Abstract

We study optimal bidder collusion in an independent private value first-price auction with two bidders and two possible valuations. There is a benevolent center that knows the bidders’ valuations and sends private signals to the bidders in order to maximize their expected payoffs. After receiving their signals, bidders compete in a standard first-price auction, that is, without side payments or bid restrictions. We find that to improve on the bidders’ payoffs, the signals must depend upon the valuations. If the bidders’ signals are restricted to be non-correlated (depend only on the opponent’s valuation), then the bidders’ payoffs are strictly higher than the larger possible set of signals. If the signals are restricted to be perfectly correlated (public), only two possible signals are needed to achieve the highest bidder payoffs. However, these payoffs can be improved upon if the two signals are allowed to be imperfectly correlated.

Similar content being viewed by others

Notes

Information about the opponents’ valuations has no impact on the equilibrium bidding strategies in second-price private value auctions and hence does not affect the revenue of the seller.

Case I641, Rifornimenti Aeroportuali, Italian Competition Authority Decision No. 15604. For a critical discussion of this case, see Caffarra and Kühn (2006).

Case COMP/E-2/37.857—Organic Peroxides, European Commission decision. To learn more about this case, see, for example, Marshall and Marx (2012).

Case p/11/03.01.-01./8, Competition Council of Latvia Decision No. E02-66.

Forges (2006) names such a center as an omniscient mediator and justifies it on several grounds. Given our earlier examples, we can assume that the role of center is played by a trade association or a consultancy company that has the right to audit accounting books of the bidders or that the center is a president of joint venture who has the access to confidential information of the bidders that own that joint venture. Our analysis remains valid if we additionally assume that the bidders pay some fixed amount to the center. To justify further the existence of the omniscient center, we show in our working paper version (Āzacis and Vida 2012) how the center can elicit the information about the bidders’ valuations in a weakly incentive compatible manner. We assume that if a bidder reports some valuation to the center, then she is not allowed to bid above it in the auction.

Different correlated equilibrium concepts, when applied to games with incomplete information, are extensively studied in Forges (1993, 2006) and Bergemann and Morris (2011). According to the equilibrium classification of Forges (1993, 2006), we look for the best (from the bidders’ point of view) Bayesian solution of a standard IPV first-price auction, where bidders can make use of an omniscient mediator. According to Bergemann and Morris (2011), we look for the best Bayes correlated equilibrium of the standard IPV first-price auction. These two concepts coincide in the current setup; see the discussion in Section 4.1 of Bergemann and Morris (2011).

However, we conjecture that introducing more signal values does not increase the bidders’ payoffs, that is, the optimal two-valued correlated signal structure gives the overall optimum.

Public signals can also arise in the absence of the center. For instance, if the bidders participate in a sequential auction for multiple objects and their valuations are correlated across the objects, then any public information about outcomes of earlier auction rounds will serve as a public signal about bidders’ valuations in later auction rounds. This, for example, happens in Ding et al. (2010) and Āzacis (2013).

Several recent papers—Chakravarty and Kaplan (2013), Condorelli (2012), Hartline and Roughgarden (2008), Yoon (2011)—build on McAfee and McMillan (1992) and study mechanisms that maximize agents’ joint surplus when side payments are not allowed. However, using the terminology of Marshall and Marx (2007), all these mechanisms are bid submission mechanisms, while our mechanism is a version of bid coordination mechanism.

The presence of entry costs can also be exploited to achieve collusion; see, for example, Miralles (2010).

All results easily extend to any \(0\le V_{L}<V_{H}\).

In their set up, bidders’ valuations are sometimes allowed to take one of the three possible values. In this case, dealing with three-valued signals already becomes intractable.

The assumption of zero reserve price is made purely for simplicity, and all subsequent results extend in the natural way if a binding reserve price is introduced.

The proof on page 151 in Maskin and Riley (1985) can also be modified and adopted to prove Lemma 1.

The observations made in Remark 2 are not true in general. For example, Landsberger et al. (2001) show that the seller can earn higher revenue by publicly disclosing information about the ranking of valuations among bidders when the valuations are drawn according to a continuous distribution.

If \(\Pr \left( 0|2\right) =0\) in Case 1, then we set \(\Pr \left( 0|1\right) /\Pr \left( 0|2\right) =\infty \).

Said differently, if a public signal \(i\) occurs, it is common knowledge that each bidder is of either type \(\left( V_L,i\right) \) or type \(\left( V_H,i\right) \). However, given that all types \(\left( V_L,i\right) \) bid 0, they are suppressed under \((V_L,\cdot )\).

If \(y_{i}=0\), then we set \(\frac{x_{i}}{y_{i}}=\infty \).

If \(y_{1}=0\), then \(P\left( x,y\right) =p\left( 1-p\right) \), that is, the same payoff as in the case when there are no signals at all.

The proof of this theorem is available in our working paper (Āzacis and Vida 2012).

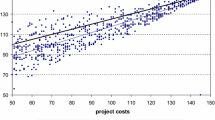

The optimum was calculated numerically.

Our numerical calculations suggest that \(y_{1}=y_{2}=\cdots =y_{n-1}\) holds in the optimum. We imposed this constraint in our calculations when \(n\) was large.

If, for example, \(x_{2}=r_{12}=0\), then type \(2\) would bid 1 with probability 1 in the equilibrium.

Alternatively, the expression in the curly brackets is zero if \(\Pr \left( k|1\right) =\Pr \left( k|2\right) \) for all \(k\), but this case has been ruled out.

Since we restrict attention to symmetric signal structures and symmetric equilibria, it is enough to maximize the payoff of single bidder.

