Abstract

Kazakhstan is a leading producer of uranium and chromium and has significant reserves of critical raw materials. We assess economic sustainability of Kazakhstan’s mining, focusing on its labor productivity, a key factor in counteracting the effects of resource depletion and increasing costs. We find that during 2000–2021, labor productivity continued improving in mining of non-ferrous metals and industrial minerals. Our firm-level analysis demonstrates that domestic non-ferrous mining firms were able to achieve productivity level comparable to that of modern mining industries. They reduced energy intensity, increased efficiency of processing plants, and accessed higher-quality reserves. In addition, managerial innovations, engaging with the workforce, and introduction of advanced technologies were prominent in analyzed firms. However, following a period of rapid growth during the early 2000s, productivity stagnated in Kazakhstan’s coal mining while it decreased in iron ore mining. We relate such performance to iron ore depletion from underinvestment in exploration. In coal mining, stagnating productivity reflects this sector’s protected status and substantial fossil fuel subsidies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Kazakhstan ranks among top ten countries globally according to its tungsten, chromium, uranium, manganese, zinc, lead, copper, coal, and silver reserves (Kazakhstan Government 2012). Many of these minerals are critical raw materials: they are relatively scarce and are important for deployment of renewable energy technologies and transport electrification (Vakulchuk and Overland 2021). In 2021, Kazakhstan mined 21,800 tons of uranium (45% of world supply; Nuclear Power Association 2022), 7 million tons of chromite (17% of world supply), and 16,000 tons of titanium sponge (7% of world supply) (USGS 2022). In addition, Kazakhstan produced 116 million tons of coal, 64 million tons of iron ore, and 520,000 tons of copper (Kazakhstan government 2022).

Due to the rich mineral endowment, a share of natural resource sector in the overall economic activity in Kazakhstan is substantial: natural resource rent represents 21% of its gross domestic product. Specifically, 15% and 4% of GDP are attributed, respectively, to the petroleum sector and mining. During 2001–2010, physical volumes of crude oil production in Kazakhstan grew at an average of 8.6% per year. At the peak of the boom, the oil sector accounted for more than 60% of Kazakhstan’s export value and more than 50% of total government revenues (Atakhanova 2021). To reduce the destabilizing effect of oil dependence and promote economic diversification, the government of Kazakhstan designed a number of programs aimed at development of non-oil sectors, including mining (Howie 2018).

However, our research finds that one of the key constraints to sustainable development of mining industry in Kazakhstan is its low productivity. Specifically, in iron ore and coal mining, output per worker in Kazakhstan represents only 10–40% of the level observed in the USA. In fact, low and decreasing productivity is observed in many sectors of Kazakhstan’s economy. After a period of rapid growth at 6% per year during the first decade of the 2000s, Kazakhstan’s economy-wide total factor productivity growth decreased to 2% per year during 2010–2019 (World Bank 2019). Deceleration of economy-wide productivity growth in Kazakhstan was due to falling commodity prices, declining productivity levels in individual industries, institutional factors (a large presence of the state in the economy, low levels of competition, and deficiencies in the rule of law), as well as economic factors (diminishing returns to capital given the high levels of public investment during the boom) (World Bank 2019).

As for mining, the non-renewable nature of resources and the resulting depletion represent an ongoing concern for mineral producers. Exploration and improving labor productivity are of crucial importance for mining as they offset the effects of depletion caused by resource extraction. Determinants of mining productivity include increasing availability of capital and other inputs per worker, relocating to low-cost mines, closing unprofitable mines, obtaining access to high-grade ores, exploiting economies of scale by building larger mines, and using larger equipment (Humphreys 2020; Topp 2008). Factors that provide lasting effects on mining productivity include new technologies (in-pit crushers, mine automation), managerial innovations, and raising skills of mining labor force (Aydin and Tilton 2000; Jara et al. 2010). Finally, commodity price cycles and government regulations produce additional impacts on mine productivity (Aydin 2020; Tilton 2014).

Sustaining productivity growth is important for international competitiveness of domestic producers and increasing standards of living. Kazakhstan has a long history of mining which played a key role in its industrial development (Peck 2003). The breakdown of the Soviet Union in 1991 and severing of the sector’s forward and backward linkages put a large strain on Kazakhstan’s mining: during the 1990s, iron ore and coal output decreased by an average of 1.5% and 4.7% per year, respectively. General economic recovery and the rise of mineral prices during the 2000s allowed the sector to revert its output decline. Nevertheless, the legacy of central planning continues, presenting challenges in Kazakhstan and other mineral-producing countries in the Eurasian region (Azhibay 2022). This legacy includes years of underinvestment, wide use of manual labor, and poor environmental and health-and-safety record, as well as deficiencies in mineral policy and its implementation (Kundakova 2016; Rastiannikova 2018; OECD 2018). Yet, research on mining in Kazakhstan and the wider Eurasian region remains limited. As a result, our study intends to reduce this gap in the literature on economic sustainability of mining Kazakhstan and the Eurasian region. Analysis of environmental and social aspects of sustainable mining is beyond the scope of our study. However, we do find important connections between the economic and environmental aspects of sustainable mining that require further investigation.

