Abstract

Fiscal considerations may shift governmental priorities away from environmental concerns: finance ministers face strong demand for public expenditures such as infrastructure investments but they are constrained by international tax competition. We develop a multi-region model of tax competition and resource extraction to assess the fiscal incentive of imposing a tax on carbon rather than on capital. We explicitly model international capital and resource markets, as well as intertemporal capital accumulation and resource extraction. While fossil resources give rise to scarcity rents, capital does not. With carbon taxes, the rents can be captured and invested in infrastructure, which leads to higher welfare than under capital taxation. This result holds even without modeling environmental damages. It is robust under a variation of the behavioral assumptions of resource importers to coordinate their actions, and a resource exporter’s ability to counteract carbon policies. Further, no green paradox occurs—instead, the carbon tax constitutes a viable green policy, since it postpones extraction and reduces cumulative emissions.

Similar content being viewed by others

Notes

The phrase “green paradox” was introduced by Sinn (2008) to describe a situation in which the implementation of carbon taxes leads to an acceleration of resource extraction and an increase of cumulative emissions by the owners of fossil fuel resources. This would counteract the purpose of the environmental policy. The idea originates in a debate lead by Sinclair (1992, 1994) and Ulph and Ulph (1994).

Irrespective of the literature on the green paradox, it is already known that a cooperating bloc of resource-importing countries can appropriate a certain fraction of the exporters’ resource rent, as discussed, for example, by Karp (1984), Amundsen and Schöb (1999), or Liski and Tahvonen (2004). We are able to reproduce this result and compare it to the outcome under non-cooperative importers.

This point is also an example of how we differ from the related literature on the double dividend hypothesis (see e.g. Bovenberg 1999; Goulder 2013, for surveys), in which usually only the income and not the expenditure side of fiscal policy is considered, and which concentrates on flows and not on stocks.

Developing countries usually have a much lower endowment with infrastructure and thus the marginal benefit of additional tax income should be higher than found using our model. Here, we would expect the advantage of the carbon tax to be even higher.

See “Appendix 1” for more details on the calibration and choice of model parameters.

The alternative assumption that it is of the factor-augmenting type, which means that G affects total factor productivity, would imply that the production technology exhibits increasing returns to scale. The solution of the non-linear program then would become technically more challenging. Using the factor-augmenting type would thus complicate matters unnecessarily, since we expect that it would not change our results qualitatively: Matsumoto (1998) addresses the technical difference between the two types in the context of tax competition.

One could also implement \(\tau _K\) or \(\tau _L\) as a unit tax, or \(\tau _R\) as an ad valorem tax. Whether unit, or ad valorem taxes are chosen for the respective input factors has only a relatively weak impact on our results—they are robust with respect to this choice. Determining the differences in detail, though, is a research question that goes beyond the scope of this paper. For a general discussion see Suits and Musgrave (1953). Studies focusing on this question in the light of capital mobility are Lockwood (2004) and Hoffmann and Runkel (2015).

In the Hotelling model it is possible to show that the extraction path remains unchanged if the resource price and the unit tax grow at the same rate.

Theoretically it would be possible to decouple the income and the expenditure sides: Governments could use positive tax transfers \(\Gamma \) as a buffer to adjust the carbon tax path such that it would be allocation neutral. Any excess in tax revenue that would not be needed for the optimal financing of infrastructure would be transferred to households as lump sum transfers. In practice, though, such an excess revenue will be competed away through a race to the bottom in carbon taxes.

We implement the possibility of lump-sum transfers in order to avoid results dominated by unrealistic timing effects due to the optimal timing of infrastructure investments. The average value of the distribution parameter \(d_t\) is 75 % (average over time and all possible policy scenarios). Across different policy cases, the time average does not vary by more than 6 % points.

Due to the Stackelberg structure of the game, at least in theory, time inconsistencies could arise. However, we have checked whether governments have an incentive to deviate from the initially announced tax paths and found no significant deviations (see “Appendix 5” for more details).

This assumption is crucial for the present study in order to ensure that governments anticipate how mobile capital will be absorbed by firms abroad. It also seems more realistic than the case in which the domestic government forms no expectations about foreign agents at all. Introducing imperfect knowledge would add further parameters and raise questions that lie beyond the scope of the present study.

Strictly speaking, the national governments are only Stackelberg leaders of the subgame in which they determine their own policy instruments optimally, taking the other governments’ policy instruments as given and taking the reactions of all other economic agents into account. In the present study, the term Stackelberg leader always refers to this specific meaning.