References

Aumann, R.J.: Subjectivity and correlation in randomized strategies. J. Math. Econ. 1(1), 67–96 (1974)

\(\bar{{\rm A}}\)zacis, H.: Information Disclosure by a Seller in a Sequential First Price Auction. Cardiff Business School, Mimeo (2013)

\(\bar{{\rm A}}\)zacis, H., Vida, P.: Collusive Communication Schemes in a First-Price Auction. Cardiff Economics Working Paper E2012/11, Cardiff Business School (2012)

Bergemann, D., Morris, S.: Correlated Equilibrium in Games with Incomplete Information. Discussion Paper 1822, Cowles Foundation (2011).

Bergemann, D., Vällimäki, J.: Information in mechanism design. In: Blundell, R., Newey, W.K., Persson, T. (eds.) Advances in Economics and Econometrics: Theory and Applications, Ninth World Congress, Chap. 5, vol. 1, pp. 186–221. Cambridge University Press, Cambridge (2006)

Caffarra, C., Kühn, K.-U.: The cost of simplistic rules for assessing information exchange: the Italian jet fuel decision. In: Bergman, M. (ed.) The Pros and Cons of Information Sharing, pp. 131–177. Swedish Competition Authority, Stockholm (2006)

Chakravarty, S., Kaplan, T.R.: Optimal allocation without transfer payments. Games Econ. Behav. 77, 1–20 (2013)

Condorelli, D.: What money can’t buy: efficient mechanism design with costly signals. Games Econ. Behav. 75, 613–624 (2012)

Cotter, K.D.: Correlated equilibrium in games with type-dependent strategies. J. Econ. Theory 54, 48–68 (1991)

Ding, W., Jeitschko, T.D., Wolfstetter, E.G.: Signal jamming in a sequential auction. Econ. Lett. 108, 58–61 (2010)

Eliaz, K., Forges, F.: Disclosing Information to Interacting Agents. Tel Aviv University, Mimeo (2012)

Eliaz, K., Serrano, R.: Sending information to interactive receivers playing a generalized prisoners dilemma. Int. J. Game Theory (2013). doi:10.1007/s00182-013-0374-x

Fang, H., Morris, S.: Multidimensional private value auctions. J. Econ. Theory 126, 1–30 (2006)

Forges, F.: An approach to communication equilibria. Econometrica 54(6), 1375–1385 (1986)

Forges, F.: Five legitimate definitions of correlated equilibrium in games with incomplete information. Theory Decis. 35(3), 277–310 (1993)

Forges, F.: Correlated equilibrium in games with incomplete information revisited. Theory Decis. 61(4), 329–344 (2006)

Genesove, D., Mullin, W.P.: The Sugar Institute Learns to Organize Information Exchange. Working Paper 5981, NBER (1997)

Hartline, J.D., Roughgarden, T.: Optimal mechanism design and money burning. In: Proceedings of the 40th Annual ACM Symposium on Theory of Computing, STOC ’08, pp. 75–84 (2008)

Kaplan, T.R.: Communication of preferences in contests for contracts. Econ. Theory 51(2), 487–503 (2012)

Kaplan, T.R., Zamir, S.: The Strategic Use of Seller Information in Private-Value Auctions. Discussion Paper 221. Hebrew University, The Center for the Study of Rationality (2000)

Kim, J., Che, Y.-K.: Asymmetric information about rivals’ types in standard auctions. Games Econ. Behav. 46, 383–397 (2004)

Landsberger, M., Rubinstein, J., Wolfstetter, E., Zamir, S.: First-price auctions when the ranking of valuations is common knowledge. Rev. Econ. Des. 6(3), 461–480 (2001)

Lopomo, G., Marx, L.M., Sun, P.: Bidder collusion at first-price auctions. Rev. Econ. Des. 15(3), 177–211 (2011)

Marshall, R.C., Marx, L.M.: Bidder collusion. J. Econ. Theory 133, 374–402 (2007)

Marshall, R.C., Marx, L.M.: The Economics of Collusion: Cartels and Bidding Rings. MIT Press, Cambridge, MA (2012)

Maskin, E.S., Riley, J.G.: Auction theory with private values. Am. Econ. Rev. 75(2), 150–155 (1985)

Maskin, E.S., Riley, J.G.: Asymmetric auctions. Rev. Econ. Stud. 67(3), 413–438 (2000a)

Maskin, E.S., Riley, J.G.: Equilibrium in sealed high bid auctions. Rev. Econ. Stud. 67(3), 439–454 (2000b)

McAfee, R.P., McMillan, J.: Bidding rings. Am. Econ. Rev. 82(3), 579–599 (1992)

Miralles, A.: Self-enforced collusion through comparative cheap talk in simultaneous auctions with entry. Econ. Theory 42(3), 523–538 (2010)

Quint, D.: Looking smart versus playing dumb in common-value auctions. Econ. Theory 44(3), 469–490 (2010)

Skreta, V.: On the informed seller problem: optimal information disclosure. Rev. Econ. Des. 15(1), 1–36 (2011)

Vives, X.: Trade association disclosure rules, incentives to share information, and welfare. RAND J. Econ. 21(3), 409–430 (1990)

Yoon, K.: Optimal mechanism design when both allocative and expenditure inefficiency matter. J. Math. Econ. 47, 670–676 (2011)

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Roberto Burguet, Amrita Dhillon, Françoise Forges, Bernard Lebrun, Volcker Nocke, Martin Peitz, Nicolas Schutz, the editor, and two anonymous referees for their comments that have helped to improve this paper. Péter Vida acknowledges the financial support from the Graf Hardegg’sche Stiftung.