Materials and methods

A common presentation of the aggregate production function is

where Q is output, K is capital, and L is labor, while α and β are respective output elasticities of capital and labor, respectively. A is total factor productivity (TFP). It represents the residual effect of changes in output that cannot be attributed to changes in quantities of capital or labor. TFP growth depends on within-firm productivity growth and resource allocation across firms. The within-firm productivity is determined by innovation and technology adoption, both of which require investments in physical, human, and intangible (R&D) capital. A key consequence of the 2008–2009 international financial crisis was a drastic reduction in global productivity growth due to the following factors (World Bank 2019):

-

1.

Secular drivers, which include population aging, waning effects of the ICT revolution, and fading effects of market liberalization in emerging and developing economies

-

2.

Cyclical factors due to tight credit conditions and weakened balance sheets of private firms, reduced capital accumulation and innovation, and risk aversion as a consequence of the 2008–2009 global financial crisis (Adler et al. 2017)

-

3.

Structural factors due to gradual decrease in the contribution of agriculture and manufacturing to aggregate output and increasing role of services. The labor-intensive nature of services and generally lower level of labor productivity in this sector affect economy-wide productivity (Howie and Atakhanova 2020).

A measure of productivity of all inputs, TFP is related to labor productivity. The latter is determined as a ratio of output per unit of labor (a worker or an hour worked). Labor productivity responds to changes in capital (physical, natural, or human capital) and changes in TFP (related to technology, management, policy, institutions, and competition). The slowdown in TFP growth was especially abrupt in mineral-exporting countries. In such countries, there are additional factors that contribute to the structural and cyclical drivers (Tilton 2014):

-

4.

Structural drivers in the mining sector imply declining productivity due to the exhaustive nature of mineral resources. Higher-quality and more readily accessible resources are extracted first. Further production requires increased intensity of the use of inputs because of the lower grade and accessibility of deposits.

-

5.

Cyclical drivers may affect mining productivity in two ways. On the one hand, falling commodity prices tighten budget and capital constraint and reduce investment in all types of capital. On the other hand, low commodity prices force high-cost producers that became operational during the booming period to leave, increasing the overall productivity.

Based on the understanding of these labor productivity drivers, our goal is to analyze the performance of the entire mining industry in Kazakhstan and its subsectors. The analysis will consider two periods: 2000–2010, i.e., the period of generally rising mineral prices, and 2011–2019, i.e., the post-financial crisis period of the generally falling mineral prices, which took place before the COVID-19 pandemic. For this purpose, we will use official statistics information of the Ministry of Economy of the Republic of Kazakhstan.

In addition, we will conduct empirical analysis of labor productivity at a firm level. A commonly used Cobb–Douglas production function may be applied to modeling mine output as follows (Aguirregabiria and Luengo 2016):

where i is the indicator for the mine and t is the time indicator. Q is mining output, L is labor, K is capital, E is energy, G is ore grade, and R is recovery rate at the mineral processing facility. All variables are in the natural logarithm form. As we make a step from the production function to modeling labor productivity, we should discuss two main approaches to its measurement: output per worker versus output per hour worked. Although the second measure is more precise as it directly controls for variations in time worked due to weather, unplanned stoppages, or contract arrangements, we use the first measure due to data availability. Modifying Aydin (1998), we define output per worker as given by the following expression:

where i is the indicator for the mine and t is the time indicator. All variables are in the natural logarithm form. q is mining output per worker, k is capital expenditures per worker in the previous period, energy is energy per ton of ore extracted, G is ore grade, and R is recovery rate at the mineral processing facility; waste is a ratio of waste rock weight to the weight of extracted ore, and share is the share of copper in total revenue. Log–log specification removes complications in interpreting estimation results due to different units of measurement of explanatory variables. Such a specification allows us to interpret a given β coefficient as percent change in per worker output due to a 1% change in a corresponding explanatory variable. This model will be estimated using the fixed-effects panel data methodology (Arellano and Bond 1991). Empirical analysis of labor productivity at the firm level will be carried out using publicly available reports of domestic mining companies.

