armstrong (1996) shows that the “almost-optimal” tariff would be a menu of cost-based two-part tariffs (with the menu designed to sort households by income) and Bakos and Brynjolfsson (1999) note that the properties of their propositions can be restored by conditioning on income. We include demographic variables (including income) as demand shifters for each offered cable bundle in our econometric model in part to account for this concern. See Crawford and Shum (2006) and Xiao et al. (2006) for analyses that allow for menus of product bundles.

As noted in BB, if preferences for components are i.i.d., the single-crossing condition (SCDC) is not particularly restrictive. It is satisfied for most common demand functions, including the logit specification used in our empirical tests. If, however, preferences for components are positively correlated or differ dramatically in their dispersion (as measured by σ), the assumption may not hold and there is no guarantee bundling reduces heterogeneity and increases profits. This provides power for our empirical tests.

For convenience, Bakos and Brynjolfsson (1999) focus on the across-component average willingness-to-pay for a bundle. The aggregate effects of bundling, however, apply equally to demand for the whole bundle: under A1–A3, mean WTP for the bundle increases at rate n while the standard deviation increases at rate \(\sqrt{n}\). The coefficient of variation for the bundle, \(\sigma_{\mbox{\tiny bun}}/\mu_{\mbox{\tiny bun}}\), therefore decreases at rate \(\sqrt{n}\). We consider both the per-good and aggregate implications in Appendix 1.

Alternative formulations of this proposition are possible (e.g. evaluating the elasticity at a given quantity, at the mean of consumer preferences, or evaluating each elasticity at its profit-maximizing price). We chose the given form as that provides the most natural empirical implementation. See footnote 25 for the implication of this choice for our empirical tests.

Versus an average 1995 price of $17.33 for the most popular bundle in our data.

Indeed if it were not so, one might expect cable systems to optimally unbundle relatively expensive basic networks as they do premium networks. Footnote 20 describes a desire for movement in this direction for sports networks.

The impact of complementarity in demand on the cable elasticity would depend on how complementarities varied within the distribution of households. If (as seems likely) preferences in high-WTP households exhibited stronger complementarities than in low-WTP households, the bundle demand curve would likely shift out and rotate clockwise with additions to the bundle, decreasing the (absolute value of the) elasticity of cable demand.

Premium networks have recently begun “multiplexing” their programming, i.e. offering multiple channels under a single network/brand (e.g. HBO, HBO 2, HBO Family, etc.).

With the rise of digital cable, many cable systems now offer more service tiers. These were not available, however, in the time period we study.

Early methods to block consumption relied on electromechanical “traps” placed at the link between the household and the cable distribution system. Most (but not all) systems now offer “addressable” converters which control access via electronic communication with the cable headend.

Cable networks typically charge moderate fees to cable systems, ranging from nothing to $1.00 or more per subscriber per month. By contrast, premium networks charge higher fees, up to several dollars per subscriber per month for HBO.

Witness the recent disputes between ESPN and Cox and the NFL Network and Time Warner/Cablevision over the possible unbundling of sports networks (e.g. www.keepespn.com, www.makethemplayfair.com, Gentile 2004 and Thompson 2006).

For example, Direct Broadcast Satellite providers of multi-channel programming in competition with cable systems face no technological constraint but also engage in widespread bundling.

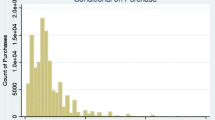

While there are over 11,000 systems in the sample, persistence in non-response over time as well as incomplete reporting of critical variables required imposing a large number of conditions in order for a system to be included in each sample. Missing information on prices, quantities, and reporting dates were responsible for the majority of the exclusions.

At the time of the sample data, the heterogeneity in carriage and allocation of a given network to a given service across systems was largely driven by two factors: variation in the tiering strategies taken by different MSOs (with a given strategy typically implemented in most but not all of an MSO’s systems) and variation in local tastes for programming (influencing especially carriage decisions). See footnote 32 for more on this issue.