Appendix

Appendix

Proposition 1

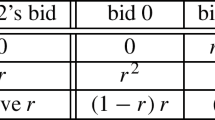

The unique symmetric equilibrium of the first-price auction is as follows:

Case 1

If \(\Pr \left( 1|1\right) \ge \Pr \left( 1|2\right) >0\) and

then

-

1.

type 1 randomizes on \(\left[ 0,\overline{b}_{1}\right] \) according to

$$\begin{aligned} F_{1}\left( b\right) =\frac{\Pr \left( 0|1\right) }{\Pr \left( 1|1\right) } \frac{b}{1-b} \end{aligned}$$(8)where

$$\begin{aligned} \bar{b}_{1}=\frac{\Pr \left( 1|1\right) }{\Pr \left( 0|1\right) +\Pr \left( 1|1\right) }; \end{aligned}$$(9) -

2.

type 2 randomizes on \(\left[ \overline{b}_{1},\overline{b}_{2}\right] \) according to

$$\begin{aligned} F_{2}\left( b\right) =\frac{\Pr \left( 0|2\right) +\Pr \left( 1|2\right) }{ \Pr \left( 2|2\right) }\frac{b-\overline{b}_{1}}{1-b} \end{aligned}$$(10)where

$$\begin{aligned} \bar{b}_{2}=1-\left( \Pr \left( 0|2\right) +\Pr \left( 1|2\right) \right) \left( 1-\bar{b}_{1}\right) . \end{aligned}$$(11)

Case 2

If \(\Pr \left( 1|1\right) >\Pr \left( 1|2\right) >0\) and

then

-

1.

type 1 randomizes on \(\left[ 0,\overline{b}_{1}\right] \) according to

$$\begin{aligned} F_{1}\left( b\right) =\frac{\Pr \left( 2|2\right) \Pr \left( 0|1\right) -\Pr \left( 2|1\right) \Pr \left( 0|2\right) }{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) }\frac{b}{1-b} \end{aligned}$$where

$$\begin{aligned} \overline{b}_{1}=\frac{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) }{\Pr \left( 2|2\right) -\Pr \left( 2|1\right) }; \end{aligned}$$ -

2.

type 2 randomizes on \(\left[ 0,\overline{b}_{1}\right] \) according to

$$\begin{aligned} F_{2}\left( b\right) =\frac{\Pr \left( 1|1\right) \Pr \left( 0|2\right) -\Pr \left( 1|2\right) \Pr \left( 0|1\right) }{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) }\frac{b}{1-b} \end{aligned}$$and on \(\left[ \overline{b}_{1},\overline{b}_{2}\right] \) according to

$$\begin{aligned} F_{2}\left( b\right) =\frac{\Pr \left( 0|2\right) }{\Pr \left( 2|2\right) } \frac{b}{1-b}-\frac{\Pr \left( 1|2\right) }{\Pr \left( 2|2\right) } \end{aligned}$$where \(\overline{b}_{2}=1-\Pr \left( 0|2\right) \).

Case 3

If \(\Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) and \(0<\Pr \left( 2|1\right) \le \Pr \left( 2|2\right) \), then the types bid as in Case 1.

Case 4

If \(\Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) and \(\Pr \left( 2|1\right) >\Pr \left( 2|2\right) \), then

-

1.

type 1 randomizes on \(\left[ 0,\underline{b}_{2}\right] \) according to (8), where

$$\begin{aligned} \underline{b}_{2}=\frac{\Pr \left( 1|1\right) \left( \Pr \left( 0|1\right) -\Pr \left( 0|2\right) \right) }{\Pr \left( 1|2\right) \Pr \left( 0|1\right) -\Pr \left( 1|1\right) \Pr \left( 0|2\right) }, \end{aligned}$$and on \(\left[ \underline{b}_{2},\overline{b}_{2}\right] \) according to

$$\begin{aligned} F_{1}\left( b\right)&= \frac{\Pr \left( 0|1\right) \left( \Pr \left( 2|2\right) -\Pr \left( 2|1\right) \right) }{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) }\frac{1}{1-b} \\&\quad +\frac{\Pr \left( 2|1\right) \Pr \left( 0|2\right) -\Pr \left( 2|2\right) \Pr \left( 0|1\right) }{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) } \end{aligned}$$where \(\overline{b}_{2}=1-\Pr \left( 0|1\right) \);

-

2.

type 2 randomizes on \(\left[ \underline{b}_{2},\overline{b}_{2}\right] \) according to

$$\begin{aligned} F_{2}\left( b\right)&= \frac{\Pr \left( 0|1\right) \left( \Pr \left( 1|1\right) -\Pr \left( 1|2\right) \right) }{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) }\frac{1}{1-b} \\&\quad +\frac{\Pr \left( 1|2\right) \Pr \left( 0|1\right) -\Pr \left( 1|1\right) \Pr \left( 0|2\right) }{\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) }. \end{aligned}$$

Proof of Proposition 1

Without loss of generality, let \(\Pr \left( 0|1\right) \ge \Pr \left( 0|2\right) \). We also assume that \(\Pr \left( 2|1\right) >0\), \(\Pr \left( 1|2\right) >0\), and \(\Pr \left( k|1\right) \ne \Pr \left( k|2\right) \) for some \(k\in \left\{ 0,1,2\right\} \) hold. As discussed in the main text, if these assumptions are not satisfied, the expected payoff of bidder is \( p\left( 1-p\right) \).

It is easy to argue that the supremum of all submitted bids does not exceed 1 in any equilibrium. Also, by bidding 1, a type \(i\) bidder, \(i=1,2\), expects a payoff of 0. To sustain it as a part of equilibrium, she must assign zero probability to the opponent bidding anything less than 1. However, given that \(x_{1}+x_{2}=1\) and \(r_{12}>0\) holds, there is a type of opponent who will bid for sure strictly less than 1.Footnote 27 It follows that the supremum of all submitted bids is strictly less than 1, and each type \(i\) bidder, \(i=1,2\), expects a strictly positive payoff and wins with a strictly positive probability in any equilibrium.