Balanced growth equivalents (BGE) are a commodity measure of welfare. The BGE of a given welfare level is the value of initial consumption yields—under a constant annual growth rate—the given level of welfare. It translates the unit-less welfare into more tangible consumption levels in dollars, and thus facilitates comparisons of policy-instrument-portfolios. It has been introduced by Mirrlees and Stern (1972). Since our model uses discrete time steps, we follow the accordingly modified method of Anthoff and Tol (2009). In calculating the BGE, we assume a constant annual growth rate of 2 %.

The net present value of any flow variable \(X_t\) is calculated as the sum over the entire time horizon, discounted by the interest rate net of depreciation \(r - \delta \), that is,

$$\begin{aligned} { NPV }(X) = \sum _t \frac{X_t}{\Pi _s^t(1+r_s-\delta )}. \end{aligned}$$We have conducted a local sensitivity analysis by varying all parameters one-at-a-time. A parameter variations of \(\pm 5\,\%\) resulted in changes of the net present value of aggregate consumption of the same or smaller order of magnitude.

The case in which both instruments are optimized does not yield any further insights.

The derivation of the demand functions from a given CES production function can be found in Allen (1938), p. 369 ff.

Since the governments are not identical with the agents who buy the resource, we cannot directly refer to the effect as monopsony. The firms, which are the ones that buy the resource, are assumed to be price takers and have no market power by themselves.

The exporter’s government could theoretically also reduce the price or create fluctuation to increase the dependence of importing economies. However, our model does not capture this possibility since we already assume complementarity between fossil resources and all other input factors, and since we assume that there is no backstop technology available. Both assumption imply a relatively inelastic demand in importing countries.

There is an extensive strand of literature discussing the so-called (strong) double dividend hypothesis: Environmental policy may not only benefit the environment (the first dividend), but the revenues it generates may be used to reduce other distortionary taxes and thus to reduce the gross costs of environmental policy (see e.g. Tullock 1967; Goulder 1995; Bovenberg 1999) Its weak form is widely accepted to hold, i.e. efficiency gains may be attained when the use of revenues from environmental policy is shifted away from lump-sum transfers to households towards reductions in other distortionary taxes. Our approach goes beyond the standard assumptions of the double dividend literature in several ways: Instead of distortionary labor taxes, we consider capital taxes; we do not include environmental quality in households’ utility; we model environmental policy to capture resource rents; we do not limit ourselves to revenue neutral tax reforms but consider instead endogenously determined optimal infrastructure investments.

To see this, compare the case in which only the capital tax is optimized with the case in which in addition also the carbon tax is available and set optimally. Then, with the carbon tax overall (non-environmental) welfare increases and carbon emissions are reduced through both a timing and a volume effect.

Both our model and PRIDE are capable of calculating 2nd best solutions in a decentralized economy with several different economic actors. Both models are formulated as non-linear programs that are implemented with the GAMS software (Brooke et al. 2005). While PRIDE involves a more detailed energy sector and a broader set of policy instruments, it does not represent multiple countries, but only one global closed economy.

References

Allen R (1938) Mathematical analysis for economists. Macmillan and Co, London

Amundsen ES, Schöb R (1999) Environmental taxes on exhaustible resources. Eur J Polit Econ 15:311–329

Anthoff D, Tol R (2009) The impact of climate change on the balanced growth equivalent: an application of FUND. Environ Resour Econ 34:351–367

Babiker MH (2001) Subglobal climate-change actions and carbon leakage: the implication of international capital flows. Energy Econ 23:121–139

Baier SL, Glomm G (2001) Long-run growth and welfare effects of public policies with distortionary taxation. J Econ Dyn Control 25:2007–2042

BEA (2013) U.S. Bureau of Economic Analysis, “fixed assets accounts tables”. http://www.bea.gov/iTable/iTable.cfm?ReqID=10&step=1#reqid=10&step=1&isuri=1. Accessed 4 Nov 2013

Benassy-Quere A, Gobalraja N, Trannoy A (2007) Tax and public input competition. Econ Policy 22:385–430

Bento AM, Jacobsen M (2007) Ricardian rents, environmental policy and the ‘double-dividend’ hypothesis. J Environ Econ Manag 53:17–31

Bom P, Ligthart J (2013) What have we learned from three decades of research on the productivity of public capital? J Econ Surv 00:1–28

Bovenberg AL (1999) Green tax reforms and the double dividend: an updated reader’s guide. Int Tax Public Finance 6:421–443

Brooke A, Kendrick D, Meeraus A, Raman R, Rosenthal R (2005) GAMS—a users guide. GAMS Development Corporation, Washington