This is a reliable measure of market size as it defines the set of households available to purchase cable services from each system.

Evaluating the elasticity at \(p^{*}_{\mbox{\tiny No MTV}}\) turns out to be difficult as we do not observe this price in the data and simulating it would require modeling firms’ optimal pricing decisions. Instead, we evaluate the elasticity at the observed bundle prices, themselves a weighted average of the optimal No-MTV and MTV bundle prices. If anything, this biases us against finding evidence of the discriminatory theory as that price is too high for the No-MTV bundle (over-estimating its elasticity) and too low for the With-MTV bundle (under-estimating its elasticity). Alternatives (e.g. evaluating elasticities at a given quantity) yielded stronger support for the discriminatory theory but made it more confusing to measure the profit and welfare effects (which necessarily had to be evaluated at profit-maximizing prices).

Examples of the former include TBS, USA, and TNT. Examples of the latter (with their primary type of programming) include ESPN (Sports), CSPAN (Public Affairs), and QVC (Home Shopping).

This is not perfect, however. As noted by a referee, tastes for some pairs of special-interest networks may be independent or even positively correlated (e.g. sports and action networks). We do not dispute that. The claim here is that, on average, tastes for a special-interest network and an existing bundle are more likely to be negatively correlated than tastes for a general-interest network and a bundle.

Estimation using logit and nested logit models simplifies the estimating equations when some products are bundles that include the contents of other products (Crawford 2000). This and a lack of precision on the nesting parameter(s) in the nested logit model led us to prefer the logit specification.

In particular, estimating using only one bundle per market—whether the lowest or highest quality—yielded similar (though less precise) results.

The logic of this argument is that households have preferences for the set of services offered by cable systems, but are unlikely to care about the size or identity of provider of those services. There is little branding of cable systems (in contrast to cable networks). This may not be true in the long run, however, if certain providers provide (unobservably) higher quality cable services. The nature of the product in cable helps alleviate this concern. It is easy to enumerate the things that matter to consumers about cable service; most important by far is the set of program networks they can watch and these are observed by the econometrician. Other features (signal quality, customer service, etc.) are likely of second-order importance to demand and regardless unlikely to be correlated with programming cost shifters.

The identification assumption may be described by assumptions on the following generic reduced form for cable prices:

$$p_{sn} = c_{sn} + \epsilon_{sn} $$where p sn measures the price of good s in market n, c sn is its marginal cost, and ε sn measures unmodeled cost and demand shocks to cable prices (including markups). Then if E(c sn c sn′) ≠ 0 and E(ε sn ε sn′) = 0, prices in other markets will be valid instruments for prices in market n. The nature of MSO bargaining for programming networks justifies the correlation in marginal costs across markets within an MSO. The validity of the assumption on ε is discussed in what follows.

This may not be as severe a problem as would appear at first glance. In cable, while local systems typically select what networks to offer, the decision to offer one or more expanded basic services and the decision of where to place networks, if offered, among these services is typically made by the MSO (GAO 2003). In addition, as most systems offer most networks (cf. Table 3), the econometric identification of tastes for networks is driven as much by the service on which a network is offered as whether it is carried at all. As such, it is the allocation of networks across services that is the important source of possible correlation with the econometric error, at least for the most popular networks. Since this decision is made by the MSO, it is unlikely to be correlated with tastes for cable in any particular market. This is less true for less popular networks, where endogeneity may therefore be a greater concern.

See Crawford and Shum (2006) for some related work on this problem.

Specifically, one can reject the null hypothesis \(H_0: \partial \epsilon_{bb} / \partial X_{k} < 0\) v. \(H_A: \partial \epsilon_{bb} / \partial X_{c}>0\) at size 0.05.

In particular, similar (unreported) regressions on more recent cable data from yielded similar results.

See Section 4.2.1 for a detailed description of the instruments.

Not reported are results using as instruments prices of other systems within the same MSO but outside the state or region of the given system. While consistent with the results presented here, the estimates are qualitatively similar, but less precise. For these reasons, we maintain a preference for the results presented above.