Suppose now that bidder 2 of a high-valuation type bids \(0<\tilde{b}<1\) with a strictly positive probability in an equilibrium. Then, bidder 1 of either high-valuation type, instead of bidding in the interval \(\left[ \tilde{b} -\delta ,\tilde{b}\right] \) for some \(\delta >0\), is better off by bidding \( \tilde{b}+\epsilon \) where \(\epsilon >0\) is sufficiently small. But then bidder 2 is better off to bid \(\tilde{b}-\delta \) instead of \(\tilde{b}\), which contradicts our assumption that she bids \(0<\tilde{b}<1\) with a strictly positive probability. Thus, only the bid of 0 can possibly occur with a strictly positive probability. Further, the high-valuation bidders cannot tie with a positive probability at 0 in the equilibrium, as either bidder will instead prefer to bid just above 0. In particular, it implies that if type \(i\) bids 0 with a positive probability, then \(r_{ii}=0\).

Let \(F_{i}\left( b\right) \) be the distribution function according to which type \(i,\, i=1,2\), randomizes in an equilibrium. Consider the union of supports of \(F_{1}\left( b\right) \) and \(F_{2}\left( b\right) \). We claim that this union of supports is a connected set. Suppose to the contrary that bidder 2 with high valuation bids \(\tilde{b}\) but does not bid in the interval \(\left[ \tilde{b}-\delta ,\tilde{b}\right) \). But then bidder 1 with high valuation prefers bidding \(\tilde{b}-\delta \) instead of \(\tilde{b} \). In the same way, we can argue that the lower limit of the union of supports is 0.

Since there are no ties between high-valuation bidders in equilibrium, the expected payoff of type \(i\) bidder from submitting a bid \(b\) is given by

Let \(\pi _{i}\) denote the expected payoff of type \(i\), \(i=1,2\). Equation (12) implies that \(\pi _{i}\ge \Pr \left( 0|i\right) \). We have already argued that there is a type \(i\) such that \(\underline{b}_{i}=0\). Therefore, either \(\pi _{1}=\Pr \left( 0|1\right) \) or \(\pi _{2}=\Pr \left( 0|2\right) \) or both must hold. If \(\pi _{i}=\Pr \left( 0|i\right) \) for \( i=1,2\), then the ex-ante payoffs are the same as in the absence of collusive communication. If \(\overline{b}_{1}=\overline{b}_{2}\), then \(\pi _{1}=\pi _{2}=\max \left\{ \Pr \left( 0|1\right) ,\Pr \left( 0|2\right) \right\} =\Pr \left( 0|1\right) \). If \(\overline{b}_{i}>\overline{b}_{j}\), then \(\pi _{j}\ge \pi _{i}=1-\overline{b}_{i}\).

Now, we derive what are the restrictions on the conditional probabilities for one or another equilibrium configuration to exist, and next, using the identified restrictions, we determine what is the equilibrium configuration for each signal structure.

Suppose there is an equilibrium in which \(0=\underline{b}_{i}<\underline{b} _{j}\) holds. Then, \(\Pr \left( i|i\right) >0\), and the expected payoff of type \(i\) from bidding on the interval \(\left[ 0,\underline{b}_{j}\right] \) is

which implies that

for \(0\le b\le \underline{b}_{j}\). Consider now type \(j\), who deviates and bids below \(\underline{b}_{j}\). The expected payoff is

It must be that the term in curly brackets is positive, or otherwise, type \(j\) will find it profitable to deviate. Hence,

must hold.

Suppose there is an equilibrium in which \(\overline{b}_{i}>\overline{b}_{j}\) holds. Then, \(\Pr \left( i|i\right) >0\), and the expected payoff of type \(i\) from bidding on the interval \(\left[ \overline{b}_{j},\overline{b}_{i}\right] \) is

which implies that

for \(b\in \left[ \overline{b}_{j},\overline{b}_{i}\right] \). Consider now type \(j\), who deviates and bids above \(\overline{b}_{j}\). The expected payoff is

It must be that the term in curly brackets is positive, or otherwise, type \(j\) will find it profitable to deviate. Hence,

or

must hold.

Suppose that \(0=\underline{b}_{i}\le \underline{b}_{j}<\overline{b}_{i}\le \overline{b}_{j}\), that is, there exists an interval, in which both types bid in an equilibrium. For the bids in this interval, we can set the expression in (12) equal to \(\pi _{i}\) and multiply both sides with \(\Pr \left( j|j\right) \). Similarly, we multiply the analogous expression for type \(j\) with \(\Pr \left( j|i\right) \):

Subtracting the second line from the first and rearranging, we obtain the expression for \(F_{i}\left( b\right) \) in the region where the supports intersect:

The conditional probabilities and payoffs must be such that \(F_{i}\left( b\right) \) is a strictly increasing function in this region. Also, note that if \(\Pr \left( 2|2\right) \Pr \left( 1|1\right) =\Pr \left( 2|1\right) \Pr \left( 1|2\right) \), then the supports of both types cannot overlap.

We are now in the position to determine the equilibria for all possible values of conditional probabilities. To simplify the analysis, we initially find a symmetric equilibrium, in which the support of bids for each type is connected. Afterward, we will argue that it is the unique symmetric equilibrium by showing that there are no symmetric equilibria, in which the support for either type is disconnected.