Results

Industry-level analysis

Let us first consider the most recent indicators for the four types of mining in Kazakhstan: coal, iron ore, non-ferrous metals (copper, lead, zinc, chromium), and industrial minerals (stone, asbestos, gypsum, phosphate rock, clay, salt, barite). Like in many other countries, during the COVID-19 pandemic, Kazakhstan’s mining companies had to deal with disruptions in supply chains, while they invested in occupational safety, and increased use of remote work (Kabdygalieva 2022). During this period, mining jobs and the number of producers fell in Kazakhstan’s coal and industrial mineral mining (see Table 1). Investment decreased in most sectors, except for industrial minerals. The latter may be related to public spending on domestic construction industry. Output grew in iron ore and non-ferrous metal mining. As for coal and industrial mineral mining, their production first contracted, but then rebound to the pre-pandemic level or higher. Judging by the number of firms, industrial mineral mining industry of Kazakhstan has a high level of domestic competition. Foreign competition may be relevant for non-ferrous and iron ore mining industries as significant shares of their output are exported, mostly to China and Russia. Exposure to competition appears to be the lowest in Kazakhstan’s coal mining as its key consumers are domestic power and steelmaking industries and households (Howie and Atakhanova 2017).

Next, we analyze Kazakhstan’s mining industry before the COVID-19 pandemic. During 2000–2010, domestic mining operated in an expansionary phase of the commodity boom when international copper, coal, and iron ore prices grew on average at 16%, 17%, and 20% per year, respectively (after adjustment for inflation). During 2011–2019, respective growth rates of these mineral prices were 2%, 2.5%, and 5.5%. To study the use of key resources in the mining industry, we use Kazakhstan’s input–output tables, which report all information as expenditures measured in monetary units. Table 2 contains expenditures on key resources as a percent of mining output value. To account for varying degrees of changes in prices, we deflate labor expenditures using the consumer price index. Other expenditures and output values are deflated using respective producer price indices. As we compare average values of the later period with the first decade of the 2000s, we observe an increasing intensity of the use of fuel by metal mining and increasing water use in industrial mineral mining. Coal mining increased its use of all resources. Across all mining subsectors, capital contribution to output remained unchanged while the share of labor expenditures in output value increased. This resulted in falling capital-labor ratio across all sectors, especially in coal mining.

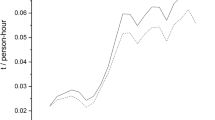

We proceed to analyzing data from a specialized official statistical publication, Industry of Kazakhstan. These data are reported in domestic currency units, KZT or Kazakhstan Tenge. Based on Figs. 1, 2, 3, and 4 and Table 3, non-ferrous metal mining was the most dynamic sector in Kazakhstan’s mining. It achieved the highest rates of growth of output, investment, and labor earnings during the entire 20-year period that we analyze. Most importantly, this sector exhibited persistent improvement in labor productivity (measured as output value per person employed). Even higher rates of labor productivity growth were observed in the industrial mineral sector. It is noteworthy that labor productivity in this sector demonstrated high growth rates despite contraction of earnings after the real estate bust in 2007. This outcome may be related to the large number of small firms in industrial mineral sector and its falling employment (see Fig. 3 and Table 1). Next, iron ore mining was the least performing mining sector in Kazakhstan. After a brief period of rapid growth of investment and output in the early 2000s, iron ore mining entered a period of contraction of investment and labor productivity. With its work force unchanged and falling output levels, contribution of iron ore mining to Kazakhstan’s economic development is the lowest one among the four mining sectors. These developments resulted in large changes in sector shares in total mining industry value: between 2001 and 2019, output shares of coal and iron ore mining decreased from 30 to 14% and from 22 to 16.5%, respectively, while the share of non-ferrous mining increased from 37 to 59%. As far as coal mining, despite continuous high levels of investment, its labor productivity stagnated since 2010 (see Table 3 and Fig. 4). Coupled with rising earnings and rapidly increasing employment, stagnating labor productivity raises concerns about sustainability of coal mining. Such outcomes in coal mining industry may be related to its protected status and subsidies that fossil fuel producers in Kazakhstan receive from the government on the account of energy affordability (Howie and Atakhanova 2022). Specifically, Organization for Economic Cooperation and Development (2014) estimated the level of subsidization of coal consumption in Kazakhstan to be around 10% while that of oil and petroleum products was 55%. In addition, as coal mining was part of vertically integrated power and smelting conglomerates, coal mining indirectly benefited from the 30% electricity subsidy (Organization for Economic Cooperation and Development 2014). Let us consider the effect of subsidies on fossil fuel producers in other countries. Research by Erickson et al. (2017) shows that at an oil price of $50 per barrel, 40–70% of oil production in key producing regions in the USA is subsidy-dependent. However, at a price of $100 per barrel, none of US production is subsidy-dependent and all subsidies go to support higher firm profits. Furthermore, research by Monasterolo and Raberto (2019) demonstrates that removal of subsidies to extractive energy producers significantly improves tax collection, reduces GHG emissions, and permits financing of broad-based renewable energy consumer subsidies. In other words, findings by other authors imply that fossil fuel subsidies keep producers’ profits at unsustainably high levels and remove incentives for productivity and efficiency improvement. In addition, subsidies to fossil fuel producers promote investment in long-lasting extraction projects. Thus, they hinder low-carbon transition in both the short and long terms (Erickson et al. 2020).