To accurately quantify the benefits of bundling, we would ideally calculate the effect on consumers, producers, and total welfare of alternative bundling strategies pursued by systems. To do so, however, requires estimates of the preferences for networks underlying the demand for cable bundles, namely their means, μ j ’s, variances, \(\sigma_j^2\)’s, and correlations, ρ j,k’s. This is quite challenging and the topic of a separate work in progress (Crawford and Yurukoglu 2007).

We focus exclusively on changes in preference heterogeneity via \(\sigma_{\mbox{\tiny bun}}\) as that is the primary consequence of bundling under the discriminatory theory.

This suggests mean preferences for cable service bundles are, on average, approximately 2.40 times their standard deviation.

Note that these results only quantify the profit and welfare consequences from the heterogeneity reduction caused by bundling. It ignores the (positive) effects to both profit and welfare of increases in the mean of preferences due to the addition of a valuable network to the bundle.

An exception is the Nashville Network.

Kagan Media Research (2005) “estimates TV channel operators would need to raise per-capita channel carriage fees by a multiple of four to offset a 50% loss of subscribers from big basic bundles.” Furthermore, Rennhoff and Serfes (2005) present a theoretical analysis of competition between program networks and cable systems with and without bundling and find costs to cable systems would increase without bundling.

Much of this proof follows ideas in Bakos and Brynjolfsson (1999, Appendix).

Letting \(\epsilon = \mu - p^*_n\) suggests we are looking at non-marginal changes in price. An alternative proof would show the elasticity of the bundle demand curve increases with bundle size when evaluate at its mean. Empirical implementation of that approach is more difficult, however, leading us to favor the given approach.

In particular, \(\frac{n - \omega A(n)}{n - \frac{\omega A(n)}{2}}~ \tilde{p}_n \geq \frac{n - \omega}{n - \frac{\omega}{2}}~ \tilde{p}_n\) simplifies to A(n) ≤ 1.

Note sign\((\partial / \partial \eta) = -\)sign\((\partial / \partial n)\).

Only results for the instruments are reported in the table.

Note since all systems that offer an Expanded Service also offer a basic service, separate parameters are not identified for the Expanded I parameters in the second column. For an analogous reason, separate parameters are not identified for either Expanded Service in the third column.

Note that because of the cross-equation restrictions on β and γ, identification obtains as long as the instruments are valid for at least one of the endogenous prices.

Not all systems belong to an MSO. To address this issue, we pool systems with a single owner and treat them as other MSOs: including as a value for the instrument in market n the average price for all single-owner systems other than that in n. While the argument advocating marginal costs are correlated is weaker in this case than in the case of a common owner, single-owner systems tend to be smaller than average and, due to a common disadvantage when bargaining with network providers, have similar marginal costs.

Specifically 16 networks * 3 services = 48 specifications.

The problem of imprecision seen in the third column of the price regressions was exacerbated in the network carriage specifications. For some networks, only one or two of the 168 systems that offered a second expanded basic service carried that network on that service, implying an inability to identify the effects of any instruments. Analogously to that described above, identification of the parameters of interest requires the instruments have power for carriage on at least one service.

References

Adams, W., & Yellen, J. (1976). Commodity bundling and the burden of monopoly. Quarterly Journal of Economics, 90, 475–498.

Angrist, J., & Krueger, A. (2001). Instrumental variables and the search for identification: From supply and demand to natural experiments. NBER Working Paper 8456.

Armstrong, M. (1996). Multiproduct non-linear pricing. Econometrica, 64(1), 51–75.

Armstrong, M. (1999). Price discrimination by a multi-product firm. Review of Economic Studies, 66, 151–168.

Bakos, Y., & Brynjolfsson, E. (1999). Bundling information goods: Pricing, profits, and efficiency. Management Science, 45(2), 1613–1630.

Bakos, Y., & Brynjolfsson, E. (2000). Bundling and competition on the Internet. Marketing Science, 19(1), 63–82.

