Abstract

We analyze the preferences of 1180 German consumers for investment guarantees in financial products by means of choice-based conjoint and latent class analysis. Based on the segment-level partworth utility profiles, we then identify the most important investment guarantee features, analyze consumer demand in a realistic market setting, and test whether individual purchasing behavior can be explained by socioeconomic characteristics. Our results show that two buyer and two nonbuyer segments exist. Although their willingness to buy varies significantly, we document only a small degree of heterogeneity with respect to the individual guarantee attributes and levels. Across the sample, the guarantee period is most important, followed by the volatility of the underlying fund, and the up-front premium. Finally, we illustrate that particularly those socioeconomic characteristics with an impact on individuals’ financial situation are promising predictors of their willingness to purchase investment guarantees.

Similar content being viewed by others

Introduction

Investment guarantees are a common component in many financial products (Mitchell and Smetters 2003; Antolín et al. 2011). Well-known examples include, among others, mutual funds (Gatzert and Schmeiser 2009), participating (Cummins et al. 2007) and unit-linked life insurance policies (Finkelstein et al. 2003), as well as defined contribution schemes such as German Riester pensions (Lachance and Mitchell 2003) or U.S. individual retirement accounts (Gale et al. 2016). Although the guarantee features vary from product to product and from country to country, their common purpose is to safeguard the investor against negative market developments.Footnote 1 This is usually achieved by fixing the minimum payout at maturity of the contract by means of a guaranteed interest rate or, to put it more succinctly, a guaranteed rate of return. In recent years, however, such constructs came under substantial pressure. The reason is that in the current low interest environment starting after the global financial crisis of 2008, providers have great difficulties to generate earnings that are sufficient to fulfill their existing guarantee commitments from the past (Holsboer 2000; Kablau and Wedow 2012; Hartley et al. 2016). Particularly in the European Union member states, this situation is further exacerbated by the consecutive introduction of Solvency II, which due to its stricter capital charges constitutes another major challenge for all guarantee providers with respect to their profitability.

From the perspective of consumers, on the other hand, investment guarantees may constitute an attractive product feature for their old-age provision. More specifically, besides preserving the invested capital, a guarantee also allows them to benefit from favorable stock market developments.Footnote 2 In practice, however, several drawbacks exist. Firstly, in the current low interest environment, the investment’s upside potential is limited, since a large fraction of the saving is required to preserve the capital base at maturity. Secondly, guarantees are typically associated with high costs in relation to their level of coverage (Finkelstein et al. 2003). Moreover, they do not offer a general protection against inflation and could also negatively impair an individual’s available pension capital (Gale et al. 2016). Against all these aspects, consumer demand for financial products with embedded investment guarantees such as unit-linked life insurance policies is still growing (EIOPA 2017). For instance, recent studies of the German market show that guaranteed products account for more than 90 per cent of new life insurance sales, from which 34 per cent are attributable to classical interest rate guarantees (GDV 2018).

Contrary to these sales figures, classical normative frameworks of rational choice such as expected utility theory (EUT) (Døskeland and Nordahl 2008) fail to explain why guaranteed products are in such strong demand. That is, as shown by Ebert et al. (2012), CRRA EUT investors would receive disutility from this feature and thus, refrain from purchasing guaranteed products. This also holds true for cumulative prospect theory (CPT) (Dierkes et al. 2010; Dichtl and Drobetz 2011; Ebert et al. 2012), the prominent behavioral counterpart of EUT, and more advanced guarantee structures such as cliquet-style or ratch-up guarantees.Footnote 3,Footnote 4 If one further bears in mind that long-term investment guarantees are typically offered at prices which are considerably higher than those derived within a Black-Scholes financial market model, their popularity among consumers is quite astonishing. One explanation might be that consumers are unaware that each guarantee is associated with costs, which, in turn, are not even reported in the small print of the contract terms.

Apart from the theoretical studies mentioned above, to the best of our knowledge, a thorough investigation of consumer preferences for long-term investment guarantees in financial products has not been conducted to date. In contrast, most academic papers analyzing the perceived importance of specific product features by policyholders focus either on the role of intermediaries (e.g., insurance brokers) or on factors relevant for purchase motivations. Using data from the Portuguese car insurance market, Dominique-Ferreira (2018), for instance, examines customer satisfaction in the context of the purchase decision process. Drawing on ad hoc questionnaires, a structural equation approach, and a multidimensional scaling unfolding model, the author shows that intermediaries play a central role in terms of customer satisfaction, claims management, and the purchase process in the Portuguese car insurance market. Based on conjoint analysis and using data from 455 insurance customers, Dominique-Ferreira et al. (2016) measure the price sensitivity of policyholders and analyze how it is affected by different factors. The authors find that the important drivers are the level of purchase participation, bundled discounts, and brand loyalty. The latter factor largely determines policyholders’ attitudes toward bundled discounts. In addition, price bundling helps to increase insurer’s profitability. Jahnert et al. (2021), on the other hand, analyze pricing behavior in the German term life insurance market by comparing market prices, actuarially fair prices, and willingness to pay for eighteen customer groups and three product categories. The estimate of policyholders’ willingness to pay is derived using choice-based conjoint analysis (CBC), which was first presented in Braun et al. (2016). The results show that premiums for low-cost term life insurance products are sometimes even lower than the actuarially fair price. For term life insurance with additional benefits, regulation and market conditions prevent insurers from using advanced price discrimination strategies that take into account policyholders’ WTP.

Consequently, little is known about the importance consumers attach to certain features of investment guarantee, such as the guarantee price, the guarantee period, or what factors influence their purchasing motives. The paper at hand is intended to fill this gap. That is, we draw on CBC analysis, a powerful indirect stated preference elicitation approach grounded in random utility theory (RUT), and collect choice data for point-to-point interest rate guarantees through a comprehensive online questionnaire among 1180 German financial decision makers. Subsequently, we run a latent class (LC) model in order to divide the latter into different customer groups. We then estimate segment-level part-worth utility profiles that reflect individuals’ preferences for specific guarantee features. Based on the respective results, we finally identify the most important guarantee features, analyze consumer demand within a hypothetical market environment comprising three fully-fledged investment guarantees, and test whether individuals’ segment membership can be explained by central socioeconomic and psychographic characteristics.

The remainder of this manuscript is organized as follows. In the next section, we shortly review the foundations of CBC analysis and the LC part-worth estimation procedure. Additionally, we introduce and discuss the guarantee attributes and levels used in the CBC experiment, our sample selection and survey design, as well as the concepts of relative attribute importance and shares of preference (SOP). The third section comprises all empirical results with respect to the consumer segments, i.e. their corresponding part-worth utility profiles, their willingness to buy investment guarantees, and their socioeconomic characteristics. Finally, the last section contains a short summary of the main findings and concludes the manuscript.

Survey data and methodology

Choice-based conjoint analysis

Generally, risk-adequate prices for investment guarantees are derived by means of option pricing theory (OPT) (Boyle and Schwartz 1977; Hansen and Miltersen 2002; Finkelstein et al. 2003; Cummins et al. 2007; Branger et al. 2010; Graf et al. 2011). While providers assume efficient capital markets and the duplication of future cash flows for their premium calculation, consumers typically lack the payoff replication capability (Doherty and Garven 1986; Gatzert et al. 2012). Rather, they tend to evaluate such product features according to their individual preferences. In order to compare whether and to what extent theoretical guarantee costs and consumer valuations differ, Gatzert et al. (2011) conducted a computer-based survey with open-ended questions among 375 financial services professionals that were asked to directly state their perceived value of different types of investment guarantees. However, such direct stated preference approaches exhibit several drawbacks and are known to lead to inaccurate estimates (Backhaus et al. 2005). While this holds particularly true for infrequently purchased, long-term financial products that are further associated with complex decision-making processes (Voelckner 2006; Miller et al. 2011), asking industry professionals instead of representative consumers has also a distorting effect on the results. Hence, this approach is not suitable for analyzing consumer preferences for investment guarantees. By contrast, one promising alternative is choice-based conjoint (CBC) analysis, a powerful indirect stated preference elicitation approach built on RUT (Johnson 1974; Green and Srinivasan 1978; Green et al. 1981; Srinivasan 1988; Gustafsson et al. 2007).Footnote 5 That is, such CBC experiments require respondents to trade off different product alternatives against each other within repeated discrete choice tasks, thereby almost perfectly mirroring real-life purchase situations (Huber 1997).Footnote 6 Each of these product alternatives, in turn, is composed of so-called attributes, each of which has a predefined set of attribute levels (cf. “CBC investment guarantee attributes and levels” section). Thus, especially in case of infrequently purchased and rather abstract product types such as long-term financial contracts, CBC is superior to other methodologies for eliciting consumer preferences (Orme 2002). To date, most conjoint studies in the insurance sector focus on preferences and willingness to pay figures for health insurance (Chakraborty et al. 1994; Telser and Zweifel 2002; Kerssens and Groenewegen 2005; van den Berg et al. 2008), crop insurance (Sherrick et al. 2003), term life insurance (Braun et al. 2016; Schreiber 2017; Jahnert et al. 2021), product attribute presentation in nonlife insurance (Dominique-Ferreira 2017), customer’s price sensitivity (Dominique-Ferreira et al. 2016), annuities (Shu et al. 2016), and mutual funds (Wilcox 2003). Our work extends this research stream by focusing on consumer preferences for different designs of investment guarantees that are regularly found in compulsory, as well as mandatory, old-age provision products.

