Abstract

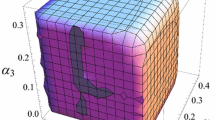

In the oligopoly insurance market, we assumed that some oligarchs make two-period delay decisions in bounded rationality and expectation, respectively, and others make decisions with bounded rationality without the condition of delay. There also exist two cases in which only one oligarch makes a delayed decision and two oligarchs make delayed decisions at the same time. Based on the analysis of these situations, we established the corresponding dynamic price game models. We then performed a numerical simulation to the complexity state of the system with different conditions such as stability, bifurcation, and chaos, and analyzed the profits of different oligarchs when the system is in different states. The results showed that when only one oligarch makes a delayed decision, with the decrease in the price weight of period t and increase in that of periods t−1 and t−2, the system’s stable region in the direction of the price adjustment of the oligarch with a delayed decision gets smaller. However, when there are two oligarchs with a delayed decision in the system, in the case where the delay parameters of oligarch 1 remain unchanged and the price parameters of different periods of oligarch 2 change, the system’s stable region in the direction of the price adjustment of oligarch 1 does not have the obvious change as that when only one oligarch makes a delayed decision. This showed that the sensibility of one oligarch in the direction of its own price adjustment is lower than other oligarchs. In addition, in the same system with delay and when the system is in chaos, the total profit of the oligarchs is obviously less than that when the system is in a stable state. However, the use of a delayed decision may not enhance the oligarch’s competitive advantages. Finally, the variable feedback control method is used to effectively control the chaos in the system.

Similar content being viewed by others

References

Puu, T.: The chaotic duopolists revisited. J. Econ. Behav. Organ. 33, 385–394 (1998)

Agiza, H.N., Elsadany, A.A.: Chaotic dynamics in nonlinear duopoly game with heterogeneous players. Appl. Math. Comput. 149, 843–860 (2004)

Dubiel-Teleseynski, T.: Nonlinear dynamics in a heterogeneous duopoly game with adjusting players and diseconomies of scale. Commun. Nonlinear Sci. Numer. Simul. 16, 296–308 (2011)

Dragone, D., Lambertini, L., Leitmann, G., Palestini, A.: A stochastic optimal control model of pollution abatement. Nonlinear Dyn. Syst. Theory 10, 117–124 (2010)

Gao, Q., Ma, J.H.: Chaos and Hopf bifurcation of a finance system. Nonlinear Dyn. 58, 209–216 (2009)

Ma, J.H., Gao, Q.: Stability and Hopf bifurcations in a business cycle model with delay. Appl. Math. Comput. 215, 829–834 (2009)

Fu, S.H., Pei, L.J.: Synchronization of chaotic systems by the generalized Hamiltonian systems approach. Nonlinear Dyn. Syst. Theory 10, 387–396 (2010)

Chen, F., Ma, J.H.: The study of dynamic process of the triopoly games in Chinese 3G telecommunication market. Chaos Solitons Fractals 42, 1542–1551 (2009)

Ma, J.H., Ji, W.Z.: Chaos control on a repeated model in electric power duopoly. Int. J. Comput. Math. 85, 961–967 (2008)

Ma, J.H., Ji, W.Z.: Complexity of repeated game model in electric power triopoly. Chaos Solitons Fractals 40, 1735–1740 (2009)

Ma, J.H., Cui, Y.Q., Liu, L.X.: A study on the complexity of a business cycle model with great excitements in non-resonant condition. Chaos Solitons Fractals 39, 2258–2267 (2009)

Ma, J.H., Mu, L.L.: Improved piece-wise linear and nonlinear synchronization of a class of discrete chaotic systems. Int. J. Comput. Math. 87, 619–628 (2010)

Chen, Z.Q., Ip, W.H., Chan, C.Y., Yung, K.L.: Two-level chaos-based video cryptosystem on H.263 codec. Nonlinear Dyn. 62, 647–664 (2010)

Chen, Z.Q., Yang, Y., Yuan, Z.Z.: A single three-wing or four-wing chaotic attractor generated from a three-dimensional smooth quadratic autonomous system. Chaos Solitons Fractals 38, 1187–1196 (2008)

Ahmed, E., Agiza, H.N., Hassan, S.Z.: On modifications of Puu’s dynamical duopoly. Chaos Solitons Fractals 11, 1025–1028 (2000)

Hassan, S.Z.: On delayed dynamical duopoly. Appl. Math. Comput. 151, 275–286 (2004)

Xu, F., Sheng, Z.H., Yao, H.X., Chen, G.H.: Study on a duopoly advertising model with delayed decisions. J. Manag. Sci. China 1, 1–10 (2007)

Elsadany, A.A.: Dynamics of a delayed duopoly game with bounded rationality. Math. Comput. Model. 52, 1479–1489 (2010)

Leonov, G.A., Shumafov, M.M.: Stabilization of controllable linear systems. Nonlinear Dyn. Syst. Theory 10, 235–268 (2010)

Su, Z., Zhang, Q., Liu, W., Su, Z.: Practical stability and controllability for a class of nonlinear discrete systems with time delay. Nonlinear Dyn. Syst. Theory 10, 161–174 (2010)

Ma, J., Zhang, Q., Gao, Q.: Stability of a three-species symbiosis model with delays. Nonlinear Dyn. 67, 567–572 (2012)

Sun, Z., Ma, J.: Complexity of triopoly price game in Chinese cold rolled steel market. Nonlinear Dyn. 67, 2001–2008 (2012)

Xu, C., Tang, X., Liao, M., He, X.: Bifurcation analysis in a delayed Lotka–Volterra predator–prey model with two delays. Nonlinear Dyn. 66(1–2), 169–183 (2011)

Zhang, J., Ma, J.: Research on the price game model about four oligarchs with different decision rules and its chaos control. Nonlinear Dyn. (2012)

Ma, J., Bangura, H.I., Zhang, Q.: Kind of financial and economic system’s complexity analysis research under the condition of three parameters change circumstances. Nonlinear Dyn. (2012)

Acknowledgements

This work was supported by Doctoral Fund of Ministry of Education of China 20090032110031 and National Natural Science Foundation of China 61273231.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Junhai, M., Junling, Z. Research on the price game and the application of delayed decision in oligopoly insurance market. Nonlinear Dyn 70, 2327–2341 (2012). https://doi.org/10.1007/s11071-012-0566-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-012-0566-0