Berry, S. (1994). Estimating discrete choice models of product differentiation. Rand Journal of Economics, 25(2), 242–262.

Berry, S., Levinsohn, J., & Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63, 841–890.

Bresnahan, T., & Gordon, R. (1996). The economics of new goods: An introduction. In T. Bresnahan, R. Gordon (Eds.), The Economics of New Goods. University of Chicago Press.

Carlton, D., & Perloff, J. (2001). Modern Industrial Organization (3rd ed.). Harper Collins

Chae, S. (1992). Bundling subscription TV channels: A case of natural bundling. International Journal of Industrial Organization, 10, 213–230.

Chipty, T. (1995). Horizontal integration for bargaining power: Evidence from the cable television industry. Journal of Economics and Management Strategy, 4(2), 375–97.

Chipty, T. (2001). Vertical integration, market foreclosure, and consumer welfare in the cable television industry. American Economic Review, 91(3), 428–453.

Crawford, G. (2000). The impact of the 1992 cable act on household demand and welfare. RAND Journal of Economics, 31(3), 422–449.

Crawford, G., & Cullen, J. (2007). Bundling, product choice, and efficiency: Should cable television networks be offered À La Carte? Information Economics and Policy (in press).

Crawford, G., & Shum, M. (2006). Empirical modeling of endogenous quality choice: The case of cable television. Mimeo, University of Arizona.

Crawford, G., & Yurukoglu, A. (2007). Demand, pricing, and bundling in subscription television markets. Mimeo, University of Arizona.

Einav, L. (2007). Seasonality in the U.S. motion picture industry. RAND Journal of Economics, 38(1).

FCC (2003). 2002 report on cable industry prices. Federal Communications Commission. Available at http://www.fcc.gov/mb/csrptpg.html.

FCC (2006). Further report on the packaging and sale of video programming to the public. Federal Communications Commission, February 2006. Available at http://www.fcc.gov/mb/csrptpg.html.

GAO (2003). Issues related to competition and subscriber rates in the cable television industry. Discussion paper, General Accounting Office, GAO-04-8.

Gentile, G. (2004). ESPN ends ugly fight with Cox over fees. Associated Press.

Griliches, Z., & Cockburn, I. (1994). Generics and new goods in pharmaceutical price indexes. American Economic Review, 84(5), 1213–1232.

Halfon, J. (2003). The failure of cable deregulation: A blueprint for creating a competitive, proconsumer cable television marketplace. United States Public Interest Research Group.

Hausman, J., Leonard, G., & Zona, D. (1994). Competitive analysis with differentiated products. Annales d’Economie et de Statistique, 34, 159–180.

Hazlett, T., & Spitzer, M. (1997). Public Policy Towards Cable Television: The Economics of Rate Controls. MIT Press.

Kagan World Media (1998). Economics of Basic Cable Television Networks. Discussion paper, Kagan World Media.

Kagan Media Research (2005). À la Carte pricing makes great theory, but tv channel bundling tough to beat. Kagan Media Research, December 2005. Available at http://www.ncta.com/IssueBrief.aspx?contentId=15.

Lancaster, K. (1971). Consumer Demand: A New Approach. Columbia University Press.

McAfee, R. P., McMillan, J., & Whinston, M. (1989). Multiproduct monopoly, commodity bundling, and correlation of values. Quarterly Journal of Economics, 103, 371–383.

Mitchener, B., & Kanter, J. (2004). EU member states back record fine for microsoft. Wall Street Journal, March 24, 2004.

Nalebuff, B. (2004). Bundling as an entry barrier. Quarterly Journal of Economics, 119(1), 159–187.

NCTA (1998). Cable television developments. Discussion paper, National Cable Television Association, Available at http://www.ncta.com.

Nevo, A. (2001). Measuring market power in the ready-to-eat cereal industry. Econometrica, 69, 307–342.

Noam, E. M. (1985). Economics of scale in cable television: A multiproduct analysis. In E. M. Noam (Ed.), Video Media Competition: Regulation, Economics, and Technology. Columbia University Press.