Estimation of aggregate-level part-worth utility profiles

We estimated aggregate-level part-worth utility profiles from the stated choices by means of LC analysis implemented in Sawtooth Lighthouse Studio V9 (Sawtooth Software 2004, 2007).Footnote 7 Let i denote the number of respondents, j the different conjoint profiles with k attributes each, n the individual choice task, and \(\hbox{M}_n\) the three alternatives shown in choice task n. Moreover, \(\hbox{X}_{jk}\) denotes the k-th dummy variable for the j-th conjoint profile, \(\hbox{S}\) the number of market segments, and \(\beta_{ks}\) the part-worth utility for the k-th attribute of market segment s. Following DeSarbo et al. (1995), we assume that \(\hbox{S}\) latent market segments of respondents with identical part-worth profiles exist. Their relative sizes are denoted via the \(\hbox{S}\) segment parameters \(\alpha_s\) with \(0 \le \alpha_s \le 1\) and \(\sum_{r=1}^S{\alpha_r=1}\), i.e. all respondents are allocated to a market segment. The choice probability of individual i can now be expressed as the choice probability of these \(\hbox{S}\) segments (Kamakura and Russell 1989). Thus, for segment s, we obtain:

with \(\beta_{0js}\) being the intrinsic part-worth utility of product profile j of segment s and \(\beta_{ks}\) the impact coefficient for attribute k in segment s (DeSarbo et al. 1995).Footnote 8 While the CBC parameters are segment-specific, the respective segment compositions are latent and unknown and thus, need to be estimated from the observed choice data. More specifically, the unconditional choice probability that conjoint profile j is chosen among \(\hbox{M}_n\) is given by (DeSarbo et al. 1995):

In Eq. (2), \(\alpha_s\) denotes the size of segment s and might be interpreted as the a priori probability of a respondent being part of segment s. With a total of \(\hbox{I}\) respondents in our sample, the likelihood (LL) of the observed CBC data is determined as (DeSarbo et al. 1995):

The dummy variable \(\hbox{Y}_{ijn}\) captures the choice of individual i in choice task n, i.e. \(\hbox{Y}_{ijn}=1\) if respondent i decides in favor of j in n among all alternatives \(\hbox{M}_n\), or \(\hbox{Y}_{ijn}=0\) otherwise. The LC estimation now strives to maximize Eq. (3) with respect to the part-worths \(\mathbf{B} =(\beta_{0js},\beta_{ks})\) and the \(\hbox{S}\) proportions \(\mathbf{A} =(\alpha_s)\), subject to the constraint \(\sum_{r=1}^{\mathrm{S}}{\alpha_{r}=1}\) (Wedel and Desarbo 1994).

Finally, by using Bayes rule, the posterior probability of respondent i’s segment membership (\(\tilde{\hbox{R}}_{is}\)) is computed as (DeSarbo et al. 1995):

with \(\tilde{\hbox{Prob}}_s(j)\) being the estimated choice probability of profile j conditional on segment s (cf. Equation 1). Although the approach shown in Eq. (4) allows for fractional segment membership of respondents, we assign each individual i to the segment for which the value of \(\tilde{\hbox{R}}_{is}\) is highest (DeSarbo et al. 1995; Sawtooth Software 2004). Compared to two-stage approaches that derive segments after the estimation of individual-level part-worth utilities, e.g., Hierarchical Bayes (HB) combined with cluster analysis (Schreiber 2017), LC has several benefits. For example, the discrete assumption of heterogeneity allows for a more accurate modeling of individuals than HB if segments are quite compact and different with respect to their preference profiles (Sawtooth Software 2004).

CBC investment guarantee attributes and levels

The academic literature on CBC analysis does not contain clearly defined guidelines on how to derive appropriate product attributes and their corresponding levels. We therefore decided to include those four characteristics that are required in addition to the current risk-free interest rate to derive the fair price of a point-to-point interest rate guarantee by means of OPT: (1) the guarantee period, (2) the up-front premium, (3) the guarantee level, and (4) the volatility of the underlying fund. Additionally, our study also comprises the attribute (5) guarantee price, since we are explicitly interested in how consumers evaluate investment guarantees if all product-relevant information is available.

The OPT price of an investment guarantee depends on the respective levels of attributes (1) to (4). For example, ceteris paribus, a longer guarantee period is associated with a higher OPT price, while a lower volatility of the underlying fund, ceteris paribus, leads to a lower OPT price. Therefore, the classical CBC experimental design, in which prices are completely independent of the product composition but randomly assigned to the product alternatives shown in each choice task, is unsuitable for investment guarantees. To ensure that the products are not assigned unrealistic prices, we have implemented the so-called conditional pricing approach (Orme 2007). The latter has the advantage that the prices of each product alternative are linked to the corresponding levels of attributes (1) to (4). This means that in contrast to classical CBC, the guarantee price levels in our experiment are not defined in fixed EUR amounts across all product alternatives, but vary in relation to the 100 per cent OPT prices of the respective guarantees (cf. Table 1).

In conclusion, as suggested by Orme (2002), our experimental design takes into account criteria regarding the number, independence, and mutual exclusivity of attributes and levels. Table 1 provides an overview of all five attributes and their levels.Footnote 9

As can be seen from the table, the guarantee period is either 10, 20, 30, or 40 years. Moreover, consumers can choose between three different up-front premiums that are invested in the respective underlying fund of the product, i.e. EUR 10,000, EUR 30,000, or EUR 50,000.Footnote 10 The guarantee level was set in line with the legislation currently in force in Germany for insurance contracts with an interest rate guarantee (see GFMJ 2016). Since providers of state-subsidized pension products in Germany are legally required to refund at least the paid-in premiums to their policyholders at the end of the contract term, the minimum guarantee level in our experiment is set to 0 per cent (and thus corresponds to a simple money-back guarantee). The maximum guarantee level in our experiment corresponds to the current maximum actuarial interest rate in Germany for participating life insurance contracts with an embedded cliquet-style investment guarantee. From 2016 to 2021, such contracts offer a minimum interest rate of 0.9 per cent per year on the policyholder’s savings account. To ensure uniform coverage of this range, we also offer two medium guarantee levels of 0.3 per cent and 0.6 per cent per year. The underlying fund in which the up-front premium is invested, on the other hand, is either of low, medium, or high risk. In this regard, we drew on current investment fund profiles as presented in the 2018 marketing material of Zurich Insurance to derive their corresponding annualized risk-return profiles. The annualized average returns (\(\mu\)) and return standard deviations (\(\sigma\)) equal \(\mu =1.44\;\text{per cent}\) and \(\sigma =2.42\;\text{per cent}\) for the low-risk fund (TIF Target Investment Fund Obligationen CHF B), \(\mu =4.47\;\text{per cent}\) and \(\sigma =5.41\;\text{per cent}\) for the medium-risk fund (TIF Target Investment Fund 45 CHF B), and \(\mu =7.67\;\text{per cent}\) and \(\sigma =12.18\;\text{per cent}\) for the high-risk fund (TIF Target Investment Fund 100 CHF B).Footnote 11 Finally, the guarantee price which customers have to pay in addition to the up-front premium in order to receive the guaranteed return at the end of their investment period, exhibits five different levels that are quoted in percent of the respective OPT price for that specific guarantee composition. In order to derive these price levels, we first calculated the OPT prices in EUR for all possible combinations of attributes (1) to (4) by means of the Black-Scholes formula with a risk-free interest rate of 1 per cent.Footnote 12 For each combination, we then identified two low (high) prices corresponding to discounts (markups) of 30 per cent and 60 per cent of the corresponding OPT price. Our experimental design ensured that each product alternative shown in the choice tasks was assigned a guarantee price from the respective range. In general, one should note that for most products on the market, the price of the guarantee charged to the customer is typically spread over the contract term—for example, via a fixed markup on the monthly investment premium. To simplify the interpretation for the survey participants, our price definition for the embedded investment guarantee is a markup on the up-front premium paid for the underlying fund. This kind of presentation creates transparency for respondents, as it is clear which part of the total premium is paid into the investment fund and which part is charged for the embedded investment guarantee.

