Abstract

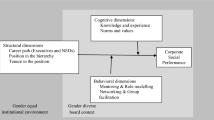

The European Commission has recently proposed the introduction of legally binding quotas for women on corporate boards of European companies. This proposal has put the spotlight on the question of whether increasing female representation on the board brings economic benefits to the firm. In order to shed light on the issue, this study investigates the direct and indirect effects of women on the board on firm value. We use a simultaneous equation model to estimate the effects of women on the board on firm value, financial performance, and compliance with ethical and social principles adopted by the firm. We find no evidence that a higher female representation on the board directly affects firm’s value. However, we find indirect effects. Women on the board are positively related with financial performance (measured in terms of return on assets and return on sales) and with ethical and social compliance, which in turn are positively related with firm value. The findings in this study suggest that greater female representation on corporate boards of large European firms can increase firm value indirectly. Further, part of the indirect effect comes from stronger compliance with ethical principles, something that is not captured by accounting-based financial performance.

Similar content being viewed by others

Notes

The relevant law was adopted in 2003, and the measures were made obligatory as of 1 January 2006.

For more details on countries’ mandatory and voluntary initiatives see European Commission progress report (European Commission 2012b).

We verify that the correlation between the error terms of the equations is high. For the model that uses ‘proportion of women on board’ the correlations between the error terms of the equations are Eq1/Eq2 = 0.460, Eq1/Eq3 = −0.848, Eq2/Eq3 = −0.608. For the model that uses ‘30 % or more women on board,’ the correlations between the error terms of the equations are Eq1/Eq2 = 0.393, Eq1/Eq3 = −0.435, Eq2/Eq3 = −0.485.

Because the existence of an ethics and social responsibility committee is self-determined, it is important to treat the variable as an endogenous one. The simultaneous equation model does that.

The sample firms are large firms that report under IFRS. Only five of the Swiss firms do not report under IFRS, but exclusion of these firms does not change the results. All the financial data are in Euros. In countries that do not use the Euro, financial data are converted to Euros using the exchange rate at fiscal year date.

We recall that the women on board variables are lagged variables, and the statistics shown in Table 1 are thus for women on board in year t − 1.

Just to ensure that our results are not driven by the simultaneous estimation methodology we estimate an OLS regression of Tobin’s Q on women on board, ROA, and ethical and social compliance plus control variables. The conclusions do not change. The estimated coefficient for women on board is not statistically significant, whereas the coefficients for ROA and ethical and social compliance are both positive and significant.

To take advantage of the panel data, we re-estimate the model adding firm individual effects. Our results are similar, and the conclusions remain the same.

Estimated coefficients (and z-stats) for the variables of interest are the following. Equation (1): women on board at year t 0.679 (1.52), ROA 0.437 (2.16), ethical and social compliance 2.19 (4.14). Equation (2): women on board at year t − 1 1.165 (3.25), ethical and social compliance 1.93 (5.99). Equation (3): women on board at year t − 1 0.474 (2.56). We obtain similar results using ROA before tax.

The estimated coefficients (and z-stats) for the variables of interest are the following. Equation (1): women on board −0.412 (−078), pre-tax ROA 0.764 (3.92), ethical and social compliance 1.632 (3.82). Equation (2): women on board 0.867 (2.45), ethical and social compliance 1.318 (5.35). Equation (3): women on board 1.359 (3.75). The results using the variable ‘30 % or more women on board’ yield similar conclusions.

References

Adams, R., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291–309.

Aggarwal, R., Erel, I., Ferreira, M., & Matos, P. (2011). Does governance travel around the world? Evidence from institutional investors. Journal of Financial Economics, 100(1), 154–181.

Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97(2), 207–221.

Bearle, A., & Means, G. (1932). The modern corporation and private property. New York: Macmillan.

Becker, G. (1964). Human capital: A theoretical and empirical analysis, with special reference to education. Chicago: University of Chicago Press.

Bilimoria, D. (2000). Building the business case for women corporate directors. In R. J. Burke & M. C. Mattis (Eds.), Women on corporate boards of directors: International challenges and opportunities. Dordrecht: Kluwer Academic Publishers.

Bilimoria, D. (2006). The relationship between women corporate directors and women corporate officers. Journal of Managerial Issues, 18(1), 47–61.

Bilimoria, D., & Wheeler, J. (2000). Women corporate directors: Current research and future directions. In R. Burke & M. Mattis (Eds.), Women in management: Current research issues (Vol. II, pp. 138–163). Dordrecht: Kluwer.

Bohren, O., & Strom, R. (2010). Governance and politics: Regulating independence and diversity in the board room. Journal of Business Finance & Accounting, 37(9–10), 1281–1308.