Case 1 \(\Pr \left( 1|1\right) \ge \Pr \left( 1|2\right) >0\) and

imply that \(0<\Pr \left( 2|1\right) <\Pr \left( 2|2\right) \) and

also hold. According to (14), conditions (18) and (19), in turn, imply that \(0=\underline{b}_{1}\le \underline{b}_{2}\) must hold. We argue by contradiction that \(\underline{b}_{2}<\overline{b}_{1}\) cannot happen in the equilibrium. If \(\pi _{1}\ge \Pr \left( 0|1\right) \) and \(\pi _{2}=\Pr \left( 0|2\right) \), then \(F_{2}\left( b\right) \) is a non-increasing function in (17) for \(\left( i,j\right) =\left( 2,1\right) \). Therefore, if \(\underline{b}_{2}<\overline{b}_{1}\), then \(\pi _{1}=\Pr \left( 0|1\right) \) and \(\pi _{2}>\Pr \left( 0|2\right) \), which also implies that \(F_{2}\left( \underline{b}_{2}\right) =0\). However, evaluating (17) for \(\left( i,j\right) =\left( 2,1\right) \) at \( \underline{b}_{2}\), we find that

or \(\underline{b}_{2}<0\). Thus, it follows that \(\overline{b}_{1}=\underline{ b}_{2}\) must hold; that is, the types bid on adjacent intervals. Thus, type 1 bids on \(\left[ 0,\overline{b}_{1}\right] \) according to (13) or (8), where \(\overline{b}_{1}\) is defined by \(F_{1}\left( \overline{b }_{1}\right) =1\) and is given in (9). Type 2 bids on \(\left[ \overline{b}_{1},\overline{b}_{2}\right] \) according to (15). Since type 2 must be indifferent between bidding \(\bar{b}_{1}\) and \(\bar{b}_{2}\), it follows that \(\bar{b}_{2}\) is given by (11). This allows to rewrite (15) into the form given in (10).

Case 2 \(\Pr \left( 1|1\right) >\Pr \left( 1|2\right) >0\) and

imply that \(0<\Pr \left( 2|1\right) <\Pr \left( 2|2\right) \) and

also hold. According to (14), conditions (20) and (21) imply that it must be the case that \(\underline{b}_{1}=\underline{b} _{2}=0 \). If \(0=\underline{b}_{i}<\underline{b}_{j}\), then type \(j\) would have incentives to bid below \(\underline{b}_{j}\). \(\Pr \left( 1|1\right) >0\) and \(\Pr \left( 2|2\right) >0\) imply that there cannot be a mass point at 0, and the payoffs are \(\pi _{1}=\Pr \left( 0|1\right) \) and \(\pi _{2}=\Pr \left( 0|2\right) \), which results in the same ex-ante payoffs as in the case without collusive communication. Further, given the assumed conditions on probabilities, we can verify that the distribution function in (17) is well-defined for \(i=1,2\); that is, it is positively sloped. Also, according to (17), the values of \(b\) at which \(F_{1}\left( b\right) =1\) and \(F_{2}\left( b\right) =1\) hold, respectively, are

Since the former value of \(b\) is smaller than the latter, it means that \( F_{1}\left( b\right) \) reaches \(1\) earlier. Therefore,

and \(\overline{b}_{2}=1-\pi _{2}=1-\Pr \left( 0|2\right) \ge \overline{b} _{1}\). Further, one can verify that distribution functions (15) and (17) for \(\left( i,j\right) =\left( 2,1\right) \) evaluated at \(\overline{ b}_{1}\) give the same answer:

To summarize, in the equilibrium, the types 1 and 2 bid according to (17), where \(\pi _{1}=\Pr \left( 0|1\right) \) and \(\pi _{2}=\Pr \left( 0|2\right) \), on the interval \(\left[ 0,\overline{b}_{1}\right] \), and type 2 also bids on \(\left[ \overline{b}_{1},\overline{b}_{2}\right] \) according to (15).

Case 3 According to (16), conditions \( \Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) and \(\Pr \left( 2|1\right) \le \Pr \left( 2|2\right) \) imply that \(\overline{b}_{1}\le \overline{b} _{2}\) holds. But then \(\pi _{2}=1-\overline{b}_{2}\), and it must be the case that \(\pi _{1}\ge \pi _{2}\) or otherwise type 1 would deviate and bid \( \overline{b}_{2}\). We argue that \(\underline{b}_{2}<\overline{b}_{1}\) cannot happen in the equilibrium. Conditions \(\Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) and \(\Pr \left( 2|1\right) \le \Pr \left( 2|2\right) \) together with \(\pi _{1}\ge \pi _{2}\) imply that \(F_{i}\left( b\right) \) in (17) is a decreasing function for one of the types, depending on the sign of \(\Pr \left( 2|2\right) \Pr \left( 1|1\right) -\Pr \left( 2|1\right) \Pr \left( 1|2\right) \). Therefore, \(\overline{b}_{1}=\underline{b}_{2}\) must hold, and the types bid as in Case 1.

Case 4 According to (16), conditions \( \Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) and \(\Pr \left( 2|1\right) >\Pr \left( 2|2\right) \) imply that there cannot be an equilibrium in which \(\overline{b}_{i}>\overline{b}_{j}\), as type \(j\) will want to deviate and bid above \(\overline{b}_{j}\). Hence, if there is an equilibrium, \(\overline{b} _{1}=\overline{b}_{2}\) must hold. This in turn implies that \(\pi _{1}=\pi _{2}\). As we know that \(\pi _{i}\ge \Pr \left( 0|i\right) \) for \(i=1,2\) and there exists a type \(j\) for whom \(\pi _{j}=\Pr \left( 0|j\right) \), it must be the case that \(\pi _{1}=\pi _{2}=\Pr \left( 0|1\right) \). This in turn implies that \(F_{2}\left( \underline{b}_{2}\right) =0\), and \(0=\underline{b} _{1}\le \underline{b}_{2}\). Also, since \(\pi _{i}=1-\overline{b}_{i}\) for \( i=1,2\), then \(\overline{b}_{1}=\overline{b}_{2}=1-\Pr \left( 0|1\right) \).