Burniaux JM, Martin JP, Nicoletti G, Martin JO (1992) GREEN a multi-sector, multi-region general equilibrium model for quantifying the costs of curbing CO\(_2\) emissions: a technical manual. OECD Economics Department Working Papers

Burniaux JM, Truong PT (2002) GTAP-E: an energy-environmental version of the GTAP model. GTAP technical paper no. 16, Purdue University

Calderón C, Moral-Benito E, Servén L (2014) Is infrastructure capital productive? A dynamic heterogeneous approach. J Appl Econom 30(2):177–198

Caselli F, Feyrer J (2007) The marginal product of capital. Q J Econ 122:535–568

Coenen G, Straub R, Trabandt M (2012) Fiscal policy and the great recession in the euro area. Am Econ Rev 102:71–76

Dasgupta P, Heal G (1974) The optimal depletion of exhaustible resources. Rev Econ Stud 41:3–28

De Mooij RA, Bovenberg AL (1994) Environmental levies and distortionary taxation. Am Econ Rev 84:1085–1089

Edenhofer O, Bauer N, Kriegler E (2005) The impact of technological change on climate protection and welfare: insights from the model MIND. Ecol Econ 54:277–292

Edenhofer O, Kalkuhl M (2011) When do increasing carbon taxes accelerate global warming? A note on the green paradox. Energy Policy 38:2208–2212

Edenhofer O, Knopf B, Barker T, Baumstark L, Bellevrat E, Chateau B, Criqui P, Isaac M, Kitous A, Kypreos S, Leimbach M, Lessmann K, Magne B, Scrieciu S, Turton H, van Vuuren D (2010) The economics of low stabilization: model comparison of mitigation strategies and costs. Energy J 31:11–48

EIA (2014) Tax database. http://www.eia.gov/countries/index.cfm?topL=imp. Accessed 29 Sept 2014

Feichtinger G, Hartl RF (1986) Optimale Kontrolle ökonomischer Prozesse. de Gruyter

Gerlagh R (2011) Too much oil. CESIFO Econ Stud 57:79–102

Goulder LH (1995) Environmental taxation and the double dividend: a reader’s guide. Int Tax Public Finance 2:157–183

Goulder LH (2013) Climate change policy’s interactions with the tax system. Energy Econ 40:S3–S11

Habla W (2014) Non-renewable resource extraction and interjurisdictional competition across space and time. Technical report, University of Munich

Hoffmann M, Runkel M (2015) A welfare comparison of ad valorem and unit tax regimes. Int Tax Public Finance 1–18

Hogan WW, Manne AS (1979) Energy-economy interactions: the fable of the elephant and the rabbit? In: Pindyck R (ed) Advances in the economics of energy and resources, vol 1. JAI Press, Greenwich

Hotelling H (1931) The economics of exhaustible resources. J Polit Econ 39:137–175

Kalkuhl M, Edenhofer O, Lessmann K (2012) Learning or lock-in: optimal technology policies to support mitigation. Resour Energy Econ 34:1–23

Karp L (1984) Optimality and consistency in a differential game with non-renewable resources. J Econ Dyn Control 8:73–97

Keen M, Konrad KA (2013) Chapter 5—the theory of international tax competition and coordination. In: Auerbach AJ, Chetty R, Feldstein M, Saez E (eds) Handbook of public economics, vol 5. Elsevier, Amsterdam, pp 257–328

Kemfert C, Welsch H (2000) Energy-capital-labor substitution and the economic effects of CO\(_2\) abatement: evidence for Germany. J Policy Model 22:641–660

Klump R, Saam M (2008) Calibration of normalised CES production functions in dynamic models. Econ Lett 99:256–259

Liski M, Tahvonen O (2004) Can carbon tax eat OPEC’s rents? J Environ Econ Manag 47:1–12

Lockwood B (2004) Competition in unit vs. ad valorem taxes. Int Tax Public Finance 11:763–772

Markandya A, Pedroso-Galinato S (2007) How substitutable is natural capital? Environ Resour Econ 37:297–312

Matsumoto M (1998) A note on tax competition and public input provision. Reg Sci Urban Econ 28:465–473

Mirrlees JA, Stern N (1972) Fairly good plans. J Econ Theory 4:268–288

OECD (2014) Tax database. http://www.oecd.org/tax/tax-policy/tax-database.htm#vat. Accessed 27 Aug 2014

Otto GD, Voss GM (1998) Is public capital provision efficient? J Monet Econ 42:47–66