Sample selection and survey design

The sample comprises 1180 German consumers who identified themselves as responsible financial decision makers in their households.Footnote 13 Participants were between 20 and 54 years old and representative of the German population with respect to their gender and domicile state. The web-based questionnaire was distributed to the consumer panel of a market research firm in order to maximize response rates and minimize the amount of missing data. For their participation, respondents received a financial reimbursement.

The questionnaire underwent a series of pretests before its three-week field phase. In order to ensure that all respondents had a common understanding of how a point-to-point interest rate guarantee works, the survey started with an explanation of its general mechanics in the context of unit-linked life insurance. More specifically, we provided a hypothetical example to illustrate how such a guarantee affects the payoff at maturity in different fund development scenarios (cf. Fig. 2 in Appendix). We then introduced the five product attributes with all corresponding levels (cf. Table 1) and carefully explained the composition of a guarantee using an exemplary choice task (see Fig. 3 in Appendix).Footnote 14 Finally, the introductory part was completed by a simple simulation tool in which respondents could familiarize themselves with the guarantee concept. That is, the simulator allowed them to first compose their most preferred guarantee by selecting the corresponding attribute levels and then, in the second step, highlighted the corresponding OPT price. After each respondent had individually decided that he or she was ready to participate in the experiment, the experiment could be started with a click of the mouse.

During the discrete choice experiment, respondents had to complete a total of twelve choice tasks, each of which comprised three fully-fledged investment guarantees as characterized by the five attributes and a so-called no-choice option.Footnote 15 This none option allowed to opt out of the purchase and has been chosen by respondents if none of the displayed guarantees met their preferences.Footnote 16 Out of the twelve choice tasks, nine were randomly composed and three were so-called holdout tasks. In the nine random tasks, the attribute order was held constant and the three guarantee profiles were generated by the balanced overlap method (Huber and Zwerina 1996).Footnote 17 In the three holdout choice tasks at positions four, eight, and 12 in the experiment (Orme 2015), on the other hand, all respondents were confronted with identical product profiles (see Table 6 in Appendix).Footnote 18 This randomized experimental design is considered efficient, since it ensures orthogonality and level balance (Sawtooth Software 2007).Footnote 19 In this regard, we used a computer algorithm to construct several different versions of our experiment, i.e. the specific compositions of the three products shown in the nine random choice tasks. Subsequently, each respondent was then randomly allocated to one of those experimental designs. Once the twelve choice tasks have been completed, the survey concluded with questions regarding central socioeconomic characteristics as well as general behavioral aspects such as investment risk attitude and financial literacy.

As already mentioned in footnote 6, our choice experiment may be subject to hypothetical bias. The latter is particularly relevant in the context of complex and structured products such as investment guarantees, where the individual must spend time to understand how they work and what they are worth. If, for example, one considers an educated, high income person who has to make an investment decision and who is offered complex financial products with investment guarantees. This person has a lot of money to invest, but also a high opportunity cost of time. In a real-life context, she would spend time understanding the complex financial products because there is a lot of money at stake. In an experimental context, on the other hand, she may not spend time understanding the details of the products, as this is associated with high opportunity costs (time). Therefore, experimental and real-life decisions can prove to be very different. Or, to put it more broadly, the relationships between financial literacy, wealth, income, and preferences for investment guarantees collected through a web-based questionnaire can be very different from the actual ones.

In order to reduce hypothetical bias in our experimental setting as much as possible, we first ensured that our sample comprises only experienced respondents who are expected to be aware of and familiar with the decision context of web-based CBC experiments. In addition, they also identified themselves as financial decision makers with experience in financial products. Second, we have also implemented the so-called cheap talk mitigation technique.Footnote 20 The latter is a compact text script with few sentences that explicitly describe the potential hypothetical bias.Footnote 21 These sentences were shown to all respondents after the introductory explanations of the guarantee mechanics and before the start of the actual CBC experiment. In general, cheap talk is intended to draw respondents’ attention to the importance of their answers, although the choice tasks remain hypothetical. Although more effective for less experienced respondents, several academic studies provide evidence that cheap talk is helpful in mitigating hypothetical bias in stated preference or contingent valuation methods (Murphy et al. 2005; Loomis 2011; Fifer et al. 2014).

Relative attribute importance and shares of preference

Since the early 1990s, the so-called effects coding of the product attributes has become the standard for estimating parameter values in CBC analysis (Sawtooth Software 2007). This method helps to avoid linear dependencies as it omits the last level of every attribute and estimates it as the negative sum of the remaining levels (Sawtooth Software 2004). To be more specific, the last level of every attribute is chosen as reference level, which allows estimating the other levels with regard to that reference (omitted) level. Consequently, the sum of part-worths within each attribute is zero. As pointed out by Orme (2010), the resulting CBC utilities are interval data, which only permit the operations of addition and subtraction. This, in turn, implies that adding any arbitrary constant to all levels of an attribute does not affect the predicted choice probabilities. However, interval data neither allows for inter-attribute comparisons nor for the forming of ratios. To tackle this issue, we therefore draw on the so-called relative attribute importance (RAI). In general, the RAI of each attribute quantifies the impact this attribute makes to the total utility of a product, i.e. it states how important this attribute is from respondents’ perspective (Orme 2010). The RAI are denoted in percentage terms and defined as:

where \(\hbox{k}\,\in \{1,2,3,4,5\}\) denotes our five product attributes with levels \(\hbox{l}\,\in \{1,2,...,\hbox{L}_{\mathrm{k}}\}\) (cf. Table 1). In contrast to CBC utilities, the \(\hbox{RAI}_{ks}\) follow a ratio scale, add up to 100 per cent, and allow for making inter-attribute comparisons. Since the impact is measured by the difference of the minimum and maximum utility values of an attribute in relation to the sum of all attribute utility ranges, we can conclude that the higher the utility range of an attribute, the higher the attribute’s potential to positively or negatively affect a segment’s choice probability for a product.Footnote 22

Beyond identifying the most important guarantee features, we are also interested in analyzing consumers’ purchasing behavior. We will therefore construct a hypothetical market environment in which three different investment guarantees are offered. By examining whether respondents decide in favor of a guarantee or not, we are able to transform their part-worth utility profiles into so-called SOP. These SOP are most intuitive for interpreting the results of CBC analysis, since they are scaled from zero to one hundred and follow a ratio scale (Orme 2010). Thus, a SOP figure of 50 per cent is indeed twice as much as a SOP figure of 25 per cent. Compared to real-world market shares, however, the concept of SOP does not take into account external effects from advertising, sales force marketing, etc. so that they should not be confounded. In our analysis, we predict the segment-level demand by the randomized first choice method (RFC). Compared to the commonly applied first choice method (maximum utility rule), RFC allows for adding error terms both at the attribute and product level.Footnote 23 Mathematically, the utility \(\hbox{U}_j\) for product j is therefore determined as (Huber et al. 1999):

with \(\hbox{X}_j\) denoting the row vector of attribute level codes associated with product j and \(\beta\) the vector of part-worth profiles. Furthermore, \(\hbox{Err}_{attr}\) is the part-worth error term, which is identical for all products, while \(\hbox{Err}_j\) is the unique product error term (Gumbel-distributed).Footnote 24 In the hypothetical market setting \(\hbox{MS}\), the probability \(\hbox{Pr}_{j|\hbox{MS}}\) that guarantee j is chosen among all available offerings equals (Huber et al. 1999):

Equation (7) is estimated by drawing the product utilities from Eq. (6) within a market simulator and then enumerating the corresponding probabilities (Huber et al. 1999). In order to stabilize the SOP, this procedure is repeated several times.Footnote 25 The main advantage of RFC compared to other choice methods is that it satisfies three critical properties in choice modeling that are required to reflect the complexity of real-life market behavior, i.e. differential impact, differential substitution, and differential enhancement (Huber et al. 1999). Differential impact relates to the fact that attribute level changes are most promising if the product is near the purchase threshold, whereas they are less relevant for alternatives that are already selected or would otherwise never be chosen. Differential substitution, on the other hand, reflects the property that a new product should take shares disproportionately from existing offerings on the market. It is therefore critical to minimize undesired cannibalization effects. Finally, differential enhancement requires that small value differences have a higher impact on highly similar alternatives and almost none impact on dissimilar product offerings. The underlying idea is that consumers find it easier to compare similar than dissimilar alternatives (Huber et al. 1999).