Since \(F_{2}\left( \underline{b}_{2}\right) =0\), from (17) for \(\left( i,j\right) =\left( 2,1\right) \), we can solve out for \(\underline{b}_{2}\):

Further, from (17) for \(\left( i,j\right) =\left( 1,2\right) \), we find that

Also note that (13) for \(i=1\) gives the same expression for \( F_{1}\left( \underline{b}_{2}\right) \). We can also verify that \(F_{1}\left( \underline{b}_{2}\right) <1\). It holds if \(\Pr \left( 0|1\right) +\Pr \left( 1|1\right) <\Pr \left( 0|2\right) +\Pr \left( 1|2\right) \), which is indeed true as it is equivalent to \(\Pr \left( 2|1\right) >\Pr \left( 2|2\right) \). Finally, one can also verify that \(\underline{b}_{2}<\overline{b}_{1}= \overline{b}_{2}\). Hence, we have characterized the equilibrium, in which type 1 bids according to (13) in \(\left[ 0,\underline{b}_{2}\right] \), and both types bid according to (17), where \(\pi _{1}=\pi _{2}=\Pr \left( 0|1\right) \), on the interval \(\left[ \underline{b}_{2},\overline{b}_{2} \right] \).

Finally, we prove that in any symmetric equilibrium, the support of equilibrium bids for each type must be connected. Suppose to the contrary that there exists an interval \(\left( \underline{b},\overline{b} \right) \) such that only type \(i\) bids in this interval, while type \(j\) (and possibly type \(i\)) bids on two disconnected intervals, and \(\underline{b}\) is the upper limit of the first of these intervals, while \(\bar{b}\) is the lower limit of the second of these intervals. Note that \(F_{j}\left( \underline{b}\right) =F_{j}\left( \overline{b}\right) \) and \(\Pr \left( i|i\right) >0\) hold. The expected payoff of type \(i\) from bidding in the interval \(\left( \underline{b},\overline{b}\right) \) is

which implies that

Consider now type \(j\), who deviates and bids in \(\left( \underline{b}, \overline{b}\right) \). The expected payoff is

The above expression is linear in \(b\). Further, note that in equilibrium, type \(j\) is indifferent between bidding \(\underline{b}\) and \(\overline{b}\). Therefore, he must be indifferent among all bids in the interval \(\left( \underline{b},\overline{b}\right) \), which implies that the expression in the curly brackets is zero. Then,Footnote 28

and

It immediately follows from (23) that there is at most one discontinuity in the support for each type.

We again consider all four cases.

-

Case 1 According to \(\Pr \left( 1|1\right) \ge \Pr \left( 1|2\right) ,\, \Pr \left( 2|1\right) <\Pr \left( 2|2\right) \) , and (19), it is true that \(F_{1}\left( \underline{b}\right) <0\) for \(\left( i,j\right) =\left( 2,1\right) \) in (23). Therefore, the support of bids for type 1 is connected. Further, from the previous analysis of Case 1, we already know that \(\underline{b}_{1}=0\). It means that type \(i=1\) must bid not only in the interval \(\left( \underline{b} ,\overline{b}\right) \), but also in \(\left[ 0,\underline{b}\right] \). But then there is an interval, in which both types bid, which has already been ruled out by the previous analysis. Hence, it must be that the support of bids for type \(j=2\) is also connected.

-

Case 2 According to \(\Pr \left( 1|1\right) >\Pr \left( 1|2\right) ,\, \Pr \left( 2|1\right) <\Pr \left( 2|2\right) \), (20), and (21), we obtain that \(F_{1}\left( \underline{b} \right) <0\) and \(F_{2}\left( \underline{b}\right) <0\) in (23), which is a contradiction. Therefore, the support of bids for each type must be connected.

-

Case 3 We already know that the supports of both types cannot overlap and \(\overline{b}_{1}<\overline{b}_{2}\) holds. Therefore, if the support of bids for type 1 is disconnected, then so is the support of bids for type 2. Thus, it is sufficient to argue that the support of bids for type 2 must be connected. We already know that \(\pi _{1}\ge \pi _{2}\). However, Eq. (24) for \(\left( i,j\right) =\left( 1,2\right) \) together with \(\Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) implies that \(\pi _{1}<\pi _{2}\). Hence, we have obtained a contradiction.

-

Case 4 We know that in any equilibrium \( \overline{b}_{1}=\overline{b}_{2}\) and \(\pi _{1}=\pi _{2}\) must hold. Then, (24) implies that \(\Pr \left( i|j\right) =\Pr \left( i|i\right) \), which contradicts the assumptions about conditional probabilities that \(\Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) and \(\Pr \left( 2|1\right) >\Pr \left( 2|2\right) \).

This completes the proof that the support of bids must always be connected for each type in a symmetric equilibrium. This also implies that the equilibrium that we have found before is the unique symmetric equilibrium for each distribution of signals.

Proof of Theorem 1

We structure the proof along the cases identified in Proposition 1.

Cases 1 and 3 These cases result in the same equilibrium structure whereby the types bid on adjacent intervals. Combining them, the restrictions on probabilities such that the types bid on adjacent intervals are

or equivalently,

The payoff of high-valuation bidder before she receives a signal is

where we have used (9) and (11), and \(\Pr \left( i\right) \) for \(i=1,2\) denotes the probability that the bidder will be of type \(i\).

Hence, the problem that we are solving isFootnote 29

subject to

and all probabilities \(\left( x_{1},x_{2},r_{11},r_{12},r_{22}\right) \) must be non-negative. The non-negativity constraints together with the above equality constraints ensure that each of the probabilities is also less than 1. The inspection of this program tells that the objective function is increasing in \(x_{1}\). Therefore, setting \(x_{1}=1\) and \(x_{2}=0\) is optimal, since it does not violate any of the constraints. Using these results, we simplify our problem to

subject to

and \(\left( r_{11},r_{12},r_{22}\right) \) must be non-negative. Note that we have taken a monotone transformation of the objective function.

Suppose the above inequality does not bind. Then, it is always possible to increase the payoff by raising \(r_{12}\) by a small amount, and correspondingly decreasing \(r_{22}\). (If \(r_{22}=0\), then \(r_{12}=0\) must also hold. But then the objective also takes zero value, which is clearly not a maximum.) Therefore, \(r_{22}\left( p+\left( 1-p\right) r_{11}\right) =\left( 1-p\right) r_{12}^{2}\) holds. Using both equalities, we can solve for \(r_{11}\) and \(r_{12}\) as functions of \(r_{22}\)

and write the objective function as

which is always increasing in \(r_{22}\).

