Abstract

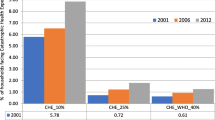

Iatrogenic poverty caused by inadequate public expenditure on health, lack of social health insurance and low penetration of private health insurance can be mitigated by micro health insurance (MHI) schemes that provide financial protection. The empirical evidence on the impact of MHI on financial protection is limited in India. This paper elucidates the effect of Sampoorna Suraksha Programme (SSP), a MHI scheme in Karnataka on financial protection. Cross-sectional study was undertaken in Karnataka and the data was gathered from 416 insured, 366 newly insured and 364 uninsured households. The impact of SSP on out of pocket expenses (OOPE), catastrophic health expenditure (CHE), non-medical consumption expenditure, hardship financing and labour supply was analysed using linear and logistic regression methods. Results of the study demonstrate that insured members incurred lower OOPE, CHE and hardship finance. There was no effect on consumption expenditure and no direct impact on labour supply measured in terms of withdrawal from workforce and substitution of labour. We advocate a larger role of MHI in health financing in India since it curtails impoverishment of households in informal sector by reducing OOPE and hardship financing.

Similar content being viewed by others

References

Aggarwal, A. (2010). Impact evaluation of India’s ‘Yeshasvini’ community-based health insurance programme. Health Economics, 19, 5–35.

Chankova, S., Sulzbach, S., & Diop, F. (2008). Impact of mutual health organizations: Evidence from West Africa. Health Policy and Planning, 23(4), 264–276.

Cochrane, J. (1991). A simple test of consumption insurance. Journal of Political Economy, 99(5), 957.

Dekker, M., & Wilms, A. (2009). Health insurance and other risk-coping strategies in Uganda: The case of Microcare Insurance Ltd. World Development, 38(3), 369–378. doi:10.1016/j.worlddev.2009.09.004.

Dercon, S., & Krishnan, P. (2000). In sickness and in health: Risk sharing within households in rural Ethiopia. Journal of Political Economy, 108(4), 688–727.

Devadasan, N., Criel, B., Damme, W. V., Ranson, K., & Stuyft, P. V. (2007). Indian community health insurance schemes provide partial protection against catastrophic health expenditure. BMC Health Services Research, 7, 43.

Ekman, B. (2007). The impact of health insurance on outpatient utilization and expenditure: Evidence from one middle-income country using national household survey data. Health Research Policy and Systems. doi:10.1186/1478-4505-5-6.

Ekman, B. (2007). Catastrophic health payments and health insurance: Some counterintuitive evidence from one low-income country. Health policy, 83(2007), 304–313.

Flores, G., Krishnakumar, J., O’Donnell, O., & Van Doorslaer, E. (2008). Coping with health-care costs: Implications for the measurement of catastrophic expenditures and poverty. Health Economics, 17(12), 1393–1412. doi:10.1002/hec.1338.

Gakidou, E., Lozano, R., Gonzalez-Pier, E., Abbott-Klafter, J., Barofsky, J. T., et al. (2006). Health system reform in Mexico 5: Assessing the effect of the 2001–2006 Mexican health reform: An interim report card. Lancet, 368(9550), 1920–1935.

Genoni, E. M. (2012). Health shocks and consumption smoothing: Evidence from Indonesia. Economic Development and Cultural Change, 60(3), 475–506.

Gertler, P., & Gruber, J. (2002). Insuring consumption against illness. American Economic Review, 92(1), 51–70.

Gumber, A. (2001). Hedging the health of the poor: The case for community financing in India. Health, Nutrition, and Population Family discussion Paper Series. Washington, DC: The World Bank.

Habicht, J., Xu, K., Couffinhal, A., & Kutzin, J. (2006). Detecting changes in financial protection: Creating evidence for policy in Estonia. Health Policy and Planning, 21(6), 421–431.

Hamid, S. A., Roberts, J., & Mosley, P. (2010). Can micro health insurance reduce poverty: Evidence from Bangladesh. Sheffield Economic Research Paper Series. Sheffield: University of Sheffield.

Jalan, J., & Ravallion, M. (1999). Are the poor less well insured? Evidence on vulnerability to income risk in rural China. Journal of development economics, 58(1), 61–81.

Jütting, J. (2003). Do community-based health insurance schemes improve poor people’s access to health care? Evidence from rural Senegal. World Development, 32, 273–288.