Empirical results

Segment membership determination

From the survey participants, we removed (i) those with answer times below five minutes and (ii) those that repeatedly gave identical answers to all Likert statements on several specific consumer characteristics such as investment experience or individual risk-taking behavior in a row. After the data cleaning was complete, our final sample comprised 1017 consumers. Respondents needed an average time of 31.9 minutes to complete the survey, which includes their familiarization with all mechanics of an investment guarantee through the explanations, minimal working examples, and the mini simulator. In the CBC experiment, the average time per choice task was 47.8 seconds.

The LC analysis provided estimates for segment solutions comprising two to five groups. For each number of groups, we ran several replications with varying starting seeds in order to avoid problems associated with local maxima and only kept those solutions with the highest Chi Square. For choosing the final number of segments, we then looked for inflection points at which selected goodness-of-fit statistics such as the consistent Akaike information criterion (CAIC) (Bozdogan 1987; Ramaswamy et al. 1993), the percent certainty, and the Chi Square did no longer change significantly.Footnote 26 As suggested by DeSarbo et al. (1995), we further took into account the replicability and managerial interpretability of each solution. According to these criteria, the four-group solution turns out to be the optimal choice and is associated with a membership probability of 94.1 per cent.Footnote 27 In the selected four-group solution, the first two segments (\(n_{s_1}=236\) and \(n_{s_2}=233\)) account for approximately 23 per cent of our sample, while the third group (\(n_{s_3}=185\)) is smallest with a share of 18.2 per cent. Finally, the remaining 363 respondents (35.7 per cent) are allocated to segment \(s_4\).

Part-worth utilities

Figure 1 shows the segment-level part-worth utility profiles for the five CBC attributes (cf. Table 1). Generally, higher utility values indicate a stronger preference for the corresponding attribute level. For the guarantee period (Fig. 1a), it is evident that all groups clearly prefer shorter over longer terms, with 10 years being their first choice. While maturities of 40 years lead to significantly negative utilities for all groups, segments \(s_1\), \(s_2\), and \(s_4\) already reject periods of 30 years. Figure 1b provides a similar result for the premium invested. In each segment, utility is decreasing with an increasing up-front premium. However, while those respondents comprising segment \(s_1\) are almost indifferent between an investment of EUR 10,000 and EUR 30,000, the three remaining groups are not willing to invest more than EUR 10,000. In contrast, we observe more heterogeneous preference distributions for both the guarantee level (Fig. 1c) and the volatility of the underlying fund (Fig. 1d). Respondents in segments \(s_1,s_2,\) and \(s_4\) prefer guarantee levels of 0.6 per cent and 0.9 per cent, whereas these levels are associated with a negative utility for segment \(s_3\). Instead, the latter clearly prefer lower to higher guarantee levels. Regarding the underlying fund, one can see that segments \(s_3\) and \(s_4\) rather favor lower volatilities. Segments \(s_1\) and \(s_2,\) on the other hand, are more interested in medium-risk and high-risk funds, respectively. Finally, as shown in Fig. 1e, the price-utility profiles of segments \(s_1,s_2,\) and \(s_4\) are falling. Thus, lower prices for investment guarantees lead to higher utilities. Group \(s_2\), on the other hand, exhibits a completely flat part-worth structure, suggesting that the level of the guarantee price does not matter for these respondents.

Latent class segment-level part-worth utility profiles. This figure shows the segment-level part-worth utility profiles for each of the five CBC attributes across the four segments \(s_1\), \(s_2\), \(s_3\), and \(s_4\). Positive utility values indicate that the corresponding attribute level is preferable, while the opposite holds true for levels with negative utility values

In addition to the part-worth utility profiles for the five attributes across the four segments in our sample, we also estimated their utility values for the none option, i.e., the utility associated with choosing no guarantee at all.Footnote 28 Taking into account that the total utility of a product is the sum of the attribute-wise utilities, the negative none utility value of − 595.5 of segment \(s_1\) indicates that those respondents would purchase any investment guarantee offered in our setting. Segments \(s_3\) and \(s_4,\) on the other hand, exhibit positive none utility values amounting to 375.3 and 257.6, respectively. Consequently, only some composed guarantees are likely to be in demand. Finally, segment \(s_2\) is associated with the highest none utility value in our sample (1173.3). In combination with its flat price-utility profile (cf. Fig. 1e), this demonstrates that this segment has no interest in purchasing any investment guarantee.

Relative attribute importance

We now draw on the segment-level part-worth utility profiles in order to derive the relative attribute importance (RAI). Table 2 shows the corresponding percentages and attribute rankings for the full sample and the four segments. Across all respondents, the guarantee period is most important (37.7 per cent), followed by the riskiness of the underlying fund (24.4 per cent), and the up-front premium (23.7 per cent). Both the guarantee level (9.3 per cent) and the guarantee price (4.9 per cent), on the other hand, are of minor relevance. From the group-level results it is apparent that segments \(s_1,s_2,\) and \(s_4\) exhibit identical attribute rankings, which are almost in line with the full sample. That is, the guarantee period is most important and accounts for approximately 50 per cent of their total product utilities, while the up-front premium is associated with RAI between 19.7 per cent and 27.2 per cent. The volatility of the underlying fund has also a RAI of roughly 20 per cent and thus, ranks ahead of the guarantee level and the guarantee price. Segment \(s_3,\) in contrast, is characterized by a completely different attribute ranking. To be more concrete, this group considers the volatility of the underlying fund as the most important attribute, whereas the guarantee period is less relevant for them. Regarding the RAI figures of the up-front premium and the guarantee level, we only find minor differences to the three other segments.

The most striking result in Table 2 is that the guarantee price is least important for all four groups. That is, the corresponding RAI range from just 0.1 to 9.9 per cent and thus, underline that the price is only a small lever for influencing the total utility consumers receive from an investment guarantee product.

Willingness to buy investment guarantees

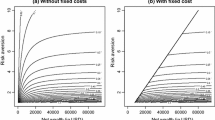

The concept of willingness to buy is linked to specific products. We therefore define three generic investment guarantees which have been designed to reflect the current and potential future product landscape of the German market (cf. Table 3).Footnote 29 As is apparent, the financial product including investment guarantee A (\(\hbox{IG}_{\mathrm{A}}\)) runs for ten years and requires an up-front premium of EUR 10,000. The guarantee level itself is 0 per cent (money-back guarantee), which among other things corresponds to the statutory minimum interest rate of German Riester contracts. Since the volatility of the underlying fund is low, the OPT price amounts to EUR 34. While both the guarantee period (10 years) and up-front premium (EUR 10,000) of investment guarantee B (\(\hbox{IG}_{\mathrm{B}}\)) are identical, its guarantee level equals 0.9 per cent per year.Footnote 30 In combination with an underlying fund of medium-risk, an OPT price of EUR 632 results. Finally, the third product alternative has a maturity of 20 years, an up-front premium of EUR 30,000, and an embedded guarantee level of 0.6 per cent per year (\(\hbox{IG}_{\mathrm{C}}\)). Moreover, the volatility of the underlying fund is high, since it contains 100 per cent equities. Thus, the OPT price equals EUR 5117.Footnote 31