To now, we have ignored the non-negativity constraints that \(r_{11}\ge 0\) and \(r_{12}>0\) must also be satisfied. One can verify from (27) that \( r_{12}>0\) is satisfied for all \(0<r_{22}\le 1\), while from (26), \( r_{11}\) is always decreasing in \(r_{22}\). Therefore, \(r_{22}\) can be raised up to the point where \(r_{11}=0\), implying that

Evaluating (25) at the optimum gives that the payoff of high-valuation bidder before she receives a signal is \(\sqrt{p}\). Therefore, bidder’s ex-ante payoff is \(\left( 1-p\right) \sqrt{p}\) in the optimum.

Case 2 The payoffs of types 1 and 2 are, respectively, \(\pi _{1}=\Pr \left( 0|1\right) \) and \(\pi _{2}=\Pr \left( 0|2\right) \); therefore, the ex-ante payoff of bidder is the same as in the case without collusive communication, \(p\left( 1-p\right) \).

Case 4 The payoff of high-valuation bidder in this equilibrium is \(\Pr \left( 0|1\right) \), irrespective of her type. Hence, we are solving the following problem:

subject to \(\Pr \left( 0|1\right) \ge \Pr \left( 0|2\right) ,\, \Pr \left( 1|1\right) <\Pr \left( 1|2\right) \), and \(\Pr \left( 2|1\right) >\Pr \left( 2|2\right) \). Constraint \(\Pr \left( 1|1\right) <\Pr \left( 1|2\right) \) can be ignored as it is implied by the other two inequalities. Thus,

subject to

and all probabilities \(\left( x_{1},x_{2},r_{11},r_{12},r_{22}\right) \) must be non-negative. The objective is increasing in \(x_{1}\) and decreasing in \( r_{11}\) and \(r_{12}\). Consider decreasing \(r_{11}\) by \(2\delta \), while increasing \(r_{12}\) by \(\delta \). Then, none of the constraints is violated and the objective has increased. Therefore, it is optimal to set \(r_{11}=0\). We can rewrite the inequality constraints as

We want

to be as high as possible but strictly less than the right-most expression in the above constraint. It follows that this program does not have a maximum. If we sat the second inequality as equality in the above constraint, we would obtain that \(\Pr \left( 0|1\right) =1-\Pr \left( 2|2\right) \). This, together with \(\Pr \left( 1|1\right) =0\), implies that \( F_{1}\left( \underline{b}_{2}\right) =1\) in (22); that is, the types bid on adjacent intervals, which contradicts the equilibrium structure of Case 4.

Although program (P2) does not have a maximum, we still need to verify that its supremum does not exceed the maximum that we have found for program (P1). To find the supremum, we can rewrite (P2) in the following form:

subject to

and all probabilities \(\left( x_{1},x_{2},r_{12},r_{22}\right) \) must be non-negative, where the objective of (P3) is obtained by combining the three equality constraints to express \(x_{1}\) as a function of \(r_{12}\). At the same time, we know that the solution to program (P1) satisfies \( r_{11}=0\) and the third inequality holds as equality. If we impose these constraints on (P1) from the outset, we obtain program (P3). (The first inequality in (P1) is automatically satisfied when \( r_{11}=0 \) and therefore can be ignored.) Hence, we conclude that (P1) and (P3) have the same solution. This completes the proof that the optimal signal structure is given as the solution to program (P1).

Proof of Proposition 2

Given a public signal \(i\in N\), if \(r_{ii}=0\), then the bidder with a high valuation knows that the opponent has a low valuation, and therefore, both will bid 0. If \(x_{1.i}=x_{2.i}=0\) and \(r_{ii}>0\), then it is common knowledge that the valuations of both bidders are equal to 1. It is a standard argument to show that the unique equilibrium involves both bidders submitting bids equal to 1.

Suppose that \(x_{l.i}\ge x_{m.i},\, x_{l.i}>0\), and \(r_{ii}>0\). First, note that \(F_{l.i}\left( \bar{b}_{i}\right) =F_{m.i}\left( \bar{b}_{i}\right) =1\) is satisfied, and so, the distribution functions (1) and (2) are well defined. The expected payoff of bidder \(l\) with valuation \(v_{l}=1\) is given by

Substituting (2) into (28), we can verify that bidder \(l\) is indifferent among all bids in the interval \(\left[ 0,\bar{b} _{i}\right] \), earning the expected payoff given in (3). Similarly, the expected payoff of bidder \(m\) with valuation \(v_{m}=1\) is

Substituting (1) into (29), we can verify that bidder \(m\) is also indifferent among all bids in the interval \(\left[ 0,\bar{ b}_{i}\right] \), earning the same expected payoff given in (3). Obviously, no bidder has incentives to bid above \(\bar{b}_{i}\), while any bid below \(0\) would give a payoff of \(0\). Thus, we can conclude that (1) and (2) represent the equilibrium strategies of high-valuation bidders when they observe the public signal \(i\).

To prove that this equilibrium is unique, we can argue as in the proof of Proposition 1 that each bidder of type \(i\) will submit a bid according to an atomless distribution function, except possibly at 0; ties occur with zero probability; the supports of both distribution functions coincide; the common support is connected with the lower limit being equal to 0. Then, the payoff of bidders 1 and 2 are given by (28) and (29), respectively. The common support also implies that the equilibrium payoffs of both bidders are the same and equal to the expression in (3). Equating (28) and (29) with (3) gives (1) and (2). Hence, the equilibrium is unique.