Petrin, A. (2003). Quantifying the benefits of new products: The case of the minivan. Journal of Political Economy, 110, 705–729.

Rennhoff, A., & Serfes, K. (2005). The role of upstream-downstream competition on bundling decisions: Should regulators force firms to unbundle? Mimeo, Drexel University.

Reuters (2003). US lawmaker urges a la Carte cable channel rates. Reuters News Service.

Rochet, J.-C., & Chone, P. (1998). Ironing, sweeping, and multidimensional screening. Econometrica, 66(4), 783–826.

Rochet, J.-C., & Stole, L. (2000). The economics of multidimensional screening. Mimeo, University of Chicago.

Salinger, M. (1995). A graphical analysis of bundling. Journal of Business, 68(1), 85–98.

Saloner, G., Shepard, A., & Podolny, J. (2001). Strategic Management. Wiley.

Schmalensee, R. (1984). Gaussian demand and commodity bundling. Journal of Business, 62, S211–S230.

Squeo, A. M., & Flint, J. (2004). Should cable be a la Carte not flat rate? Wall Street Journal.

Stigler, G. (1963). United States v. Loew’s Inc.: A note on block booking. In P. Kurland (Ed.), The Supreme Court Review: 1963 (pp. 152–157). University of Chicago Press.

Stigler, G. (1968). A note on block booking. In G. Stigler, R. D. Irwin (Eds.), The Organization of Industry.

Stole, L. (2003). Price discrimination in competitive environments. Mimeo, University of Chicago.

Thompson, A. (2006). NFL v. cable is turning into a real nailbiter. Wall Street Journal.

Varian, H. (2003). Intermediate Microeconomics (6th ed.). Norton

Waterman, D. H., & Weiss, A. A. (1996). The effects of vertical integration between cable television systems and pay cable networks. Journal of Econometrics, 72, 357–95.

Whinston, M. (1990). Tying, foreclosure, and exclusion. American Economic Review, 80(4), 837–859.

Wildman, S., & Owen, B. (1985). Program competition, diversity, and multichannel bundling in the New Video Industry. In E. M. Noam (Ed.) Video Media Competition: Regulation, Economics, and Technology. Columbia University Press.

Xiao, P., Chan, T., & Narasimhan, C. (2006). Product bundles under three-part tariffs. Mimeo, Washington University.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to the editor and two anonymous referees for their detailed comments on the paper. We would also like to thank Cathleen McHugh for her assistance inputting the data, Mike Riordan, Joe Harrington, Matt Shum, Steve Coate, Roger Noll, Bruce Owen, V. Kerry Smith, Mark Coppejans, Frank Wolak, Phillip Leslie, and seminar participants at Cornell University and the 1999 IDEI/NBER Econometrics of Price and Product Competition conference for helpful comments.

Appendices

Appendix

Appendix 1: Proofs of propositions

Proof of Proposition 1

Suppose there are n discrete products (components) supplied by a monopolist and consumers differ in their preferences (willingness-to-pay) for each of these products, given by a type vector, v i = (v i1, ..., v in ). Let each v ic , c = 1, ..., n, be independent with means μ c and variances σ c . Let \(x_{in} \equiv \frac{1}{n} \sum_{c=1}^{n} v_{ic}\) be the per-good valuation for consumer i of a bundle of n goods, let μ n be its mean, and let \(\sigma^2_n\) be its variance. Note that μ n and \(\sigma^2_n\) follow the well-known formulas for the mean and variance of an average of (independent) random variables:

and

Because the sequences v ic are uniformly bounded, \(\lim_{n \rightarrow \infty} \bar{\mu}_c\) and \(\lim_{n \rightarrow \infty} \bar{\sigma}^2_c\) exist. Let \(\lim_{n \rightarrow \infty} \bar{\mu}_c = \mu\) and \(\lim_{n \rightarrow \infty} \bar{\sigma}^2_c = \sigma^2\). Note this implies limn → ∞ μ n = μ and \(\lim_{n \rightarrow \infty} \sigma^2_n = \lim_{n \rightarrow \infty} \frac{\sigma^2}{n} = 0\).