Burke, R. (2000). Company size, board size and the number of women directors. In R. J. Burke & M. C. Mattis (Eds.), Women on corporate boards of directors: International challenges and opportunities. Dordrecht: Kluwer Academic Publishers.

Campbell, K., & Mínguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics, 83(3), 435–451.

Carter, D., D’Souza, F., Simkins, B., & Simpson, W. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review, 18(5), 396–414.

Carter, D., Simkins, B., & Simpson, W. (2003). Corporate governance, board diversity, and firm value. Financial Review, 38(1), 33–53.

Catalyst. (2011a). The bottom line: Corporate performance and women’s representation on boards (2004–2008). New York: Catalyst.

Catalyst. (2011b). Gender and corporate social responsibility: It’s a matter of sustainability. New York: Catalyst.

Clarke, C. (2005). The XX factor in the boardroom: Why women make better directors. Washington, D.C.: National Association of Corporate Directors, Directors Monthly

Daily, C., & Dalton, D. (2003). Women in the boardroom: A business imperative. The Journal of Business Strategy, 24(5), 8–9.

Demsetz, H., & Villalonga, B. (2001). Ownership structure and corporate performance. Journal of Corporate Finance, 7, 209–233.

Donker, H., Poff, D., & Zahir, S. (2008). Corporate values, codes of ethics, and firm performance: A look at the Canadian context. Journal of Business Ethics, 82(2), 527–537.

Earley, P., & Mosakowski, E. (2000). Creating hybrid team cultures: An empirical test of transnational team functioning. Academy of Management Journal, 43, 26–49.

Ellis, K., & Keys, P. (2003). Stock returns and the promotion of workforce diversity. Working Paper, University of Delaware.

Erhardt, N., Werbel, J., & Shrader, C. (2003). Board of director diversity and firm financial performance. Corporate Governance: An International Review, 11(2), 102–111.

European Commission. (2009). Report on equality between women and men. Luxembourg: European Commission.

European Commission. (2012b). Women in economic decision-making in the EU: Progress report. Brussels: European Commission.

European Commission. (2012a). Press release ‘Women on Boards: Commission proposes 40 % objective’. Brussels, November 14 2012.

European Commission Gender Equality Newsroom. (2013). http://ec.europa.eu/justice/newsroom/gender-equality/.

Fama, F., & Jensen, M. (1983). Agency problems and residual claims. Journal of Law and Economics, 26(2), 288–307.

Francoeur, C., Labelle, R., & Sinclair-Desgagne, B. (2008). Gender diversity in corporate governance and top management. Journal of Business Ethics, 81(1), 83–95.

Gillan, S. (2006). Recent developments in corporate governance: An overview. Journal of Corporate Finance, 12, 381–402.

Greene, T., & Jame, R. (2013). Company name fluency, investor recognition, and firm value. Journal of Financial Economics, 109(3), 813–834.

Gul, F., Srinidhi, B., & Ng, A. (2011). Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics, 51(3), 314–338.

Hafsi, T., & Turgut, G. (2013). Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. Journal of Business Ethics, 112(3), 463–479.

Hillman, A., Cannella, A, Jr, & Paetzhold, R. (2000). The resource dependence role of corporate directors: Strategic adaption of board composition in response to environmental change. Journal of Management Studies, 37, 235–255.

Hillman, A., & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review, 28(3), 383–396.

Huse, M., Nielsen, S., & Hagen, I. (2009). Women and employee-elected board members, and their contributions to board control tasks. Journal of Business Ethics, 89(4), 581–597.

Huse, M., & Solberg, A. (2006). Gender-related boardroom dynamics: How Scandinavian women make and can make contributions on corporate boards. Women in Management Review, 21(2), 113–130.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jo, H., & Harjoto, M. (2011). Corporate governance and firm value: The impact of corporate social responsibility. Journal of Business Ethics, 103(3), 351–383.

Kanter, R. (1977). Men and women of the corporation. New York: Basic Books.

Kim, B., Burns, M., & Prescott, J. (2009). The strategic role of the board: The impact of board structure on top management team strategic action capability. Corporate Governance: An International Review, 17(6), 728–743.

Kochan, T., Bezrukova, K., Ely, R., Jackson, S., Joshi, A., Jehn, K., et al. (2003). The effects of diversity on business performance: Report of the diversity research network. Human Resource Management, 42(1), 3–21.

Labelle, R., Gargouri, R., & Francoeur, C. (2010). Ethics, diversity management, and financial reporting quality. Journal of Business Ethics, 93(2), 335–353.