Considering data from Tables 2 and 3 allows us to offer an interpretation of changes in capital-labor ratio and productivity. Capital compensation in input–output tables is determined as a residual. In the case of extractive industries, it measures the contribution of not only man-made physical capital but also natural capital. Natural capital refers to the value of natural resources in the ground, which changes as prices of commodities fluctuate, resources are discovered and depleted, or technology of their production improves (Ericsson and Lof 2019). From Table 2, overall investment in physical capital in Kazakhstan’s mining grew and it grew at rates higher than that of the output (except iron ore mining). This means that a decrease in capital-labor ratio may be due to declining natural capital from depletion and falling mineral prices. To verify our proposition, we obtain estimates of reserves presented in Table 4 (based on USGS 2022). We find that reserves did fall in the case of iron ore, i.e., reduction in natural capital may explain falling productivity of iron ore mining. However, in the case of coal mining reserves, investment and employment increased. As a result, given increasing physical and natural capital, falling productivity may be indicative of declining skills of the workforce. This may be a plausible explanation because by increasing employment by 9% per year (see Table 2), Kazakhstan’s coal mining companies likely accepted lower skills to hire more workers, as skilled mining labor is scarce. In addition, Kazakhstan’s coal mining labor force became less diverse in terms of gender: the share of female managers decreased during 2010–2020, and there were signs of persistent vertical gender discrimination in labor compensation. These findings are important because gender diversity is associated with greater firm efficiency and better ESG outcomes (Atakhanova and Howie 2022).

To evaluate the availability of skills in mining, we rely on the results of the Annual Survey of Mining Companies (Yunis and Aliakbari 2022). This international survey evaluates investment attractiveness of mining jurisdictions based on responses of mining companies’ executives. Table 5 presents shares of respondents that consider the availability of labor and skills as conducive to mining investment in a given jurisdiction. These data suggest that after 2007, most respondents perceived Kazakhstan’s mining labor availability and skills as not a deterrent to investment. However, by 2021 50% of respondents considered this factor as a mild deterrent to investment. (Perception of availability of mining labor and its skills in Russia was similar to that of Kazakhstan, with some signs of improvements in the later period. Russia is an acceptable comparator due to the common past and similarities in education systems of the two countries.) These findings suggest that mining labor in Kazakhstan, including skilled labor, has become more scarce, especially in comparison to neighboring counties. This may explain why mining salaries in Kazakhstan grew without matching increases in labor productivity (see Table 3).

To conclude industry-level analysis, we may compare Kazakhstan’s mining labor productivity indicators to the USA, where the average annual coal output per worker during 2001–2011 was around 9400 tons (US EIA 2012). Furthermore, in the USA, the average iron output per worker in 2003 was around 10,000 tons (USGS 2003). In contrast, coal production per worker in Kazakhstan was on average at 3766–3850 tons per year in 2001–2019. As for iron ore mining, labor productivity in Kazakhstan was 904–978 tons during 2001–2019. These results suggest that labor productivity in Kazakhstan coal and iron ore-metal mining represents 10–40% of its level in countries with modern mining industries. This is consistent with the finding by Rastiannikova (2018) that labor productivity in gold mining in Russia is 7–8 times lower than that in the USA and Australia.

Firm-level analysis

Next, we analyze individual companies to gain an understanding of firm-level productivity drivers. First, we consider the Eurasian Resources Group (ERG). It is the largest integrated mining and metallurgy company in Kazakhstan. Established in 1994, the ERG inherited large Soviet-time mining assets such as Aluminium of Kazakhstan (established in 1964; 8000 people employed) and SSGPO iron-ore mining subsidiary (established in 1954; 12,000 people employed). The largest asset of the ERG is KazChrome, established in 1938 and employing 19,000 workers. KazChrome is a world leader in high-quality chrome ore and top global producer of high-carbon ferrochrome. In addition, the ERG produces coal in Kazakhstan, and, starting from the mid-2010s, copper and cobalt in Africa and iron ore in Brazil. Table 6 presents key data for Kazakhstan operations of the ERG.