Let \(q_n(p) \equiv \int_{p}^{\infty} dF(x_{in})\) give the market share of a bundle of size n offered at per-good price p, where F(x in ) is the CDF of x in . Note that \(q_n(\mu - \epsilon) = \mbox{Prob}(x_{in} > \mu - \epsilon) = \mbox{Prob}(x_{in} - \mu > - \epsilon)\).

Let \(\epsilon^{n}(p) \equiv - \frac{\partial q^n(p)}{\partial p} \frac{p}{q_n}\) be the (absolute value of the) elasticity of the per-good demand curve evaluated at per-good price p and let \(\tilde{\epsilon}^{n}(\tilde{p}) \equiv -\frac{\partial q^n(\tilde{p})}{\partial p} \frac{\tilde{p}}{q_n(\tilde{p})}\) be the corresponding (aggregate) elasticity of the bundle demand curve evaluate at total price \(\tilde{p}\). For a bundle of size n, \(\tilde{p} = np\).

By the weak law of large numbers and symmetry, \(\mbox{Prob}(x_{in} - \mu < -\epsilon) \leq \frac{1}{2}\frac{\sigma^2}{\epsilon^2 n}\), implying \(q_n(\mu - \epsilon) \geq 1 - \frac{1}{2}\frac{\sigma^2}{\epsilon^2 n}\). By a similar argument, \(q_n(\mu + \epsilon) \leq \frac{1}{2}\frac{\sigma^2}{\epsilon^2 n}\).

Case I Per-good elasticity. We first prove the proposition for the per-good elasticity, εn.

Let \(\omega = \frac{\sigma^2}{\epsilon^2}\) and consider a change in price from μ − ε to μ + ε on the per-good demand for a bundle of size n.

Then

Differentiating this with respect to the bundle size n yields

Let \(\epsilon = \mu - p^*_n\) so that \(p^*_n = \mu - \epsilon\).Footnote 46 Then increasing bundle size makes the per-good bundle demand curve more elastic when evaluated at the profit-maximizing price for a bundle of size n.

Case II Aggregate bundle elasticity. When considering the impact of increases in n on the aggregate bundle elasticity, one has to accommodate that a given change in the per-good bundle price has a larger effect on the aggregate price for a larger bundle than for a smaller bundle. While this does not impact the elasticity of the size-n bundle demand curve evaluated at price p n , it does impact the elasticity of the size-(n + 1) bundle demand curve evaluated at price p n . In particular,

Under A4, it is easy to show that for the per-good elasticities, \(\epsilon^{n+1}(p_n) \geq \epsilon^{n}(p_n)\). For the aggregate size-(n + 1) bundle elasticity, however, we must scale \(\epsilon^{n+1}(p_n)\) by A(n) < 1. What impact does this have on the comparison? One can show that \(\tilde{\epsilon}^{n+1}(\tilde{p}_n) \geq \tilde{\epsilon}^{n}(\tilde{p}_n)\) whenever the right-hand side of the last inequality in Eq. 8 is greater than the right-hand side of the last inequality in Eq. 6. This holds for all n.Footnote 47

Proof of Proposition 2

Let preferences be as for Proposition 1 above except in allowing for correlation between consumer valuations, v i = (v i1, ..., v in ). Let ρ c,d = corr(v ic ,v id ). With correlation, the variance of the per-good valuation for a bundle of size n, x in , may be written as

The primary benefit of bundling is due to heterogeneity reduction as measured by the variance of per-good tastes for the bundle, \(\sigma^2_n\). Unlike for Proposition 1 above, once we allow for correlation in tastes, bundle size, n, is not a sufficient statistic for \(\sigma^2_n\). In particular, adding a new good to a bundle changes \(\sigma^2_n\) by both (1) changing \(\bar{\sigma}^2_c\) and (2) increasing n.