Proof of Theorem 2

We partition all signals into two sets, \(S\) and \(N\backslash S\). The former contains all signals \(i\) such that \(x_{1.i}>x_{2.i}\), while the latter contains all signals such that \(x_{1.i}<x_{2.i}\). Signals \(i\) for whom \(x_{1.i}=x_{2.i}\) holds are assigned arbitrarily as long as each set is non-empty.

Using the results of Proposition 2, the joint ex-ante payoff of bidders is \(p\left( 1-p\right) \) times the following expression:

The first two terms represent the payoff of bidder 1, and the other two terms—the payoff of bidder 2. Using

we can rewrite the joint payoff as

The expression in (30) is increasing in \(x_{1.i}\) for all \(i\in S\), but decreasing for all \(i\in N\backslash S\). Similarly, (30) is increasing in \(x_{2.i}\) for all \(i\in N\backslash S\), but decreasing for all \( i\in S\). Therefore, \(x_{1.i}=0\) for all \(i\in N\backslash S\) and \(x_{2.i}=0\) for all \(i\in S\), and we simplify (30) to

One can verify that

(This inequality can be rewritten as \(\left( ad-bc\right) ^{2}\ge 0\).) Therefore,

where we have additionally used the fact that \(\sum _{i\in N\backslash S}x_{2.i}=\sum _{i\in S}x_{1.i}=1\). Therefore, we can increase the joint payoff if we aggregate all signals \(i\in S\) into a (new) signal 1 and all signals \(i\in N\backslash S\) into a (new) signal 2 such that \(\tilde{x} _{1.1}=1,\, \tilde{x}_{1.2}=0,\, \tilde{x}_{2.1}=0,\, \tilde{x}_{2.2}=1,\, \tilde{r}_{11}=\sum _{i\in S}r_{ii}\), and \(\tilde{r}_{22}=\sum _{i\in N\backslash S}r_{ii}=1-\tilde{r}_{11}\). Given these signals 1 and 2, we can apply Proposition 2 to verify that the joint equilibrium payoff is indeed given by

This completes the proof that it is sufficient that the public signal takes one of the two values in order to achieve the maximal joint payoff.

To find the optimal distribution of signals, it remains to maximize (31) subject to \(\tilde{r}_{11}+\tilde{r}_{22}=1\). It follows that \( \tilde{r}_{11}=\tilde{r}_{22}=0.5\). According to (3), a high-valuation bidder expects a payoff of \(\frac{2p}{1+p}\) irrespective of the public signal that she observes. The ex-ante payoff of bidder is \(p\left( 1-p\right) \frac{2}{1+p}\).

Proof of Proposition 3

First, note that \(F_{i}\left( \bar{b}_{i}\right) =1\) for all \(i\in N\) is satisfied, and so the mixed strategies are well defined. Suppose that bidder 2 follows the strategy given in Proposition 3 and \(y_{1}>0\). Consider bidder 1 of type \(i\in N\). Her expected payoff when bidding \(b\in \left[ \bar{b}_{i-1},\bar{b}_{i}\right] \) is

Substituting \(F_{i}\left( b\right) \) from (4) yields a positive constant

Therefore, bidder 1 is indeed indifferent between any bid in the interval \( \left[ \bar{b}_{i-1},\bar{b}_{i}\right] \).

Suppose now that bidder 1 of type \(i\) bids in an interval \(\left[ \bar{b} _{j-1},\bar{b}_{j}\right] \) for \(j\ne i\). Her expected payoff is

where the rest of the terms that do not contain \(b\) are collected in the parameter \(\varPhi \). Since \(x_{j}/y_{j}>x_{i}/y_{i}\) for all \(j<i\), it follows that the payoff of type \(i\) is increasing in \(b\) for \(b<\bar{b}_{i-1}\), and therefore, bidder 1 of type \(i\) does not want to deviate by bidding below \( \bar{b}_{i-1}\). Similarly, since \(x_{j}/y_{j}<x_{i}/y_{i}\) for all \(j>i\), it follows that the payoff of type \(i\) is decreasing in \(b\) for \(b>\bar{b}_{i}\), and therefore, bidder 1 of type \(i\) does not want to deviate by bidding above \(\bar{b}_{i}\) either. The same argument establishes that there is no equilibrium, in which the supports of equilibrium strategies are arranged in a different order. That is, for any two types \(i\) and \(j\) such that \(i<j\), it must be the case that the support of type \(i\)’s mixed strategy must lie to the left of the support of type \(j\)’s mixed strategy.

It remains to prove that supports cannot overlap in an equilibrium. Suppose on the contrary that an interval \(\left[ \underline{b},\overline{b}\right] \) belongs to the support of equilibrium mixed strategies of more than one type. Let the set of these types be denoted by \(S\). The expected payoff of type \(i\in S\) from bidding in the interval \(\left[ \underline{b},\overline{b} \right] \) is

where \(\tilde{F}_{k}\left( b\right) \) denotes the distribution of bids for type \(k\) in this equilibrium. If we multiply both sides with

where \(j\in S\backslash \left\{ i\right\} \), we obtain

If we subtract the analogous expression, in which the roles of types \(i\) and \(j\) are reversed, from the above expression, we have that

Given that \(x_{i}y_{j}\ne x_{j}y_{i}\), the above expression is satisfied only for a single value of \(b\). Therefore, the supports of mixed strategies of types \(i\) and \(j\) cannot overlap in the equilibrium. This completes the proof that the symmetric equilibrium, described in Proposition 3, is unique. If \(y_{1}=0\), using the tie-breaking rule, the proof is basically the same.

Rights and permissions

About this article

Cite this article

Āzacis, H., Vida, P. Collusive communication schemes in a first-price auction. Econ Theory 58, 125–160 (2015). https://doi.org/10.1007/s00199-013-0778-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-013-0778-7

Keywords

- Bidder-optimal signal structure

- Bid coordination mechanism

- Collusion

- (Bayes) correlated equilibrium

- First-price auction

- Public and private signals