The left panel in Table 4 shows the SOP in percentage points for the single-product analysis in which respondents could choose to buy the respective guarantee or decide to opt out. As one can see from the results for the full sample and the lowest price level, only between about 26 per cent (\(\hbox{IG}_{\mathrm{C}}\)) to 39 per cent (\(\hbox{IG}_{\mathrm{A}}\) and \(\hbox{IG}_{\mathrm{B}}\)) would choose an investment guarantee.Footnote 32 However, when looking at the individual segments, a different picture is obtained. First, with their SOP ranging from 77.64 per cent (\(\hbox{IG}_{\mathrm{C}}\) sold at the highest price) to 90.87 per cent (\(\hbox{IG}_{\mathrm{B}}\) sold at the lowest price), the 236 respondents in segment \(s_1\) are not only highly interested in all three investment guarantees, but also almost insensitive to changes in the price. Second, although group \(s_4\) is associated with notable SOP figures as well, it is characterized by a much stronger product orientation than \(s_1\). That is, while \(\hbox{IG}_{\mathrm{A}}\) and \(\hbox{IG}_{\mathrm{B}}\) capture SOP of approximately 39 per cent to 48 per cent, the corresponding figures for \(\hbox{IG}_{\mathrm{C}}\) are much lower. Thus, guarantee providers must design their products carefully in order to attract buyers within this customer group. Third, as indicated by very low SOP of \(\hbox{IG}_{\mathrm{B}}\) and \(\hbox{IG}_{\mathrm{C}}\), this applies even more to segment \(s_3\), in which customers are barely interested in investment guarantees and particularly averse against risky investment funds (cf. Fig. 1d). Finally, the 223 respondents belonging to \(s_2\) clearly identify themselves as nonbuyers. More specifically, in line with their flat price-utility curve (cf. Fig. 1e) and their high none utility value of 357.3, neither different product designs nor substantial price discounts of up to 60 per cent of the OPT price do result in noteworthy SOP.

In the right panel of Table 4, we allow for competition between the three guarantees. At first glance, the last column illustrates that in contrast to the single-product analysis, the number of nonbuyers is reduced in all segments. To be more specific, providing consumers with different product alternatives helps to expand the overall market size of guarantee products. Examining segment \(s_1\), we notice that it is highly competitive, since each offering attracts substantial interest with SOP figures amounting to approximately 30 per cent. Nevertheless, due to its guarantee level of 0.9 per cent and medium-risk underlying fund (cf. Fig. 1), \(\hbox{IG}_{\mathrm{B}}\) is ranked first. Although \(\hbox{IG}_{\mathrm{A}}\) and \(\hbox{IG}_{\mathrm{B}}\) obtained almost similar SOP among the consumers in \(s_4\) in the single-product analysis, the former is clearly preferred once we introduce competition. In contrast, almost minor deviations are observed for the nonbuyer-segments \(s_2\) and \(s_3\). That is, even with a mixed product portfolio, between 83.97 per cent (at the lowest price level in \(s_3\)) and 95.58 per cent (at the highest price level in \(s_2\)) of consumers stay out of the market. Particularly the guarantees \(\hbox{IG}_{\mathrm{B}}\) and \(\hbox{IG}_{\mathrm{C}}\) are not of importance in \(s_3\), while those respondents in \(s_2\) reject all offerings.

To sum up, the results in Table 4 demonstrate that even when indicating the applicable costs explicitly, more than half of our respondents show significant interest in point-to-point investment guarantees. In this regard, the 599 respondents allocated to groups \(s_1\) and \(s_4\) are identified as buyers with their SOP exceeding 70 per cent. Furthermore, the former segment is neither sensitive to changes in the product design nor the guarantee price, while the latter group is particularly focusing on the overall guarantee composition. Segments \(s_2\) and \(s_3\), on the other hand, clearly reveal themselves as nonbuyers with little or no preferences for investment guarantees.

Socioeconomic characteristics

We conclude our analyses by examining how the four consumer segments differ in terms of selected socioeconomic characteristics such as gender, age, monthly household income, level of education, etc. Table 5 contains the average percentage frequencies for the full sample in column (1) and the group-specific figures in columns (2) to (5). Additionally, columns (6) to (11) contain post-hoc one-way analysis of variance (ANOVA) p values indicating whether the observed differences between the segments are statistically significant different or not. We observe that the nonbuying groups \(s_2\) and \(s_3\) are predominantly female, whereas the opposite holds true for the buyers in \(s_1\) and \(s_4\). Although \(s_2\) and \(s_3\) are characterized by an above-average (below-average) share of respondents older than 45 years (younger than 25 years), we do not find any significant differences regarding the variable age. Similarly, apart from the larger portion of highly-educated respondents in \(s_4\) compared to \(s_2\), this also holds true for the level of education, which is almost equal across segments.Footnote 33 However, with respect to financial literacy, the majority of the former has a significant higher knowledge than those persons in segment \(s_1\).Footnote 34

A different picture, on the other hand, is obtained for the variables “monthly household income” and “total assets”. That is, 42.9 per cent of \(s_2\) and 34.6 per cent of \(s_3\) state that their monthly income is below EUR 1500, which is a significantly higher share than in the two buyer segments. Furthermore, the latter are also more strongly presented in the income bracket of EUR 3001 to EUR 5000. Regarding the total assets, substantial shares of the nonbuyer groups \(s_2\) and \(s_3\) state that they have less than EUR 50,000. We also find that the buyers are significantly overrepresented in the bracket of EUR 100,001 to EUR 250,000, i.e., 11.4 per cent (\(s_1\)) and 10.5 per cent (\(s_4\)) compared to 3.4 per cent (\(s_2\)) and 7.6 per cent (\(s_3\)), respectively. In contrast, however, particularly nonbuyers belong into the highest category with total assets above EUR 1,000,000. The economic interpretation of these findings is not straightforward. First, one could argue that the three products may not be suitable for them as they require up-front investments of EUR 10,000 to EUR 30,000. The latter, however, would exceed the available assets of about 69 per cent (61 per cent) of respondents in segment \(s_2\) (\(s_3\)). Furthermore, their high RAI of the up-front premium and the fact that they clearly prefer smaller investment amounts support this interpretation (cf. Table 2 and Fig. 1). Second, one could also assume that low-income households cannot spend much money on saving, regardless of the design of available financial products. However, this interpretation seems too strong, especially since almost 55 per cent (\(s_2\)) and 50 per cent (\(s_3\)) of these segments are characterized by a high investment risk attitude. We therefore conclude that they do not regard investment guarantees as an interesting product feature, which is supported by their low ownership rates.

With respect to a respondent’s investment risk attitude, we observe that the buyer segment \(s_1\) is significantly different from the three other groups.Footnote 35 More specifically, just like \(s_4,\) it is characterized by a less risky investment behavior, which also provides evidence that guarantees are an attractive product feature for them.Footnote 36 Finally, it is also these two segments that are identified as actual owners of investment guarantees or, if that is not yet the case, as these groups that are most likely to purchase such a product in the future. More than 90 per cent of the nonbuyer segments, on the other hand, stated to have no investment guarantee and almost 60 per cent of them do not even show any interest in purchasing.Footnote 37 Overall, it becomes clear that particularly those characteristics with an impact on an individual’s financial situation, i.e., the monthly income, the total assets, and the investment risk attitude, are well suited to classify them as potential buyers or nonbuyers of investment guarantee products.

Main findings of the analyses and managerial implications

Discrete choice experiment

The following list provides a condensed overview of the major results from our discrete choice experiment:

-

All four customer groups prefer shorter over longer guarantee periods. Guarantee periods over 30 years are mostly rejected.

-

In all segments, utility is decreasing with an increasing up-front premium.

-

In contrast, we observe heterogeneous preference distributions for both the guarantee level and the volatility of the underlying funds.

-

For most customers, utility decreases as the price of the investment guarantee increases.

-

In addition, we draw on part-worth utility profiles to determine the relative importance of the attributes. Across all respondents, the guarantee period is most important, followed by the volatility of the underlying fund and the amount of premium paid into the contract. The guarantee level and the price of the investment guarantee, however, are of secondary importance.

-

We also conducted a willingness-to-buy analysis for investment guarantees based on three generic investment guarantees with three different guarantee levels (0 per cent investment guarantee p.a.; 0.6 per cent p.a.; 0.9 per cent p.a.). The analysis is performed at the individual product level, but also as a portfolio analysis. The results show that even with explicitly stated guarantee prices that are higher than the “fair” option price, more than half of the respondents show significant interest in point-to-point investment guarantees. However, the feedback from the different segments is heterogeneous: some respondents have no interest in investment guarantees, while other respondents are primarily concerned with the composition of the overall guarantee.