The ERG provides output and employment information by asset only for recent years. If we assume stable shares of employment across operations, then on average during 2014–2021, output per worker is estimated around 200 tons for chrome and alumina mining, while in iron ore and coal mining, output was around 900–1000 tons per worker. Based on our imputed values, these productivity levels did not change in chrome ore mining during 2014–2021. However, productivity grew on average at 4% per year in coal mining and 5.8% per year in iron ore and alumina mining. In general, between 1994 and 2018, the ERG invested around $14 billion in construction and renovation of plants and mines in Kazakhstan. An example of productivity-enhancing measure by the ERG was launching of USD 10 million “Smart Mine” project at Kacharsky iron-ore mine in Kazakhstan, intended to expand it to the rest of the company assets (ERG 2017). The project employed AI and real-time monitoring of the mine’s performance and production cycle. This enabled operators to prepare optimal production scenarios and schedule equipment dispatch and product delivery. This technology was connected to the firm’s systems of asset planning and geo-data. Implementation of Smart Mine enhanced productivity growth through minimization of failures, elimination of unscheduled downtime, optimization of equipment allocation, and reduction of expenses. Overall, the ERG planned to spend a total of $1.8 billion between 2018 and 2025 to enhance efficiency by 10% per year by implementing innovative technologies in its Kazakhstan operations (ERG 2017). Major investment expenditures of the ERG are summarized in Table 7. In addition, the company spent KZT39.2 billion over 5 years on social welfare, health care, benefits, and catering. Furthermore, the company supports continuous education, leadership programs, safety culture, and professional development.

In order to obtain a better understanding of firm-level productivity drivers, we use publicly available information on one more domestic mining company. We choose KAZ Minerals because this relatively young company disclosed detailed production and financial information to raise funds from the UK stock market. This company positions itself as a high-growth low-cost large-scale producer focused on open-pit copper mining in the Eurasian region, employing around 16,000 people. In 2020, the company produced 306,000 tons of copper, 5.6 tons of gold, 96 tons of silver, and 50,000 tons of zinc in concentrate (see Fig. 5). In 2014, this company branched out from Kazakhmys, the largest and the oldest copper-producing company in Kazakhstan. KAZ Minerals inherited from Kazakhmys three underground copper-zinc mines in Eastern Kazakhstan (47,000 tons of copper output per year) and a copper-silver-gold open-pit Bozymchak mine in Kyrgyzstan (5000 tons of copper output per year). Upon acquisition, the company modernized a concentrator and upgraded IT systems and electrical equipment at the older mines in Eastern Kazakhstan. At the same time, the company acquired two greenfield open-pit copper mines in Kazakhstan, Aktogay, and Bozshakol (see Table 8). Aktogay mine has an annual processing capacity of 50 million tons (an average copper grade is 0.25% for oxide ore and 0.33% for sulfide ore) at the net cash cost of 2.56 USD per kg with the remaining life of 25 years. The second new mine, Bozshakol, has an annual processing capacity of 30 million tons (an average copper grade is 0.35% for sulfide ore) at the net cash cost of 0.26 USD per kg, with the remaining life of 40 years. Both mines were within short distance to existing rail transportation and power infrastructure, which allowed KAZ Minerals to develop both sites within short time. At these greenfield open-pit mines, the company constructed large-scale processing plants that use modern grinding and floatation technologies. Automated remote dispatch systems were introduced to optimize truck dispatching and minimize consumption of diesel. In 2022–2023, the company introduced the use of artificial intelligence at Aktogay concentrator plant. This technology allowed the plant to increase the amount of ore processed by 7–8% while increasing the output by 2–3% and reducing costs. Currently, each new mine produces around 120,000–130,000 tons of copper per year (see Fig. 5). Finally, in 2019, KAZ Minerals acquired the Baimskaya copper project in Russia’s Chukotka region. Beginning of production from Baimskaya is anticipated in 2027 with an annual output of 300,000 tons of low-carbon copper, based on nuclear power generation.

Let us compare labor productivity at KAZ Minerals with international levels. According to Aydin (2020), US annual production during 2005–2015 was around 1.2 million tons with an annual employment of 13,000 people. In the case of KAZ Minerals, the company’s employment is 15,000–16,000 and copper output was 0.12–0.13 million tons in 2019–2020. Furthermore, according to Aydin (2020), US annual productivity in copper mining was around 120 tons/worker during 1995–2010, thereafter declining to around 90 tons/worker. During 2017–2020, KAZ Minerals productivity at its new mines was 46–65 tons/worker per year, which represents 50–75% of the US copper mining productivity. At its older mines, labor productivity was 6.5 tons/worker per year. Our empirical analysis would allow us to determine factors that explain such a large variation between labor productivities at different mines of the same company.