Let \(\eta = \frac{\omega}{n} = \frac{\sigma^2}{\epsilon^2 n} = \frac{lim_{n \rightarrow \infty} \bar{\sigma}^2_c}{\epsilon^2 n}\). Then we may re-write Eq. 6 above as

Differentiating this with respect to η yields

This is a more general statement of Eq. 7 above.Footnote 48 Reducing the (limiting) variance of the bundle (e.g. by increasing n or reducing σ 2) makes per-good demand for a bundle of size n more elastic.

The result of the proposition follows from Eq. 11. To see this, suppose the bundle had only two goods (i.e. component 2 was the nth good). It is easy to see that \(\frac{\partial \sigma^2_n}{\partial \rho_{1,2}} > 0\), i.e. making the correlation between components 1 and 2 more negative reduces \(\sigma^2_n\). Since, \(\frac{\partial \eta}{\partial \sigma^2} >0\) it follows that \(\frac{\partial \epsilon^{n}}{\partial \rho_{\tilde{1},2}} < 0\): making correlations more negative makes the bundle demand curve more elastic. For the case of general n, simply note that the variance of a bundle of size n can be decomposed into the variance of a bundle of size (n − 1), the variance of component n, and twice the covariance between a bundle of size (n − 1) and component n.

Appendix 2: Instruments

In this appendix, we present an analysis of the instruments used for prices and network carriage in the econometric analysis.

Price instruments To assess the power of the price instruments, Table 7 presents results from reduced form regressions of prices on the instruments and exogenous variables.Footnote 49 The results are organized in sets of three columns. For each set of three, the first column reports the point estimates from the regression of the price of basic service, p b , on the instruments and included exogenous variables. Similarly in the second and third columns for the price of Expanded basic services I and II, pI and pII, if offered.

The first set of three columns report estimates using cost shifters as instruments for cable prices. As these shifters do not vary across services, we interact them with cable service dummy variables to allow their effects to differ by service. Reported are the estimated parameters for these interactions.Footnote 50 Evidence in support of the cost instruments is mixed. While homes passed does not appear to be an important cost shifter in any equation, the remaining variables enter intermittently. Most influential are affiliation (negative and significant in the first and third columns) and MSO subscribers and its square (negative for large values and occasionally significant in the first and third columns). Channel capacity enters as expected only in the second column. That said, p values associated with the hypothesis test of joint insignificance for all parameters are trivially small in all but the expanded I equation.Footnote 51 On balance, while supporting their use as instruments, lack of variation across services and an indirect connection to marginal costs suggests the cost shifters may be weak instruments.

The second set of three columns report estimates using prices of cable services of other systems within an MSO as instruments.Footnote 52 The results are quite promising. Other-system prices within an MSO provide strong and significant effects for both basic and Expanded I equations, particularly for prices of the same service. Results for a second expanded service are poor, possibly due to relatively few observations. As expected, p values associated with the hypothesis of joint insignificance are soundly rejected for the basic and Expanded I equations.

Network instruments To assess the power of the network instruments, Table 8 presents a synopsis of reduced form (probit) regressions of network carriage on the instruments and included exogenous variables. As above, the results are organized in sets of three columns. As we must predict the carriage of each of the top-15 cable networks (as well as the sum of other cable networks) on all the exogenous variables and instruments, the number of estimations performed was considerable.Footnote 53 Rather than report the point estimates of the instruments for each specification, we simply report the p value from the hypothesis test of joint insignificance of the instrument set. As can be seen from the table, the instruments have considerable power, at least for the basic and first expanded basic equation.Footnote 54 Coefficient estimates were as expected—particularly powerful predictors of the carriage of network q on service s was the corresponding likelihood it was carried on service s by other systems within its MSO.

Rights and permissions

About this article

Cite this article

Crawford, G.S. The discriminatory incentives to bundle in the cable television industry. Quant Market Econ 6, 41–78 (2008). https://doi.org/10.1007/s11129-007-9031-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-007-9031-7