-

Our empirical analysis concludes with a section examining how the four consumer segments differ with respect to selected socioeconomic characteristics. Statistically significant differences between the segments with a p value < 0.01 can be found with respect to monthly income, own wealth, attitude toward investment risk, and ownership of a financial product with a guarantee. Other differences such as age, financial knowledge, or gender, on the other hand, are not significant or only significant at higher p values.

Managerial implications

The following list provides a condensed overview of the major managerial implications from our discrete choice experiment:

-

On the one hand, our analysis shows that there are potential customers who have a strong interest in investment guarantees. Some have a high willingness to pay, well above the “fair” option price. On the other hand, we found subgroups that are not at all interested in investment guarantees in savings products. The group segmentation approach presented in this paper and the link with socioeconomic factors help insurance companies to identify which customers are typically interested in which type of guarantee. This procedure can be a helpful tool in tailoring customized products to the specific needs of the different market segments.

-

In many countries, mandatory pension provision products must include an embedded investment guarantee. Although there may be good reasons for this from the government’s point of view (e.g., avoiding old-age poverty), our study shows that the utility for many customers is reduced by the “investment guarantee” product feature.

Summary and conclusion

We conduct a CBC analysis for investment guarantees on a sample of 1017 German financial decision makers using data collected through online-based experiments. Segment-level part-worth utility profiles are estimated by means of LC analysis. Drawing on those preference structures, we compute relative attribute importances and derive comprehensive simulation results for a realistic market environment that allow us to assess consumers’ willingness to buy investment guarantees. Moreover, we also test whether individual group membership can be explained by central socioeconomic characteristics.

Our study provides several important insights. Firstly, one can distinguish a total of four different market segments of which two are divided into buyers and nonbuyers, respectively. That is, even when disclosing the associated product costs explicitly, groups \(s_1\) and \(s_4\) show significant interest in purchasing investment guarantees. While those persons in \(s_1\) are neither sensitive to changes in the product design nor the guarantee price, these two attributes are important levers for segment \(s_4\). The two nonbuying groups \(s_2\) and \(s_3\), on the other hand, are not interested in purchasing investment guarantees. This is particularly pronounced for \(s_2\), whereas a small portion of the persons in \(s_3\) can be attracted if the guarantee is directly tailored to their needs. Secondly, although their willingness to buy is significantly different, we only document a small degree of heterogeneity among the four segments with regard to the individual guarantee attributes and levels. The guarantee period is most important, followed by the volatility of the underlying fund, and the up-front premium. In contrast, the guarantee level and guarantee price are only of minor importance. Regarding the attribute levels, we find that all segments prefer shorter guarantee periods and lower up-front premiums. Thus, guarantee providers can contribute to an increased utility of their customers with appropriately designed products. Thirdly, we find that particularly those socioeconomic characteristics with an impact on individuals’ financial situation seem to be promising predictors of their group membership and their willingness to buy investment guarantee products. Hence, guarantee providers with reliable preference information are likely to gain additional market shares that may translate into increased profits.

Despite these contributions, some questions remain open. For instance, our analysis only concentrates on consumers’ product-related preferences, whereas the latent conflict of interest between the buyer and the seller of a guaranteed product is neglected. This conflict of interest, however, could also serve as potential explanation for the high SOP that we observe in the two buying segments. More specifically, once a guaranteed product has been purchased, customers would favor an increase in the volatility of the underlying fund as long as the insolvency risk of the guarantee provider remains unchanged. Guarantee providers, on the other hand, have clear incentives to reduce the risk of the underlying, since they want to avoid losses caused by negative market developments. In light of the fact that the guarantee provider decides about the investment strategy and the buyer is, at least to some extent, locked into the product, e.g., via surrender fees, customers could end up overpaying. Therefore, if buyers were explicitly made aware of this latent conflict of interest, their willingness to purchase an investment guarantee might be reduced. Finally, one could also extend our analysis to other countries with a comparable market for investment guarantees in order to investigate which role the cultural environment plays in consumers’ purchase decision processes.

Notes

While classical interest rate guarantees ensure a prespecified minimum rate of return at maturity, some newer and more complex forms ensure that customers receive at least a proportion of their initial investment back. In many countries, however, the level of the guarantee is set by law. For example, in the case of state-subsidized Riester pension contracts in Germany, at least the contributions paid in by the policyholder must be paid out again when the contract expires. In Belgium, on the other hand, there are fixed guarantees for occupational pension plans, whereas in other OECD countries (e.g., Denmark, Chile, Hungary, etc.) the guarantees are defined in relation to the industry average or some market benchmark. Another example is the compulsory pension scheme in Switzerland which offers a yearly minimum interest rate guarantee of 1 per cent.

Note that for the latter types, Ruß and Schelling (2018) proposed the so-called multi cumulative prospect theory (MCPT), which takes into account that investors’ utility is also affected by interim changes in the contract value. In such a setting, a demand for cliquet-style guarantees can be explained if policyholders exhibit a strong preference for small changes in the value of the contract before maturity.

A comparison of different forms of investment guarantees with respect to their price sensitivity is provided by Orozco-Garcia and Schmeiser (2015).

Note that irrespective of the tangible presentation of choices, CBC experiments remain artificial in nature and thus, may give rise to hypothetical bias (Cummings et al. 1995; Harrison and Rutström 2008). Some authors therefore suggest drawing on incentive-aligned study designs such as the well-known Becker et al. (1964) mechanism. In the latter, for example, respondents are obligated to purchase a product if the price drawn from a lottery is less than or equal to their stated willingness to pay (Miller et al. 2011). Although the implementation of such economic incentive has generated good results in some studies (Wertenbroch and Skiera 2002), it is not practical for investment guarantees.

These so-called part-worth utility profiles are the main result of the CBC analysis and contain information on respondents’ preferences for each attribute level included in the experiment (Orme 2010). LC analysis, in turn, is a statistical technique that allows classifying observations based on patterns of categorical input variables (responses).

We imposed a monotonicity utility constraint for estimating the part-worth profiles of the attribute guarantee price, which ensured that higher prices have larger negative utility values. As pointed out by Sawtooth Software (2004), such constraints are helpful to obtain more meaningful and interpretable within-segment preferences.

Note that our analysis exclusively concentrates on consumer preferences for the interest rate guarantee, whereas the underlying financial product is not of interest. Since one cannot purchase point-to-point interest rate guarantees on a standalone basis, this up-front premium could therefore be understood as the savings component of a unit-linked life insurance contract, etc. However, it neither covers any risk components nor the guarantee price itself.

The corresponding fact sheets of the three investment funds are available at Zurich Insurance (2018).

Financial decision makers are either fully responsible for making financial decisions or are at least involved in doing so. This criterion ensured that each respondent understands the central mechanics of a point-to-point interest rate guarantee and can therefore make sufficiently informed decisions in the discrete choice experiment.

To ensure that the participants knew at all times during the experiment what the individual guarantee attributes meant or which levels were available at all, a continuous “mouseover” with the respective background information was implemented. This means that all relevant information could be called up at any time by clicking on the attribute in the form of an info box.

We refrained from showing the guaranteed amount at contract maturity since it might induce unintended framing or anchoring effects (Tversky and Kahneman 1981).

Instead of presenting the no-choice option as the fourth “product alternative” in the choice tasks (i.e., Guarantee A, Guarantee B, Guarantee C, None), we decided to implement the so-called dual-response none option (see Diener et al. 2006). That is, respondents must first decide which of the three investments guarantees they prefer and then state afterwards, whether, if given the option, they would actually be willing to purchase the investment guarantee. Despite a possibly greater tendency to actually choose the none option, this experimental design has the advantage that no information regarding the estimation of the actual parameters (i.e., the guarantee attributes) is lost (see Diener et al. 2006). The concrete design of the dual-response none option is shown in Fig. 3 in Appendix: “If given the option, would you purchase the guarantee? Yes/No”.

In contrast to minimal overlap designs in which each attribute level is shown as little as possible per choice task, balanced overlap with a modest degree of level repeating has the advantage that respondents cannot select or exclude a product purely based on their individual “must-have” or “unacceptable” level. To be more specific, if the latter is present in more than one alternative, respondents are required to trade off all remaining attribute levels against each other and thus, provide more information about their individual preferences. Moreover, besides avoiding such superficial responses based on only one attribute level, balanced overlap is also a more realistic representation of actual product offerings that usually tend to overlap in their respective characteristics such as brand, price, etc. as well (Orme 2015).