We use the company’s public reports to obtain quarterly data during Q1.2016–Q4.2020 for the four mine sites: Aktogay, Bozshakol, Bozymchak, and East Region. This allows us to evaluate our labor productivity model (3) described in the section “Materials and methods.” Fixed effects panel-data modeling estimation results are presented in Table 9.

First, we check for correlations between the explanatory variables, which are found to be at acceptable levels. Next, estimation results indicate that variations in explanatory variables jointly account for 70–90% of variation in labor productivity across time and mine sites. Variations in ore grades are significant in explaining the variability in labor productivity: a 10% higher grade is associated with 8% higher labor productivity. Whether or not by-products represent a sizable share of a company’s revenue does not influence labor productivity as evident from lack of statistical significance of the “copper share” variable. In addition, waste ratio does not produce a significant impact on labor productivity. However, as expected, the amount of capital per worker is important: a 10% increase in capital per worker is associated with a 2.5–5.6% increase in labor productivity. Efficiency of the processing plant is even more important: a 10% increase in recovery rate is associated with a 9–12% increase in labor productivity. Next, reduction in energy intensity of mining matters for productivity: a 10% decrease in energy intensity is associated with an 11% increase in labor productivity (this result is consistent with Ram et al. 2015 and Yepez-Garcia et al. 2021). Note that the model with the highest predictive power (based on within, between, and overall R2) is the one that uses consumption of diesel per ton of ore extracted as a proxy for energy intensity. Overall, our estimation results imply that increasing recovery rates at processing facilities and controlling the use of diesel fuel were the most important factors that are associated with output expansion and productivity growth at this company. We admit that our quantitative model overlooks qualitative productivity drivers at KAZ Minerals. These include technological innovations used by this company (e.g., automated dispatch, AI use previously discussed), as well as its managerial innovations (annual “Direct Line” live video feed with the company CEO, quarterly “town halls” with General Directors, “Speak Up” confidential telephone reporting of ethical concerns). In addition, an important factor is company strategy aimed at employee engagement, retention, and empowerment. For instance, KAZ Minerals provides annual HSE training and medical checkups for all employees, promotes team safety culture, conducts exit surveys, cooperates with labor unions, and conducts annual reviews of employee performance. The company has instituted Leadership Development Program that identifies potential future leaders and their individual development plans. Expatriate employees are explicitly required to mentor, coach, and train their local successors.

Conclusion

This study has analyzed economic sustainability of Kazakhstan’s mining industry with an emphasis on labor productivity. In early 2000 Kazakhstan’s mining output grew in response to positive price dynamics in the international commodity markets and rising level of investment. However, since 2010, economic growth decelerated worldwide and Kazakhstan’s mining output growth slowed down. Labor productivity decreased in iron ore mining and stagnated in coal mining. In these two sectors, labor productivity was around only 10–40% of mining output per worker in the USA. Declining productivity in Kazakhstan’s iron ore mining may be related to depletion: low levels of exploration activity in the non-fuel mineral sector did not match the high rates of mineral extraction (Brekeshev 2021). In addition, we believe that fossil fuel subsidies and declining mining labor force skills are important for understanding the lack of growth of productivity in coal mining.

Nevertheless, throughout our study period, labor productivity continued to improve in Kazakhstan’s mining of non-ferrous metals and industrial minerals. To understand factors that influenced labor productivity of non-ferrous metal mining industry, we analyze two most prominent mining companies in Kazakhstan. The ERG, the oldest and the largest integrated multi-product mining and metallurgy company, improved its productivity while it modernized older assets, digitized operations, and invested in workforce. KAZ Minerals, a copper mining company, achieved high growth and low production cost at open-pit mines in Eastern Kazakhstan. Access to high-grade reserves, proximity to existing infrastructure, automation of new mines, modernization of older mines, and managerial innovations aimed at empowering its employees allowed the firm to produce consistent performance. We demonstrate that, for such a dynamic Kazakhstani mining company, it was possible to achieve 75% of the level of labor productivity in US copper mining.

Our findings suggest that energy intensity may be one of the key factors of mine productivity. On the one hand, KAZ Minerals, an export-oriented copper-mining company, actively worked on addressing their energy use which, together with other factors, positively influenced their labor productivity. On the other hand, Kazakhstan’s coal mining with its close ties to domestic power and steelmaking industries faced limited competition and experienced no productivity growth during the last decade. Moreover, coal mining was the only sector that increased the intensity of use of all resources: power, fuel, and water. In addition, our results imply that limited competition and market distortions such as fossil fuel subsidies reduce incentives for energy intensity improvement and may indirectly affect labor productivity. Studies by other researchers find that fossil fuel subsidies not only delay low-carbon transition, but increase fossil fuel producer profits and investment in energy extraction. We believe that, although such subsidies benefited Kazakhstan’s coal mining output and employment expansion, they removed incentives for improving efficiency and productivity. More analysis is required to confirm spillovers and reinforcing effects of activities that improve both economic and environmental impacts of mining.

