Abstract

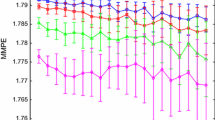

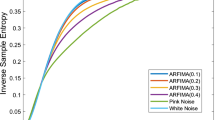

In this paper, we propose the weighted multiscale permutation entropy (WMPE) as a novel measure to quantify the complexity of nonlinear time series containing amplitude-coded information. WMPE is different from multiscale permutation entropy (MPE) in the sense that it suits better signals having considerable amplitude information and also succeed in accounting for the multiple time scales inherent in the financial systems. We first perform the MPE and WMPE methods on synthetic data showing the power of WMPE. Then, we apply the MPE and WMPE methods to the US and Chinese stock markets and make a comparison to discuss their differences and similarities between these different markets. The WMPE of each US and Chinese stock market points out the necessity of applying permutation entropy on multiple scales and reveals amplitude-coded information contained in the signals and immunity to degradation by noise when \(m = 5-7\). Some new conclusions are gotten by the new characteristics we detected in the comparison. WMPE method can distinguish ShangZheng and ShenCheng from these markets and imply that HSI is more similar to the US markets. WMPE moves the fluctuation range of entropy values of different market down differently reflecting more accurate complexity of different stock markets containing amplitude information. Compared WMPE of ShangZheng and ShenCheng with the WMPE of US markets and HSI, US stock market and HSI may have more amplitude information carried by the signals of stock market. Furthermore, compared with MPE, WMPE can reduce the standard deviation which ensures the results more robust. The conclusion that \(m = 7\) is the best embedding dimension to investigate the WMPE results can be drawn because the WMPE tends to be stable in a certain range and reflects the necessity of investigation on multiscale and advantages of adding different weight, and it can distinguish these markets while reducing the standard deviations of all the markets.

Similar content being viewed by others

References

Bachelier, L.: Théorie de la spéculation. Ann. Sci. de L’Ecole Normale Supérieure 17, 21–88 (1900)

Fama, E.F.: Efficient capital markets: a review of theory and empirical work. J. Financ. 25, 383–417 (1970)

Stanley, H.E., Amaral, L.A.N., Canning, D., Gopikrishnan, P., Lee, Y., Liu, Y.: Econophysics: can physicists contribute to the science of economics? Phys. A 269, 156–169 (1999)

Plerou, V., Gopikrishnan, P., Rosenow, B., Amaral, L.A.N., Stanley, H.E.: Econophysics: financial time series from a statistical physics point of view. Phys. A 279, 443–456 (2000)

Lan, B.L., Tan, Y.O.: Statistical properties of stock market indices of different economies. Phys. A 375, 605–611 (2007)

Cortines, A.A.G., Anteneodo, C., Riera, R.: Stock index dynamics worldwide: a comparative analysis. Eur. Phys. J. B 65, 289–294 (2008)

Zunino, L., Tabak, B.M., Figliola, A., Pérez, D.G., Garavaglia, M., Rosso, O.A.: A multifractal approach for the stock market inefficiency. Phys. A 387, 6558–6566 (2008)

Darbellay, G.A., Wuertz, D.: The entropy as a tool for analysing statistical dependences in financial time series. Phys. A 287, 429–439 (2000)

Bentes, S.R., Menezes, R., Mendes, D.A.: Long memory and volatility clustering: is the empirical evidence consistent across stock markets? Phys. A 387, 3826–3830 (2008)

Costa, M., Goldberger, A.L., Peng, C.K.: Multiscale entropy analysis of complex physiologic time series. Phys. Rev. Lett. 89, 068102 (2002)

Costa, M., Goldberger, A.L., Peng, C.K.: Multiscale entropy to distinguish physiologic and synthetic RR time series. In: Computers in Cardiology, pp. 137–140 (2002)

Costa, M., Goldberger, A.L., Peng, C.K.: Multiscale entropy analysis of biological signals. Phys. Rev. E 71, 021906 (2005)

Costa, M., Goldberger, A.L., Peng, C.K., Hausdorff, J.M.: Multiscale entropy analysis of human gait dynamics. Phys. A 330, 53–60 (2003)

Richman, J.S., Moorman, J.R.: Physiological time series analysis using approximate entropy and sample entropy. Am. J. Physiol. 278, H2039–H3049 (2000)

Pincus, S.M.: Approximate entropy as a measure of system complexity. Proc. Natl. Acad. Sci. 88, 2297–2301 (1991)

Pincus, S.M., Goldberger, A.L.: Physiological time series analysis: what does regularity quantify? Am. J. Physiol. 266, H1643–H1656 (1994)

Bandt, C., Pompe, B.: Permutation entropy a natural measure of complexity. Phys. Rev. Lett. 88, 174102 (2002)

Fadlallah, B., Chen, B., Keil, A., Príncipe, J.: Weighted-permutation entropy: a complexity measure for time series incorporating amplitude information. Phys. Rev. E 87, 022911 (2013)

Guiasu, S.: Weighted entropy. Rep. Math. Phys. 2, 165–179 (1971)

Ribeiro, H.V., Zunino, L., Mendes, R.S., Lenzi, E.K.: Complexity-entropy causality plane: a useful approach for distinguishing songs. Phys. A 391, 2421–2428 (2012)

Zunino, L., Soriano, M.C., Fischer, I., Rosso, O.A., Mirasso, C.R.: Permutation-information-theory approach to unveil delay dynamics from time-series analysis. Phys. Rev. E 82, 046212 (2010)

Zunino, L., Soriano, M.C., Rosso, O.A.: Distinguishing chaotic and stochastic dynamics from time series by using a multiscale symbolic approach. Phys. Rev. E 86, 046210 (2012)

Li, Q.L., Fu, Z.T.: The effects of non-stationarity on the clustering properties of the boundary-layer vertical wind velocity. Boundary-Layer Meteorol. 149, 219–230 (2013)

Gao, J.B., Hu, J., Tung, W.W.: Complexity measures of brain wave dynamics. Cogn. Neurodyn. 5, 171–182 (2011)

Acknowledgments

The financial supports from the funds of the China National Science (61071142, 61371130), the Beijing National Science (4122059), and the National High Technology Research Development Program of China (863 Program) (2011AA110306) are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix: MPE and WMPE results of US and Chinese stock markets on different time delay \(\tau \) from 2 to 5

Appendix: MPE and WMPE results of US and Chinese stock markets on different time delay \(\tau \) from 2 to 5

Figures 14, 15, 16 and 17 show the MPE and WMPE results of US markets: S&P500, DJI and NQCI on various embedding dimension \(m\) when time delay \(\tau =2-5\), while Figs. 18, 19, 20 and 21 show the MPE and WMPE results of Chinese markets: ShangZheng, ShenCheng and HSI on various embedding dimension \(m\) when time delay \(\tau =2-5\).

Rights and permissions

About this article

Cite this article

Yin, Y., Shang, P. Weighted multiscale permutation entropy of financial time series. Nonlinear Dyn 78, 2921–2939 (2014). https://doi.org/10.1007/s11071-014-1636-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-014-1636-2