Note that the number of holdout choices was chosen in accordance with the results of Chrzan (2015). In line with the random tasks, the attribute order was held constant as well. Regarding their specific design, the first two holdout tasks were generated by balanced overlap and the third task by minimal overlap (cf. Table 6 in Appendix). Overall, the general purpose of holdout tasks is to test the consistency of responses across the CBC experiment, i.e. to provide an indication of face validity of the utility estimates (Orme 2015). In this regard, we first estimated all segment-level part-worth utility profiles from the responses to the nine random choice tasks and then drew on these estimates to predict the individual choices to the holdout tasks. Table 7 in Appendix contains the differences between the actual and predicted holdout choices.

In CBC analysis, level balance means that each level of an attribute is shown to respondents approximately the same number of times (Sawtooth Software 2007). An orthogonal experimental design, on the other hand, is given when the patterns of attribute levels shown during the choice tasks are balanced and uncorrelated. For example, if an experiment contains only two attributes, each with three different levels, the result is a nine-cell contingency table. This table captures how often the respondents were shown each pair of levels. In orthogonal designs, these counts are equal.

Cummings and Taylor (1999) were the first to introduce a cheap talk design with the aim of analyzing whether the contingent valuation method leads to inflated real economic values.

The exact wording is available from the authors upon request.

The maximum utility rule assumes that each respondent chooses the product alternative that provides him with the highest utility (Orme 2010). However, while taking into account neither errors in respondents’ choice processes nor errors in the part-worth estimation (Louviere 1988; Elrod and Kumar 1989), it further predicts more extreme market shares than observed in reality. For instance, if a respondent would be 51 per cent in favor of guarantee A and 49 per cent in favor of guarantee B, guarantee A would capture 100 per cent of her SOP, although both products are almost identically preferred. This simple example illustrates that the maximum utility rule only provides information about the first choice of the respondent, whereas all preference information about the remaining product alternatives in the market are ignored. Moreover, it is less robust than other choice rules, since small changes in utility values can lead to substantially different SOP figures.

As suggested by Orme (2005), we ran a total of 200,000 sample iterations.

Further information on these goodness-of-fit statistics can be found in Sawtooth Software (2004). However, it is important to note that choosing the number of segments according to the absolute values of these statistics is less useful. Instead, Sawtooth Software (2004) rather recommends to look at differences if one group is added or removed.

The log-likelihood of the four-group solution is − 14,560 compared to − 20,576 for the null solution.

Note that a product is only chosen if its total utility exceeds the none utility. Hence, high none utility values make it unlikely that a guarantee is purchased, while the opposite holds true for low or even negative none utilities.

To the best of our knowledge, there is no aggregated overview of the German market for investment guarantees. In order to nevertheless define a realistic product range, we have therefore searched the websites of life insurers such as Allianz Leben, R+V Lebensversicherung, or AachenMuenchener Leben as well as other financial service providers offering German Riester pensions such as Deutsche Bank, Sparkasse, Union Investment, etc.

Note that this corresponds to the maximum permissible guarantee level for cliquet-style participating life insurance policies in Germany.

Although investment guarantee C may not be representative for the majority of investment guarantees sold in Germany, we decide to include it in our analysis in order to illustrate consumer preferences for high-end products as well.

Note that the SOP decrease to approximately 24 per cent (\(\hbox{IG}_{\mathrm{C}}\)) and 35 per cent (\(\hbox{IG}_{\mathrm{A}}\) and \(\hbox{IG}_{\mathrm{B}}\)), when the guarantee price is at its maximum of 160 per cent of the OPT price.

Note that a low level of education covers pre-vocational trainings and secondary education, a medium level covers apprenticeships and vocational trainings, and a high level covers university degrees.

Following van Rooij et al. (2011), we measured financial literacy by four questions that capture respondents’ understanding of basic concepts such as numeracy, interest rates, inflation, and money illusion (see Table 9 in Appendix). Those with more than two correct answers were classified as having a “high” financial literacy, whereas those with two or less correct answers were classified as having a “low” financial literacy. In this regard, note that we further distinguished between “incorrect” and “do not know/refusal” answers (Mitchell and Lusardi 2011).

We measured a respondent’s investment risk attitude by three questions that have been adapted from the so-called Domain-Specific Risk-Taking (DOSPERT) scale of Weber et al. (2002). Since our survey has been conducted in Germany, we drew on the translated version provided by Johnson et al. (2004). Moreover, in line with Blais and Weber (2006), the number of points on the Likert scale has been increased from five to seven in order to improve its psychometric quality (Visser et al. 2000). Those respondents with a mean score equal to and above four were classified as having a “high” investment risk attitude, whereas those with a mean score below four were classified as having a “low” investment risk attitude (Blais and Weber 2006).

While segment \(s_3\) constitutes an exception, the remaining figures are in line with their CBC part-worth profiles for the volatility of the underlying fund as shown in Fig. 1.

However, although 34.3 per cent of \(s_2\) and 33.0 per cent of \(s_3\) stated their general interest in investment guarantees, this does not necessarily mean that they will actually become buyers. Instead, as demonstrated by our results in Table 4, it requires a tailor-made product design to attract a small portion of \(s_3,\) whereas those respondents in \(s_2\) will be hard to convince.

References

Antolín, P., S. Payet, E.R. Whitehouse, and J. Yermo. 2011. The role of guarantees in defined contribution pensions. OECD Working Papers on Finance, Insurance and Private Pensions.

Backhaus, K., R. Wilken, M. Voeth, and C. Sichtmann. 2005. An empirical comparison of methods to measure willingness to pay by examining the hypothetical bias. International Journal of Market Research 47 (5): 543–562.

Becker, G.M., M.H. DeGroot, and J. Marschak. 1964. Measuring utility by a single response sequential method. Behavioral Science 9 (1): 226–232.

Blais, A.-R., and E.U. Weber. 2006. A domain-specific risk-taking (DOSPERT) scale for adult populations. Judgement and Decision Making 1 (1): 33–47.

Boyle, P.P., and E.S. Schwartz. 1977. Equilibrium prices of guarantees under equity-linked contracts. Journal of Risk and Insurance 44 (4): 639–660.

Bozdogan, H. 1987. Model selection and Akaike’s Information Criterion (AIC): The general theory and its analytical extensions. Psychometrika 52 (3): 345–370.

Branger, N., A. Mahayni, and J.C. Schneider. 2010. On the optimal design of insurance contracts with guarantees. Insurance: Mathematics and Economics 46 (3): 485–492.

Braun, A., H. Schmeiser, and F. Schreiber. 2016. On consumer preferences and the willingness to pay for term life insurance. European Journal of Operational Research 253 (3): 761–776.

Chakraborty, B.G., R. Ettenson, and G. Gaeth. 1994. How consumers choose health insurance. Journal of Health Care Marketing 14 (1): 21–33.

Chrzan, K. 2015. How many holdout tasks for model validation? Sawtooth Software Research Paper.

Cummings, R.G., G.W. Harrison, and E.E. Rutström. 1995. Homegrown values and hypothetical surveys: Is the dichotomous choice approach incentive-compatible? American Economic Review 85 (1): 260–266.

Cummings, R.G., and L.O. Taylor. 1999. Unbiased value estimates for environmental goods: a cheap talk design for the contingent valuation method. American Economic Review 89 (3): 649–665.

Cummins, J.D., K.R. Miltersen, and S.-A. Persson. 2007. International comparison of interest rate guarantees in life insurance. Working Paper at the Norwegian School of Economics and Business Administration, Bergen.

DeSarbo, W.S., V. Ramaswamy, and S.H. Cohen. 1995. Market segmentation with choice-based conjoint analysis. Marketing Letters 6 (2): 137–147.

Dichtl, H., and W. Drobetz. 2011. Portfolio insurance and prospect theory investors: Popularity and optimal design of capital protected financial products. Journal of Banking & Finance 35 (7): 1683–1697.

Diener, C., B.K. Orme, and J. Orlyn. 2006. Dual response “none” approaches: Theory and practice. In Proceedings of the Sawtooth software conference, pp. 157–168.