In addition, managerial interventions that reduce inefficiencies in resource use may have multiple benefits: firm-level analysis suggested that reduced energy intensity is associated with increasing labor productivity. This result differs from earlier studies of mining productivity. Specifically, Aydin (1998) finds that energy/labor ratio has a positive impact on labor productivity in the US copper mining while De Solminihac et al. (2018) find that higher energy prices (i.e., lower energy consumption) reduce labor productivity in Chilean copper mining. Aydin (1998) explains their result by the substitutability of energy and labor due to the substitution between labor and capital. Our results imply that, in our case study, labor and energy are complementary. More research is required in this direction, specifically the one that distinguishes between skill levels of mining labor force.

To conclude, our research contributes to learning about the economic sustainability of mining in the Eurasian region, as reflected in developments in labor productivity of Kazakhstan’s mining. Our study has limitations due to data availability. Further research is necessary to assess the importance of efficient resource pricing and mining workforce skills for mining productivity. In addition, analysis of mining policy and the overall business environment would allow mining industry stakeholders to identify and address additional constraints to economic sustainability of mining.

Data availability

Data are not provided as part of this manuscript.

References

Adler G, Duval RA, Furceri D, Celik K, Koloskova K, Poplawski-Ribeiro M (2017) Gone with the headwinds: global productivity. IMF Staff Discussion Notes No. 17/04. https://doi.org/10.5089/9781475589672.006

Aguirregabiria V, Luengo A (2016) A microeconometric dynamic structural model of copper mining decisions. University of Toronto. Economics Department working paper. Available online at: http://aguirregabiria.net/wpapers/copper_mining.pdf. Accessed 30 Oct 2021

Aydin H, Tilton JE (2000) Mineral endowment, labor productivity, and comparative advantage in mining. Resour Energy Econ 22(4):281–294

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Atakhanova Z (2021) Kazakhstan’s oil boom, diversification strategies, and the service sector. Miner Econ 34:399–409

Atakhanova Z, Howie P (2022) Women in Kazakhstan’s energy industries: implications for energy transition. Energies 15:4540. https://doi.org/10.3390/en15134540

Aydin H (1998) Labor productivity growth in the US copper industry. Unpublished Ph.D. Dissertation. Colorado School of Mines

Aydin H (2020) Fifty years of copper mining: the US labor productivity. Miner Econ 33:11–19

Azhibay S (2022) Assessing mining productivity in Kazakhstan: industry and firm-level analysis. Master’s thesis. Nazarbayev University. Available online at: https://nur.nu.edu.kz/bitstream/handle/123456789/6133/Thesis%20-%20Seribolat%20Azhibay.pdf?sequence=1. Accessed 1 Jun 2022

Brekeshev S (2021) New deposit discovery, development of investment potential, and personnel development in Kazakhstan’s geosciences. Prime Minister of the Republic of Kazakhstan News Portal. Available online at: https://primeminister.kz/ru/news/reviews/otkrytie-novyh-mestorozhdeniy-razvitie-investicionnogo-potenciala-i-podgotovka-molodyh-kadrov-s-brekeshev-o-geologicheskoy-otrasli-kazahstana-183140 (In Russian). Accessed 30 May 2022

De Solminihac H, Gonzales LE, Cerda R (2018) Copper mining productivity: lessons from Chile. J Policy Model 40:182–193

Erickson P, Down A, Lazarus M, Koplow D (2017) Effect of subsidies to fossil fuel companies of United States crude oil production. Nat Energy 2:891–898

Erickson P, van Asselt H, Koplow D, Lazarus M, Newell P, Oreskes N, Supran G (2020) Why fossil fuel producer subsidies matter. Nature 578:E1–E4

Ericsson M, Lof O (2019) Mining’s contribution to national economies between 1996 and 2016. Miner Econ 32:223–250

Eurasian Resources Group (2017) Eurasian Resources Group launches a “Smart Mine” for its iron ore production complex in Kazakhstan. Available online at www.eurasianresources.lu (accessed on April 15, 2023)

Howie P (2018) Policy transfer and diversification in resource-dependent economies: lessons for Kazakhstan from Alberta. Politics and Policy 46(1):110–140

Howie P, Atakhanova Z (2017) Household coal demand in rural Kazakhstan: subsidies, efficiency, and alternatives. Energy and Policy Research 4(1):55–64