Paltsev S, Reilly JM, Jacoby HD, Eckaus RS, McFarland J, Sarofim M, Asadoorian M, Babiker M (2005) The MIT emissions prediction and policy analysis (EPPA) model: version 4. Report no. 125. Massachusetts Institute of Technology

Rodrik D (2011) The globalization paradox. Oxford University Press, Cambridge

Rogner HH (1997) An assessment of world hydrocarbon resources. Annu Rev Energy Environ 22:217–262

Romp W, de Haan J (2007) Public capital and economic growth: a critical survey. Perspekt Wirtsch 8:6–52

Sinclair PJN (1992) High does nothing and rising is worse: carbon taxes should keep declining to cut harmful emissions. Manch Sch 60:41–52

Sinclair PJN (1994) On the optimum trend of fossil fuel taxation. Oxf Econ Pap 46:869–877

Sinn HW (2003) The new systems competition. Wiley-Blackwell, Hoboken

Sinn HW (2008) Public policies against global warming: a supply side approach. Int Tax Public Finance 15:360–394

Suits DB, Musgrave RA (1953) Ad valorem and unit taxes compared. Q J Econ 67:598–604

Tullock G (1967) Excess benefit. Water Resour Res 3:643–644

Ulph A, Ulph D (1994) The optimal time path of a carbon tax. Oxf Econ Pap 46:857–868

van der Meijden G, van der Ploeg F, Withagen C (2014) International capital markets. Oil producers and the green paradox. Technical report, Oxford Centre for the Analysis of Resource Rich Economies

van der Ploeg F, Withagen C (2012) Is there really a green paradox? J Environ Econ Manag 64:342–363

van der Ploeg F, Withagen C (2014) Growth, renewables, and the optimal carbon tax. Int Econ Rev 55:283–311

Wilson JD (1986) A theory of interregional tax competition. J Urban Econ 19:296–315

Wilson JD (1999) Theories of tax competition. Natl Tax J 52:269–304

Withagen C, Halsema A (2013) Tax competition leading to strict environmental policy. Int Tax Public Finance 20:434–449

World Bank (2014) World development indicators, labor tax and contributions. http://data.worldbank.org/indicator/IC.TAX.LABR.CP.ZS. Accessed 27 Aug 2014

Zodrow GR (2010) Capital mobility and capital tax competition. Natl Tax J 63:865–902

Zodrow GR, Mieszkowski P (1986) Pigou, Tiebout, property taxation, and the underprovision of local public goods. J Urban Econ 19:356–370

Acknowledgments

We thank Patrick Doupé, Beatriz Gaitan, Ulrike Kornek, Linus Mattauch, Warwick McKibben, Gregor Schwerhoff, Sjak Smulders, Iris Staub-Kaminski, the CREW project members, in particular Marco Runkel and Karl Zimmermann, the participants of the FEEM workshop on Climate Change and Public Goods 2014, the GGKP Annual Conference 2015, the Annual Conference of the Royal Economic Society 2015, as well as the RD3 PhD seminars at PIK, and two anonymous referees for useful comments and fruitful discussions. Max Franks and Kai Lessmann received funding from the German Federal Ministry for Education and Research (BMBF promotion references 01LA1121A), which is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Appendices

Appendix 1: Calibration and Implementation of Model

We assume that resource-importing countries are characterized by the same economic parameters. The model should apply to countries with comparable endowments and production technologies, which compete on international capital markets. These could be member states of the EU, or China and the USA. Each resource-importing country’s initial endowment of public and private capital is given by the same share of the initial global endowment. Table 5 summarizes the parameters used in the model. If not otherwise indicated, we have chosen their values in accordance with the closely related model PRIDE,Footnote 24 as introduced in Kalkuhl et al. (2012), and the model comparison exercise referenced therein, Edenhofer et al. (2010).

We estimate the initial global level of infrastructure \(G_0\) according the ratio of public to private fixed assets from US data published by the Bureau of Economic Analysis (BEA 2013). The tax rate on consumption of 16 % is calculated as weighted average over all countries of 2013 rates taken from data of the OECD (2014), where the respective countries are weighted according to their GDP. The average payroll tax rate of 16 % is taken from the World Banks’ world development index on labor tax and contributions (World Bank 2014).

The parameters of the production function are calibrated according to the empirical literature. We insert the elasticities of substitution between the respective factors directly. The share parameters \(\alpha _i\), \(i=1,2,3\) are chosen such that the observed output elasticities reported in Calderón et al. (2014), Bom and Ligthart (2013), and Caselli and Feyrer (2007) are matched.

