Abstract

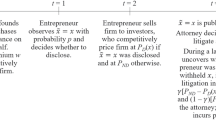

In this article, we show that the effects of a legal system depend on the cost of litigation. For very low levels of legal costs, an equilibrium exists where the manager always fraudulently reports firm quality (i.e., always reports “good news”) and the investors bring suit any time firm earnings are low. For an intermediate range of legal costs, there exists an equilibrium where the frequency of fraudulent reporting is an increasing function of the costs of litigation. In this equilibrium, investors will follow a mixed strategy of bringing suit. With high legal costs, the manager always issues fraudulent disclosures and the investors never bring suit. When legal costs are not high, the threat of lawsuits removes moral hazard and adverse selection problems. The dead-weight loss from lawsuits creates a demand for auditing and may cause the manager to manipulate the amount of retained ownership.

Similar content being viewed by others

References

Akerlof, G., “The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism.”Quarterly Journal of Economics 488–500, (August 1977).

Bebchuk, L. “Litigation and Settlement under Imperfect Information.”Rand Journal of Economics 404–415, (Autumn 1984).

Datar, S., G. Feltham, and J. Hughes, “The Role of Audits and Audit Quality in Valuing New Issues.”Journal of Accounting and Economics 3–49, (March 1991).

Dye, R. “Earnings Management in an Overlapping Generations Model.”Journal of Accounting Research 195–235, (Autumn 1988).

Easterbrook, R. and D. Fischel, “Mandatory Disclosures and the Protection of Investors,”Virginia Law Review 669–715, (May 1984).

Farrell, J. “Voluntary Disclosure: Robustness of the Unraveling Result, and Comments on Its Importance.”Antitrust and Regulation, ed. R. Grieson, 91–103. Lexington, MA: Lexington Books, 1986.

Grossman, S. “The Informational Role of Warranties and Private Disclosure About Product Quality.”Journal of Law and Economics 461–483, (December 1981).

Grossman, S. and O. Hart, “Disclosure Laws and Takeover Bids.”Journal of Finance 323–334, (May 1980).

Hughes, P. “Signaling by Direct Disclosure under Asymmetric Information.”Journal of Accounting and Economics 119–142, (June 1986).

Ibbotson, R., J. Sindelar, and J. Ritter, “Initial Public Offerings.”Journal of Applied Corporate Finance 323–329, (Summer 1990).

Jovanovic, B. “Truthful Disclosure of Information.”Bell Journal of Economics, 13, 36–44, (1982).

King, R. and D. Wallin, “The Effects of Antifraud Rules and Ex Post Verifiability on Managerial Disclosures.”Contemporary Accounting Research 855–887, (Spring 1990).

King, R. and D. Wallin, “Legal Cost Allocation and Incentives to Issue Fraudulent Disclosures: An Analytical Assessment.” Working Paper, The Ohio State University, 1993.

Leland, H. and D. Pyle, “Informational Asymmetries, Financial Structure, and Financial Intermediation.”Journal of Finance 371–387, (May 1977).

Loss, L.Fundamentals of Securities Regulation. Boston: Little, Brown and Company, 1983.

Milgrom, P. “Good News and Bad News: Representation Theorems and Applications.”Bell Journal of Economics 380–391, (Autumn 1981).

Milgrom, P. and J. Roberts, “Relying on the Information of Interested Parties.”Rand Journal of Economics 18–32, (Spring 1986).

P'ng, I. “Strategic Behavior in Suit, Settlement, and Trial.”Bell Journal of Economics 539–550, (Autumn 1983).

Reinganum, J. and L. Wilde, “Settlement, Litigation, and the Allocation of Litigation Costs.”Rand Journal of Economics 557–566, (Winter 1986).

Shavell, S. “Suit, Settlement, and Trial: A Theoretical Analysis Under Alternative Methods for the Allocation of Legal Costs.”Journal of Legal Studies 55–81, (January 1982a).

Shavell, S. “The Social Versus the Private Incentive to Bring Suit in a Costly Legal System.”Journal of Legal Studies 333–339, (June 1982b).

Titman, S. and B. Trueman, “Information Quality and the Valuation of New Issues.”Journal of Accounting and Economics 159–172, (June 1986).

Wallin, D. “Legal Recourse and the Demand for Auditing.”Accounting Review 121–147 (January 1992).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

King, R.R., Wallin, D.E. Optimal level of fraudulent disclosure when litigation is costly. Rev Quant Finan Acc 3, 283–309 (1993). https://doi.org/10.1007/BF02406993

Issue Date:

DOI: https://doi.org/10.1007/BF02406993