Howie P, Atakhanova Z (2020) Heterogeneous labor and structural change in low- and middle-income, resource-dependent countries. Econ Change Restruct 53:297–332

Howie P, Atakhanova Z (2022) Assessing initial conditions and ETS outcomes in a fossil-fuel dependent economy. Energy Strat Rev 100818. https://doi.org/10.1016/j.esr.2022.100818

Humphreys D (2020) Mining productivity and the fourth industrial revolution. Miner Econ 33:115–125

Kazakhstan Government (2022) Industry of Kazakhstan. Annual official statistical publication

Jara JJ, Perez P, Villalobos P (2010) Good deposits are not enough: mining labor productivity analysis in the copper industry in Chile and Peru 1992–2009. Resour Policy 35:247–256

Kabdygalieva Z (2022) Impact of COVID-19 on the mining sector in Kazakhstan. Bachelor of Science thesis. Nazarbayev University

Kundakova LR (2016) Assessment of factors determining labor productivity at processing plants of Kazakhmys Corporation. Bulletin of Ryskulov Kazakh Economic University 5:117–126

Monasterolo I, Raberto M (2019) The impact of phasing out fossil fuel subsidies on the low-carbon transition. Energy Policy 124:355–370

Organization for Economic Cooperation and Development (2014) Energy subsidies and climate change in Kazakhstan. Available online at: https://www.oecd.org/env/outreach/Energy%20subsidies%20and%20climate%20change%20in%20Kazakhstan.pdf. Accessed 10 Feb 2021

Organization for Economic Cooperation and Development (2018) Reform of the mining sector in Kazakhstan: investment, sustainability, competitiveness. Available online at: https://www.oecd.org/eurasia/countries/Kazakhstan_Mining_report_ENG.pdf (accessed on 1 August 2022)

Peck AE (2003) Economic development in Kazakhstan: the role of large enterprises and foreign investment. Routledge, London

Ram MM, Gundimeda H, Kathura C (2015) Does energy intensity affect labor productivity in Indian firms? Preliminary estimates. In: Reddy B, Ulgiati S (eds) Energy security and development. Springer, pp 293–306

Rastiannikova EV (2018) Gold mining in BRICS countries: new production factors and labor productivity. Innovations and Investments 8:91–95

Kazakhstan Government (2012) The concept of development in the sphere of geology of the Republic of Kazakhstan

Tilton J (2014) Cyclical and secular determinants of productivity in the copper, aluminum, iron ore and coal industries. Miner Econ 27:1–19

Topp V (2008) Productivity in the mining industry: measurement and interpretation. Government of the Commonwealth of Australia. Productivity Commission Staff Working Paper. Available online at: https://www.pc.gov.au/research/supporting/mining-productivity. Accessed 10 Jan 2021

United States Energy Information Agency (2012) Annual energy review

United States Geological Survey (2003) Minerals yearbook. Employment at iron ore mines and beneficiation plants. Available online at: https://www.usgs.gov/centers/national-minerals-information-center/iron-ore-statistics-and-information. Accessed 15 Sept 2022

United States Geological Survey (2022) Mineral commodity summaries. Available online at: https://pubs.usgs.gov/periodicals/mcs2022/mcs2022.pdf (accessed on 7 November 2022).

Vakulchuk R, Overland I (2021) Central Asia is a missing link in analyses of critical materials for the global clean energy transition. One Earth. https://doi.org/10.1016/j.oneear.2021.11.012

World Bank (2019) Kazakhstan reversing productivity stagnation: country economic memorandum. World Bank, Washington, DC

World Nuclear Association (2022) World uranium production. Available online at: https://world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production. Accessed 7 Nov 2022

Yepez-Garcia A, San Vincente Portes L, Guerrero S (2021) Productivity and energy intensity in Latin America. Inter-American Development Bank. https://doi.org/10.18235/0003219

Yunis J, Aliakbari E (2022) Annual survey of mining companies, 2021. Fraser Institute. Available online at https://www.fraserinstitute.org/studies/annual-survey-of-mining-companies-2021 (accessed on April 2, 2023)

Funding

This work was supported by the Nazarbayev University Social Policy Grant (Grant number 064.01.00).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation and data collection and analysis were performed by Seribolat Azhibay and Zauresh Atakhanova. The first draft of the manuscript was written by Zauresh Atakhanova. All authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This research did not collect or use primary data.

Consent for publication

The authors give Mineral Economics consent to publish our research. We confirm that the manuscript has not been submitted for publication elsewhere.

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Atakhanova, Z., Azhibay, S. Assessing economic sustainability of mining in Kazakhstan. Miner Econ 36, 719–731 (2023). https://doi.org/10.1007/s13563-023-00387-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-023-00387-x