Dierkes, M., C. Erner, and S. Zeisberger. 2010. Investment horizon and the attractiveness of investment strategies: A behavioral approach. Journal of Banking & Finance 34 (5): 1032–1046.

Doherty, N.A., and J.R. Garven. 1986. Price regulation in property–liability insurance: A contingent-claims approach. Journal of Finance 41 (5): 1031–1050.

Dominique-Ferreira, S. 2017. How important is the strategic order of product attribute presentation in the non-life insurance market? Journal of Retailing and Consumer Services 34 (January): 138–144.

Dominique-Ferreira, S. 2018. The key role played by intermediaries in the retail insurance distribution. International Journal of Retail & Distribution Management 46 (11/12): 1170–1192.

Dominique-Ferreira, S., H. Vasconcelos, and J. Proença. 2016. Determinants of customer price sensitivity: An empirical analysis. Journal of Services Marketing 30 (3): 327–340.

Døskeland, T.M., and H.A. Nordahl. 2008. Optimal pension insurance design. Journal of Banking & Finance 32 (3): 382–392.

Ebert, S., B. Koos, and J. Schneider. 2012. On the optimal type and level of guarantees for prospect theory investors. In Paris December 2012 Finance Meeting EUROFIDAI-AFII Paper, p. 32.

Elrod, T., and S.K. Kumar. 1989. Bias in the first choice rule for predicting share. In Proceedings of the Sawtooth software conference, vol. 1, pp. 259–271.

European Insurance and Occupational Pensions Authority (EIOPA). 2017. Report on thematic review on monetary incentives and remuneration between providers of asset management services and insurance undertakings. https://eiopa.europa.eu.

Fifer, S., J. Rose, and S. Greaves. 2014. Hypothetical bias in stated choice experiments: Is it a problem? And if so, how do we deal with it? Transportation Research Part A: Policy and Practice 61: 164–177.

Finkelstein, G., E. McWilliam, S. Nagle, P. de Beus, R. van Leijenhorst, L. Maas, and J. Cui. 2003. Guarantee and embedded options. Working Paper.

Gale, W.G., D.C. John, and B. Kim. 2016. You get what you pay for: guaranteed returns in retirement saving accounts. The Brookings Institution, March.

Gatzert, N., I. Holzmüller, and H. Schmeiser. 2012. Creating customer value in participating life insurance. Journal of Risk and Insurance 79 (3): 645–670.

Gatzert, N., C. Huber, and H. Schmeiser. 2011. On the valuation of investment guarantees in unit-linked life insurance: A customer perspective. Geneva Papers on Risk and Insurance 36 (1): 3–29.

Gatzert, N., and H. Schmeiser. 2009. Pricing and performance of mutual funds: Lookback versus interest rate guarantees. Journal of Risk 11 (4): 31–49.

German Federal Ministry of Justice and Consumer Protection. 2016. Verordnung über Rechnungsgrundlagen für die Deckungsrückstellungen (Deckungsrückstellungsverordnung—DeckRV).

German Insurance Association (GDV). 2018. Das Versicherungsjahr 2018 (in German only).

Graf, S., A. Kling, and J. Ruß. 2011. Risk analysis and valuation of life insurance contracts: Combining actuarial and financial approaches. Insurance: Mathematics and Economics 49 (1): 115–125.

Green, P.E., J. Carroll, and S. Goldberg. 1981. A general approach to product design optimization via conjoint analysis. Journal of Marketing 45 (3): 17–37.

Green, P.E., and V. Srinivasan. 1978. Conjoint analysis in consumer research: Issues and outlook. Journal of Consumer Research 5 (September 1978): 103–123.

Gustafsson, A., A. Herrmann, and F. Huber. 2007. Conjoint analysis as an instrument of market research practice. In Conjoint measurement: Methods and applications, 4th ed., ed. A. Gustafsson, A. Herrmann, and F. Huber, 3–30. Berlin: Springer.

Hansen, M., and K.R. Miltersen. 2002. Minimum rate of return guarantees: The Danish case. Scandinavian Actuarial Journal 2002 (4): 280–318.

Harrison, G.W., and E.E. Rutström. 2008. Experimental evidence on the existence of hypothetical bias in value elicitation methods. In Handbook of experimental economics results, ed. C.R. Plott and V.L. Smith, vol. 1. Amsterdam: Elsevier.

Hartley, D., A. Paulson, and R.J. Rosen. 2016. Measuring interest rate risk in the life insurance sector: The U.S. and the U.K. Working Paper at the Federal Reserve Bank of Chicago.

Hausman, J.A., and D.A. Wise. 1978. A conditional probit model for qualitative choice: Discrete decisions recognizing interdependence and heterogeneous preferences. Econometrica 46 (2): 403–426.

Holsboer, J.H. 2000. The impact of low interest rates on insurers. Geneva Papers on Risk and Insurance - Issues and Practice 25 (1): 38–58.

Huber, J. 1997. What we have learned from 20 years of conjoint research: When to use self-explicated, graded pairs, full profiles or choice experiments. In Proceedings of the Sawtooth software conference, August, pp. 243–257. Provo: Sawtooth Software Inc.

Huber, J., B. Orme, and R. Miller. 1999. Dealing with product similarity in conjoint simulations. Sawtooth Software Research Paper.

Huber, J., and K. Zwerina. 1996. The importance of utility balance in efficient choice designs. Journal of Marketing Research 33 (3): 307–317.

Jahnert, J.R., H. Schmeiser, and F. Schreiber. 2021. Pricing strategies in the German term life insurance market: An empirical analysis.

Johnson, J.G., A. Wilke, and E.U. Weber. 2004. Beyond a trait view of risk taking: A domain-specific scale measuring risk perceptions, expected benefits, and perceived-risk attitudes in German-speaking populations. Polish Psychological Bulletin 35 (3): 135–163.

Johnson, R.M. 1974. Trade-off analysis of consumer values. Journal of Marketing Research 11 (2): 121–127.

Johnson, R.M. 1987. Adaptive conjoint analysis. In Sawtooth software conference on perceptual mapping, conjoint analysis, and computer interviewing, pp. 253–265..

Kablau, A., and M. Wedow. 2012. Gauging the impact of a low interest rate environment on German life insurers. Applied Economics Quarterly 58 (4): 279–298.

Kamakura, W.A., and G.J. Russell. 1989. A probabilistic choice model for market segmentation and elasticity structure. Journal of Marketing Research 26 (4): 379–390.

Kerssens, J.J., and P.P. Groenewegen. 2005. Consumer preferences in social health insurance. European Journal of Health Economics 6 (1): 8–15.

Lachance, M.E., and O.S. Mitchell. 2003. Guaranteeing Individual accounts. American Economic Review 93 (2): 257–260.

Loomis, J. 2011. What’s to know about hypothetical bias in stated preference valuation studies? Journal of Economic Surveys 25 (2): 363–370.

Louviere, J.J. 1988. Conjoint analysis modelling of stated preferences: A review of theory, methods, recent developments and external validity. Journal of Transport Economics and Policy 22 (1): 93–119.

McFadden, D. 1974. Conditional logit analysis of qualitative choice behavior. In Frontiers in econometrics, Chap. 4, 105–142. New York: Academic Press.

Miller, K.M., R. Hofstetter, H. Krohmer, and Z.J. Zhang. 2011. How should consumers’ willingness to pay be measured? An empirical comparison of state-of-the-art approaches. Journal of Marketing Research 48 (1): 172–184.

Miltersen, K.R., and S.-A. Persson. 2003. Guaranteed investment contracts: Distributed and undistributed excess return. Scandinavian Actuarial Journal 2003 (4): 257–279.

Mitchell, O., and K. Smetters. 2003. The pension challenge: Risk transfers and retirement income security. Oxford: Oxford University Press.

Mitchell, O.S., and A. Lusardi. 2011. Financial literacy: Implications for retirement security and the financial marketplace. Oxford: Oxford University Press.

Murphy, J.J., T. Stevens, and Darryl Weatherhead. 2005. Is cheap talk effective at eliminating hypothetical bias in a provision point mechanism? Environmental and Resource Economics 30 (3): 327–343.

Orme, B.K. 2002. Formulating attributes and levels in conjoint analysis. Sawtooth Software Research Paper.

Orme, B.K. 2005. Client conjoint simulator (CCS). Sequim, WA: Sawtooth Software.