Lang, M., Lins, K., & Miller, D. (2003). ADRs, analysts, and accuracy: Does cross listing in the United States improve a firm’s information environment and increase market value? Journal of Accounting Research, 41(2), 317–345.

Loderer, C., & Waelchli, U. (2009). Firm age and performance. Working paper, University of Bern.

Mattis, M. (2000). Women corporate directors in the United States. In R. J. Burke & M. C. Mattis (Eds.), Women on corporate boards of directors: International challenges and opportunities. Dordrecht: Kluwer Academic Publishers.

McCabe, A., Ingram, R., & Dato-on, M. (2006). The business of ethics and gender. Journal of Business Ethics, 64(2), 101–116.

Moscovici, S., & Faucheux, C. (1972). Social influence, conformity bias and the study of active minorities. In L. Berkowitz (Ed.), Advances in experimental social psychology, vol. 6 (pp. 149–202). New York: Academic Press.

Nemeth, C. (1986). Differential contributions of majority and minority influence. Psychological Review, 93, 23–32.

Peterson, C., & Philpot, J. (2007). Women’s roles on U.S. Fortune 500 boards: Director expertise and committee memberships. Journal of Business Ethics, 72(2), 177–196.

Peterson, C., Philpot, J., & O’Shaughnessy, K. (2007). African-American diversity in the boardrooms of the US Fortune 500: Director presence, expertise and committee membership. Corporate Governance: An International Review, 15(4), 558–575.

Pfeffer, J., & Salancik, G. (1978). The external control of organizations: A resource-dependence perspective. New York: Harper & Row.

Purcell, T. (1982). The ethics of corporate governance. Review of Social Economy, 40, 360–370.

Rodgers, W., Choy, H. L., & Guiral, A. (2013). Do investors value a firm’s commitment to social activities? Journal of Business Ethics, 114(4), 607–623.

Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404–413.

Rosener, J. (1990). Ways women lead. Harvard Business Review, 68(6), 119–125.

Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737–783.

Shrader, C., Blackburn, V., & Iles, P. (1997). Women in management and firm financial performance: An exploratory study. Journal of Managerial Issues, 9(3), 355–372.

Singh, V., Terjesen, S., & Vinnicombe, S. (2008). Newly appointed directors in the boardroom: How do women and men differ. European Management Journal, 26(1), 48–58.

Singh, V., Vinnicombe, S., & Johnson, P. (2001). Women directors on top UK boards. Corporate Governance: An International Review, 9, 206–216.

Smith, N., Smith, V., & Verner, M. (2006). Do women in top management affect firm performance? A panel study of 2300 Danish firms. International Journal of Productivity and Performance Management, 55(7), 569–593.

Tanford, S., & Penrod, S. (1984). Social influence model: A formal integration of research on majority and minority influence processes. Psychological Bulletin, 95, 189–225.

Terjesen, S., Sealy, R., & Singh, V. (2009). Women directors on corporate boards: A review and research agenda. Corporate Governance: An International Review, 17(3), 320–337.

Torchia, M., Calabrò, A., & Huse, M. (2011). Women directors on corporate boards: From tokenism to critical mass. Journal of Business Ethics, 102(2), 299–317.

Tsui, A., Egan, T., & O’Reilly, C. (1992). Being different: Relational demography and organizational attachment. Administrative Science Quarterly, 37, 549–579.

van der Walt, N., & Ingley, C. (2003). Board dynamics and the influence of professional background, gender and ethnic diversity of directors. Corporate Governance: An International Review, 11(3), 218–234.

Westphal, J., & Milton, L. (2000). How experience and network ties affect the influence of demographic minorities on corporate boards. Administrative Science Quarterly, 45(2), 366–398.

Williams, R. (2003). Women on corporate boards of directors and their influence on corporate philanthropy. Journal of Business Ethics, 42(1), 1–10.

Williams, K., & O’Reilly, C. (1998). Forty years of diversity research: A review. In B. M. Staw & L. L. Cummings (Eds.), Research in organizational behavior (pp. 77–140). Greenwich, CT: JAI Press.

Zahra, S., & Stanton, W. (1988). The implications of board of directors’ composition for corporate strategy and performance. International Journal of Management, 5, 229–236.

Zellner, A., & Henri, T. (1962). Three-stage least squares: Simultaneous estimation of simultaneous equations. Econometrica, 30(1), 54–78.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Table 6.

Rights and permissions

About this article

Cite this article

Isidro, H., Sobral, M. The Effects of Women on Corporate Boards on Firm Value, Financial Performance, and Ethical and Social Compliance. J Bus Ethics 132, 1–19 (2015). https://doi.org/10.1007/s10551-014-2302-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-014-2302-9