Jutting, J. & Tine, J. (2000). Micro insurance schemes and health care provision in developing countries: An empirical analysis of the impact of mutual health insurance schemes in rural Senegal. ILO/ZEF-Project No. 7359 Project report: 5. Germany: Centre for Development Research (ZEF).

Knaul, F. M., Arreola-Ornelas, H., Mendez-Carniado, O., Bryson-Cahn, C., Barofsky, J., et al. (2006). Health System Reform in Mexico 4: Evidence is good for your health system: Policy reform to remedy catastrophic and impoverishing health spending in Mexico. Lancet, 368(9549), 1828–1841.

Kochar, A. (1995). Explaining household vulnerability to idiosyncratic income shocks. The American Economic Review, 85(2), 159–164.

Lei, X., & Lin, W. (2009). The New Cooperative Medical Scheme in rural China: Does more coverage mean more service and better health? Health Economics, 18(52), S25–S46.

Limwattananon, S., Tangcharoensathien, V., & Prakongsai, P. (2007). Catastrophic and poverty impacts of health payments: Results from national household surveys in Thailand. Bulletin of the World Health Organization, 85(8), 600–606.

Liu, K. (2013). Health insurance coverage for low-income households: Consumption smoothing and investment, Discussion Papers 16/2013, Norwegian School of Economics. http://www.hdl.handle.net/11250/163453. Accessed 10 June 2014.

Morduch, J. (1995). Income smoothing and consumption smoothing. The Journal of Economic Perspectives, 9(3), 103–114.

OECD/World Health Organization. (2012). Health at a Glance: Asia/Pacific 2012. OECD Publishing. doi:10.1787/9789264183902-en.

Peters, D., Yazbeck, A., Sharma, R., Ramana, G., Pritchett, L., & Wagstaff, A. (2002). India, raising the sights: Better health systems for India’s poor, poor: Findings, analysis, and options. health, nutrition, and population series. Washington, DC: The World Bank.

Pradhan, M., & Prescott, N. (2002). Social riskmanagement options for medical care in Indonesia. Journal of Health Economics, 11, 431–446.

Ranson, K. M. (2002). Reduction of catastrophic health care expenditures by a community-based health insurance scheme in Gujarat, India: Current experiences and challenges. Bulletin of World Health Organization, 80(8), 613–621.

Rao, K., Waters, H., Steinhardt, L., Alam, S., Hansen, P., & Naeem, A. (2009). An experiment with community health funds in Afghanistan. Health Policy and Planning. doi:10.1093/heapol/czp018.

Rosenzweig, M. R., & Wolpin, K. (1993). Credit market constraints, consumption smoothing, and the accumulation of durable production assets in low-income countries: investment in bullocks in India. Journal of Political Economy, 101(2), 223–244.

Schneider, P., & Diop, F. (2001). Synopsis of results on the impact of community-based health insurance on financial accessibility to health care in Rwanda, health, nutrition, and population series. Washington, DC: The World Bank.

Townsend, R. M. (1994). Risk and insurance in village India. Econometrica, 62(3), 539–591.

Wagstaff, A. (2008). Measuring financial protection in health, policy research Working Paper 4554. Development Research Group, Washington, DC: The World Bank. http://econ.worldbank.org. Accessed 12 June 2014.

Wagstaff, A., & Lindelow, M. (2008). Can insurance increase financial risk? The curious case of health insurance in China? Journal of Health Economics, 27(4), 990–1005.

Wagstaff, A., Lidelow, M., Jun, G., & Juncheng, Q. (2008). Extending health insurance to the rural population: An impact evaluation of China’s new cooperative medical scheme. Journal of Health Economics, 28(2009), 1–19.

Wagstaff, A., Pradhan, M. (2005). Health insurance impacts on health and nonmedical consumption in a developing country. Policy Research Working Paper 3563. Washington DC: The World Bank.

Yip, W., Wang, H., Hsiao, W. (2007). the impact of rural mutual health care on access to care: Evaluation of a social experiment in rural China. 6th World Congress of Health Economics. Copenhagen, Denmark. July 8–11, 2007.

Zhang, L., Cheng, X., Tolhurst, R., Tang, S., & Liu, X. (2010). How effectively can the New Cooperative Medical Scheme reduce catastrophic health expenditure for the poor and non- poor in rural China? Tropical Medicine and International Health, 15(4), 468–475.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Savitha, S., Kiran, K.B. Effectiveness of micro health insurance on financial protection: Evidence from India. Int J Health Econ Manag. 15, 53–71 (2015). https://doi.org/10.1007/s10754-014-9158-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-014-9158-5