The variation of \(\sigma _1\), the elasticity of substitution between the fossil resource R and general capital \(\mathbf {Z}\), is a key method to generate part of our results. In particular, results are relatively sensitive to variations of \(\sigma _1\). Therefore, we have calibrated the CES production function to a specific baseline point (Klump and Saam 2008). As standard value, we choose \(\sigma _1 = 0.5\), which is in line with the literature on CGE models (see for example Burniaux et al. 1992; Babiker 2001; Burniaux and Truong 2002; Paltsev et al. 2005; Edenhofer et al. 2010).

As the benchmark case for the elasticity of substitution between public and private capital, \(\sigma _3\), we have implemented a value of 1.1. The empirical literature gives mixed evidence about the substitutability between public and private capital and identifies both cases of relatively high and low substitutability between the two factors. It turns out that the results presented in this paper are quite robust under variation of \(\sigma _3\), cf. Sect. 3.3.

1.1 Exogenously Given Growth Rates

The productivity of labor \(A_L\) and fossil resources \(A_R\) are assumed to increase over time due to exogenous technological change. The parameters are chosen in accordance with empirically observed output and consumption growth rates:

Appendix 2: First-Order Conditions of Representative Agents

To determine the first-order conditions, we use a maximum principle for discrete time steps as given in Feichtinger and Hartl (1986). We use their concept of the discrete Hamiltonian, which is more convenient than the equivalent formulation of the optimization problems with Lagrangians. In the following we shall use the term Hamiltonian in this sense.

1.1 Household

The household maximizes its intertemporal welfare (6) taking into account the budget constraint (7) and the equation of motion for his assets (8). Since the economic impact of a single household on the total of all profits is small, the representative household takes \(\Pi ^F\) and governmental transfers \(\Gamma \) as given. The Hamiltonian is given by

and thus the first order and terminal conditions for the control and costate variables C and \(\lambda \) are

1.2 Resource Extraction Sector

The resource owner maximizes her intertemporal stream of profits (16) taking into account the resource constraint (17), the equation of motion for the stock (13), and possibly a unit tax \(\tau _{RO}\) on exports. We assume that the government of the resource-exporting country recycles the tax revenue \(\tau _{RO,t}R_t =: \Psi _t\) as lump-sum transfer to the resource owner. The resource owner does not anticipate its influence on \(\Psi \), but takes it as given. The Hamiltonian then reads

and thus the first-order and terminal conditions for the control and costate variables R and \(\lambda ^R\) are

Appendix 3: Solution Algorithm

We solve the model in four phases:

-

Phase 1 Find good initial values.

-

Phase 2 Find symmetric policy variables with Nash algorithm.

-

Phase 3 Solve model with fixed policy variables to find good lower bound for investment in last period.

-

Phase 4 Find symmetric policy variables with Nash algorithm and fixed lower bound for last-period investment.

To find a Nash equilibrium, we use the following algorithm:

Appendix 4: Additional Data

1.1 Extension of Table 1

1.2 Data Table Corresponding to Fig. 1

1.3 Data Tables Corresponding to Figs. 3, 4 and 5

Appendix 5: Time Consistency

To check whether governments have an incentive to deviate from the tax paths they have announced at the beginning of the first period, we have performed the following experiments. First, we calculate the tax paths of two standard benchmark cases in which the governments may only use the carbon tax or only the capital to finance the infrastructure investments, \(\{\tau _R\}_t\) and \(\{\tau _K\}_t\), respectively. Then, we run the model again, but fixate the respective tax rate in the first n time periods to the value we have found in the benchmark case. Now, we compare the benchmark tax paths with the newly found ones \(\{\widetilde{\tau _R}\}_t\) and \(\{\widetilde{\tau _K}\}_t\), respectively.

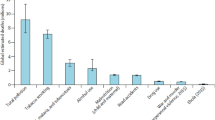

For the carbon tax it turns out that governments do not deviate at all from the announced tax path (Fig. 6). For the capital tax we observe minor unsystematic deviations (Fig. 7). Measured in tax revenues, we find that on average this difference is less than 0.01 % points if \(n=5\) and less than 0.26 % points if \(n=10\). Here, we express the relative difference in fractions of GDP. More precisely, for each period t we calculate the difference as

Rights and permissions

About this article

Cite this article

Franks, M., Edenhofer, O. & Lessmann, K. Why Finance Ministers Favor Carbon Taxes, Even If They Do Not Take Climate Change into Account. Environ Resource Econ 68, 445–472 (2017). https://doi.org/10.1007/s10640-015-9982-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9982-1

Keywords

- Carbon pricing

- Green paradox

- Infrastructure

- Optimal taxation

- Strategic instrument choice

- Supply-side dynamics

- Tax competition